Irrational investing represents the phenomenon where psychological biases and emotional decision-making override logical financial analysis, leading investors to make choices that systematically underperform market benchmarks.

In today’s volatile financial landscape, understanding these behavioral patterns has become crucial as studies show that emotional decision-making costs the average investor approximately 2-3% in annual returns. This psychological approach to investing contradicts fundamental principles of rational economic theory and continues to destroy portfolio value across global markets.

Welcome to our in-depth exploration of irrational investing – we’re excited to help you master these powerful behavioral finance strategies!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

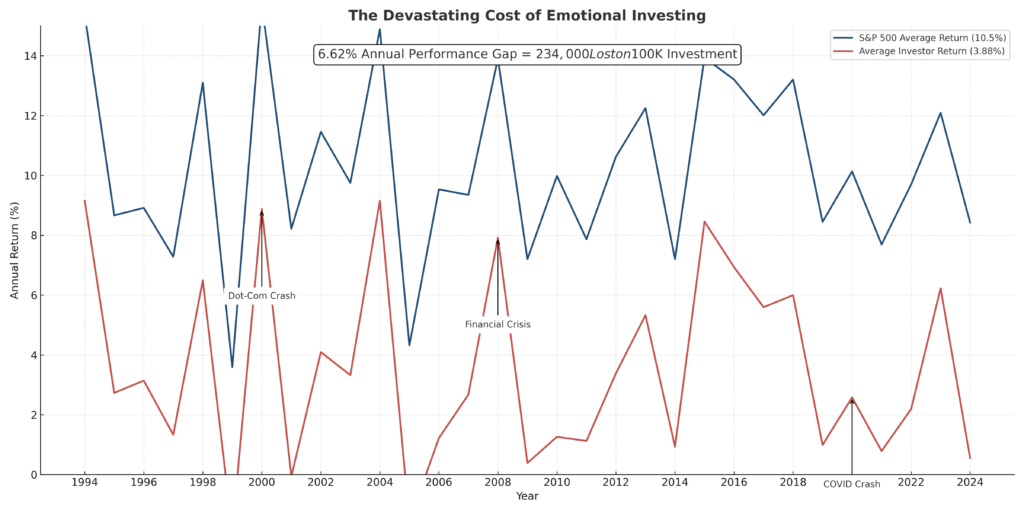

1. Emotional Decision-Making Costs Investors Significantly Research by DALBAR Inc. demonstrates that the average equity investor earned only 3.88% annually over the 30-year period ending in 2020, while the S&P 500 returned 10.5% annually. This 6.62% performance gap primarily results from emotional buying and selling decisions driven by market fear and greed.

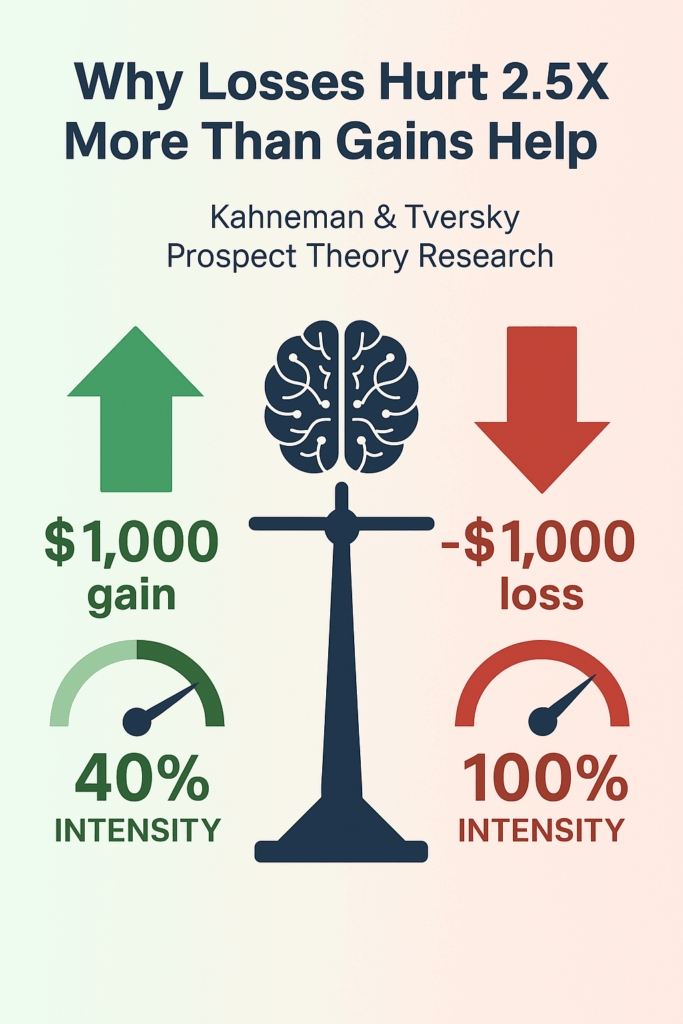

2. Loss Aversion Triggers Destructive Investment Behaviors Behavioral finance studies reveal that investors feel losses approximately 2.5 times more intensely than equivalent gains, causing them to sell winning positions too early and hold losing investments too long. This phenomenon, known as the disposition effect, systematically reduces portfolio returns and prevents wealth accumulation.

3. Herd Mentality Amplifies Market Volatility and Individual Losses During the 2008 financial crisis, retail investors withdrew $234 billion from equity mutual funds near market lows, locking in losses averaging 31% per investor. Conversely, during the dot-com bubble, individual investors poured $260 billion into technology funds in 1999-2000, just before the market crash that eliminated 78% of NASDAQ value.

Understanding Irrational Investing

Irrational investing encompasses a broad spectrum of behavioral patterns where investors make decisions based on emotions, cognitive biases, and psychological triggers rather than fundamental analysis or sound financial principles. This phenomenon represents a significant departure from the efficient market hypothesis, which assumes that all market participants act rationally and have access to complete information.

The concept gained prominence following the work of behavioral economists Daniel Kahneman and Amos Tversky, whose prospect theory demonstrated that individuals consistently make decisions that deviate from rational economic models. Their research revealed that human psychology introduces systematic errors in financial decision-making, creating predictable patterns of irrational behavior.

Modern behavioral finance research identifies over 150 cognitive biases that influence investment decisions. These biases operate at both conscious and subconscious levels, affecting everything from asset allocation to timing decisions. The impact extends beyond individual portfolios, as collective irrational behavior contributes to market bubbles, crashes, and persistent price anomalies.

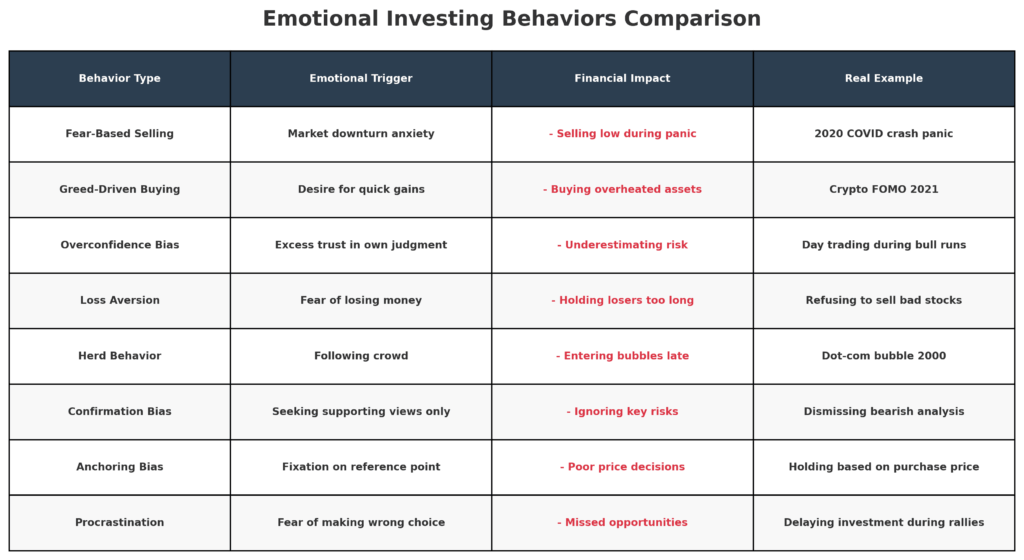

Emotional investing manifests through various psychological mechanisms, including overconfidence, anchoring bias, confirmation bias, and mental accounting. These cognitive shortcuts, while useful in daily life, prove counterproductive in financial markets where objective analysis and disciplined execution determine long-term success.

The financial cost of irrational investing extends far beyond individual portfolios. Studies estimate that behavioral biases cost investors globally approximately $1.2 trillion annually in foregone returns. This figure represents the difference between what investors could earn through disciplined, rational investing versus their actual performance when emotions drive decisions.

Types of Irrational Investing Behaviors

Emotional-Driven Behaviors

Fear-Based Selling occurs when investors liquidate positions during market downturns, often at the worst possible times. During March 2020, retail investors sold $326 billion in equity funds during the COVID-19 market crash, missing the subsequent 74% recovery over the following 18 months.

Greed-Driven Buying manifests as excessive risk-taking during bull markets, leading to overconcentration in speculative assets. The 2021 meme stock phenomenon exemplified this behavior, with retail investors concentrating 40% or more of their portfolios in single stocks like GameStop and AMC.

Panic Selling represents extreme fear-based behavior where investors abandon long-term strategies in favor of perceived safety. Historical data shows that panic selling typically occurs within 5-10% of market bottoms, resulting in permanent capital loss for those who fail to reinvest.

Cognitive Bias-Driven Behaviors

Overconfidence Bias leads investors to overestimate their ability to predict market movements and stock performance. Studies show that overconfident investors trade 45% more frequently than average, reducing their annual returns by approximately 2.65%.

Confirmation Bias causes investors to seek information that supports their existing beliefs while ignoring contradictory evidence. This selective information processing prevents objective evaluation of investment thesis and risk factors.

Anchoring Bias occurs when investors fixate on specific price points or past performance, preventing them from adapting to changing market conditions. Research indicates that anchoring reduces portfolio performance by 1.5-2% annually.

Timing-Related Behaviors

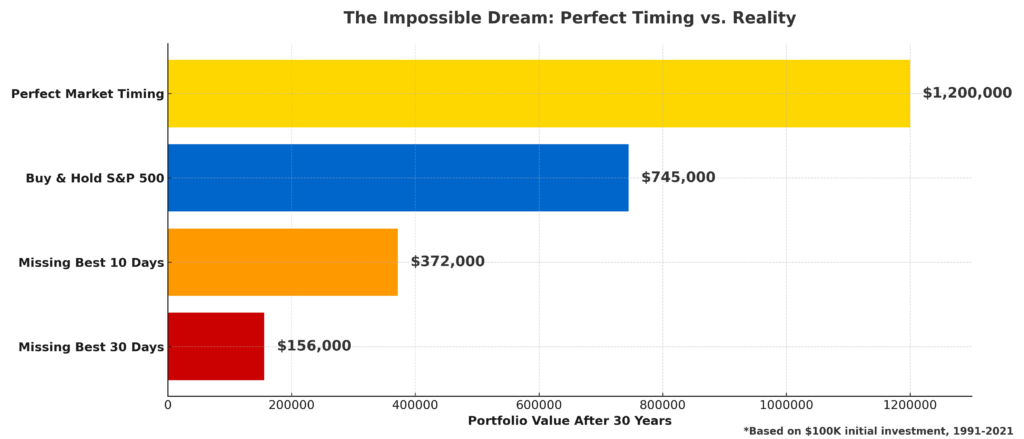

Market Timing Attempts involve trying to predict short-term market movements to optimize entry and exit points. SPIVA research shows that 89% of actively managed funds fail to outperform their benchmarks over 15-year periods, largely due to timing decisions.

Trend Chasing describes the tendency to invest in assets after they have already experienced significant price appreciation. This behavior typically results in buying high and selling low, the opposite of successful investing principles.

Benefits of Understanding Irrational Investing

Performance Improvement

Recognizing and addressing irrational investing behaviors can significantly enhance portfolio performance. Investors who implement systematic approaches to counter emotional decision-making typically achieve returns 2-4% higher than those who rely on intuition and emotion.

Behavioral Coaching programs demonstrate measurable improvement in investor outcomes. Vanguard’s research indicates that behavioral coaching adds approximately 1.5% in annual returns through improved decision-making and reduced emotional trading.

Risk Management Enhancement

Understanding irrational investing patterns enables better risk management through:

• Diversification Discipline: Emotional investors often concentrate holdings in familiar or recently successful assets, increasing portfolio risk

• Systematic Rebalancing: Regular portfolio rebalancing counteracts the tendency to let winners run too long and losers persist

• Stress Testing: Preparing for emotional responses to market volatility through scenario planning and predetermined decision frameworks

Long-Term Wealth Preservation

Irrational investing awareness helps preserve wealth by preventing common destructive behaviors:

• Avoiding Market Timing: Studies show that missing just the 10 best days in the market over 30 years reduces returns by approximately 50%

• Reducing Transaction Costs: Emotional trading increases costs through frequent transactions, typically reducing returns by 0.5-1% annually

• Maintaining Investment Discipline: Consistent application of investment principles regardless of market conditions

Challenges and Risks of Irrational Investing

Financial Performance Risks

Underperformance Risk represents the most significant challenge of irrational investing. The behavior gap between investor returns and market returns has persisted across decades, with emotional decision-making consistently reducing portfolio performance.

Sequence of Returns Risk becomes amplified through irrational behavior, particularly during retirement. Emotional selling during market downturns can permanently impair retirement income capacity, as portfolios have less time to recover from losses.

Psychological Challenges

Cognitive Overload occurs when investors attempt to process too much information simultaneously, leading to decision paralysis or impulsive choices. The modern information environment exacerbates this challenge, with 24/7 financial news and social media commentary creating constant decision pressure.

Emotional Exhaustion results from the stress of constant portfolio monitoring and decision-making. This psychological burden often leads to either excessive trading or complete disengagement from investment management.

Systematic Market Risks

Bubble Formation occurs when collective irrational behavior drives asset prices far above fundamental values. The 2000 technology bubble and the 2008 housing bubble demonstrate how widespread irrational investing can create systemic risks.

Market Volatility Amplification results when emotional investors simultaneously rush to buy or sell, creating price movements that exceed what fundamental factors would justify.

Implementation: Overcoming Irrational Investing

Systematic Approaches

Dollar-Cost Averaging helps counteract timing biases by investing fixed amounts regularly regardless of market conditions. This approach reduces the impact of emotional decision-making and provides price averaging benefits over time.

Automatic Rebalancing removes emotional decision-making from portfolio maintenance. Studies show that systematic rebalancing adds 0.5-1% annually to portfolio returns while maintaining target risk levels.

Rule-Based Investing involves creating predetermined criteria for investment decisions, removing emotion from the process. This approach includes:

• Stop-Loss Orders: Predetermined exit points that prevent emotional holding of declining positions

• Profit-Taking Rules: Systematic approach to capturing gains and managing position sizes

• Asset Allocation Targets: Specific percentages for different asset classes that guide investment decisions

Behavioral Modification Techniques

Mindfulness Training helps investors recognize emotional responses before they impact decision-making. Research shows that mindfulness practices can improve investment performance by 7-15% through reduced emotional trading.

Decision Journaling involves documenting the reasoning behind investment decisions, creating accountability and enabling post-decision analysis. This practice helps identify patterns of irrational behavior and improve future decision-making.

Cooling-Off Periods require waiting 24-48 hours before making significant investment changes, allowing emotions to subside and rational analysis to prevail.

Professional Support Systems

Behavioral Coaching provides objective guidance during emotional periods, helping investors maintain long-term perspective. Professional coaches can identify emerging irrational patterns and provide intervention strategies.

Algorithmic Trading Systems remove human emotion from investment execution, following predetermined strategies regardless of market conditions or investor sentiment.

Future Trends in Addressing Irrational Investing

Technology Solutions

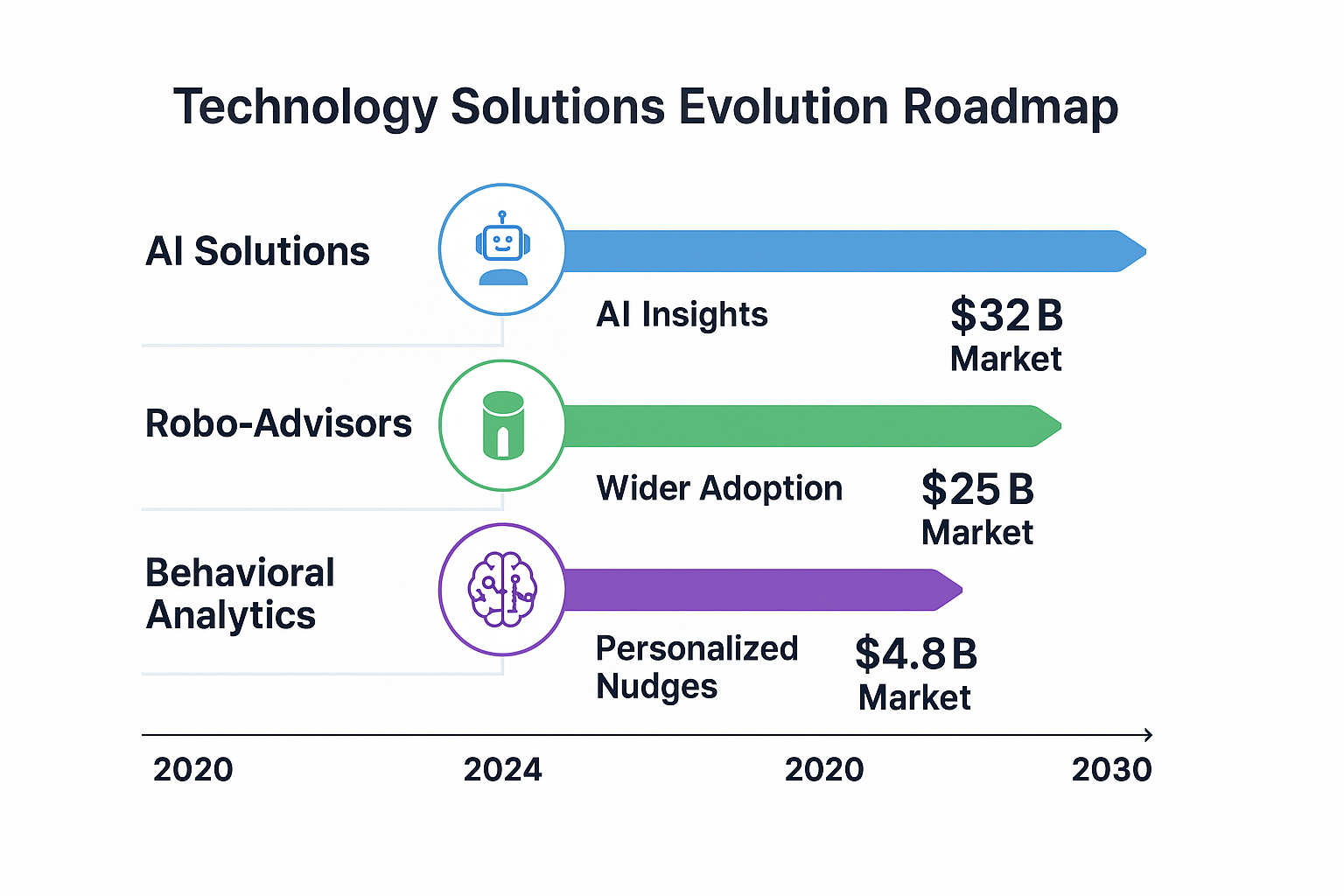

Artificial Intelligence applications increasingly focus on identifying and counteracting irrational investing behaviors. Machine learning algorithms can detect patterns of emotional decision-making and provide real-time intervention suggestions.

Robo-Advisors continue evolving to incorporate behavioral finance principles, offering personalized coaching and automated behavioral interventions. The global robo-advisor market, valued at $4.6 billion in 2022, is projected to reach $41.8 billion by 2027.

Behavioral Analytics platforms provide detailed analysis of investor behavior patterns, enabling personalized intervention strategies. These systems track decision-making patterns and provide feedback to improve future choices.

Regulatory Developments

Fiduciary Standards increasingly emphasize behavioral considerations in investment advice, requiring advisors to consider client psychology and behavioral biases in their recommendations.

Disclosure Requirements evolve to include behavioral warnings and education about common irrational investing patterns, helping investors understand their own psychological tendencies.

Educational Initiatives

Behavioral Finance Curricula expand in academic programs and professional certifications, creating a new generation of finance professionals trained in the psychological aspects of investing.

Investor Education Programs increasingly incorporate behavioral components, teaching investors to recognize and manage their own irrational tendencies.

FAQs – Irrational Investing

1. What is the primary cause of irrational investing behavior? The primary cause stems from evolutionary psychology, where human brains developed to make quick survival decisions rather than long-term financial calculations. Modern markets trigger these ancient fight-or-flight responses, causing investors to prioritize immediate emotional relief over long-term financial success.

2. How much does irrational investing typically cost investors annually? Research consistently shows that irrational investing costs the average investor 2-3% in annual returns. DALBAR’s Quantitative Analysis of Investor Behavior demonstrates that emotional decision-making creates a persistent performance gap between investor returns and market returns.

3. Can professional investors avoid irrational investing behaviors? Professional investors are not immune to irrational behavior, though they typically have better systems and training to manage these tendencies. Studies show that even professional fund managers exhibit behavioral biases, though to a lesser degree than individual investors.

4. What is the most effective strategy to overcome emotional investing? Systematic investing approaches, particularly dollar-cost averaging combined with automatic rebalancing, prove most effective. These strategies remove emotional decision-making from the investment process while maintaining consistent market exposure.

5. How do market crashes amplify irrational investing behaviors? Market crashes trigger intense fear responses, causing investors to abandon long-term strategies in favor of perceived safety. Historical data shows that investors typically sell near market bottoms and fail to reinvest during recovery periods.

6. Are certain age groups more susceptible to irrational investing? Younger investors often exhibit overconfidence and excessive risk-taking, while older investors tend toward excessive conservatism and loss aversion. However, behavioral biases affect all age groups differently rather than more or less intensely.

7. How does social media influence irrational investing decisions? Social media amplifies herd mentality and confirmation bias by creating echo chambers of investment opinion. The immediate nature of social media commentary often triggers impulsive decisions without proper analysis or consideration of long-term consequences.

8. What role does financial education play in reducing irrational investing? Traditional financial education shows limited effectiveness in reducing irrational behavior because it focuses on technical knowledge rather than psychological awareness. Behavior-focused education that teaches investors to recognize their own biases proves more effective.

9. How can investors identify their own irrational investing patterns? Investors can identify patterns through decision journaling, performance analysis relative to benchmarks, and reflection on past decisions during different market conditions. Professional behavioral assessments can also reveal specific bias tendencies.

10. What is the difference between risk tolerance and risk capacity in relation to irrational investing? Risk tolerance represents emotional comfort with volatility, while risk capacity reflects actual financial ability to withstand losses. Irrational investing often occurs when these two factors are misaligned, leading to inappropriate investment decisions based on emotions rather than financial reality.

Conclusion

Irrational investing represents one of the most significant barriers to long-term financial success, costing investors billions of dollars annually through emotional decision-making and cognitive biases.

The evidence consistently demonstrates that psychological factors, rather than market conditions or investment selection, primarily determine investor outcomes. Understanding these behavioral patterns provides the foundation for developing effective strategies to overcome emotional decision-making and achieve superior portfolio performance.

The future of investing increasingly recognizes the critical importance of behavioral factors in financial decision-making. Technology solutions, regulatory developments, and educational initiatives continue to evolve in addressing the psychological aspects of investing. Investors who acknowledge their own behavioral tendencies and implement systematic approaches to counter emotional decision-making position themselves for significantly improved long-term outcomes.

As markets become more complex and information more abundant, the ability to maintain rational, disciplined investment approaches becomes increasingly valuable for preserving and growing wealth over time.

For your reference, recently published articles include:

-

- Investment Risk Monitoring – All You Need To Know

- How to Become a Rational Investor in 2025

- Market Anomaly Detection: Your Edge In Volatile Markets

- How To Choose The Best Risk Tolerance Questionnaire

- Proven High Net Worth Investing Strategies For Growth

- Proven Seasonal Investing Strategies Every Investor Should Know

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage