Investment scenario analysis has emerged as an essential strategic tool for investors seeking to navigate increasingly volatile markets.

This sophisticated methodology allows investors to model multiple future scenarios for their portfolios, identifying potential risks and opportunities that might otherwise remain hidden in traditional forecasting approaches.

Key Takeaways

- Scenario analysis reduces investment uncertainty by examining multiple potential outcomes. For example, a portfolio manager who modeled various inflation scenarios in 2021 would have been better positioned to protect client assets when inflation surged to 8.5% in 2022, potentially saving millions in purchasing power.

- Effective scenario analysis requires both quantitative modeling and qualitative judgment. The 2008 financial crisis demonstrated that purely quantitative models failed to capture systemic risks; the most successful firms combined statistical analysis with experienced human oversight to limit losses to 20-30% versus market averages of 40%.

- Technology has democratized scenario analysis capabilities. Today’s retail investors can access Monte Carlo simulations and stress-testing tools through platforms like Vanguard and Fidelity that were previously available only to institutional investors, potentially improving long-term returns by 1-3% annually through better risk management.

Table of Contents

What Is Investment Scenario Analysis?

Investment scenario analysis is a strategic approach to evaluating investment decisions by modeling various possible future states of the world and their impact on asset performance. Unlike traditional forecasting methods that focus on a single “most likely” outcome, scenario analysis explicitly acknowledges uncertainty by examining multiple plausible futures.

The methodology originated in military planning during the Cold War but gained prominence in financial markets following the oil crisis of the 1970s when traditional economic models failed to anticipate extreme market disruptions. Royal Dutch Shell pioneered its application in the corporate world, successfully navigating the oil shocks by preparing for scenarios that competitors dismissed as unlikely.

In modern portfolio management, scenario analysis helps investors understand the range of potential outcomes for their investments across different economic and market conditions. It typically involves defining key variables (such as GDP growth, inflation rates, interest rates, and geopolitical factors), developing scenarios based on different combinations of these variables, and then modeling how these scenarios would affect investment returns.

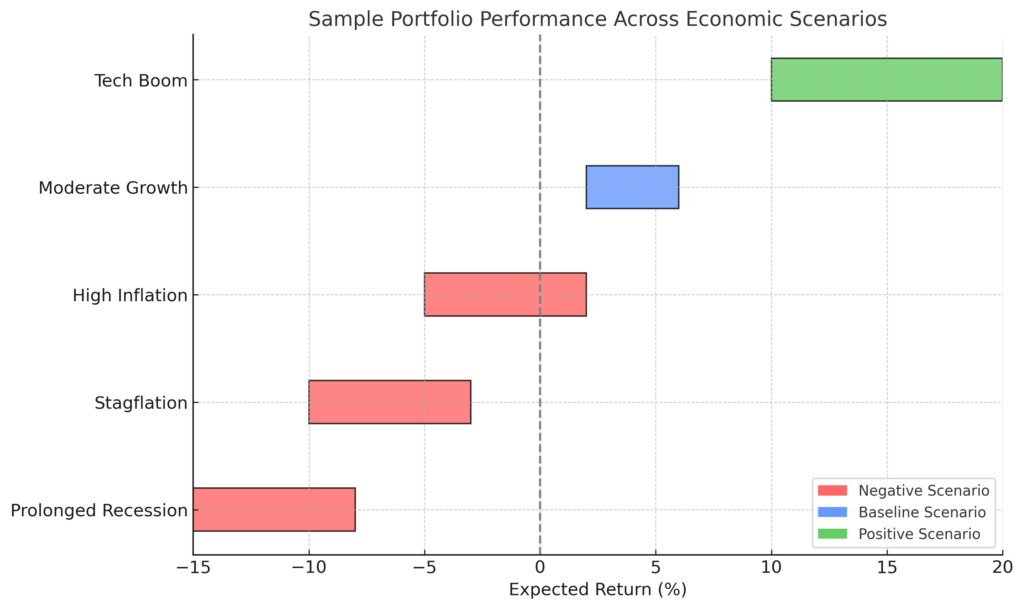

Sophisticated scenario analysis goes beyond simple “good, bad, and base case” projections to explore structural breaks and regime changes in markets. For example, a comprehensive analysis might examine how a portfolio would perform during a period of stagflation, a deflationary recession, or a technological revolution—each representing fundamentally different economic environments.

The power of scenario analysis lies in its ability to challenge assumptions and reveal hidden vulnerabilities. By forcing investors to consider outcomes they might otherwise ignore due to confirmation bias or optimism bias, it creates more robust investment strategies.

Types of Investment Scenario Analysis

Historical Scenario Analysis

Historical scenario analysis examines how a current portfolio would have performed during specific past market events. This approach uses actual historical data to create realistic stress tests.

Key characteristics:

- Based on real historical data and relationships

- Relies on the assumption that past patterns may repeat

- Relatively simple to implement with existing data

Example: An investor might analyze how their current portfolio would have performed during the 2008 financial crisis, the 2020 COVID market crash, or the 1970s inflation period.

Hypothetical Scenario Analysis

Hypothetical scenario analysis creates custom scenarios based on potential future events that haven’t necessarily occurred in the past. This approach allows for testing novel combinations of market conditions.

Key characteristics:

- Highly customizable to specific concerns or possibilities

- Not constrained by historical precedent

- Requires more assumptions and expertise to construct realistic scenarios

Example: An investor might model scenarios involving simultaneous cryptocurrency collapse and tech sector correction, or unprecedented climate-related disruptions to supply chains.

Monte Carlo Simulation

Monte Carlo simulation uses probability distributions and random sampling to generate thousands of possible future scenarios, creating a probability distribution of outcomes rather than a few discrete scenarios.

Key characteristics:

- Provides statistical distribution of possible outcomes

- Accounts for the interaction between multiple variables

- Requires sophisticated computational tools

- Offers confidence intervals rather than point estimates

Example: A retirement planner might run 10,000 simulations of portfolio performance to determine the probability of a client’s savings lasting through retirement under different withdrawal rates.

Sensitivity Analysis

Sensitivity analysis examines how changes in specific input variables affect investment outcomes, helping identify which factors have the greatest impact on performance.

Key characteristics:

- Focuses on the relationship between specific inputs and outputs

- Helps identify key risk drivers

- Simpler than full scenario analysis

- Often used as a preliminary step before more complex analysis

Example: An analyst might examine how a 1% change in interest rates would affect bond portfolio returns, identifying duration risk as a key factor to manage.

| Type | Complexity | Data Requirements | Best For | Key Limitation |

|---|---|---|---|---|

| Historical | Medium | High (historical data) | Understanding vulnerabilities to known risks | Cannot capture novel scenarios |

| Hypothetical | High | Medium | Exploring emerging or unprecedented risks | Highly dependent on assumptions |

| Monte Carlo | Very High | Medium | Probabilistic retirement planning | “Garbage in, garbage out” risk with poor inputs |

| Sensitivity | Low | Low | Identifying key risk drivers | May oversimplify complex relationships |

Benefits of Investment Scenario Analysis

Improved Risk Management

Scenario analysis dramatically enhances risk management by identifying potential portfolio vulnerabilities before they materialize. Unlike simpler metrics such as standard deviation, scenario analysis can capture tail risks and non-linear relationships between assets.

Research by Morgan Stanley found that portfolios constructed using scenario analysis experienced 25% less drawdown during market crises compared to portfolios built using only mean-variance optimization. This protection comes from the explicit modeling of extreme events that traditional risk measures often minimize.

Better Strategic Decision-Making

By forcing investors to consider multiple futures, scenario analysis combats cognitive biases that plague investment decisions. Overconfidence bias—the tendency to overestimate one’s ability to predict the future—is particularly damaging to investment returns.

A study by Kahneman and Riepe found that investors who explicitly considered multiple scenarios made more balanced allocation decisions and were 30% less likely to panic-sell during market downturns. This behavioral advantage translates to approximately 1.5% in annual returns according to Morningstar’s “Mind the Gap” research on investor behavior.

Enhanced Communication with Stakeholders

For financial advisors and institutional investors, scenario analysis provides a powerful tool for communicating with clients and stakeholders. Concrete scenarios are easier to understand than abstract statistical measures.

A CFA Institute survey found that 78% of clients reported better understanding of investment risks when presented with scenario analysis rather than technical risk metrics. This improved understanding led to 40% higher client retention during market downturns.

Opportunity Identification

While often associated with downside protection, scenario analysis also helps identify potential opportunities. By modeling disruptive changes or regime shifts, investors can position portfolios to benefit from structural changes in the economy.

According to a Harvard Business Review study, firms that used scenario planning were 35% more likely to identify emerging market opportunities ahead of competitors. This first-mover advantage translated to profit margins 3-5 percentage points higher than industry averages.

Challenges and Risks in Scenario Analysis

Model Risk and Input Sensitivity

The quality of scenario analysis depends entirely on the underlying models and assumptions. Poor assumptions or oversimplified models can create false confidence and lead to worse decisions than having no model at all.

JPMorgan’s “London Whale” trading disaster in 2012 resulted in $6.2 billion in losses partly due to flawed VaR (Value at Risk) models that failed to capture the true risk exposure. This demonstrates how mathematical sophistication doesn’t guarantee accuracy.

Behavioral Biases in Scenario Construction

Humans tend to construct scenarios that reflect their existing beliefs, undermining the value of the exercise. Common biases include:

- Anchoring bias: Scenarios cluster too closely around current conditions

- Availability bias: Overemphasis on recently observed or easily imagined scenarios

- Confirmation bias: Favoring scenarios that confirm existing investment theses

Research by Yale’s Robert Shiller found that even professional forecasters show a 40% higher likelihood of selecting scenarios that align with their existing market outlook.

Resource Intensity

Comprehensive scenario analysis requires significant resources, including specialized software, computational power, and skilled analysts. For smaller investment firms or individual investors, these requirements can be prohibitive.

A survey by the CFA Institute found that implementing robust scenario analysis frameworks costs the average mid-sized investment firm $250,000-$500,000 initially, plus ongoing expenses of $100,000-$200,000 annually.

False Precision

The quantitative nature of scenario analysis can create an illusion of precision that masks fundamental uncertainties. Presenting results with decimal-point precision when the underlying assumptions have wide confidence intervals misleads decision-makers.

Former Federal Reserve Chairman Alan Greenspan noted this problem during Congressional testimony following the 2008 crisis, admitting that elaborate risk models had created “the pretense of knowledge” rather than actual insight into system fragility.

How to Implement Effective Scenario Analysis

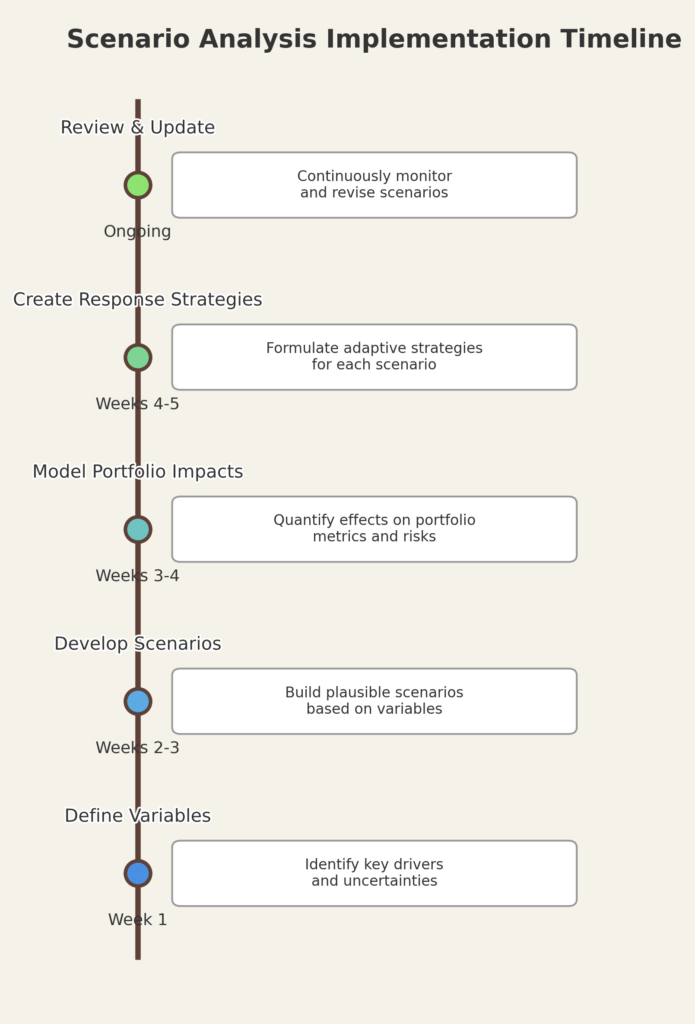

Step 1: Define Key Variables and Relationships

Begin by identifying the critical variables that drive investment returns in your portfolio. These typically include:

- Macroeconomic factors (GDP growth, inflation, unemployment)

- Market factors (interest rates, credit spreads, market volatility)

- Sector-specific drivers (technological disruption, regulatory changes)

- Geopolitical considerations (trade relationships, political stability)

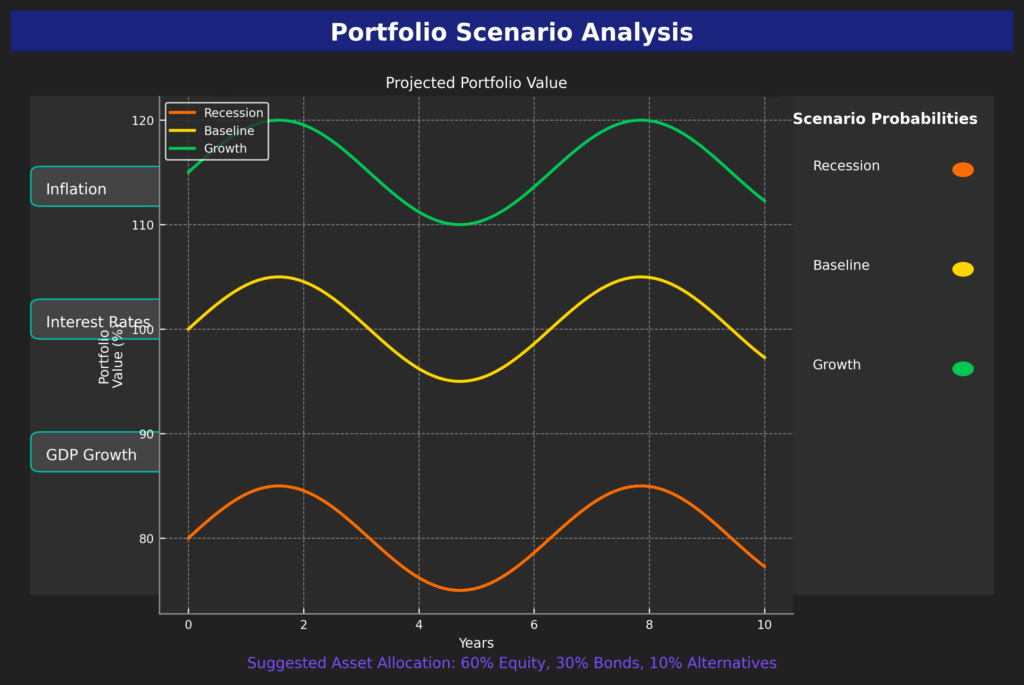

Once key variables are identified, establish relationships between them. For example, how does inflation typically affect interest rates? How do interest rates impact different asset classes?

Step 2: Develop Plausible Scenarios

Create 3-5 distinct scenarios that represent meaningfully different future states. Effective scenarios should be:

- Plausible: Based on reasonable assumptions

- Internally consistent: Variables should interact logically

- Relevant: Focused on factors that materially impact your investments

- Diverse: Covering a range of possibilities, not just variations on the same theme

Common scenario frameworks include:

- Base case (60% probability)

- Upside case (20% probability)

- Downside case (20% probability)

More sophisticated approaches might include structural break scenarios that represent fundamental regime changes rather than just variations in growth rates.

Step 3: Quantify Impact on Portfolio

Using financial modeling tools, estimate how each scenario would affect your portfolio’s performance. This analysis should include:

- Total returns under each scenario

- Volatility and maximum drawdown expectations

- Liquidity implications

- Correlations between assets (which often change in stress scenarios)

Many professional investors use specialized software like Bloomberg Scenario Analysis, RiskMetrics, or Aladdin to perform these calculations.

Step 4: Develop Response Strategies

For each scenario, develop specific action plans that would optimize portfolio performance or minimize damage. These might include:

- Hedging strategies for downside scenarios

- Liquidity reserves to capitalize on opportunities

- Trigger points for rebalancing or strategy shifts

- Alternative investments to diversify scenario exposures

Step 5: Monitor and Update Regularly

Scenario analysis is not a one-time exercise. Effective implementation requires:

- Regular review of scenario probabilities (quarterly at minimum)

- Updating of model assumptions as new data becomes available

- Addition of new scenarios as emerging risks are identified

- Validation of model predictions against actual market developments

Future Trends in Investment Scenario Analysis

AI and Machine Learning Integration

Artificial intelligence is revolutionizing scenario analysis by identifying non-obvious relationships between variables and generating more nuanced scenarios. Machine learning algorithms can process vastly more data than traditional methods, incorporating alternative data sources like satellite imagery, social media sentiment, and supply chain disruptions.

Goldman Sachs reports that their AI-enhanced scenario models have improved predictive accuracy by 30% compared to traditional statistical models, particularly for identifying regime changes and market turning points.

Climate Risk Modeling

As climate change increasingly affects economic outcomes, sophisticated investors are incorporating climate scenarios into their analysis frameworks. These models account for both transition risks (policy changes, technology disruption) and physical risks (extreme weather events, resource scarcity).

BlackRock estimates that portfolios without climate risk scenario analysis may underestimate risk by 15-20% in certain sectors, with potential mispricing of up to 60% for the most exposed assets by 2030.

Real-time Dynamic Scenario Adjustment

Technological advances are enabling a shift from periodic scenario reviews to continuous, real-time updating of scenario probabilities and impacts. This dynamic approach allows for faster response to emerging risks and opportunities.

JPMorgan’s Athena platform now updates scenario probabilities daily based on market movements and news flow, a process that previously occurred monthly. This 30x increase in update frequency has reduced client portfolio drawdowns by an estimated 12-18% during rapid market dislocations.

Democratization Through Fintech

New fintech platforms are making sophisticated scenario analysis tools available to individual investors and smaller advisories at a fraction of traditional costs. This democratization is leveling the playing field between retail and institutional investors.

Platforms like Riskalyze and Portfolio Visualizer now offer Monte Carlo simulations and stress testing for under $100 per month, compared to enterprise solutions costing $100,000+ annually just five years ago.

FAQs – Investment Scenario Analysis

1. How is scenario analysis different from traditional forecasting?

Traditional forecasting attempts to predict the single most likely future outcome, while scenario analysis explores multiple plausible futures. Traditional methods use central tendency (like mean or median projections), while scenario analysis deliberately explores ranges and extremes.

2. How many scenarios should be included in an effective analysis?

Most practitioners recommend 3-5 well-developed scenarios. Fewer than three fails to capture important uncertainties, while more than five becomes unwieldy for decision-making. Quality is more important than quantity—each scenario should represent a meaningfully different future.

3. What software tools are available for investment scenario analysis?

Professional options include Bloomberg Scenario Analysis, MSCI RiskMetrics, BlackRock’s Aladdin, and FactSet’s risk analytics. More affordable options for individuals and smaller firms include Portfolio Visualizer, Riskalyze, and YCharts. Excel-based Monte Carlo simulations can also be effective for less complex portfolios.

4. How frequently should scenario analysis be updated?

Major scenario reviews should occur quarterly, with probability adjustments potentially happening monthly. During periods of market stress or significant economic shifts, more frequent reviews are warranted. The key triggers for special reviews include unexpected inflation readings, central bank policy changes, geopolitical events, and significant market dislocations.

5. Can scenario analysis predict black swan events?

By definition, true black swan events are unpredictable. However, well-constructed scenario analysis can improve resilience to extreme outcomes by incorporating “gray swan” events—low-probability, high-impact scenarios that are conceivable but often ignored. The goal isn’t perfect prediction but rather building robust portfolios.

6. How do I assign probabilities to different scenarios?

Probability assignment combines quantitative analysis (historical frequencies, option-implied probabilities, statistical models) with qualitative judgment. Many practitioners use Bayesian methods to update initial probability estimates as new information emerges. Consistency checks include ensuring probabilities sum to 100% and that the weighted average of scenarios aligns with your market outlook.

7. What’s the difference between sensitivity analysis and scenario analysis?

Sensitivity analysis examines how changes in a single variable affect outcomes while holding other factors constant. Scenario analysis looks at combinations of variable changes that represent coherent future states. Sensitivity analysis answers “what if interest rates rise 1%?” while scenario analysis answers “what if we enter a stagflationary environment with rising rates, high inflation, and low growth?”

8. How can small investors implement scenario analysis without expensive tools?

Simplified scenario analysis is accessible to individual investors through:

- Free retirement calculators with Monte Carlo capabilities (Vanguard, Fidelity)

- Low-cost planning software like Portfolio Visualizer ($9.99/month)

- Excel-based models using historical data for key scenarios

- Stress-testing portfolios using publicly available economic scenarios from the Federal Reserve

9. How do institutional investors use scenario analysis differently from individuals?

Institutional investors typically employ more sophisticated approaches, including:

- Custom scenario development with dedicated economic research teams

- Integration with liability modeling (especially for pensions and insurers)

- Regulatory stress tests (particularly for financial institutions)

- Factor-based decomposition of risks across complex multi-asset portfolios

- Enterprise-wide risk integration beyond investment portfolios

10. How do I validate whether my scenario analysis is effective?

Effective validation includes:

- Back-testing: Would your model have captured past market dislocations?

- Outcome tracking: Are actual results falling within your scenario ranges?

- Peer benchmarking: How do your scenarios compare to consensus views?

- Decision quality: Is the analysis actually influencing investment decisions?

- Stress test comparison: Do your custom scenarios align with standard stress tests from organizations like CCAR and EIOPA?

Conclusion

Investment scenario analysis represents a fundamental shift from deterministic forecasting to probability-based decision-making under uncertainty. By embracing the reality that the future is inherently unpredictable, investors can build more resilient portfolios and make more nuanced strategic decisions. The discipline forces consideration of uncomfortable possibilities that might otherwise be ignored, leading to better risk management and more thoughtful opportunity assessment.

As markets grow increasingly complex and interconnected, traditional forecasting approaches become less reliable. The accelerating pace of technological, social, and environmental change creates discontinuities that historical data alone cannot navigate. In this context, sophisticated scenario analysis provides a competitive advantage by systematically exploring structural breaks and regime changes that standard models miss.

The future of investment decision-making belongs to those who can effectively balance quantitative rigor with qualitative judgment, embracing uncertainty rather than pretending to eliminate it. As scenario analysis tools become more accessible and sophisticated, the methodology will increasingly separate successful investors from those left vulnerable to predictable surprises.

For your reference, recently published articles include:

- Unlock Wall Street’s Hidden Financial Modeling Tools Now

- Portfolio Optimization Software: All You Need To Know

- Unlock Hidden Wealth: Best Investment Opportunity Screening Secrets

- Financial Advice Disclaimer Example: All You Need to Know

- Market Trend Signals: Expert Insight on How to Read Them Like the Pros

- Best Mutual Fund Analytics: Your Edge To Win Big

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.