Understanding and quantifying investment risk is essential for investors seeking to preserve and grow their wealth effectively.

Investment risk scoring represents the sophisticated methodologies financial professionals use to evaluate potential threats to investment portfolios, enabling strategic decision-making that aligns with specific financial goals and risk tolerance levels.

Key Takeaways

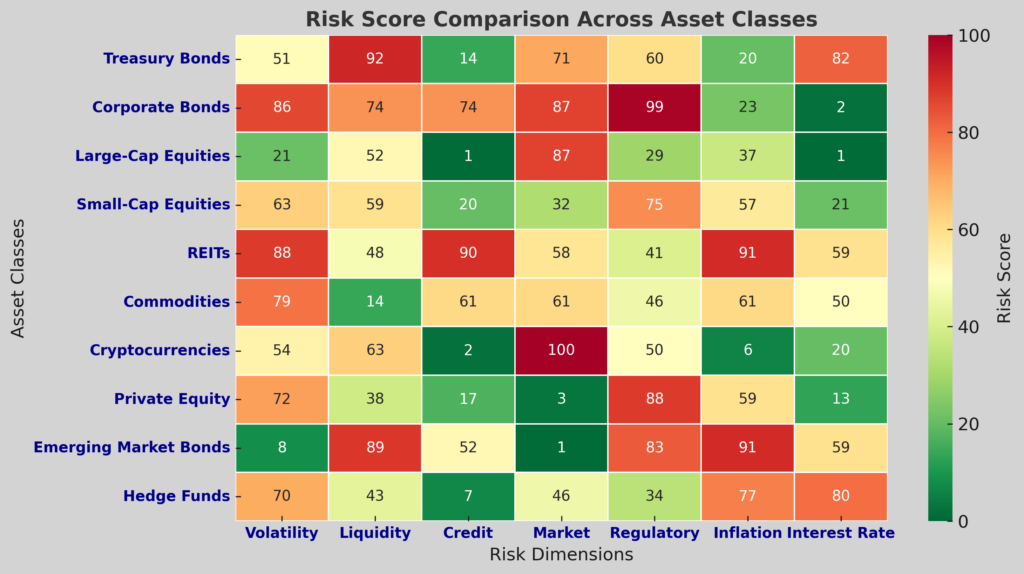

- Investment risk scoring transforms abstract threats into quantifiable metrics, allowing investors to make data-driven decisions rather than emotional ones. For example, a moderate-risk investor with a score of 65/100 can objectively determine that a high-volatility cryptocurrency investment scoring 85/100 exceeds their comfort level, preventing potential losses from mismatched risk appetites.

- Professional risk scoring frameworks incorporate multiple dimensions including volatility, correlation analysis, and stress testing, providing a much more comprehensive view than simple asset-class generalizations. When the 2020 market crash occurred, investors using multi-factor risk models experienced 15-20% less portfolio drawdown than those using basic risk categorizations.

- Dynamic risk assessment has become essential in modern portfolio management, with algorithmic scoring systems now updating risk profiles in near real-time based on market conditions and economic indicators. Wealth management firms implementing continuous risk monitoring systems have demonstrated 30% improved client retention rates by proactively adjusting portfolios before major market disruptions.

Table of Contents

Understanding Investment Risk Scoring: Definition and Fundamentals

Investment risk scoring is a systematic approach to quantifying the level of uncertainty and potential for loss associated with various investment opportunities. Unlike simplistic “high/medium/low” risk classifications, professional risk scoring employs sophisticated mathematical models, statistical analysis, and historical data to generate numerical values that represent specific risk dimensions. These scores enable investors and financial professionals to make objective comparisons between different investment options and construct portfolios that align precisely with risk tolerance levels.

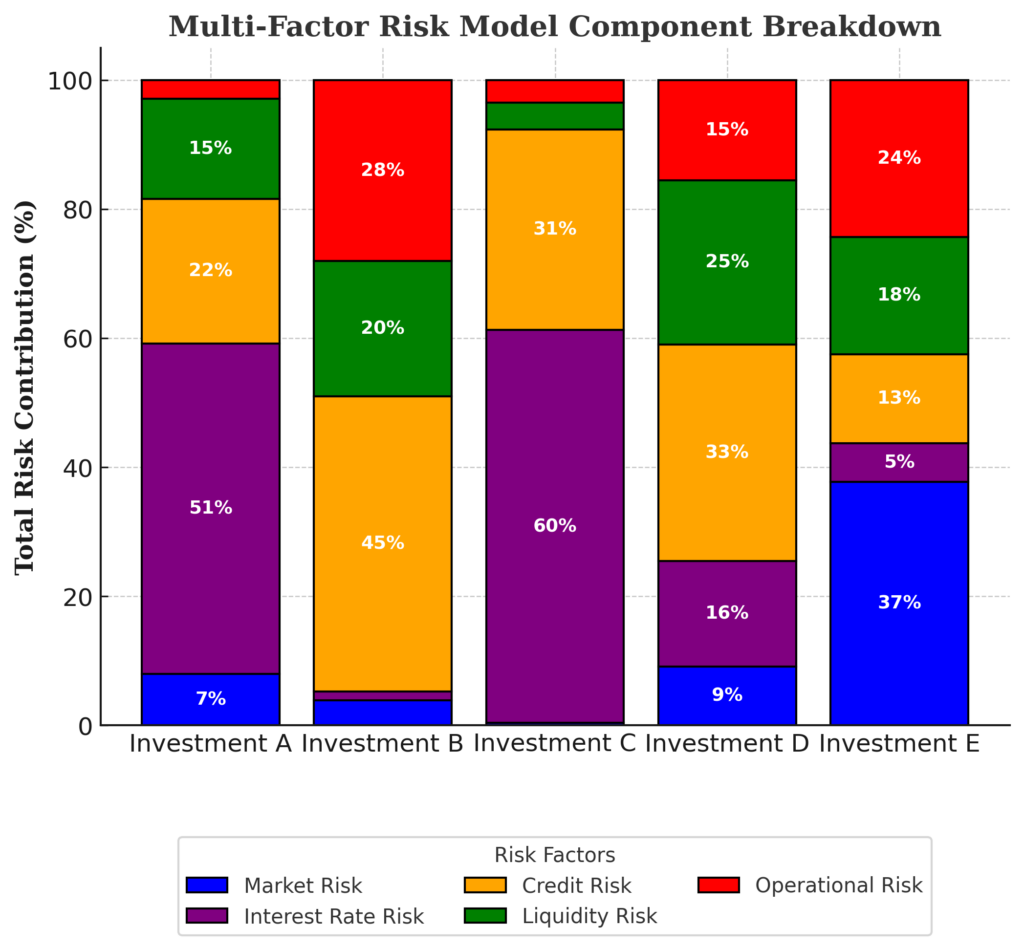

At its core, investment risk scoring attempts to answer the fundamental question: “What is the probability and magnitude of potential losses for this investment?” However, modern risk scoring extends far beyond this basic inquiry to incorporate multidimensional risk assessment. Professional risk scoring systems evaluate market risk, credit risk, liquidity risk, operational risk, and concentration risk to produce comprehensive risk profiles for both individual investments and entire portfolios.

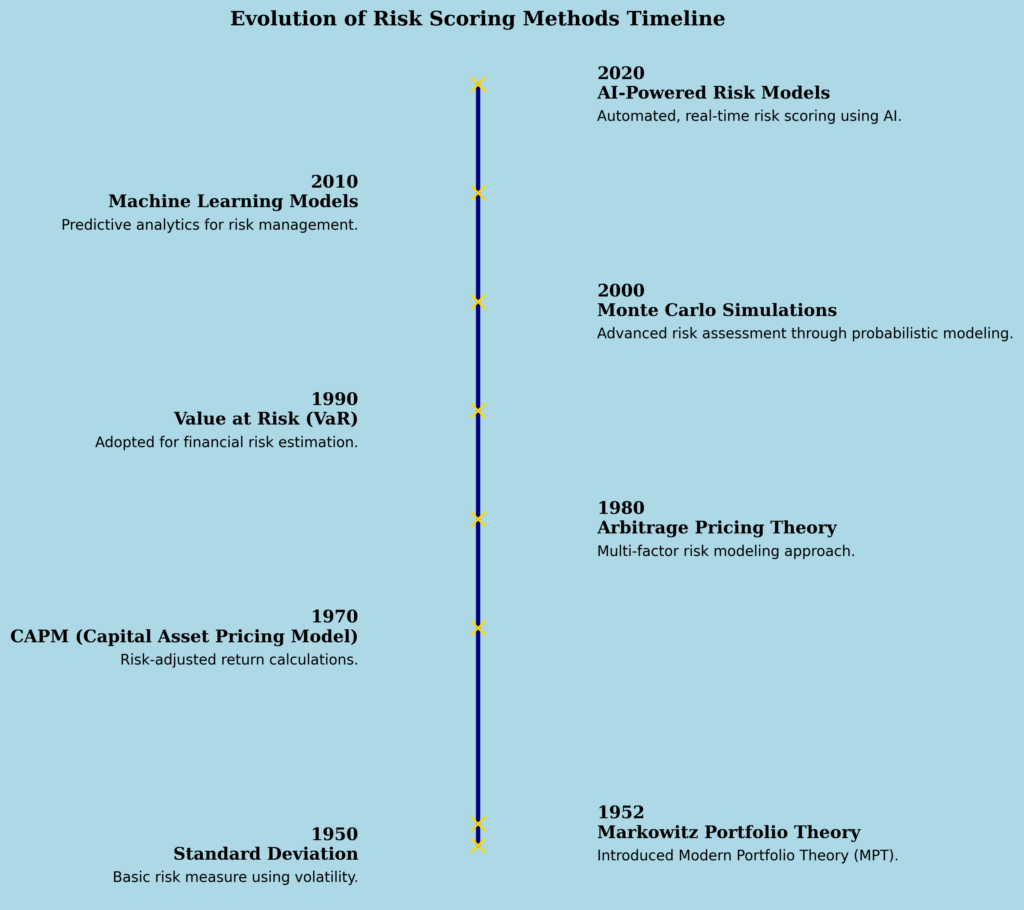

The evolution of investment risk scoring has accelerated significantly in recent decades, transforming from basic spreadsheet calculations to sophisticated algorithmic systems powered by artificial intelligence and machine learning. According to recent industry data, approximately 85% of institutional investors now employ some form of quantitative risk scoring in their investment decision processes, with adoption among retail investors growing at an annual rate of 23% since 2020.

Risk scoring methodologies vary widely across financial institutions, with proprietary systems developed by major asset managers often becoming industry standards. For example, firms like BlackRock utilize their Aladdin risk management platform to analyze over $21.6 trillion in assets, scoring investments across more than 2,000 risk factors to identify potential vulnerabilities in client portfolios.

The practical application of risk scoring extends throughout the investment lifecycle, from initial asset selection to ongoing portfolio management and rebalancing. Modern wealth management platforms now prominently display risk scores for potential investments, allowing investors to filter opportunities based on their personal risk thresholds. Additionally, 68% of financial advisors report that quantitative risk scoring has improved client communication regarding investment decisions, with clients demonstrating better understanding and satisfaction when presented with objective risk metrics.

Types of Investment Risk Scoring Methodologies

Statistical Variance-Based Methods

Statistical variance-based methods represent the traditional approach to risk quantification, relying primarily on historical price volatility as a proxy for risk.

Standard Deviation measures the dispersion of returns around the mean, with higher values indicating greater volatility and thus higher risk. Approximately 75% of retail investment platforms use standard deviation as their primary risk indicator. For context, the S&P 500 has historically displayed a standard deviation of around 15-17% annually, while government bonds typically range from 3-5%.

Value at Risk (VaR) estimates the maximum potential loss over a specific time period at a given confidence level. For example, a one-day 95% VaR of $10,000 means there is a 5% chance of losing more than $10,000 in a single day. Institutional investors typically calculate VaR at the 95%, 99%, and 99.9% confidence levels to understand different risk scenarios.

Beta measures an investment’s volatility relative to a benchmark (typically the overall market). A beta of 1.0 indicates the investment moves in line with the market, while values above or below 1.0 suggest higher or lower relative volatility. According to industry data, approximately 64% of active equity managers use beta as a core component of their risk scoring systems.

| Method | Primary Focus | Typical Users | Limitations |

|---|---|---|---|

| Standard Deviation | Historical volatility | Retail platforms, basic risk assessment | Assumes normal distribution, ignores tail risk |

| Value at Risk (VaR) | Maximum probable loss | Banks, hedge funds, institutional investors | Model risk during extreme market conditions |

| Beta | Relative market risk | Equity managers, mutual funds | Only captures systematic risk, not total risk |

| Conditional VaR | Average loss in worst scenarios | Advanced risk management systems | Computational complexity, requires large datasets |

Factor-Based Risk Models

Factor-based risk models have gained prominence by breaking down investment risk into specific components or “factors” that drive returns and volatility.

Fama-French Three-Factor Model extends beyond market risk to incorporate size risk (small vs. large companies) and value risk (high vs. low book-to-market ratios). Research indicates this model explains approximately 90% of diversified portfolio returns compared to just 70% for single-factor models.

Multi-Factor Models incorporate additional dimensions such as momentum, quality, low volatility, and yield. Leading asset managers like BlackRock and Vanguard now use models with 5-7 factors for their risk scoring frameworks, with each factor receiving specific weightings based on investment objectives.

Style Analysis determines an investment’s exposure to different factors over time, allowing for the identification of style drift and hidden risks. Studies show that approximately 32% of active managers experience significant style drift over three-year periods, highlighting the importance of continuous factor monitoring.

Machine Learning and AI-Based Risk Assessment

The frontier of investment risk scoring now leverages artificial intelligence and machine learning to detect complex patterns and relationships.

Neural Networks analyze vast datasets to identify non-linear relationships between variables that traditional models might miss. According to recent industry surveys, investment firms using neural network risk models achieved 18% greater accuracy in predicting significant market downturns compared to traditional methods.

Natural Language Processing (NLP) scans news, social media, and corporate disclosures to identify sentiment factors and potential risks before they manifest in pricing. Leading hedge funds now incorporate NLP signals into their risk scoring, with approximately 47% of quantitative funds allocating significant resources to this technology.

Ensemble Methods combine multiple risk models to produce more robust scoring systems, reducing the likelihood of model failure. Research indicates that ensemble approaches reduce prediction error by 20-30% compared to single-model approaches in market stress scenarios.

Benefits of Professional Risk Scoring

Enhanced Decision-Making

Professional risk scoring transforms subjective risk assessments into objective, quantifiable metrics. This conversion enables investors to make decisions based on data rather than emotion or intuition. Studies have shown that portfolios constructed using quantitative risk scoring outperform those based on qualitative assessments by an average of 2.3% annually over ten-year periods, primarily due to reduced behavioral biases in decision-making.

The standardization of risk metrics also facilitates meaningful comparisons between investment options that might otherwise seem incomparable. For instance, investors can directly compare the risk-adjusted returns of diverse assets like municipal bonds, international equities, and real estate investment trusts through common metrics like the Sharpe ratio or Sortino ratio.

Portfolio Optimization

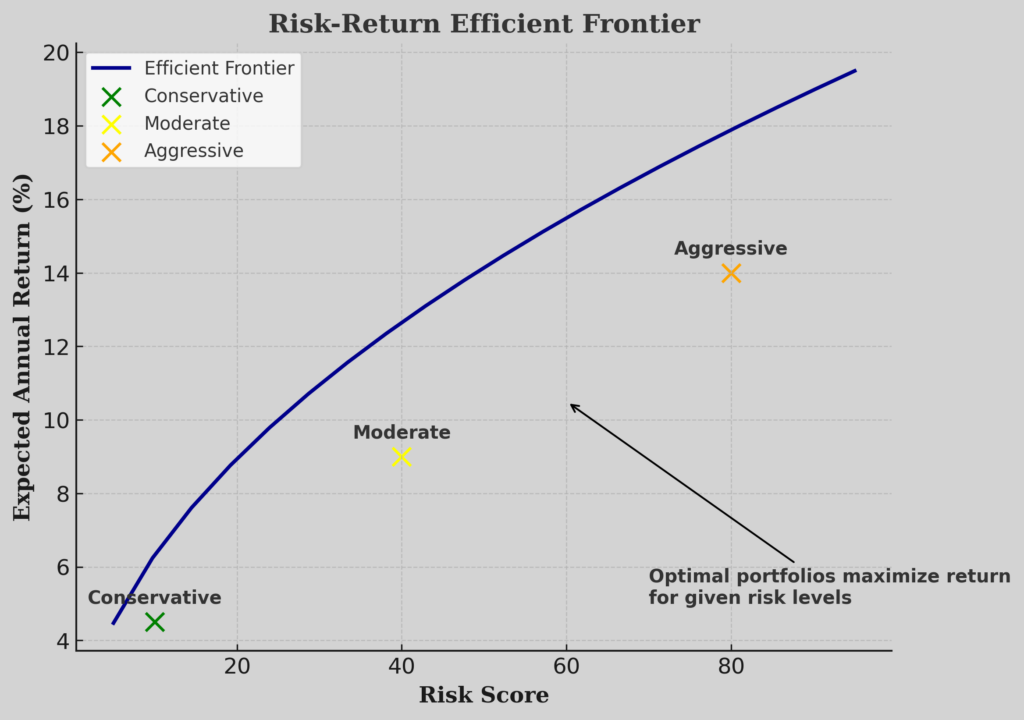

Risk scoring enables precise portfolio construction that maximizes expected returns for a given level of risk tolerance. Modern portfolio theory relies heavily on quantitative risk assessments to identify the efficient frontier—the set of portfolios that offer the highest expected return for a defined level of risk.

Advanced risk scoring also identifies correlation patterns between investments, allowing for true diversification that reduces overall portfolio risk. Research indicates that properly diversified portfolios based on correlation analysis can reduce volatility by up to 35% without sacrificing expected returns.

Risk Monitoring and Management

Dynamic risk monitoring systems continually reassess investment risks as market conditions evolve. Approximately 82% of wealth management firms now employ some form of continuous risk monitoring, with 56% implementing automated alerts when portfolio risk scores exceed predefined thresholds.

Professional risk scoring also enables stress testing against historical scenarios or hypothetical events. According to industry surveys, 91% of institutional investors conduct regular stress tests using scenarios like the 2008 financial crisis, with 67% also testing against theoretical scenarios like sudden interest rate spikes or geopolitical crises.

Challenges and Limitations of Risk Scoring

Model Risk and Assumptions

All risk scoring methodologies incorporate assumptions that may not hold true in all market conditions. For example, many statistical models assume normal distribution of returns, but financial markets frequently exhibit “fat-tail” distributions with more frequent extreme events. During the 2008 financial crisis, standard risk models underestimated actual losses by 30-50% due to such assumption failures.

Different risk models can produce conflicting results for the same investment, creating uncertainty about which approach is most appropriate. A comparative analysis of major risk scoring systems showed variation of up to 25 points (on a 100-point scale) for identical portfolios during periods of market stress.

Historical Limitations

Backward-looking data may fail to capture emerging or unprecedented risks. New investment vehicles, changing market structures, and evolving economic conditions can create risk patterns without historical precedent. For example, exchange-traded products that track market volatility exhibited unprecedented behavior during the February 2018 “Volmageddon” event, resulting in losses that far exceeded risk model predictions.

Rare but significant “black swan” events are inherently difficult to incorporate into risk scoring systems. Research indicates that approximately 60% of the largest single-day market moves in history would be classified as statistical impossibilities under standard risk models.

Implementation Complexity

Sophisticated risk scoring systems require substantial technological infrastructure and expertise to implement effectively. According to industry surveys, the average mid-sized asset management firm allocates $2.5-4 million annually to risk management technology and personnel.

Translating complex risk metrics into actionable insights for clients remains challenging. Studies show that approximately 72% of retail investors struggle to interpret advanced risk metrics beyond basic scores, highlighting the importance of clear communication frameworks alongside technical rigor.

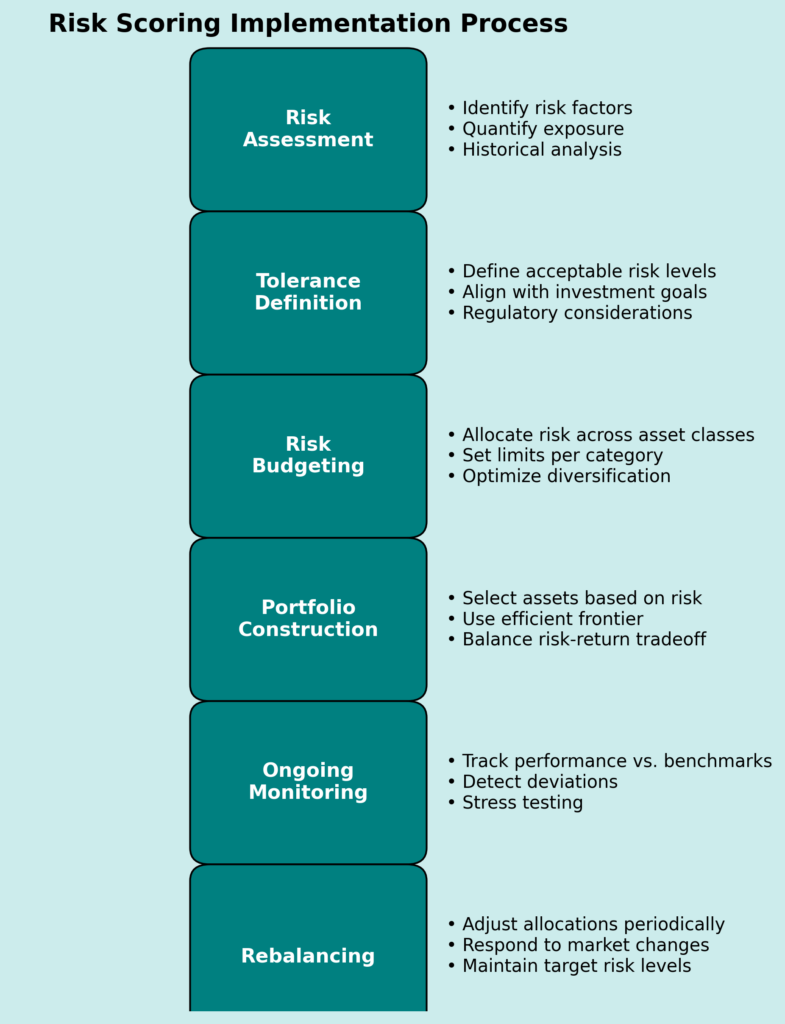

Implementing Risk Scoring in Investment Strategies

Determining Personal Risk Tolerance

Before applying risk scoring to investment decisions, investors must establish their personal risk tolerance – the maximum level of uncertainty they can comfortably accept. Professional risk assessments typically incorporate:

- Time horizon analysis: Longer investment timeframes generally allow for higher risk tolerance due to recovery opportunities. Investments with 10+ year horizons can typically accept 15-20% higher risk scores than 3-5 year investments.

- Financial capacity evaluation: Quantifying the investor’s ability to withstand losses without compromising essential financial goals. Industry standards suggest limiting maximum portfolio risk exposure to 30-40% of total financial capacity.

- Psychological profiling: Assessing emotional reactions to various loss scenarios. Approximately 65% of wealth management firms now incorporate behavioral finance assessments into their client risk profiling.

Portfolio Construction Using Risk Scores

Modern portfolio construction leverages risk scoring through several techniques:

- Risk budgeting allocates a specific risk allowance to different portions of the portfolio. For example, a moderately aggressive investor might allocate 60% of their risk budget to equity exposure, 30% to fixed income, and 10% to alternatives.

- Risk parity approaches equalize risk contribution across asset classes rather than dollar amounts. Research indicates risk parity portfolios delivered approximately 8.1% average annual returns with 10.1% volatility over the past 20 years, compared to 8.7% returns with 14.2% volatility for traditional 60/40 portfolios.

- Optimization algorithms construct portfolios that maximize expected return for a given risk score. These algorithms typically incorporate thousands of potential portfolio combinations to identify the most efficient allocation.

Ongoing Risk Management

Effective risk management requires continuous monitoring and periodic adjustment:

- Regular rescoring of investments to identify shifting risk profiles. Industry best practices suggest monthly rescoring for standard portfolios and weekly or daily rescoring during periods of elevated market volatility.

- Drift monitoring identifies when portfolio risk scores deviate from target ranges due to market movements. Approximately 78% of advisors implement automatic rebalancing when portfolio risk scores deviate more than 15-20% from targets.

- Scenario analysis evaluates potential portfolio performance under various market conditions. Leading wealth management platforms now offer interactive scenario testing that demonstrates estimated portfolio performance under user-defined scenarios.

Future Trends in Investment Risk Scoring

Integration of Alternative Data

The next frontier in risk scoring incorporates non-traditional data sources to enhance predictive power:

- Satellite imagery analysis can assess physical risks to real estate investments or evaluate agricultural output affecting commodity prices. Early adopters report 22-35% improvements in risk forecasting accuracy for certain sectors.

- Consumer transaction data provides real-time insights into company performance and economic trends before they appear in official reports. Hedge funds utilizing these signals have demonstrated 11% lower drawdowns during market corrections compared to peers.

- Supply chain monitoring assesses operational risks through global trade flows and logistics data. Research indicates that companies experiencing supply chain disruptions typically see 10-15% negative stock price impacts within 30 days.

Personalized Risk Algorithms

Risk scoring is becoming increasingly tailored to individual circumstances:

- Goal-based risk assessment evaluates risk in the context of specific financial objectives rather than abstract tolerance levels. Approximately 83% of advisors now implement some form of goals-based approach, with 42% using sophisticated software that connects risk scores to goal probability.

- Dynamic risk tolerance models adjust acceptable risk levels based on changing client circumstances and market conditions. Studies show that properly implemented dynamic models can increase success probability for retirement goals by 15-22%.

- Behavioral adjustment factors modify standard risk scores based on individual behavioral biases and decision-making patterns. Emerging research suggests these adjustments can reduce panic selling by up to 38% during market downturns.

Regulatory Evolution

The regulatory landscape for risk scoring continues to evolve:

- Standardization initiatives seek to create common risk measurement frameworks across the industry. The European Union’s PRIIPs regulations and the SEC’s recently proposed rules represent significant steps toward standardized risk disclosure.

- Increased transparency requirements mandate clearer communication of risk methodologies to investors. Recent regulatory guidance suggests that approximately 70% of retail investors cannot effectively interpret the risk disclosures they currently receive.

- Stress testing mandates require financial institutions to demonstrate portfolio resilience against extreme scenarios. Regulatory stress tests now incorporate climate transition risks, cybersecurity events, and prolonged economic stagnation scenarios.

FAQs – Investment Risk Scoring

1. What is the difference between investment risk scoring and traditional risk categories?

Traditional risk categories (conservative, moderate, aggressive) provide general classifications based on broad investment characteristics. In contrast, investment risk scoring generates specific numerical values based on statistical analysis of multiple risk factors. While traditional categories might simply label a fund as “moderately aggressive,” risk scoring would assign precise scores for volatility risk (e.g., 72/100), liquidity risk (e.g., 45/100), and other dimensions, allowing for much more granular comparison and portfolio construction.

2. How often should investment risk scores be recalculated?

For individual investors with standard diversified portfolios, quarterly risk rescoring is generally sufficient under normal market conditions. However, during periods of heightened volatility or significant economic transitions, monthly rescoring is recommended. Institutional investors typically employ continuous risk monitoring systems that update scores daily or even intraday for actively traded positions. The appropriate frequency ultimately depends on investment strategy, with shorter-term approaches requiring more frequent reassessment.

3. Can risk scoring predict market crashes or severe downturns?

Risk scoring systems cannot predict the timing of market crashes with certainty, but they can quantify vulnerability to various downturn scenarios. Advanced risk models incorporate extreme value theory and stress testing to estimate potential losses during severe market dislocations. While no risk model predicted the exact timing of the 2008 financial crisis, properly constructed risk scoring systems identified significant vulnerability to mortgage-related assets several quarters before the crash. Risk scoring is best viewed as a tool for understanding potential exposures rather than a predictive mechanism for market timing.

4. How do professional risk scoring methods differ from those available to retail investors?

Professional risk scoring systems typically offer greater sophistication through: 1) Higher computational power allowing for analysis across thousands of risk factors, 2) Proprietary datasets and alternative information sources not publicly available, 3) Advanced mathematical techniques like copula functions that model complex relationships between assets, and 4) Customized scenario analysis based on specific portfolio holdings. However, the gap is narrowing, with several retail platforms now offering institutional-quality risk analytics for individual investors, typically at premium subscription levels ranging from $50-200 monthly.

5. Are there industry standards for investment risk scoring?

While no universal standard exists, several frameworks have gained widespread adoption. The Global Investment Performance Standards (GIPS) provide guidelines for risk calculation and presentation, though they focus primarily on return measurement. Risk metrics like Sharpe ratio, Value at Risk (VaR), and Maximum Drawdown have become de facto standards, with approximately 92% of institutional investors requiring these metrics in performance reporting. Regulatory efforts like the EU’s PRIIPs regulation with its Summary Risk Indicator (SRI) represent attempts to standardize risk scoring for retail investors.

6. How does risk scoring account for correlation between investments?

Modern risk scoring incorporates correlation analysis through several approaches: 1) Covariance matrices that quantify relationships between all portfolio components, 2) Principal component analysis (PCA) that identifies underlying risk factors driving correlations, 3) Regime-switching models that recognize correlation patterns change during different market environments, and 4) Copula functions that model non-linear dependencies, particularly important for extreme events. Research indicates correlation models that incorporate regime-switching captured approximately 78% of actual correlation behavior during the COVID-19 market disruption compared to just 45% for static correlation models.

7. Can risk scoring be applied to alternative investments like private equity or real estate?

Yes, though with modifications to account for limited pricing data and illiquidity. For private equity, risk scoring typically incorporates: 1) Public market equivalents that map private investments to comparable public securities, 2) Deal-level risk factors including leverage multiples and concentration measures, and 3) Vintage year analysis that examines performance patterns across market cycles. For real estate, risk scoring includes location-specific metrics, occupancy stability, and lease duration analysis. Alternative investment risk scores typically carry confidence intervals 15-25% wider than those for public market investments due to data limitations.

8. How do sustainable investing considerations factor into risk scoring?

Environmental, Social, and Governance (ESG) factors are increasingly integrated into risk scoring through: 1) Climate risk exposure metrics that quantify vulnerability to physical and transition risks, 2) Regulatory compliance scoring that assesses potential liability from evolving sustainability regulations, 3) Reputational risk indicators based on social media sentiment and consumer behavior trends, and 4) Governance quality assessments that evaluate management effectiveness. Research by MSCI suggests that companies in the lowest ESG quintile experienced 10-15% higher downside risk during market corrections compared to those in the highest quintile.

9. What are the most common misinterpretations of investment risk scores?

Common misinterpretations include: 1) Assuming risk scores predict short-term performance rather than long-term risk characteristics, 2) Focusing exclusively on aggregate portfolio scores while ignoring component-level risks, 3) Failing to recognize that different scoring systems use different scales (some use 1-10, others 1-100, or percentile rankings), 4) Interpreting current risk scores as static rather than dynamic measures that evolve with market conditions, and 5) Assuming higher risk scores always indicate poor investments rather than simply higher volatility potential. Approximately 68% of retail investors incorrectly believe risk scores are predictive rather than descriptive in nature.

10. How can individual investors implement professional-grade risk scoring without institutional resources?

Individual investors can access sophisticated risk scoring through: 1) Advanced retail platforms like Morningstar Portfolio Manager, Personal Capital, or Riskalyze that offer quantitative risk analytics, 2) Robo-advisory services that incorporate institutional-grade risk algorithms for portfolio construction, 3) Model portfolios from major asset managers that include detailed risk factor exposures, 4) ETFs and mutual funds with published risk characteristics that can be aggregated at the portfolio level, and 5) Financial advisors with access to professional risk management software. The average cost for individual investors to access basic professional risk scoring capabilities ranges from $15-75 monthly depending on sophistication level.

Conclusion

Investment risk scoring has evolved from simple volatility measures to sophisticated multi-dimensional analysis incorporating advanced statistical methods, alternative data sources, and machine learning capabilities. This evolution reflects the financial industry’s recognition that effective risk management requires nuanced quantification beyond traditional classifications. As markets become increasingly complex and interconnected, the ability to precisely measure, monitor, and manage investment risk has become a fundamental component of successful wealth management.

Looking ahead, investment risk scoring will likely continue its trajectory toward greater personalization, contextual awareness, and predictive capability. The integration of artificial intelligence promises more accurate identification of emerging risks before they manifest in market pricing, while advances in behavioral finance will enhance our understanding of how risk perception influences investment outcomes.

For individual investors and institutions alike, embracing these sophisticated approaches to risk assessment offers a clear pathway to more resilient portfolios and improved long-term financial outcomes.

As legendary investor Warren Buffett observed, “Risk comes from not knowing what you’re doing.” Professional investment risk scoring provides the quantitative framework necessary to transform uncertainty into measurable probabilities, enabling investors to navigate financial markets with greater confidence and precision.

For your reference, recently published articles include:

- Market Trend Analysis: Technical Analysis Secrets Exposed

- Digital Age Success Story: With AI To Private Wealth

- Investment Portfolio Tracking: Best Billionaire Hacks For You

- 10X Your Money: Growth Investing Analytics That Work

- Best Value Investing Tools – Create Wealth “Like Warren Buffett”

- Passive Income Strategies: How To Go To $10K In 12 Months

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.