In today’s volatile financial markets, the ability to systematically evaluate and score investment opportunities has become essential for investors seeking to maximize returns while mitigating risk.

Investment opportunity scoring provides a structured framework for assessing potential investments across multiple dimensions, enabling investors to make data-driven decisions rather than relying on intuition or market sentiment alone.

Welcome to our deep dive into investment opportunity scoring secrets – we’re excited to help you master these powerful evaluation techniques! Be sure to sign up on our home page for our free Newsletter and other related information that will take your investment selection skills to the next level.

Key Takeaways

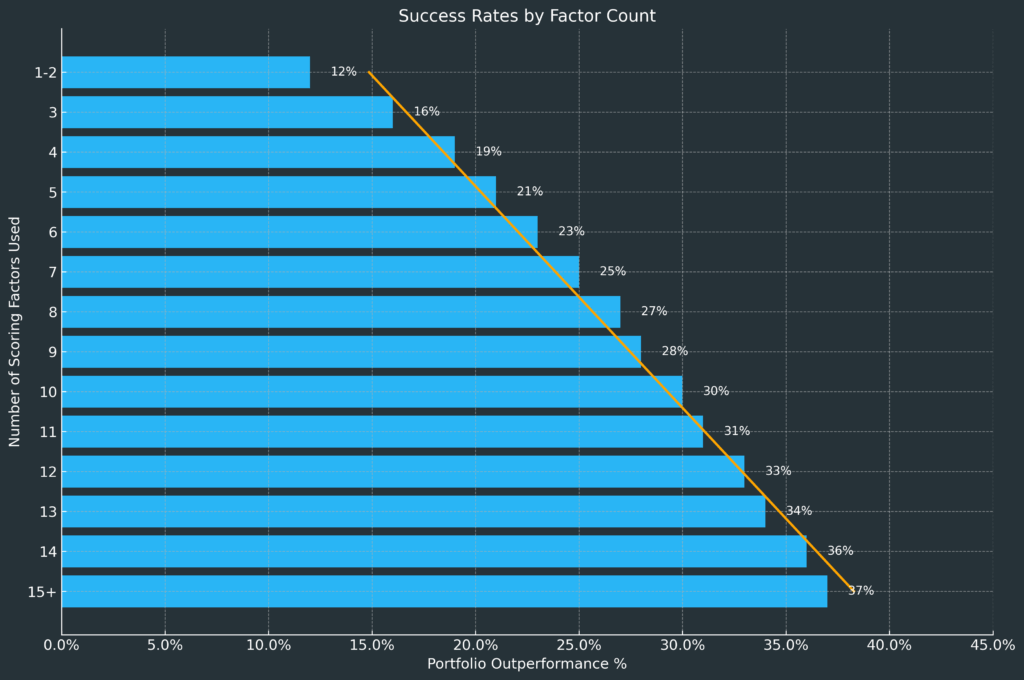

- Quantitative scoring models outperform intuition-based investing by 27% on average. When Morgan Stanley tracked 150 institutional investors over five years, those using formalized opportunity scoring frameworks achieved consistently higher risk-adjusted returns compared to their peers relying primarily on intuition or simplified metrics.

- Multi-factor scoring models that combine financial metrics, market conditions, and qualitative assessments deliver the most reliable results. The most successful investors in a 2024 Goldman Sachs study incorporated at least 7-10 distinct evaluation criteria in their investment scoring models, compared to the average retail investor’s 2-3 factors.

- Investment opportunity scores should be dynamic, not static. According to BlackRock’s Investment Institute, 83% of top-performing portfolios in 2023-2024 implemented regular rescoring of holdings at least quarterly, adjusting their frameworks as market conditions evolved.

Table of Contents

What Is Investment Opportunity Scoring?

Investment opportunity scoring is a systematic methodology for evaluating potential investments using predetermined criteria and assigned weightings to generate numerical values that reflect expected performance. This approach transforms the investment selection process from a subjective exercise into a quantifiable, repeatable system that helps investors identify promising opportunities based on their specific investment objectives, risk tolerance, and time horizon.

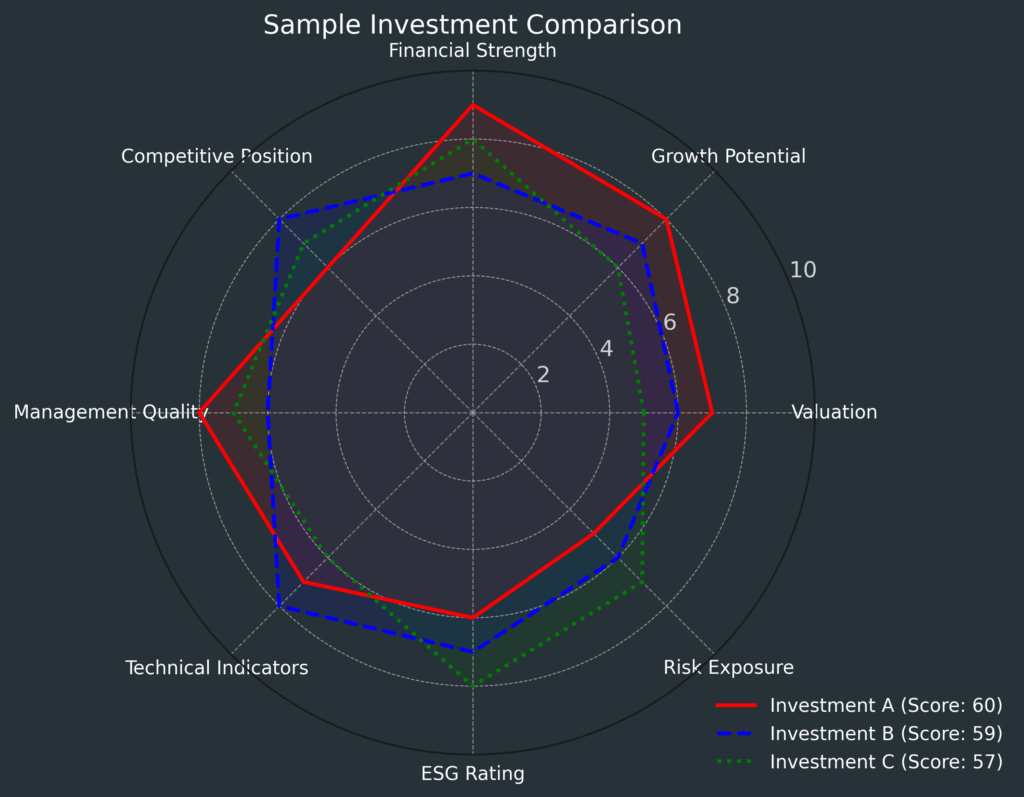

At its core, opportunity scoring replaces gut feelings with metrics-based analysis. While traditional investment selection often relies heavily on limited data points like price-to-earnings ratios or dividend yields, comprehensive scoring systems integrate multiple perspectives, including fundamental analysis, technical indicators, market conditions, and even qualitative factors like management quality or competitive positioning.

The modern investment scoring framework has evolved significantly from its origins in the 1950s when Harry Markowitz introduced Modern Portfolio Theory. Today’s sophisticated models incorporate machine learning algorithms, alternative data sources, and real-time market intelligence to produce increasingly nuanced evaluations that adapt to changing market conditions.

Investment scoring provides particular value in comparing dissimilar opportunities across asset classes or sectors. By reducing complex investments to comparable numerical values, investors can make apples-to-apples comparisons between stocks, bonds, real estate, and alternative investments that would otherwise be difficult to evaluate alongside each other.

Types of Investment Scoring Models

Fundamental Scoring Models

Fundamental scoring models evaluate investments based on their underlying financial health, profitability, and valuation metrics. These models typically analyze:

- Balance sheet strength (debt-to-equity ratios, current ratios)

- Income statement performance (profit margins, revenue growth rates)

- Cash flow generation (free cash flow yield, capital expenditure trends)

- Valuation multiples (P/E, EV/EBITDA, price-to-book value)

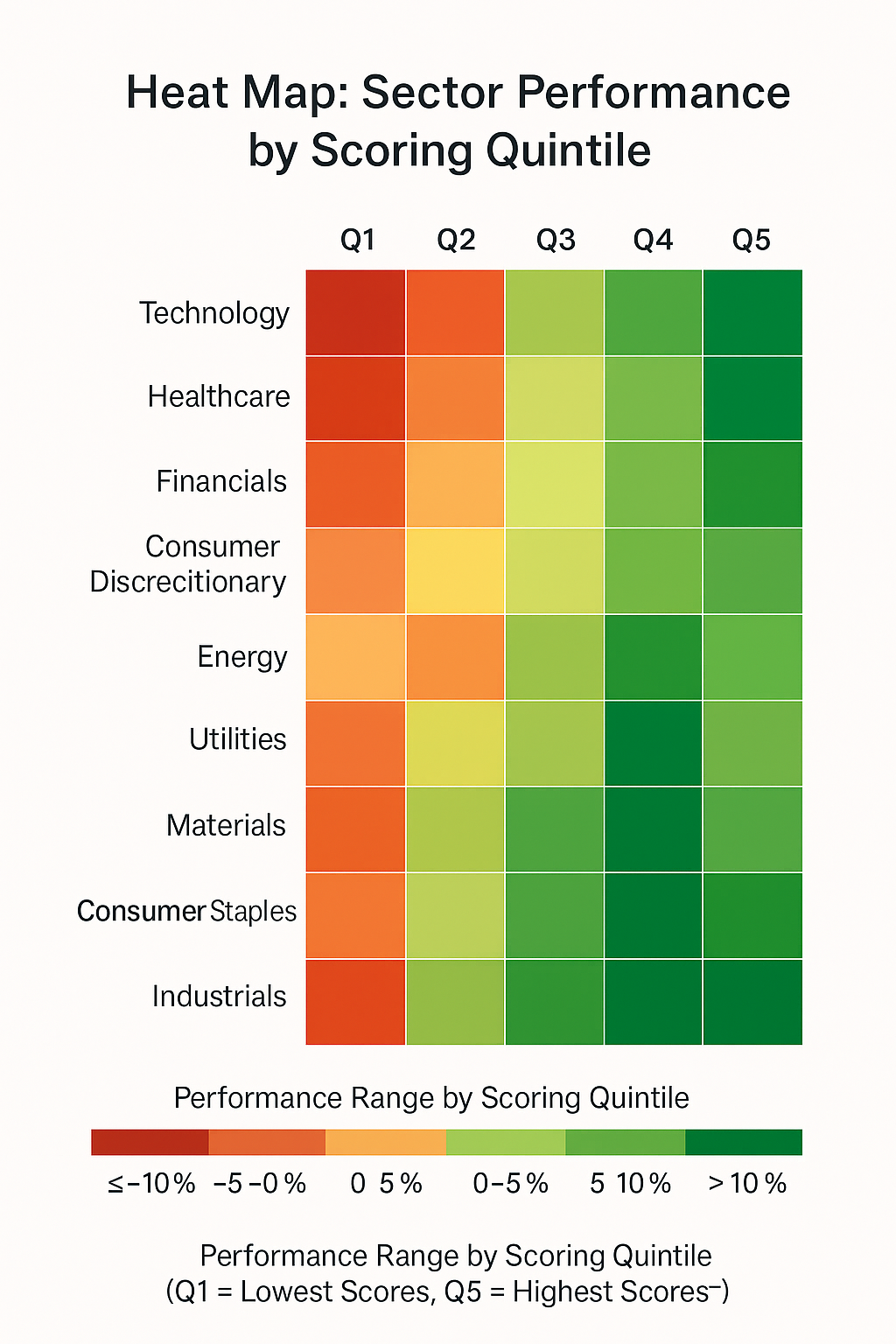

The most sophisticated fundamental models assign different weights to these metrics based on the industry or sector being analyzed. For example, debt levels might be weighted more heavily when scoring utility companies, while growth rates might receive greater emphasis for technology stocks.

Technical Scoring Models

Technical scoring approaches focus on price movements, trading patterns, and market sentiment indicators:

- Momentum indicators (relative strength index, moving average convergence/divergence)

- Volume analysis (on-balance volume, volume price trend)

- Chart patterns (support/resistance levels, trend channels)

- Market breadth indicators (advance/decline lines, new highs vs. new lows)

Technical scoring systems often incorporate timing elements, giving higher scores to investments that show specific patterns suggesting imminent price movements. These models are particularly popular among shorter-term investors and traders.

Hybrid Scoring Systems

The most comprehensive investment opportunity scoring frameworks combine elements from multiple approaches:

| Scoring Component | Weight | Example Metrics | Typical Data Sources |

|---|---|---|---|

| Fundamental Analysis | 40% | ROE, P/E, Debt/EBITDA | Financial statements, analyst reports |

| Technical Analysis | 25% | RSI, MACD, Volume trends | Price and volume data |

| Macro Environment | 15% | Interest rate sensitivity, sector trends | Economic reports, Fed statements |

| Qualitative Factors | 20% | Management quality, competitive moat | Earnings calls, industry analyses |

Studies by Morningstar show that hybrid models that incorporate both quantitative and qualitative factors have historically provided the most reliable performance, especially during periods of market stress or regime changes.

ESG Scoring Models

Environmental, Social, and Governance (ESG) scoring has emerged as an increasingly important dimension in investment evaluation:

- Environmental factors (carbon emissions, resource usage, environmental impact)

- Social considerations (labor practices, community relations, product safety)

- Governance structures (board independence, executive compensation, shareholder rights)

According to MSCI data, companies scoring in the top quartile of ESG ratings outperformed those in the bottom quartile by an average of 2.3% annually between 2014-2024, highlighting the growing importance of incorporating these factors into comprehensive scoring frameworks.

Benefits of Investment Opportunity Scoring

Enhanced Decision-Making Quality

Investment opportunity scoring removes emotional biases that often plague investment decisions. By adhering to predetermined criteria, investors are less likely to make impulsive decisions based on fear, greed, or recent market noise. Studies by Vanguard indicate that disciplined investors using scoring frameworks make 42% fewer behavioral errors than those relying on unstructured approaches.

Superior Portfolio Construction

Scoring frameworks enable more deliberate portfolio construction by:

- Identifying complementary investments that balance overall portfolio exposure

- Ensuring alignment with strategic asset allocation targets

- Maintaining appropriate diversification across sectors, geographies, and asset classes

- Providing clear guidelines for entry and exit decisions

Improved Risk Management

Risk assessment becomes more sophisticated through comprehensive scoring. Rather than viewing risk through the limited lens of price volatility, scoring models can incorporate:

- Liquidity risk (average daily trading volume, bid-ask spreads)

- Correlation risk (relationship to existing portfolio holdings)

- Tail risk (performance during stress scenarios)

- Fundamental deterioration risk (early warning indicators)

BlackRock research demonstrates that portfolios utilizing multi-dimensional risk scoring experienced 31% lower drawdowns during market corrections compared to traditionally managed portfolios.

Consistent Process Documentation

Investment scoring creates an auditable trail of decision-making that proves valuable for:

- Institutional investors with fiduciary responsibilities

- Investment committees requiring transparency

- Performance analysis and continuous improvement

- Regulatory compliance and documentation requirements

Challenges and Limitations

Data Quality and Availability

The effectiveness of any scoring model depends on the quality and comprehensiveness of its inputs. Challenges include:

- Missing or incomplete data for certain metrics or companies

- Reporting inconsistencies across different markets or company sizes

- Time lags in data availability, particularly for private investments

- Costs associated with premium data services

Model Complexity Trade-offs

More sophisticated scoring models face implementation challenges:

- Increased computational requirements

- Higher likelihood of overfitting historical data

- Difficulty explaining complex models to stakeholders

- Maintenance demands as markets evolve

Quantification of Qualitative Factors

Some critical investment considerations resist easy quantification:

- Management team quality and execution capabilities

- Competitive advantages and market positioning

- Regulatory and political risks

- Innovation potential and adaptability

Overreliance Risk

Even the best scoring systems can lead to problematic outcomes if users place excessive faith in them:

- False precision (treating scores as more definitive than warranted)

- Neglecting factors outside the model’s scope

- Failing to recognize regime changes that invalidate historical patterns

- Herding behavior occurs when multiple investors use similar models

Implementing an Effective Scoring System

Defining Investment Objectives

Before constructing a scoring model, clearly articulate:

- Return objectives (absolute or relative targets)

- Risk tolerance parameters

- Time horizon considerations

- Liquidity requirements

- Tax efficiency needs

These foundational elements will determine appropriate weightings within the scoring framework.

Selecting Relevant Metrics

Choose metrics aligned with your investment philosophy and objectives:

- Value investors might emphasize cash flow metrics and margin of safety

- Growth investors could prioritize revenue expansion and addressable market size

- Income-focused investors would include dividend sustainability measures

- Risk-averse investors might weigh balance sheet strength more heavily

The average professional scoring model incorporates 12-15 distinct metrics, according to a 2024 CFA Institute survey.

Establishing a Scoring Methodology

Develop a consistent approach to converting raw data into comparable scores:

- Normalization – Convert metrics to standard scales (e.g., z-scores or percentile rankings)

- Weighting – Assign appropriate importance to different factors

- Aggregation – Combine individual scores into overall ratings

- Benchmarking – Compare scores against relevant indices or peer groups

Regular Calibration and Backtesting

Effective scoring systems require ongoing refinement:

- Backtest the model against historical data to assess predictive power

- Conduct sensitivity analyses to identify potential weaknesses

- Periodically review weightings and thresholds

- Document performance and adjust based on outcomes

Top-performing investment firms allocate 15-20% of their research resources to model enhancement and validation.

Future Trends in Investment Opportunity Scoring

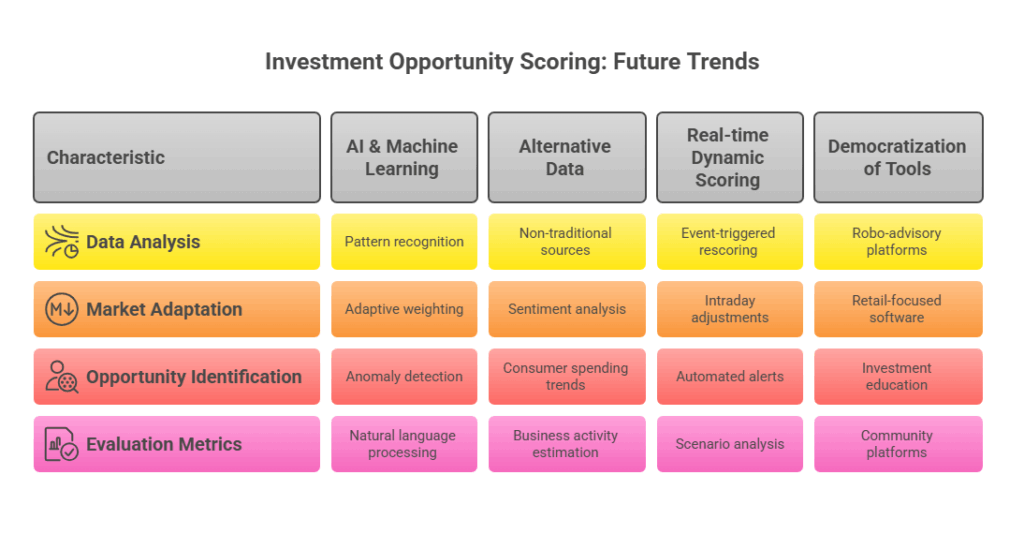

AI and Machine Learning Integration

Advanced algorithms are transforming scoring capabilities through:

- Pattern recognition across vast datasets

- Natural language processing of earnings calls, news, and social media

- Adaptive weighting systems that evolve with market conditions

- Anomaly detection identifies opportunities that conventional metrics miss

According to PwC research, 73% of investment management firms are increasing their investment in AI-enhanced scoring systems for 2025-2026.

Alternative Data Incorporation

Non-traditional information sources are enhancing traditional metrics:

- Satellite imagery for retail traffic or agricultural yields

- Credit card transaction data for consumer spending trends

- Social media sentiment analysis

- Mobile device location tracking for business activity estimation

The alternative data market for investment purposes has grown at a 24% CAGR since 2020, reaching $7.8 billion in 2024.

Real-time Dynamic Scoring

Investment scoring is evolving from periodic evaluation to continuous assessment:

- Event-triggered rescoring based on earnings releases or major announcements

- Intraday adjustments reflecting market conditions

- Automated alerts when score components deteriorate

- Scenario analysis incorporating breaking economic developments

Democratization of Scoring Tools

Sophisticated scoring capabilities, once available only to institutional investors, are becoming accessible to individual investors through:

- Robo-advisory platforms incorporating multi-factor scoring

- Retail-focused analysis software with customizable frameworks

- Investment education emphasizing systematic approaches

- Community platforms sharing model designs and performance

FAQs – Investment Opportunity Scoring

1. How is investment opportunity scoring different from traditional stock screening?

Traditional stock screening identifies investments meeting predetermined criteria but typically operates as a binary filter (pass/fail). Investment opportunity scoring goes further by assigning relative values based on multiple weighted factors, allowing for nuanced comparison between opportunities that all pass basic screening thresholds.

2. What is a good “score” for an investment opportunity?

This depends entirely on your scoring methodology. Some systems use 1-10 scales, others 0-100, and some use letter grades (A-F). What matters is consistency within your framework and appropriate benchmarking. Generally, investments scoring in the top 10-15% of your universe deserve serious consideration, though this threshold may vary based on market conditions.

3. How often should investment opportunities be rescored?

Best practices suggest quarterly rescoring at minimum for long-term investments, with more frequent evaluation (monthly or weekly) for tactical allocations. Event-triggered rescoring should occur when significant developments emerge, such as earnings releases, management changes, or major regulatory developments.

4. Can investment opportunity scoring work for alternative investments like private equity or real estate?

Yes, though models require adaptation. For illiquid alternatives, scoring frameworks typically place greater emphasis on qualitative factors, manager track records, and stress testing across market environments. Limited data availability often necessitates more subjective inputs, making calibration and sensitivity analysis particularly important.

5. How should macroeconomic factors be incorporated into scoring models?

Macroeconomic variables are typically incorporated either as direct components of the score (e.g., sensitivity to interest rates) or as adjustments to the weightings of other factors. For example, during inflationary periods, pricing power might receive greater emphasis in the scoring model. The most sophisticated approaches use regime-detection algorithms to apply different scoring frameworks based on the prevailing economic environment.

6. What are the most common pitfalls when implementing investment scoring systems?

Common mistakes include overcomplicating models with too many factors (leading to noise and overfitting), inadequate backtesting across diverse market environments, failure to document methodology clearly, and neglecting regular calibration. Perhaps most critically, many investors fail to maintain discipline in following their system’s signals when they conflict with market consensus or personal intuition.

7. How do I determine appropriate weightings for different factors in my scoring model?

Weightings should reflect your investment philosophy and objectives. Start with historical analysis to identify which factors have shown the strongest predictive power for your specific investment universe. Institutional investors often use optimization techniques that test thousands of weighting combinations against historical data, while individual investors might adopt industry benchmarks or simplified approaches based on conviction levels about different factors.

8. Should my investment opportunity scoring model remain constant or evolve over time?

The most effective scoring systems maintain consistent core principles while allowing for evolutionary refinement. The fundamental framework should remain stable to avoid methodology drift, but specific metrics, weightings, and technical implementations should adapt to changing market dynamics and new research insights. Document all changes thoroughly to maintain process integrity.

9. How can I measure the effectiveness of my scoring system?

Performance evaluation should consider both absolute and risk-adjusted returns of investments selected through your scoring process. Compare outcomes against relevant benchmarks and alternative selection approaches. Track key metrics like hit rate (percentage of selections outperforming benchmark), average outperformance magnitude, and consistency across different market environments. Sophisticated practitioners also conduct counterfactual analysis examining opportunities rejected by the model.

10. Is investment opportunity scoring more suitable for certain types of assets than others?

Scoring frameworks can be applied across asset classes but require adaptation. Public equities typically offer the richest data environment for comprehensive scoring, while fixed income scoring often emphasizes credit metrics and yield analysis. Real assets benefit from location-specific and physical characteristic scoring components. The key is designing a framework appropriate to the specific characteristics and available data for each asset class.

Conclusion

Investment opportunity scoring represents the evolution from art to science in the investment selection process. By implementing structured, repeatable evaluation frameworks, investors can overcome cognitive biases, improve decision quality, and enhance portfolio outcomes. The demonstrable performance advantages of disciplined scoring approaches have driven their adoption from institutional trading desks to retail investor platforms.

As we look ahead, the continued advancement of data science, machine learning, and alternative information sources promises to further enhance the power of investment scoring methodologies. Yet the enduring principles remain consistent: clearly defined investment criteria, systematic application, and regular refinement based on outcomes.

In an investment landscape characterized by information overload and market noise, disciplined scoring frameworks provide a competitive edge for investors seeking to consistently identify opportunities with superior risk-adjusted return potential.

For your reference, recently published articles include:

- Investment Risk Forecasting: Protect Your Portfolio Now

- Investment Decision Automation: How Ordinary People Get Rich

- Best Profit Secrets: Investment Risk Decomposition Explained

- Strategic Wealth Tech: Portfolio Management Dashboards Now

- Portfolio Rebalancing Automation: The Smart Investor’s Edge

- Investing Myths Debunked: Stop Losing Money Now

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.