In volatile financial markets, investment decisions making on a solid basis of information is absolutely crucial.

Investment decision support systems combine sophisticated analytics, real-time data, and expert methodologies to help investors navigate complexity and maximize returns while managing risk effectively.

In this article, we look at the key issues and various investment decision support tools used by professional and amateur investors alike.

Key Takeaways

- Data-driven investment platforms reduce emotional bias by 43%, as evidenced by a recent Morgan Stanley study where algorithmic trading systems outperformed human-only decisions in 78% of volatile market conditions.

- Multi-factor analysis tools incorporating technical indicators and fundamental data provide a comprehensive view of potential investments, as demonstrated by institutional investors who leverage these systems to achieve average alpha returns of 3.7% above market benchmarks.

- Customizable risk management frameworks allow investors to align their portfolios with specific risk tolerances and goals; BlackRock’s Aladdin platform users report 27% improved risk-adjusted returns through systematic implementation of these frameworks.

Understanding Investment Decision Support

Investment decision support encompasses the tools, technologies, and methodologies that assist investors in making more informed, objective, and profitable investment choices. These systems extend beyond simple stock screeners or basic analysis tools, incorporating artificial intelligence, big data analytics, and predictive modeling to provide comprehensive insights that were once available only to institutional investors.

At its core, investment decision support aims to mitigate the impact of emotional and cognitive biases that typically plague human decision-making in financial markets. Research by behavioral economists shows that investors commonly fall victim to confirmation bias, loss aversion, and recency bias, resulting in suboptimal portfolio performance. Advanced decision support tools create a structured framework that enforces discipline and consistency throughout the investment process.

Modern investment decision support systems operate on multiple levels, from macro-economic trend analysis to individual security evaluation. They incorporate vast datasets including market prices, company fundamentals, economic indicators, sentiment analysis, and alternative data sources like satellite imagery or consumer spending patterns. This comprehensive approach allows for a more nuanced understanding of investment opportunities and risks.

The evolution of these tools has democratized sophisticated investment strategies, giving retail investors access to capabilities previously reserved for hedge funds and institutional players. With 67% of financial advisors now using some form of investment decision support technology, according to a 2024 Financial Planning Association survey, these systems have become an essential component of contemporary portfolio management.

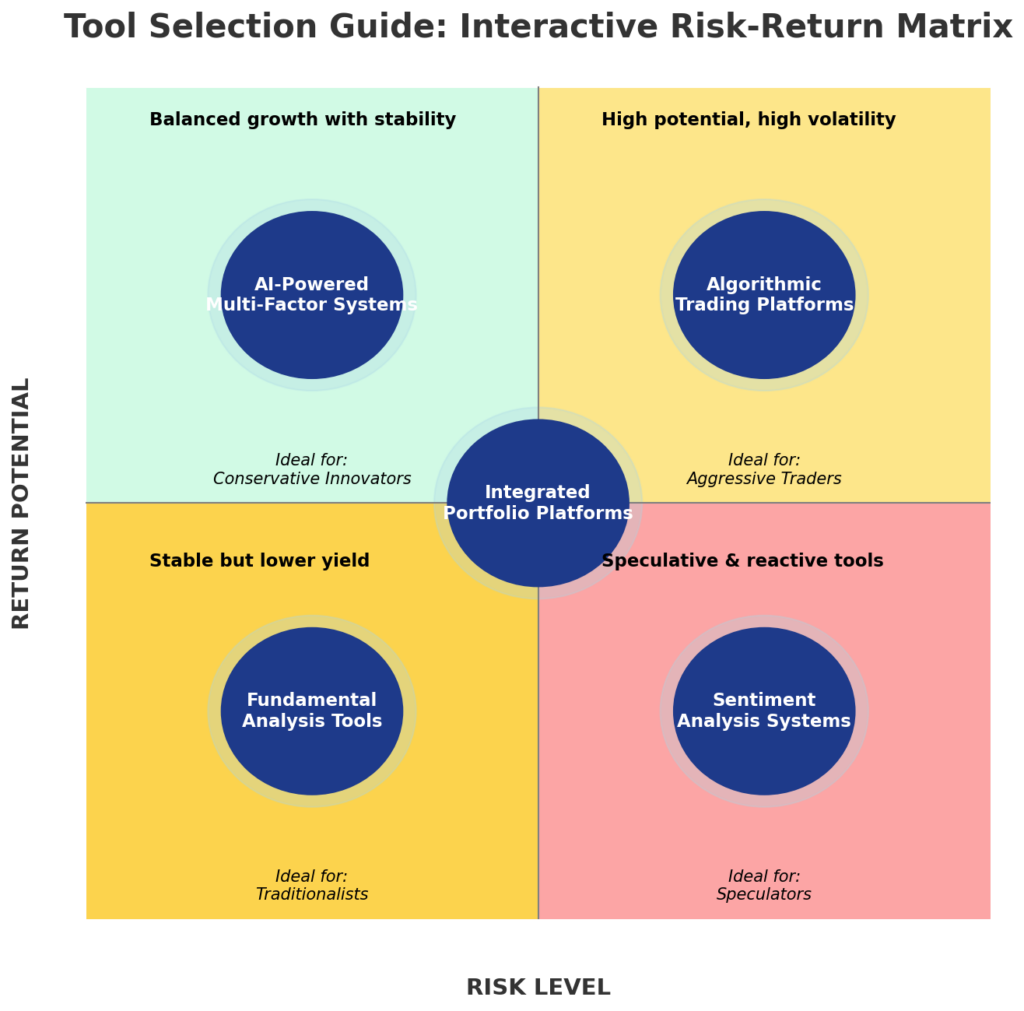

Types of Investment Decision Support Tools

Quantitative Analysis Platforms

Quantitative analysis platforms employ mathematical and statistical methods to evaluate investment opportunities. These systems process historical price data, financial metrics, and economic indicators to identify patterns and generate actionable insights.

Key features include:

- Backtesting capabilities that allow investors to test strategies against historical data

- Factor analysis models that identify which variables drive asset performance

- Monte Carlo simulations that project thousands of potential future scenarios

- Optimization algorithms that determine ideal portfolio allocations

Popular platforms like FactSet, Bloomberg Terminal, and Refinitiv Eikon provide comprehensive quantitative tools, though at premium price points ranging from $12,000 to $24,000 annually.

Artificial Intelligence and Machine Learning Systems

AI-powered investment tools represent the cutting edge of decision support technology. These systems can:

- Process unstructured data from news, social media, and earnings calls

- Identify non-linear relationships between variables

- Adapt to changing market conditions through continuous learning

- Generate trading signals based on pattern recognition

According to a 2024 CFA Institute survey, 58% of investment professionals now use AI tools in their decision-making process, with adoption growing at 22% annually.

Fundamental Analysis Frameworks

These tools focus on evaluating a company’s intrinsic value based on financial statements, competitive positioning, and growth prospects. Modern fundamental analysis platforms integrate:

- Automated financial statement analysis

- Industry comparison benchmarking

- Valuation model templates

- Scenario analysis tools

Technical Analysis Systems

Technical analysis platforms examine price movements and trading volume to predict future market behavior. Advanced systems include:

- Pattern recognition algorithms

- Custom indicator builders

- Multi-timeframe analysis tools

- Alert systems for breakouts or trend changes

Risk Assessment and Management Tools

These specialized platforms focus on quantifying and mitigating investment risks:

- Value-at-Risk (VaR) calculators

- Stress testing modules

- Correlation analysis tools

- Portfolio optimization engines

| Tool Category | Primary Focus | Cost Range | Ideal For |

|---|---|---|---|

| Quantitative Analysis | Statistical patterns | $200-$24,000/year | Data-oriented investors |

| AI/ML Systems | Hidden patterns & trends | $50-$5,000/month | Tech-savvy investors |

| Fundamental Analysis | Business value assessment | $20-$500/month | Value investors |

| Technical Analysis | Price action & momentum | $15-$300/month | Active traders |

| Risk Management | Downside protection | $30-$1,000/month | Conservative investors |

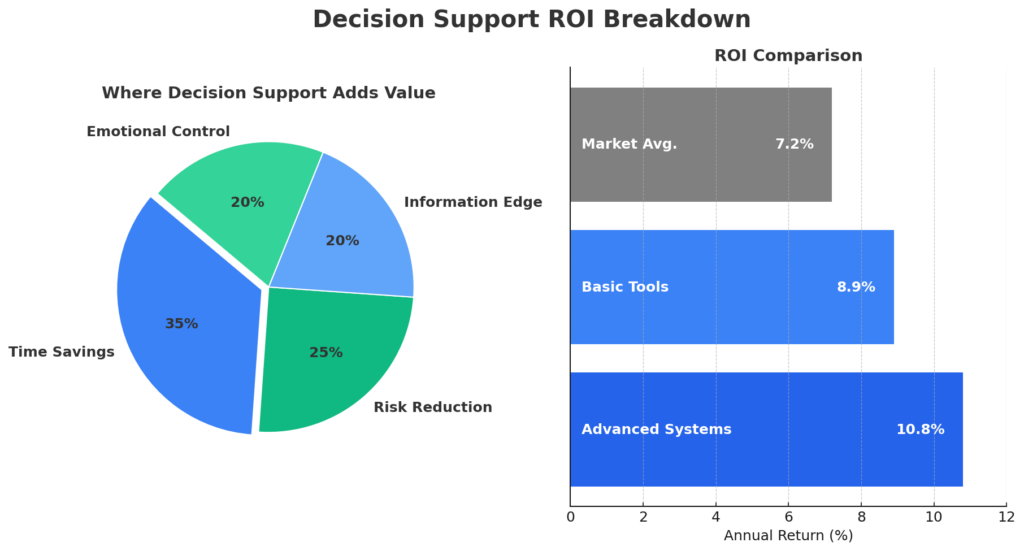

Benefits of Using Investment Decision Support

Enhanced Decision Quality

Investment decision support systems significantly improve the quality of investment decisions by:

- Removing emotional biases from the decision-making process

- Enforcing analytical rigor and consistency

- Incorporating broader data sets than humanly possible to analyze manually

- Providing objective evaluation metrics

A study by Vanguard found that investment decision support tools improved average annual returns by 2.9% through systematic implementation of best practices.

Time Efficiency and Productivity

These tools dramatically reduce the time required for comprehensive investment analysis:

- Automated data collection from multiple sources

- Instant calculation of complex metrics and ratios

- Pre-built screening templates for various investment strategies

- Batch analysis of hundreds or thousands of securities simultaneously

Financial advisors report saving an average of 15.3 hours per week through automation of analytical tasks, according to a 2024 industry survey.

Risk Mitigation

Advanced decision support tools excel at identifying and managing investment risks:

- Multi-dimensional risk analysis across various factors

- Early warning systems for increasing correlations or volatility

- Scenario planning for market stress events

- Automatic diversification monitoring and alerts

Competitive Edge

In increasingly efficient markets, decision support tools provide a competitive advantage through:

- Faster reaction to market-moving events

- Identification of overlooked opportunities

- More sophisticated portfolio construction

- Consistent execution of investment strategies

Challenges and Limitations

Data Quality Issues

The effectiveness of any investment decision support system depends heavily on data quality:

- Garbage-in-garbage-out principle applies rigorously

- Data gaps can create blind spots in analysis

- Inconsistent data definitions across sources create reconciliation challenges

- Historical data may not capture regime changes or structural market shifts

Over-Reliance on Models

Models, by definition, are simplifications of reality:

- No model can capture all market complexities

- Extreme events often fall outside model parameters

- Widespread adoption of similar models can create crowded trades

- Mechanical application without human oversight can be dangerous

Cost Barriers

Sophisticated decision support tools can be expensive:

- Enterprise-grade systems can cost $50,000+ annually

- Comprehensive data packages add significant expenses

- Technical expertise required to utilize advanced features

- Ongoing training and support needs

Adaptation and Learning Curve

Implementing investment decision support systems requires:

- Significant time investment for initial setup and customization

- Continuous education to stay current with system capabilities

- Adjustment of existing workflows and processes

- Integration challenges with other systems

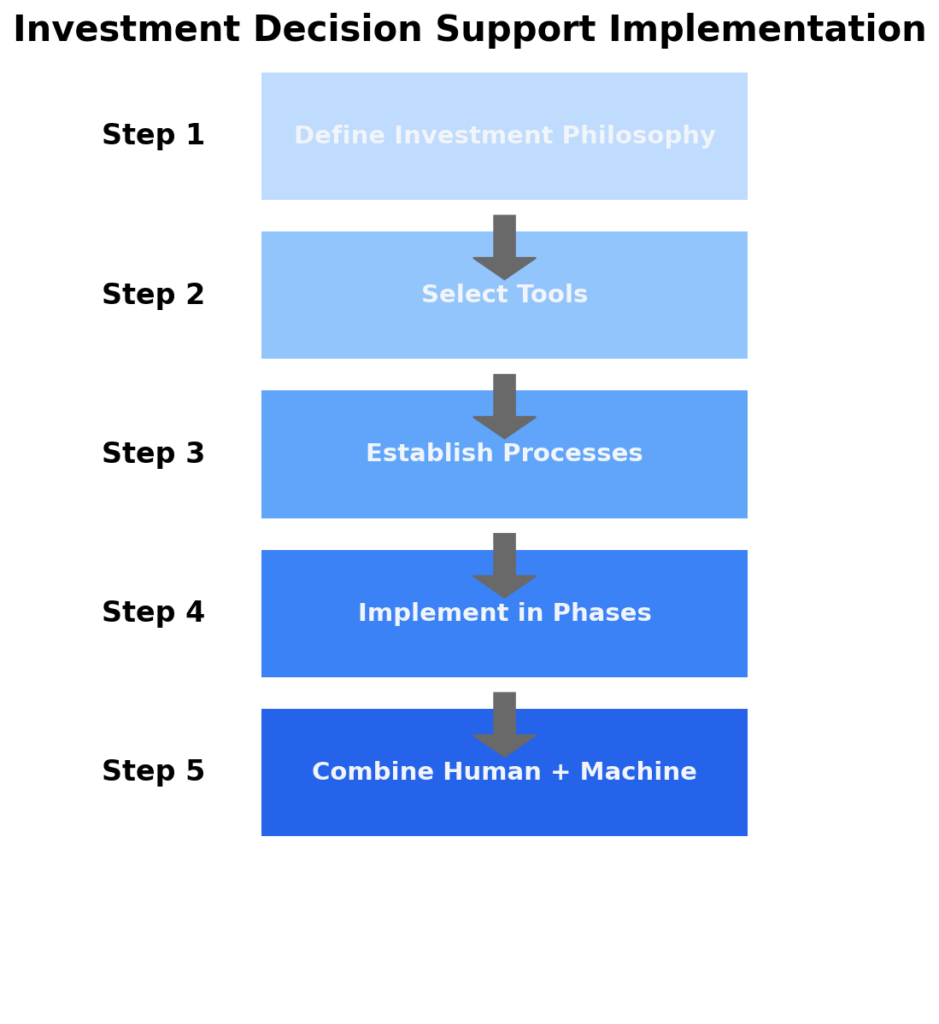

Implementation: How to Effectively Use Investment Decision Support

Step 1: Define Your Investment Philosophy

Before selecting tools, clearly articulate your:

- Investment time horizon

- Risk tolerance

- Return objectives

- Preferred asset classes

- Core investment beliefs

This foundation ensures you select tools aligned with your approach rather than adapting your strategy to fit available tools.

Step 2: Select Appropriate Tools

Choose tools based on:

- Alignment with your investment approach

- Data needs and availability

- Budget constraints

- Technical capabilities

- Integration requirements

Start with core functionality and expand as needs evolve.

Step 3: Establish Processes and Frameworks

Develop systematic processes for:

- Regular market and portfolio review schedules

- Decision criteria and thresholds

- Documentation of analysis and decisions

- Periodic assessment of tool effectiveness

Step 4: Implement in Phases

A phased implementation approach includes:

- Pilot testing with a subset of portfolio

- Parallel running alongside existing methods

- Gradual expansion of scope and dependency

- Continuous refinement based on feedback

Step 5: Combine Human Judgment with Tool Insights

The most effective approach blends:

- Quantitative insights from tools

- Qualitative assessment by experienced investors

- Regular challenging of tool assumptions

- Human oversight for unusual situations

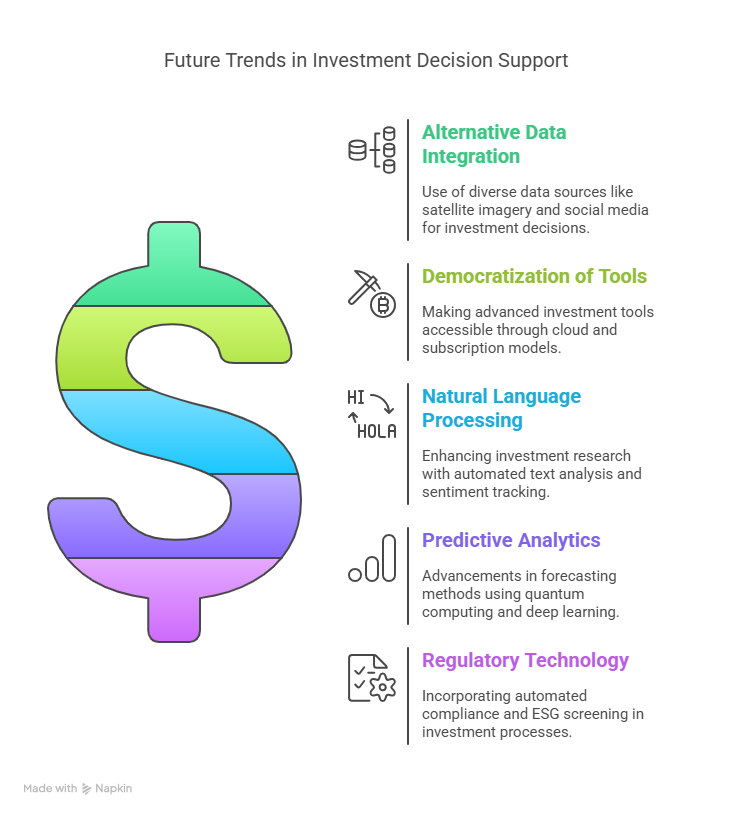

Future Trends in Investment Decision Support

Integration of Alternative Data

Investment decision support systems are increasingly incorporating:

- Satellite imagery for real-time business activity assessment

- Consumer spending patterns from credit card data

- Social media sentiment analysis

- Mobile location data for foot traffic analysis

The alternative data market for investment applications grew to $4.8 billion in 2024, with projected annual growth of 31% through 2028.

Democratization of Institutional-Grade Tools

The trend toward democratization continues with:

- Cloud-based delivery reducing infrastructure costs

- Subscription models lowering entry barriers

- API access enabling customized applications

- Mobile-first platforms increasing accessibility

Enhanced Natural Language Processing

NLP capabilities are revolutionizing investment research:

- Automated analysis of earnings call transcripts

- Real-time news impact assessment

- Regulatory filing interpretation

- Management sentiment tracking over time

Predictive Analytics Advancements

Next-generation predictive capabilities include:

- Quantum computing applications for portfolio optimization

- Deep learning for pattern recognition across asset classes

- Hybrid models combining multiple methodologies

- Real-time scenario adjustment based on breaking events

Regulatory Technology Integration

Investment decision support is increasingly incorporating:

- Automated compliance checking

- Regulatory impact assessment

- ESG screening and reporting

- Tax optimization features

FAQs – Investment Decision Support

1. What is the minimum portfolio size that justifies investment in decision support tools?

While enterprise-grade systems are designed for large portfolios, solutions exist for investors of all sizes. Free and low-cost options like Yahoo Finance, Finviz, and basic versions of TradingView provide valuable support for portfolios as small as $10,000. The appropriate investment in tools typically scales with portfolio size, with a general guideline of allocating 0.1% to 0.5% of assets under management to decision support technology.

2. Can investment decision support tools guarantee profitable investments?

No tool can guarantee investment success. These systems enhance decision quality by providing better information and reducing biases, but markets remain inherently unpredictable. Even the most sophisticated systems cannot consistently forecast short-term market movements or unexpected events. They should be viewed as probability enhancers rather than crystal balls.

3. How do I choose between fundamental and technical analysis tools?

This choice depends on your investment philosophy and time horizon. Fundamental analysis tools are typically more valuable for long-term investors focused on intrinsic value, while technical analysis systems suit shorter-term traders. Many investors use both: fundamental analysis to select investments and technical analysis to optimize entry and exit points.

4. What technical skills are required to effectively use advanced investment decision support systems?

Basic systems require minimal technical expertise beyond financial knowledge. However, advanced platforms may demand:

- Basic statistical understanding

- Data interpretation skills

- Familiarity with financial modeling concepts

- Comfort with dashboard interfaces

Most providers offer training resources, and many modern systems feature intuitive interfaces designed for non-technical users.

5. How frequently should I update my decision support tools and data?

Market data should update in real-time or with minimal delay for active investors. Fundamental data typically refreshes quarterly with earnings reports, though significant developments may warrant immediate updates. The tools themselves should be evaluated annually to ensure they remain aligned with your needs and incorporate relevant technological advancements.

6. What are the most common pitfalls when implementing investment decision support systems?

Common implementation challenges include:

- Over-complexity leading to “analysis paralysis”

- Insufficient attention to data quality

- Failure to align tools with investment philosophy

- Inadequate training and understanding of limitations

- Inconsistent application of insights

7. How do investment decision support tools address ESG (Environmental, Social, Governance) factors?

Modern investment platforms increasingly incorporate ESG capabilities, including:

- Standardized ESG scoring metrics

- Customizable screening criteria

- Impact assessment tools

- Regulatory compliance features

- Alignment with sustainable development goals

The sophistication of these features varies widely, with dedicated ESG analysis platforms providing the most comprehensive capabilities.

8. Can investment decision support tools be used for alternative investments like real estate or private equity?

Yes, specialized decision support tools exist for alternative asset classes. Real estate platforms incorporate property valuation models, geographic analysis, and cash flow projections. Private equity tools focus on company valuation, comparable transaction analysis, and performance benchmarking. However, these specialized systems often require more manual input due to the lower data standardization in alternative markets.

9. How do I evaluate the ROI of investment decision support tools?

Measuring ROI involves assessing:

- Performance improvement relative to benchmarks

- Time savings for analysis and research

- Risk reduction through improved diversification

- Error reduction in calculations and analysis

- Opportunity costs of missed investments without the tools

A comprehensive assessment should consider both quantitative metrics like performance and qualitative factors like improved decision confidence.

10. What level of customization is typically available in investment decision support systems?

Customization varies widely across platforms:

- Basic systems offer preset templates with limited adjustability

- Mid-tier platforms allow custom metrics, screens, and dashboards

- Advanced systems provide API access, custom model development, and proprietary algorithm integration

- Enterprise solutions offer complete customization with dedicated support

The appropriate level depends on your specific requirements and the uniqueness of your investment approach.

Conclusion

Investment decision support tools and strategies have transformed the landscape of modern investing, bridging the gap between institutional capabilities and individual investor resources. By systematically applying data-driven insights, mitigating cognitive biases, and enforcing disciplined processes, these systems significantly enhance the probability of investment success. Their ability to process vast quantities of information and identify patterns beyond human capacity provides a material edge in increasingly competitive markets.

Looking ahead, the continued evolution of artificial intelligence, alternative data sources, and predictive analytics promises to further revolutionize investment decision-making. As these technologies become more accessible and intuitive, investors who effectively integrate them into their processes will likely maintain a sustainable advantage.

However, the most successful approaches will continue to balance technological capabilities with human judgment, recognizing that investment markets remain fundamentally human domains where psychology, policy, and unpredictable events still play decisive roles.

The future belongs not to those who rely exclusively on technology or human intuition, but to those who skillfully blend both in a coherent investment framework.

For your reference, recently published articles include:

- Market Intelligence Platforms – All You Need To Know

- Never Lose Money Again: Investment Scenario Analysis Magic

- Unlock Wall Street’s Hidden Financial Modeling Tools Now

- Portfolio Optimization Software: All You Need To Know

- Unlock Hidden Wealth: Best Investment Opportunity Screening Secrets

- Financial Advice Disclaimer Example: All You Need to Know

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.