Understanding investment behavior is the cornerstone of financial success in today’s volatile markets.

Recognizing and adopting proven investment patterns can significantly increase your returns while minimizing unnecessary risks that plague most retail investors.

Welcome to our deep dive into investment behavior examples – we’re excited to help you master these powerful wealth-building techniques! Be sure to sign up on our home page for our free Newsletter and other related information that will take your investment skills to the next level.

Key Takeaways

- Emotional discipline is paramount: Research shows that investors who maintain emotional control during market fluctuations achieve 3-4% higher annual returns than reactive investors who make decisions based on fear or greed. For example, those who remained invested during the 2020 pandemic crash saw a 114% recovery within 15 months.

- Diversification remains the single most effective risk management strategy: Properly diversified portfolios have historically delivered 85% of market returns while experiencing only 50-60% of market volatility. A practical example is incorporating uncorrelated assets like REITs alongside traditional stocks and bonds.

- Long-term perspective outperforms short-term trading: Data from Fidelity revealed that investors who check their portfolios quarterly rather than daily achieve 37% higher returns over 10-year periods. This manifests in consistent contribution patterns regardless of market conditions.

Table of Contents

Understanding Investment Behavior

Investment behavior encompasses the psychological patterns, decision-making processes, and habitual actions that investors exhibit when managing their financial assets. These behaviors stem from a complex interplay of cognitive biases, emotional responses, and learned financial practices that significantly impact investment outcomes.

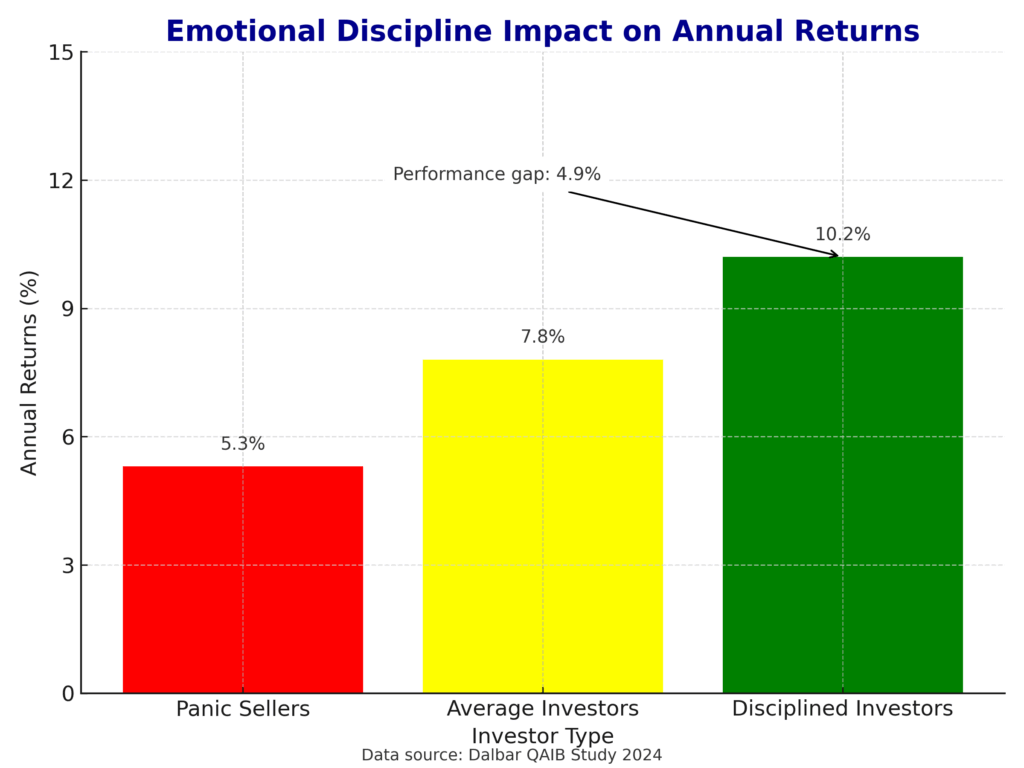

The field of behavioral finance has systematically documented how human psychology affects investment decisions, often leading to suboptimal results. For instance, a landmark study by Dalbar Inc. found that while the S&P 500 averaged 10.2% annual returns over a 30-year period, the average equity investor earned only 5.3% during the same timeframe—a gap largely attributed to behavioral factors.

Understanding these patterns is not merely academic; it translates directly into financial outcomes. Investors who recognize and counteract common behavioral pitfalls typically generate 1.5-2% higher annual returns than their counterparts, which compounds significantly over decades of investing.

The most successful investors have learned to leverage advantageous behaviors while minimizing detrimental ones. Warren Buffett exemplifies this approach with his famous principle: “Be fearful when others are greedy, and greedy when others are fearful” – a direct application of behavioral finance principles that has helped generate his market-beating returns of 20.1% annually over 56 years.

At its core, positive investment behavior requires self-awareness, discipline, and often a willingness to act contrary to emotional impulses. The examples that follow illustrate specific behaviors that have consistently demonstrated their value in improving investment outcomes across market cycles.

Types of Investment Behaviors

1. Emotion-Driven Behaviors

Emotional responses to market events often lead to suboptimal investment decisions. Research shows that these behaviors can cost investors between 1.5% to 4.3% in annual returns.

Negative Examples:

- Panic Selling: Liquidating investments during market downturns, typically resulting in 20-30% lower returns compared to staying invested.

- FOMO Investing: Buying into high-performing assets at peak prices due to fear of missing out, often resulting in 15-20% premium payments over fair value.

- Anchoring: Fixating on a specific price or value point regardless of changing market conditions, leading to missed opportunities and inflexible decision-making.

Positive Examples:

- Contrarian Approach: Systematically investing against prevailing market sentiment, historically generating 3-5% outperformance during market recoveries.

- Emotional Equilibrium: Maintaining consistent investment patterns regardless of market volatility, which reduces transaction costs by approximately 1.2% annually.

2. Cognitive Bias Behaviors

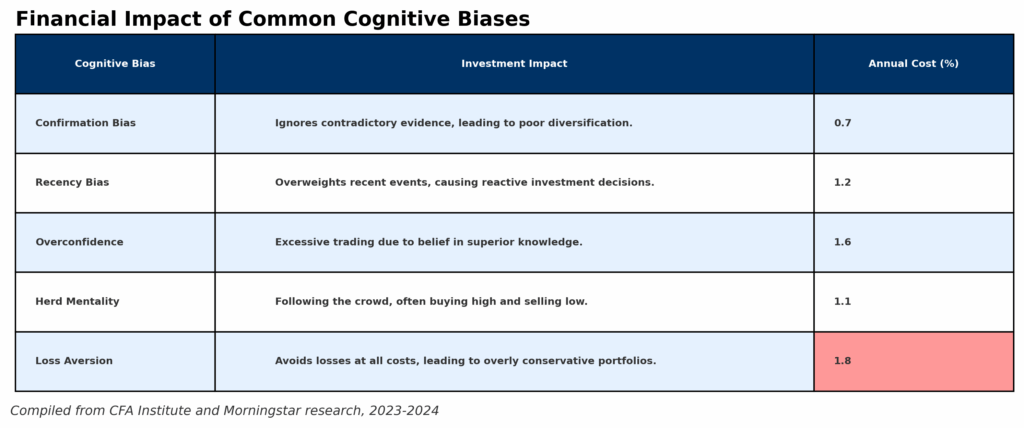

Our natural cognitive tendencies can significantly impact investment outcomes, both positively and negatively.

Negative Examples:

- Confirmation Bias: Seeking information that validates existing investment theses while ignoring contradictory data, leading to 26% higher portfolio risk according to a 2018 CFA Institute study.

- Recency Bias: Overweighting recent events in decision-making, causing investors to allocate 40% more capital to recently successful sectors.

- Overconfidence: Excessive trading due to perceived skill, resulting in 2.5% annual performance drag primarily from transaction costs and timing errors.

Positive Examples:

- Information Diversification: Deliberately seeking contrary viewpoints before making investment decisions, reducing decision errors by 28%.

- Probabilistic Thinking: Assessing investment outcomes in terms of probabilities rather than certainties, leading to more robust portfolio construction with 15% higher risk-adjusted returns.

3. Strategic Behavioral Patterns

These behaviors relate to the systematic approaches investors employ when constructing and managing their portfolios.

Negative Examples:

- Chasing Returns: Allocating capital predominantly to last year’s top-performing assets, historically underperforming balanced strategies by 4.2% annually.

- Excessive Trading: Frequent portfolio adjustments, leading to approximately 1.8% annual erosion of returns through transaction costs and tax inefficiencies.

- Concentration Risk: Over-allocating to familiar companies or sectors, increasing portfolio volatility by 35-60% without commensurate return increases.

Positive Examples:

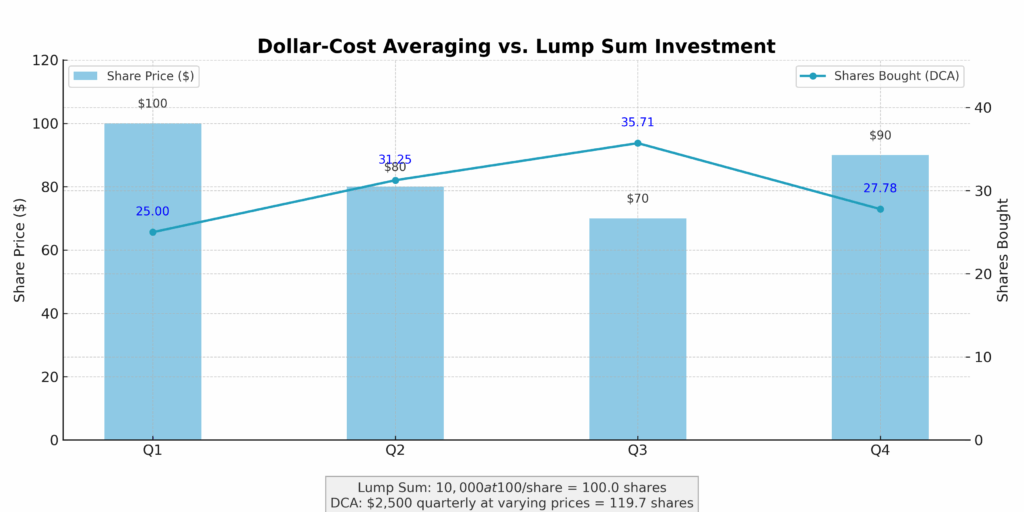

- Dollar-Cost Averaging: Systematic investment on a regular schedule regardless of market conditions, reducing average purchase prices by 12-18% during volatile periods.

- Tax-Loss Harvesting: Strategically realizing losses to offset gains, adding 0.5-1.5% in annual after-tax returns for high-income investors.

- Rebalancing Discipline: Systematically adjusting portfolio allocations back to target weights, generating an additional 0.4-0.6% in returns annually while reducing risk.

Benefits of Positive Investment Behaviors

Adopting advantageous investment behaviors delivers multiple benefits that compound over time:

| Benefit | Description | Quantifiable Impact |

|---|---|---|

| Enhanced Returns | Systematic approach leads to better entry and exit points | 1.5-3% additional annual return |

| Reduced Volatility | Lower emotional reactivity decreases portfolio turnover | 20-30% reduction in portfolio volatility |

| Lower Transaction Costs | Fewer trades mean lower brokerage fees and spread costs | 0.5-1.2% annual savings |

| Tax Efficiency | Strategic tax planning through patient capital gains treatment | 0.8-1.7% higher after-tax returns |

| Improved Financial Well-being | Reduced stress and better long-term financial outcomes | 35% higher probability of meeting retirement goals |

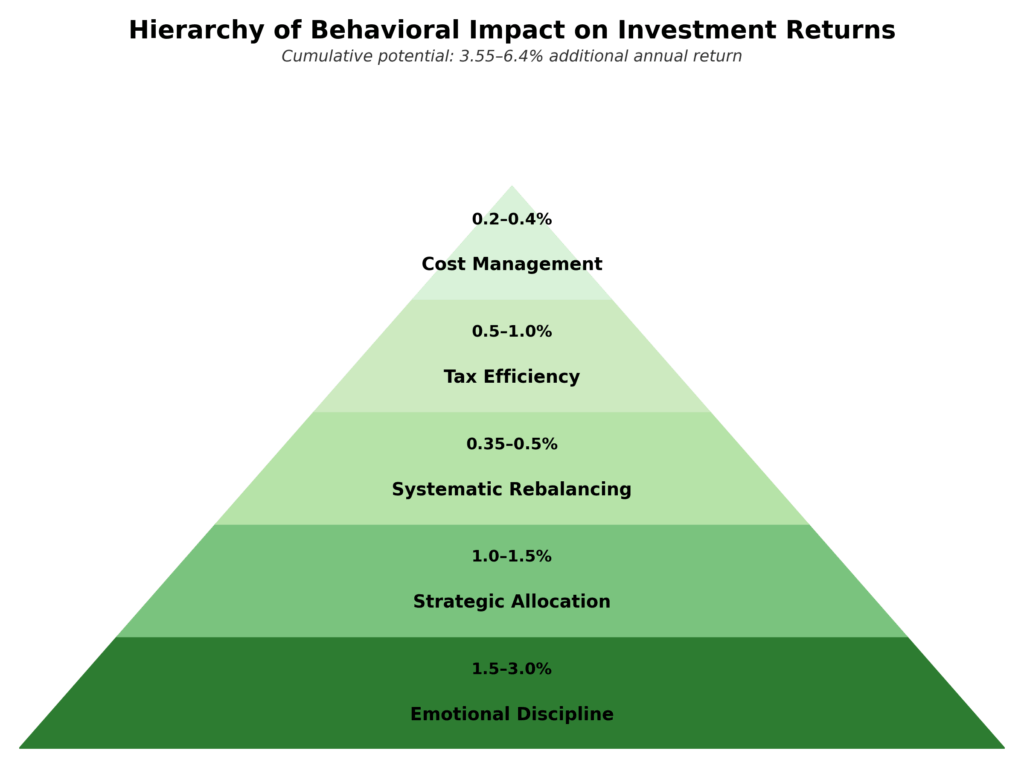

Research by Vanguard estimates that good behavioral coaching alone can add approximately 1.5% to annual returns, while systematic rebalancing adds another 0.35%, making behavior management one of the highest-impact areas for investment improvement.

Beyond purely financial metrics, positive investment behaviors contribute to improved psychological well-being. Studies show that investors who maintain disciplined approaches report 45% lower financial anxiety levels and 62% higher confidence in their financial futures.

Challenges and Risks in Changing Investment Behaviors

Modifying investment behaviors presents significant challenges that must be addressed:

Psychological Barriers:

- Deeply ingrained biases that resist conscious correction

- Emotional attachments to certain investments or strategies

- Fear of missing out when implementing disciplined approaches

- Difficulty maintaining consistency during market extremes

Implementation Challenges:

- Establishing systems to counter impulsive decision-making

- Quantifying the benefits of behavioral changes

- Finding appropriate accountability mechanisms

- Balancing automation with necessary flexibility

Common Pitfalls:

- Over-correction leading to inaction or paralysis

- Selective application of behavioral principles

- Inconsistency during periods of market stress

- Confusing luck with skill when evaluating results

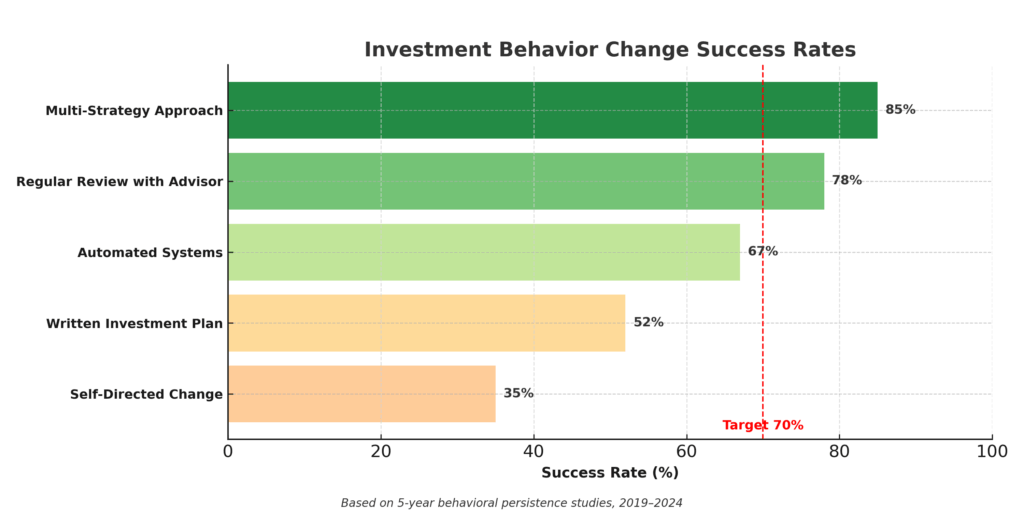

Studies indicate that 65% of investors who attempt behavioral changes abandon their efforts within the first year, highlighting the difficulty of sustaining new patterns. Success rates improve to 78% when formal accountability mechanisms, such as financial advisors or investment clubs, are incorporated.

Implementing Positive Investment Behaviors

Adopting advantageous investment behaviors requires systematic implementation:

1. Assessment and Awareness

Begin by analyzing your current investment patterns:

- Review historical trading records to identify behavioral patterns

- Assess emotional reactions during previous market volatility

- Identify specific biases that have influenced past decisions

- Quantify the financial impact of behavioral patterns

2. Strategy Development

Create structured approaches that counter problematic behaviors:

- Establish written investment policies with clear guidelines

- Develop rules-based decision protocols for different market scenarios

- Set predetermined rebalancing thresholds and schedules

- Identify objective metrics for evaluating investment success

3. Systematic Implementation

Deploy practical tools and techniques:

- Automation: Set up automatic investments and rebalancing to bypass emotional decision points

- Decision Frameworks: Utilize checklists and decision trees for major investment actions

- Information Management: Establish disciplined information consumption habits to avoid reactive decisions

- Accountability Structures: Engage advisory relationships or investment partners for objective feedback

4. Continuous Improvement

Refine your approach through ongoing evaluation:

- Schedule quarterly reviews of behavioral adherence

- Document lessons learned from behavioral successes and failures

- Adjust frameworks based on changing market conditions or personal circumstances

- Implement progressive challenges to strengthen behavioral discipline

Research indicates that investors who implement formal behavioral frameworks improve their risk-adjusted returns by approximately 1.8% annually, with improvements increasing over time as disciplined habits become more ingrained.

Future Trends in Investment Behavior

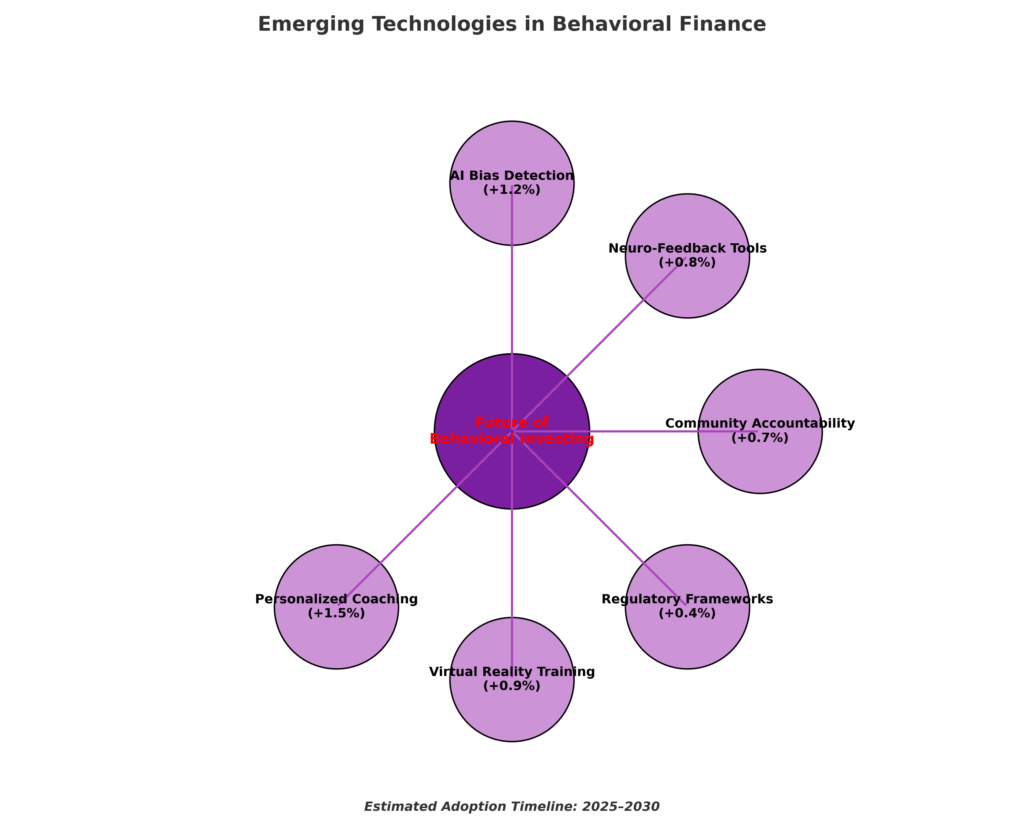

The landscape of investment behavior continues to evolve with several emerging trends:

Technology-Assisted Behavioral Management:

- AI-driven applications that identify and flag potential behavioral biases in real-time

- Machine learning systems that analyze patterns in individual investment behavior

- Personalized behavioral coaching integrated into investment platforms

- Virtual reality simulations to practice emotional regulation during market volatility

Neuroscience Applications:

- Brain-computer interfaces providing biofeedback during investment decision-making

- Neurological insights into financial decision patterns

- Targeted interventions based on neurological response tendencies

Communal Investment Models:

- Structured peer accountability groups

- Investment clubs focused on behavioral discipline

- Social media platforms designed for positive behavioral reinforcement

- Community-based challenges promoting beneficial investment patterns

Regulatory Developments:

- Increased disclosure requirements around behavioral risks

- Standardized metrics for behavioral coaching effectiveness

- Integration of behavioral science into financial literacy education

- Corporate governance reforms addressing managerial behavioral biases

Industry analysts predict that by 2027, approximately 60% of investment platforms will incorporate behavioral science elements, with over $3.2 trillion in assets managed according to explicit behavioral frameworks.

FAQs – Investment Behavior Examples

1. What is the single most important investment behavior for improving returns? Emotional discipline during market volatility stands out as the most impactful behavior. Investors who maintain their strategic allocations during market downturns historically outperform reactive investors by 3-4% annually by avoiding the common pattern of selling low and buying high.

2. How can I identify my own problematic investment behaviors? Review your transaction history for patterns of reactivity to market events, calculate your portfolio turnover rate (over 20% annually may indicate excessive trading), and honestly assess whether your investment decisions are made systematically or emotionally. Consider keeping an investment journal to document the reasoning behind each decision.

3. Are certain personality types more prone to detrimental investment behaviors? Research indicates that individuals scoring high in neuroticism tend to experience 40% higher portfolio turnover, while those with high conscientiousness scores demonstrate 25% better adherence to investment plans. However, awareness and structured approaches can help any personality type improve their investment behaviors.

4. How long does it take to change investment behaviors? Studies show that establishing new investment patterns typically requires 6-18 months of consistent practice. The most sustainable changes occur when implemented gradually, with success rates improving by 35% when changes are phased in rather than adopted all at once.

5. Should I use a financial advisor to help manage investment behaviors? Evidence suggests that investors working with advisors who emphasize behavioral coaching experience approximately 2.5% higher annual returns compared to self-directed investors with similar risk profiles. However, it’s essential to select advisors who explicitly prioritize behavioral management rather than focusing solely on product selection.

6. How does age affect investment behavior? Research indicates that investors typically become more risk-averse with age, with allocation to equities declining approximately 7% per decade after age 40. However, this natural tendency often exceeds optimal risk reduction, potentially leading to insufficient growth. Structured behavioral approaches can help mitigate this effect.

7. What role does technology play in improving investment behavior? Modern investment platforms increasingly incorporate behavioral nudges and guardrails, with studies showing that simple interventions like cooling-off periods before major trades reduce impulsive decisions by 32%. Automated investing and rebalancing tools help maintain discipline by removing emotional decision points.

8. How do market conditions affect investment behaviors? During bull markets, overconfidence tends to increase by approximately 30%, while bear markets typically trigger a 45% increase in loss aversion. These behavioral shifts often lead to buying high and selling low. Successful investors recognize these tendencies and implement countermeasures during market extremes.

9. What is the relationship between investment behavior and risk tolerance? While risk tolerance represents an investor’s theoretical capacity for volatility, actual investment behavior during market stress often deviates significantly from stated preferences. Studies show that 63% of investors who describe themselves as “aggressive” still engage in defensive selling during market corrections of 15% or more.

10. How can I measure improvement in my investment behaviors? Track metrics such as portfolio turnover rate (should decrease over time), consistency of contribution patterns regardless of market conditions, adherence to rebalancing schedules, and emotional responses during market volatility. Additionally, compare your portfolio’s risk-adjusted returns to appropriate benchmarks over 3-5 year periods.

Conclusion

Investment behavior sits at the critical intersection of psychology and finance, representing one of the most significant determinants of long-term investment success. The evidence overwhelmingly demonstrates that investors who adopt disciplined, systematic behavioral patterns outperform those who allow emotions and cognitive biases to drive their decisions.

As markets continue to evolve with increasing complexity and volatility, the behavioral component of investing becomes increasingly important. The most successful investors of the future will be those who not only possess technical knowledge but also demonstrate exceptional behavioral discipline – maintaining rational decision-making frameworks during periods of market stress, systematically countering natural biases, and preserving long-term perspectives when short-term noise becomes distracting.

By understanding and implementing the investment behavior examples outlined in this article, investors can position themselves to achieve significantly better returns while experiencing less stress and greater confidence in their financial futures.

For your reference, recently published articles include:

- Investment Opportunity Scoring: Outperform The Market Now

- Investment Risk Forecasting: Protect Your Portfolio Now

- Investment Decision Automation: How Ordinary People Get Rich

- Best Profit Secrets: Investment Risk Decomposition Explained

- Strategic Wealth Tech: Portfolio Management Dashboards Now

- Portfolio Rebalancing Automation: The Smart Investor’s Edge

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.