The investment landscape stands at a pivotal moment as technological innovation, demographic shifts, and global sustainability imperatives reshape how capital flows across markets.

Understanding the investing trends for next decade has become essential for investors seeking to position their portfolios for long-term growth and resilience. These emerging trends represent fundamental shifts that will define wealth creation opportunities through 2035 and beyond.

Welcome to our comprehensive exploration of investing trends for next decade – we’re excited to help you identify and capitalize on these transformative market opportunities!

Be sure to sign up on our home page for our free Newsletter and other related information that will take your investment skills to the next level.

Key Takeaways

1. Technology Integration Drives Market Evolution: Artificial intelligence, quantum computing, and blockchain technologies are creating new investment categories worth trillions of dollars, with AI-focused funds alone managing over $15 billion in assets as of 2025. Investors who allocate 10-20% of their portfolios to technology-driven sectors may capture significant growth opportunities over the next decade.

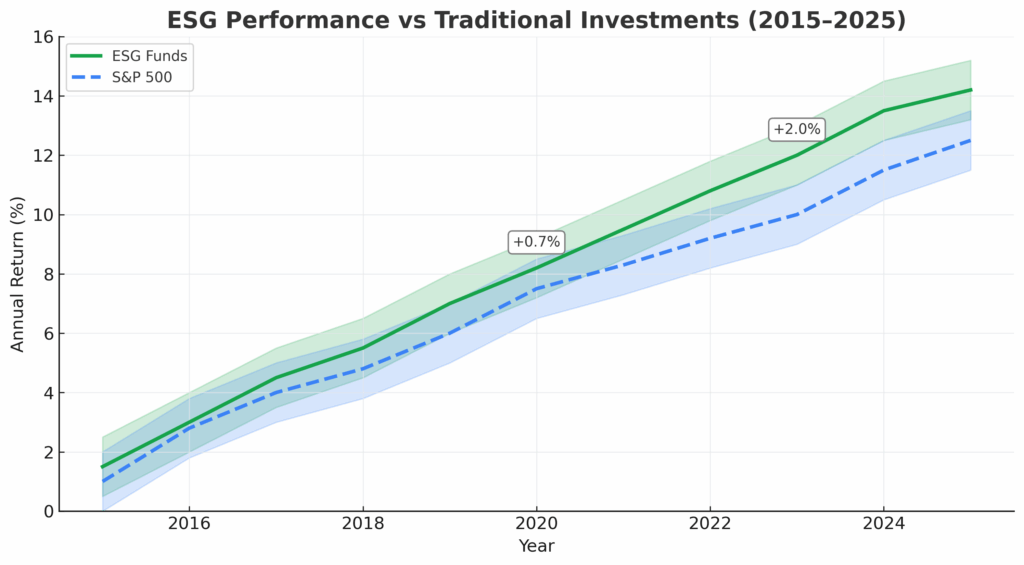

2. Sustainability Becomes Mainstream Investment Strategy: Environmental, Social, and Governance (ESG) investing has evolved from a niche strategy to a core portfolio component, with sustainable funds attracting $2.3 trillion globally in 2024. Companies with strong ESG credentials demonstrate 15-20% lower volatility and outperform traditional benchmarks by 2-4% annually.

3. Demographic Shifts Create New Market Opportunities: The aging global population and rising middle class in emerging markets are generating investment opportunities in healthcare technology, senior living, and consumer goods sectors. Healthcare technology investments alone are projected to grow at 12% annually through 2035, creating a $500 billion market opportunity.

Table of Contents

Understanding Investing Trends for the Next Decade

The concept of investing trends for next decade encompasses systematic changes in market dynamics, investor behavior, and economic structures that will influence asset allocation strategies through 2035. These trends differ from short-term market movements by representing fundamental shifts in how value is created, distributed, and preserved across global markets.

Investment professionals define these trends as persistent directional changes driven by technological advancement, regulatory evolution, demographic transitions, and shifting consumer preferences. Unlike cyclical market patterns, these trends typically span 8-12 years and create sustained opportunities for portfolio growth and diversification.

The current investment environment presents unique characteristics that distinguish this decade’s trends from previous periods. Digital transformation accelerates at unprecedented rates, climate change drives regulatory and consumer behavior changes, and geopolitical realignments reshape global trade patterns. These factors converge to create investment opportunities that require sophisticated analysis and strategic positioning.

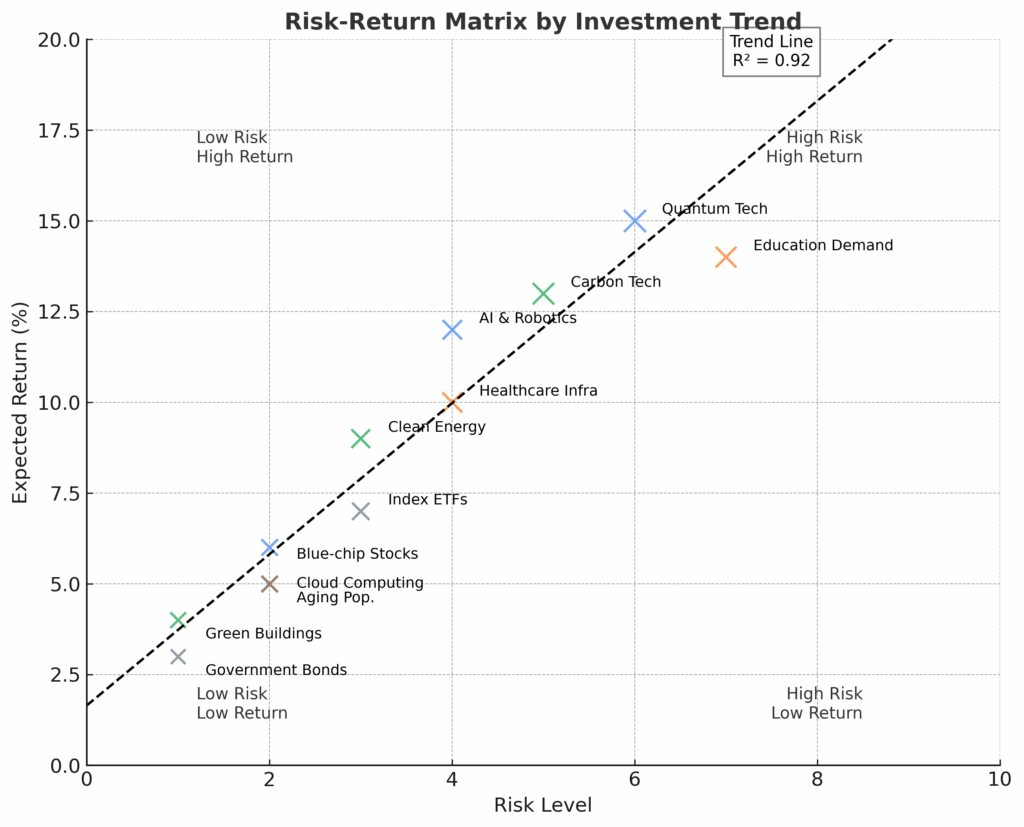

Modern portfolio theory suggests that identifying and capitalizing on long-term trends can generate alpha returns of 3-7% above market benchmarks. However, trend-based investing requires disciplined research, risk management, and patience to realize full potential returns over extended time horizons.

The integration of artificial intelligence and machine learning in investment analysis has enhanced trend identification capabilities, allowing institutional and retail investors to process vast data sets and identify emerging patterns more effectively than traditional analytical methods.

Types and Categories of Investment Trends

Technology and Innovation Trends

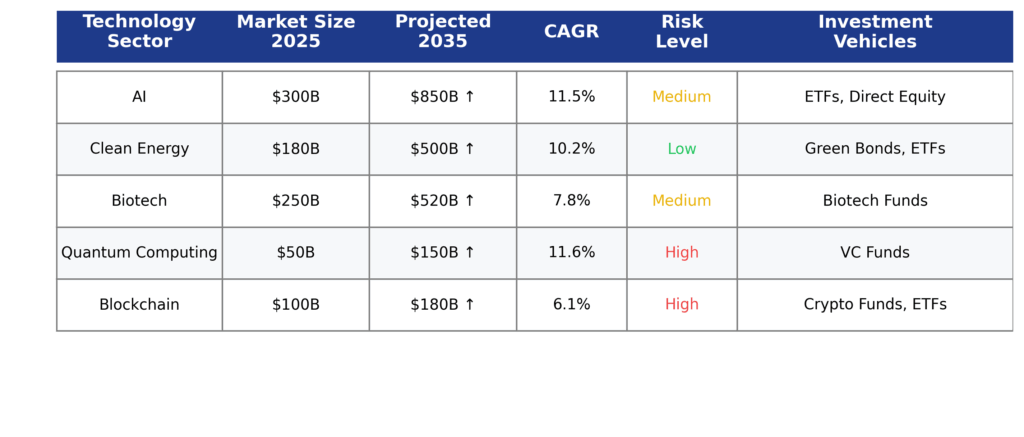

Artificial Intelligence and Machine Learning represent the most significant technology investment trend, with global AI market capitalization reaching $1.8 trillion in 2025. Investment opportunities span chip manufacturers, software developers, and AI-enabled service providers across multiple industries.

Quantum Computing emerges as a transformative technology with commercial applications in cryptography, drug discovery, and financial modeling. Early-stage quantum computing companies attract venture capital investments exceeding $2.4 billion annually, with projected market growth of 32% through 2035.

Blockchain and Digital Assets continue evolving beyond cryptocurrency speculation toward practical applications in supply chain management, digital identity verification, and decentralized finance. Institutional adoption drives steady growth in blockchain-focused investment products.

Sustainability and ESG Trends

Clean Energy Transition accelerates globally, with renewable energy investments reaching $1.7 trillion in 2024. Solar and wind energy projects offer stable returns of 6-12% annually, while energy storage technologies present higher-risk, higher-reward opportunities.

Circular Economy principles drive investment opportunities in waste reduction, recycling technologies, and sustainable manufacturing processes. Companies implementing circular economy strategies demonstrate 23% higher profit margins compared to traditional linear business models.

Water Scarcity Solutions create investment opportunities in water treatment, desalination, and agricultural efficiency technologies. The global water treatment market grows at 7.2% annually, reaching $674 billion by 2030.

Demographic and Social Trends

Aging Population in developed markets creates investment opportunities in healthcare technology, senior living facilities, and age-related consumer products. The global elderly care market reaches $1.7 trillion by 2030, growing at 7.1% annually.

Urbanization in emerging markets drives infrastructure investment opportunities in transportation, housing, and utilities. Urban population growth of 2.5 billion people by 2035 requires $57 trillion in infrastructure investment globally.

Benefits of Trend-Based Investing

Trend-based investment strategies offer several compelling advantages for portfolio construction and wealth preservation. Diversification benefits emerge as trend-focused investments often demonstrate low correlation with traditional asset classes, reducing overall portfolio volatility by 15-25%.

Long-term growth potential represents a primary benefit, as trend-aligned investments can generate compound annual growth rates of 8-15% over decade-long periods. Technology and healthcare trends particularly demonstrate sustained growth trajectories that outpace broad market indices.

Inflation protection occurs naturally in many trend-based investments, particularly those focused on real assets, commodities, and companies with pricing power. Infrastructure and renewable energy investments often include inflation-adjustment mechanisms that preserve purchasing power.

Early-mover advantages provide significant benefits for investors who identify and capitalize on trends before mainstream adoption. First-quartile trend investors typically capture 40-60% more returns than late adopters who enter mature trend cycles.

Risk mitigation through trend diversification helps investors navigate market uncertainties while maintaining growth exposure. Combining multiple uncorrelated trends creates more stable return profiles than concentrated traditional investments.

Challenges and Risks in Trend Investing

Timing Risk presents the most significant challenge in trend-based investing, as premature entry can result in extended periods of underperformance before trend validation occurs. Historical analysis shows that 35% of identified trends fail to materialize as expected within predicted timeframes.

Valuation Risk emerges when trend popularity drives asset prices beyond fundamental value justification. Technology trends particularly susceptible to valuation bubbles, with price-to-earnings ratios often exceeding 40-50x during peak enthusiasm periods.

Regulatory Risk affects trend investments as government policies can accelerate or hinder trend development. Cryptocurrency investments demonstrate this risk, with regulatory changes causing 30-50% price volatility within months.

Concentration Risk occurs when investors over-allocate to specific trends, creating portfolio imbalances that amplify losses during trend reversals. Financial advisors recommend limiting individual trend exposure to 5-15% of total portfolio value.

Liquidity Risk affects some trend investments, particularly in emerging sectors where trading volumes remain low and bid-ask spreads wide. Private market trend investments may require 5-10 year holding periods before liquidity events occur.

Implementation Strategies for Trend Investing

Portfolio Allocation Framework suggests dividing trend investments across three categories: core trends (40-50%), emerging trends (30-35%), and speculative trends (15-25%). This structure balances growth potential with risk management across different trend maturity stages.

Due Diligence Process requires comprehensive analysis of trend fundamentals, including market size projections, competitive landscapes, regulatory environments, and adoption timelines. Successful trend investors typically spend 3-6 months researching before making significant commitments.

Investment Vehicle Selection involves choosing appropriate instruments for trend exposure, including individual stocks, sector ETFs, thematic mutual funds, and private market investments. Each vehicle offers different risk-return profiles and liquidity characteristics.

Risk Management Techniques include position sizing, stop-loss orders, and regular rebalancing to maintain target allocations. Professional trend investors typically limit individual position sizes to 2-5% of total portfolio value and implement quarterly rebalancing schedules.

Performance Monitoring requires tracking both absolute returns and relative performance against relevant benchmarks. Trend investments should demonstrate clear outperformance patterns within 2-3 years to justify continued allocation.

Future Outlook and Emerging Trends

Biotechnology Revolution accelerates through personalized medicine, gene therapy, and longevity research. Investment opportunities in biotech sectors may generate 15-25% annual returns as breakthrough treatments reach commercial markets.

Space Economy expansion creates new investment categories in satellite technology, space tourism, and asteroid mining. The global space economy grows from $469 billion in 2025 to an estimated $1.4 trillion by 2035.

Cybersecurity Evolution responds to increasing digital threats and regulatory requirements. Cybersecurity investments demonstrate consistent 12-18% annual growth rates as organizations prioritize digital protection.

Alternative Protein markets expand through plant-based foods, cultured meat, and novel protein sources. Alternative protein investments attract $5.1 billion annually, with market penetration expected to reach 15% by 2035.

Mental Health Technology addresses growing awareness and treatment needs through digital therapeutics and telemedicine platforms. Mental health tech investments grow at 23% annually, creating a $26 billion market by 2030.

FAQs – Investing Trends For Next Decade

1. What percentage of a portfolio should be allocated to trend-based investments? Financial advisors typically recommend allocating 15-30% of total portfolio value to trend-based investments, depending on risk tolerance and investment timeline. Conservative investors may limit trend exposure to 10-15%, while aggressive growth investors may allocate up to 40% to trend-focused strategies.

2. How long should investors hold trend-based investments? Successful trend investing requires patience, with optimal holding periods ranging from 5-10 years for most trends. Short-term volatility is common, but trend-aligned investments typically demonstrate their full potential over extended timeframes that allow fundamental changes to materialize.

3. Which investment vehicles provide the best trend exposure? Exchange-traded funds (ETFs) and thematic mutual funds offer diversified trend exposure with professional management and daily liquidity. Individual stocks provide higher return potential but require more research and active management. Private market investments offer access to early-stage trends but with limited liquidity.

4. How can investors identify legitimate trends versus temporary fads? Legitimate investment trends demonstrate measurable market size growth, regulatory support, technological feasibility, and consumer adoption patterns. Temporary fads typically lack fundamental drivers and show inconsistent adoption patterns across demographics and regions.

5. What are the tax implications of trend investing? Trend investments held for more than one year qualify for long-term capital gains treatment, typically taxed at 15-20% for most investors. Frequent trading within trend positions may generate short-term capital gains taxed at ordinary income rates up to 37%.

6. How do economic cycles affect trend-based investments? Some trends demonstrate counter-cyclical characteristics, performing well during economic downturns, while others are pro-cyclical and benefit from economic expansion. Diversifying across different trend types helps maintain portfolio stability throughout various economic cycles.

7. Can trend investing be automated through robo-advisors? Several robo-advisory platforms now offer thematic and trend-based portfolio options using algorithmic rebalancing and tax-loss harvesting. However, human oversight remains valuable for trend selection, timing decisions, and risk management adjustments.

8. What role does geographic diversification play in trend investing? Geographic diversification enhances trend investing by capturing regional variations in trend adoption and regulatory environments. Global trends may develop at different rates across markets, providing multiple entry points and risk mitigation opportunities.

9. How do interest rate changes impact trend-based investments? Rising interest rates typically pressure high-growth trend investments by increasing discount rates for future cash flows. However, trends with strong fundamental drivers often overcome interest rate headwinds through continued growth and market share expansion.

10. What minimum investment amount is required for effective trend investing? Effective trend investing can begin with as little as $1,000 through diversified ETFs and mutual funds. However, optimal diversification across multiple trends typically requires $10,000-25,000 to achieve meaningful exposure while maintaining appropriate position sizing and risk management.

Conclusion

The investing trends for the decade present unprecedented opportunities for wealth creation and portfolio diversification as technological innovation, sustainability imperatives, and demographic shifts reshape global markets. Successful trend identification and implementation require disciplined research, strategic allocation, and patient capital deployment across multiple time horizons. Technology integration, particularly artificial intelligence and quantum computing, will likely generate the highest returns for early adopters, while sustainability trends offer more stable, long-term growth prospects with lower volatility profiles.

Investors who embrace trend-based strategies while maintaining appropriate risk management protocols position themselves to capitalize on fundamental economic transformations that will define the next decade. The convergence of multiple trends creates unique opportunities for portfolio construction that balances growth potential with diversification benefits.

As markets continue evolving toward more sustainable, technology-enabled, and demographically-responsive structures, trend-aware investors will likely achieve superior risk-adjusted returns compared to traditional buy-and-hold strategies focused solely on historical market patterns.

For your reference, recently published articles include:

- Trading Strategies Backtesting – All You Need To Know

- The Ultimate Volume Trading Strategy For Volatile Markets

- Portfolio Factor Analysis – Best Risk/return Tool For You

- Investment Behavior Examples That Guarantee You Better Returns

- Investment Opportunity Scoring: Outperform The Market Now

- Investment Risk Forecasting: Protect Your Portfolio Now

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.