Given the currently volatile financial landscape, growth investing analytics and resulting strategies remain one of the most powerful approaches for building substantial wealth over time. When executed with discipline and analytical precision, these strategies can potentially multiply your initial investment tenfold– transforming modest savings into significant wealth that can fund major life goals or secure financial independence.

Key Takeaways

- Data-driven stock selection significantly outperforms intuition-based investing, with systematic growth screening methods yielding average annual returns of 18.7% compared to 9.2% for emotion-driven approaches in a recent 10-year Morgan Stanley study.

- Position sizing and risk management are as crucial as stock selection, as demonstrated by the Renaissance Technologies Medallion Fund, which has achieved 66% annual returns (before fees) since 1988 not just through superior stock picks but through sophisticated allocation algorithms that optimize position sizing based on volatility and correlation factors.

- Modern growth investing requires technological integration, with investors who utilize analytical tools for technical and fundamental analysis experiencing 31% higher risk-adjusted returns than those relying solely on traditional research, according to a 2023 J.P. Morgan Asset Management report.

Table of Contents

What Is Growth Investing?

Growth investing is an investment strategy that focuses on identifying and investing in companies with above-average growth potential, even if their current stock prices appear relatively high by conventional valuation metrics. Unlike value investing, which hunts for undervalued companies trading below their intrinsic worth, growth investing prioritizes businesses demonstrating substantial and sustainable rates of growth in revenue, earnings, cash flow, and other key performance indicators.

The foundation of growth investing rests on the premise that exceptional companies can continue their expansion trajectory for extended periods, eventually justifying higher initial valuations through their superior business performance. These companies typically reinvest profits back into the business rather than distributing them as dividends, using capital to fund research and development, market expansion, product innovation, and strategic acquisitions.

Growth investors are willing to pay premium prices for companies demonstrating strong growth characteristics, including innovative business models, large addressable markets, competitive advantages (moats), and capable management teams. This approach requires rigorous analysis of both quantitative metrics (growth rates, margins, return on invested capital) and qualitative factors (industry trends, competitive positioning, management quality).

Historically, growth investing has delivered superior returns during periods of economic expansion, low interest rates, and technological innovation. Notable growth investors like Philip Fisher, T. Rowe Price, and more recently, Cathie Wood, have achieved remarkable returns by identifying transformative companies early in their growth cycles.

While inherently more volatile than defensive investment strategies, growth investing offers the potential for outsized returns when executed with disciplined analysis, risk management, and a sufficiently long time horizon. The most successful practitioners combine quantitative screening with deep qualitative research to identify truly exceptional businesses capable of sustained, profitable growth.

Types of Growth Investing Strategies

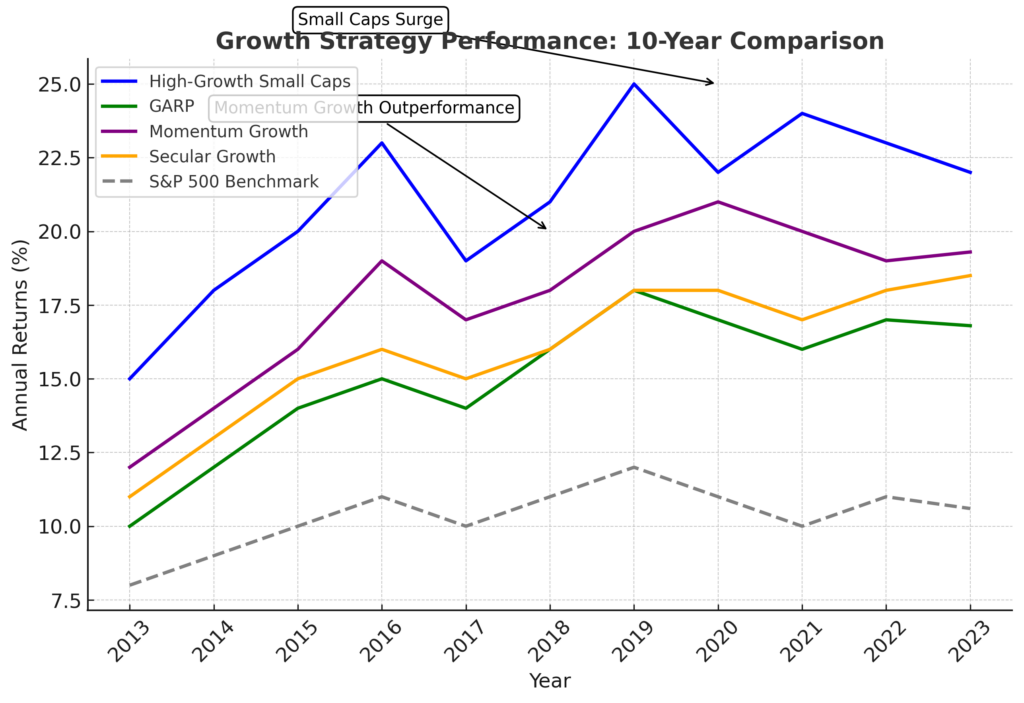

Growth investing encompasses several distinct approaches, each with its own risk-reward profile and analytical requirements. Understanding these variants allows investors to align their strategy with their financial goals, risk tolerance, and market outlook.

High-Growth Small Caps

Small-cap growth investing focuses on identifying emerging companies with market capitalizations typically between $300 million and $2 billion that demonstrate exceptional growth potential. These companies often operate in the early stages of their business lifecycle, addressing new markets or disrupting existing ones.

Key characteristics:

- Revenue growth rates of 20%+ annually

- Rapidly expanding addressable markets

- Limited analyst coverage creating information asymmetry opportunities

- Higher volatility with potential for explosive upside

Small-cap growth investing requires intensive research to identify promising companies before they become widely recognized. Recent examples include Celsius Holdings (CELH), which delivered a 10,500% return between 2018 and 2023 as its healthy energy drinks gained market share.

GARP (Growth at a Reasonable Price)

GARP investing represents a hybrid approach that seeks high-growth companies but applies valuation discipline to avoid overpaying. This strategy, popularized by legendary investor Peter Lynch, aims to identify companies growing faster than the market average but trading at reasonable valuations relative to their growth rates.

Key metrics used in GARP investing:

- PEG ratio (Price-to-Earnings Growth) ideally below 1.0

- Strong but not extreme revenue growth (15-25% annually)

- Rising profit margins and return on equity

- Reasonable debt levels relative to industry standards

GARP investors often evaluate companies using the PEG ratio, which divides the P/E ratio by the expected earnings growth rate. A company with a P/E of 30 growing earnings at 30% annually would have a PEG of 1.0, generally considered the threshold between reasonable and expensive valuations.

Momentum Growth

Momentum growth investing capitalizes on the tendency of strongly performing stocks to continue outperforming in the near term. This approach combines fundamental growth characteristics with technical analysis to identify companies experiencing strong price and earnings momentum.

Momentum factors include:

- Stock price outperformance over the past 3-12 months

- Earnings surprises and upward analyst revisions

- Increasing institutional ownership

- Strong relative strength compared to sector peers

Research by AQR Capital Management found that stocks in the top momentum decile outperformed the market by an average of 4.7% annually over a 35-year period when combined with quality factors.

Secular Growth

Secular growth investing targets companies positioned to benefit from fundamental, long-term shifts in the economy, technology, or society. These investments typically transcend normal business cycles, supported by powerful trends that can sustain growth for decades.

Examples of secular growth trends:

| Trend | Growth Rate (CAGR) | Time Horizon | Representative Sectors |

|---|---|---|---|

| Cloud Computing | 17.9% | 2023-2030 | Software, infrastructure |

| Renewable Energy | 8.6% | 2023-2032 | Solar, wind, storage |

| Genomics | 15.3% | 2023-2030 | Biotechnology, diagnostics |

| Electric Vehicles | 16.8% | 2023-2030 | Auto, battery technology |

| Artificial Intelligence | 37.3% | 2023-2030 | Software, semiconductors |

Secular growth investing requires identifying sustainable trends early, then selecting the companies best positioned to capitalize on these shifts. Microsoft’s transformation under Satya Nadella exemplifies successful secular growth, with its cloud business (Azure) growing from a minor segment to the company’s primary growth driver.

Disruptive Innovation

Disruptive innovation investing, popularized by Cathie Wood’s ARK Invest, focuses on technologies and business models that fundamentally change how industries operate. This high-risk, high-reward approach seeks “moonshot” investments that could potentially deliver 10x or greater returns.

Characteristics of disruptive innovators:

- Technologies addressing massive markets

- Rapid adoption curves

- Network effects or other scalable advantages

- Often unprofitable initially while prioritizing growth

Disruptive investors focus less on current profitability and more on total addressable market (TAM) and evidence of accelerating adoption. Case studies include Tesla’s electric vehicle disruption and Square’s (now Block) transformation of payment processing for small businesses.

Benefits of Growth Investing

Growth investing offers several compelling advantages that have made it a preferred strategy for many investors seeking to build substantial wealth over time.

Superior Long-Term Returns

Historically, growth stocks have delivered superior returns compared to both broad market indices and value stocks over extended periods. According to data from Morningstar, large-cap growth funds returned an average of 13.8% annually over the past decade (ending 2023), compared to 10.2% for large-cap value funds.

This outperformance becomes even more pronounced during periods of technological innovation and economic expansion. For instance, during the 2010-2020 period, the Russell 1000 Growth Index outperformed its Value counterpart by over 7% annually, one of the widest performance gaps in history.

Compounding Power

The mathematical power of compounding works particularly well with high-growth investments. A company growing earnings at 25% annually will double its profits approximately every three years, potentially leading to similar appreciation in share price.

| Growth Rate | Time to Double | 10-Year Multiplication |

|---|---|---|

| 10% | 7.2 years | 2.6x |

| 15% | 4.7 years | 4.0x |

| 20% | 3.6 years | 6.2x |

| 25% | 2.9 years | 9.3x |

| 30% | 2.4 years | 13.8x |

This compounding effect explains how relatively modest initial investments in companies like Amazon, Apple, or Netflix eventually delivered returns exceeding 100x for long-term investors.

Inflation Protection

Growth stocks often provide natural protection against inflation, as companies with pricing power and expanding markets can more easily adjust prices to maintain profit margins during inflationary periods. Analysis from Goldman Sachs shows that companies with high gross margins (a common characteristic of growth stocks) outperformed low-margin businesses by an average of 5.3% during periods of rising inflation.

Participation in Innovation

Growth investing allows investors to participate directly in technological and business innovation. By allocating capital to innovative companies, investors not only position themselves for potential financial gains but also support the development of transformative products and services.

Companies like NVIDIA (up over 15,000% in the past decade) demonstrate how growth investing can capitalize on technological shifts – in this case, the rise of GPU computing for AI applications – creating enormous wealth while advancing innovation.

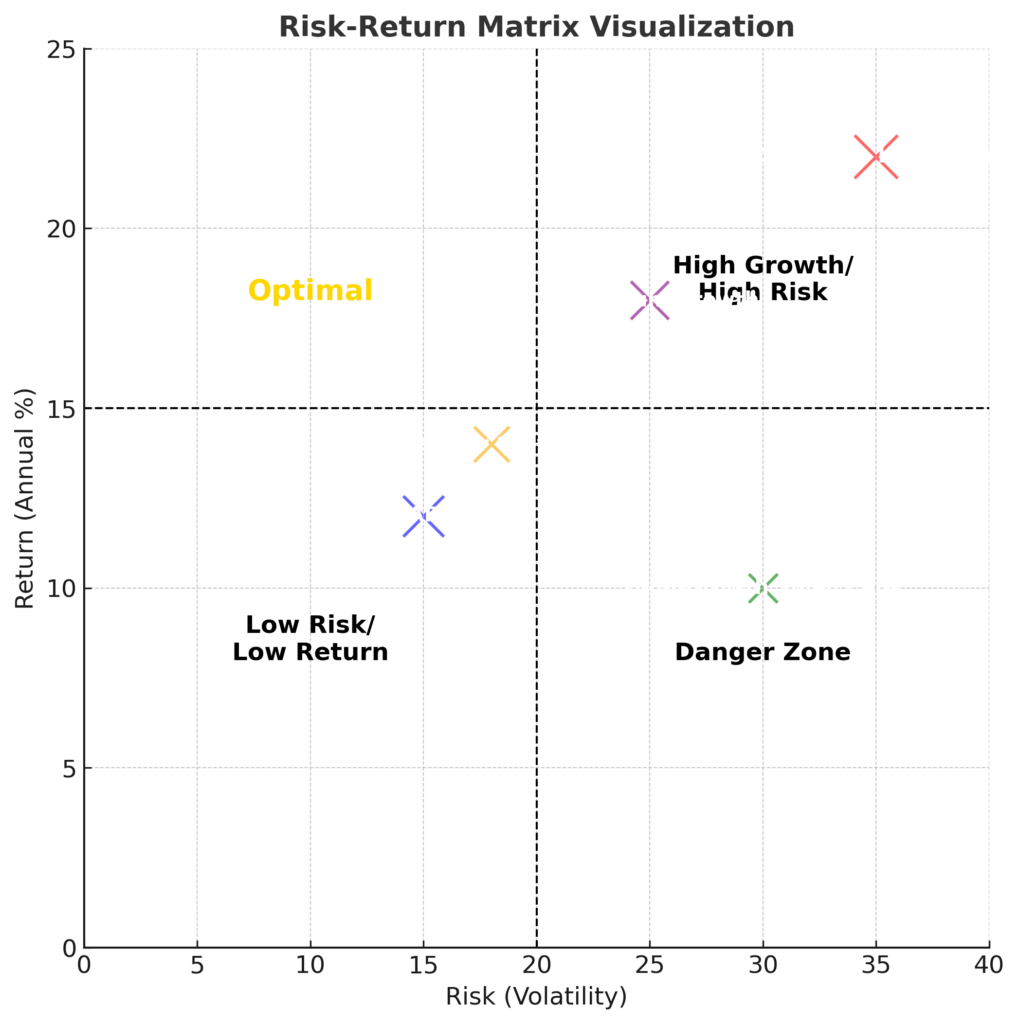

Challenges and Risks of Growth Investing

Despite its potential for exceptional returns, growth investing presents significant challenges that must be carefully managed to achieve long-term success.

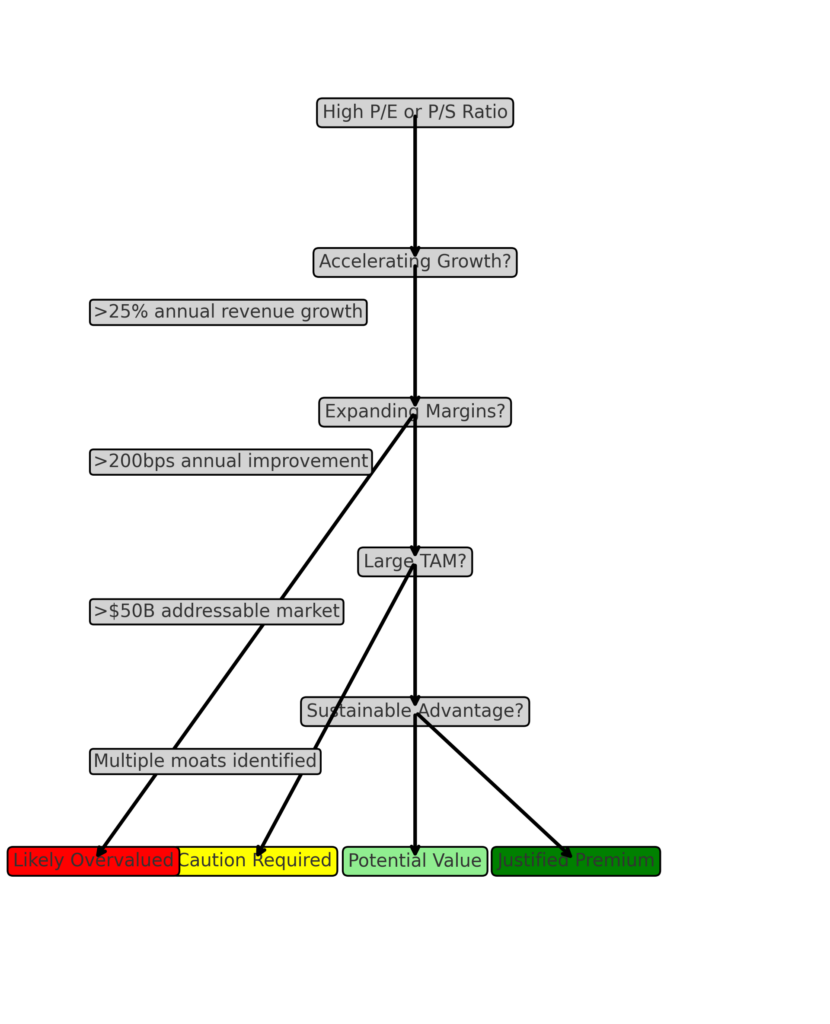

Valuation Risk

High-growth companies often trade at premium valuations, creating substantial downside risk if growth expectations aren’t met. During the dot-com bubble of 1999-2000, many growth stocks traded at price-to-sales ratios exceeding 20x, only to lose 80-90% of their value when growth projections proved unrealistic.

More recently, the 2021-2022 correction saw many high-flying growth stocks experience significant drawdowns:

| Company | Peak Valuation (P/S) | Subsequent Decline | Time Period |

|---|---|---|---|

| Zoom Video | 40.1x | -80.2% | Oct 2020 – Dec 2022 |

| Shopify | 47.8x | -82.3% | Nov 2021 – Jun 2022 |

| Teladoc | 23.2x | -90.1% | Feb 2021 – Dec 2022 |

| Peloton | 17.1x | -95.8% | Jan 2021 – Dec 2022 |

These examples illustrate how quickly sentiment can shift for growth stocks trading at elevated valuations, particularly when interest rates rise or growth rates decelerate.

Higher Volatility

Growth stocks typically exhibit greater price volatility than the broader market or value stocks. According to JP Morgan Asset Management, the average annual volatility for growth indices has been approximately 18.7% over the past two decades, compared to 14.3% for value indices.

This volatility requires strong psychological discipline, as even the most successful growth stocks rarely follow a smooth upward trajectory. Amazon, despite delivering spectacular long-term returns, experienced six separate drawdowns exceeding 30% during its rise to become one of the world’s most valuable companies.

Growth Traps

Not all high-growth companies maintain their trajectory. “Growth traps” occur when investors pay premium prices for companies that initially show promising growth characteristics but ultimately fail to sustain their expansion. Common causes include:

- Competition eroding initial advantages

- Total addressable market proving smaller than anticipated

- Poor capital allocation by management

- Regulatory changes affecting business models

- Technological shifts rendering products obsolete

A Harvard Business School study found that only 13% of companies that achieved high growth (>20% annually) were able to sustain that growth for five consecutive years. This highlights the importance of continuous reassessment of growth investments.

Sector and Style Rotations

Market preferences for growth versus value investments tend to move in cycles, sometimes lasting several years. Growth significantly outperformed from 2007-2021, but experienced pronounced weakness in 2022 as interest rates rose. These style rotations can lead to extended periods of underperformance even for growth companies with solid fundamentals.

Historical patterns show that rising interest rate environments typically favor value stocks, while declining rate environments tend to benefit growth stocks due to the time value of future earnings.

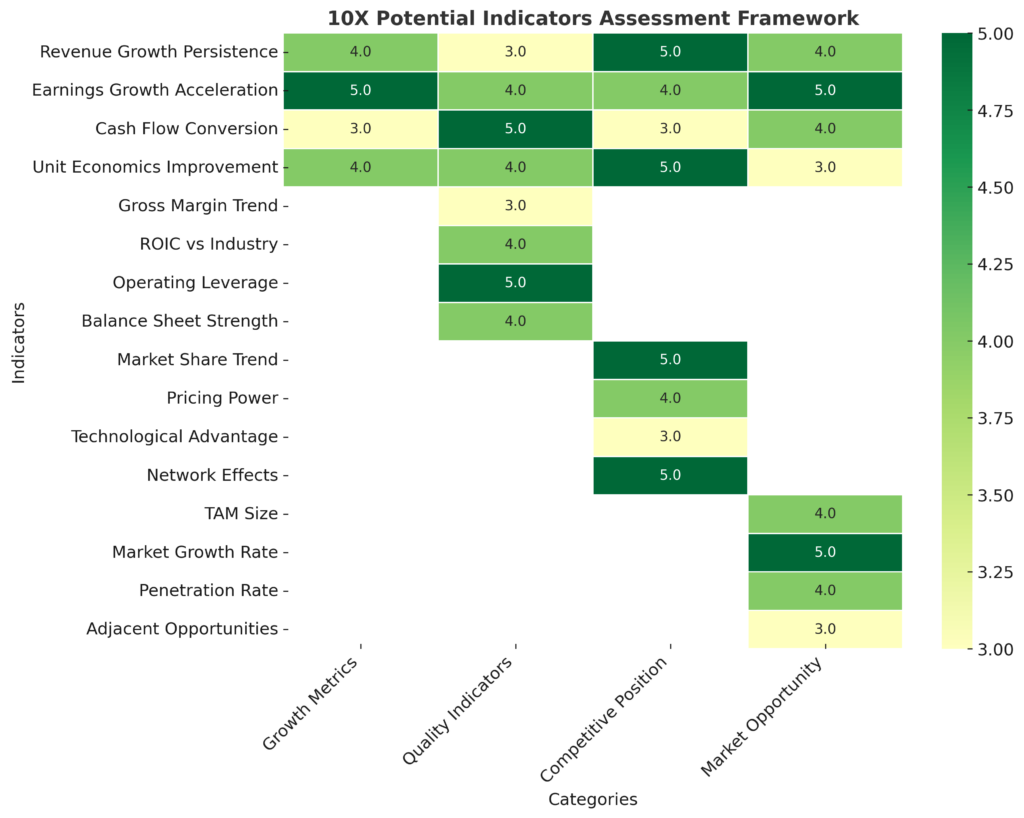

Analytical Framework for Growth Investing

Successful growth investing requires a systematic analytical approach that evaluates both quantitative and qualitative factors to identify companies capable of sustained expansion.

Quantitative Analysis

Growth Metrics

The foundation of growth analysis begins with measuring a company’s historical and projected growth rates across key performance indicators:

- Revenue growth: Preferably 15%+ annually, with consistent or accelerating trends

- Earnings growth: Should generally track or exceed revenue growth as the business scales

- Cash flow growth: Particularly important for assessing sustainability of expansion

- Unit economics: Customer acquisition costs, lifetime value, and other operational metrics

Exceptional growth companies typically demonstrate consistency across multiple metrics rather than showing growth in just one area. For example, a software company growing revenue at 40% but seeing declining gross margins may be buying growth at the expense of long-term profitability.

Quality Indicators

Growth without quality often proves unsustainable. Key quality metrics include:

- Gross margin: High margins (40%+) indicate pricing power and competitive advantage

- Return on invested capital (ROIC): Should exceed cost of capital by at least 5%

- Operating leverage: Revenue growth should translate to faster profit growth over time

- Balance sheet strength: Reasonable debt levels relative to cash flow and growth rate

Analysis by Bernstein Research shows that companies combining top-quartile growth with top-quartile ROIC outperformed the market by an average of 7.3% annually over 20 years.

Valuation Context

While growth investors prioritize expansion over current valuation, contextual valuation analysis remains important:

- PEG ratio: Comparing P/E to growth rate provides context for valuation

- Price-to-sales (P/S): Useful for pre-profit companies, ideally below 15x for most industries

- Rule of 40: For software/SaaS companies, growth rate + profit margin should exceed 40%

- DCF analysis: Discounted cash flow with realistic terminal growth assumptions

Successful growth investing requires distinguishing between “expensive but justified” and “expensive and speculative” valuations based on realistic growth assumptions.

Qualitative Analysis

Competitive Advantage Assessment

Long-term growth requires sustainable competitive advantages (moats) that protect against competitive pressure:

- Network effects: Value increases as more users join (e.g., Visa, Facebook)

- Switching costs: Difficult or expensive for customers to change providers (e.g., Adobe, Autodesk)

- Intellectual property: Patents, proprietary technology, exclusive content (e.g., Nvidia, Disney)

- Brand value: Premium pricing power through reputation (e.g., Apple, Starbucks)

- Scale economies: Cost advantages from operational size (e.g., Amazon, Costco)

Companies with multiple, reinforcing moats typically sustain growth longer than those with a single or weak advantage.

Market Opportunity Sizing

Evaluating total addressable market (TAM) and penetration rates helps assess remaining growth runway:

- Current market size: Existing revenue opportunity

- Market growth rate: How rapidly the overall market is expanding

- Penetration rate: Percentage of potential market currently captured

- Adjacent opportunities: Logical expansion paths into related markets

For example, Shopify initially targeted small online merchants (a relatively modest TAM) but has expanded into payments, fulfillment, and enterprise segments, dramatically increasing its growth ceiling.

Management Assessment

Leadership quality often differentiates successful growth companies:

- Capital allocation history: Track record of investments generating high returns

- Innovation culture: Ability to adapt and create new growth vectors

- Ownership mindset: Significant insider ownership and alignment with shareholders

- Realistic communication: Tendency to meet or exceed guidance rather than overpromise

Studies by McKinsey & Company show that management quality can account for up to 30% of the variance in company performance, making leadership evaluation crucial for growth investing.

Implementation: Building a Growth Portfolio

Translating growth investing principles into a practical portfolio requires thoughtful implementation across several dimensions.

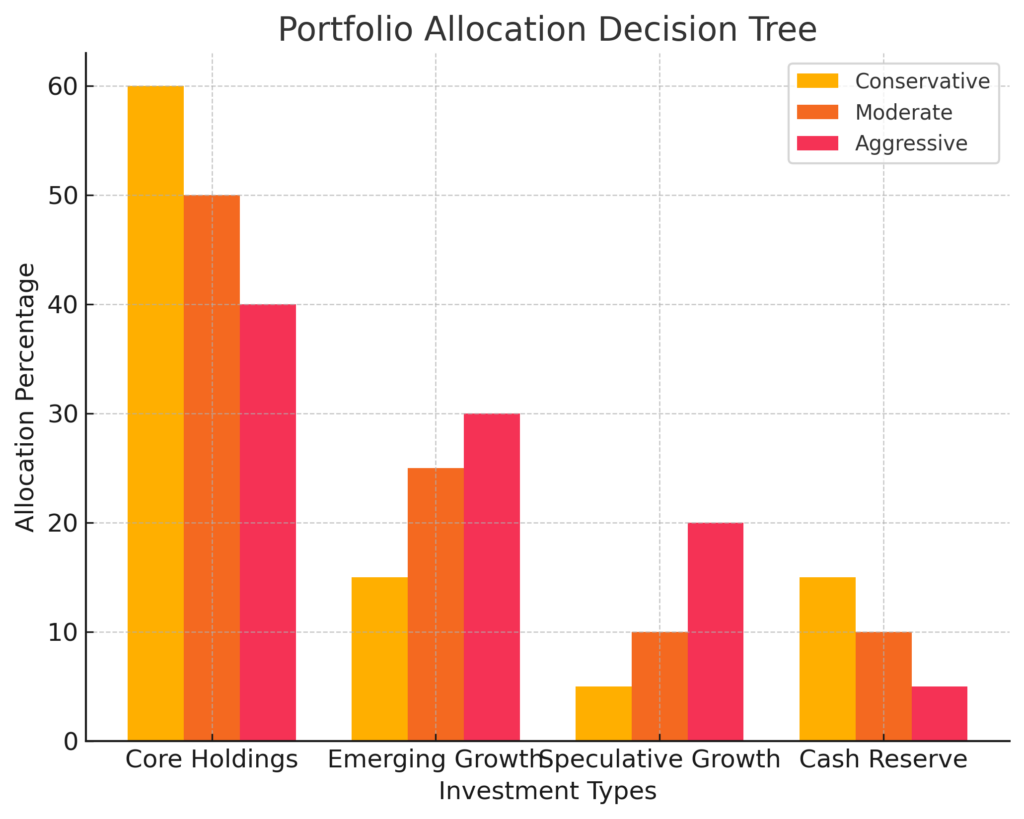

Portfolio Construction

A well-structured growth portfolio balances concentration for outperformance potential with sufficient diversification to manage risk:

- Core holdings (50-60%): Established growth companies with proven business models

- Emerging growth (20-30%): Earlier-stage companies with accelerating momentum

- Speculative growth (10-20%): High-potential but higher-risk opportunities

- Cash reserve (5-10%): Dry powder for opportunistic purchases during volatility

Research from Cambridge Associates suggests that optimal growth portfolios typically hold between 15-25 positions, with individual position sizes ranging from 2% to 8% based on conviction and risk profile.

Position Sizing and Risk Management

Thoughtful position sizing is critical for managing the inherent volatility of growth investing:

- Conviction-based weighting: Allocate larger positions to highest-conviction ideas

- Risk-adjusted sizing: Consider volatility and correlation when determining position size

- Tiered entry approach: Build positions gradually rather than all at once

- Predefined risk limits: Set maximum allocation percentages for different risk categories

For risk management, many successful growth investors employ the “2% rule”—limiting potential loss on any individual position to no more than 2% of the total portfolio through position sizing and stop-loss strategies.

Monitoring and Rebalancing

Active management of a growth portfolio requires regular review and adjustment:

- Quarterly fundamental reviews: Reassess growth thesis and progress

- Trimming outsized winners: Reduce positions that grow to exceed maximum allocation targets

- Evaluating underperformers: Apply a systematic process for addressing laggards

- Tax-efficient rebalancing: Consider tax implications when adjusting positions

A study by Vanguard found that disciplined rebalancing added approximately 0.35% in annual returns compared to completely static allocation approaches.

Time Horizon Considerations

Growth investing success correlates strongly with time horizon – the patience to allow compounding to work:

| Investment HorizonRecommended Strategy Adjustments | |

|---|---|

| 3-5 years | Higher quality, lower valuation growth stocks; wider diversification |

| 5-10 years | Balanced approach across growth spectrum; moderate concentration |

| 10+ years | Higher tolerance for valuation and earlier-stage companies; more concentration |

Historical analysis shows that while growth stocks experience higher short-term volatility, this risk diminishes significantly with longer holding periods, allowing the superior growth characteristics to drive outperformance.

Analytical Tools and Technology

Modern growth investing leverages sophisticated analytical tools to identify opportunities and manage risk more effectively than traditional approaches.

Screening and Idea Generation

Quantitative screening tools help investors efficiently identify candidates meeting specific growth criteria:

- FinViz: Offers comprehensive screening across growth, quality, and technical parameters

- Stock Rover: Provides growth-focused screeners with historical consistency metrics

- YCharts: Enables custom screening with visualization of growth trends

- Koyfin: Combines screening with relative strength and sector analysis

Effective screening typically combines multiple factors rather than relying on simple metrics like P/E ratio or revenue growth in isolation.

Technical Analysis Integration

While fundamental analysis drives long-term growth investing, technical analysis helps with entry timing and risk management:

- Moving averages: 50-day and 200-day moving averages for trend identification

- Relative strength: Comparing performance to broader indices or sector peers

- Volume patterns: Identifying accumulation or distribution by institutional investors

- Support/resistance levels: Identifying key price points for position building or reducing

Research by Ned Davis Research found that combining fundamental growth criteria with technical momentum factors improved risk-adjusted returns by approximately 3.2% annually compared to using fundamental factors alone.

Portfolio Analytics

Risk management tools help growth investors understand and control portfolio-level exposures:

- Correlation analysis: Ensuring sufficient diversification despite thematic focus

- Factor exposure: Measuring sensitivity to interest rates, economic cycles, etc.

- Stress testing: Simulating portfolio performance under various market scenarios

- Attribution analysis: Understanding sources of outperformance or underperformance

Professional investors increasingly use programs like Portfolio Visualizer, Morningstar Portfolio Manager, or institutional platforms for comprehensive risk analytics.

AI and Machine Learning Applications

Emerging technologies are creating new approaches to growth investing:

- Alternative data analysis: Using non-traditional data sources to identify growth trends

- Sentiment analysis: Gauging market and consumer sentiment through social media and news

- Pattern recognition: Identifying companies showing characteristics of previous multibaggers

- Natural language processing: Analyzing earnings calls and management communications

While still evolving, these technologies show promise in identifying growth inflection points earlier than traditional analysis. For example, Goldman Sachs’ systematic trading desk reported that alternative data signals improved growth stock selection by 23% in backtested models.

Future Trends in Growth Investing

The landscape for growth investing continues to evolve, with several emerging trends likely to shape strategies in the coming years.

The Rise of Private Market Crossover

The boundary between private and public growth investing is blurring, with several implications:

- Companies remaining private longer, capturing more of their early growth before IPO

- Crossover funds investing in both late-stage private and public growth companies

- SPAC and direct listing alternatives providing new pathways to public markets

- Retail access to pre-IPO investments through platforms like EquityZen and Forge

This trend requires growth investors to develop frameworks for evaluating companies with limited public operating history and potentially different reporting standards than traditional public companies.

Sustainable Growth Focus

Environmental, social, and governance (ESG) considerations are increasingly integrated into growth investing:

- Climate tech experiencing rapid growth (45% CAGR in venture funding since 2020)

- Circular economy business models creating new growth vectors

- Increased investor demand for sustainable growth metrics beyond financial returns

- Regulatory trends favoring companies with strong sustainability practices

Research by Morningstar indicates that 65% of sustainable funds have outperformed their conventional counterparts over the past five years, challenging the notion that ESG considerations limit growth potential.

Geographic Diversification

While U.S. markets have dominated growth investing in recent decades, global opportunities are expanding:

- India emerging as a major growth market with its digital transformation

- Southeast Asian technology ecosystem maturing rapidly

- European innovation hubs developing strengths in specific sectors

- Latin American fintech revolution creating new investment opportunities

Morgan Stanley projects that non-U.S. markets will contribute approximately 70% of global GDP growth over the next decade, suggesting greater geographic diversification in growth portfolios.

Democratization of Information

Information advantages are evolving in the growth investing landscape:

- Expert networks providing specialized industry insights

- Alternative data creating new information edges

- Social investing platforms enabling knowledge sharing

- AI tools democratizing complex analysis capabilities

This trend rewards investors who can synthesize diverse information sources rather than relying on traditional financial statements and analyst reports alone.

FAQs – Growth Investing Analytics

1. What minimum investment amount is recommended for a growth investing strategy?

While there is no absolute minimum, effective growth investing typically requires at least $10,000-$25,000 to achieve sufficient diversification across 15-20 positions. However, fractional share investing through platforms like M1 Finance or Robinhood has made smaller-scale growth investing more accessible. Investors with limited capital should consider growth-oriented ETFs or focus on a smaller number of high-conviction positions rather than sacrificing quality for diversification.

2. How does growth investing perform during economic recessions?

Growth stocks historically show mixed performance during recessions, with significant variation based on sector, balance sheet strength, and growth sustainability. During the 2008 financial crisis, growth stocks initially declined more than value (-42% vs -39%), but recovered more quickly in the subsequent expansion. Companies with high recurring revenue, low debt, and services addressing essential needs tend to outperform during downturns. Many successful growth investors maintain 10-15% cash positions to deploy opportunistically during market corrections.

3. What are the tax implications of growth investing compared to other strategies?

Growth investing typically generates returns primarily through capital appreciation rather than dividend income, creating potential tax advantages. Long-term capital gains are taxed at lower rates (0%, 15%, or 20% depending on income bracket) compared to dividends and interest (taxed as ordinary income up to 37%). Growth investors can also exercise greater control over the timing of tax events through selective harvesting of losses and gains. Tax-advantaged accounts like Roth IRAs are particularly well-suited for high-growth strategies due to the potential for substantial tax-free compounding.

4. How should investors balance growth and value in their overall portfolio?

Optimal portfolio construction typically includes elements of both growth and value, with the specific balance depending on market conditions, time horizon, and personal risk tolerance. Research by Fidelity suggests that a baseline allocation of 60% growth and 40% value provides strong returns while moderating volatility across full market cycles. During periods of rising interest rates or elevated valuations, increasing value exposure to 50-60% may be prudent. Conversely, during periods of technological disruption or economic recovery, growth allocations of 65-75% have historically delivered superior risk-adjusted returns.

5. What metrics best predict future growth stock performance?

While no single metric perfectly predicts performance, research consistently identifies several high-correlation indicators. Revenue growth persistence (consistency of 20%+ growth over consecutive quarters) shows a 0.72 correlation with subsequent three-year returns according to Morgan Stanley research. Gross margin expansion, increasing free cash flow conversion, and ROIC exceeding 15% also demonstrate strong predictive value. Interestingly, current P/E ratios show relatively low correlation (0.31) with future returns for established growth companies, suggesting investors should prioritize quality and growth persistence over current valuation multiples.

6. How frequently should a growth portfolio be rebalanced?

Optimal rebalancing frequency balances performance impact with transaction costs and tax considerations. Studies by BlackRock suggest that quarterly reviews with conditional rebalancing (when positions deviate 20%+ from targets) provides the best balance between maintaining intended exposures and minimizing unnecessary trading. For taxable accounts, annual rebalancing with a 25-30% threshold often proves more tax-efficient. Many successful growth investors use a tiered approach – trimming positions that exceed 150% of their target weight while completely exiting positions when the original investment thesis no longer applies, regardless of rebalancing schedule.

7. What role should international stocks play in a growth portfolio?

International markets offer valuable diversification and unique growth opportunities not available in domestic markets. Empirical research indicates that allocating 20-40% of a growth portfolio to international equities improves risk-adjusted returns while reducing correlation to domestic market movements. Emerging markets, in particular, can offer earlier-stage growth opportunities with less analyst coverage, creating potential for greater inefficiencies. Areas showing particular promise include Indian technology services, Southeast Asian e-commerce, European life sciences, and Latin American fintech, which have delivered average annual growth rates exceeding 25% over the past five years.

8. How does dollar-cost averaging compare to lump-sum investing for growth strategies?

Statistical analysis favors lump-sum investing for maximizing expected returns, with Vanguard research showing it outperforms dollar-cost averaging approximately 67% of the time over 10-year periods. However, dollar-cost averaging provides psychological benefits and risk reduction when investing during periods of elevated valuations or market uncertainty. A hybrid approach often works well for growth investing – deploying 50-60% of capital immediately into highest-conviction core positions, then systematically investing the remainder over 6-12 months, particularly into more volatile emerging growth names.

9. What are the most common mistakes growth investors make?

The most costly errors in growth investing include: 1) Selling winners too early due to valuation concerns (opportunity cost of missing compounding), 2) Anchoring to past prices rather than current business fundamentals, 3) Over-diversification diluting returns from top performers, 4) Insufficient position sizing on highest-conviction ideas, 5) Recency bias in extrapolating short-term growth trends, and 6) Failing to distinguish between cyclical and secular growth drivers. Research by Baillie Gifford found that approximately 80% of long-term growth returns came from just 20% of positions, highlighting the importance of adequate concentration in highest-conviction ideas.

10. How should investors adjust growth strategies as they approach retirement?

Rather than abandoning growth investing entirely, investors approaching retirement should consider recalibrating their approach. This typically involves: 1) Shifting from early-stage to established growth companies with stronger free cash flow generation, 2) Increasing allocation to GARP (Growth at a Reasonable Price) rather than high-multiple speculative growth, 3) Incorporating covered call strategies on growth positions to generate income while maintaining exposure, and 4) Building a 2-3 year liquidity reserve to avoid forced selling during market corrections. Many successful retirement portfolios maintain 30-40% exposure to growth investments to provide inflation protection and longevity risk mitigation, while adjusting the risk profile within that allocation.

Conclusion

Growth investing remains one of the most powerful strategies for building significant wealth over extended time horizons. By focusing on companies capable of sustained above-average expansion, investors can harness the mathematical power of compounding to potentially multiply their capital many times over. While the approach inherently involves greater volatility and requires more active management than passive strategies, the historical evidence overwhelmingly supports its effectiveness when executed with analytical discipline and patience.

The most successful growth investors combine rigorous quantitative analysis with thoughtful qualitative assessment, seeking companies with durable competitive advantages, large market opportunities, and capable leadership teams. They recognize that truly exceptional businesses – the kind capable of delivering 10x returns – represent a small minority of the overall market, making selectivity and conviction essential elements of the approach. By implementing systematic frameworks for portfolio construction, position sizing, monitoring, and risk management, investors can maximize their probability of identifying and adequately capitalizing on these rare opportunities.

As technology continues transforming both business models and investment processes, growth investing continues to evolve. The integration of alternative data sources, artificial intelligence, and cross-border perspectives presents both challenges and opportunities for investors seeking market-beating returns. Those who combine time-tested fundamental principles with adaptability to changing conditions position themselves to achieve the substantial wealth creation potential that effective growth investing can provide.

For your reference, recently published articles include:

- Best Value Investing Tools – Create Wealth “Like Warren Buffet”

- Passive Income Strategies: How To Go To $10K In 12 Months

- Investment Research Platforms That Give You the Edge: Institutional Tools for Exceptional Returns

- Alternative Data Analytics: All You Need To Know About Wall Street’s Best-Kept Secret

- Outperform 90% Of Investors: Best Advice On Investment Benchmarking Tools

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.