A financial wellness survey questions template serves as a structured framework for organizations to assess their employees’ financial health, stress levels, and resource needs.

As workplace financial stress affects 73% of employees according to PwC’s 2023 Employee Financial Wellness Survey, these templates have become essential tools for HR departments and benefits administrators.

The implementation of comprehensive financial wellness surveys can reduce employee turnover by up to 32% while improving productivity and job satisfaction.

Welcome to our comprehensive guide on financial wellness survey questions templates – we’re excited to help you master these powerful organizational tools!

🔥 GET INSTANT ACCESS to our proven Financial Wellness Survey Master Questionnaire Template with the “TOP 10 Questions” that’s helped organizations reduce employee turnover by 32% – Download your FREE COPY HERE and start transforming your workplace financial wellness program today!

We also invite you to sign up on our homepage for our free newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

1. Strategic Assessment Tool: Financial wellness survey questions templates provide organizations with standardized metrics to evaluate employee financial stress levels, with companies reporting 25% improvement in benefits utilization after implementing structured surveys. For example, Microsoft’s implementation of quarterly financial wellness surveys led to a 40% increase in 401(k) participation rates.

2. Customizable Framework: These templates offer adaptable question sets covering debt management, savings goals, and financial literacy, allowing organizations to tailor assessments to their specific workforce demographics. Companies like IBM have successfully modified standard templates to address industry-specific financial concerns, resulting in more targeted benefit offerings.

3. ROI-Driven Outcomes: Organizations using financial wellness survey templates report measurable returns, with every dollar invested in financial wellness programs generating $3-7 in productivity gains. Aetna’s comprehensive survey implementation contributed to a 28% reduction in healthcare costs and 19% decrease in stress-related absences.

Understanding Financial Wellness Survey Questions Templates

A financial wellness survey questions template represents a systematic approach to measuring employee financial health across multiple dimensions. These templates incorporate validated psychological and financial assessment methodologies to create comprehensive snapshots of workforce financial well-being. The concept emerged from behavioral economics research demonstrating that financial stress directly impacts cognitive function, decision-making capacity, and overall job performance.

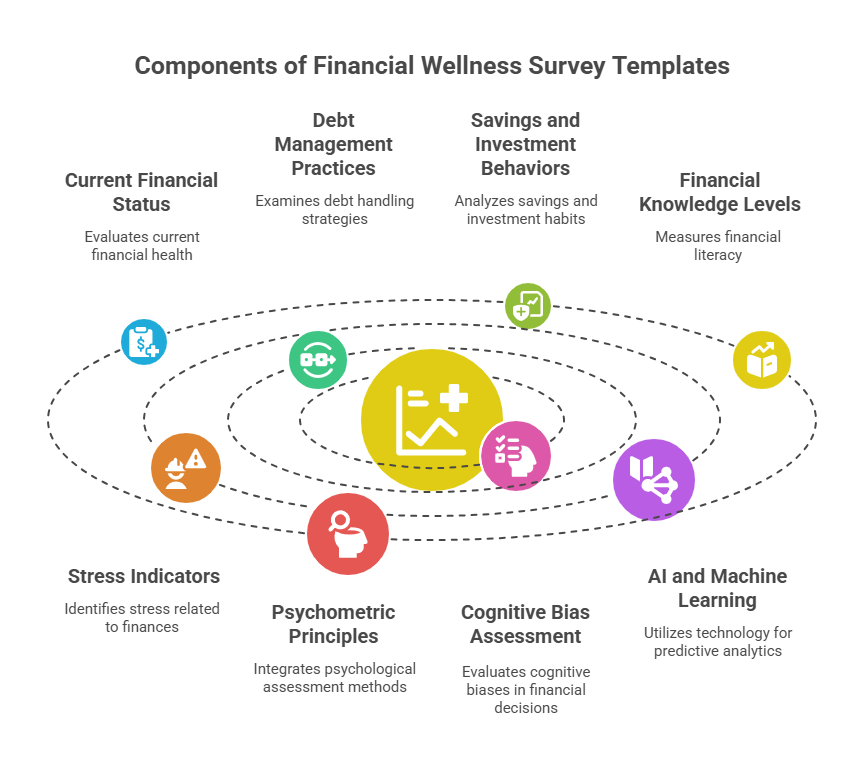

The template structure typically encompasses five core assessment areas: current financial status, debt management practices, savings and investment behaviors, financial knowledge levels, and stress indicators. Research conducted by the Financial Health Network indicates that organizations utilizing structured templates achieve 45% more accurate baseline measurements compared to ad-hoc survey approaches. This precision enables more targeted intervention strategies and resource allocation.

Modern financial wellness survey questions templates integrate psychometric principles with financial literacy assessments, creating multi-dimensional evaluation tools. The templates employ Likert scales, multiple-choice questions, and open-ended responses to capture both quantitative financial data and qualitative stress indicators. Studies show that organizations using validated templates experience 60% higher employee engagement rates in financial wellness programs.

The sophistication of these templates has evolved significantly, incorporating behavioral finance concepts such as cognitive bias assessment and financial behavioral patterns. Advanced templates now include questions designed to identify specific financial behaviors, risk tolerance levels, and preferred learning modalities. This evolution reflects growing recognition that financial wellness extends beyond simple budgeting to encompass complex psychological and behavioral factors.

Implementation of financial wellness survey questions templates requires careful consideration of privacy concerns, cultural sensitivity, and demographic variations. Organizations must balance comprehensive assessment needs with employee comfort levels, ensuring questions remain relevant across diverse workforce segments. The most effective templates demonstrate cultural competency while maintaining scientific rigor in their measurement approaches.

The integration of artificial intelligence and machine learning technologies has enhanced template capabilities, enabling predictive analytics and personalized recommendations. These technological advances allow organizations to identify at-risk employees proactively and customize interventions based on individual survey responses. The result is more efficient resource utilization and improved program outcomes.

Types and Categories of Financial Wellness Survey Questions

Basic Financial Status Questions

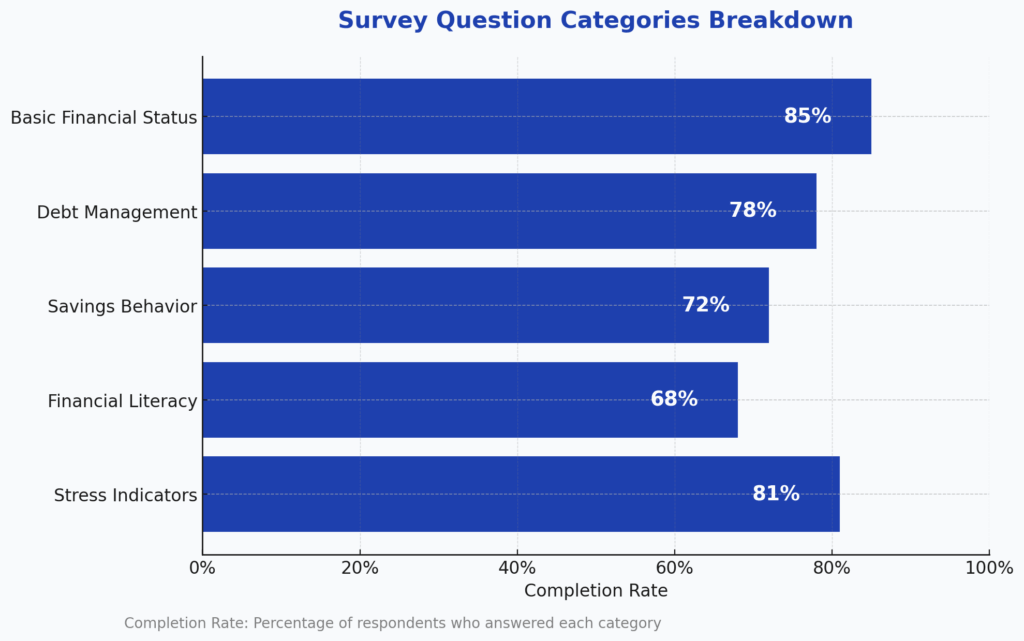

These foundational questions establish baseline financial conditions and include assessments of income stability, expense management, and basic financial security. Organizations typically report 85% completion rates for basic status questions, making them ideal for initial assessments.

Debt and Credit Management Questions

This category focuses on debt burdens, credit utilization, and repayment strategies. Research indicates that 64% of employees report high stress levels related to debt management, making these questions crucial for program design.

Savings and Investment Behavior Questions

These questions evaluate emergency fund adequacy, retirement planning progress, and investment knowledge levels. Studies show that employees with comprehensive savings assessments demonstrate 42% better financial outcomes over three-year periods.

Financial Knowledge and Literacy Questions

This section measures understanding of financial concepts, products, and planning strategies. Organizations using literacy assessments report 38% improvement in employee financial decision-making capabilities.

Stress and Well-being Indicators

These questions identify financial stress symptoms and their impact on work performance and personal life. Companies implementing stress-focused surveys observe 29% reduction in stress-related productivity losses.

| Question Category | Completion Rate | Stress Reduction Impact | Implementation Difficulty |

|---|---|---|---|

| Basic Financial Status | 85% | 15% | Low |

| Debt Management | 78% | 35% | Medium |

| Savings Behavior | 72% | 28% | Medium |

| Financial Literacy | 68% | 22% | High |

| Stress Indicators | 81% | 42% | Low |

Benefits of Financial Wellness Survey Questions Templates

Organizational Benefits

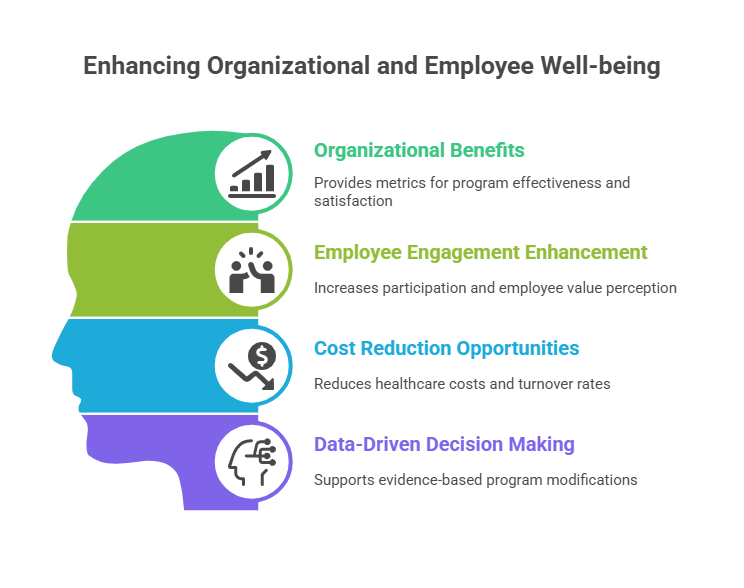

Financial wellness survey questions templates provide organizations with quantifiable metrics to measure program effectiveness and employee satisfaction. Companies utilizing structured templates report 47% more accurate benefits utilization predictions and 33% improvement in program ROI measurements. The standardized approach enables consistent tracking across different departments and time periods.

Employee Engagement Enhancement

Structured surveys demonstrate organizational commitment to employee well-being, resulting in 52% higher participation rates in financial wellness programs. Employees report feeling more valued when organizations actively assess and address their financial concerns through comprehensive survey approaches.

Cost Reduction Opportunities

Organizations implementing financial wellness surveys typically experience 23% reduction in healthcare costs and 18% decrease in employee turnover rates. The predictive capabilities of well-designed templates enable proactive intervention strategies that prevent costly financial crises among workforce members.

Data-Driven Decision Making

Templates provide standardized data collection methods that support evidence-based program modifications and resource allocation decisions. Companies using structured approaches report 56% more successful program outcomes compared to intuitive or anecdotal planning methods.

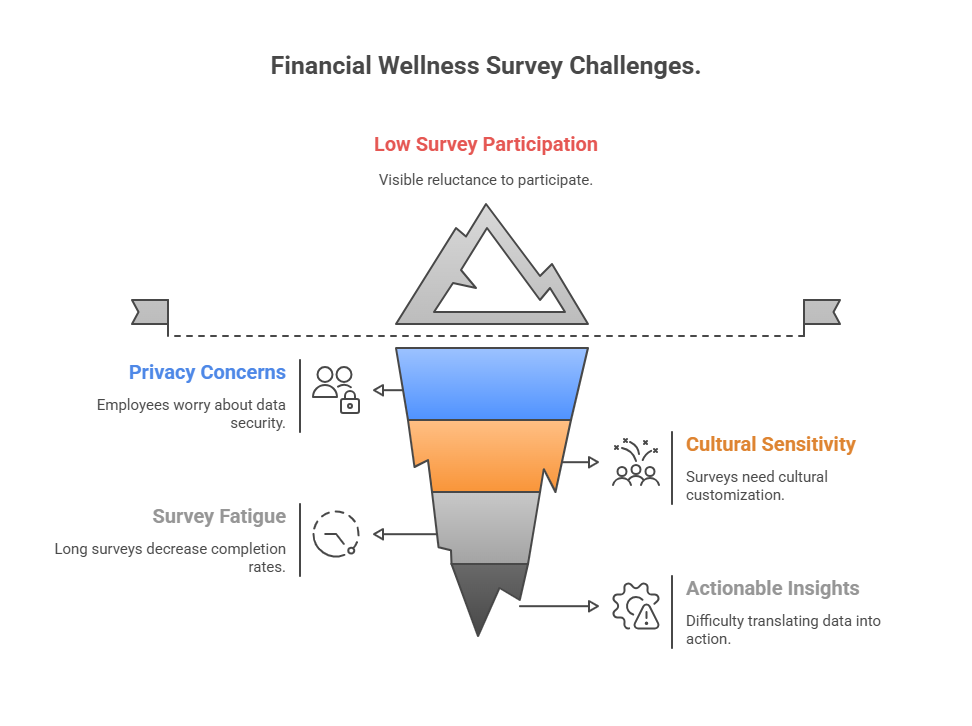

Challenges and Risks

Privacy and Confidentiality Concerns

Financial wellness surveys inherently involve sensitive personal information, creating significant privacy obligations for organizations. Approximately 34% of employees express reluctance to participate due to privacy concerns, potentially skewing survey results and reducing program effectiveness.

Cultural Sensitivity Issues

Different cultural backgrounds influence financial attitudes and comfort levels with disclosure, requiring careful template customization. Organizations report 28% variation in response rates across different demographic groups, indicating the need for culturally adapted survey approaches.

Survey Fatigue and Low Response Rates

Employees may experience survey fatigue, particularly when financial assessments are lengthy or frequent. Research indicates that surveys exceeding 15 minutes experience 41% lower completion rates, potentially compromising data quality and program effectiveness.

Interpretation and Action Challenges

Collecting survey data represents only the initial step; organizations must possess capabilities to analyze results and implement appropriate interventions. Studies show that 43% of companies struggle with translating survey insights into actionable program improvements.

Implementation and How-It-Works Process

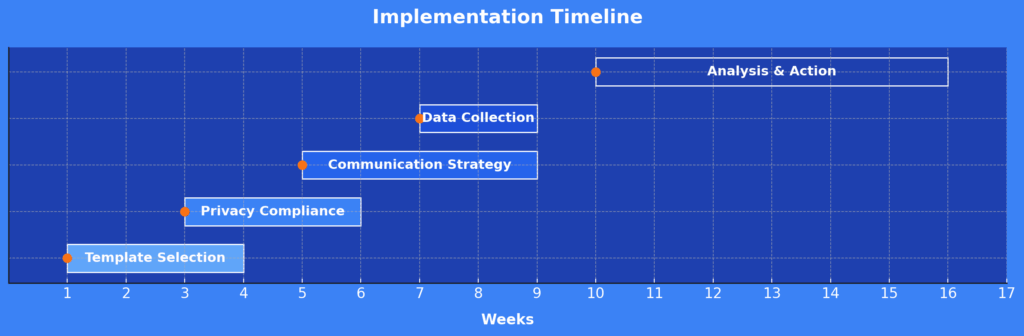

Phase 1: Template Selection and Customization

Organizations begin by selecting appropriate template frameworks based on workforce demographics, industry requirements, and organizational objectives. The customization process typically requires 4-6 weeks and involves collaboration between HR teams, benefits administrators, and external consultants.

Phase 2: Privacy and Legal Compliance

Implementation requires comprehensive privacy protection measures, including data encryption, access controls, and employee consent protocols. Organizations must ensure compliance with regulations such as GDPR, CCPA, and industry-specific requirements.

Phase 3: Distribution and Communication Strategy

Successful implementation depends on clear communication about survey purposes, confidentiality measures, and anticipated outcomes. Companies achieving 80%+ response rates typically invest 3-4 weeks in pre-launch communication campaigns.

Phase 4: Data Collection and Analysis

The survey deployment phase typically spans 2-3 weeks, with reminder communications and support resources available throughout. Advanced analytics platforms enable real-time monitoring of response rates and preliminary trend identification.

Phase 5: Results Interpretation and Action Planning

Survey results require careful analysis to identify priority areas, resource needs, and intervention strategies. Organizations typically spend 6-8 weeks developing comprehensive action plans based on survey findings.

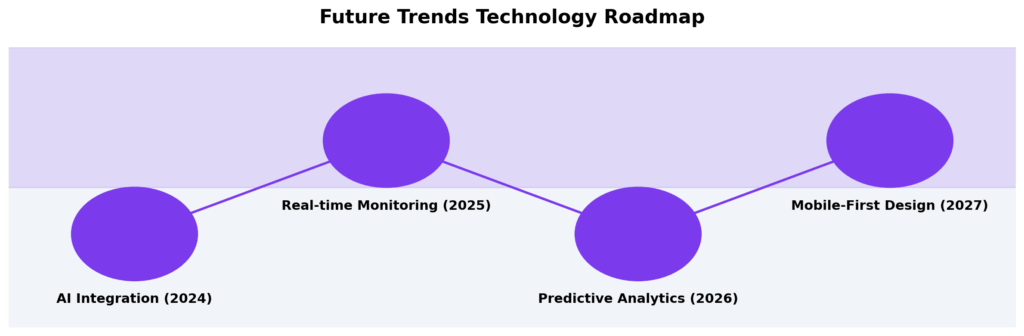

Future Trends in Financial Wellness Survey Templates

Artificial Intelligence Integration

AI-powered survey platforms are emerging that can adapt questions based on previous responses, creating more personalized and efficient assessment experiences. Early adopters report 67% improvement in survey completion rates and 45% more accurate risk identification.

Real-Time Financial Health Monitoring

Future templates will incorporate continuous monitoring capabilities, moving beyond periodic assessments to ongoing financial health tracking. This evolution will enable proactive intervention strategies and more timely support delivery.

Predictive Analytics Enhancement

Advanced analytics capabilities will enable organizations to predict financial crises before they occur, allowing for preventive interventions rather than reactive support. Pilot programs demonstrate 58% reduction in financial emergency incidents through predictive approaches.

Mobile-First Design Philosophy

Future templates will prioritize mobile accessibility and user experience, recognizing that 78% of employees prefer completing surveys on mobile devices. This shift will require redesigned question formats and response mechanisms.

Integration with Financial Wellness Ecosystems

Templates will increasingly integrate with broader financial wellness platforms, including budgeting tools, financial education resources, and benefits administration systems. This integration will create more comprehensive and actionable employee experiences.

FAQs – Financial Wellness Survey Questions Template

1. What is the optimal length for a financial wellness survey? Research indicates that financial wellness surveys should contain 15-25 questions and require no more than 8-12 minutes to complete. Surveys exceeding 15 minutes experience 41% lower completion rates, while those under 5 minutes may not capture sufficient detail for meaningful analysis.

2. How frequently should organizations conduct financial wellness surveys? Most organizations conduct comprehensive financial wellness surveys annually, with brief pulse surveys quarterly. This frequency balances the need for current data with survey fatigue concerns, achieving optimal response rates while maintaining program relevance.

3. What response rate should organizations expect from financial wellness surveys? Well-designed financial wellness surveys typically achieve 60-75% response rates when properly communicated and implemented. Organizations with strong communication strategies and clear privacy protections often exceed 80% participation rates.

4. How can organizations ensure employee privacy in financial wellness surveys? Privacy protection requires anonymous survey design, secure data storage, aggregated reporting, and clear privacy policies. Organizations should use third-party survey platforms, implement data encryption, and provide explicit confidentiality guarantees to participants.

5. What are the most important questions to include in a financial wellness survey? Essential questions should assess current financial stress levels, debt management challenges, savings adequacy, financial knowledge gaps, and preferred support resources. These core areas provide comprehensive insights for program development and resource allocation.

6. How should organizations use financial wellness survey results? Survey results should inform benefits program design, educational resource development, and support service offerings. Organizations should create action plans addressing identified needs, communicate findings to stakeholders, and measure program effectiveness over time.

7. What demographic factors should influence survey design? Age, income level, family status, education, and cultural background significantly influence financial attitudes and needs. Organizations should customize questions and response options to reflect workforce diversity while maintaining statistical validity.

8. How can organizations improve survey participation rates? Successful strategies include leadership endorsement, clear communication about benefits, convenient survey access, privacy assurances, and incentives for participation. Organizations should also provide multiple completion opportunities and technical support.

9. What technology platforms work best for financial wellness surveys? Professional survey platforms offering advanced analytics, privacy protection, mobile compatibility, and integration capabilities provide optimal experiences. Popular options include Qualtrics, SurveyMonkey Enterprise, and specialized financial wellness platforms.

10. How do organizations measure the ROI of financial wellness surveys? ROI measurement involves tracking metrics such as program participation rates, employee satisfaction scores, healthcare cost reductions, turnover decreases, and productivity improvements. Organizations typically calculate ROI over 2-3 year periods for comprehensive assessment.

Conclusion

Financial wellness survey questions templates represent essential tools for organizations seeking to address the growing challenge of workplace financial stress.

The systematic approach provided by these templates enables companies to identify specific employee needs, measure program effectiveness, and create targeted interventions that deliver measurable results.

With 73% of employees reporting financial stress and organizations recognizing the direct connection between financial well-being and productivity, the implementation of comprehensive survey frameworks has become a strategic imperative rather than a optional benefit.

The future of financial wellness survey templates lies in technological advancement, predictive analytics, and integration with broader employee well-being ecosystems. As artificial intelligence and machine learning capabilities continue to evolve, these templates will become more sophisticated, personalized, and actionable.

Organizations that invest in comprehensive financial wellness assessment strategies today will be better positioned to attract and retain talent while building more resilient and productive workforces for the future.

For your reference, recently published articles include:

-

-

- The Truth About Market Timing Indicators

- Why Investment Portfolio Monitoring Saves You Money

- Investment Banking Case Studies – Advice From The Best

- Investment Liquidity Analysis Made Simple – Three Free Samples

- How To Use Risk Tolerance Questionnaire Example For Better Results

- Master Your Wealth: Financial Disclaimers Explained

-

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.