Introduction: The Silent Wealth Destroyer

Expense ratios are among the most overlooked yet critically important factors in investment success. While investors spend countless hours analyzing market trends and selecting individual securities, many pay little attention to the annual fees quietly eroding their portfolio returns year after year. These seemingly small percentages, often ranging from 0.03% to 2.00% of assets under management, can compound into staggering sums over an investment lifetime.

In today’s competitive investment landscape, understanding expense ratios has never been more critical. The difference between a low-cost index fund charging 0.03% and an actively managed fund charging 1.25% might seem trivial in any given year, but over a 30-year investment horizon, this gap can translate to hundreds of thousands of dollars in lost wealth.

This comprehensive guide examines what expense ratios are, why they matter profoundly, and how investors can minimize their impact to maximize long-term returns. Please check the “EXPENSE RATIO CALCULATOR” at the bottom of this article.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways

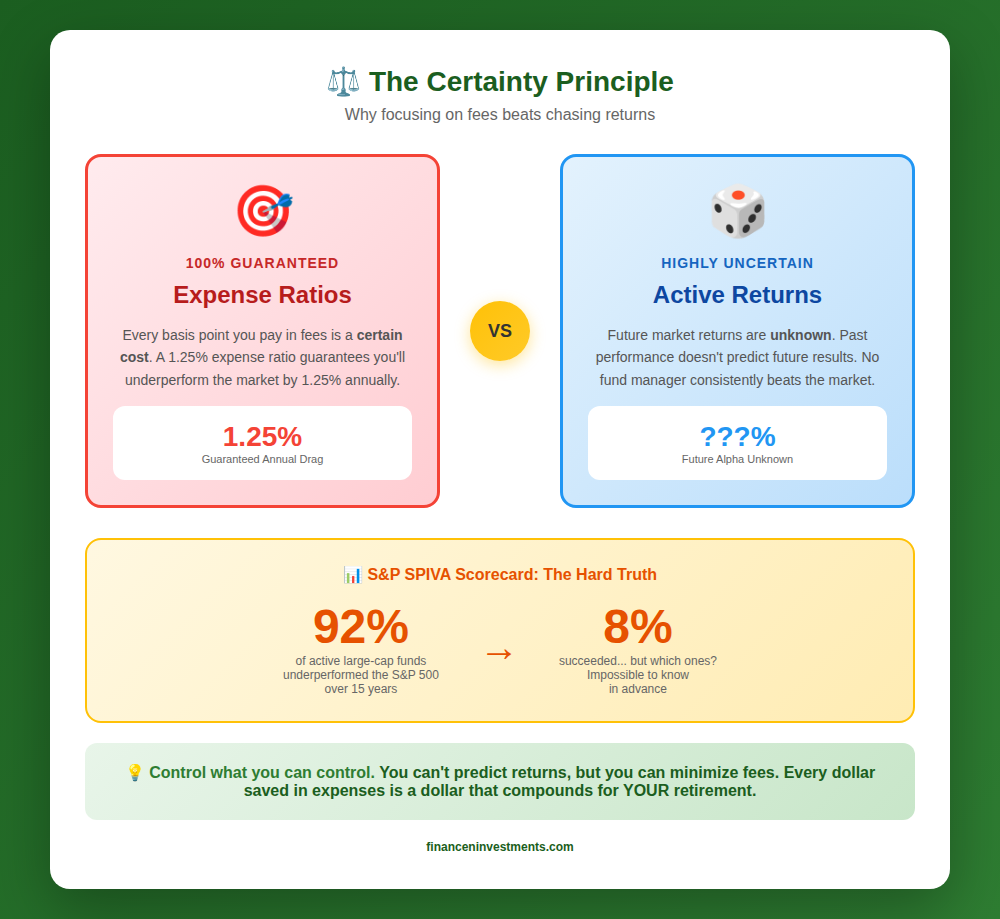

- Expense ratios create guaranteed costs while returns remain uncertain. An investor paying 1.25% annually is guaranteed to underperform a comparable 0.05% fund by 1.20% before any other factors are considered. Over 30 years with a $100,000 initial investment earning 7% gross returns, this difference compounds to approximately $438,000 in lost wealth.

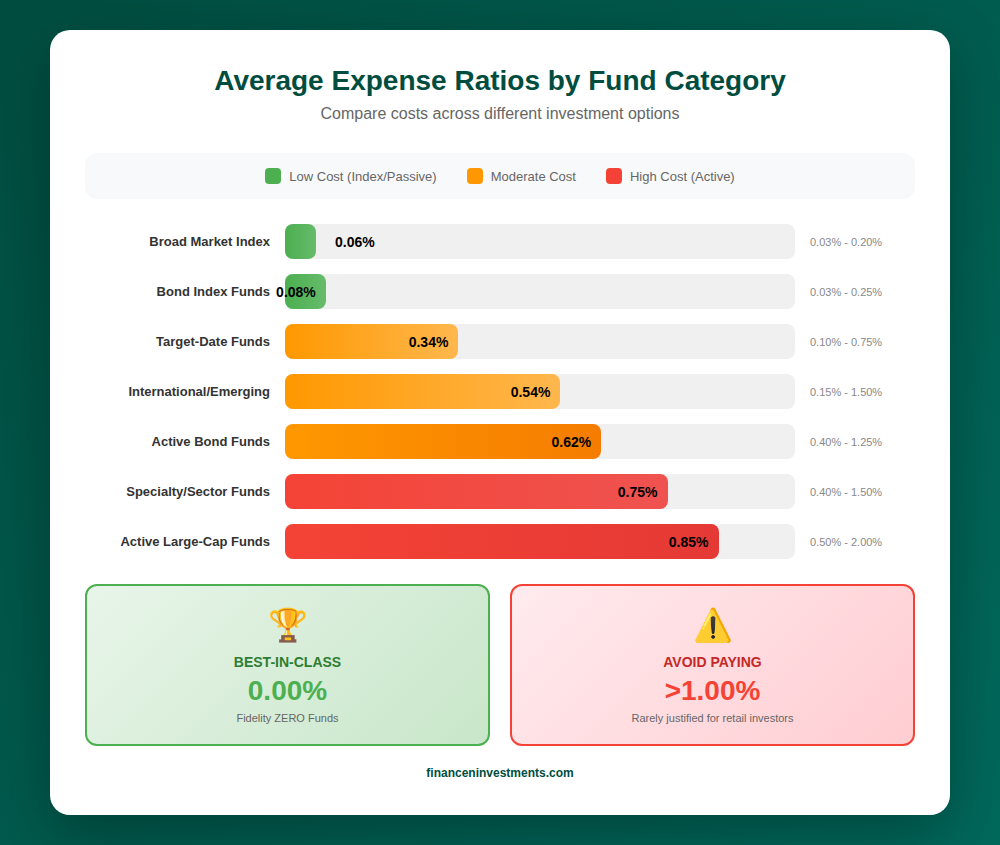

- Index funds have revolutionized fee structures, with leading providers now offering expense ratios as low as 0.00% to 0.03%. Fidelity’s ZERO series charges no expense ratio whatsoever, while Vanguard and Schwab offer total market funds below 0.05%. These ultra-low-cost options make expensive actively managed funds increasingly difficult to justify.

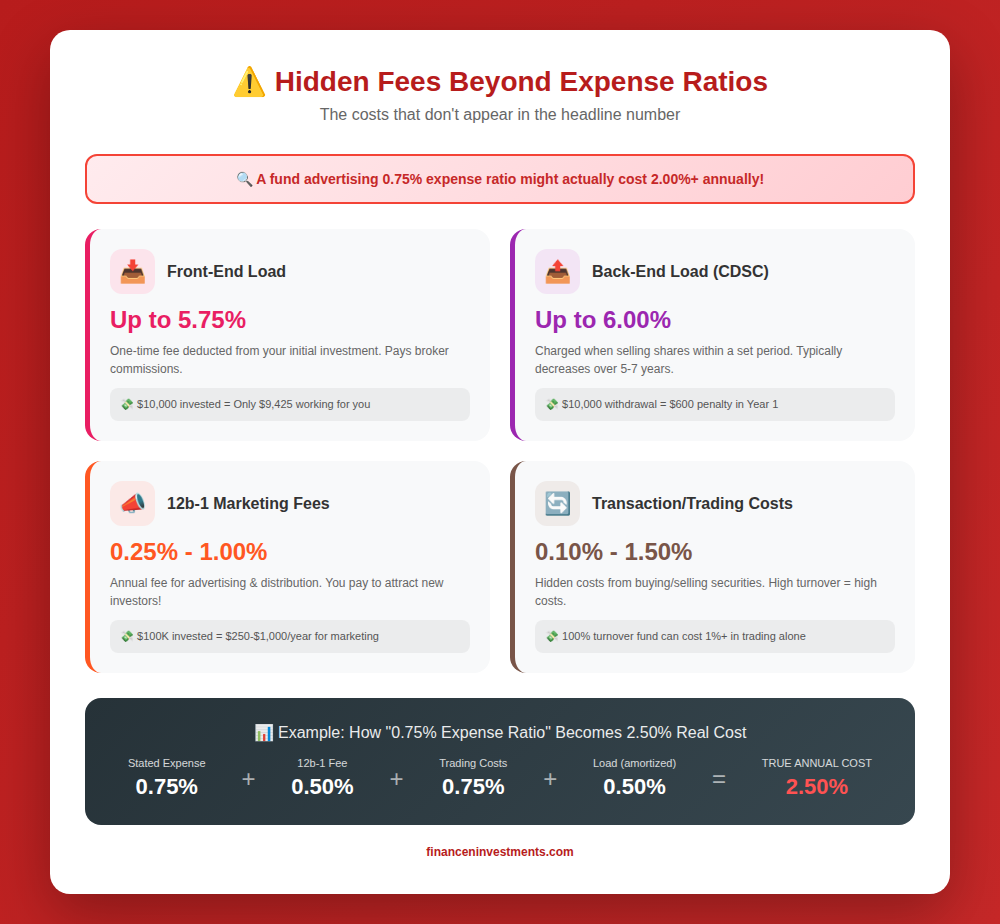

- Beyond expense ratios, investors must watch for hidden fees, including front-end loads, back-end loads, 12b-1 fees, and transaction costs. A fund advertising a 0.75% expense ratio might actually cost 1.50% or more annually when all fees are included, making comprehensive fee analysis essential before investing.

Table of Contents

What Are Expense Ratios?

Definition and Basic Mechanics

An expense ratio represents the annual percentage of a fund’s assets deducted to cover operating expenses. Expressed as a percentage, a fund with a 0.50% expense ratio charges $50 annually for every $10,000 invested. Unlike transaction fees or sales loads, expense ratios are deducted automatically from fund assets, making them invisible to investors who do not actively monitor their impact.

The expense ratio calculation divides a fund’s total operating expenses by its average assets under management. For example, a fund managing $10 billion with $30 million in annual operating expenses would have an expense ratio of 0.30%. This fee is assessed daily in small increments, typically 1/365th of the annual rate, and reduces the fund’s net asset value (NAV) accordingly.

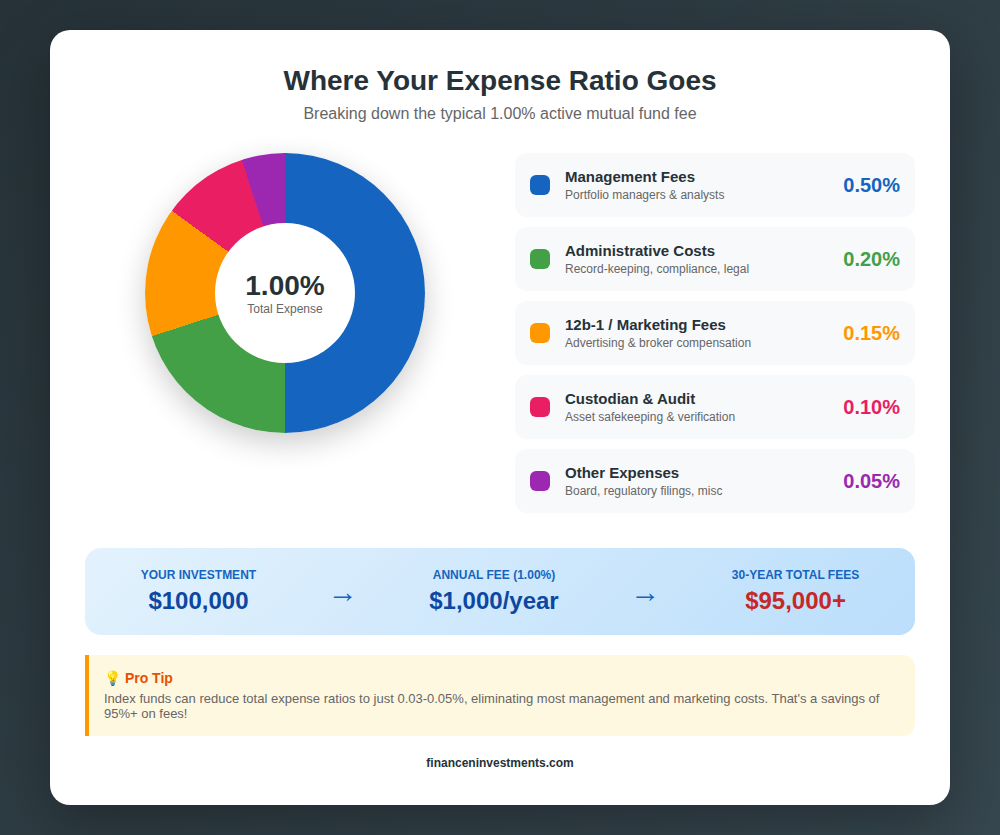

Where Your Money Goes

Expense ratio fees cover several categories of fund operating costs:

- Management fees: Compensation paid to portfolio managers and investment analysts who make buy and sell decisions. This typically represents the largest component, ranging from 0.25% to 1.50% for actively managed funds.

- Administrative costs: Record-keeping, customer service, legal compliance, and accounting expenses. These costs typically range from 0.05% to 0.25% annually.

- Marketing and distribution (12b-1 fees): Costs associated with advertising, broker compensation, and fund distribution. These fees can add 0.25% to 1.00% annually, though many low-cost funds eliminate them entirely.

- Other operational expenses: Custodian fees, audit costs, board member compensation, and regulatory filing expenses. These typically represent a small fraction of total costs.

Why Expense Ratios Matter Profoundly

The $438,000 Difference: A Real-World Example

Consider two investors, each beginning with $100,000 and earning identical gross market returns of 7% annually over 30 years. Investor A selects a low-cost S&P 500 index fund with a 0.05% expense ratio, while Investor B chooses an actively managed large-cap fund charging 1.25%. The mathematics reveal a staggering divergence in outcomes.

| Metric | Low-Cost Fund (0.05%) | High-Cost Fund (1.25%) | Difference |

| Initial Investment | $100,000 | $100,000 | $0 |

| Gross Annual Return | 7.00% | 7.00% | 0% |

| Net Annual Return | 6.95% | 5.75% | 1.20% |

| Value After 10 Years | $195,259 | $174,845 | $20,414 |

| Value After 20 Years | $381,261 | $305,704 | $75,557 |

| Value After 30 Years | $744,710 | $534,469 | $210,241 |

| Total Fees Paid Over 30 Years | $16,990 | $227,231 | $210,241 |

Note: With additional contributions of $500 monthly, the 30-year difference grows to approximately $438,000.

Compounding Works Against You

The mathematics of compounding, often celebrated as the investor’s greatest ally, becomes a formidable adversary when applied to fees. Each dollar paid in expenses is not merely lost; it represents the loss of all future returns that dollar would have generated. A $1,000 fee paid in year one, assuming 7% annual returns, would have grown to $7,612 by year 30. This opportunity cost multiplies with every dollar of fee paid over an investment’s lifetime.

The Certainty Principle

Perhaps the most compelling argument for minimizing expense ratios lies in their certainty relative to returns. Expense ratios are guaranteed costs; investment returns are not. An investor selecting a fund with a 1.25% expense ratio is guaranteed to underperform an identical fee-free portfolio by 1.25% annually. Meanwhile, the fund manager’s ability to generate excess returns sufficient to overcome this fee drag remains entirely uncertain. Research from S&P Global’s SPIVA scorecard consistently shows that over 15-year periods, more than 90% of actively managed large-cap funds fail to outperform their benchmarks.

Typical Expense Ratios by Fund Type

Expense ratios vary dramatically across fund categories, reflecting differences in management complexity, research requirements, and competitive pressures. Understanding typical ranges helps investors identify funds charging unreasonable premiums.

| Fund Category | Typical Range | Industry Average | Best-in-Class |

| Broad Market Index Funds | 0.03% – 0.20% | 0.06% | 0.00% – 0.03% |

| Active Large-Cap Mutual Funds | 0.50% – 2.00% | 0.85% | 0.40% – 0.60% |

| Target-Date Retirement Funds | 0.10% – 0.75% | 0.34% | 0.08% – 0.15% |

| International/Emerging Market Funds | 0.15% – 1.50% | 0.54% | 0.07% – 0.20% |

| Specialty/Sector Funds | 0.40% – 1.50% | 0.75% | 0.10% – 0.40% |

| Bond Index Funds | 0.03% – 0.25% | 0.08% | 0.03% – 0.05% |

| Active Bond Funds | 0.40% – 1.25% | 0.62% | 0.25% – 0.40% |

Other Hidden Fees to Watch

While expense ratios receive the most attention, several additional fees can significantly impact investment returns. Investors conducting due diligence should examine the complete fee structure disclosed in fund prospectuses.

Front-End Loads (Sales Charges)

Front-end loads represent one-time sales commissions deducted from initial investments. A fund with a 5.75% front-end load immediately reduces a $10,000 investment to $9,425. These fees compensate brokers and financial advisors who recommend the fund. While front-end loads have declined in popularity, they remain common in broker-sold mutual funds. No-load funds, available directly from fund companies like Vanguard and Fidelity, eliminate this cost entirely.

Back-End Loads (Redemption Fees)

Back-end loads, also called contingent deferred sales charges (CDSC), are assessed when investors sell fund shares within a specified period. These fees typically start at 5-6% and decline by one percentage point annually, reaching zero after five to seven years. While marketed as encouraging long-term investing, back-end loads primarily serve to lock in investors and compensate sales intermediaries.

12b-1 Fees (Marketing Costs)

Named after the SEC rule authorizing them, 12b-1 fees cover fund marketing and distribution expenses. These fees, included within the expense ratio, can add 0.25% to 1.00% annually. Ironically, investors pay these fees to attract additional investors to the fund, a benefit that does not necessarily accrue to existing shareholders. Most low-cost index funds eliminate 12b-1 fees entirely.

Transaction Fees and Trading Costs

Transaction fees represent costs incurred when funds buy and sell securities. While not reflected in the expense ratio, these costs reduce fund returns. Actively managed funds with high turnover rates, sometimes exceeding 100% annually, may incur substantial trading costs. Low-turnover index funds, by contrast, typically trade only to accommodate investor inflows and outflows, minimizing these hidden expenses.

Benefits of Low Expense Ratios

- Guaranteed return improvement: Every basis point saved in fees translates directly to improved net returns, regardless of market conditions or fund manager performance.

- Compounding advantage: Lower fees allow more capital to compound over time, creating an exponentially growing advantage as investment horizons lengthen.

- Increased probability of success: Research consistently demonstrates that low-cost funds outperform high-cost alternatives over extended periods, as active managers struggle to generate excess returns sufficient to overcome their fee disadvantage.

- Simplicity and transparency: Low-cost index funds typically employ straightforward strategies that investors can easily understand and monitor.

- Tax efficiency: Low-cost index funds generally generate fewer taxable events due to lower portfolio turnover, providing additional after-tax return advantages.

Challenges and Considerations

- Limited active management options: Investors seeking exposure to specialized strategies, alternative assets, or specific factor tilts may find low-cost options limited.

- Market cap concentration: Low-cost broad market index funds are inherently market-cap weighted, potentially overweighting popular stocks at expensive valuations.

- Reduced downside protection: Index funds provide no active risk management during market downturns, falling in lockstep with their benchmark indices.

- Behavioral challenges: The simplicity of low-cost investing can lead some investors to undervalue their approach, making them susceptible to abandoning their strategy during market volatility.

How to Find Low-Cost Funds

Best Index Fund Providers

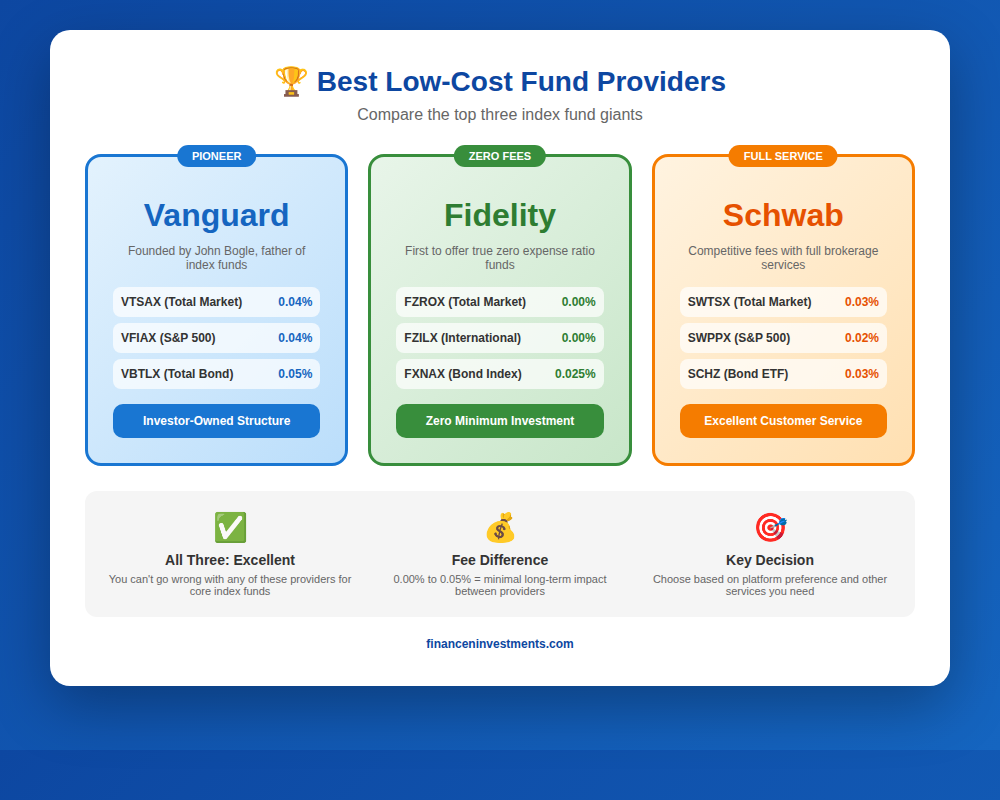

Three major providers dominate the low-cost investment landscape, each offering compelling options with expense ratios below 0.10%:

- Vanguard: The pioneer of index investing, Vanguard’s Total Stock Market Index Fund (VTSAX) charges just 0.04%, while its S&P 500 fund (VFIAX) costs 0.04%. Vanguard’s unique mutual company structure ensures investor interests remain paramount.

- Fidelity: Fidelity’s ZERO fund series charges no expense ratio whatsoever, including FZROX (Total Market) and FZILX (International). While these funds use proprietary indices, their performance closely tracks traditional benchmarks.

- Charles Schwab: Schwab’s index funds, including SWTSX (Total Stock Market) at 0.03%, offer competitive expense ratios with the backing of a full-service brokerage platform.

Fee Comparison Tools

Several resources help investors compare fund costs and analyze fee impact. FINRA’s Fund Analyzer allows side-by-side expense comparisons, projecting total costs over various time horizons. Personal Capital’s fee analyzer examines entire portfolios for hidden fees, providing comprehensive cost assessments. Morningstar provides detailed fee breakdowns alongside performance data, enabling informed fund selection.

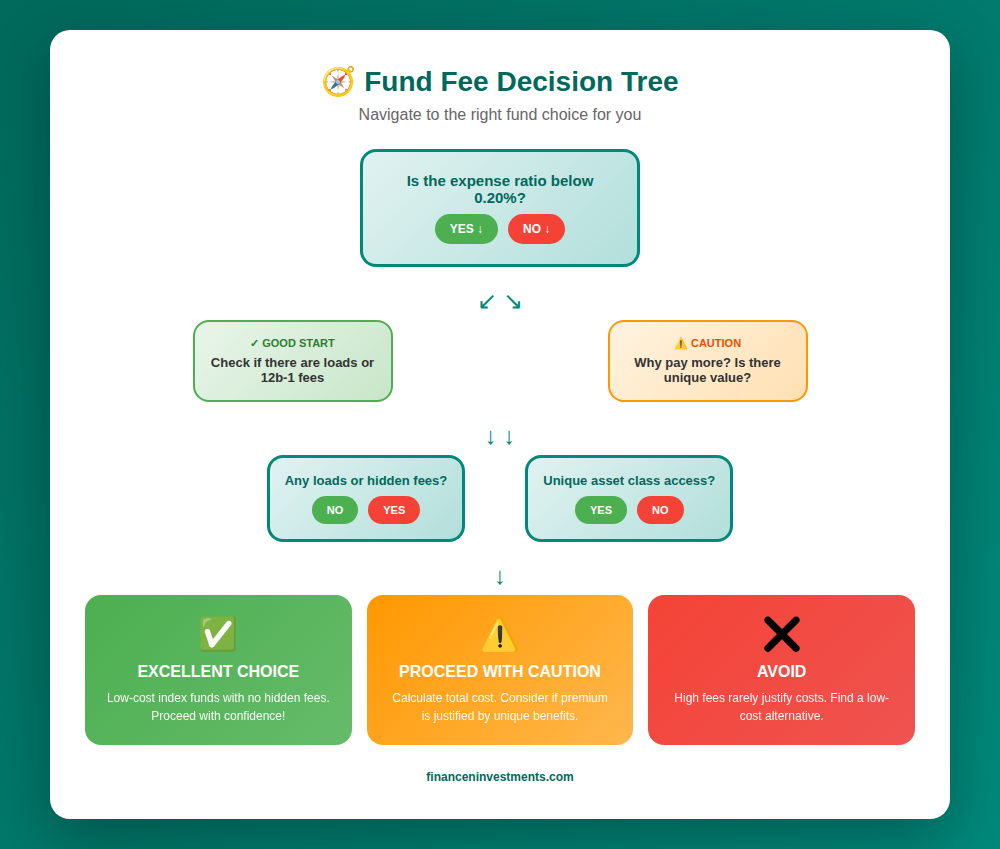

When Higher Fees Might Be Justified

While low costs should remain a priority, certain situations may warrant accepting higher expense ratios. Accessing otherwise unavailable asset classes, such as certain alternative investments or niche international markets, may require specialized funds with elevated fees. Additionally, investors requiring comprehensive financial planning services bundled with fund investments might find higher-fee options more suitable, though these services should be evaluated separately from investment management.

Future Trends in Fund Fees

The investment industry continues experiencing significant fee compression, with several emerging trends likely to further benefit cost-conscious investors:

- Zero-fee expansion: Following Fidelity’s introduction of zero-expense-ratio funds, competitors may expand similar offerings to maintain market share.

- Direct indexing democratization: Technological advances are making direct indexing, previously available only to high-net-worth investors, increasingly accessible at competitive fee levels.

- Performance-based fee structures: Some fund managers are experimenting with fee models that adjust based on performance relative to benchmarks, aligning manager and investor interests.

- Regulatory transparency requirements: Continued regulatory focus on fee disclosure may further empower investors to make cost-informed decisions.

Frequently Asked Questions

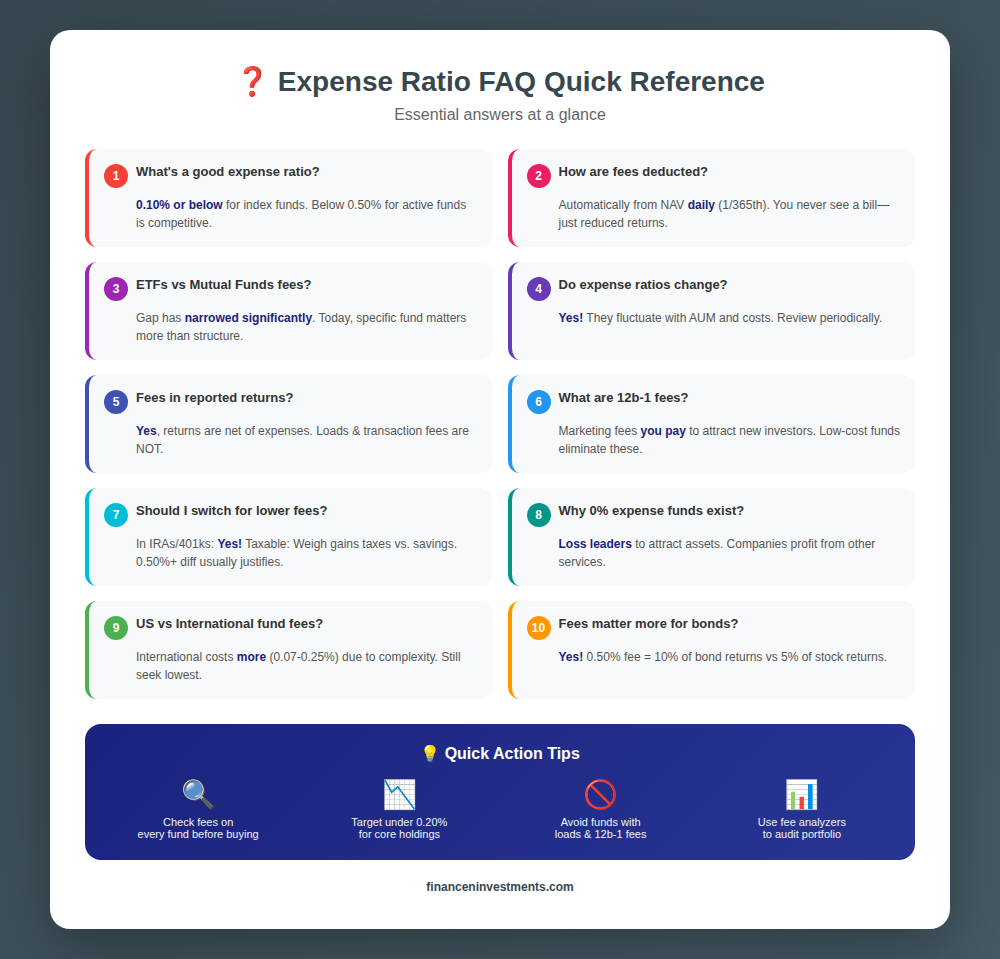

1. What is a good expense ratio for a mutual fund?

For broad market index funds, an excellent expense ratio is 0.10% or below, with many options available at 0.03% to 0.05%. For actively managed funds, anything below 0.50% is considered competitive, though investors should question whether active management adds sufficient value to justify any premium over index alternatives.

2. How are expense ratios deducted from my investment?

Expense ratios are deducted daily from the fund’s net asset value (NAV), typically at 1/365th of the annual rate. Investors never see a direct withdrawal; instead, the fund’s share price reflects returns already reduced by fees. This automatic deduction makes expense ratios less visible than direct charges.

3. Do ETFs have lower expense ratios than mutual funds?

ETFs historically offered lower expense ratios than comparable mutual funds due to structural efficiencies. However, this gap has narrowed significantly, with many mutual fund families now offering index funds at expense ratios matching or approaching ETF levels. Today, the specific fund matters more than the ETF versus mutual fund structure.

4. Can expense ratios change over time?

Yes, expense ratios can change as fund operating costs fluctuate and assets under management grow or shrink. Large asset growth typically reduces expense ratios as fixed costs are spread across more shareholders. Conversely, significant outflows may cause expense ratios to increase. Investors should periodically review their funds’ current expense ratios.

5. Are expense ratios included in a fund’s reported returns?

Yes, fund returns are always reported net of expense ratios. When a fund reports a 10% annual return, that figure already reflects the deduction of all fees included in the expense ratio. However, loads and transaction fees are typically not reflected in stated returns, requiring additional analysis.

6. What is a 12b-1 fee, and how does it affect my investment?

A 12b-1 fee is a marketing and distribution charge included within a fund’s expense ratio, named after the SEC rule authorizing it. These fees, which can add 0.25% to 1.00% annually, pay for advertising, broker compensation, and shareholder services. Low-cost index funds typically eliminate these fees entirely.

7. Should I switch funds solely to get a lower expense ratio?

The decision depends on the fee difference and potential tax consequences. In tax-advantaged accounts like IRAs and 401(k)s, switching to a significantly lower-cost fund is generally advisable. In taxable accounts, investors must weigh potential capital gains taxes against long-term fee savings. A fee reduction of 0.50% or more typically justifies switching regardless of tax implications.

8. Why do some funds charge no expense ratio?

Zero-expense-ratio funds, such as Fidelity’s ZERO series, represent a loss-leader strategy to attract assets and cross-sell other products. Fund companies absorb operating costs, betting that customers will generate revenue through cash balances, margin lending, or other fee-generating activities. These funds remain economically viable for providers while offering exceptional value to investors.

9. How do expense ratios compare between U.S. and international funds?

International funds typically carry higher expense ratios than domestic funds due to increased research costs, currency management, and regulatory complexity. While U.S. total market index funds may cost 0.03% to 0.05%, comparable international developed market funds typically range from 0.07% to 0.15%, and emerging market funds from 0.10% to 0.25%.

10. Do expense ratios matter more for bond funds or stock funds?

Expense ratios are particularly critical for bond funds because expected returns are lower. A 0.50% expense ratio consumes approximately 10% of a bond fund’s expected annual return (assuming 5% returns), compared to roughly 5% of a stock fund’s expected return (assuming 10% returns). This proportionally larger impact makes fee minimization even more important for fixed-income investments.

Conclusion

Expense ratios represent one of the few factors in investing that investors can control with certainty. While future market returns remain unpredictable, the impact of fees on portfolio performance is guaranteed and quantifiable. The evidence overwhelmingly demonstrates that minimizing expense ratios significantly improves long-term investment outcomes, with differences compounding to hundreds of thousands of dollars over typical investment horizons.

The modern investment landscape offers unprecedented access to low-cost investment options. With index funds available at expense ratios as low as 0.00% to 0.03%, there is little justification for paying 1.00% or more for similar market exposure. Investors who prioritize expense ratios alongside asset allocation and tax efficiency position themselves for superior long-term results.

As fee compression continues and investor awareness grows, the competitive advantage of cost-conscious investing will only become more pronounced, making expense ratio optimization an essential component of any successful investment strategy.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- Dollar-Cost Averaging Explained: The Simple Strategy That Removes Emotion from Investing

- What Are Dividend Stocks – The Ultimate Income Guide

- ETF vs Mutual Fund: Best Comparison Guide for Investors

- What Is Diversification?

- How Compound Interest Works: The Complete Guide to Growing Your Wealth

- Investing 101: Everything You Need to Know to Start

- What Is an Index Fund? The Beginner’s Complete Guide

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

FREE RESOURCE: Expense Ratio Calculator

Calculate Your Fee Impact

How much are expense ratios really costing you? Use our free Expense Ratio Calculator below to see the long-term impact of fees on your specific investment situation. Simply enter your initial investment, monthly contributions, and compare two expense ratios to discover how much wealth you could be losing – or saving – over time.