Understanding the ETF vs Mutual Fund Debate

If you’re building an investment portfolio, you’ve likely encountered the age-old question: Should I invest in ETFs or mutual funds?

The ETF vs Mutual Fund debate has dominated investment forums, financial advisors’ offices, and dinner table conversations for decades. The truth? Both ETFs (Exchange-Traded Funds) and mutual funds are excellent investment vehicles that can help you build wealth. However, they operate differently, have distinct cost structures, and may be better suited for different types of investors.

In this comprehensive guide, I’ll break down everything you need to know about ETFs versus mutual funds. Drawing on over 30 years of experience in international finance, I’ll help you understand not just the technical differences, but which option truly makes sense for your specific situation.

What you’ll learn in this article:

- The fundamental structures of ETFs and mutual funds

- Critical differences in trading, costs, and tax efficiency

- Practical pros and cons of each investment type

- A clear decision framework for choosing between them

- Expert insights that go beyond the basic comparisons

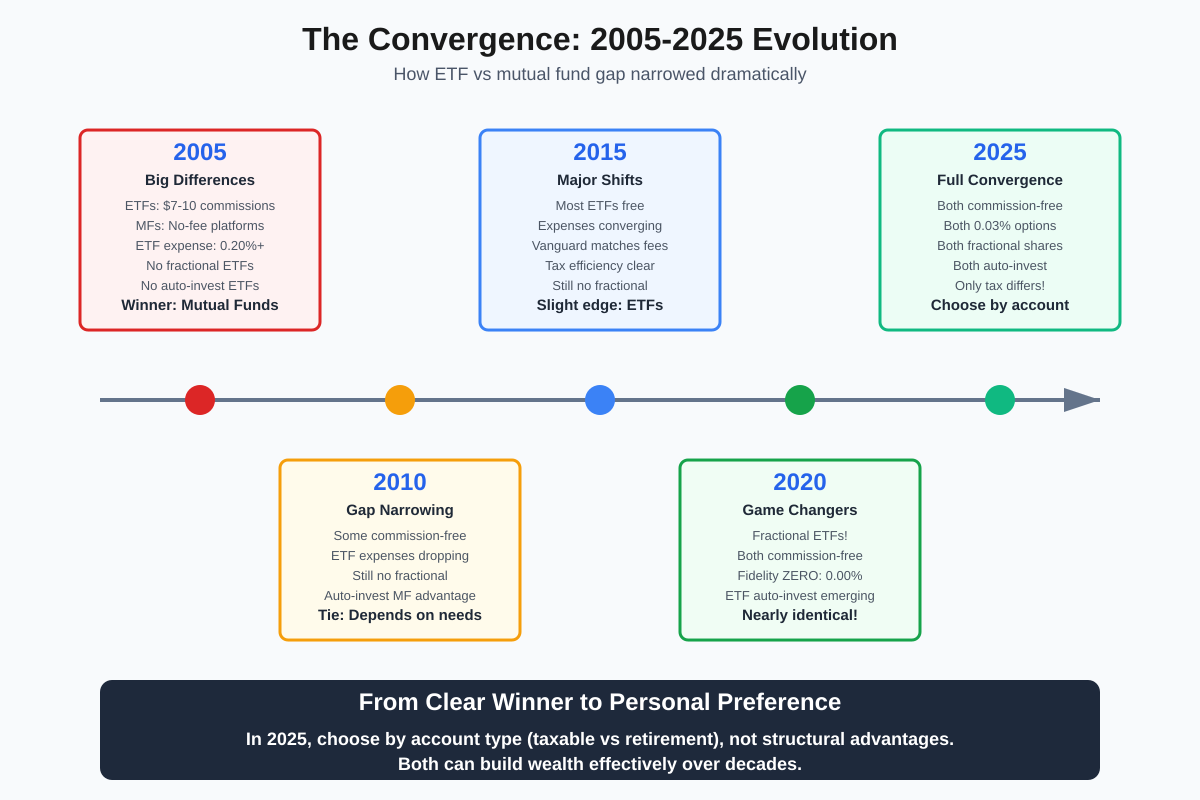

The reality is that the differences between ETFs and mutual funds have narrowed considerably in recent years. Some distinctions that mattered tremendously in 2010 barely register today. Let’s cut through the noise and focus on what actually matters for your investment success. In case you’re new to investing, we highly recommend that you read our recent article, “Investing 101: Complete Beginner’s Guide“, before deciding between ETFs and mutual funds.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways: ETF vs Mutual Fund Decision Points

Tax Efficiency Makes ETFs Superior for Taxable Accounts – ETFs’ unique structure minimizes capital gains distributions, potentially adding 0.5-1.0% annually to after-tax returns in taxable brokerage accounts. In retirement accounts (401k, IRA), this advantage disappears entirely.

The Cost Gap Has Nearly Disappeared – Today’s best index funds charge identical fees whether ETF or mutual fund (both ~0.03%). The real cost difference is between index funds and expensive active funds, not between structures.

Minimum Investment Barriers Favor ETFs for Beginners – ETFs allow you to start with one share ($50-200) while most mutual funds require $1,000-$3,000 minimums. Fractional share trading makes ETFs more accessible for new investors with limited capital.

Automation and Simplicity Still Slightly Favor Mutual Funds – Mutual funds offer easier “set it and forget it” automated investing with built-in fractional shares and dollar-amount purchases. They dominate employer retirement plans for good reason.

For Most Investors, the Differences Are Shrinking Rapidly – Commission-free trading, fractional shares, and comparable costs mean your choice matters less than ever. Focus on low costs, proper asset allocation, and long-term discipline – these determine success far more than ETF vs mutual fund.

Table of Contents

📥 Want a Quick Reference? Download our free “ETF vs Mutual Fund – Quick Decision Guide” that summarizes everything you need to know about choosing between ETFs and mutual funds.

What Are ETFs? (Exchange-Traded Funds Explained)

The ETF Definition and Core Mechanism

An Exchange-Traded Fund (ETF) is an investment fund that trades on stock exchanges, just like individual stocks. When you buy an ETF, you’re purchasing shares of a fund that holds a basket of underlying assets-stocks, bonds, commodities, or other securities.

The first ETF, the SPDR S&P 500 ETF (ticker: SPY), launched in 1993. It was revolutionary: investors could finally buy the entire S&P 500 index with a single trade, just like buying shares of Apple or Microsoft. This innovation democratized index investing in a way that mutual funds never could.

Today, the ETF industry has exploded into a $10+ trillion global market with over 8,000 ETFs available worldwide. You can find ETFs tracking virtually anything: broad market indices, specific sectors, international markets, bonds, commodities, and even niche strategies like ESG investing or dividend aristocrats.

How ETFs Actually Work

ETFs operate through a unique creation and redemption mechanism that distinguishes them from mutual funds:

1. Authorized Participants (APs): Large financial institutions can create or redeem ETF shares in large blocks (typically 50,000 shares called “creation units”)

2. In-kind transactions: APs deliver a basket of the underlying securities to the ETF provider in exchange for ETF shares (or vice versa for redemptions)

3. Market trading: Individual investors buy and sell ETF shares on exchanges throughout the trading day, just like stocks

4. Price discovery: ETF prices fluctuate continuously based on supply and demand, though they generally track the net asset value (NAV) of underlying holdings

This structure creates several important characteristics:

- Intraday trading: Buy or sell anytime the market is open

- Transparent pricing: See the current price instantly

- Tax efficiency: The in-kind creation/redemption process minimizes taxable events

- No minimum investment: Buy a single share (though your broker may have minimums)

ETF Types and Varieties

The ETF universe has expanded far beyond simple index tracking:

Passive index ETFs track market indices (S&P 500, total stock market, bonds)

Sector ETFs focus on specific industries (technology, healthcare, energy)

International ETFs provide exposure to foreign markets (emerging markets, Europe, Asia)

Bond ETFs hold fixed-income securities (government, corporate, municipal bonds)

Commodity ETFs track gold, oil, agriculture, or broader commodity baskets

Active ETFs employ professional managers making investment decisions (growing category)

Thematic ETFs target trends like clean energy, AI, robotics, or genomics

The proliferation of ETF options means you can construct virtually any portfolio strategy using these vehicles. However, more choice isn’t always better – many niche ETFs carry higher costs and liquidity risks.

What Are Mutual Funds? (Traditional Fund Structure)

Mutual Fund Definition and Mechanism

A mutual fund is a pooled investment vehicle managed by a professional investment company. When you invest in a mutual fund, you’re buying shares directly from the fund company at the fund’s net asset value (NAV), which is calculated once daily after markets close.

Mutual funds have existed since the 1920s, though they gained massive popularity in the 1970s and 1980s as Americans increasingly invested for retirement. Unlike ETFs, mutual funds don’t trade on exchanges. Instead, all transactions occur directly with the fund company.

How Mutual Fund Pricing Works (NAV Structure)

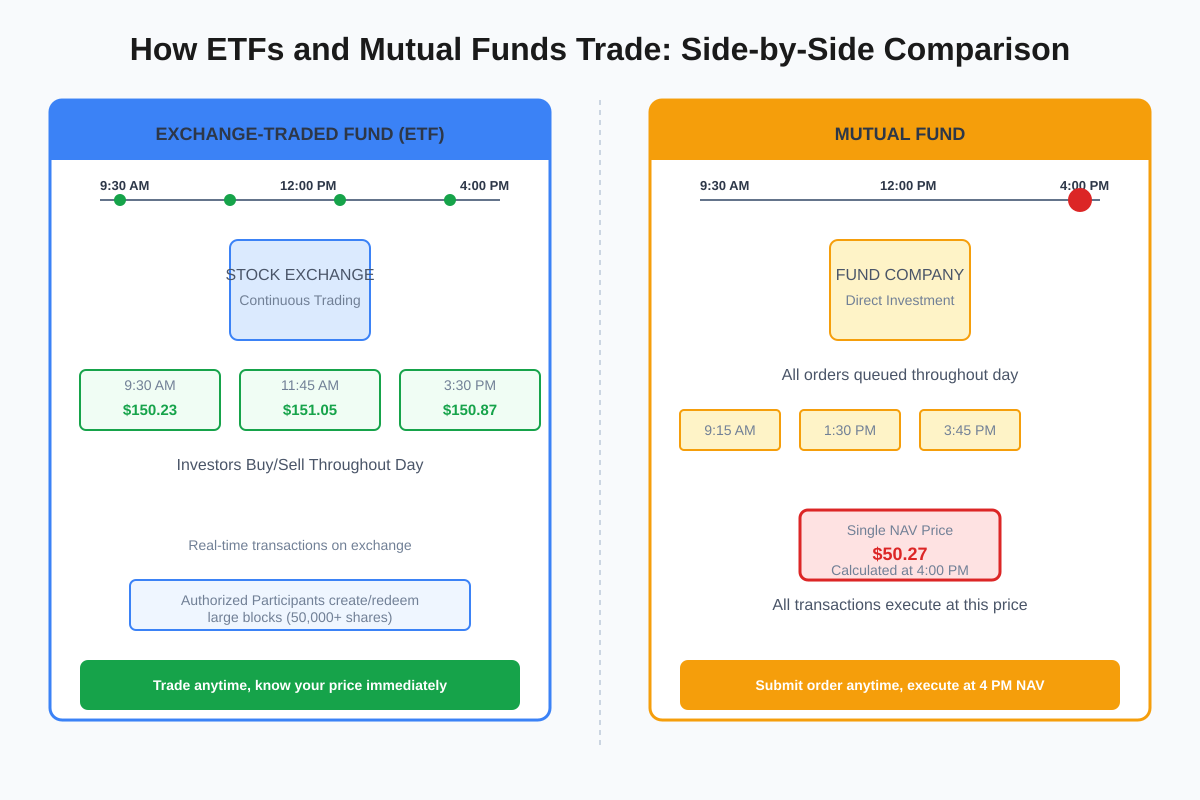

The most fundamental difference between mutual funds and ETFs lies in their pricing:

Net Asset Value (NAV) calculation:

- Computed once daily after market close (typically 4:00 PM ET)

- Total value of all holdings minus liabilities, divided by shares outstanding

- All buy and sell orders execute at this single daily price

Practical implications:

- Submit your order anytime during the day

- Your transaction executes at the closing NAV (unknown when you place the order)

- No intraday price fluctuations or trading opportunities

- No bid-ask spreads to worry about

This structure was designed for long-term investors who don’t need intraday trading flexibility. However, it also means you can’t respond to market movements or news events during the trading day.

Active vs Passive Mutual Funds

Mutual funds come in two fundamental varieties:

Active mutual funds employ professional managers who:

- Research and select individual securities

- Make buy/sell decisions attempting to outperform benchmarks

- Adjust holdings based on market conditions and analysis

- Charge higher fees (typically 0.50% to 1.50%+ annually)

Examples: Fidelity Contrafund, American Funds Growth Fund, T. Rowe Price Blue Chip Growth

Passive (index) mutual funds simply track market indices:

- Hold all securities in a target index (or representative sample)

- Make minimal trading decisions (only when index composition changes)

- Aim to match benchmark performance, not beat it

- Charge much lower fees (often 0.05% to 0.20%)

Examples: Vanguard Total Stock Market Index Fund, Fidelity ZERO Total Market Index Fund, Schwab S&P 500 Index Fund

The performance reality: Over 15-year periods, approximately 90% of active mutual funds underperform their benchmark indices after fees. This persistent underperformance has driven massive flows from active to passive funds and ETFs over the past two decades.

Mutual Fund Share Classes Explained

Many mutual funds offer multiple share classes with different fee structures:

Class A shares:

- Front-end load (sales charge when you buy, typically 3-6%)

- Lower ongoing expenses

- Best for large investments held long-term

Class B shares:

- No front-end load

- Higher ongoing expenses

- Back-end load (sales charge when you sell, declining over time)

- Less common today

Class C shares:

- No front-end load

- Highest ongoing expenses

- Small back-end load if sold within one year

- Suitable for shorter holding periods

Institutional/Admiral shares:

- No loads

- Lowest expense ratios

- Require high minimums ($50,000 to $1,000,000+)

- Best option if you qualify

Retail/Investor shares:

- No loads (at discount brokers)

- Moderate expense ratios

- Lower minimums ($1,000 to $3,000)

- Most common for individual investors

The share class structure adds unnecessary complexity, which is one reason many investors prefer the simpler ETF structure.

Key Differences Between ETFs and Mutual Funds (The Critical Distinctions)

Trading: All Day vs End of Day

ETFs: Continuous trading

- Buy or sell anytime markets are open (9:30 AM to 4:00 PM ET)

- Execute trades at current market prices

- Use limit orders, stop-loss orders, market orders

- See exactly what price you’ll pay before confirming

- Can respond to market news and events intraday

Mutual funds: Single daily price

- Submit orders anytime, but all execute at 4:00 PM NAV

- Unknown execution price when placing your order

- No intraday trading strategies possible

- Can’t react to market movements during the day

- Simpler for long-term, buy-and-hold investors

When this matters: If you’re a long-term investor making quarterly or annual investments, the trading difference is largely irrelevant. The closing price today versus the average price during the day makes minimal difference over decades. However, if you want to dollar-cost average weekly, use technical analysis, or respond to market volatility, ETF flexibility wins.

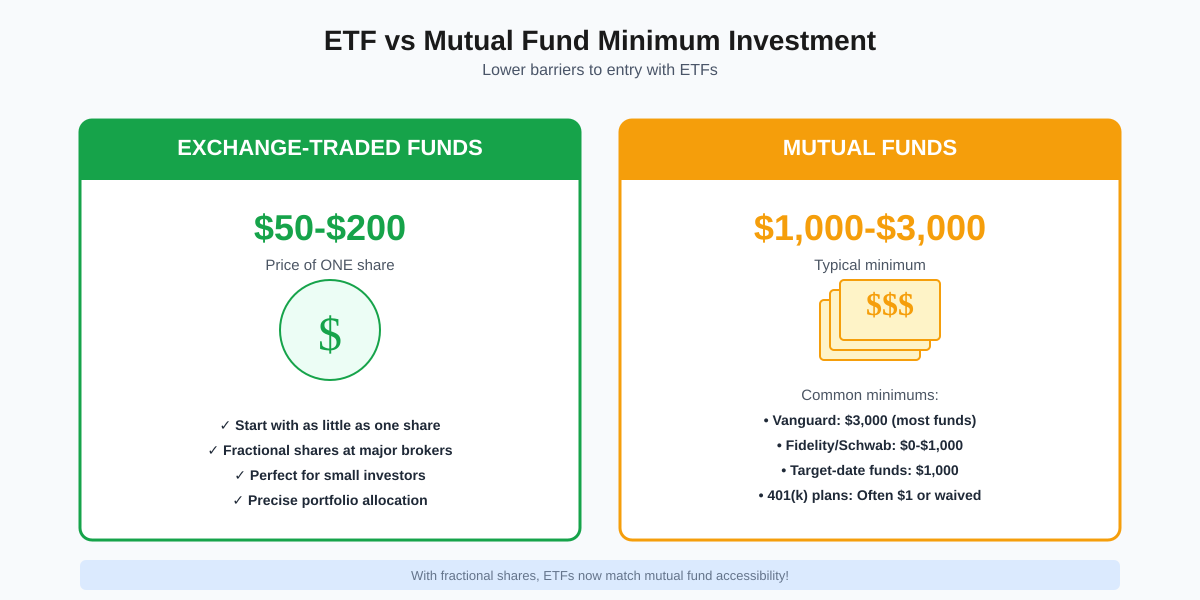

Minimum Investment: $1 vs $1,000-$3,000

ETFs: Share-based investing

- Minimum investment = price of one share

- Popular ETFs range from $30 to $500+ per share

- Can buy fractional shares at some brokers (Fidelity, Schwab, Interactive Brokers)

- Easier for small investors to start

- Better for precise allocation (though fractional shares solve this)

Mutual funds: Fund-set minimums

- Typically $1,000 to $3,000 for initial investment

- Some as low as $0 (Fidelity ZERO funds) or $1 (employer retirement plans)

- Vanguard requires $3,000 for most funds ($1,000 for target-date funds)

- Can invest exact dollar amounts, not share quantities

- Automatic fractional shares included

When this matters: For investors with less than $3,000 to start, ETFs provide easier access to diversified investing. However, if you’re investing through a 401(k) or employer retirement plan, mutual funds often have $1 minimum or allow any amount. The introduction of fractional share trading for ETFs has significantly reduced this advantage for mutual funds.

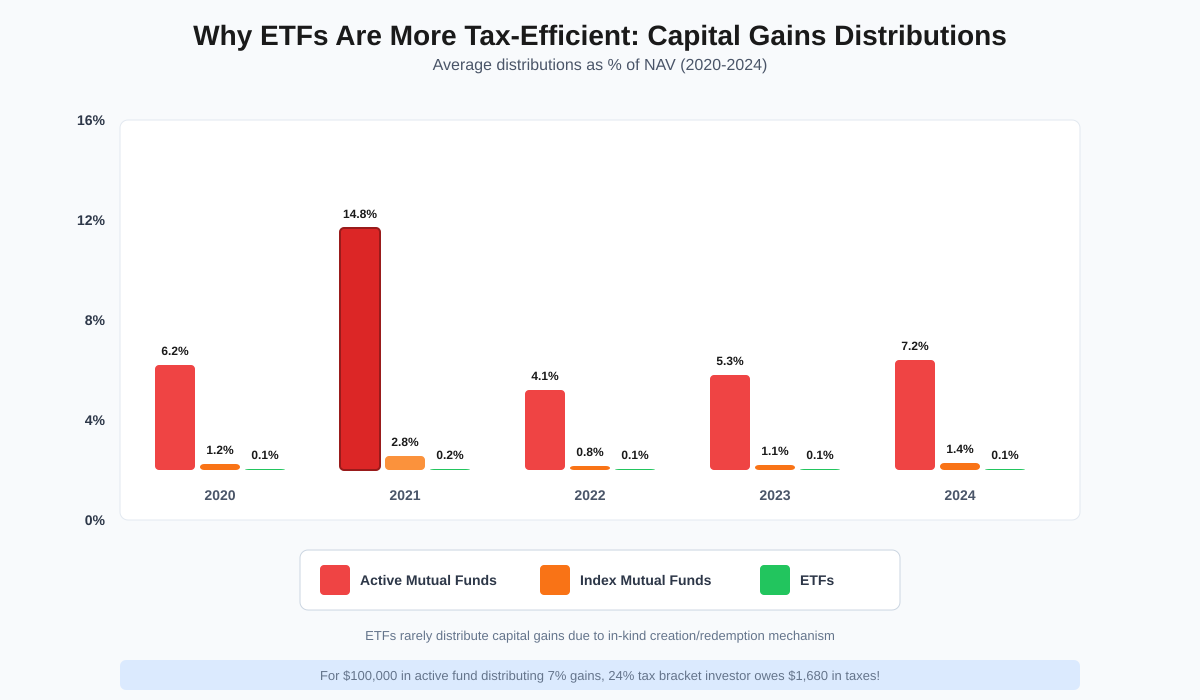

Tax Efficiency: ETFs Win Decisively

This is where ETFs demonstrate a clear structural advantage:

ETF tax efficiency benefits:

- In-kind creation/redemption mechanism minimizes capital gains distributions

- You control when you sell (and thus when you realize gains)

- Rarely distribute capital gains to shareholders

- Highly tax-efficient even in taxable brokerage accounts

Mutual fund tax drawbacks:

- Must distribute capital gains to shareholders when they sell holdings

- You may receive taxable distributions even if you didn’t sell shares

- Other investors’ redemptions can trigger your tax bill

- Active funds especially prone to distributing capital gains

Real-world example: In 2021, many active mutual funds distributed massive capital gains (some 20%+ of NAV) to shareholders, creating unexpected tax bills. Investors who held these funds in taxable accounts owed taxes on gains they never realized themselves. Comparable ETFs typically distributed zero capital gains.

When this matters: Tax efficiency is crucial in taxable brokerage accounts but irrelevant in tax-advantaged accounts (401(k), IRA, Roth IRA). If you’re investing in a retirement account, this distinction doesn’t matter. But for taxable investing, ETFs provide a significant advantage that can add 0.5% to 1.0% annually to after-tax returns over decades.

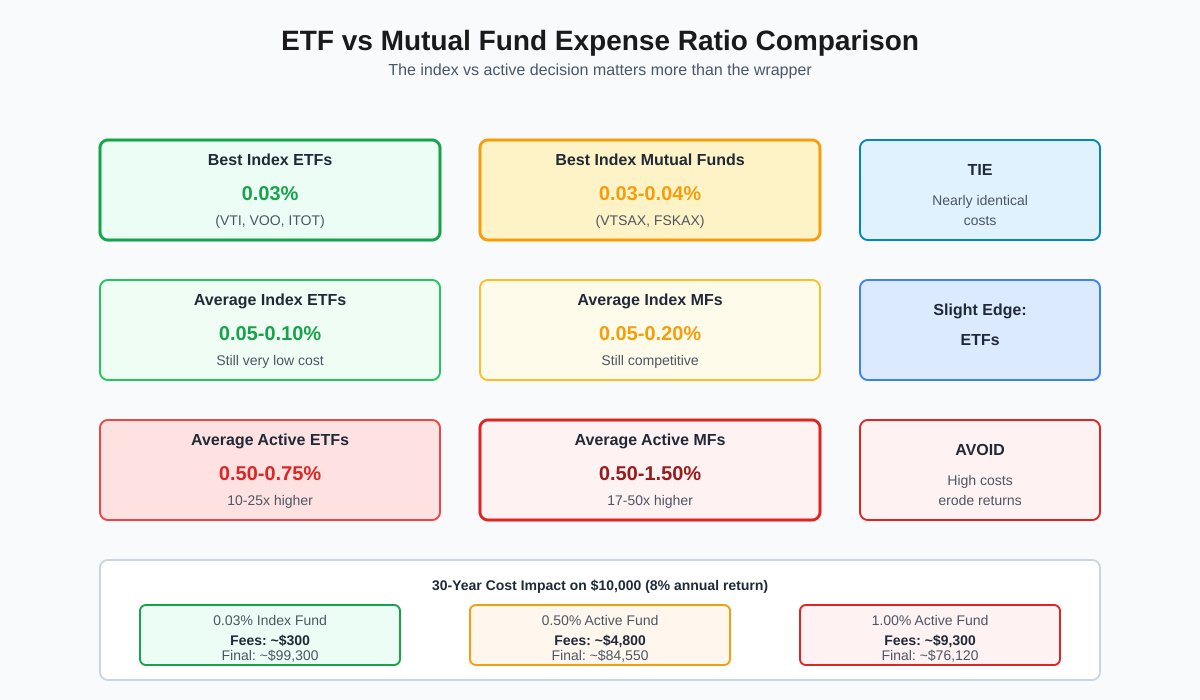

Expense Ratios: Slight ETF Advantage

ETF expense ratios:

- Average equity ETF: ~0.50%

- Popular index ETFs: 0.03% to 0.20%

- Lowest-cost options: 0.03% (Vanguard Total Stock Market, Fidelity ZERO equivalent)

- Generally lower than comparable mutual funds

Mutual fund expense ratios:

- Average active equity fund: ~1.00%

- Average passive equity fund: ~0.15%

- Lowest-cost options: 0.00% to 0.04% (Fidelity ZERO funds, Vanguard index funds)

- Wide variation by share class

The honest truth: The expense ratio gap has narrowed dramatically. For index funds and ETFs tracking the same index (e.g., Vanguard S&P 500 Index Fund vs Vanguard S&P 500 ETF), expense ratios are often identical. The bigger cost difference exists between active and passive strategies, not between ETFs and mutual funds.

When this matters: A 0.03% expense ratio versus 0.05% on a $10,000 investment costs you $2 annually. Over 30 years, assuming 8% returns, that’s approximately $200 difference. Material, but not life-changing. The much bigger issue is avoiding high-cost active funds (1.00%+ expense ratios), whether mutual fund or ETF format.

Automatic Investing: Mutual Funds Easier (Historically)

Mutual fund advantages:

- Set up automatic investments easily (dollar amounts, not shares)

- Invest every paycheck automatically

- Dollar-cost averaging built into the process

- Fractional shares automatic

- No trading required

ETF historical challenges:

- Required manual trading for each investment

- Couldn’t invest exact dollar amounts

- Left uninvested cash sitting idle

- More effort for regular investing

Current reality: Many brokers now offer automatic ETF investing with fractional shares:

- Fidelity: Auto-invest in ETFs with fractional shares

- Schwab: Stocks & ETFs Slices (fractional investing)

- Interactive Brokers: Fractional shares and auto-invest

This historical advantage for mutual funds has largely disappeared, though some investors still find mutual fund auto-investing slightly more intuitive.

Trading Costs and Spreads

ETFs face trading costs:

- Bid-ask spread (difference between buy and sell price)

- Typically $0.01 to $0.05 for popular ETFs

- Wider spreads for niche or low-volume ETFs

- Possible commission (though most brokers now commission-free)

Mutual funds have no spreads:

- Buy and sell at NAV (no bid-ask spread)

- No transaction-level costs at most discount brokers

- Transaction fees possible at some brokers for out-of-network funds

When this matters: For popular, high-volume ETFs like SPY, VOO, or VTI, bid-ask spreads are negligible (often 1 cent). For a $10,000 investment, you might pay $5-10 in spread costs. Over time, this is trivial. However, for exotic, low-volume ETFs, spreads can reach 0.5% to 1.0%, making mutual funds cheaper for that specific investment.

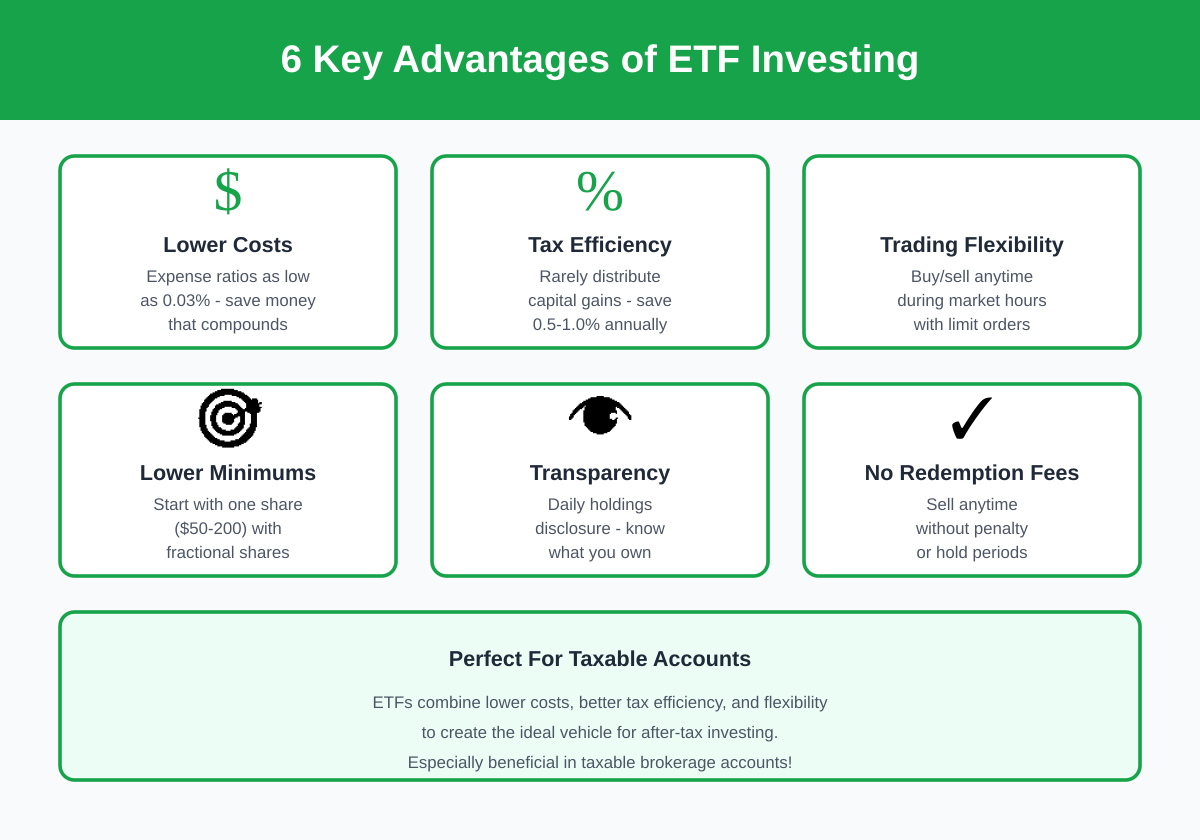

Pros and Cons of ETFs

ETF Advantages

1. Lower expense ratios (generally): The average ETF charges approximately 0.50% less than the average mutual fund. For index-tracking vehicles, ETFs typically have expense ratios of 0.03% to 0.10%, compared to 0.05% to 0.20% for mutual fund equivalents. Over decades, these small differences compound significantly.

2. Superior tax efficiency: The in-kind creation/redemption mechanism means ETFs rarely distribute capital gains. You control when you realize gains (by selling), rather than receiving unwanted distributions triggered by other investors’ actions. In taxable accounts, this can add 0.5% to 1.0% annually to after-tax returns.

3. Trading flexibility: Buy or sell anytime markets are open. Use limit orders to control your entry price. Implement stop-loss orders to manage risk. This flexibility matters for investors who want precision timing or who employ specific trading strategies.

4. Lower minimums: Most ETFs can be purchased for the price of a single share – often $50 to $200 for diversified index ETFs. With fractional share trading now widely available, you can invest any amount. This accessibility makes ETFs ideal for beginning investors or those implementing precise asset allocations.

5. Transparency: Most ETFs disclose their holdings daily. You can see exactly what you own at any time. Active mutual funds typically disclose holdings quarterly with a 30-60 day lag, leaving you somewhat in the dark about current positions.

6. No redemption fees: Unlike some mutual funds that charge fees for selling within 30-90 days, ETFs have no redemption fees. You’re free to adjust your portfolio without penalty (though frequent trading isn’t advisable for other reasons).

ETF Disadvantages

1. Requires brokerage account: You must open and maintain a brokerage account to buy ETFs. While this is free at major brokers (Fidelity, Schwab, Vanguard), it adds a layer of complexity compared to investing directly with a fund company.

2. Bid-ask spreads: Every ETF trade involves a spread between the buy and sell price. For popular ETFs, this is minimal (often 1 cent per share or 0.01%). For niche ETFs, spreads can reach 0.50% to 1.00%, effectively adding to your costs.

3. Potential for intraday volatility: Because ETFs trade continuously, you might be tempted to react to short-term price movements. This can lead to poorly-timed trades based on emotion rather than strategy. The mutual fund structure’s once-daily pricing actually protects investors from themselves in this regard.

4. Temptation to trade excessively: The ease of trading ETFs can encourage portfolio tinkering. Behavioral studies show that investors who can check prices and trade frequently often achieve worse returns than those who invest passively. The friction of mutual funds sometimes helps long-term performance.

5. Commission-free trading not universal: While most major brokers now offer commission-free ETF trading, some specialty ETFs or smaller brokers may still charge commissions. Always verify before buying.

6. Automatic investing historically complicated: Until recently, setting up automatic investments in ETFs was difficult. While this has improved with fractional share programs, mutual funds still offer slightly easier automation for some investors.

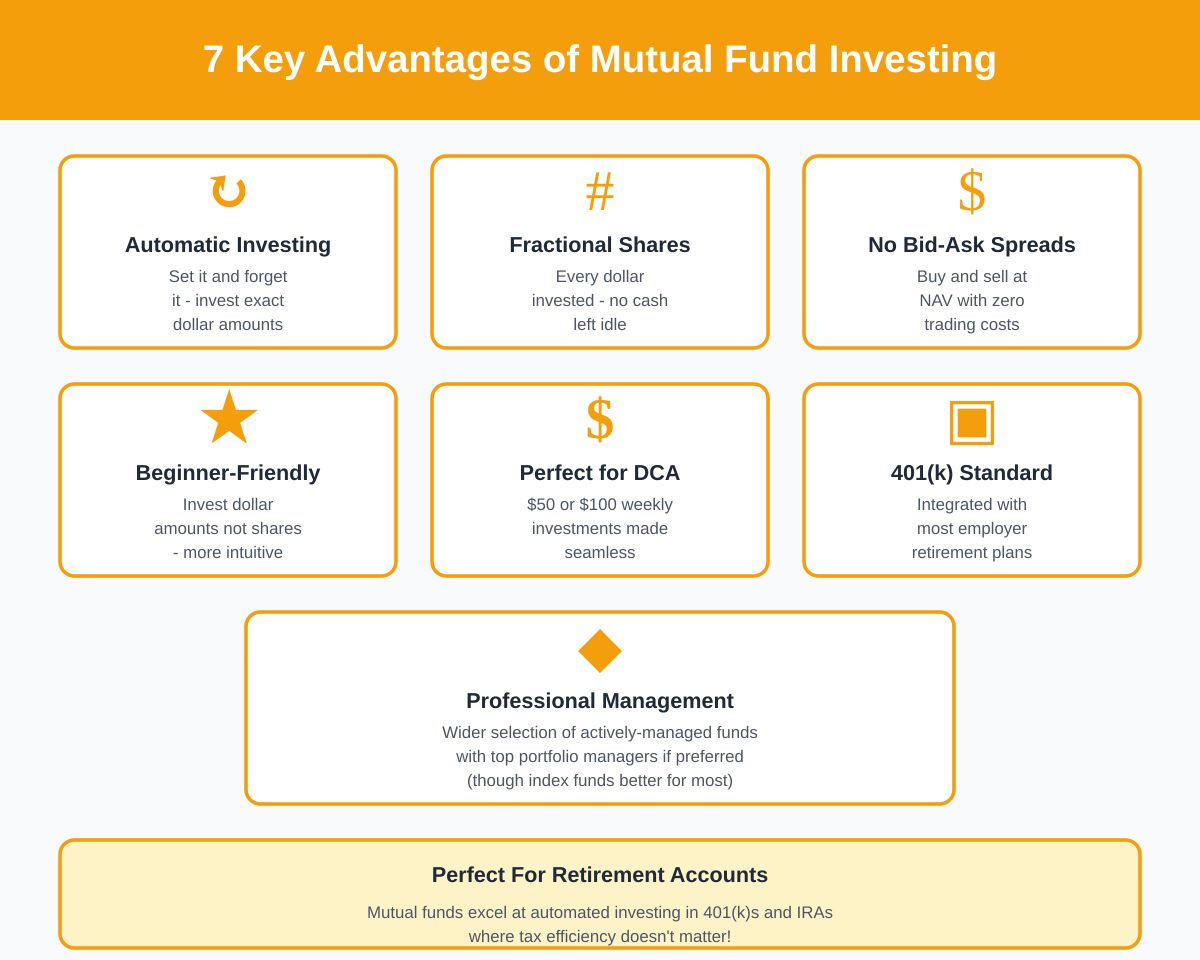

Pros and Cons of Mutual Funds

Mutual Fund Advantages

1. Simplified automatic investing: Mutual funds excel at recurring investments. Set up automatic transfers from your bank account and invest exact dollar amounts every month. No manual trading, no worrying about share prices, no uninvested cash. This “set it and forget it” approach encourages consistent investing behavior.

2. Fractional shares built-in: Every mutual fund automatically allows fractional share investing. Invest $100, $237.43, or any amount – the fund company calculates your fractional ownership. This makes asset allocation precise and ensures every dollar works for you immediately.

3. No bid-ask spreads: You buy and sell at NAV with no spread. This eliminates one cost component entirely. For large investments in ETFs, bid-ask spreads might total $50-$100, while mutual funds have zero spread cost.

4. Simpler for beginners: Many investors find mutual funds more intuitive. You invest dollar amounts, not shares. You don’t see intraday price fluctuations. You can’t make impulsive trades. This simplicity can be valuable, especially for newer investors who might otherwise make emotional decisions.

5. Better for small, frequent investments: If you’re investing $50 or $100 weekly, mutual funds make this seamless. You don’t worry about share prices, lot sizes, or having cash left over. Every dollar goes to work immediately.

6. Integration with retirement plans: Most 401(k) plans, 403(b) plans, and other employer-sponsored retirement accounts use mutual funds exclusively. If you’re investing through work, mutual funds are typically your only option, and they work excellently in this context.

7. Professional management available: While most investors should use passive index funds, those who want active management will find a much wider selection of actively-managed mutual funds than active ETFs. Top managers like Joel Tillinghast (Fidelity Low-Priced Stock Fund) only manage mutual funds.

Mutual Fund Disadvantages

1. Higher minimum investments: Most mutual funds require $1,000 to $3,000 to start. Vanguard Admiral shares require $3,000 to $50,000. These minimums create barriers for beginning investors or those trying to achieve precise asset allocations across multiple funds.

2. Tax inefficiency: Mutual funds must distribute capital gains when they sell appreciated securities, even if you haven’t sold your shares. Other investors’ redemptions can trigger your tax bill. This structural problem makes mutual funds significantly less tax-efficient than ETFs in taxable accounts.

3. Once-daily pricing only: You can’t choose your execution price or time your entry. Submit your order at 9:00 AM or 3:59 PM – you’ll get the same 4:00 PM closing price. For long-term investors, this rarely matters, but it eliminates any tactical flexibility.

4. Share class confusion: The proliferation of share classes (A, B, C, Institutional, Admiral, Investor) creates unnecessary complexity. Understanding which share class to buy, which has the lowest fees, and whether you qualify for institutional shares requires research that ETFs don’t demand.

5. Potential for front-running: Because mutual funds must disclose holdings quarterly and redeem shares at NAV regardless of time-of-day submission, sophisticated traders can sometimes exploit time-zone differences or late-day information. This “mutual fund timing” problem has largely been solved through fair-value pricing, but it remains a theoretical vulnerability.

6. Less transparent: Active mutual funds disclose holdings quarterly with a 30-60 day lag. You might not know what you actually own for up to four months after the fund bought it. ETFs typically offer daily disclosure.

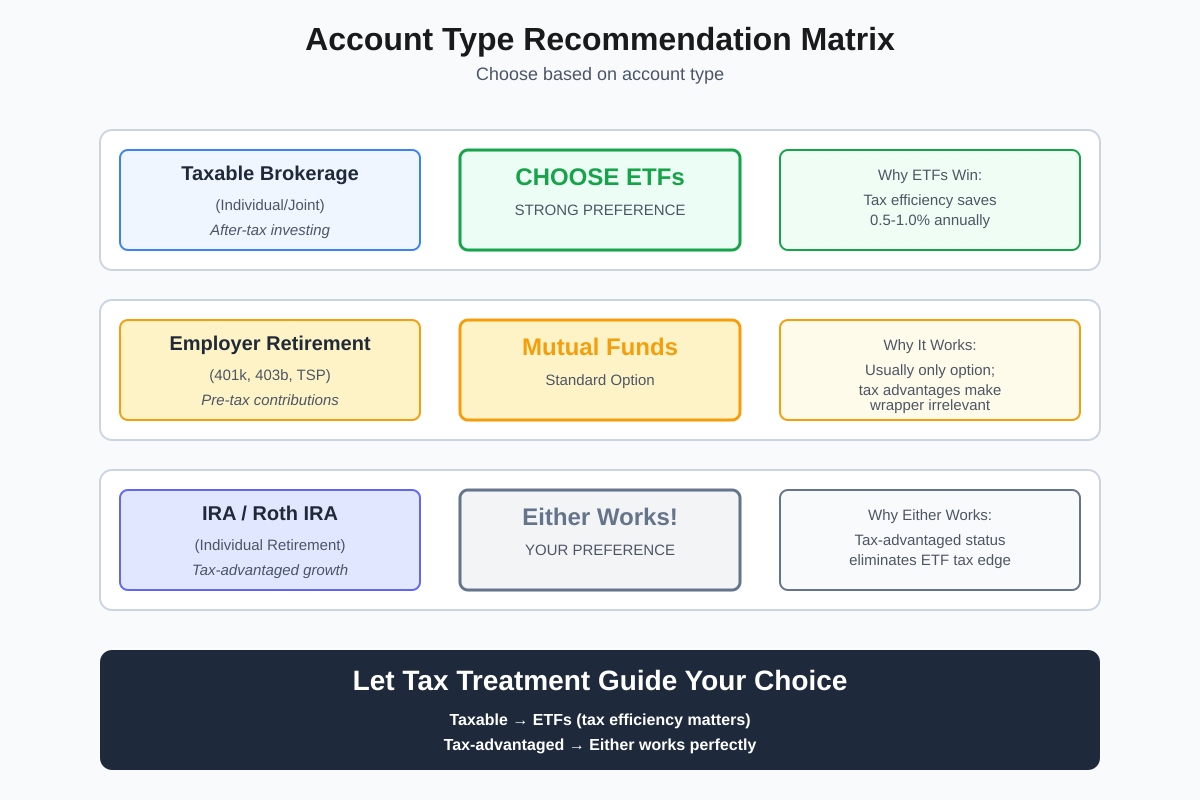

Which Should You Choose? Making the Right Decision

ETFs Are Optimal For:

Taxable brokerage accounts: The tax efficiency of ETFs makes them clearly superior for taxable investing. The ability to defer capital gains until you choose to sell, combined with minimal capital gains distributions, can add 0.5% to 1.0% annually to after-tax returns. Over 30 years, these compounds to tens of thousands of dollars on a six-figure portfolio.

Small starting amounts: If you’re beginning with $500 or $1,000, ETFs provide immediate access to diversified portfolios. Fractional share trading means you can build a three-fund portfolio with any amount, rather than waiting to meet mutual fund minimums.

Investors who value trading flexibility: Want to invest when markets drop 2%? Need to rebalance at a specific price point? Prefer to use limit orders? ETFs deliver complete trading flexibility that mutual funds can’t match.

Cost-conscious investors: While the gap has narrowed, ETFs still offer the absolute lowest expense ratios available. The Vanguard Total Stock Market ETF (VTI) charges 0.03%, and several Fidelity and Schwab offerings match this. For very large portfolios, saving even 0.02% annually matters.

Those who prefer simplicity: Ironically, despite being “complex” trading vehicles, ETFs offer simpler fee structures. No share classes, no load fees, no 12b-1 fees. You see the expense ratio and the bid-ask spread – that’s it.

Mutual Funds Are Optimal For:

Employer retirement plans (401k, 403b): If your employer offers a retirement plan, it almost certainly uses mutual funds exclusively. This is where mutual funds truly shine – tax advantages make tax efficiency irrelevant, minimums are often waived, and automatic payroll deductions make investing effortless.

Automated investing programs: Want to invest $500 every month on the 15th without thinking about it? Mutual funds make this completely automatic. While some brokers now offer ETF auto-investing, mutual funds pioneered this approach and still execute it slightly more smoothly.

IRA and Roth IRA accounts (if you prefer mutual funds): In tax-advantaged accounts, the tax efficiency advantage of ETFs disappears. If you prefer mutual fund automation or already have a relationship with Vanguard/Fidelity mutual funds, there’s no compelling reason to switch to ETFs.

Investors seeking specific active strategies: The universe of actively-managed mutual funds dwarfs active ETFs. If you want exposure to a specific manager or strategy (emerging market value, dividend growth, municipal bonds with a particular tax treatment), you’ll likely find more options among mutual funds.

Those who benefit from behavioral guardrails: The inability to trade mutual funds intraday actually helps many investors avoid emotional decisions. If you know you’re tempted to sell during market panics or chase hot sectors, the friction of once-daily pricing can improve long-term returns.

The Honest Truth: Differences Are Shrinking

Here’s what I’ve observed over 40+ years in finance: The practical differences between ETFs and mutual funds have narrowed dramatically.

In 2005:

- ETFs required commissions ($7-$10 per trade)

- Mutual funds had no-transaction-fee platforms

- ETFs had 0.20%+ expense advantages

- Fractional ETF shares didn’t exist

- Auto-investing in ETFs was impossible

- Clear winner: Mutual funds for most investors

In 2025:

- Both are commission-free at major brokers

- Both offer expense ratios as low as 0.03%

- Both allow fractional shares

- Both support automatic investing

- Narrower winner: Depends on account type and personal preference

My recommendation: For taxable accounts, default to ETFs. For tax-advantaged accounts, choose whichever structure you prefer – the differences are minimal.

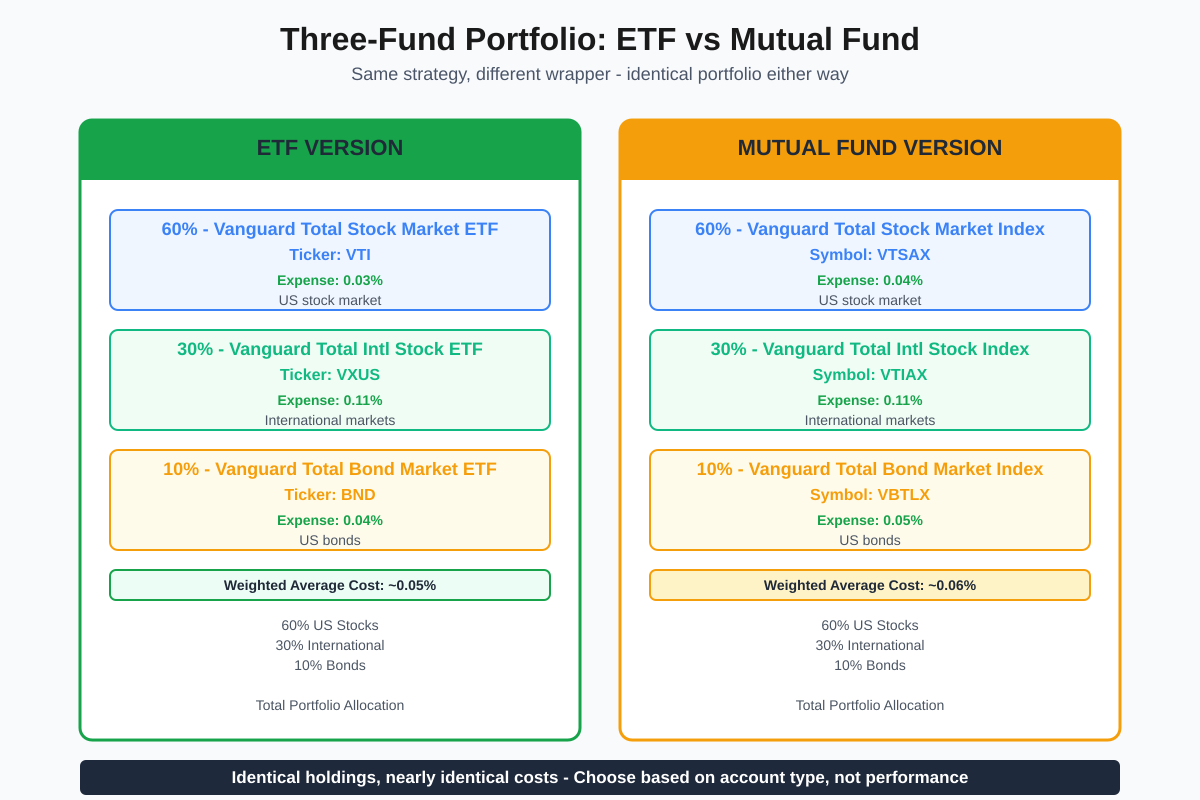

The three-fund portfolio example:

- Taxable account: VTI + VXUS + BND (ETFs for tax efficiency)

- IRA/401k: VTSAX + VTIAX + VBTLX (mutual funds if preferred) or the ETF equivalents

The truth is that fund selection (which index you track, whether you pay 0.03% or 1.00% in fees, and your asset allocation) matters far more than the ETF vs mutual fund decision. Don’t let this choice paralyze you – both work excellently for long-term wealth building.

ETF vs Mutual Fund: Detailed Comparison Table

| Feature | ETFs | Mutual Funds | Winner |

|---|---|---|---|

| Expense Ratios | 0.03% to 0.50% average (index ETFs 0.03%-0.10%) | 0.00% to 1.50% average (index funds 0.05%-0.20%, active 0.50%-1.50%) | Slight edge to ETFs |

| Minimum Investment | One share price ($30-$500 typical) or fractional shares | $0 to $3,000 (most common: $1,000-$3,000) | ETFs |

| Trading Flexibility | Anytime during market hours (9:30 AM – 4:00 PM) | Once daily at 4:00 PM NAV | ETFs |

| Tax Efficiency | Excellent (minimal capital gains distributions) | Poor to moderate (frequent capital gains distributions) | ETFs decisively |

| Automatic Investing | Recently available with fractional shares | Built-in and seamless | Mutual funds (slightly) |

| Fractional Shares | Available at major brokers (Fidelity, Schwab, Interactive Brokers) | Always available | Tie |

| Bid-Ask Spread | Yes (typically $0.01-$0.05, up to 0.5% for niche ETFs) | No | Mutual funds |

| Intraday Pricing | Continuous real-time prices | One price per day (NAV at 4 PM) | ETFs (flexibility) |

| Transaction Fees | Generally $0 (commission-free at major brokers) | Generally $0 at discount brokers | Tie |

| Holdings Transparency | Daily disclosure (most ETFs) | Quarterly with 30-60 day lag | ETFs |

| Share Classes | Single class (simple) | Multiple classes (A, B, C, Institutional, Admiral) | ETFs |

| Best for Taxable Accounts | Yes | No | ETFs |

| Best for Retirement Accounts | Either works well | Either works well | Tie |

| Professional Management Options | Limited (active ETF market smaller) | Extensive (thousands of active funds) | Mutual funds |

| Ease of Use for Beginners | Moderate (requires brokerage account) | Easy (direct investment with fund company) | Mutual funds |

| Order Types Available | Market, limit, stop-loss, stop-limit | Market only (at NAV) | ETFs |

| Reinvestment of Dividends | Automatic at most brokers (may create fractional shares) | Automatic (always fractional shares) | Tie |

| Availability in 401(k) Plans | Rare | Standard | Mutual funds |

| Suitability for Dollar-Cost Averaging | Good (with auto-invest features) | Excellent (purpose-built for this) | Mutual funds (slightly) |

| Risk of Overtrading | Higher (easy access can encourage frequent trading) | Lower (friction of once-daily pricing helps discipline) | Mutual funds (behavioral) |

FAQs – ETF vs Mutual Fund

1. What is the main difference between ETFs and mutual funds?

The fundamental difference lies in how they trade. ETFs trade on stock exchanges throughout the day like individual stocks, with prices fluctuating continuously. Mutual funds trade once per day after market close, with all orders executing at the Net Asset Value (NAV) calculated at 4:00 PM Eastern.

Additionally, ETFs are significantly more tax-efficient due to their unique creation/redemption structure. Mutual funds must distribute capital gains to shareholders when they sell appreciated securities, even if you haven’t sold your shares. ETFs use an in-kind mechanism that minimizes these distributions, giving you more control over when you realize taxable gains.

2. Are ETFs better than mutual funds?

Neither is universally “better” – the optimal choice depends on your account type and preferences. For taxable brokerage accounts, ETFs are generally superior due to their tax efficiency, which can add 0.5% to 1.0% annually to after-tax returns over time.

For tax-advantaged accounts (401(k), IRA, Roth IRA), the tax efficiency advantage disappears, making the choice more about personal preference. If you value automated investing and have access to low-cost index mutual funds, they work excellently. If you prefer trading flexibility or lower minimums, ETFs are equally effective.

The honest answer: For most index fund investors, fund selection (low costs, proper asset allocation, consistent investing) matters far more than the ETF vs mutual fund decision.

3. Can you lose money in ETFs or mutual funds?

Yes, absolutely. Both ETFs and mutual funds invest in underlying securities (stocks, bonds, etc.) that fluctuate in value. When those underlying investments decline, your ETF or mutual fund declines proportionally.

For example, if you own an S&P 500 ETF and the S&P 500 drops 20%, your ETF will drop approximately 20%. The same applies to mutual funds. Neither vehicle protects you from market risk.

Important distinction: The ETF vs mutual fund structure doesn’t determine risk – the underlying holdings do. An S&P 500 ETF and an S&P 500 mutual fund carry identical market risk. Your choice between them should focus on taxes, costs, and convenience, not safety.

4. Why are ETFs more tax-efficient than mutual funds?

ETFs use a unique “in-kind” creation and redemption mechanism. When large institutional investors (called Authorized Participants) want to redeem ETF shares, they receive a basket of the underlying stocks rather than cash. This process doesn’t trigger capital gains for the ETF or its shareholders.

Mutual funds, conversely, must sell holdings to raise cash for redemptions, potentially triggering capital gains that get distributed to all shareholders – even those who didn’t sell anything. This means you can owe taxes on a mutual fund even in years when your account lost value.

Real-world impact: During the 2021 bull market, many active mutual funds distributed capital gains of 15%+ of their NAV to shareholders. Investors in high tax brackets faced unexpected tax bills of thousands of dollars. Comparable ETFs typically distribute zero capital gains.

5. Do ETFs have lower fees than mutual funds?

Generally, yes, but the gap has narrowed significantly. The average equity ETF charges around 0.50%, while the average equity mutual fund charges approximately 1.00%. However, this average is misleading because it includes many high-cost active funds.

For index funds specifically:

- Lowest-cost ETFs: 0.03% (VTI, VOO, ITOT)

- Lowest-cost mutual funds: 0.03-0.04% (VTSAX, FSKAX)

- Some mutual funds: 0.00% (Fidelity ZERO funds)

The takeaway: The index vs active decision matters far more than ETF vs mutual fund. An index mutual fund at 0.04% will outperform an active ETF charging 0.75%, even though the ETF structure is theoretically more efficient.

6. Can I invest in ETFs through a 401(k)?

Some employer retirement plans now offer ETFs, but the vast majority still use mutual funds exclusively. This isn’t a disadvantage – in tax-advantaged accounts like 401(k)s, the tax efficiency benefit of ETFs disappears, making mutual funds equally effective.

If your 401(k) offers only mutual funds, focus on selecting the lowest-cost options available (target-date funds or index funds with expense ratios below 0.20%). Don’t worry about missing out on ETFs – the tax-advantaged structure of the 401(k) itself provides far more benefit than switching to ETFs would.

Pro tip: If you have access to a brokerage window in your 401(k) allowing ETF purchases, the complexity and potential for poor decisions usually outweigh any marginal benefits. Stick with the simple, low-cost mutual fund options your plan provides.

7. Should I convert my mutual funds to ETFs?

In tax-advantaged accounts (IRA, Roth IRA, 401k): There’s rarely any benefit to converting. The tax efficiency advantage of ETFs doesn’t apply in these accounts. If you’re happy with your current mutual funds and they have low expense ratios, leave them alone.

In taxable accounts: The tax efficiency of ETFs provides a compelling argument for switching, but consider the tax cost of conversion. Selling mutual funds to buy ETFs triggers capital gains taxes. If you’ve held the funds for many years with significant gains, the tax hit might exceed any future benefits.

Better strategy for taxable accounts: Keep existing mutual funds (especially if you have large unrealized gains), but direct all new investments to ETFs. This hybrid approach avoids triggering immediate taxes while capturing tax efficiency going forward.

8. What are the disadvantages of ETFs compared to mutual funds?

1. Bid-ask spreads: Every ETF trade involves a small cost from the spread between buy and sell prices. For popular ETFs this is minimal (1-2 cents), but it’s still more than the zero spread cost of mutual funds.

2. Intraday volatility temptation: Because you can see real-time prices and trade anytime, ETFs might encourage emotional reactions to market movements. The once-daily pricing of mutual funds actually helps some investors avoid poor decisions.

3. Automated investing complexity: While improving, setting up automatic investments in ETFs still requires more steps at some brokers compared to mutual funds’ built-in automation.

4. Less access to active management: The universe of actively-managed ETFs is smaller than active mutual funds. If you want exposure to specific managers or strategies, you’ll find more options in mutual fund format.

9. Can I buy fractional shares of ETFs?

Yes, most major brokers now offer fractional ETF shares:

Brokers offering fractional ETFs:

- Fidelity: Yes

- Schwab: Yes (through Slices program)

- Interactive Brokers: Yes

- Robinhood: Yes

Brokers not yet offering fractional ETFs:

- Vanguard: No (full shares only)

- E*TRADE: No

This development has largely eliminated one of mutual funds’ biggest advantages. You can now invest exact dollar amounts in ETFs and ensure every dollar works for you immediately, just like mutual funds.

Important note: Some features like dividend reinvestment and automatic investing work better with fractional shares, so verify your broker’s specific capabilities.

10. Are index funds ETFs or mutual funds?

Index funds can be either ETFs or mutual funds – “index fund” describes the strategy (tracking a market index), not the structure. Many fund companies offer the same index fund in both formats.

Examples of the same fund in both structures:

Vanguard S&P 500:

- ETF: VOO (expense ratio 0.03%)

- Mutual fund: VFIAX (expense ratio 0.04%)

Vanguard Total Stock Market:

- ETF: VTI (expense ratio 0.03%)

- Mutual fund: VTSAX (expense ratio 0.04%)

Fidelity 500 Index:

- Mutual fund: FXAIX (expense ratio 0.015%)

- ETF equivalent: IVV or VOO

The index they track is identical; you’re choosing the delivery mechanism. For taxable accounts, prefer the ETF version. For retirement accounts, choose whichever you prefer.

11. How do I choose between Vanguard ETFs and Vanguard mutual funds?

Vanguard is unique in offering most of its index funds in both ETF and mutual fund formats with nearly identical expense ratios. Your decision should focus on account type and personal preferences:

Choose Vanguard ETFs (VTI, VOO, VXUS, BND) if:

- Investing in taxable accounts (tax efficiency wins)

- Starting with less than $3,000 (lower minimums)

- You prefer trading flexibility

- You want the absolute lowest expense ratios (sometimes 0.01% lower)

Choose Vanguard mutual funds (VTSAX, VFIAX, VTIAX, VBTLX) if:

- Investing in retirement accounts (tax efficiency irrelevant)

- You want completely automated investing

- You prefer to avoid any trading decisions

- You already meet the $3,000 Admiral share minimums

Vanguard’s unique feature: For some funds, owning the mutual fund gives you access to the ETF share class at NAV with no trading costs. This offers the best of both worlds for advanced strategies.

12. Do mutual funds or ETFs perform better?

The structure (ETF vs mutual fund) doesn’t determine performance – the underlying holdings and expense ratio do. An S&P 500 ETF and S&P 500 mutual fund will perform virtually identically before taxes and fees.

What actually matters for performance:

- Expense ratio: A fund charging 0.03% will outperform one charging 1.00%, regardless of structure

- Tracking efficiency: How accurately the fund matches its benchmark

- Taxes (in taxable accounts): ETFs’ tax efficiency can add 0.5-1.0% annually after taxes

- Trading costs: Bid-ask spreads for ETFs vs $0 for mutual funds (usually minimal)

Long-term data: Index mutual funds and equivalent ETFs tracking the same benchmark show nearly identical returns over 10+ year periods. The ETF advantage appears only in after-tax returns in taxable accounts.

Focus on: Low costs and tax efficiency (if taxable), not the wrapper.

13. Can I automatically invest in ETFs like I can with mutual funds?

Yes, automatic ETF investing has become widely available, though the implementation varies by broker:

Fidelity: Offers automatic investments in ETFs with fractional shares. Set up recurring transfers and specify dollar amounts.

Schwab: Schwab Stock Slices allows automated fractional share investing in ETFs and stocks.

Interactive Brokers: Supports scheduled ETF purchases with fractional shares.

Vanguard: Does not currently offer automatic ETF investing (mutual funds only for auto-invest).

M1 Finance: Built around automated ETF investing with customizable “pies.

While mutual funds pioneered this feature and still offer slightly smoother automation at some brokers, the gap has closed significantly. If automated investing is your priority, verify your specific broker’s ETF auto-invest capabilities before opening an account.

14. Are ETFs safer than mutual funds?

No. Safety depends entirely on the underlying investments, not the ETF or mutual fund structure. Both vehicles hold the same types of securities and carry identical market risks.

Same holdings = same risk:

- S&P 500 ETF (VOO) and S&P 500 mutual fund (VFIAX) are equally safe/risky

- International stock ETF and international stock mutual fund carry the same foreign market risk

- Bond ETF and bond mutual fund have identical interest rate and credit risk

Structural differences don’t affect safety:

- ETFs can’t “go bankrupt” any more than mutual funds

- Both are regulated investment vehicles with investor protections

- Your shares represent ownership of underlying securities in both cases

What actually determines safety:

- Asset class (stocks are riskier than bonds)

- Geographic diversification

- Sector concentration

- Credit quality (for bond funds)

Choose between ETFs and mutual funds based on taxes, costs, and convenience – not safety.

15. Should beginners invest in ETFs or mutual funds?

For absolute beginners, mutual funds often provide a simpler starting point:

- Direct investment with fund companies (Vanguard, Fidelity) is straightforward

- Automatic investing is easier to set up

- Dollar amount investing (rather than shares) is more intuitive

- No bid-ask spreads or trading decisions to consider

However, ETFs offer advantages for beginners too:

- Lower minimum investments (one share vs $1,000-$3,000)

- Simpler fee structure (no share classes to understand)

- Fractional share programs now make them equally accessible

My recommendation for beginners:

If investing in a 401(k) or employer plan: You’ll likely use mutual funds automatically – this is perfect for beginners.

If opening your first IRA or taxable account: Start with low-cost ETFs at Fidelity or Schwab, use their fractional share programs, and set up automatic investments. The combination of low minimums and tax efficiency (for taxable accounts) makes ETFs slightly better for beginners today.

Most important for beginners: Choose low-cost index funds (whether ETF or mutual fund), invest consistently, and avoid frequent trading. The vehicle matters less than these fundamentals.

Conclusion: Making Your ETF vs Mutual Fund Decision

After examining the mechanics, costs, tax implications, and practical differences between ETFs and mutual funds, the path forward is straightforward: Let your account type drive your decision.

For taxable brokerage accounts, ETFs offer clear advantages through superior tax efficiency that compounds to significant savings over decades. The ability to defer capital gains until you sell makes ETFs the rational choice for after-tax investing.

For retirement accounts (401k, IRA, Roth IRA), the playing field levels completely. Tax-advantaged status eliminates ETFs’ primary benefit. Choose mutual funds for seamless automation or ETFs for flexibility and lower minimums – both work equally well.

The honest truth from four decades in finance? This debate matters less each year. Commission-free trading, fractional shares, rock-bottom expense ratios, and improved automation have converged these once-distinct vehicles into remarkably similar tools.

What truly determines investment success isn’t the wrapper you choose – it’s maintaining low costs (expense ratios below 0.20%), building proper asset allocation, investing consistently regardless of market conditions, and resisting the temptation to trade frequently.

Your action plan: Choose ETFs for taxable accounts, either format for retirement accounts. Then focus on what actually builds wealth: time in the market, consistent contributions, and the discipline to stay invested through decades of market cycles.

Open an account at Fidelity, Schwab, or Vanguard, select low-cost index funds in your preferred format, automate your investments, and let compounding work its magic. The best investment decision is the one you’ll stick with for 30 years.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- What Is Diversification?

- How Compound Interest Works: The Complete Guide to Growing Your Wealth

- Investing 101: Everything You Need to Know to Start

- What Is an Index Fund? The Beginner’s Complete Guide

- Brokerage Account vs IRA vs 401k: Where to Invest First

- How the Stock Market Works: Simple Explanation

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance