A Comprehensive Guide to Building Wealth Through Systematic Investing

Introduction

Dollar-cost averaging (DCA) represents one of the most powerful yet straightforward investment strategies available to both novice and experienced investors. By committing to invest a fixed amount at regular intervals regardless of market conditions, investors can systematically build wealth while eliminating the psychological burden of trying to time market movements. In today’s volatile financial landscape, where market swings of 2-3% in a single day have become commonplace, understanding and implementing dollar-cost averaging has never been more relevant for achieving long-term financial security. Plus, use our free DCA Calculator below to see exactly how much wealth you could build with your own numbers.

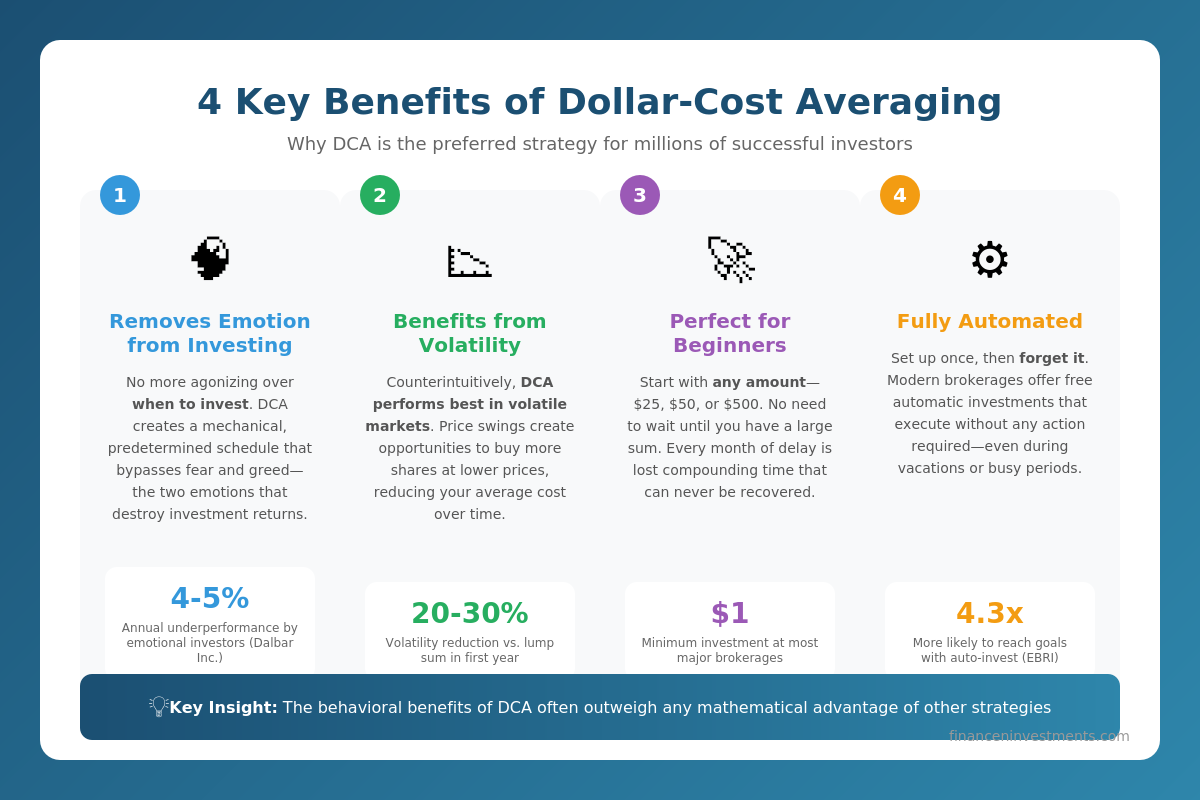

This strategy matters because it addresses the fundamental challenge that derails most individual investors: emotional decision-making. Research from Dalbar Inc. consistently shows that the average equity fund investor underperforms the S&P 500 by approximately 4-5% annually, primarily due to poor timing decisions driven by fear and greed. Dollar-cost averaging provides a disciplined framework that bypasses these emotional pitfalls entirely.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways

1. Dollar-cost averaging eliminates timing risk by spreading purchases across multiple price points. An investor contributing $500 monthly to an S&P 500 index fund over 12 months purchases shares at various prices, achieving an average cost that smooths out volatility. Historical data shows this approach reduces portfolio volatility by approximately 20-30% compared to lump-sum investing during the first year.

2. While lump-sum investing outperforms DCA approximately 66% of the time mathematically, DCA provides superior behavioral outcomes for most investors. A Vanguard study analyzing data from 1926-2015 found that immediate investment beats DCA two-thirds of the time, yet DCA investors are significantly more likely to stay invested during market downturns rather than panic-selling at losses.

3. Automation transforms DCA from a strategy into a wealth-building system. Investors who set up automatic monthly contributions are 4.3 times more likely to reach their retirement savings goals compared to those who invest manually. Platforms like Fidelity, M1 Finance, and Vanguard offer free automatic investment features that make implementation effortless.

Table of Contents

What Is Dollar-Cost Averaging?

The Simple Definition

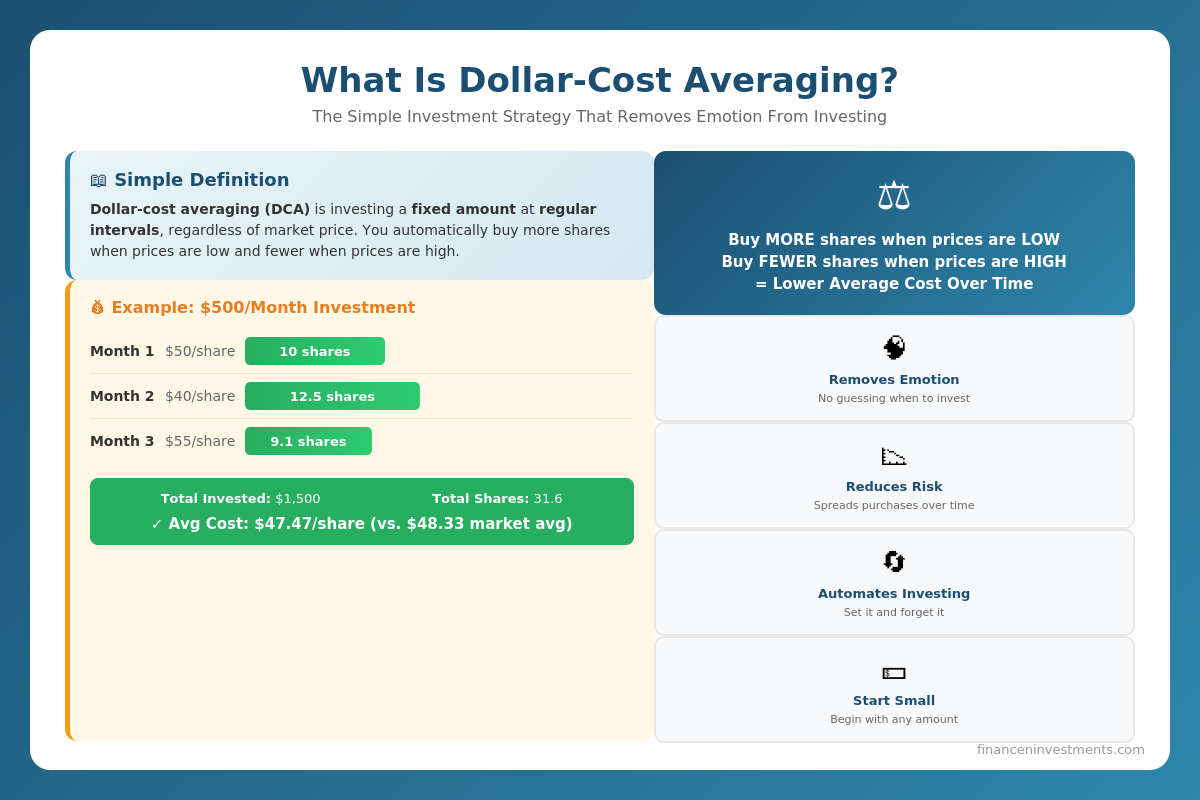

Dollar-cost averaging is an investment strategy in which an individual invests a fixed dollar amount into a particular investment on a regular schedule, regardless of the share price at the time of purchase. The core principle is elegantly simple: by investing consistently – whether weekly, bi-weekly, or monthly -investors automatically purchase more shares when prices are low and fewer shares when prices are high, resulting in a lower average cost per share over time.

Example: Consider an investor who commits to investing $500 per month into a total stock market index fund. In January, when the share price is $50, that $500 purchases 10 shares. In February, the market drops and shares cost $40, so the same $500 now purchases 12.5 shares. In March, the market rebounds to $55 per share, and $500 buys approximately 9.1 shares. Over these three months, the investor has invested $1,500 and acquired 31.6 shares at an average cost of $47.47 per share – lower than the simple average price of $48.33.

The Opposite of Market Timing

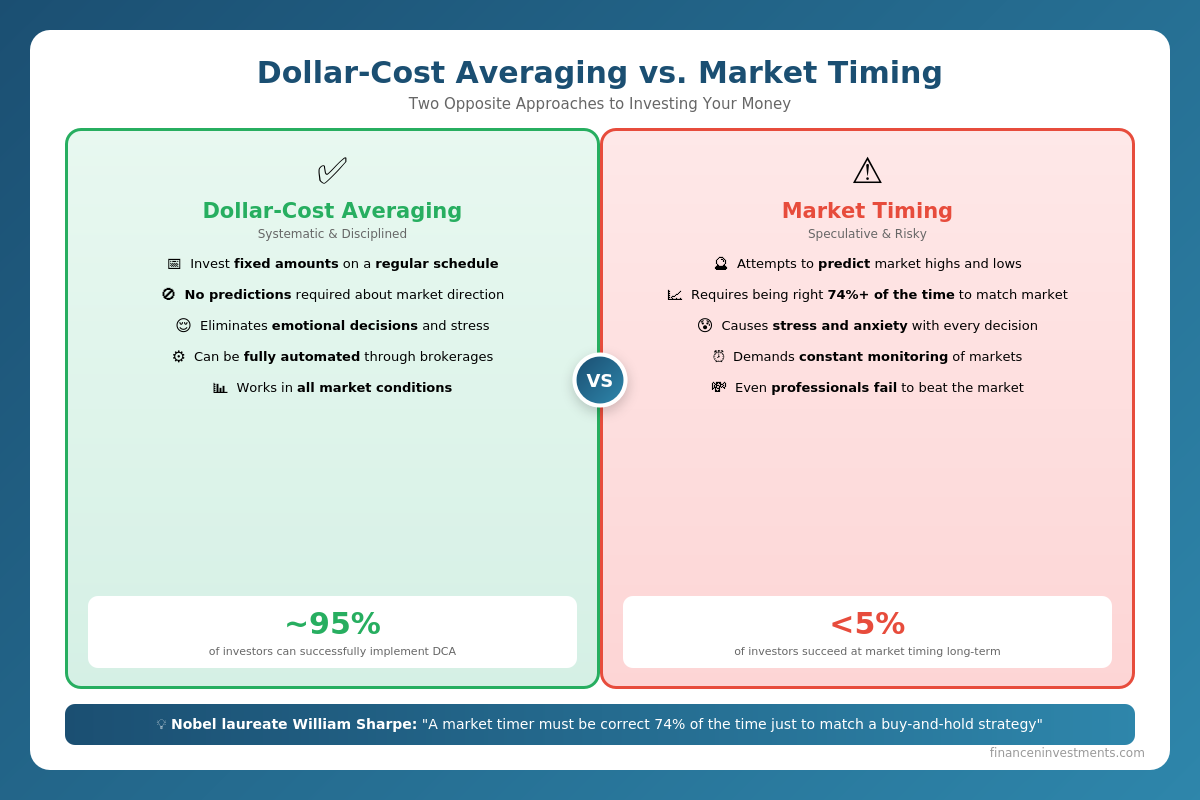

Dollar-cost averaging stands in direct philosophical opposition to market timing – the strategy of attempting to predict market highs and lows to maximize returns. While market timing sounds appealing in theory, decades of research demonstrate its practical impossibility for the vast majority of investors.

A landmark study by Nobel laureate William Sharpe found that a market timer would need to be correct approximately 74% of the time just to match a buy-and-hold strategy. Given that even professional fund managers struggle to beat market benchmarks consistently, the odds of individual investors successfully timing the market are exceedingly low. Dollar-cost averaging acknowledges this reality and removes the need for prediction entirely.

Why It Reduces Timing Risk

Timing risk refers to the possibility that an investor will enter the market at an unfavorable time – such as immediately before a significant decline. Dollar-cost averaging mitigates this risk through several mechanisms:

- Diversification across time: Instead of concentrating all capital at a single price point, DCA spreads purchases across multiple time periods, capturing both highs and lows.

- Reduced impact of volatility: Sharp market movements have less effect on the overall portfolio when contributions are distributed over time.

- Psychological protection: Knowing that future contributions will occur at potentially lower prices provides comfort during market declines.

- Elimination of decision paralysis: The automatic nature of DCA removes the need to decide when to invest, preventing analysis paralysis.

How Dollar-Cost Averaging Works

The Mathematical Explanation

The mathematics behind dollar-cost averaging reveals why this strategy produces a lower average cost than simple price averaging. When investing a fixed dollar amount, the number of shares purchased varies inversely with the price:

Shares Purchased = Fixed Investment Amount ÷ Current Share Price

This formula guarantees that more shares are acquired when prices are depressed and fewer when prices are elevated. The weighted average cost per share – calculated as total dollars invested divided by total shares acquired – will always be less than or equal to the arithmetic mean of all purchase prices, assuming prices vary at all during the investment period.

Real Example: $500 Per Month Over 12 Months

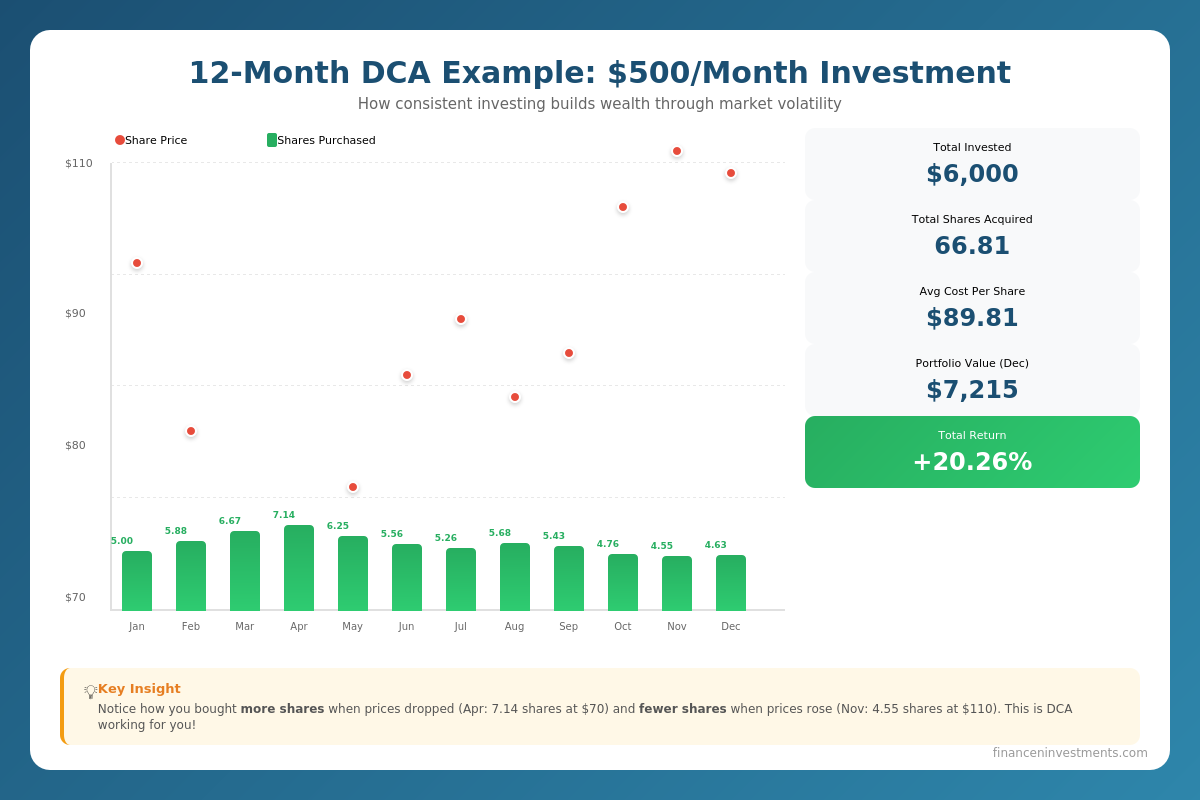

Consider an investor who contributes $500 monthly to an S&P 500 index fund throughout a turbulent year. The following table illustrates how DCA performs across varying market conditions:

| Month | Price | Invested | Shares | Total Shares |

|---|---|---|---|---|

| January | $100 | $500 | 5.00 | 5.00 |

| February | $85 | $500 | 5.88 | 10.88 |

| March | $75 | $500 | 6.67 | 17.55 |

| April | $70 | $500 | 7.14 | 24.69 |

| May | $80 | $500 | 6.25 | 30.94 |

| June | $90 | $500 | 5.56 | 36.50 |

| July | $95 | $500 | 5.26 | 41.76 |

| August | $88 | $500 | 5.68 | 47.44 |

| September | $92 | $500 | 5.43 | 52.87 |

| October | $105 | $500 | 4.76 | 57.63 |

| November | $110 | $500 | 4.55 | 62.18 |

| December | $108 | $500 | 4.63 | 66.81 |

| TOTAL | Avg: $91.50 | $6,000 | 66.81 | 66.81 |

Average Cost Per Share Calculation

In this example, the investor’s weighted average cost per share is:

Average Cost = $6,000 ÷ 66.81 = $89.81 per share

Compare this to the arithmetic average of all monthly prices ($91.50), and the DCA investor has achieved a 1.85% advantage simply by investing consistently. With a final share price of $108, the portfolio is worth $7,215.48 – a gain of $1,215.48 or 20.26% on the $6,000 invested.

Types of Dollar-Cost Averaging Approaches

While the fundamental concept of DCA remains consistent, investors can implement the strategy through several variations tailored to their specific circumstances and goals.

Classic Fixed-Amount DCA

The traditional approach involves investing an identical dollar amount at each interval. This method is ideal for investors with predictable income who want maximum simplicity. An investor might commit to investing $500 on the 15th of every month, regardless of market conditions or account balance.

Value Averaging (Enhanced DCA)

Value averaging is a more sophisticated variation where the investor adjusts each contribution to maintain a predetermined portfolio growth trajectory. If the target is for the portfolio to grow by $500 monthly and the market drops, the investor contributes more than $500 to reach the target. Research suggests value averaging can outperform traditional DCA by 1-2% annually, though it requires more active management.

Percentage-of-Income DCA

This approach ties investment amounts to income rather than fixing a specific dollar amount. An investor might commit to investing 15% of each paycheck. This method naturally increases contributions as income grows and provides flexibility during periods of variable earnings, making it particularly suitable for freelancers or anyone with irregular income.

Hybrid DCA with Market Triggers

Some investors combine regular DCA with opportunistic additions during significant market declines. The base strategy might involve $400 monthly contributions, with an additional $200 invested whenever the market drops more than 5% from recent highs. While this introduces an element of timing, it remains disciplined and rules-based rather than emotional.

Benefits of Dollar-Cost Averaging

Removes Emotion from Investing

The greatest advantage of dollar-cost averaging lies not in mathematics but in psychology. Behavioral finance research consistently demonstrates that emotional decision-making is the primary destroyer of investment returns. Fear causes investors to sell at market bottoms; greed leads to buying at peaks. DCA circumvents both tendencies by establishing a mechanical, predetermined investment schedule.

Takes Advantage of Market Volatility

Counterintuitively, DCA performs best in volatile markets. While volatility distresses most investors, DCA practitioners recognize that price swings create opportunities to acquire more shares at discounted prices. A market that fluctuates provides better DCA outcomes than a market that moves steadily upward.

Perfect for Beginners with Limited Capital

Many potential investors hesitate to begin because they believe they need a substantial sum to invest. DCA shatters this barrier by allowing investment of any amount that fits the individual’s budget. Starting with $50 per month is infinitely better than waiting years to accumulate $10,000 for a lump-sum investment – particularly given the power of compound growth.

Automation Makes It Effortless

Modern brokerage platforms enable complete automation of the DCA process. Once configured, automatic investments occur without any action required from the investor. Platforms such as Fidelity, M1 Finance, and Vanguard all offer robust automatic investment features at no additional cost.

Dollar-Cost Averaging vs. Lump Sum Investing

The Data: Lump Sum Wins Two-Thirds of the Time

Intellectual honesty requires acknowledging that, from a purely mathematical perspective, lump-sum investing outperforms DCA more often than not. A comprehensive Vanguard study analyzing U.S., U.K., and Australian markets from 1926-2015 found that investing a lump sum immediately beat dollar-cost averaging over 12-month periods approximately 66% of the time. The average outperformance was 2.39% in the U.S. market.

When DCA Makes Sense

Despite the mathematical advantage of lump-sum investing, DCA remains the superior choice in several circumstances:

- Behavioral concerns: If an investor would be devastated by an immediate market decline following a lump-sum investment – potentially leading to panic selling – DCA provides emotional protection.

- Risk tolerance limitations: Investors with lower risk tolerance may find the gradual entry of DCA more palatable.

- Income-based investing: For most workers, DCA is not a choice but a necessity – investment capital arrives in periodic paychecks.

- Elevated valuations: When markets appear significantly overvalued by historical metrics, DCA may reduce near-term loss risk.

The Compromise: Invest Over 6-12 Months

Many investors choose a middle path: investing a windfall over 6-12 months rather than all at once or over many years. Splitting a $60,000 inheritance into six monthly $10,000 investments provides meaningful diversification across time while ensuring full investment within a reasonable period.

Comparison: DCA vs. Lump Sum vs. Market Timing

| Factor | DCA | Lump Sum | Market Timing |

|---|---|---|---|

| Expected Returns | Moderate (~34%) | Highest (~66%) | Lowest (<26%) |

| Risk Level | Lower | Higher | Highest |

| Effort Required | Minimal | Minimal | Maximum |

| Emotional Stress | Low | Medium-High | Extreme |

| Best For | Most investors | Disciplined investors | Professionals only |

Challenges and Risks of Dollar-Cost Averaging

Opportunity Cost in Rising Markets

The most significant risk of DCA is underperforming during sustained bull markets. When markets rise steadily, uninvested cash earns minimal returns while equity prices climb higher. The investor’s future contributions purchase fewer shares at progressively higher prices, reducing overall returns compared to immediate full investment.

False Sense of Security

DCA reduces timing risk but does not eliminate market risk. An investor who dollar-cost averages into an individual stock that ultimately declines to zero still loses their entire investment – just more gradually. DCA should be combined with proper diversification through broad index funds rather than concentrated positions.

Requires Discipline and Consistency

DCA only works when investors maintain consistency through all market conditions. Abandoning the strategy during market downturns – precisely when DCA provides the greatest benefit – defeats its purpose entirely. Automation helps ensure consistency, but investors must resist the urge to cancel automatic investments during frightening market periods.

How to Implement Dollar-Cost Averaging

Setting Up Automatic Investments

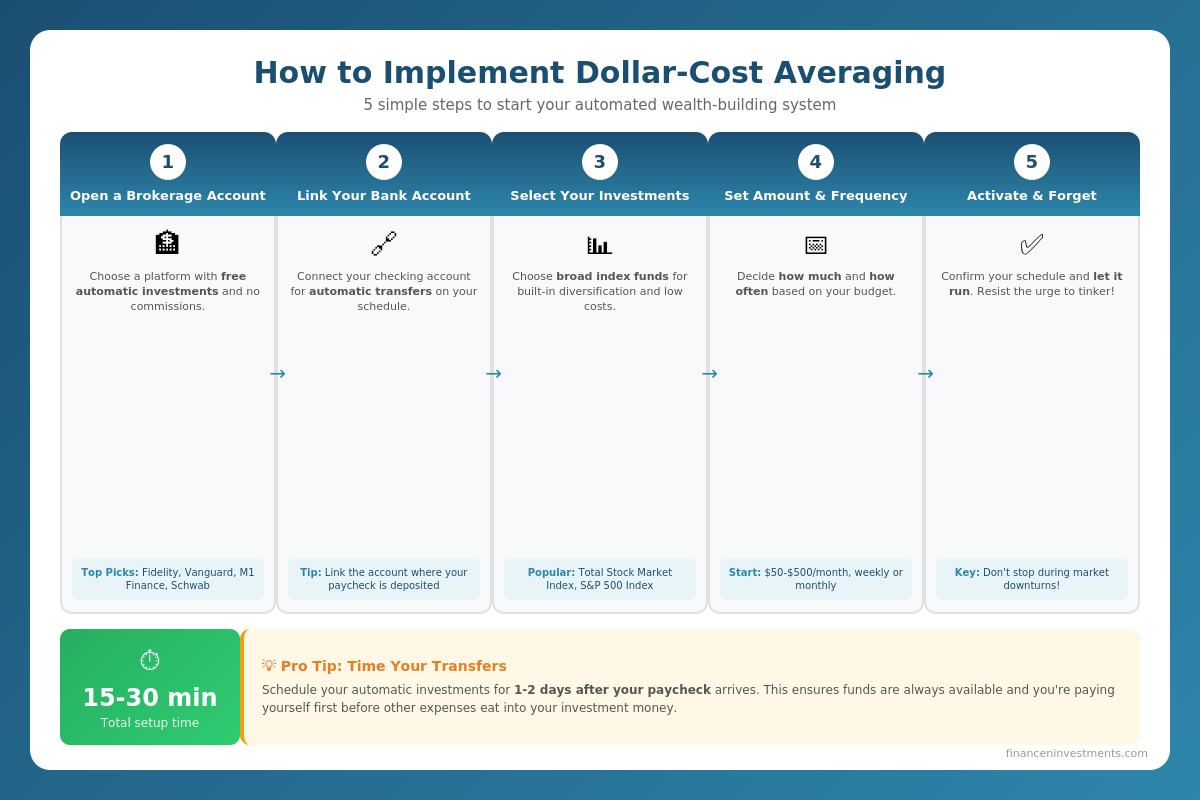

Implementing DCA begins with selecting a brokerage platform and establishing automatic contributions:

- Open a brokerage account at a platform offering free automatic investments (Fidelity, M1 Finance, Vanguard, Schwab)

- Link a bank account for automatic fund transfers

- Select investments (typically broad index funds such as a total stock market fund)

- Choose contribution amount and frequency (weekly, bi-weekly, monthly)

- Confirm the automatic investment schedule and allow the system to operate without interference

🧮

FREE TOOL

Try Our Dollar-Cost Averaging Calculator

Ready to see how DCA could work for your specific situation? Use our free interactive calculator below to visualize your potential wealth growth. Simply enter your monthly investment amount, time horizon, and expected return rate to see:

💰Your total portfolio value over time

📈How much comes from contributions vs. growth

🎯5-year milestone projections

🏖️Potential passive income at retirement

Pro tip: Try different scenarios—see what happens if you increase your monthly contribution by just $100, or extend your time horizon by 5 years. The results might surprise you!

💡 What Did You Discover?

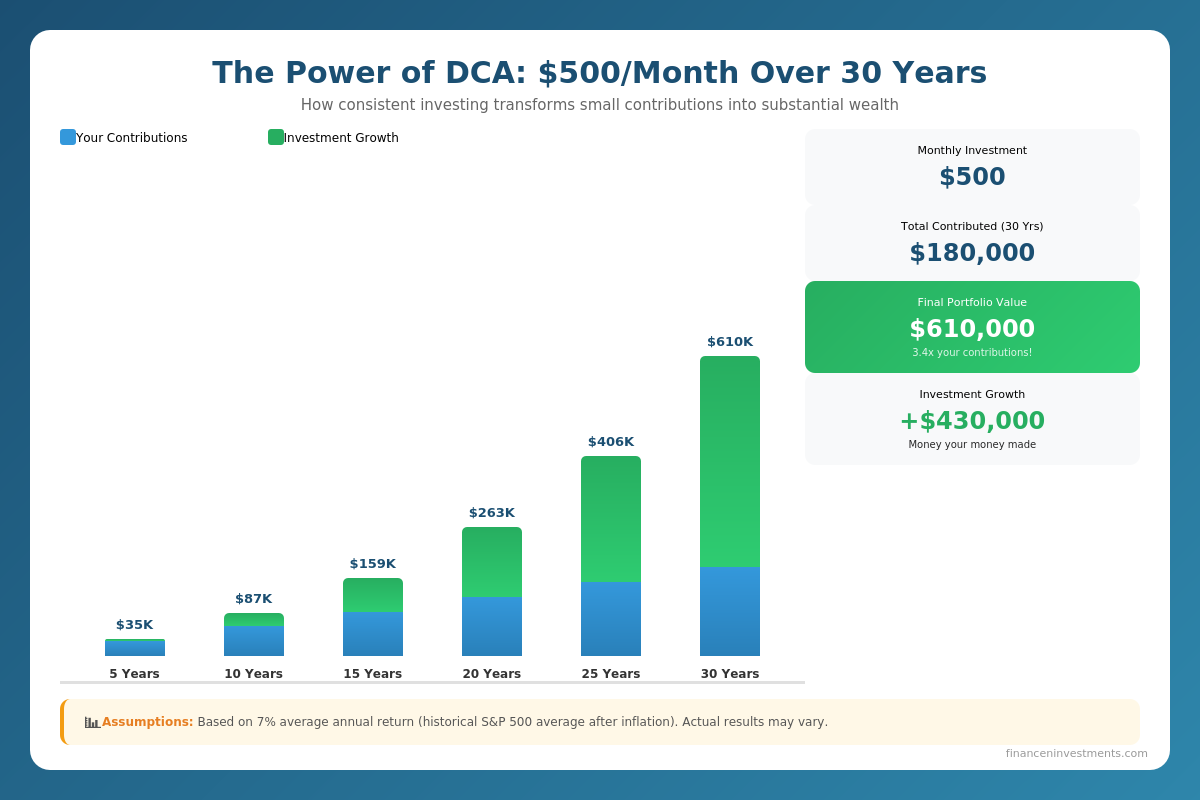

Most people are shocked when they see how much of their final portfolio comes from investment growth rather than their own contributions. This is the magic of compound returns working through dollar-cost averaging.

Key insight: Notice how at the 20-year mark, investment growth typically surpasses your total contributions? Every year you delay starting is a year of compounding you can never get back. The best time to start DCA was yesterday—the second best time is today.

Best Platforms for Auto-Investing

| Platform | Auto-Invest Feature | Minimum | Best For |

|---|---|---|---|

| Fidelity | Free recurring investments | $1 | All-around excellence |

| M1 Finance | Pie-based auto-invest | $100 | Best DCA interface |

| Vanguard | Automatic investment plan | $1 | Index fund investors |

| Schwab | Automatic investing | $1 | Full-service banking |

How Much to Invest Per Month

- Minimum viable: Whatever amount you can commit to consistently. Even $25/month builds wealth over time.

- Retirement benchmark: 15-20% of gross income for retirement savings.

- Aggressive wealth building: 50%+ savings rate for financial independence pursuits.

🧮 Try Our Free DCA Calculator

Dollar-Cost Averaging Calculator

Ready to see how DCA could work for your specific situation? Enter your numbers below to instantly visualize your potential wealth growth:

✨ Your Projected Results

💡 What Did You Discover?

Most people are shocked when they see how much of their final portfolio comes from investment growth rather than their own contributions. This is the magic of compound returns working through dollar-cost averaging.

Key insight: Notice how around the 20-year mark, investment growth typically surpasses your total contributions? Every year you delay starting is a year of compounding you can never get back. The best time to start DCA was yesterday—the second best time is today.

Future Trends in Dollar-Cost Averaging

AI-Enhanced DCA Strategies

Emerging robo-advisors and fintech platforms are beginning to offer “intelligent” DCA that adjusts contribution amounts based on market conditions, valuation metrics, and individual investor profiles. While maintaining the core principle of regular investment, these systems may slightly increase contributions during market weakness and reduce them during apparent euphoria.

Integration with Behavioral Finance

Financial platforms increasingly incorporate behavioral nudges designed to keep investors committed to their DCA strategies. Features such as progress trackers, milestone celebrations, and social proof elements leverage psychological research to improve adherence rates and long-term outcomes.

Expansion to Alternative Assets

DCA is extending beyond traditional stocks and bonds into cryptocurrency, fractional real estate, and other alternative assets. Platforms now enable automatic recurring purchases of Bitcoin, Ethereum, and even fractional shares of investment properties, democratizing access to asset classes previously available only to wealthy investors.

Personalized Contribution Optimization

Future systems may dynamically adjust DCA amounts based on an individual’s cash flow, upcoming expenses, and savings goals. By integrating with bank accounts and financial planning software, these platforms could automatically increase contributions during high-income months and reduce them when expenses spike.

Frequently Asked Questions

1. What is the ideal frequency for dollar-cost averaging?

Monthly investing aligns well with most pay schedules and provides meaningful diversification across time. The most important factor is consistency rather than frequency.

2. Does dollar-cost averaging work with individual stocks?

DCA can be applied to individual stocks, but the strategy is significantly more effective with diversified investments such as index funds. Individual stocks carry company-specific risk that DCA cannot mitigate.

3. Should I stop dollar-cost averaging during a market crash?

No – market crashes represent the optimal time for DCA. Continuing to invest during downturns means purchasing more shares at discounted prices, which amplifies long-term returns when markets recover.

4. How long should I continue dollar-cost averaging?

DCA should continue throughout the accumulation phase of an investor’s life – typically until retirement or the point when withdrawals begin.

5. What is the minimum amount needed to start dollar-cost averaging?

With fractional shares now available at most brokerages, investors can begin DCA with as little as $1. However, contributions of $25-$50 monthly represent a more practical starting point.

6. Is dollar-cost averaging tax-efficient?

DCA itself is tax-neutral, but it creates multiple tax lots with different cost bases. This can enable tax-loss harvesting opportunities and provide flexibility when selling to optimize tax outcomes.

7. Can I use dollar-cost averaging in retirement accounts?

Yes—DCA is particularly well-suited to retirement accounts such as 401(k)s and IRAs. Regular payroll contributions to a 401(k) represent automatic DCA.

8. Does dollar-cost averaging protect against all market losses?

No. DCA reduces timing risk but not market risk. Proper diversification across asset classes remains essential.

9. How does dollar-cost averaging compare to value averaging?

Value averaging adjusts contribution amounts to maintain a target portfolio growth rate, while DCA uses fixed contributions. Value averaging can produce slightly higher returns but requires more active management.

10. What happens to my dollar-cost averaging strategy during high inflation?

During inflationary periods, investors should consider increasing their DCA contribution amounts to maintain purchasing power. Periodic reviews and increases help preserve the strategy’s effectiveness.

Conclusion

Dollar-cost averaging represents one of the most accessible and effective investment strategies available to individual investors. By committing to invest fixed amounts at regular intervals, investors eliminate the impossible task of predicting market movements and instead focus on what they can control: Consistent, disciplined saving.

While mathematics may favor lump-sum investing slightly more often than not, the behavioral benefits of DCA – reduced anxiety, eliminated timing decisions, and protection against emotional mistakes – make it the superior choice for the majority of investors.

Looking ahead, dollar-cost averaging will remain a cornerstone of sound investment practice even as technology enhances its implementation. The fundamental truth underlying DCA – that time in the market matters more than timing the market – will not change regardless of market conditions or technological advances.

Investors who establish automatic investment programs today, maintain consistency through inevitable market turbulence, and allow compound growth to work over decades will find themselves far ahead of those who perpetually wait for the “perfect” moment to invest.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- What Are Dividend Stocks – The Ultimate Income Guide

- ETF vs Mutual Fund: Best Comparison Guide for Investors

- What Is Diversification?

- How Compound Interest Works: The Complete Guide to Growing Your Wealth

- Investing 101: Everything You Need to Know to Start

- What Is an Index Fund? The Beginner’s Complete Guide

- Brokerage Account vs IRA vs 401k: Where to Invest First

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Investment decisions should be made based on individual circumstances and, when appropriate, in consultation with a qualified financial advisor. Past performance does not guarantee future results.

© 2025 FinancenInvestments.com | All Rights Reserved