Introduction: Why Diversification Is Your Investment Safety Net

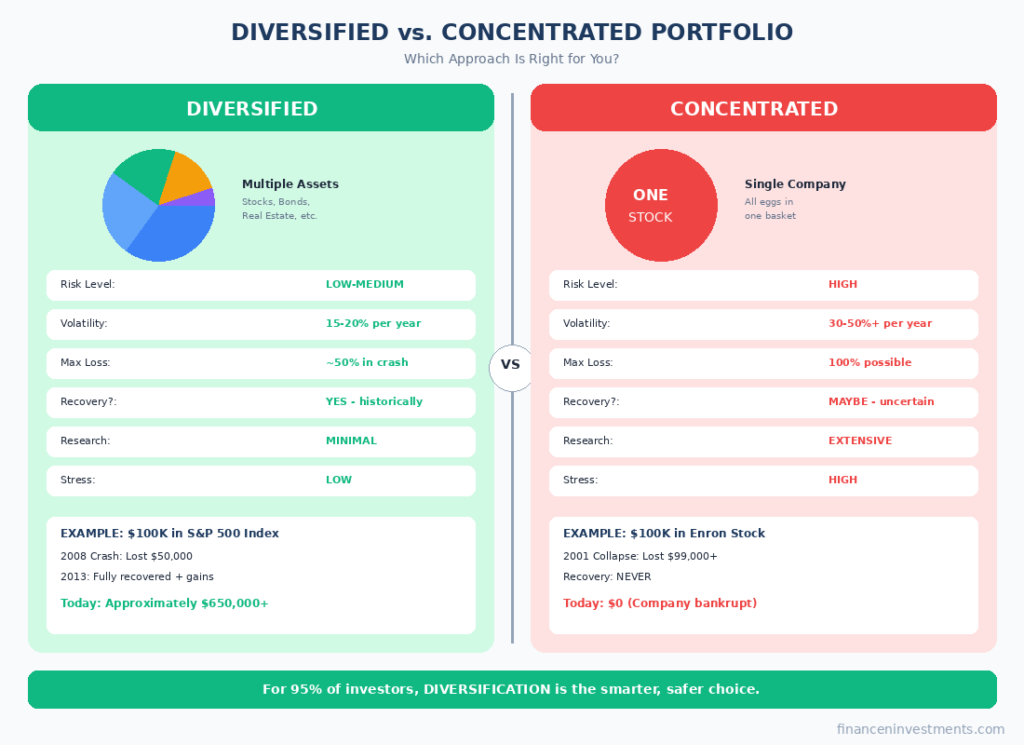

In 2000, employees at Enron had an average of 62% of their retirement savings invested in Enron stock. When the company collapsed in 2001, those employees didn’t just lose their jobs – they lost their entire life savings. Retirement accounts worth $1 million became worth less than $10,000 almost overnight.

This devastating outcome was entirely preventable through one simple concept: diversification.

Diversification is often called the only “free lunch” in investing – a rare strategy that can reduce your risk without necessarily reducing your expected returns. Yet despite its importance, many investors either ignore diversification entirely or implement it incorrectly.

In this comprehensive guide, you’ll learn exactly what diversification is, why it works, the different types of diversification, common mistakes to avoid, and how to build a properly diversified portfolio that can weather any market storm.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways

- Diversification reduces risk by spreading investments across different assets, sectors, geographies, and time periods

- You can eliminate company-specific risk almost entirely with just 20-30 stocks from different sectors, or instantly with index funds

- Diversify across four dimensions: asset classes, within asset classes, geography, and time

- Avoid false diversification (multiple similar investments) and over-diversification (too complex)

- A simple 3-fund portfolio provides world-class diversification at minimal cost

- Adjust allocation by age and rebalance annually to maintain your target

Table of Contents

What Is Diversification? (Don’t Put All Your Eggs in One Basket)

The Simple Definition

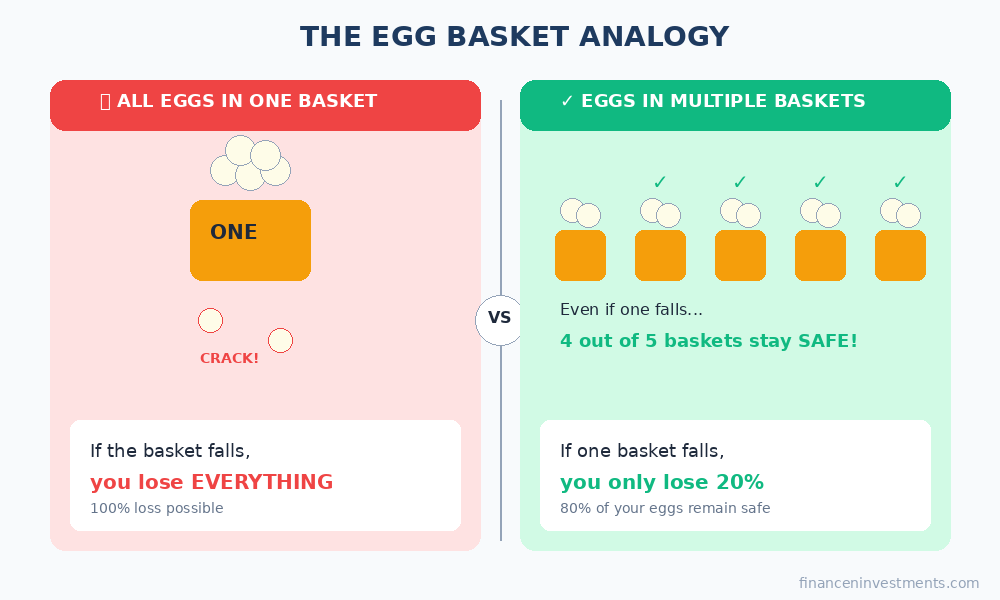

Diversification is an investment strategy that spreads your money across different investments to reduce risk. The core principle is simple: don’t put all your eggs in one basket.

Imagine you’re a farmer with 100 eggs. You could carry all 100 eggs in one basket. Easy to manage, right? But if you trip and drop that basket, you lose everything. Now imagine spreading those eggs across 10 different baskets. If one falls, you only lose 10% of your eggs instead of 100%.

Investing works the same way. If you invest your entire $100,000 retirement savings in a single company’s stock, and that company fails, you lose everything. But if you spread that $100,000 across 500 different companies, even if 10 companies fail completely, you’ve only lost 2% of your portfolio.

Why Diversification Matters: The Risk Reduction Principle

Every investment carries two types of risk:

- Systematic Risk (Market Risk): This affects the entire market – recessions, interest rate changes, global crises. You cannot eliminate this risk through diversification. When the entire stock market crashes 40% (like in 2008), even a diversified portfolio feels the impact.

- Unsystematic Risk (Company-Specific Risk): This affects individual companies – bad management, product failures, scandals, lawsuits. This risk CAN be eliminated through diversification.

Here’s the powerful insight: diversification can eliminate company-specific risk almost entirely. By owning many different companies, the winners offset the losers.

The Math Behind Risk Reduction

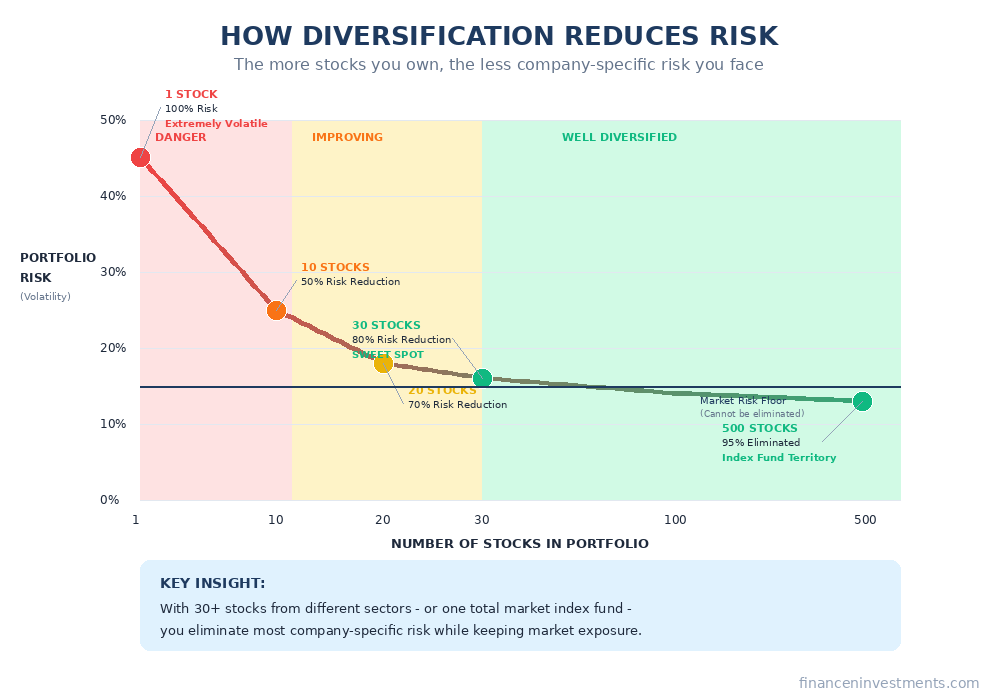

The mathematics of diversification is surprisingly powerful. Research by economists has shown:

- 1 stock: You face 100% of company-specific risk (extremely volatile)

- 10 stocks: Risk drops by approximately 50%

- 20 stocks: Risk drops by approximately 70%

- 30 stocks: Risk drops by approximately 80%

- 500+ stocks: Virtually all company-specific risk is eliminated

Nobel laureate Harry Markowitz formalized this concept in his Modern Portfolio Theory (1952), demonstrating mathematically that investors can optimize their portfolios by considering how different investments move in relation to each other (correlation) – not just individual risk and return.

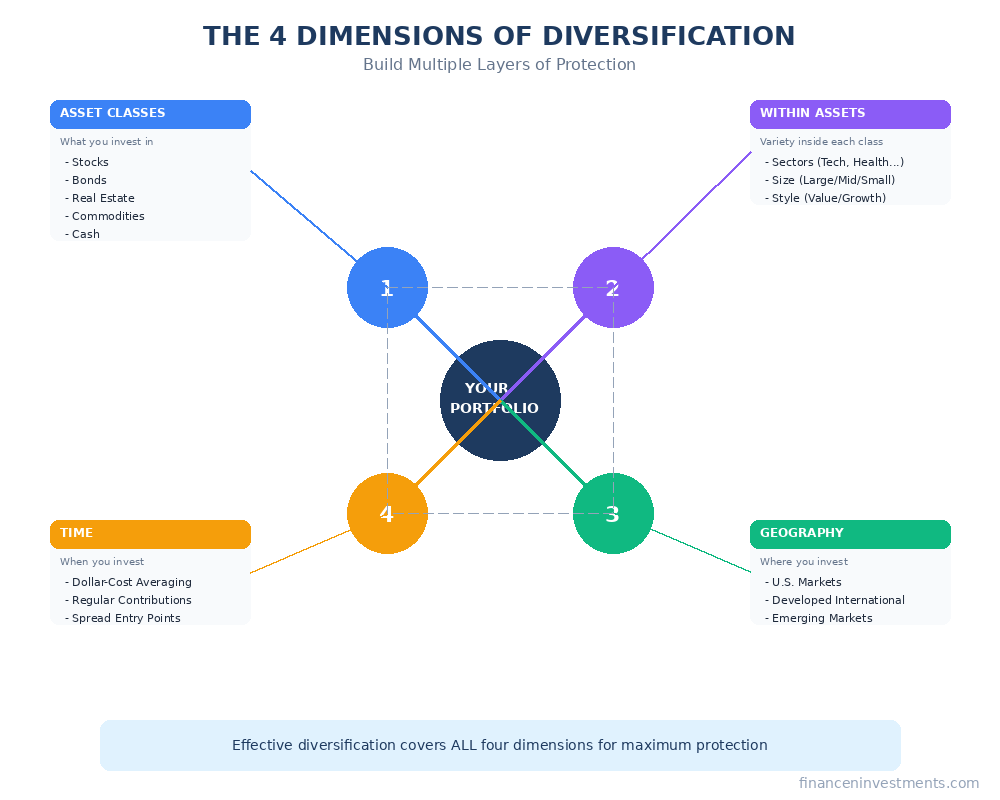

Types of Diversification: The Four Dimensions

Effective diversification operates across multiple dimensions. Think of it as building a fortress with multiple layers of protection.

1. Asset Class Diversification

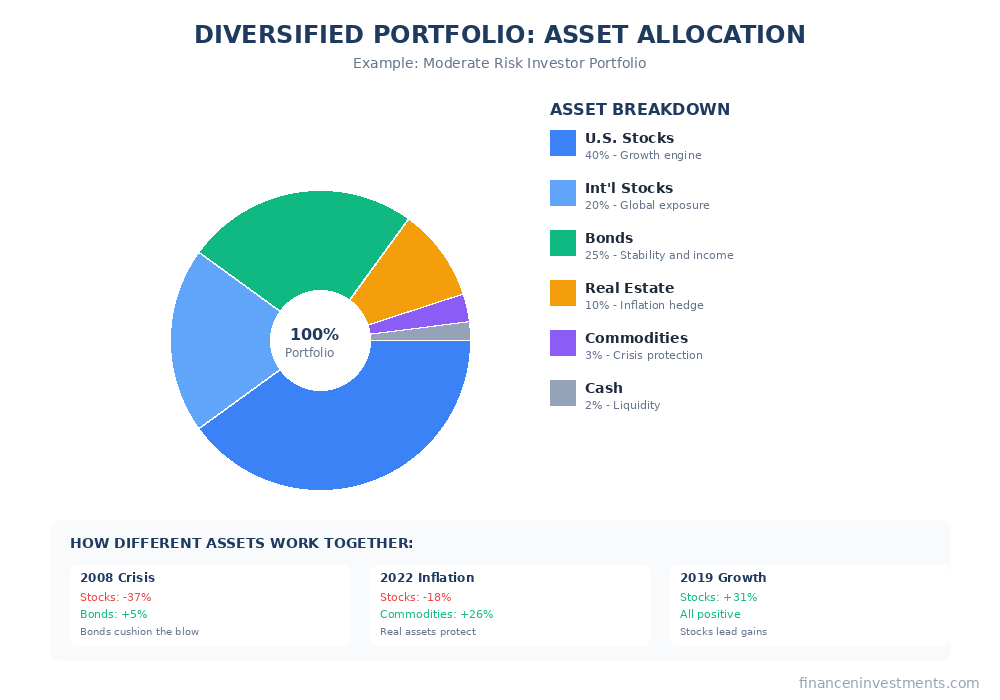

This is the most fundamental form of diversification – spreading your investments across different types of assets that behave differently under various economic conditions.

- Stocks: Higher risk, higher potential returns. Perform well during economic growth.

- Bonds: Lower risk, steady income. Often rise when stocks fall, providing portfolio stability.

- Real Estate (REITs): Provides inflation protection and income. Partially correlated with stocks.

- Commodities: Gold, oil, agricultural products. Often move independently of stocks and bonds.

- Cash/Money Market: Lowest risk, lowest return. Provides liquidity and stability.

Why it works: In 2008, stocks crashed 37% while high-quality bonds gained 5%. In 2022, stocks and bonds both fell – but real assets like commodities rose 26%. Different assets take turns performing well.

2. Within-Asset-Class Diversification

Even within a single asset class, you should spread across different categories.

For stocks, diversify across:

- Sectors: Technology, healthcare, financial, energy, consumer goods, industrials, utilities

- Company size: Large-cap (stable), mid-cap (growth potential), small-cap (higher risk/reward)

- Investment style: Value stocks (underpriced) vs. growth stocks (fast-growing)

For bonds, diversify across:

- Duration: Short-term (less rate sensitive), intermediate, long-term (higher yield)

- Credit quality: Government (safest), investment-grade corporate, high-yield (riskier)

- Type: Treasury, municipal (tax-advantaged), corporate, inflation-protected (TIPS)

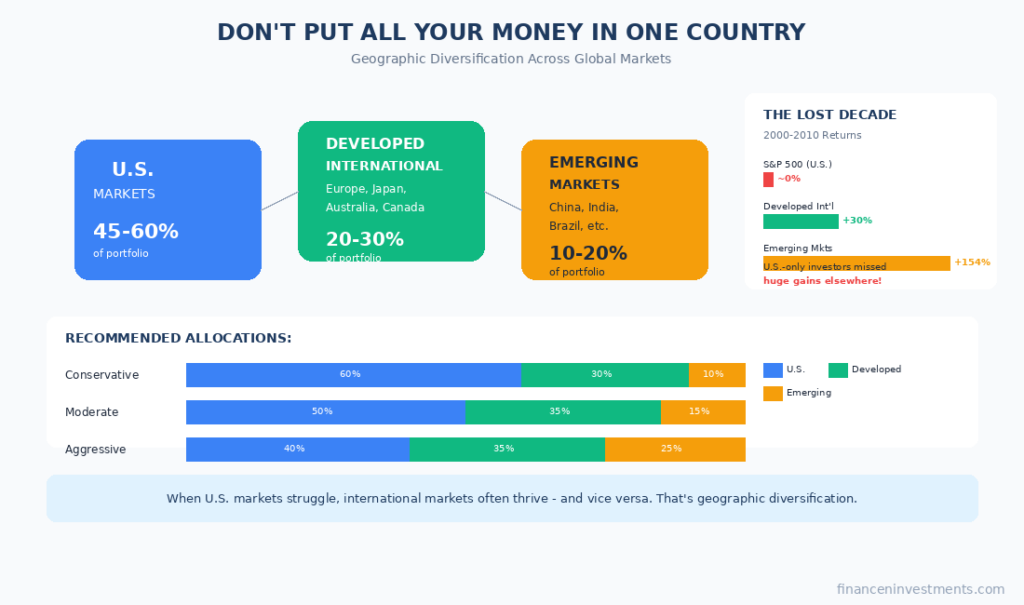

3. Geographic Diversification

Don’t limit yourself to one country’s economy. Spreading investments globally provides protection against regional economic problems and access to different growth opportunities.

- U.S. Markets: The world’s largest economy, home to global giants like Apple, Microsoft, and Amazon

- Developed International: Europe, Japan, Australia, Canada – stable economies with different cycles

- Emerging Markets: China, India, Brazil – higher risk but faster growth potential

Real-world example: From 2000-2010 (the “lost decade” for U.S. stocks), the S&P 500 returned approximately 0%. But international developed markets returned about 30%, and emerging markets returned over 150%. Investors with U.S.-only portfolios missed significant gains available elsewhere.

4. Time Diversification (Dollar-Cost Averaging)

You can also diversify when you invest, not just what you invest in. Dollar-cost averaging (DCA) means investing a fixed amount on a regular schedule, regardless of market prices.

Example: Instead of investing $12,000 all at once (which might be at a market peak), you invest $1,000 per month for 12 months. Some months you buy at higher prices, some at lower prices, but you average out your purchase price over time.

Benefits:

- Removes the stress of trying to “time the market”

- Forces you to buy more shares when prices are low (better value)

- Matches how most people actually save (from regular paychecks)

- Reduces regret if market drops right after you invest

How Much Diversification Is Enough?

The Diminishing Returns of Diversification

More isn’t always better. The benefits of diversification follow a curve of diminishing returns.

Going from 1 stock to 10 stocks dramatically reduces your risk. Going from 10 to 30 stocks provides meaningful additional protection. But going from 100 to 500 stocks? The additional risk reduction is minimal – you’ve already eliminated most company-specific risk.

The Sweet Spot: 20-30 Individual Stocks vs. 500+

Academic research suggests that:

- 20-30 stocks from different sectors can eliminate approximately 80-90% of unsystematic risk

- Beyond 30 stocks, additional diversification benefits become marginal

However, there’s a catch: achieving proper diversification with 20-30 individual stocks requires you to select stocks from truly different sectors and industries. If all your “diversification” is within technology, you’re not actually diversified (more on this common mistake later).

Index Funds: Instant Diversification

This is why index funds have become the go-to solution for most investors. A single investment in a total market index fund gives you instant exposure to hundreds or even thousands of companies.

Example: The Vanguard Total Stock Market Index Fund (VTSAX) holds over 3,600 U.S. stocks. With one purchase, you own a tiny slice of almost every publicly traded company in America – from Apple to tiny startups you’ve never heard of.

Benefits of index fund diversification:

- Automatic rebalancing as companies grow or shrink

- No research required – you own “the whole haystack”

- Extremely low costs (0.03-0.10% expense ratios)

- Eliminates virtually all company-specific risk

Our Tip: Learn more about index funds in our guide, “What is an Index Fund? The Simple Investment Strategy That Beats 90% of Professionals”

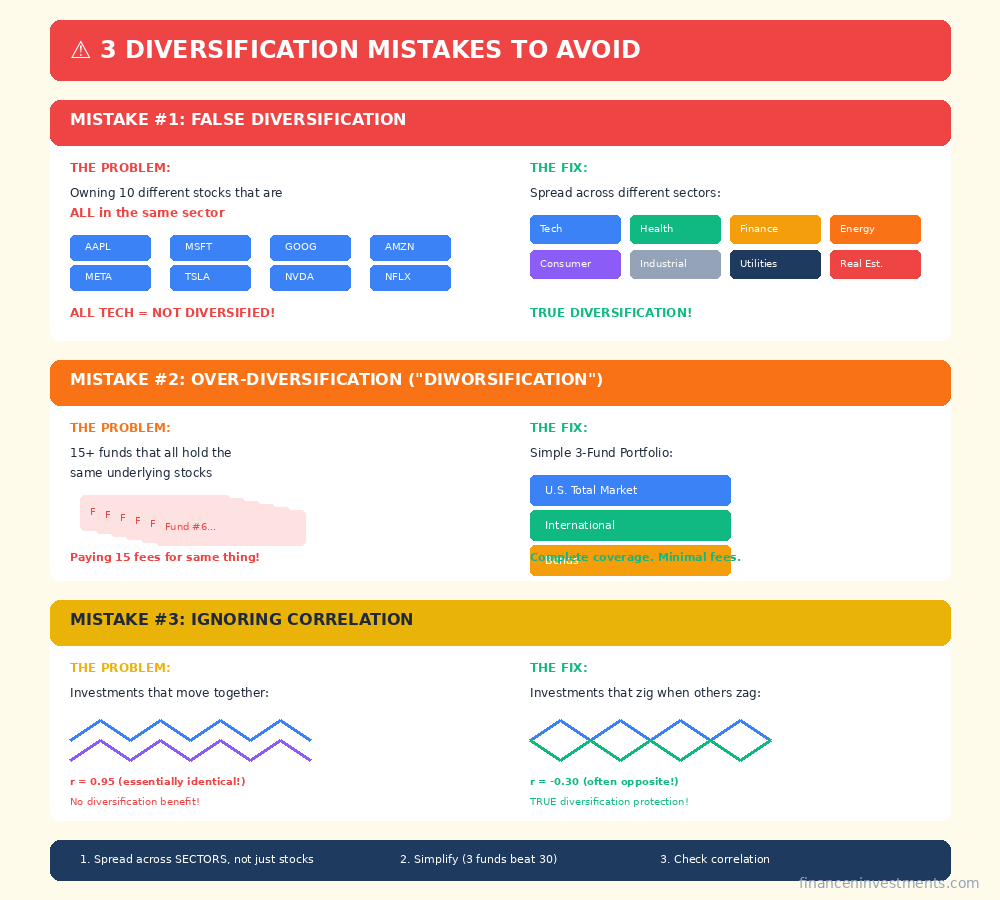

Common Diversification Mistakes

Many investors think they’re diversified when they’re not. Avoid these common pitfalls:

Mistake #1: False Diversification (Owning 10 Tech Stocks)

Just because you own multiple stocks doesn’t mean you’re diversified. If you own Apple, Microsoft, Google, Amazon, Meta, Tesla, Nvidia, Adobe, Netflix, and Salesforce – you own 10 different companies, but they’re all technology or tech-adjacent companies.

When the tech sector crashes (as it did in 2000-2002, losing over 75%), all 10 of your “diversified” stocks crash together. True diversification means owning companies that don’t all move in the same direction at the same time.

Fix: Spread across sectors – technology, healthcare, financials, consumer staples, energy, industrials, utilities, real estate, and communication services.

Mistake #2: Over-Diversification (“Diworsification”)

Legendary investor Peter Lynch coined the term “diworsification” to describe the opposite problem: diversifying so much that you dilute your returns without meaningfully reducing risk.

Signs of over-diversification:

- Owning 15+ mutual funds that overlap significantly

- Adding investments you don’t understand “for diversification”

- Paying high fees on multiple actively managed funds that essentially replicate an index

- Having 50+ individual stock positions that become impossible to monitor

Fix: Simplify. A basic 3-fund portfolio (U.S. stocks, international stocks, bonds) provides excellent diversification. You don’t need complexity to be diversified.

Mistake #3: Ignoring Correlation

Correlation measures how investments move in relation to each other, on a scale from -1 to +1:

- +1 correlation: Move perfectly together (no diversification benefit)

- 0 correlation: Move independently (good diversification)

- -1 correlation: Move in opposite directions (perfect diversification)

Many investors add investments thinking they’re diversifying, but those investments are highly correlated. For example, large-cap growth funds and technology sector funds have correlations near 0.95 – they’re essentially the same investment.

Fix: Focus on truly uncorrelated assets. Stocks and high-quality bonds historically have low or negative correlation. International stocks have moderate correlation with U.S. stocks. Real assets often move independently from both stocks and bonds.

Comparison: Diversified vs. Concentrated Portfolio

| Factor | Diversified Portfolio | Concentrated Portfolio |

|---|---|---|

| Risk Level | Lower (market risk only) | Higher (market + company risk) |

| Potential Return | Market average returns | Higher OR lower than average |

| Volatility | 15-20% annually | 30-50%+ annually |

| Worst-Case Scenario | Lose 50% in crash, recover | Lose 100% if company fails |

| Research Required | Minimal with index funds | Extensive ongoing research |

| Emotional Stress | Lower—no single decision matters | Higher—every decision critical |

| Best For | Most long-term investors | Professional investors/traders |

Building a Diversified Portfolio

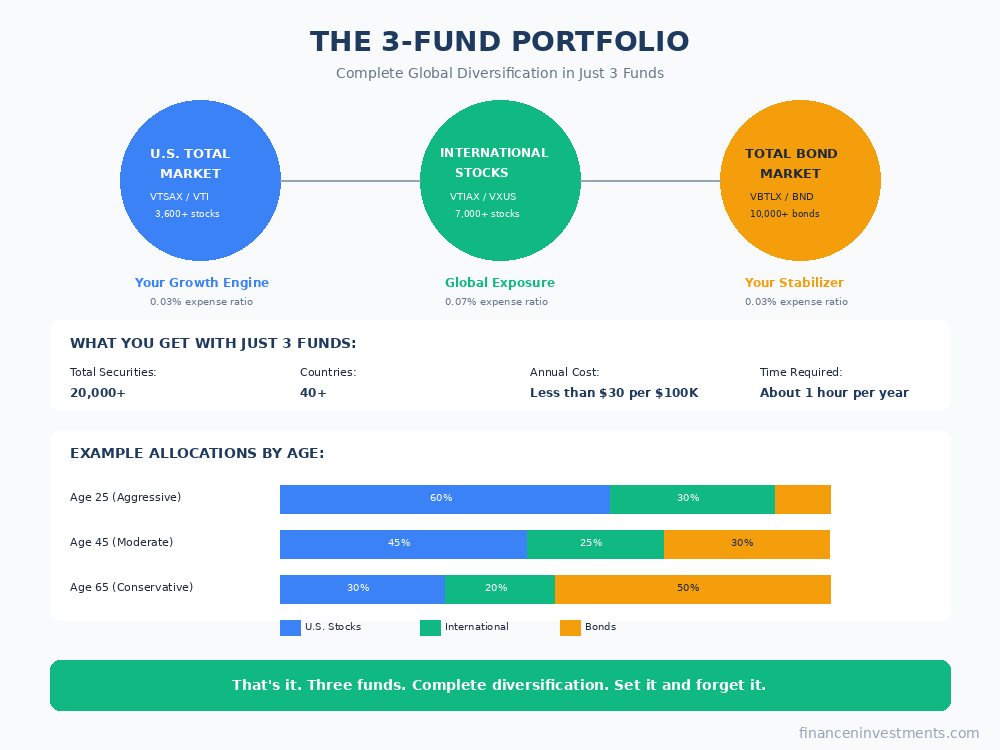

The Simple 3-Fund Portfolio

You don’t need dozens of funds to be properly diversified. The legendary “3-fund portfolio” provides exposure to virtually the entire global investment market with just three holdings:

- U.S. Total Stock Market Index Fund (e.g., VTSAX or VTI) – Covers large, mid, and small U.S. companies

- International Stock Index Fund (e.g., VTIAX or VXUS) – Covers developed and emerging international markets

- Total Bond Market Index Fund (e.g., VBTLX or BND) – Covers government and corporate bonds

With these three funds, you own pieces of over 10,000 stocks and thousands of bonds from around the world. That’s comprehensive diversification for under 0.10% in annual fees.

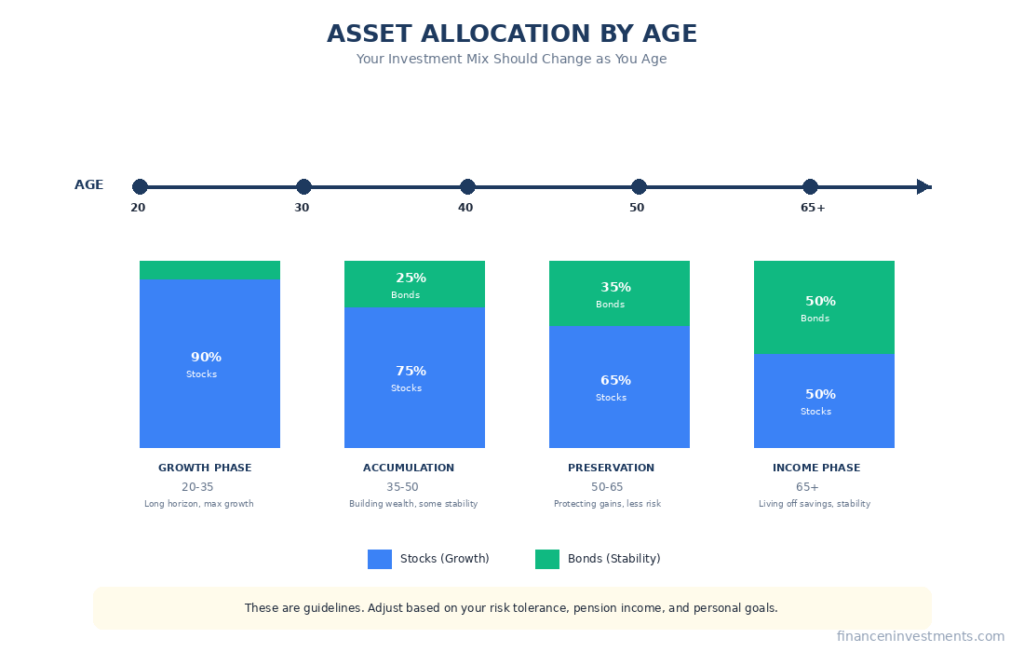

Asset Allocation by Age

How you divide your portfolio between stocks and bonds depends primarily on your time horizon. The traditional rule of thumb is: “Your age in bonds” meaning a 30-year-old might hold 30% bonds and 70% stocks.

However, modern guidelines often suggest holding fewer bonds when young because life expectancies are longer:

- Age 20-35: 90/10 to 80/20 stocks/bonds – Long time horizon, can handle volatility

- Age 35-50: 80/20 to 70/30 stocks/bonds – Still growth-focused with some stability

- Age 50-65: 70/30 to 60/40 stocks/bonds – Shifting toward preservation

- Age 65+: 60/40 to 50/50 stocks/bonds – Focus on stability and income

Important: These are guidelines, not rules. Your personal allocation depends on your risk tolerance, other income sources, and financial goals. Someone with a guaranteed pension might take more stock risk; someone with high anxiety about volatility might prefer more bonds.

Rebalancing Strategy

Over time, different investments perform differently, and your portfolio drifts from its target allocation. Rebalancing means periodically selling some winners and buying some losers to return to your target.

Example: You start with 80% stocks and 20% bonds. After a great stock market year, you’re now at 88% stocks and 12% bonds. Rebalancing means selling some stocks and buying bonds to get back to 80/20.

Why rebalancing works:

- Forces you to “sell high” and “buy low” automatically

- Maintains your intended risk level

- Removes emotion from investment decisions

How often to rebalance:

- Calendar method: Rebalance annually on a set date (simple, effective)

- Threshold method: Rebalance when any asset class drifts 5%+ from target (more responsive)

- Contribution method: Direct new contributions to underweight assets (tax-efficient)

FAQs

1. How many stocks do I need for proper diversification?

Research shows that 20-30 stocks from different sectors can eliminate approximately 80-90% of company-specific risk. However, using a total market index fund gives you instant diversification across thousands of stocks with less effort and lower cost. For most investors, index funds are the easiest path to proper diversification.

2. Does diversification guarantee I won’t lose money?

No. It eliminates company-specific risk, but you’re still exposed to market risk. When the entire market crashes (like 2008 or 2020), even a diversified portfolio will lose value. The difference is that a diversified portfolio will recover, while a concentrated portfolio invested in failing companies might not.

3. Can I be too diversified?

Yes. “Over-diversification” happens when you add so many holdings that you increase costs and complexity without meaningful risk reduction. If you own 15 mutual funds that all hold similar stocks, you’re paying multiple fees for no additional benefit. A simple 3-fund portfolio is often better than a complex 15-fund portfolio.

4. Should I diversify internationally?

Yes. While U.S. stocks have outperformed international stocks in recent years, that pattern can reverse. From 2000-2010, international stocks significantly outperformed U.S. stocks. Holding 20-40% of your stock allocation in international funds provides geographic diversification that can smooth returns over time.

5. What about crypto, gold, or other alternative investments?

Alternative investments can provide diversification benefits because they often move independently of stocks and bonds. However, they typically should represent a small portion (5-10%) of your portfolio at most. They tend to be more volatile and less researched than traditional assets. Most investors should master the basics (stocks, bonds, real estate) before adding alternatives.

6. How often should I rebalance my portfolio?

Most experts recommend rebalancing annually or when your allocation drifts more than 5% from your target. More frequent rebalancing increases transaction costs without meaningfully improving results. If you’re still making regular contributions, you can often rebalance simply by directing new money to underweight asset classes.

7. What’s the difference between diversification and asset allocation?

Asset allocation is deciding HOW MUCH to put in each asset class (e.g., 70% stocks, 30% bonds). Diversification is spreading investments WITHIN each asset class (e.g., owning stocks from different sectors and countries). Both work together: asset allocation sets your overall risk level, while diversification reduces risk within each category.

8. Is owning multiple mutual funds the same as being diversified?

Not necessarily. Many mutual funds hold similar stocks, especially large-cap growth funds. If you own five different funds that all hold Apple, Microsoft, and Amazon as their top holdings, you’re not as diversified as you think. Check the overlap between your funds using free tools like Morningstar’s X-Ray feature.

9. Should I diversify across different brokerages?

It’s generally unnecessary for diversification purposes. Major brokerages are protected by SIPC insurance up to $500,000 per account. However, some investors spread assets across brokerages for practical reasons: accessing different research tools, separating retirement from taxable accounts, or having backup access if one platform has technical issues.

10. How does diversification affect my taxes?

Diversification itself doesn’t directly affect taxes, but rebalancing can. When you sell appreciated investments to rebalance in a taxable account, you may owe capital gains taxes. To minimize this, you can rebalance by directing new contributions to underweight assets, or do your rebalancing in tax-advantaged accounts like IRAs and 401(k)s where there are no tax consequences.

11. What is correlation and why does it matter for diversification?

Correlation measures how two investments move in relation to each other, from -1 (perfectly opposite) to +1 (perfectly together). For diversification to work, you want investments with low or negative correlation. Stocks and bonds historically have low correlation—when stocks crash, bonds often rise. This is why a stock/bond mix reduces volatility more than either asset alone.

12. Does diversification reduce my returns?

Diversification may reduce your maximum potential return, but it also reduces your maximum potential loss. A concentrated portfolio in the right stock could outperform, but it could also go to zero. Historically, diversified portfolios have provided excellent returns while letting investors sleep at night. The reduction in stress and prevention of catastrophic losses is worth the slightly lower upside potential for most investors.

13. Should I diversify my retirement accounts differently than taxable accounts?

Your overall diversification should consider all your accounts together as one portfolio. However, you might place investments strategically for tax efficiency: bonds and REITs (which generate taxable income) are often better in tax-advantaged accounts, while stocks (which benefit from lower capital gains rates) can go in taxable accounts. The total allocation across all accounts should match your target.

14. How do target-date funds handle diversification?

Target-date funds are “all-in-one” solutions that automatically diversify across U.S. stocks, international stocks, and bonds. They also automatically adjust your allocation as you age, becoming more conservative as your target retirement date approaches. For investors who want simplicity, a single target-date fund can provide complete diversification with zero maintenance required.

15. What’s the minimum amount of money needed to be properly diversified?

With index funds and ETFs, you can be fully diversified with very little money. Many brokerages allow you to buy fractional shares, so you could invest $100 in a total market ETF and own a piece of thousands of companies. The 3-fund portfolio can be built with any amount. Gone are the days when you needed thousands of dollars to buy individual shares of multiple companies for diversification.

Recommended Diversified Investment Options

Building a diversified portfolio is easiest with low-cost index funds. Here are the most popular options:

Vanguard

- Total Stock Market (VTSAX/VTI): Expense ratio 0.03%

- Total International (VTIAX/VXUS): Expense ratio 0.07%

- Total Bond Market (VBTLX/BND): Expense ratio 0.03%

Fidelity

- Total Market (FSKAX): Expense ratio 0.015%

- Zero Total Market (FZROX): Expense ratio 0.00% (yes, zero)

- International Index (FSPSX): Expense ratio 0.03%

Schwab

- Total Stock Market (SWTSX): Expense ratio 0.03%

- International Index (SWISX): Expense ratio 0.06%

AFFILIATE DISCLOSURE: We may earn a commission if you open an account through our links. This doesn’t affect our recommendations—we suggest these funds because they’re genuinely the best low-cost options available.

Your Next Steps

Diversification isn’t complicated, but it is essential. Here’s how to get started:

- Assess your current portfolio – Use our Diversification Checklist to identify any concentration risks

- Determine your target allocation – Based on your age and risk tolerance, decide on a stock/bond split

- Choose your investments – Start with a simple 3-fund portfolio using low-cost index funds

- Set up automatic contributions – Enable dollar-cost averaging for time diversification

- Schedule annual rebalancing – Put a reminder on your calendar to review and adjust once per year

Remember: The goal of diversification isn’t to maximize returns – it’s to optimize your returns for the amount of risk you’re taking. A properly diversified portfolio lets you sleep at night while still building wealth over time.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- How Compound Interest Works: The Complete Guide to Growing Your Wealth

- Investing 101: Everything You Need to Know to Start

- What Is an Index Fund? The Beginner’s Complete Guide

- Brokerage Account vs IRA vs 401k: Where to Invest First

- How the Stock Market Works: Simple Explanation

Keep Learning: Get Our Free Investing Resources

Download our Investing Basics Glossary, plus get weekly tips for beginner investors delivered to your inbox.

OUR TIP: We recommend you download the “SMART INVESTING GUIDE” from our homepage too!

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance