Introduction

Albert Einstein allegedly called it ‘the eighth wonder of the world.’ Warren Buffett credits it for 99% of his $100+ billion fortune. And yet, 65% of Americans don’t fully understand how it works.

Compound interest is the single most powerful force in personal finance. It’s the difference between retiring with $400,000 or $1.2 million – using the exact same monthly contribution. It’s what separates people who struggle financially from those who build generational wealth.

Here’s the uncomfortable truth: every day you delay understanding compound interest costs you money. Not a little money – potentially hundreds of thousands of dollars over your lifetime.

This guide will show you exactly how compound interest works, why time is your greatest asset, and how to harness this force to build real wealth – regardless of your starting point.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways

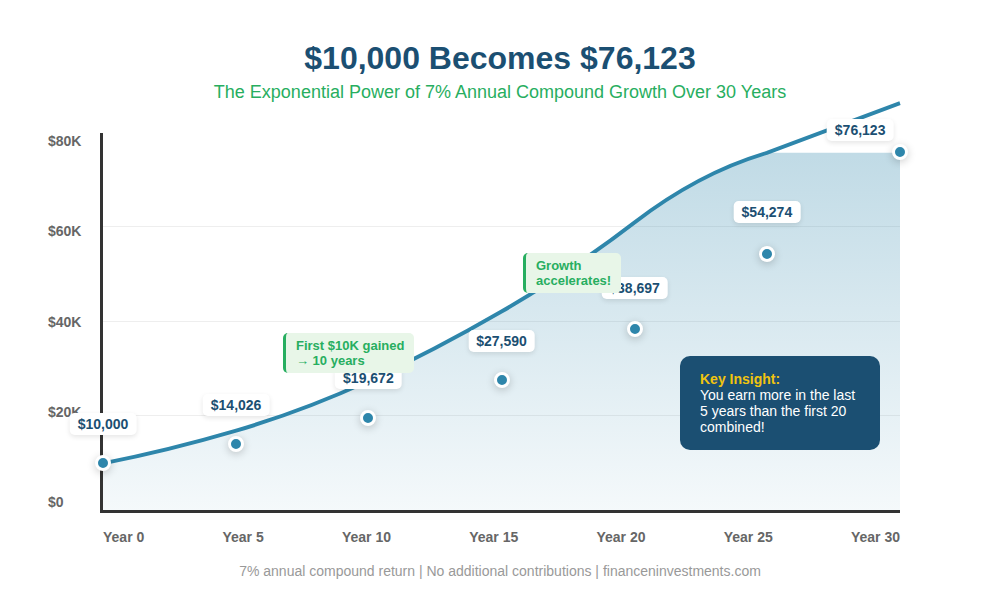

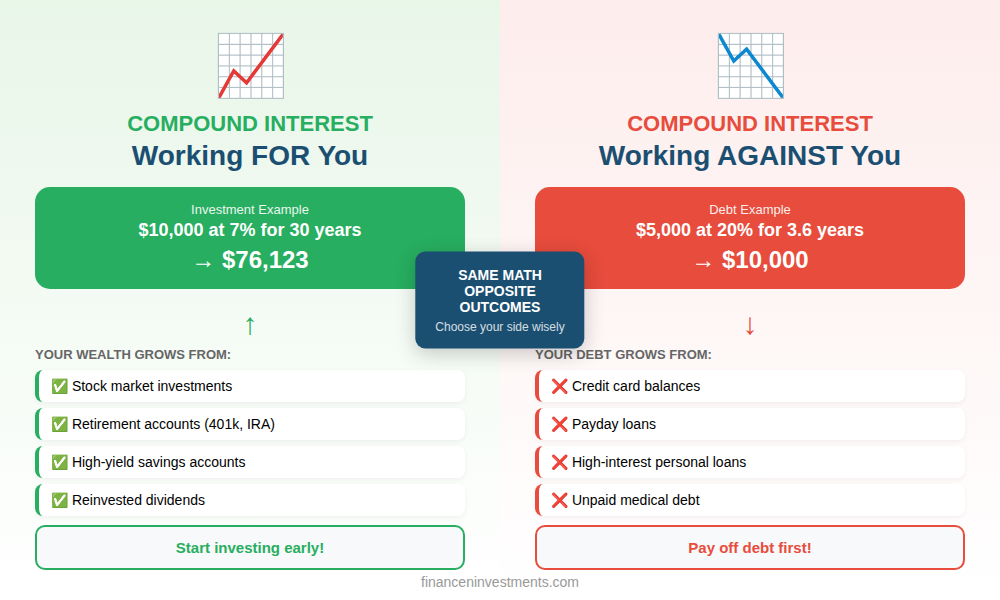

• Compound interest is earning interest on your interest – it’s what makes $10,000 grow to $76,000 over 30 years without adding another dollar

• Time matters more than amount – starting at 25 instead of 35 can mean $500,000+ more at retirement with the same contributions

• The Rule of 72 tells you how fast money doubles: Divide 72 by your return rate (72 ÷ 7% = ~10 years)

• Compound interest works against you with debt – a credit card balance can double in just 4 years at typical rates

Table of Contents

What Is Compound Interest?

Compound interest is when you earn interest on both your original investment AND on the interest you’ve already earned. It’s money making money, which then makes more money.

Think of it like a snowball rolling downhill. It starts small, but as it rolls, it picks up more snow. The bigger it gets, the more snow it picks up with each rotation. Eventually, that tiny snowball becomes an avalanche.

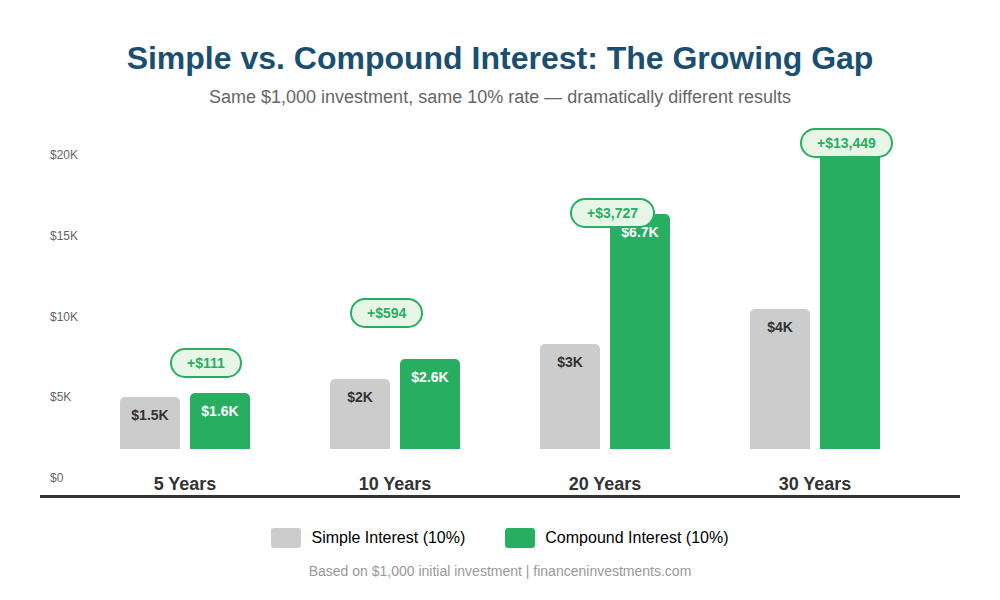

Simple Interest vs. Compound Interest

Simple interest: You only earn interest on your original amount. If you invest $1,000 at 10% simple interest, you earn $100 every year, forever. After 10 years: $2,000.

Compound interest: You earn interest on your original amount PLUS all accumulated interest. If you invest $1,000 at 10% compound interest, year one you earn $100. But year two, you earn 10% on $1,100 = $110. Year three, 10% on $1,210 = $121. After 10 years: $2,594.

That’s $594 more – nearly 30% extra – from the same starting amount and interest rate. And the gap only widens over time.

| Year | Simple Interest | Compound Interest | Difference |

|---|---|---|---|

| 5 | $1,500 | $1,611 | +$111 |

| 10 | $2,000 | $2,594 | +$594 |

| 20 | $3,000 | $6,727 | +$3,727 |

| 30 | $4,000 | $17,449 | +$13,449 |

Based on $1,000 initial investment at 10% annual return

How Compound Interest Works: The Math Explained

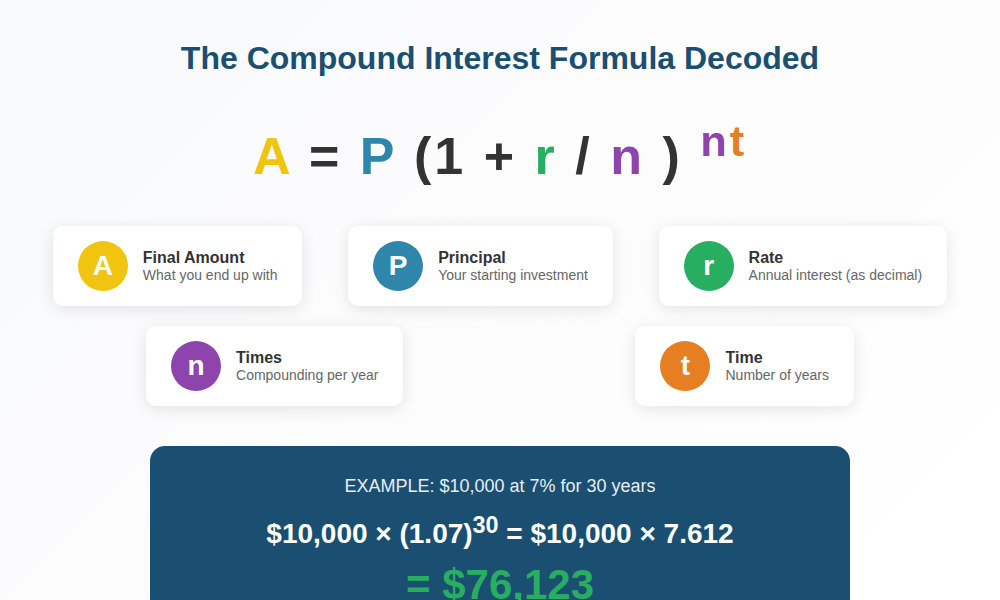

Don’t worry – you don’t need to be a math genius. But understanding the formula helps you see why small changes create massive differences.

The Compound Interest Formula

A = P(1 + r/n)^nt

Where:

• A = Final amount (what you end up with) • P = Principal (your starting amount) • r = Annual interest rate (as a decimal: 7% = 0.07) • n = Number of times interest compounds per year • t = Number of years

Let’s Calculate: $10,000 Over 30 Years

Scenario: You invest $10,000 in an S&P 500 index fund averaging 7% annual returns, compounded annually, for 30 years.

P = $10,000

r = 0.07 (7%)

n = 1 (compounded annually)

t = 30 years

A = $10,000 × (1 + 0.07/1)^30

A = $10,000 × (1.07)^30

A = $10,000 × 7.612

A = $76,123

Your $10,000 becomes $76,123 – a gain of $66,123 without adding another penny. That’s the power of compound interest working for you over time.

The Power of Time: Why Starting Early Beats Starting Big

This is the most important concept in this entire article. Time is the secret ingredient that supercharges compound interest.

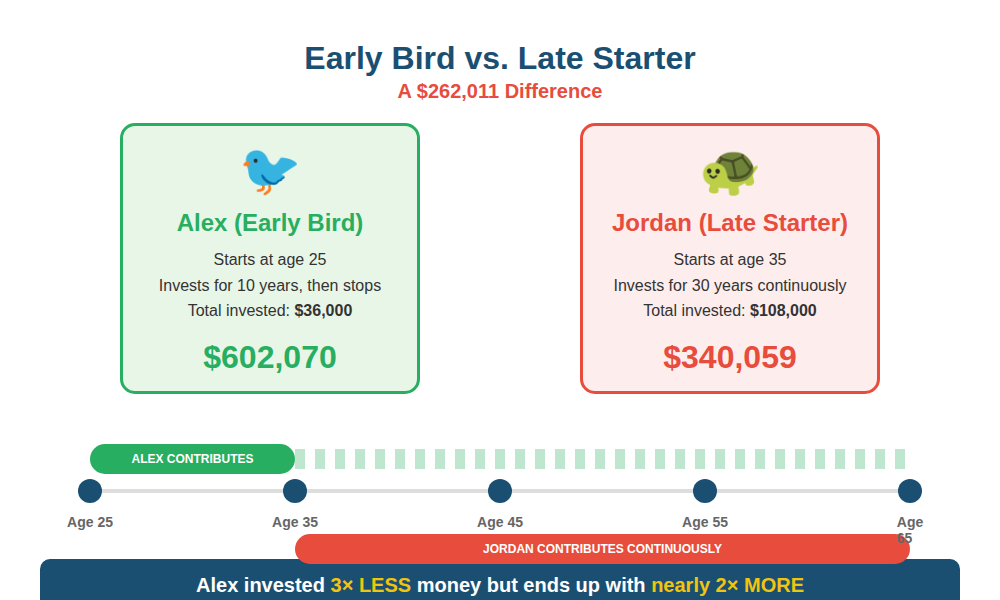

The Tale of Two Investors

Meet Alex and Jordan. Both want to retire at 65. Both invest in the same index fund, averaging 7% annual returns. But they start at different ages.

Alex (The Early Bird): • Starts at age 25 • Invests $300/month for 10 years, then stops • Total invested: $36,000

Jordan (The Late Starter): • Starts at age 35 • Invests $300/month for 30 years, never stops • Total invested: $108,000

| Alex (Early) | Jordan (Late) | |

|---|---|---|

| Age Started | 25 | 35 |

| Years Invested | 10 years | 30 years |

| Total Contributed | $36,000 | $108,000 |

| Balance at Age 65 | $602,070 | $340,059 |

The result? Alex invested 3× LESS money but ended up with nearly 2× MORE. That’s $262,011 extra in retirement – from doing less, but starting earlier. This is why financial advisors say, “Time in the market beats timing the market.“

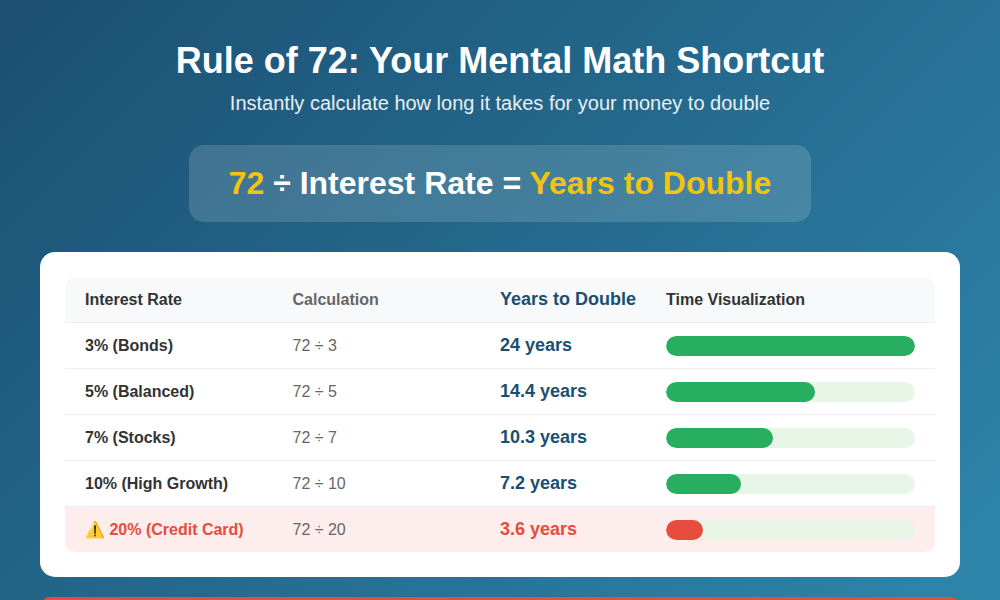

The Rule of 72: A Mental Shortcut

Want to know how long it takes for your money to double? Use the Rule of 72 – no calculator needed.

Years to Double = 72 ÷ Interest Rate

Rule of 72 Examples

| Interest Rate | Calculation | Years to Double |

|---|---|---|

| 3% (Bonds) | 72 ÷ 3 | 24 years |

| 7% (Stocks) | 72 ÷ 7 | 10.3 years |

| 10% (High Growth) | 72 ÷ 10 | 7.2 years |

| 20% (Credit Card Debt) | 72 ÷ 20 | 3.6 years |

Notice that last row? Compound interest works against you with debt. A $5,000 credit card balance at 20% APR doubles to $10,000 in under 4 years if you don’t pay it down. This is why paying off high-interest debt should come before investing.

Real-World Calculator Examples

Let’s run through three common scenarios to see compound interest in action.

Scenario 1: The Lunch Money Investor

You skip one $15 lunch per week and invest it instead.

• Weekly savings: $15 (about $65/month) • Annual return: 7% • Time period: 30 years • Result: $76,000

One skipped lunch per week = $76,000 for retirement. That’s compound interest, making your small sacrifices meaningful.

Scenario 2: The Consistent Contributor

You max out your IRA every year ($7,000 in 2025).

• Monthly contribution: $583 • Annual return: 7% • Time period: 30 years • Result: $708,000

Total contributed: $210,000. Earnings from compound interest: $498,000. You more than tripled your money.

Scenario 3: The Aggressive Saver

You max out both your 401(k) and IRA ($30,500 total in 2025).

• Monthly contribution: $2,542 • Annual return: 7% • Time period: 25 years • Result: $2.03 million

Millionaire status isn’t reserved for the lucky few. It’s mathematics, time, and consistency.

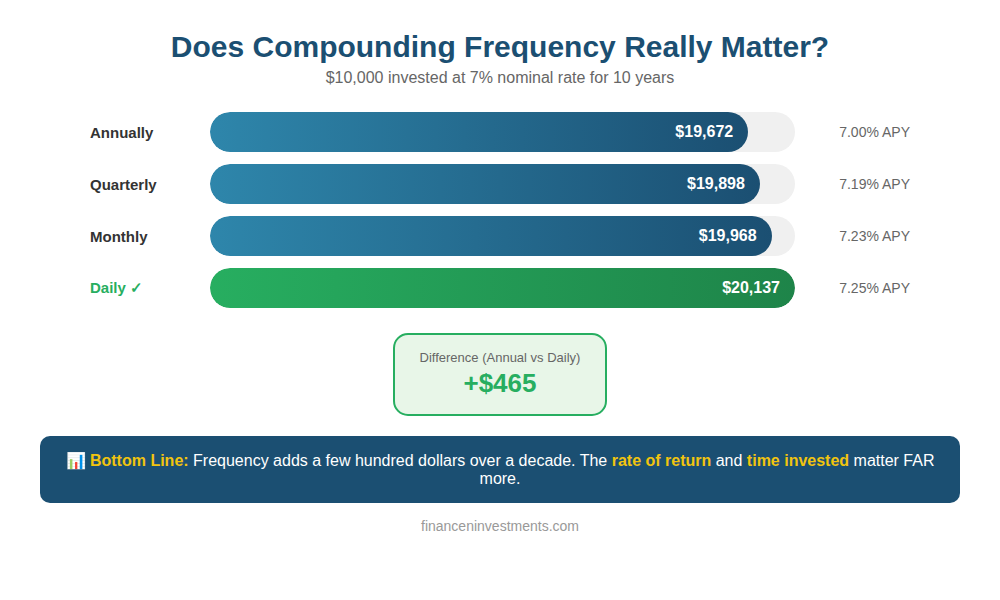

Compounding Frequency: How Often Matters

Interest can compound at different intervals – and more frequent compounding means more growth.

| Frequency | Times/Year | $10K After 10yr | Effective Rate |

|---|---|---|---|

| Annually | 1 | $19,672 | 7.00% |

| Quarterly | 4 | $19,898 | 7.19% |

| Monthly | 12 | $19,968 | 7.23% |

| Daily | 365 | $20,137 | 7.25% |

Based on $10,000 at 7% nominal rate over 10 years

Practical impact: Most savings accounts compound daily, while many investments compound monthly or quarterly. The difference over a decade is a few hundred dollars – nice, but not life-changing. The rate of return and time invested matter far more than compounding frequency.

FAQs about “Compound Interest”

1. What’s the difference between APR and APY?

APR (Annual Percentage Rate) is the simple interest rate without compounding. APY (Annual Percentage Yield) includes compounding and shows your true return. A 7% APR compounded monthly equals roughly 7.23% APY.

2. Can compound interest make me a millionaire?

Absolutely. Investing $500/month at 7% returns for 35 years creates over $1 million. The formula is simple: consistent contributions + time + reasonable returns = wealth.

3. Does compound interest work with stocks?

Yes, when you reinvest dividends and hold for the long term. While stocks don’t pay “interest,” the combination of price appreciation and reinvested dividends creates compound growth.

4. What if I can only invest a small amount?

Start anyway. $50/month at 7% for 40 years becomes $131,000. The habit of investing matters more than the amount – you can increase contributions as your income grows.

5. Should I pay off debt or invest for compound interest?

Generally, pay off high-interest debt first (above 7-8%). A 20% credit card compounds against you faster than a 7% investment compounds for you. Low-interest debt (mortgages, student loans) can often coexist with investing.

6. What’s the best account for compound growth?

Tax-advantaged accounts (401(k), IRA, Roth IRA) are best because you don’t lose returns to annual taxes. A Roth IRA is particularly powerful – all compound growth is completely tax-free.

7. How often should I check my compound growth?

Quarterly at most. Checking too often leads to emotional decisions. Set up automatic contributions and let compound interest work in the background.

8. Does inflation affect compound interest?

Yes. A 7% return with 3% inflation gives you ~4% “real” returns. This is why investing in stocks (which historically beat inflation) matters more than savings accounts that may not keep pace.

9. What’s the minimum time to see compound interest benefits?

Compound interest is always working, but meaningful results typically become visible after 7-10 years. The real magic happens after 20+ years when your earnings generate more earnings than your contributions.

10. Can I calculate compound interest without the formula?

Use the Rule of 72 for quick estimates (72 ÷ rate = years to double), or download our free Compound Interest Calculator for precise projections with monthly contributions.

11. What happens if I withdraw money early?

Early withdrawals break the compounding chain. Taking out $10,000 from a $50,000 portfolio doesn’t just cost you $10,000 – it costs you all the future growth that money would have generated. A $10,000 withdrawal at age 35 could mean $76,000 less at retirement.

12. Is compound interest guaranteed?

In savings accounts and CDs, yes – the rate is fixed. In investments like stocks and index funds, no – returns vary year to year. However, historically, the stock market has averaged 7-10% annually over long periods. The principle of compounding is guaranteed; the exact rate depends on your investment choice.

13. How do dividends affect compound interest?

Reinvested dividends supercharge compounding. When you receive a $100 dividend and reinvest it, that $100 now earns returns too. Over 30 years, reinvested dividends can account for 40-50% of your total returns. Most brokerages offer automatic dividend reinvestment (DRIP) for free.

14. What’s the best age to start benefiting from compound interest?

The best age was yesterday; the second-best is today. Someone starting at 20 with $200/month will have more at 65 than someone starting at 30 with $400/month. However, it’s never too late – even starting at 50, compound interest can still double or triple your money before retirement.

15. How do taxes impact compound interest growth?

Taxes can significantly slow compounding in taxable accounts because you pay taxes on gains each year. That’s why tax-advantaged accounts are so powerful: in a Roth IRA, your money compounds completely tax-free. In a traditional 401(k), taxes are deferred until withdrawal, allowing full compounding during your working years.

Start Harnessing Compound Interest Today

Compound interest is the closest thing to a financial superpower that exists. It rewards patience, punishes procrastination, and treats every dollar you invest as a seed that grows more seeds.

The math is clear:

- Starting earlier beats investing more

- Consistency beats perfection

- Small amounts become large sums given enough time

- Debt compounds against you – pay it off first

The best day to start investing was 10 years ago. The second-best day is today.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- Investing 101: Everything You Need to Know to Start

- What Is an Index Fund? The Beginner’s Complete Guide

- Brokerage Account vs IRA vs 401k: Where to Invest First

- How the Stock Market Works: Simple Explanation

Keep Learning: Get Our Free Investing Resources

Download our Investing Basics Glossary, plus get weekly tips for beginner investors delivered to your inbox.

OUR TIP: We recommend you download the “SMART INVESTING GUIDE” from our homepage too!

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance.