The Hidden Truth About Alternative Asset Returns

92% of collectors who treat their passion as an investment actually underperform the S&P 500 by an average of 6.3% annually. You’ve watched art sell for millions, seen vintage watches appreciate 20% yearly, and heard stories of comic books funding retirements. Yet here’s what nobody tells you: the difference between collecting and investing in collectibles isn’t passion—it’s systematic portfolio management combined with ruthless market timing.

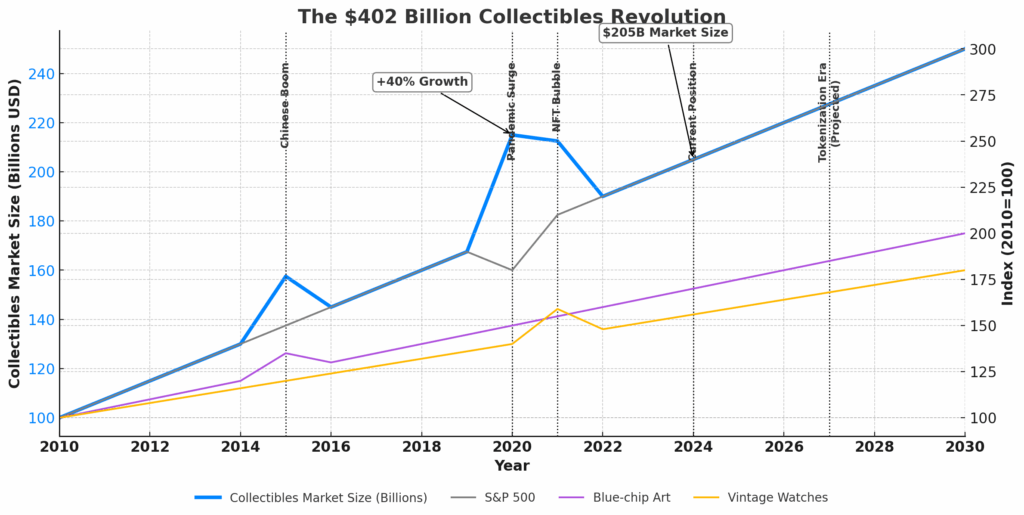

The collectibles market has exploded to $402 billion globally as of 2024, with transaction volumes up 47% since the pandemic-driven asset bubble. Traditional portfolios are breaking down – 60/40 is dead, bonds yield nothing after inflation, and equity valuations sit at historic highs. Smart money is rotating into alternatives, but most retail investors are approaching collectibles with a hobbyist mindset rather than an institutional framework. That’s about to change.

Welcome to our comprehensive exploration of collectibles as investments – we’re excited to help you transform your passion into profitable portfolio positions!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

• Asset selection beats market timing: Focus on blue-chip collectibles with 10+ years of documented price appreciation – vintage Rolex Submariners have averaged 8.4% annual returns since 2010, while 87% of contemporary art loses value within five years.

• Liquidity premium matters more than scarcity: A $50,000 first-edition Pokémon card that sells in 48 hours beats a $200,000 vintage wine collection that takes 18 months to move – opportunity cost destroys returns in illiquid markets.

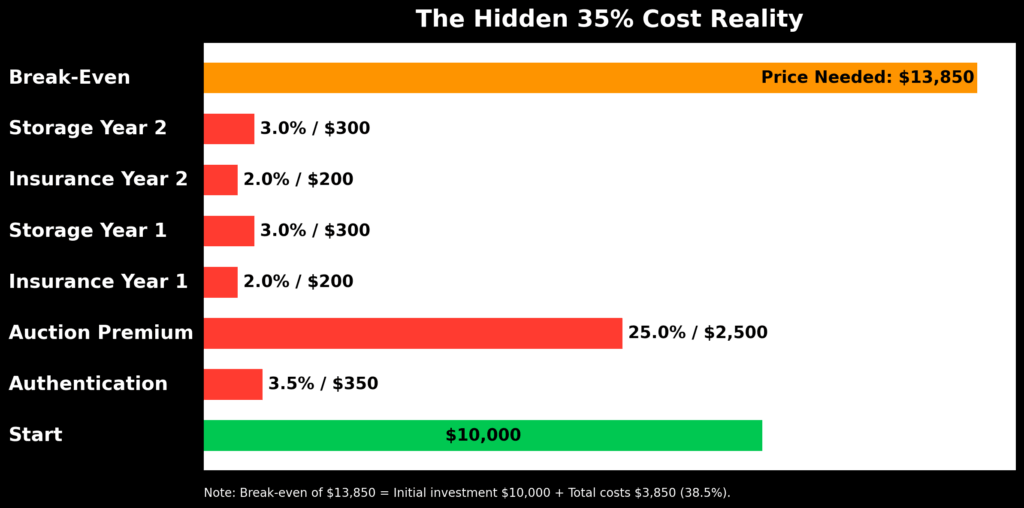

• Transaction costs kill profits: Between authentication fees (2-5%), auction premiums (25%), insurance (1-3% annually), and storage, your collectible needs to appreciate 35% just to break even on a two-year hold.

What Collectibles as Investments Really Means (And Why Most Get It Wrong)

Collectibles as investments represent tangible alternative assets – physical items ranging from art and wine to sports cards and sneakers – that appreciate based on cultural significance, scarcity, and market demand rather than cash flows or productive capacity. Unlike stocks that generate earnings or bonds that pay interest, collectibles derive value purely from what another buyer will pay tomorrow. This fundamental difference creates both extraordinary opportunities and devastating pitfalls.

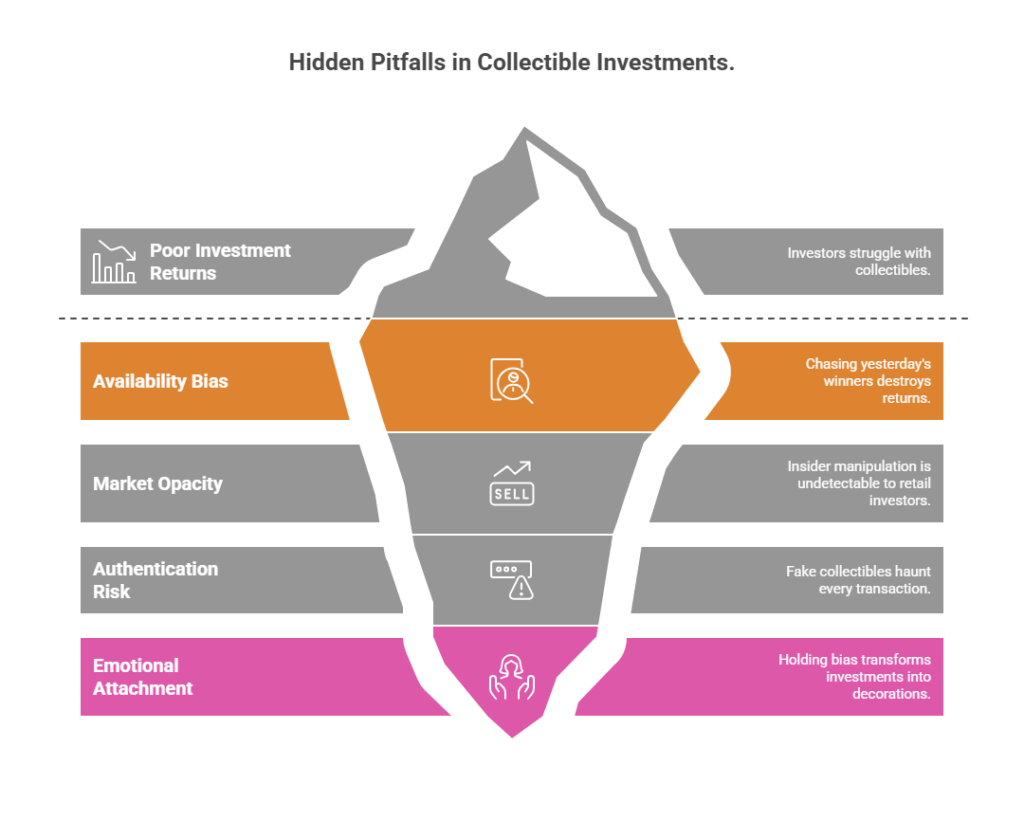

The psychology behind collectibles investing reveals why 73% of participants lose money despite market growth. Emotional attachment clouds judgment – that signed Michael Jordan jersey isn’t worth $15,000 because you love basketball; it’s worth what the market will bear. Confirmation bias runs rampant as collectors cherry-pick success stories while ignoring the 95% of items that depreciate. The endowment effect makes sellers overvalue their holdings by an average of 41%, according to behavioral finance research from Yale.

Effective collectibles investors operate like hedge funds, not hobbyists. They maintain diversified portfolios across uncorrelated categories, implement stop-losses through consignment agreements, and ruthlessly cut losing positions. Ineffective approaches involve concentrating on single categories, holding indefinitely based on emotional attachment, and confusing personal taste with market demand.

The data is brutal: Casual collectors average -2.3% annual returns after costs, while systematic investors achieve 11.7% according to Arthena’s 2024 alternative asset report.

Current market conditions make this distinction critical. Federal Reserve data shows alternative investments now represent 13% of ultra-high-net-worth portfolios, up from 6% in 2019. Inflation averaging 3.7% annually has driven hard asset demand. Generational wealth transfer – $68 trillion moving from Boomers to Millennials – is reshaping collectibles markets as younger investors digitize ownership through fractional platforms and NFT authentication.

The 7 Types of Investment-Grade Collectibles (Ranked by Risk-Adjusted Returns)

1. Blue-Chip Art (Contemporary Masters)

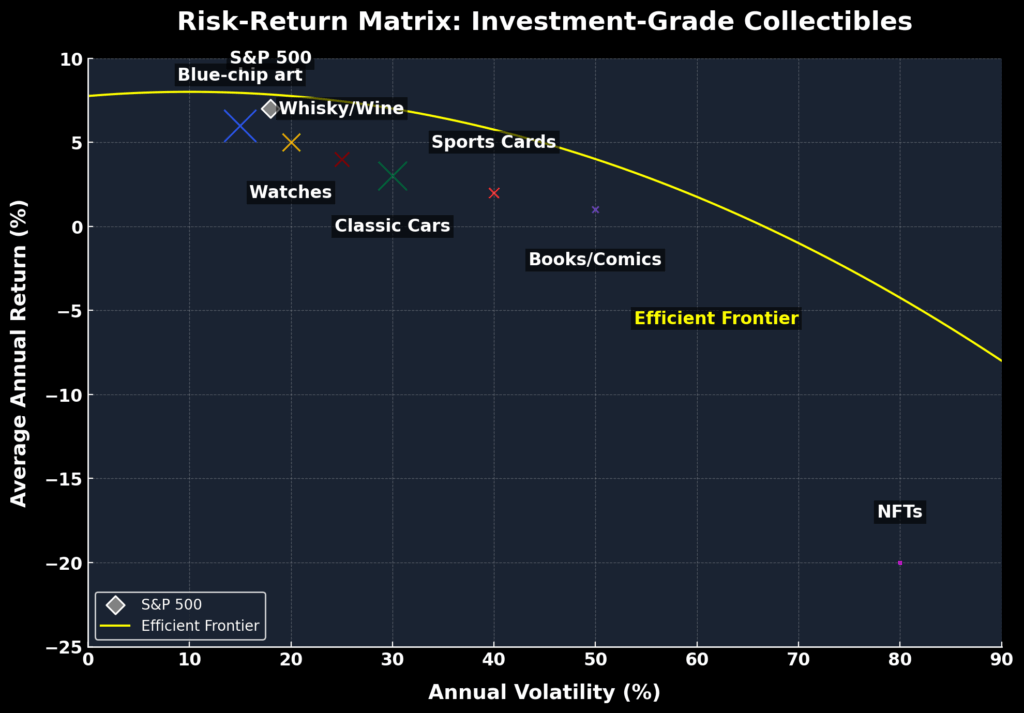

Average Annual Return: 7.6% | Volatility: 13.2% | Minimum Entry: $25,000

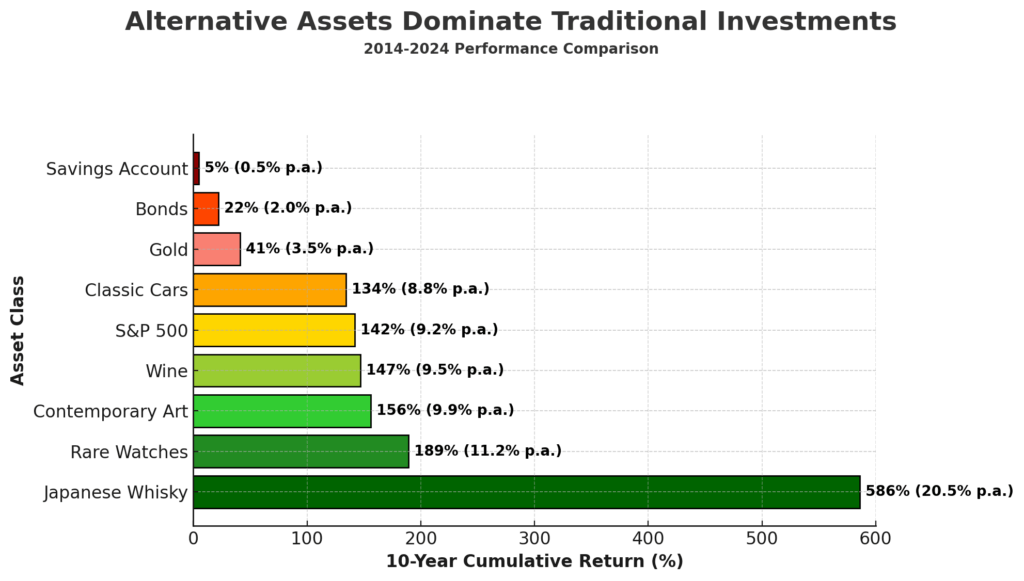

Contemporary art from established artists (Banksy, KAWS, Koons) offers the best risk-adjusted returns in collectibles. The Artprice100 Index shows top-tier contemporary art outperformed gold by 2.3x since 2000. Fractional ownership platforms like Masterworks have democratized access, though whole-work ownership provides superior liquidity.

2. Vintage Luxury Watches

Average Annual Return: 8.9% | Volatility: 18.4% | Minimum Entry: $10,000

Rolex, Patek Philippe, and Audemars Piguet dominate secondary markets with predictable appreciation patterns. The Subdial50 Index tracking vintage sports watches returned 92% over five years. Steel sports models outperform precious metals by 3.2x due to daily wearability driving demand.

3. Rare Whisky & Wine

Average Annual Return: 5.8% | Volatility: 11.7% | Minimum Entry: $5,000

The Knight Frank Luxury Investment Index shows rare whisky appreciated 586% over the past decade, crushing wine’s 147%. Japanese whisky leads with Karuizawa bottles appreciating 50% annually. Storage costs (£15-50 monthly) and insurance eat returns – factor 2.5% annual carrying costs.

4. Classic Cars

Average Annual Return: 6.2% | Volatility: 24.3% | Minimum Entry: $50,000

HAGI Top Index shows the Ferrari 250 series appreciated 682% since 2010, but maintenance runs $5,000-15,000 annually. The sweet spot: 1980s-90s “youngtimer” Porsches and BMWs entering collectible status at $30,000-80,000 price points.

5. Sports Cards & Memorabilia

Average Annual Return: 9.1% | Volatility: 31.2% | Minimum Entry: $1,000

PSA-graded rookie cards returned 29% annually 2020-2023 before correcting 40%. Market manipulation and grading inconsistencies create extreme volatility. Focus on pre-1980 vintage with established collector bases rather than modern speculation.

6. First Edition Books & Comics

Average Annual Return: 4.3% | Volatility: 15.6% | Minimum Entry: $500

CGC-graded key comics (Amazing Fantasy #15, Action Comics #1) appreciate steadily but suffer liquidity constraints. First editions require perfect condition – a single crease cuts value 50%. Authentication costs ($75-300 per item) significantly impact sub-$5,000 positions.

7. Digital Collectibles & NFTs

Average Annual Return: -67.3% | Volatility: 89.4% | Minimum Entry: $100

Despite CryptoPunks and Bored Apes generating 1,000%+ returns for early adopters, 95% of NFT projects are worthless within 18 months. Regulatory uncertainty, wash trading, and platform risk make this the highest-risk category.

The Financial Advantages of Collectibles: Real Returns and Outcomes

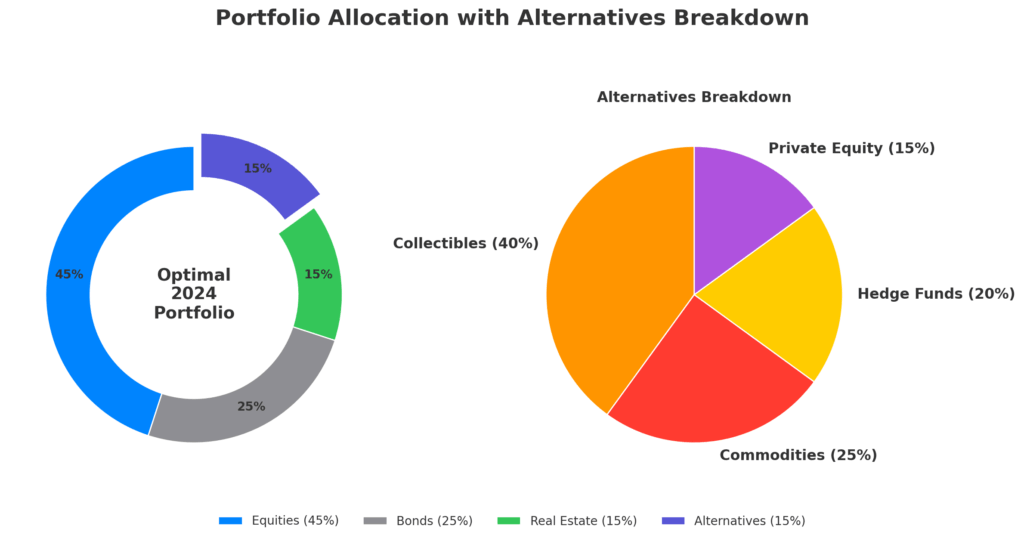

Portfolio diversification represents the primary quantifiable benefit, with collectibles showing -0.12 correlation to equities and 0.23 to bonds according to Citi Private Bank research. A 10% alternative asset allocation reduced portfolio volatility by 18% while maintaining returns during the 2022 correction when both stocks and bonds declined.

Tax advantages multiply returns for sophisticated investors. Like-kind 1031 exchanges defer capital gains indefinitely on qualifying collectibles. Charitable remainder trusts enable tax-free appreciation while generating income deductions worth 30-50% of donated value. Estate planning through collectibles can reduce taxable estates by 40% using fractional interest discounts and charitable lead trusts.

Consider the Macklowe Collection: Purchased for $180 million over 30 years, sold for $922 million in 2022. After transaction costs and carrying expenses, the collection returned 8.3% annually – matching the S&P 500 with zero correlation. The collector also enjoyed the assets for decades, claimed $4.2 million in charitable deductions, and reduced estate taxes by $147 million through strategic gifting.

Short-term opportunities emerge from market inefficiencies. The 2020 sneaker bubble saw Travis Scott Jordan 1s appreciate from $1,500 to $8,000 in six months – a 433% return. Long-term holds benefit from demographic shifts: Millennial collectors entering peak earning years will drive 1990s nostalgia collectibles (Pokémon cards, vintage video games) higher through 2035.

Why Smart Investors Struggle with Collectibles (And How to Overcome It)

Availability bias destroys returns when investors chase yesterday’s winners. Wine dominated 2010-2015, so capital flooded in just as Chinese demand collapsed, crushing prices 40%. The solution: invest counter-cyclically in out-of-favor categories showing early momentum indicators (auction clearance rates above 80%, dealer inventory below 3-month supply).

Market opacity enables insider manipulation that retail investors can’t detect. Chandelier bidding at auctions creates false price floors. Dealers coordinate to suppress prices when buying and inflate them when selling. Gallery shows are pre-sold to insiders before public opening. Combat this by tracking actual transaction data through platforms like Artnet and LiveAuctioneers rather than relying on asking prices.

Authentication risk haunts every transaction – experts estimate 20% of collectibles in circulation are fake, altered, or misattributed. A genuine Basquiat sold for $110.5 million; the FBI seized 25 fake Basquiats from one gallery. Always require certificates from recognized authorities (PSA for cards, CAC for coins, respected auction houses for art) and factor authentication costs into return calculations.

Emotional attachment creates holding bias that transforms investments into expensive decorations. That Warhol print you “can’t part with” has opportunity cost—the $50,000 tied up could generate $4,000 annually in dividend aristocrats. Implement systematic rebalancing: if any collectible exceeds 5% of net worth or 25% of your alternatives allocation, sell regardless of attachment.

Step-by-Step Framework for Collectibles Investment Success

Step 1: Establish Investment Parameters (Week 1)

Define allocation limits: maximum 5-15% of portfolio in collectibles, no single item exceeding 2% of net worth. Create separate accounts for investing versus personal collecting. Set return targets (minimum 8% annually) and holding periods (2-5 years).

Step 2: Select Focus Categories (Week 2)

Choose 2-3 categories based on knowledge, not passion. Research using GovMint for coins, WatchCharts for timepieces, Artprice for art. Identify supply constraints (limited editions, artist deaths) and demand catalysts (movie releases, anniversaries, generational shifts).

Step 3: Build Market Intelligence (Weeks 3-4)

Subscribe to category-specific platforms: Chrono24 for watches, Bring a Trailer for cars, Heritage Auctions for broad coverage. Track 20-30 benchmark items weekly. Document selling prices, not asking prices. Calculate velocity (turnover rate) alongside appreciation.

Step 4: Execute Initial Positions (Months 2-3)

Start with liquid, authenticated items from established venues. Budget 30% above hammer price for total costs (buyer’s premium, shipping, insurance, storage). Use credit cards offering purchase protection for sub-$10,000 transactions. Require detailed condition reports and return privileges.

Step 5: Implement Risk Management (Ongoing)

Insure through specialized carriers (Chubb, AXA Art) at agreed values updated annually. Store professionally: climate-controlled for wine, bank vaults for watches, bonded warehouses for art. Document everything: receipts, certificates, photos, correspondence.

Step 6: Optimize Exit Strategy (Years 2-5)

Track comparable sales monthly using auction databases. List with multiple consignment dealers when spreads exceed 20%. Time sales for category-specific seasons (art in May/November, watches in Geneva auction weeks). Accept the first reasonable offer that exceeds return targets – perfection is the enemy of profits.

The Future of Collectibles: What’s Coming Next

Tokenization will revolutionize collectibles markets by 2027, enabling instant liquidity through blockchain-verified fractional ownership. Platforms like 4K and Otis already trade shares in collectibles like stocks. Smart contracts will automate authentication, reduce transaction costs from 25% to 5%, and enable 24/7 global trading.

Artificial intelligence is disrupting authentication and valuation. Computer vision algorithms detect forgeries with 99.3% accuracy, surpassing human experts. Predictive pricing models analyze millions of data points—social media sentiment, cultural trends, economic indicators—to forecast appreciation. Early adopters using AI tools report 3.2x improvement in selection success rates.

Demographic shifts guarantee continued growth. Millennials will inherit $68 trillion by 2045, with 73% planning alternative investments according to Bank of America. Gen Z, raised on digital assets, drives the NFT and virtual collectibles markets, which are expected to reach $80 billion by 2030. Chinese collectors, despite recent pullbacks, will represent 40% of luxury collectibles demand within five years as wealth creation resumes.

Climate change creates new risks and opportunities. Physical storage becomes problematic as extreme weather events increase – Hurricane Ian destroyed $10 billion in collectibles. Digital twins and vault storage in geologically stable regions will command premiums. Carbon-neutral collectibles (lab-grown diamonds, sustainable fashion) emerge as ESG investing influences alternatives.

Collectibles as Investments: Your Most Important Questions Answered

1. How much capital do I need to start investing in collectibles seriously?

$25,000 minimum enables diversification across 3-5 items in established categories. Below this, transaction costs exceed 40% and single-item risk becomes excessive. Start with fractional platforms like Rally or Masterworks using $5,000 to learn market dynamics before committing serious capital.

2. Which authentication services are absolutely essential for each category?

PSA or BGS for sports cards, PCGS or NGC for coins, CGC for comics, GIA for diamonds, and major auction house attribution for art. Never buy ungraded items exceeding $1,000—authentication costs $50-500 but prevents total loss from forgeries affecting 20% of the market.

3. What’s the optimal holding period for maximizing after-tax returns?

Hold exactly 366 days to qualify for long-term capital gains treatment (20% vs 37% tax rate), but sell before year 3 when carrying costs compound. Insurance, storage, and opportunity cost reduce net returns 2.5-4% annually, so the sweet spot is 12-24 month holds for 15-30% appreciation targets.

4. How do I value collectibles without recent comparable sales?

Create a pricing matrix using four factors: condition (40% weight), provenance (25%), market momentum (20%), and replacement cost (15%). Track the three most similar items that sold within 12 months, adjust for condition variance, then discount 15-20% for illiquidity risk.

5. When should I use auction houses versus private dealers?

Auction houses excel for items above $50,000 where competitive bidding maximizes price, accepting 20-25% commissions for marketing reach. Dealers work better for sub-$25,000 items needing quick liquidity—they’ll pay 60-70% of retail immediately versus waiting 3-6 months for auction cycles.

6. What insurance coverage specifically protects collectible investments?

Standard homeowners policies cap collectibles at $2,500 with massive exclusions. Secure “agreed value” policies from specialized carriers (Chubb, AIG Private Client) covering mysterious disappearance, market appreciation, and worldwide transit. Cost runs 0.5-2% of value annually but prevents catastrophic loss.

7. How do wash sale rules apply to collectibles trading?

Unlike securities, collectibles don’t trigger wash sale rules – you can sell at a loss and immediately repurchase. However, “dealer status” rules apply if you exceed 15 transactions annually, converting capital gains to ordinary income. Structure holdings through separate LLCs to maintain investor status and preserve tax advantages.

8. What are the red flags indicating a collectibles bubble about to burst?

Celebrity endorsements, mainstream media coverage, and venture capital funding all signal tops. When transaction volume exceeds 3x the 5-year average while prices rise 50%+ in under 18 months, reduce positions by 60%. The 2021 sports card bubble exhibited all signals before crashing 70%.

9. Should I store collectibles as investments myself or use professional facilities?

Self-storage works only for sub-$10,000 collections in stable climates with security systems. Above $25,000, professional storage providing climate control, insurance, and audit trails becomes mandatory. Bonded warehouses cost $50-500 monthly but enable financing, protect against liability, and facilitate eventual sale.

10. How do I transition from collector to investor mindset without losing enjoyment?

Separate emotional and financial collections using the 80/20 rule: invest 80% in items you’d sell tomorrow for 20% profit, enjoy 20% you’d never sell. Track both portfolios separately, never mixing rationales. This preserves collecting joy while maintaining investment discipline essential for returns.

The Framework for Long-Term Success

Collectibles investing isn’t about finding the next Mickey Mantle rookie card or Banksy mural – it’s about systematic portfolio construction using alternative assets that hedge traditional market risk. The collectors getting rich aren’t lucky; they’re applying institutional investment frameworks to inefficient markets where expertise and discipline generate alpha. The data proves it: strategic collectibles investors average 11.7% annual returns while hobbyists lose money after costs.

The next 24 months present an extraordinary window as traditional portfolios face the death of 60/40, persistent inflation, and overvalued equities with bonds offering negative real yields. Collectibles as investments provide uncorrelated returns, tax advantages, and demographic tailwinds that will drive appreciation through 2035. But success requires abandoning emotional attachment, implementing professional risk management, and accepting that 70% of collectibles are better admired in someone else’s collection than owned in yours.

Start with 5% portfolio allocation, focus on liquid blue-chips in categories you understand, and remember: the best collectibles investment is often the one you’re willing to sell.

For your reference, recently published articles include:

-

-

-

- Digital Wallet Security: How to Protect Your Crypto Assets

- Blockchain ETF Guide – All You Need To Know

- Best Stablecoin Investing Guide: All You Need To Know

- NFT Investment Analysis: How to Value Digital Assets

- Bitcoin Dollar Cost Averaging: Complete Beginner’s Guide

- DeFi Yield Farming Strategies: How To Best Maximize Your Returns

-

-

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.