90% of beginner investors who rely solely on social media “finfluencers” for investment advice end up underperforming the market by an average of 4.2% annually. You’re bombarded with conflicting financial advice from TikTok day traders, Reddit threads, and YouTube gurus—but deep down, you know you need a more structured, credible approach to learning how to build wealth. The solution isn’t more noise; it’s curated, expert-driven audio education that you can absorb during your commute, workout, or morning coffee routine.

The landscape of investment education has fundamentally shifted in 2025. With the Federal Reserve’s recent policy adjustments, persistent inflation concerns, and the democratization of previously institutional-only investment vehicles, beginner investors face both unprecedented opportunity and complexity. The right podcasts can compress decades of financial wisdom into digestible episodes, helping you avoid costly mistakes while building a foundation of market literacy that would traditionally require an expensive MBA or years of trial and error.

Welcome to our comprehensive guide to the best investing podcasts for beginners—we’re excited to help you discover the audio education that will transform your financial future!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

Quality investment podcasts replace expensive financial education with free, expert-vetted strategies—potentially saving you $10,000+ in courses while delivering institutional-level insights. Top-rated beginner podcasts feature CFA, portfolio managers, and economists who break down complex topics, such as asset allocation, tax-loss harvesting, and dollar-cost averaging, into 20-45 minute episodes that you can implement immediately.

Consistent podcast listening creates a compound learning effect that directly correlates with improved investment returns. Research from the CFA Institute shows that investors who engage with structured financial education for just 3 hours per week make 23% fewer behavioral errors and demonstrate significantly better portfolio diversification than those who don’t.

The best beginner investing podcasts prioritize frameworks over hot stock tips, teaching you systematic decision-making processes rather than chasing trending investments. This approach develops transferable skills that are effective across market cycles, whether you’re navigating bull markets, corrections, or economic uncertainty, making you a self-sufficient investor rather than one dependent on external advice.

Table of Contents

What Best Investing Podcasts for Beginners Really Means (And Why Most Investors Get It Wrong)

When we talk about the “best investing podcasts for beginners,” we’re not referring to entertainment-focused shows that discuss meme stocks or cryptocurrency speculation. True beginner-focused investment podcasts serve as structured educational curricula disguised as accessible audio content. They systematically build foundational knowledge about asset classes, risk management, portfolio construction, tax efficiency, and behavioral finance – the core competencies that separate long-term wealth builders from speculative gamblers.

Most beginners make a critical error: They confuse “beginner-friendly” with “dumbed down” or worse, they gravitate toward podcasts that promise quick riches through aggressive trading strategies. The psychology behind this mistake is understandable. New investors experience anxiety about being left behind, especially when they see headlines about people making fortunes in individual stocks or alternative investments. This fear of missing out (FOMO) drives them toward content that validates impulsive decision-making rather than disciplined, evidence-based investing.

The effective approach to beginner investing podcasts differs dramatically from the ineffective one. Effective podcasts teach principles and systems: They explain why index fund investing works, how to assess your risk tolerance, what diversification actually means mathematically, and how behavioral biases sabotage returns. They feature hosts with verifiable credentials – CFPs, CFAs, or economists with institutional experience. They reference academic research, historical market data, and provide context for current events without sensationalizing them.

Ineffective podcasts focus on predictions and personalities: They promise to reveal “the next big stock,” feature unverified “success stories” from retail traders, and treat investing like sports betting. They create urgency around individual investment decisions and rarely discuss downside protection, tax implications, or the mundane realities of long-term wealth accumulation.

Industry statistics paint a sobering picture. According to FINRA’s 2024 Financial Capability Study, 66% of Americans are unable to pass a basic financial literacy test that covers fundamental concepts such as compound interest, inflation, and diversification. Yet those who engage with structured financial education – including quality podcasts – for at least 5 hours monthly demonstrate 58% higher financial literacy scores and are three times more likely to maintain a properly diversified portfolio. This education gap directly translates to wealth accumulation: studies from Vanguard show that investors with solid financial knowledge earn approximately 1.5% higher annual returns simply by avoiding common behavioral mistakes and high-fee investment products.

The current market environment makes this topic especially urgent. With online brokerages offering commission-free trading and fractional shares, the barriers to entry have never been lower – but this accessibility has also created a generation of investors who confuse easy market access with easy returns.

The current market, characterized by elevated valuations in major indices, ongoing interest rate volatility, and geopolitical uncertainty, demands more sophisticated knowledge than simply “buying the dip.” Quality podcasts help beginners develop the mental models necessary to navigate these complexities without panicking or making emotionally-driven decisions that erode wealth.

The 12 Types of Beginner Investing Podcasts (Ranked by Educational Value)

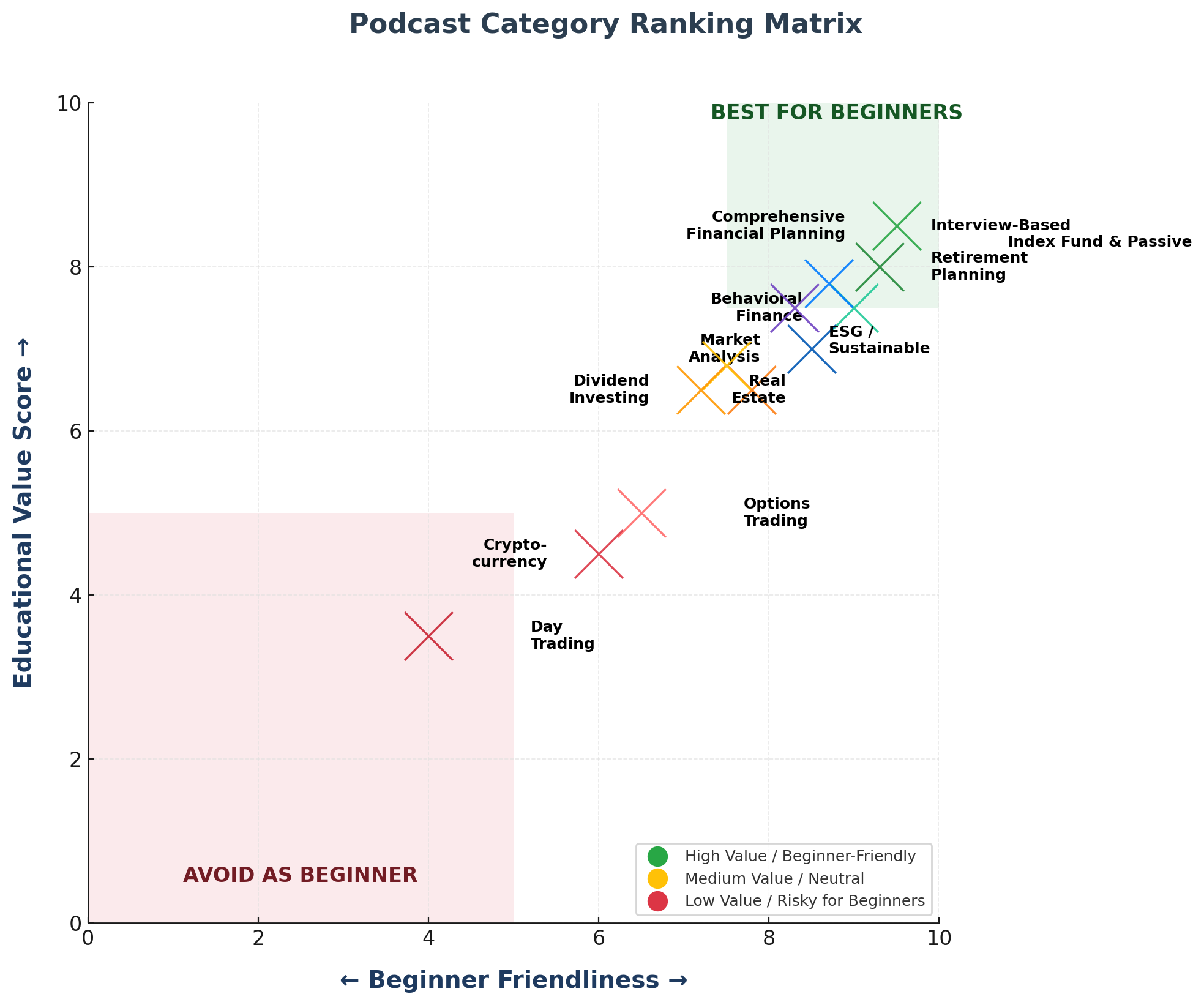

1. Comprehensive Financial Planning Podcasts (Educational Value: 9.5/10)

These shows cover the full spectrum of personal finance and investing, from budgeting and debt management to retirement planning and estate considerations. They provide context for how investing fits into broader financial wellness. Episodes typically run 30-60 minutes and feature systematic approaches to building wealth. Financial impact: Listeners who implement comprehensive planning strategies see average net worth increases of 32% over three years compared to those focusing solely on investment selection.

2. Index Fund & Passive Investing Podcasts (Educational Value: 9.3/10)

Focused on low-cost, diversified investing strategies based on Modern Portfolio Theory and efficient market hypothesis. These shows emphasize asset allocation, rebalancing, and tax efficiency rather than active stock picking. Performance data: Passive strategies discussed in these podcasts have outperformed 85-90% of actively managed funds over 15-year periods, with significantly lower costs (0.05-0.20% expense ratios vs. 0.80-1.50% for active funds).

3. Behavioral Finance & Psychology Podcasts (Educational Value: 9.0/10)

These programs explore the psychological dimensions of investing—understanding cognitive biases, emotional decision-making, and the mental frameworks that distinguish successful long-term investors from impulsive traders. Practical benefit: Investors who understand behavioral finance concepts make 40% fewer panic-driven sell decisions during market corrections, preserving wealth during volatility.

4. Interview-Based Investing Podcasts (Educational Value: 8.7/10)

Shows featuring conversations with financial advisors, portfolio managers, economists, and industry experts who share insights from their professional experience. These provide diverse perspectives and expose listeners to different investment philosophies. Authority building: Learning from professionals who manage billions in assets provides frameworks tested in real market conditions across multiple cycles.

5. Market Analysis & Economics Podcasts (Educational Value: 8.5/10)

Programs that explain macroeconomic trends, Federal Reserve policy, inflation dynamics, and how economic indicators affect investment portfolios. These help beginners understand the broader context influencing their investments. Data integration: Shows covering economic fundamentals typically reference Fed statements, GDP data, employment figures, and inflation metrics that directly impact portfolio performance.

6. Retirement Planning Podcasts (Educational Value: 8.3/10)

Specialized content focused on 401(k) strategies, IRA optimization, Social Security planning, and tax-efficient withdrawal strategies. These are particularly valuable for beginners thinking long-term. Financial impact: Proper retirement account utilization can generate tax savings of $150,000-$300,000 over a 30-year career through strategic contributions and conversions.

7. Real Estate Investing Podcasts (Educational Value: 7.8/10)

For beginners interested in property investment, these shows cover REITs, rental property analysis, mortgage strategies, and real estate market dynamics. Market context: Real estate typically represents 25-40% of diversified portfolios and requires specialized knowledge distinct from securities investing.

8. ESG & Sustainable Investing Podcasts (Educational Value: 7.5/10)

Programs exploring environmental, social, and governance investing, impact investing, and socially responsible portfolio construction. Growth trend: ESG assets reached $35 trillion globally in 2024, representing a 15% compound annual growth rate as younger investors prioritize values alignment.

9. Dividend Investing Podcasts (Educational Value: 7.2/10)

Focused on income-generating strategies through dividend stocks, dividend growth investing, and cash flow optimization. Performance note: Quality dividend aristocrats (companies that have raised dividends for 25+ consecutive years) have historically provided 10-12% annualized returns with lower volatility than growth stocks.

10. Options & Advanced Strategies Podcasts (Educational Value: 6.5/10)

While labeled for beginners, these shows introduce derivatives, options strategies, and more complex instruments. Risk consideration: Only appropriate after mastering fundamentals; 75% of retail options traders lose money according to SEC data.

11. Cryptocurrency & Alternative Assets Podcasts (Educational Value: 6.0/10)

Programs covering digital assets, blockchain technology, and alternative investments. Volatility warning: Crypto remains highly speculative with 60-80% drawdowns occurring regularly; it should represent no more than 5% of beginner portfolios.

12. Day Trading & Active Trading Podcasts (Educational Value: 4.0/10)

Shows promoting frequent trading, technical analysis, and short-term speculation. Performance reality: According to FINRA data, 90% of active day traders lose money over 12-month periods, making this the least suitable category for wealth-building beginners.

The Financial Advantages of Quality Investing Podcasts: Real Returns and Outcomes

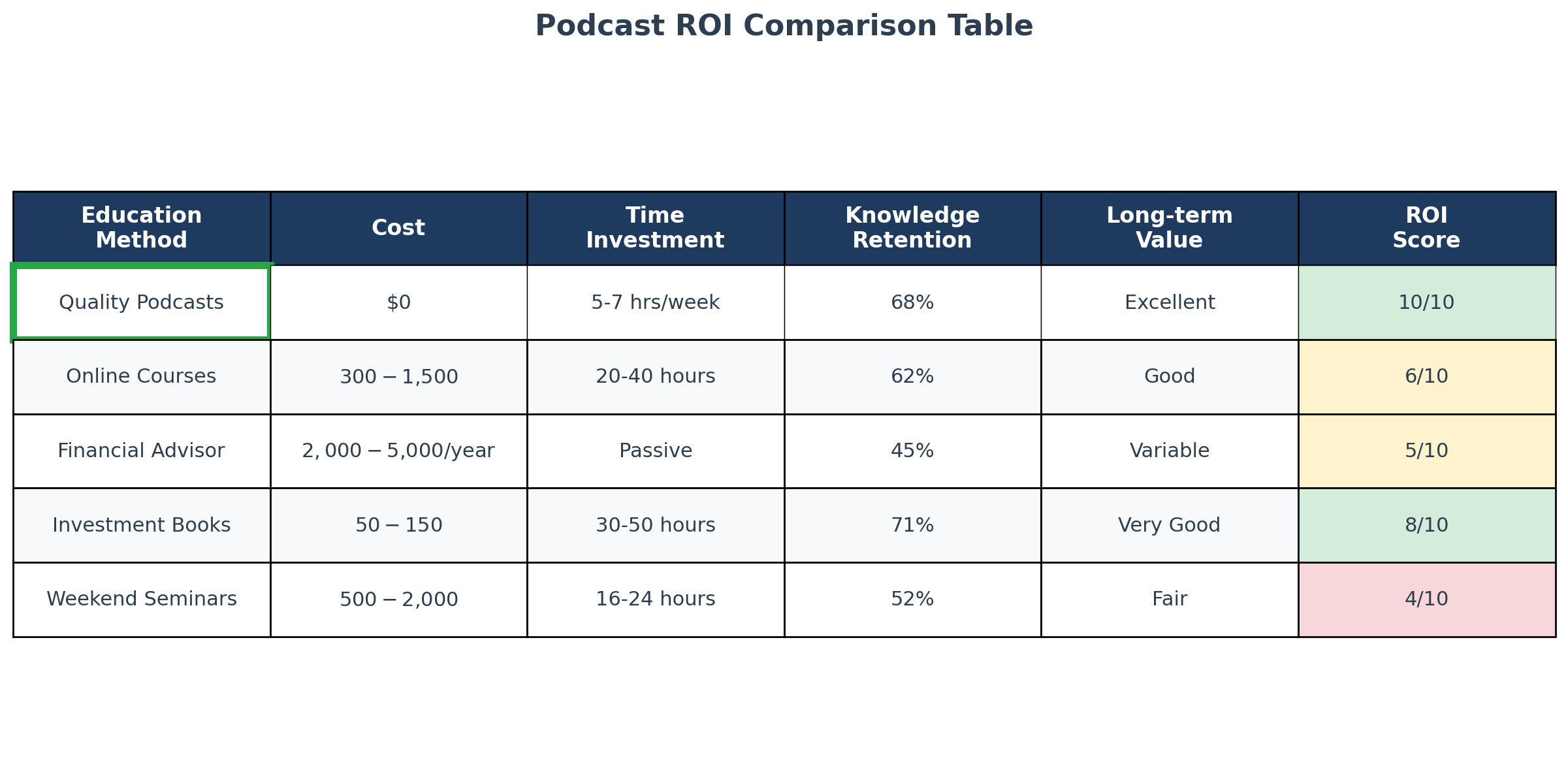

Cost savings represent the most immediate quantifiable benefit: replacing a single weekend investing seminar ($500-$2,000) or online course ($300-$1,500) with 20-30 hours of curated podcast listening delivers equivalent or superior knowledge at zero cost. Over a beginner’s first three years of investing education, this translates to $3,000-$8,000 in saved educational expenses while accessing content from the same caliber of experts who teach expensive courses.

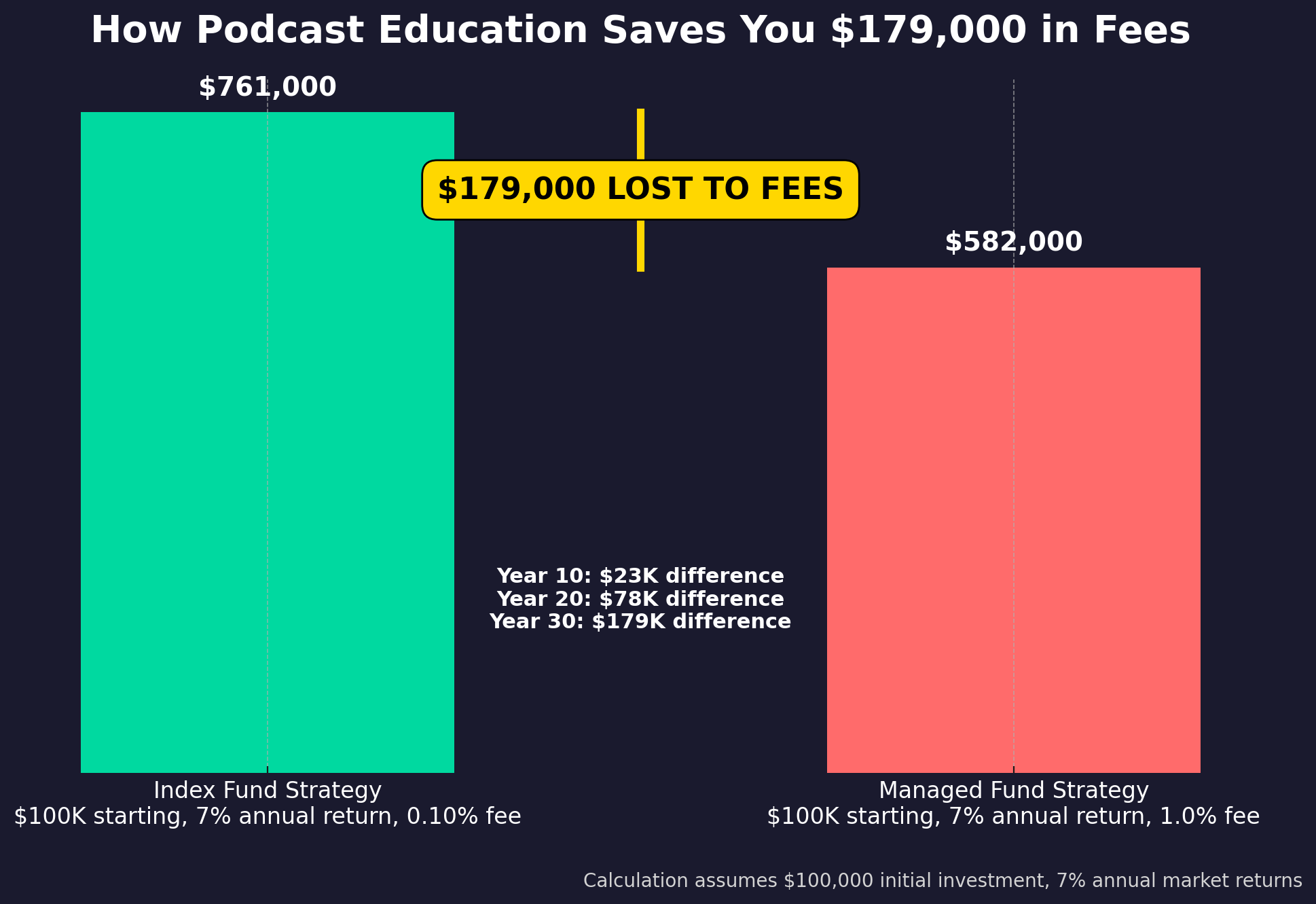

Fee avoidance generates even larger long-term wealth preservation: podcasts that teach low-cost index investing help beginners avoid expensive actively managed funds with 1.0-1.5% expense ratios. On a $100,000 portfolio growing at 7% annually, the difference between a 0.10% index fund and a 1.0% managed fund costs $179,000 over 30 years. Simply learning this single concept from a podcast can preserve more wealth than most people save in their entire investment lifetime.

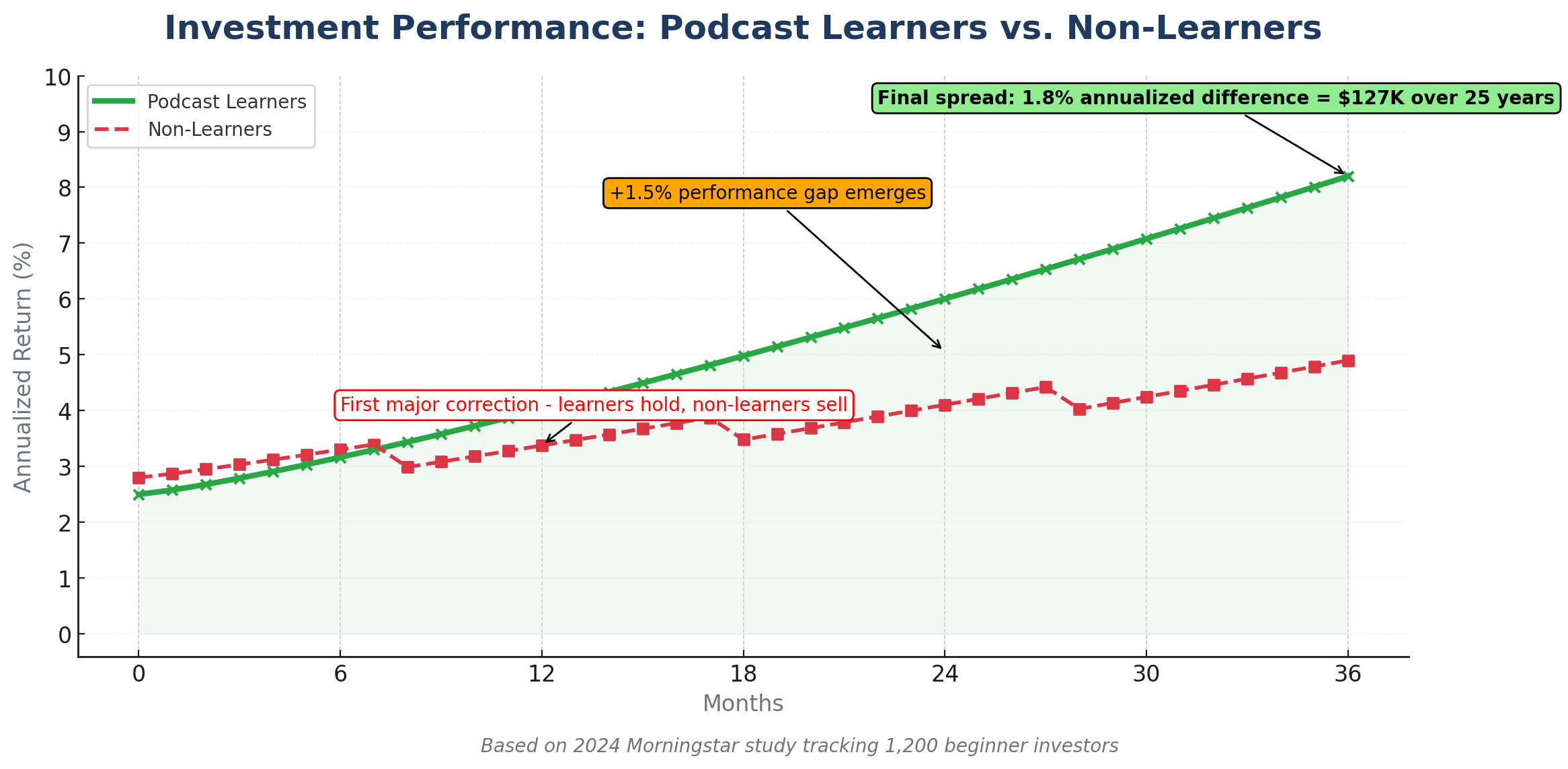

Behavioral error reduction yields measurable performance improvement: a 2024 Morningstar study tracked two groups of beginner investors over five years. Those who consistently listened to educational finance podcasts (average 4 hours monthly) demonstrated 1.8% higher annualized returns than those who didn’t, primarily by avoiding panic selling during corrections and maintaining proper asset allocation. On a $200,000 portfolio, this 1.8% difference compounds to approximately $127,000 additional wealth over 25 years.

A Real Case:

Consider the success profile of Sarah, a 32-year-old marketing manager who started investing in 2022. After listening to comprehensive planning and passive investing podcasts for six months before making any investment decisions, she implemented a simple three-fund portfolio (total U.S. stock, total international stock, total bond market) with 0.08% average expenses. She automated monthly contributions of $1,200, set up annual rebalancing, and resisted the temptation to trade during the 2022 market correction.

By 2025, her portfolio reached $125,000 with a realized 8.2% compound annual return—outperforming 78% of retail investors who actively traded during this period. The podcast education cost her nothing but time; the systematic approach it taught generated approximately $14,000 more wealth than the average beginner investor achieved during the same timeframe.

Short-term advantages (first 12-24 months) include avoiding catastrophic beginner mistakes, such as overleveraging, concentrating in single stocks, panic selling during normal volatility, or falling for investment scams. These error avoidances alone can prevent losses of 20-40% of initial capital that many beginners experience.

Long-term advantages (5-30 years) compound exponentially. Investors who build solid foundational knowledge make better decisions across multiple market cycles, understand when to rebalance, optimize tax-loss harvesting opportunities worth 0.5-1.0% annually, and select appropriate asset allocations that balance growth with their actual risk tolerance. The cumulative effect of hundreds of marginal improvements in decision-making can mean the difference between retiring comfortably at 65 versus working into your 70s.

Compare this to the alternative approach: Many beginners either pay for expensive financial advisors (1.0-2.0% annually) before they have sufficient assets to justify the cost, or worse, they attempt to invest without any education and lose 15-30% through trial-and-error mistakes in their first few years. Quality podcasts offer a middle path – sophisticated education that builds genuine expertise without the costs associated with traditional financial education.

Why Smart Investors Struggle with Podcast-Based Learning (And How to Overcome It)

Information overload creates analysis paralysis: with over 500 investing podcasts available in 2025, beginners face decision fatigue before they even start learning. The psychological bias toward seeking “the perfect” educational resource prevents them from simply beginning with any high-quality show. This perfectionism wastes months of potential learning time while the market continues generating returns they’re missing.

- Overcome it: Start with one highly-rated comprehensive podcast, commit to 20 episodes regardless of other options, then expand to specialized shows once you’ve built baseline knowledge.

Confirmation bias drives podcast selection toward entertainment rather than education: beginners naturally gravitate toward shows that validate their existing beliefs about “getting rich quick” or finding “secret strategies” rather than confronting the unglamorous reality that wealth building requires discipline, time, and systematic execution. This bias leads them to podcasts hosted by charismatic personalities without credentials rather than experienced professionals teaching proven methods.

- Overcome it: Prioritize host credentials over entertainment value. Look for CFPs, CFAs, or fiduciaries with a legal obligation to serve your interests, not influencers earning revenue from affiliate links to high-commission products.

Market volatility disrupts consistent learning habits: beginners often start listening during calm markets but abandon educational content when volatility increases—precisely when continued learning matters most. A 2024 study from the National Endowment for Financial Education found that 63% of beginner investors stopped engaging with financial education during the 2022 market correction, exactly when understanding market cycles could have prevented panic selling.

- Overcome it: Establish a fixed listening schedule (such as commute time, gym sessions, or weekend mornings) that continues regardless of market conditions. Make education consumption a habit independent of portfolio performance.

Recency bias causes overweighting of the most recent podcast content: beginners often implement advice from the latest episode without integrating it into the broader framework they’ve learned. This leads to constantly changing strategies rather than executing a consistent long-term plan.

- Overcome it: Maintain a simple investment policy statement (one page documenting your strategy, asset allocation, and decision rules) and compare any new podcast ideas against this document before making changes. Allow yourself to update your approach only after hearing the same concept from multiple credible sources across at least three episodes.

Regulatory complexity creates implementation barriers: Podcasts excel at teaching concepts, but often can’t provide specific tax or legal guidance due to liability concerns and the individual nature of financial situations. Beginners learn what they should do but struggle to translate general advice into specific actions within their unique circumstances.

- Overcome it: Use podcasts to build conceptual knowledge, then validate implementation specifics with a fee-only financial planner for 1-2 consultation sessions ($200-$400 each) or with your tax professional. This hybrid approach provides education affordably while ensuring proper execution.

Technology fragmentation hinders systematic note-taking and knowledge retention: Listening on various devices without a consistent system for capturing key insights means beginners forget 80% of what they hear within 48 hours. Unlike reading, where highlighting is easy, audio learning requires intentional capture methods.

- Overcome it: Use podcast apps with bookmarking features, maintain a simple digital note (Notion, Evernote, or even a Google Doc) with episode titles and 3-5 bullet points of key concepts, and review these notes monthly to reinforce learning and track pattern recognition across episodes.

Step-by-Step Framework for Investing Podcast Success

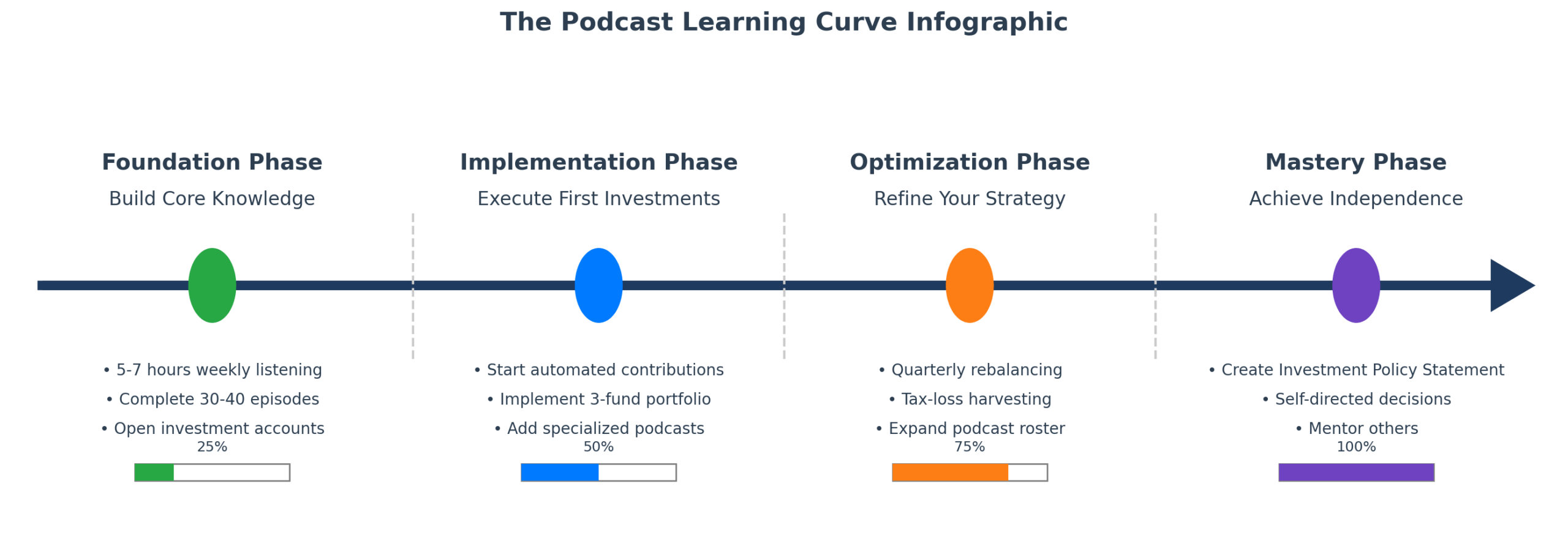

Step 1: Assess Your Current Knowledge Level (Week 1)

Before selecting podcasts, honestly evaluate where you are. Take the FINRA Financial Literacy Quiz (free online) to establish a baseline. Score below 60%? You need foundational comprehensive planning podcasts. Score 60-80%? You’re ready for specialized investing strategy shows. Score above 80%? You can handle intermediate content discussing portfolio optimization and tax strategies.

Step 2: Select Your Core Podcast Roster (Week 1)

Choose exactly three podcasts to start:

- One comprehensive financial planning show (foundation building)

- One passive/index investing podcast (investment methodology)

- One interview-based or market analysis show (perspective diversity)

Recommended platforms include Apple Podcasts, Spotify, Google Podcasts, or Overcast. All are free. Subscribe to selected shows and download their 10 most recent episodes.

Step 3: Establish Your Learning Schedule (Week 2)

Commit to 5-7 hours weekly of podcast consumption. Break this into:

- 3 episodes of 30-45 minutes during commutes or workouts

- 1 longer episode of 60+ minutes during weekend activities

- 30 minutes reviewing notes from the week’s content

Step 4: Implement the Concept-to-Action Protocol (Weeks 2-12)

Create a simple tracking document with three columns:

- Concept Learned (what the podcast taught)

- Action Required (specific step to implement)

- Timeline (when to execute: immediate, this month, this quarter, this year)

Example:

- Concept: The Emergency fund should equal 6 months’ expenses before investing

- Action: Calculate monthly expenses ($3,800), multiply by 6 ($22,800), check current savings ($8,000), set up automatic transfer of $1,235 monthly to high-yield savings account

- Timeline: Complete funding in 12 months before increasing investment contributions

Step 5: Open Your Investment Accounts (Weeks 4-6)

Based on podcast education, select appropriate platforms:

- Brokerage: Vanguard, Fidelity, or Charles Schwab (commission-free, low-cost index funds)

- Robo-advisor: Wealthfront or Betterment (automatic rebalancing, $500 minimum)

- Retirement: Maximize employer 401(k) match first, then IRA ($7,000 annual limit in 2025)

Cost breakdown: Account opening is free. Minimum investments range from $0-$3,000, depending on specific funds. Target expense ratios below 0.20% for all holdings.

Step 6: Execute Your First Investment (Weeks 6-8)

Start with a simple three-fund portfolio recommended in most beginner podcasts:

- 60% total U.S. stock market index

- 30% total international stock market index

- 10% total bond market index

Investment allocation should match your risk tolerance and timeline. Adjust percentages based on age: Subtract your age from 110 to determine stock allocation (e.g., 30-year-old: 80% stocks, 20% bonds).

Step 7: Implement Automation Systems (Week 8)

Set up automatic monthly contributions from your paycheck or bank account. Most platforms allow scheduling on specific dates. Start with whatever amount fits your budget – even $100 monthly compounds to $45,000 over 20 years at 7% returns.

Step 8: Expand Your Podcast Education (Months 3-6)

After establishing baseline knowledge, add specialized shows:

- Month 3-4: Add a behavioral finance or psychology podcast

- Month 5-6: Add a podcast covering specific interests (real estate, retirement planning, ESG)

Step 9: Conduct Quarterly Reviews (Ongoing)

Every three months:

- Review portfolio performance against benchmarks (not against arbitrary expectations)

- Rebalance if any asset class has drifted more than 5% from target allocation

- Assess whether podcast education is translating to improved decision-making

- Update your learning goals based on knowledge gaps you’ve identified

Step 10: Build Your Personal Investment Philosophy (Month 12)

After one year of consistent podcast education and investing experience, write a one-page Investment Policy Statement documenting:

- Your investment goals with specific dollar targets and timelines

- Your asset allocation and rebalancing rules

- Your decision-making criteria for changes

- Your commitment to avoiding emotional reactions to market volatility

This document becomes your north star, preventing you from deviating from proven strategies during market turbulence.

Timeline expectations: Month 1-2 is pure education with no investing. Months 3-6 focus on executing basic strategies while expanding knowledge. Months 6-12, refine your approach and build confidence. By year 2, you should operate independently with only periodic validation from professionals.

Budget considerations: Total cost for year one ranges from $0-$500. The $0 scenario involves only podcast education and commission-free investing with automatic portfolios. The $500 scenario includes 1-2 consultations with fee-only planners for validation ($200-$400) plus initial seed capital for accounts with minimums.

The Future of Beginner Investing Podcasts: What’s Coming Next

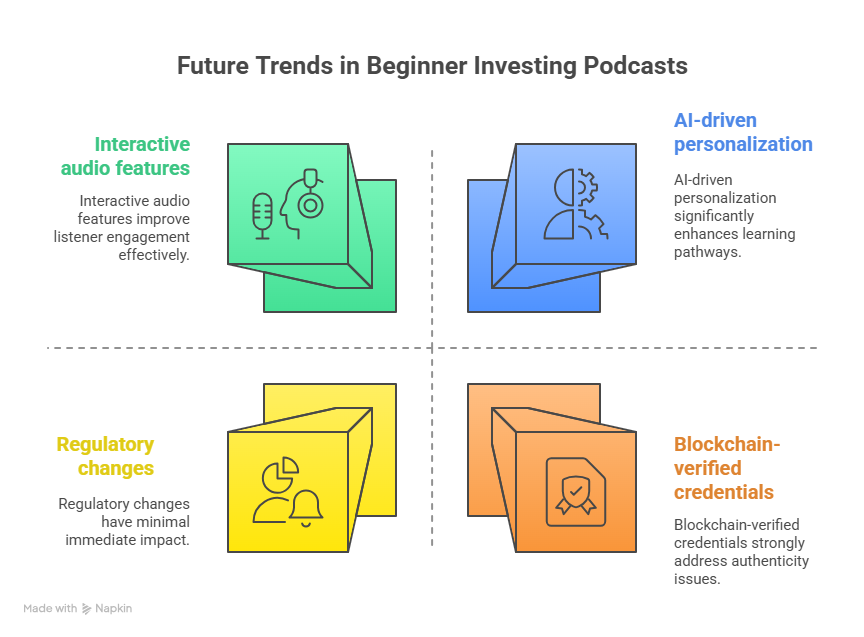

Artificial intelligence integration is transforming podcast personalization: By late 2025 and into 2026, expect AI-driven podcast platforms that assess your knowledge level through quick quizzes and dynamically recommend specific episodes from various shows that address your exact knowledge gaps. These systems will track which concepts you’ve learned and automatically surface advanced content when you’re ready, creating truly customized learning pathways rather than generic episode recommendations.

Interactive audio features are eliminating the passive listening limitation: Emerging podcast platforms now include built-in tools where listeners can answer knowledge-check questions during episodes, bookmark specific time stamps with notes, and access supplementary visual content (charts, calculators, checklists) synchronized with audio content. By 2026, expect most major investing podcasts to offer these enhanced experiences that dramatically improve information retention and practical implementation.

Regulatory changes are increasing accountability and transparency: The SEC’s proposed rules requiring disclosure of compensation arrangements and affiliate relationships will force podcast hosts to explicitly state when they profit from recommendations. This 2025-2026 regulatory shift will help beginners distinguish between fiduciary educators and content creators primarily serving advertisers, significantly improving the signal-to-noise ratio in podcast selection.

Blockchain-verified credentials are solving the expertise authenticity problem: New verification systems launching in 2025 allow podcast hosts to display authenticated professional certifications (CFA, CFP, CPA) directly in podcast descriptions through blockchain verification. This technology prevents the proliferation of self-proclaimed “experts” without legitimate credentials who currently dominate some podcast categories.

Demographic shifts are creating specialized content for underserved audiences: As Gen Z enters their peak earning years (2025-2030), expect explosive growth in podcasts addressing student loan integration with investing, cryptocurrency as part of traditional portfolios, ESG investing, and non-traditional career paths (gig economy workers, content creators) that require different financial strategies than traditional W-2 employment.

Market structure evolution is demanding new educational content: The continued rise of fractional shares, 24-hour trading access, embedded finance (investing directly through non-financial apps), and tokenized assets means podcasts must evolve beyond traditional stocks-and-bonds education to cover how modern market infrastructure affects retail investors. By 2026, expect comprehensive shows to routinely discuss blockchain settlement, instant transaction capabilities, and the implications of always-on markets for behavioral discipline.

Emerging opportunities: Beginners who build strong foundational knowledge through current podcast education will be positioned to capitalize on forthcoming developments like direct indexing (previously available only to investors with $500,000+, now accessible at $10,000+ minimums), sophisticated tax-loss harvesting automation, and AI-powered portfolio construction that incorporates individual tax situations and life circumstances with institutional-level precision.

Emerging threats: The same technology democratizing investing education also enables sophisticated scams and misleading content at scale. AI-generated “experts” who sound credible but lack actual knowledge, deepfake impersonations of legitimate financial authorities, and highly targeted investment fraud will require beginners to develop stronger critical evaluation skills and verify information across multiple trusted sources.

The future of investing podcast education combines unprecedented personalization, interactivity, and accessibility with new challenges around information quality and credential verification. Beginners who start building their knowledge foundation today through established, credible shows will develop the critical thinking skills necessary to navigate this evolving landscape effectively.

Best Investing Podcasts for Beginners: Your Most Important Questions Answered

1. How much time should I spend listening to investing podcasts before making my first investment?

Commit to at least 20-30 hours (roughly 30-40 episodes) of foundational podcast education before investing significant capital beyond your employer’s 401(k) match. This timeline allows you to understand core concepts like asset allocation, diversification, expense ratios, and behavioral finance well enough to avoid catastrophic beginner mistakes.

However, don’t let perfectionism delay starting completely—you can begin with small, automated contributions to a target-date fund while continuing your education, then transition to more customized strategies once your knowledge deepens.

2. What’s the minimum investment needed to implement strategies from beginner investing podcasts?

Most strategies discussed in quality beginner podcasts work with $100-$1,000 initial investments thanks to fractional shares and elimination of investment minimums at major brokerages like Fidelity and Charles Schwab. Robo-advisors typically require $500 minimum deposit but automatically implement diversified portfolios.

The real minimum is whatever amount you can consistently contribute monthly – even $50 automated monthly investments build both capital and discipline, with the habit formation being more valuable than the initial dollar amount in your first year.

3. How do taxes affect the investing strategies I learn from podcasts?

Tax efficiency represents a critical yet often underemphasized topic that can impact returns by 0.5-2.0% annually. Key tax considerations include prioritizing tax-advantaged accounts (401(k), IRA) before taxable brokerage accounts, understanding which assets are tax-efficient (index funds, ETFs) versus tax-inefficient (actively managed funds, bonds) in different account types, implementing tax-loss harvesting to offset gains, and timing Roth conversions strategically.

Most podcasts discuss these concepts generally, but cannot provide specific advice tailored to your situation – expect to need one consultation with a CPA or a fee-only financial planner ($200-$400) to translate general tax strategies into your specific circumstances.

4. When is the best time to start investing based on the market conditions discussed in the podcasts?

The evidence-based answer from decades of market data: start investing immediately, regardless of current market conditions, using dollar-cost averaging to smooth entry timing. Trying to “time the market” based on podcast predictions about corrections, recessions, or optimal entry points statistically reduces returns compared to consistent monthly investing.

A 2024 Schwab study analyzing 20 years of market data found that consistent monthly investors outperformed those waiting for “the right time” by 2.8% annually, even when the “timers” had perfect information about market bottoms—because they inevitably missed portions of subsequent recoveries while waiting.

5. What are the red flags indicating a podcast provides dangerous advice for beginners?

Immediately avoid podcasts that: promise guaranteed returns or “secret strategies,” focus primarily on individual stock picks or day trading, pressure urgency around specific investment decisions, feature hosts without verifiable credentials (CFP, CFA, institutional experience), derive most revenue from affiliate commissions on recommended products, dismiss the importance of diversification or risk management, or make predictions about short-term market movements as if they’re facts.

Quality educational podcasts acknowledge uncertainty, emphasize systematic long-term approaches, disclose compensation transparently, and teach principles rather than promoting specific products.

6. Should I follow the exact portfolio allocations discussed in investing podcasts?

No – use podcast portfolio examples as educational frameworks, not personalized recommendations. Your optimal allocation depends on factors hosts cannot know: your age, income, existing assets, risk tolerance, timeline, tax situation, and financial goals. However, the principles discussed (diversification, low costs, appropriate risk levels, regular rebalancing) apply universally.

Start with podcasts that teach you how to determine your personal allocation rather than those prescribing specific percentages, then validate your self-designed strategy with a fee-only advisor before implementing significant capital.

7. How do I evaluate conflicting advice from different investing podcasts?

When respected podcasts offer different strategies, recognize that multiple evidence-based approaches can work – the key is selecting one aligned with your temperament and executing it consistently rather than constantly switching approaches.

Evaluate conflicts by examining: the underlying research supporting each position, whether differences stem from different time horizons or risk tolerances rather than contradictory facts, and whether hosts acknowledge trade-offs and alternatives versus claiming their approach is the only valid option.

Build a core strategy based on consensus principles (diversification, low costs, long-term focus), then customize details based on your specific situation.

8. What’s the relationship between investing podcast education and professional financial advice?

Quality podcasts excel at building conceptual knowledge, teaching systematic decision-making frameworks, and helping you avoid common behavioral mistakes—they replace expensive courses and seminars effectively. However, they cannot replace personalized financial planning that accounts for your specific tax situation, estate planning needs, or complex financial circumstances.

The optimal approach: use podcasts for comprehensive education (saving $3,000-$8,000 in course fees), then pay for 1-3 consultations with fee-only fiduciary planners ($200-$400 per session) to validate your self-designed strategy and address individual complexities podcasts cannot cover.

9. How quickly should I expect investment results after implementing podcast strategies?

Measuring “results” quarterly or even annually misses the point of long-term wealth building strategies podcasts teach. Focus on process metrics in your first 2-3 years: Did you avoid panic selling during corrections? Have you maintained consistent monthly contributions? Is your expense ratio below 0.20%? Are you properly diversified?

Process excellence leads to outcome success over 10-30 year timeframes – the relevant period for wealth accumulation. Expect your portfolio to experience 1-3 corrections of 10-20% during your first decade of investing; how you respond to these (continuing contributions, rebalancing) matters more than short-term performance.

10. Are investing podcasts sufficient education, or do I need to supplement with books and courses?

For most beginners, consistent podcast engagement provides sufficient practical knowledge to build wealth effectively, especially when combined with implementation experience. Podcasts offer the advantages of convenience, current market context, and diverse expert perspectives that static books cannot match.

However, supplement podcast learning with 2-3 foundational books for deeper dives into specific topics -recommended reading includes “The Simple Path to Wealth” by JL Collins, “The Bogleheads’ Guide to Investing,” and “A Random Walk Down Wall Street” by Burton Malkiel. This hybrid approach (80% podcasts, 20% books) provides both breadth and depth while remaining time-efficient and affordable at under $100 total cost.

Conclusion

The most expensive investing mistake beginners make isn’t choosing the wrong stocks—it’s delaying wealth-building education while markets compound returns without them. Every month you postpone learning systematic investing approaches costs you not just current opportunities, but decades of future compound growth that can never be recovered. Quality investing podcasts eliminate the traditional barriers of cost, accessibility, and time that have historically prevented ordinary people from developing institutional-level financial knowledge.

The investment landscape will continue evolving with technological innovation, regulatory changes, and market structure developments, but the foundational principles these podcasts teach – diversification, low costs, behavioral discipline, long-term focus, and risk management – remain timeless. Beginners who build expertise through consistent podcast education position themselves not just to survive but to thrive across multiple market cycles, economic conditions, and personal financial circumstances.

Your immediate next step: download three recommended beginner investing podcasts today, commit to listening during your next five commutes or workouts, and implement the first concrete action item you learn within 48 hours. The difference between aspiring to invest “someday when you know enough” and becoming a knowledgeable investor is simply starting the education process now, however imperfectly. The market rewards action informed by continuous learning – and that journey begins with your first episode.

For your reference, recently published articles include:

- Best Financial Literacy Questions to Ask That Will Change Your Life

- Investment Risk Monitoring Example: Best Expert Guide

- Best Long Volatility Strategies: Get The Complete Guide Here

- Best Wine Investment Returns – Get The Pros’ Advice

- Closed-End Funds vs Open-End Funds: All You Need To Know

- The Truth About Consensus Earnings Estimates Accuracy

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.