In the rapidly evolving financial technology landscape, AI investment advisory services have emerged as game-changing tools that leverage artificial intelligence and machine learning to deliver personalized investment guidance, automate portfolio management, and enhance decision-making capabilities.

These sophisticated platforms transform how investors navigate market complexities, offering unprecedented access to data-driven insights that were once the exclusive domain of wealthy individuals and institutional investors.

In this comprehensive guide, we compare the best AI investment advisory platforms, cover the top robo-advisors, features & costs to optimize your portfolio.

Key Takeaways

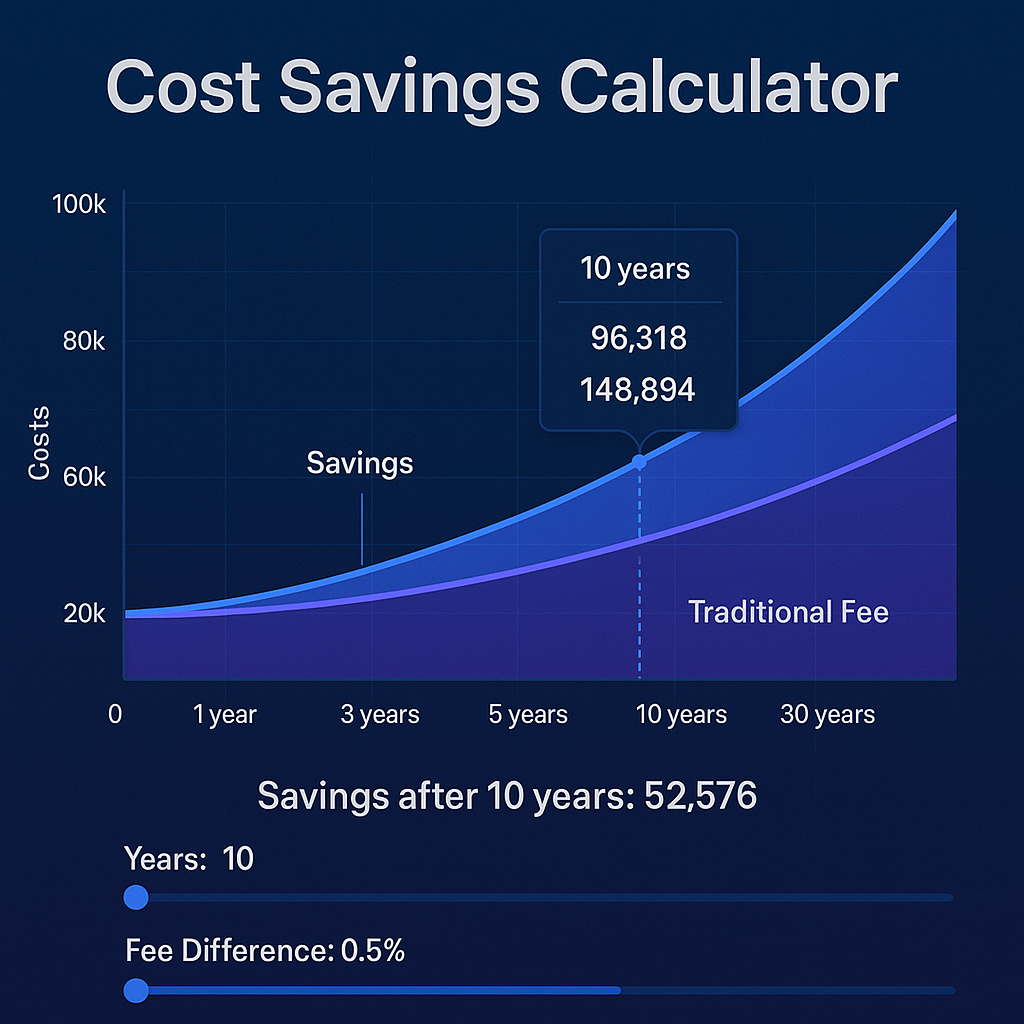

- AI investment advisors deliver cost-effective solutions with management fees typically ranging from 0.25% to 0.50% annually, compared to traditional financial advisors who charge 1% to 2%, while maintaining 24/7 availability and processing vast amounts of market data instantly.

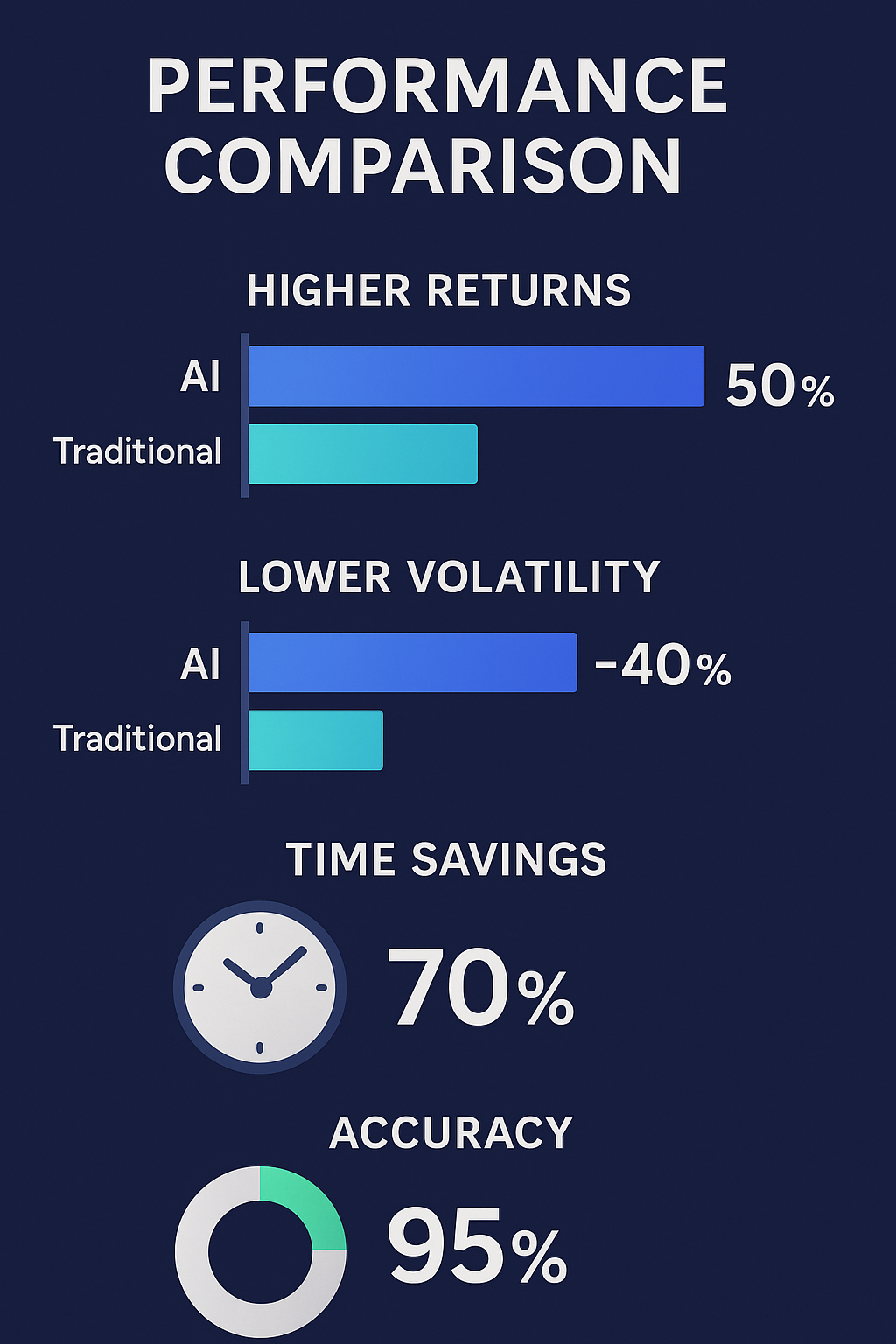

- Advanced algorithms enable personalized portfolio optimization by analyzing thousands of data points, including risk tolerance, investment goals, time horizon, and market conditions, to create tailored strategies that adapt in real-time, achieving an average improvement of 1-2% in portfolio performance through tax-loss harvesting and automated rebalancing.

- Hybrid models combining AI and human expertise are emerging as the dominant approach, with 68% of financial services firms planning to integrate AI advisory services by 2026, offering the perfect balance between technological efficiency and human judgment for complex financial decisions.

Comprehensive Definition

AI investment advisory represents a revolutionary approach to wealth management that employs artificial intelligence, machine learning algorithms, and big data analytics to provide automated, personalized investment advice and portfolio management services. These digital platforms analyze vast quantities of market data, economic indicators, and individual investor preferences to generate real-time investment recommendations and execute trades autonomously.

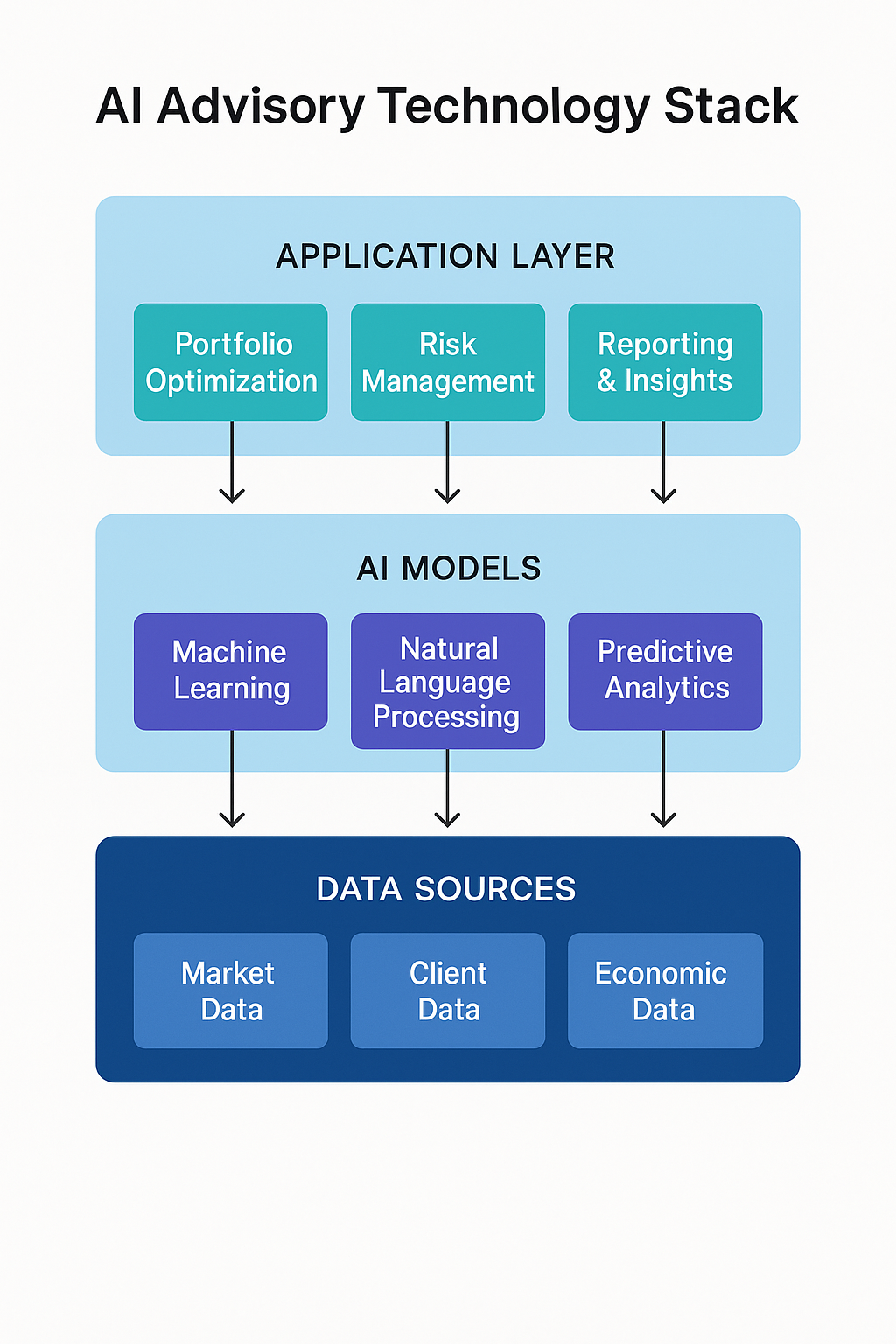

Unlike traditional advisory services that rely primarily on human expertise and intuition, AI investment advisory systems process terabytes of information daily, identifying patterns and opportunities that human analysts might overlook. These platforms utilize sophisticated mathematical models, natural language processing, and predictive analytics to forecast market trends, assess risk levels, and optimize portfolio allocation based on each investor’s unique financial objectives.

The core functionality of AI investment advisory encompasses several key components: algorithmic trading, automated rebalancing, tax-loss harvesting, risk assessment, and continuous portfolio monitoring. These systems operate on cloud-based infrastructures, enabling seamless integration with various financial institutions and real-time synchronization of financial data.

AI investment advisors democratize access to professional-grade investment management by lowering entry barriers, reducing costs, and eliminating emotional biases that often impair investment decisions. By leveraging computational power and data-driven insights, these platforms provide consistent, objective advice based purely on mathematical analysis and historical performance patterns.

Types of AI Investment Advisory Services

| Type | Description | Key Features | Typical Cost |

|---|---|---|---|

| Robo-Advisors | Fully automated platforms using algorithms | Goal-based investing, automated rebalancing, tax optimization | 0.15% – 0.50% AUM |

| Hybrid Advisors | Combination of AI and human financial advisors | Personal consultation, AI-driven insights, complex planning | 0.30% – 0.75% AUM |

| AI-Enhanced Platforms | Traditional firms augmented with AI tools | Research automation, portfolio analytics, predictive modeling | 0.75% – 1.25% AUM |

| Algorithmic Trading Systems | AI-powered trade execution platforms | High-frequency trading, market timing, arbitrage opportunities | 1% – 2% of profits |

| Sentiment Analysis Advisors | Systems analyzing market sentiment and news | News processing, social media monitoring, sentiment scoring | 0.40% – 0.85% AUM |

Benefits of AI Investment Advisory

Cost Efficiency

- Reduced Management Fees: AI advisors charge 75-85% less than traditional financial advisors

- Lower Minimum Investment: Entry points as low as $0-$500 compared to $25,000-$100,000 for traditional advisors

- No Transaction Fees: Most platforms offer commission-free trading and rebalancing

Enhanced Decision-Making

- Data-Driven Insights: Analysis of 10,000+ data points per second

- Emotion-Free Investing: Eliminates behavioral biases affecting 85% of individual investors

- 24/7 Market Monitoring: Continuous portfolio optimization without human fatigue

Personalization at Scale

- Customized Portfolio Allocation: Algorithms consider 50+ personal factors

- Goal-Based Investment Strategies: Tailored plans for retirement, education, or wealth preservation

- Dynamic Risk Management: Real-time adjustment based on market conditions and personal risk tolerance

Advanced Features

- Tax-Loss Harvesting: Potential to improve after-tax returns by 0.77% annually

- Automated Rebalancing: Maintains optimal asset allocation without manual intervention

- Diversification Optimization: Access to thousands of securities across global markets

Challenges and Risks

Technical Limitations

- Algorithm Bias: AI models may perpetuate historical patterns and overlook unprecedented events

- Data Dependencies: Performance heavily relies on quality and quantity of available data

- Cybersecurity Vulnerabilities: Potential risks of data breaches and system hacks

Market-Related Risks

- Black Swan Events: Difficulty in programming responses to rare, unpredictable market events

- Market Anomalies: Challenges in adapting to unusual market behaviors

- Liquidity Concerns: Potential issues during extreme market volatility

Human Factor Considerations

- Loss of Personal Touch: Reduced human interaction may not suit all investors

- Complex Decision Support: Limitations in handling sophisticated financial planning scenarios

- Regulatory Uncertainty: Evolving regulations around AI in financial services

Performance Limitations

- Historical Bias: Models based on past performance may not predict future outcomes

- One-Size-Fits-All Approach: Some platforms may not fully capture individual nuances

- Technology Dependence: System failures could temporarily disrupt services

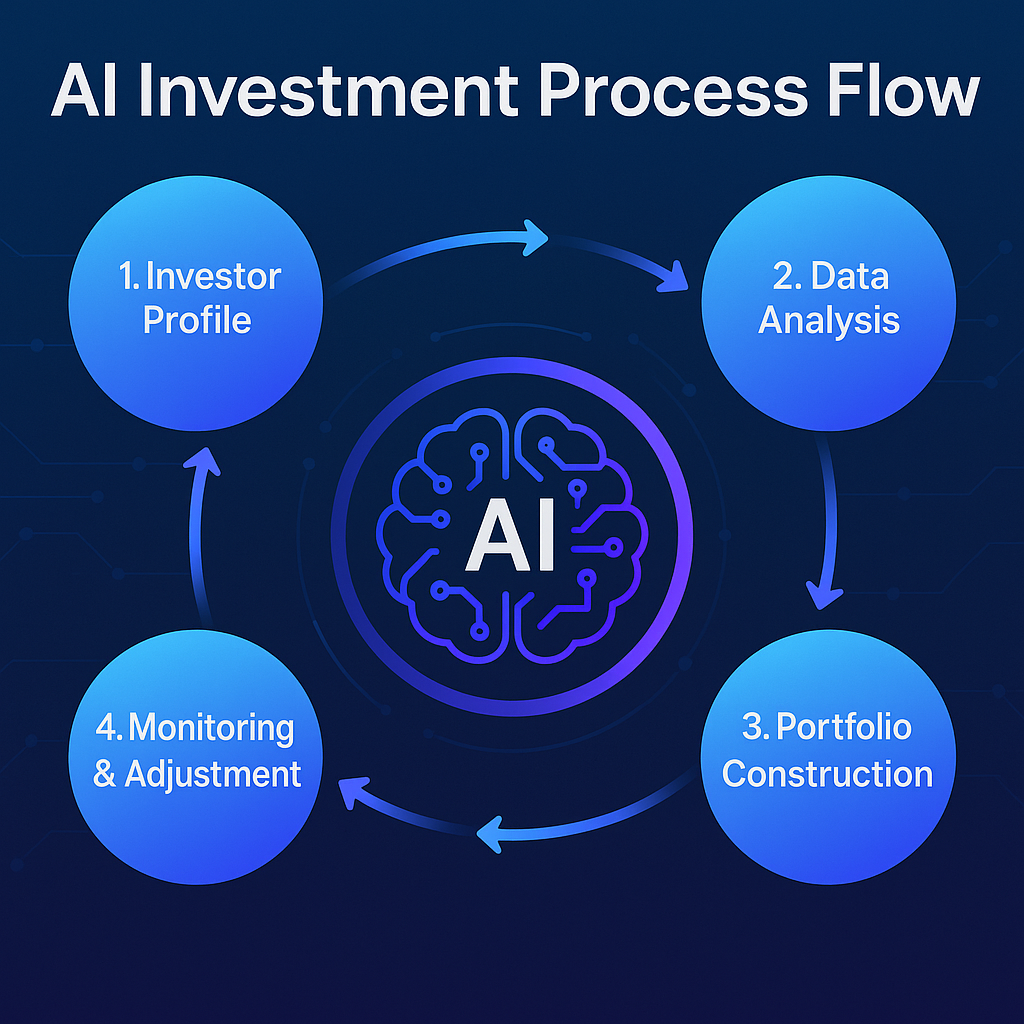

How AI Investment Advisory Works

Data Collection and Analysis

- Personal Financial Data Integration

- Connection to bank accounts, investment accounts, and credit cards

- Manual input of goals, risk tolerance, and time horizons

- Continuous monitoring of financial changes

- Market Data Processing

- Real-time analysis of market prices, volumes, and trends

- Economic indicator tracking and correlation analysis

- Global event monitoring and impact assessment

Portfolio Construction

- Risk Profiling

- Questionnaire-based risk assessment

- Behavioral finance analysis

- Time-horizon consideration

- Asset Allocation Strategy

- Modern Portfolio Theory implementation

- Optimization algorithms for maximum return at given risk levels

- Diversification across asset classes

Execution and Management

- Automated Trading

- Algorithm-driven buy/sell decisions

- Order execution at optimal times

- Trade cost minimization

- Continuous Optimization

- Portfolio rebalancing based on market conditions

- Tax-loss harvesting opportunities

- Performance monitoring and adjustment

Reporting and Communication

- Real-Time Dashboards

- Portfolio performance tracking

- Goal progress visualization

- Market insight summaries

- Periodic Reporting

- Monthly/quarterly performance reviews

- Tax reporting and documentation

- Investment strategy updates

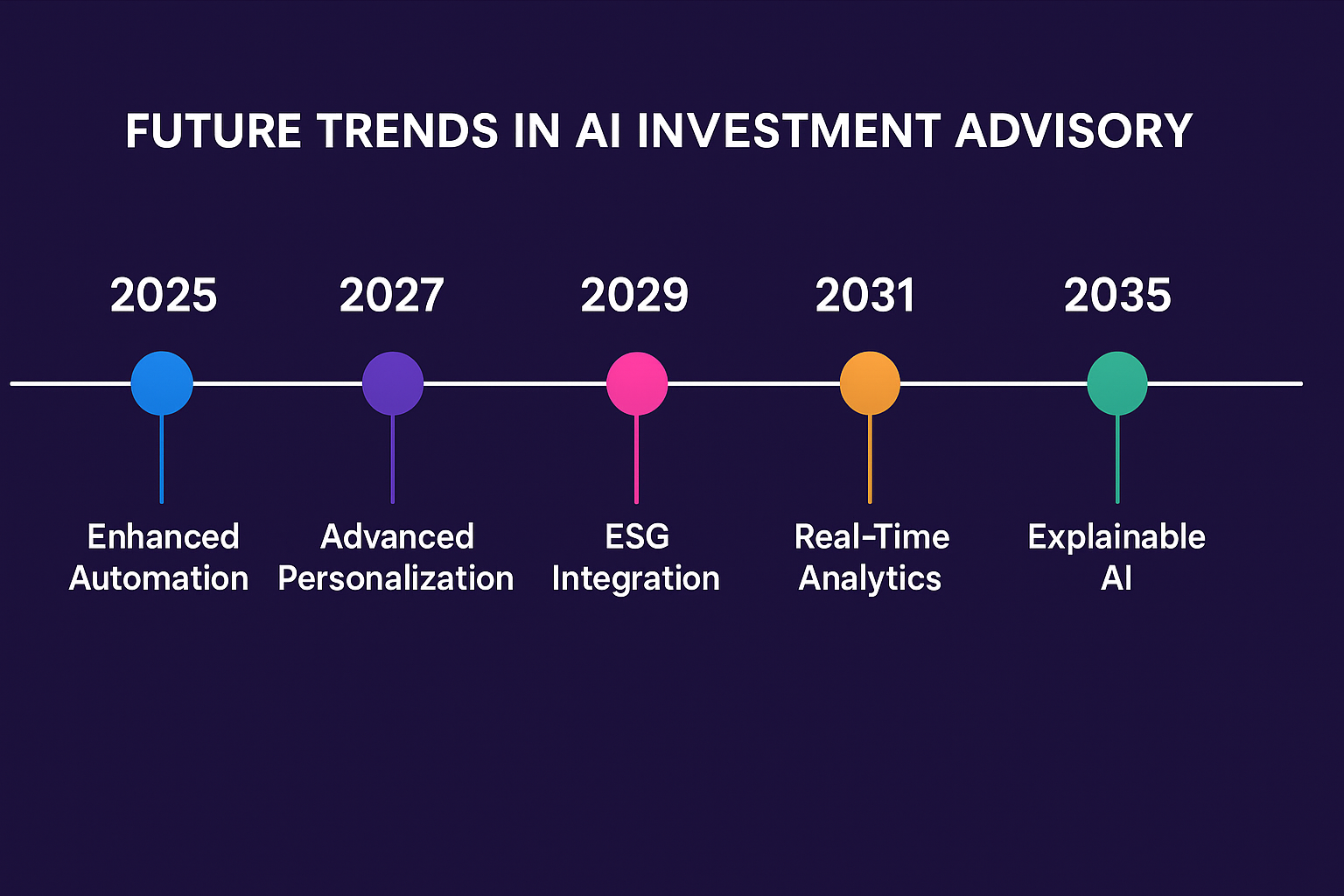

Future Trends in AI Investment Advisory

Advanced AI Technologies

- Natural Language Processing (NLP): Enhanced ability to understand and respond to complex financial queries

- Quantum Computing Integration: Exponential improvement in computational power for market predictions

- Explainable AI: Greater transparency in algorithmic decision-making processes

Market Predictions

- Global Market Expansion: AI advisory services expected to reach $5.5 trillion in assets under management by 2030

- Increased Adoption Rate: Projected 45% annual growth in AI advisory users from 2025-2030

- Regulatory Frameworks: Development of comprehensive guidelines for AI in financial services

Innovation Frontiers

- Behavioral Finance Integration: Advanced understanding of investor psychology

- ESG Investment Focus: AI-driven sustainable and responsible investing strategies

- Cryptocurrency and Digital Assets: Expanded coverage of alternative investment classes

Industry Transformation

- Traditional Advisor Evolution: Increased adoption of AI tools by human advisors

- Cost Structure Changes: Further reduction in advisory fees through technological efficiency

- Service Democratization: Universal access to sophisticated investment strategies

FAQs – Best AI Investment Advisory

1. What is the minimum investment required for AI investment advisory services?

Many AI investment advisory platforms have eliminated or significantly reduced minimum investment requirements. Popular services like Wealthfront and Betterment accept accounts starting from $0, though some premium features may require balances of $500-$1,000. Traditional automated platforms typically require $500-$1,000, while premium AI-enhanced services may require $10,000-$25,000.

2. How secure are AI investment advisory platforms?

AI investment advisory platforms employ bank-level security measures, including 256-bit encryption, two-factor authentication, and segregated client accounts. Most platforms are SIPC insured up to $500,000 and maintain additional private insurance. However, investors should verify specific security protocols and regularly monitor their accounts for unauthorized activity.

3. Can AI investment advisors handle complex financial situations like estate planning?

While AI advisors excel at portfolio management and basic financial planning, complex scenarios like estate planning, tax optimization for high-net-worth individuals, and business succession planning may require human expertise. Many platforms offer hybrid models where AI handles routine tasks while human advisors address complex situations.

4. What types of investments do AI advisors typically recommend?

AI investment advisors primarily recommend diversified portfolios of low-cost Exchange-Traded Funds (ETFs) and index funds. Typical allocations include domestic and international stocks (40-70%), bonds (20-40%), and alternative investments (0-10%). Some platforms also offer access to individual stocks, real estate investment trusts (REITs), and cryptocurrency options.

5. How does AI investment advisory compare in performance to traditional financial advisors?

Studies show AI investment advisors typically achieve comparable or slightly better returns than traditional advisors when adjusted for fees. The 0.25-0.50% fee structure of AI advisors versus 1-2% for traditional advisors can result in significant savings over time. However, performance varies based on market conditions, investment strategy, and individual circumstances.

6. Can I withdraw my money anytime from an AI investment advisory account?

Most AI investment advisory accounts offer high liquidity with the ability to withdraw funds anytime. However, tax-advantaged accounts like IRAs or 401(k)s maintain standard withdrawal restrictions. Some platforms may charge early withdrawal fees or have minimum balance requirements that could trigger account closure.

7. How do AI investment advisors handle market downturns?

AI systems employ sophisticated risk management strategies during market downturns, including dynamic asset allocation, automatic rebalancing, and defensive positioning. They analyze historical correlations and volatility patterns to adjust portfolios proactively. However, extreme market events may still impact portfolio values as AI systems cannot eliminate market risk entirely.

8. What data do AI investment advisors need to get started?

Initial setup typically requires personal information (age, income, assets, liabilities), investment goals, risk tolerance assessment, and financial accounts for linking. Many platforms also request information about existing investments, retirement plans, and debt obligations. This data enables accurate portfolio modeling and goal tracking.

9. Are AI investment advisory services regulated?

Yes, AI investment advisory services must comply with financial regulations in their operating jurisdictions. In the United States, they are regulated by the SEC and FINRA, requiring registration as investment advisors. They must adhere to fiduciary standards, maintain transparent fee structures, and provide required disclosures to clients.

10. How often should I review my AI-managed portfolio?

While AI systems continuously monitor and adjust portfolios, investors should review their accounts quarterly at a minimum. Annual comprehensive reviews are recommended to assess goal progress, update personal circumstances, and adjust risk tolerance. Major life events (marriage, job changes, inheritance) warrant immediate portfolio reviews regardless of timing.

Conclusion

AI investment advisory represents a transformative force in the financial services industry, offering sophisticated investment management capabilities at unprecedented accessibility and affordability. These platforms have successfully democratized access to professional-grade investment strategies, enabling millions of investors to benefit from data-driven insights and automated portfolio optimization that were previously reserved for high-net-worth individuals.

As technology continues to advance and regulatory frameworks evolve, AI investment advisory services will likely become the standard rather than the exception in wealth management. The convergence of artificial intelligence, big data analytics, and behavioral finance promises to deliver even more personalized and effective investment solutions.

While challenges remain, particularly in handling complex financial situations and navigating unprecedented market events, the trajectory clearly indicates that AI investment advisory will play an increasingly central role in shaping the future of personal finance and wealth management, offering investors powerful tools to achieve their financial goals more efficiently and effectively than ever before.

For your reference, recently published articles include:

-

- AI Investment Advisory Explained – Get Best Advice Here!

- Investment Research Automation: The Way To Your Success

- Global Expense Management Tools – Save Your Time And Money

- Business Credit Cards No Foreign Transaction Fee – Get Best Advice Here

- 7 Beginner Mistakes In ETF Investing: The Expert Guide

- Unlock Hidden Perks: Best Credit Cards For Freelancers Revealed!

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.