Introduction

Dividend stocks represent ownership in companies that regularly distribute a portion of their earnings to shareholders in the form of cash payments. These investments serve as a cornerstone strategy for investors seeking to generate passive income while building long-term wealth through both appreciation and reinvestment opportunities. In an era of market volatility and economic uncertainty, dividend-paying equities offer a compelling combination of income generation and relative stability that appeals to both conservative and growth-oriented investors.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways

- Sustainable Income Generation: Dividend stocks provide investors with regular cash distributions, typically paid quarterly, that can supplement retirement income or be reinvested for compound growth. For example, Johnson & Johnson has increased its dividend for 62 consecutive years, providing shareholders with reliable income regardless of market conditions while maintaining an average yield of approximately 2.8%.

- Lower Volatility Profile: Companies that pay consistent dividends tend to exhibit 15-20% less price volatility compared to non-dividend-paying growth stocks, as the regular income component provides a cushion during market downturns. During the 2008 financial crisis, dividend-paying stocks in the S&P 500 declined an average of 35% versus 50% for non-payers, demonstrating their defensive characteristics.

- Tax-Advantaged Returns: Qualified dividends receive preferential tax treatment in the United States, with maximum tax rates of 0%, 15%, or 20% depending on income level – significantly lower than ordinary income tax rates that can reach 37%. This tax efficiency enhances after-tax returns for investors in taxable accounts, particularly those in higher income brackets seeking to optimize their investment income.

Table of Contents

Understanding Dividend Stocks

Definition and Core Mechanics

Dividend stocks represent equity securities in corporations that distribute a portion of their profits to shareholders on a regular basis. Unlike growth companies that reinvest all earnings back into operations, dividend-paying firms share their success directly with investors through cash payments. These distributions typically occur quarterly, though some companies pay monthly, semi-annually, or annually.

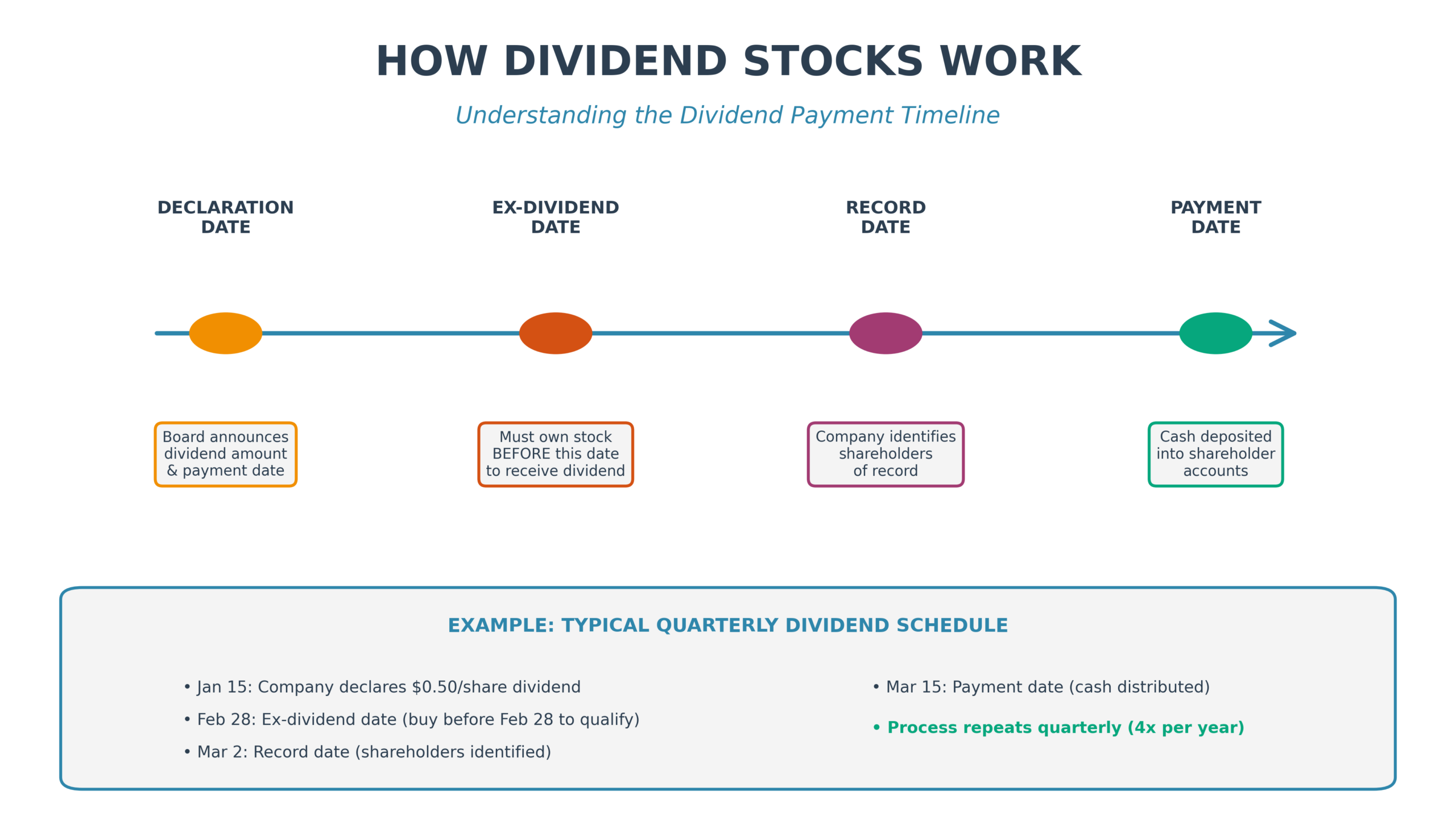

The dividend payment process follows a specific timeline with four critical dates. The declaration date marks when a company’s board of directors announces the upcoming dividend payment. The ex-dividend date determines which shareholders qualify to receive the payment – investors must own the stock before this date to be eligible. The record date identifies shareholders of record entitled to the dividend. Finally, the payment date represents when the company actually distributes cash to eligible shareholders.

Calculating Dividend Yield

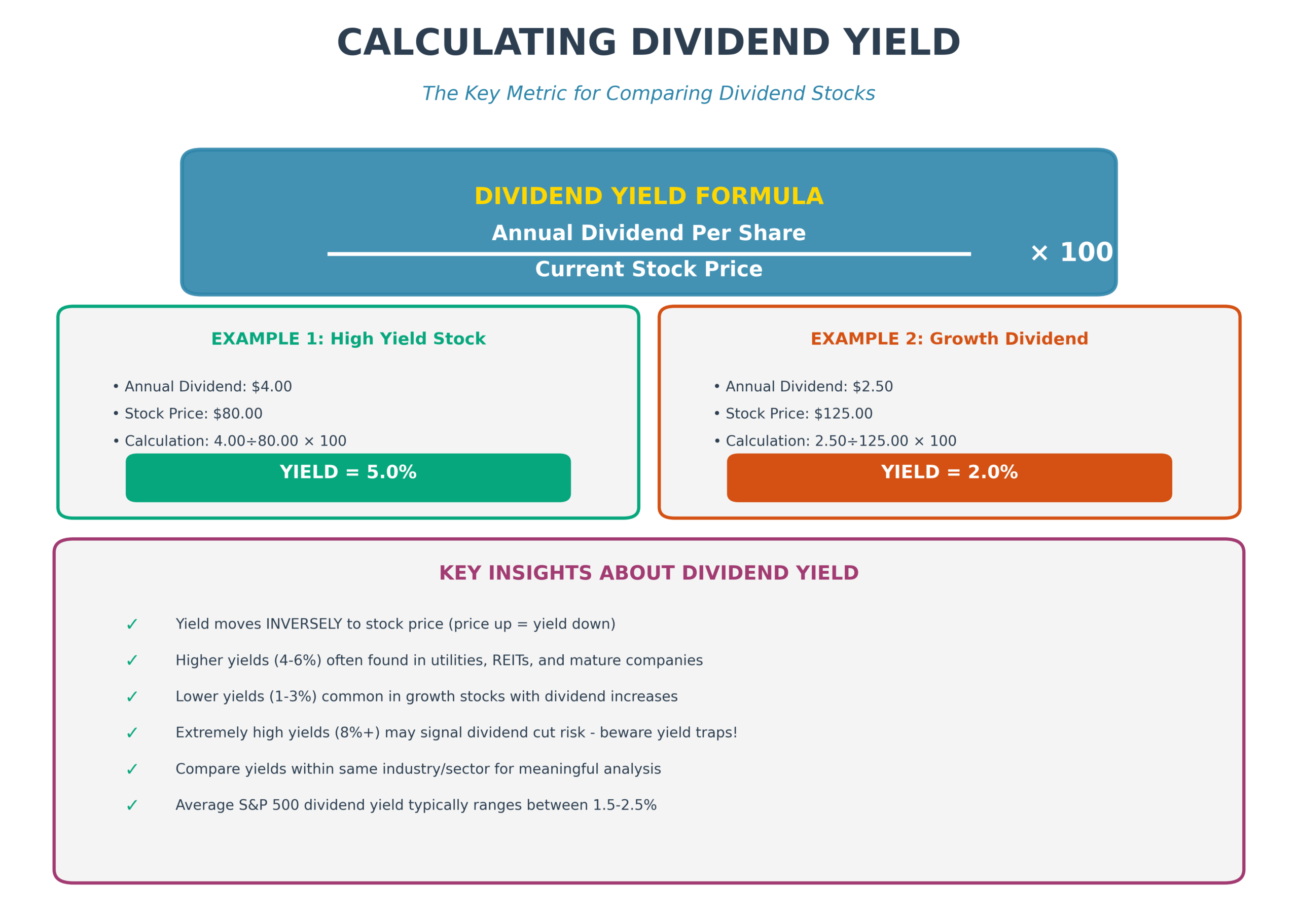

Dividend yield serves as the primary metric for evaluating dividend stocks, calculated by dividing the annual dividend per share by the current stock price, then multiplying by 100 to express as a percentage. For example, if a company pays $4.00 in annual dividends and trades at $100 per share, the dividend yield equals 4.0%. This calculation provides investors with a standardized method to compare income potential across different securities.

The formula appears as follows:

Dividend Yield = (Annual Dividend Per Share / Current Stock Price) × 100

Understanding dividend yield proves essential because it fluctuates inversely with stock price movements. When share prices increase, yield decreases, and vice versa. A stock yielding 3.0% at $100 per share would yield 3.75% if the price fell to $80, assuming the dividend remained constant at $3.00 annually.

Dividend Payout Ratio

The payout ratio measures what percentage of earnings a company distributes as dividends, calculated by dividing dividends per share by earnings per share. A payout ratio of 60% indicates that the company retains 40% of earnings for reinvestment while distributing 60% to shareholders. Conservative payout ratios between 30-60% suggest sustainability, while ratios exceeding 80% may signal potential vulnerability to dividend cuts during economic downturns.

Types of Dividend Stocks

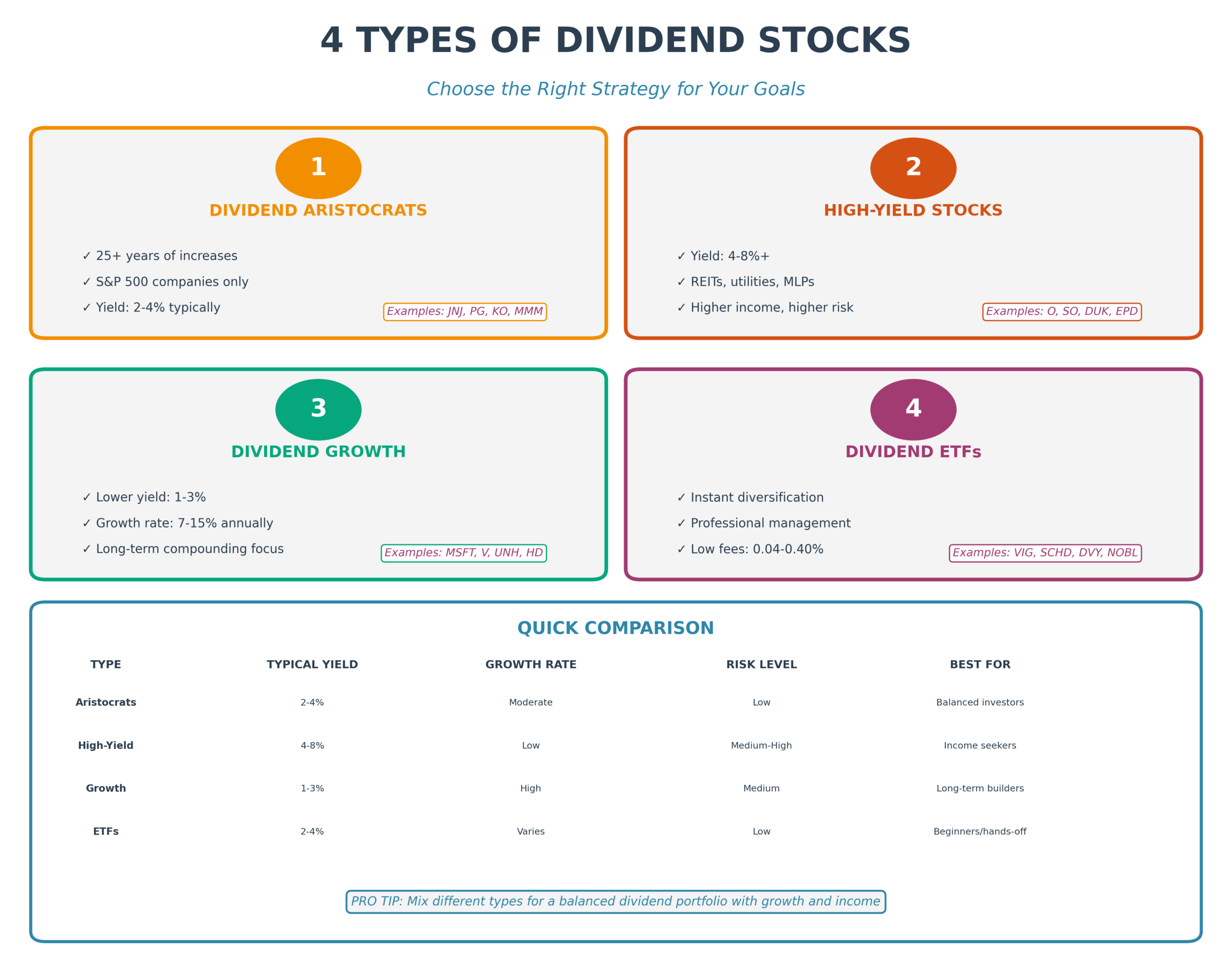

Dividend Aristocrats

Dividend Aristocrats comprise an elite group of S&P 500 companies that have increased their dividend payments for at least 25 consecutive years. This designation demonstrates exceptional financial stability, disciplined management, and commitment to shareholder returns. As of 2025, approximately 68 companies hold Aristocrat status, including industry leaders such as Coca-Cola (62 consecutive years of increases), Procter & Gamble (68 years), and 3M Company (66 years).

These companies typically exhibit strong competitive advantages, diversified revenue streams, and resilient business models that enable consistent profit generation across economic cycles. Dividend Aristocrats have historically outperformed the broader market during bear markets while providing competitive returns during bull markets, making them attractive core holdings for income-focused portfolios.

High-Yield Dividend Stocks

High-yield dividend stocks offer above-average yields, typically exceeding 4-5%, attracting investors prioritizing immediate income over capital appreciation. Real Estate Investment Trusts (REITs) dominate this category, as tax regulations require them to distribute at least 90% of taxable income to shareholders. Realty Income Corporation, known as “The Monthly Dividend Company,” provides a representative example with yields frequently exceeding 5.0%.

Utility companies also feature prominently among high-yielders due to regulated business models that generate stable cash flows. Southern Company, Duke Energy, and Dominion Energy typically offer yields between 3.5-5.0%. Master Limited Partnerships (MLPs) in the energy infrastructure sector historically provided yields exceeding 6-8%, though tax complexities and sector volatility require careful evaluation.

Investors should approach extraordinarily high yields (above 8-10%) with caution, as unsustainable distributions often precede dividend cuts. Yield traps occur when declining stock prices artificially inflate yields, masking underlying business deterioration.

Dividend Growth Stocks

Dividend growth stocks prioritize increasing dividend payments over time rather than offering maximum current yield. These companies typically yield 1.5-3.0% initially but demonstrate annual dividend growth rates of 7-15%, enabling income to compound significantly over decades. Microsoft exemplifies this category, having increased its dividend by over 140% during the past decade while maintaining a modest current yield around 0.8%.

Other prominent dividend growth stocks include Visa, UnitedHealth Group, and Home Depot – companies with strong competitive positions, expanding markets, and robust free cash flow generation. The dividend growth strategy appeals to younger investors with extended time horizons who prioritize future income potential over current distributions.

Dividend ETFs and Funds

Dividend-focused exchange-traded funds and mutual funds provide instant diversification across numerous dividend-paying stocks. Popular dividend ETFs include:

- Vanguard Dividend Appreciation ETF (VIG): Focuses on companies with 10+ years of dividend increases, yielding approximately 1.9%

- Schwab U.S. Dividend Equity ETF (SCHD): Emphasizes quality and yield, offering approximately 3.5%

- iShares Select Dividend ETF (DVY): Targets high-yield stocks, providing yields around 3.8%

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL): Exclusively holds Dividend Aristocrats, yielding approximately 2.2%

These funds eliminate individual stock selection risk while providing professional management and automatic rebalancing, making them ideal for investors seeking simplified dividend exposure.

Benefits of Dividend Investing

Passive Income Generation

Dividend stocks create reliable passive income streams without requiring investors to sell shares. A $500,000 portfolio yielding 4.0% generates $20,000 annually in dividend income, paid regardless of market fluctuations. This income proves particularly valuable during retirement when investors transition from wealth accumulation to distribution phases.

Unlike bond interest, which remains fixed, dividend income typically increases over time. Companies raising dividends at 5% annually effectively provide built-in inflation protection, maintaining purchasing power across decades. An initial $10,000 annual dividend growing at 5% reaches $16,289 after ten years and $26,533 after twenty years.

Reduced Volatility

Academic research demonstrates that dividend-paying stocks exhibit lower price volatility compared to non-dividend-payers. Historical data from 1972-2023 shows that dividend stocks in the S&P 500 experienced average annual volatility of 15.2% versus 19.7% for non-payers – approximately 23% lower volatility.

This reduced volatility stems from multiple factors. Regular dividend payments provide tangible returns independent of price appreciation, cushioning total returns during market declines. Additionally, dividend-paying companies typically represent mature, established businesses with predictable cash flows rather than speculative growth ventures.

Compound Growth Through Reinvestment

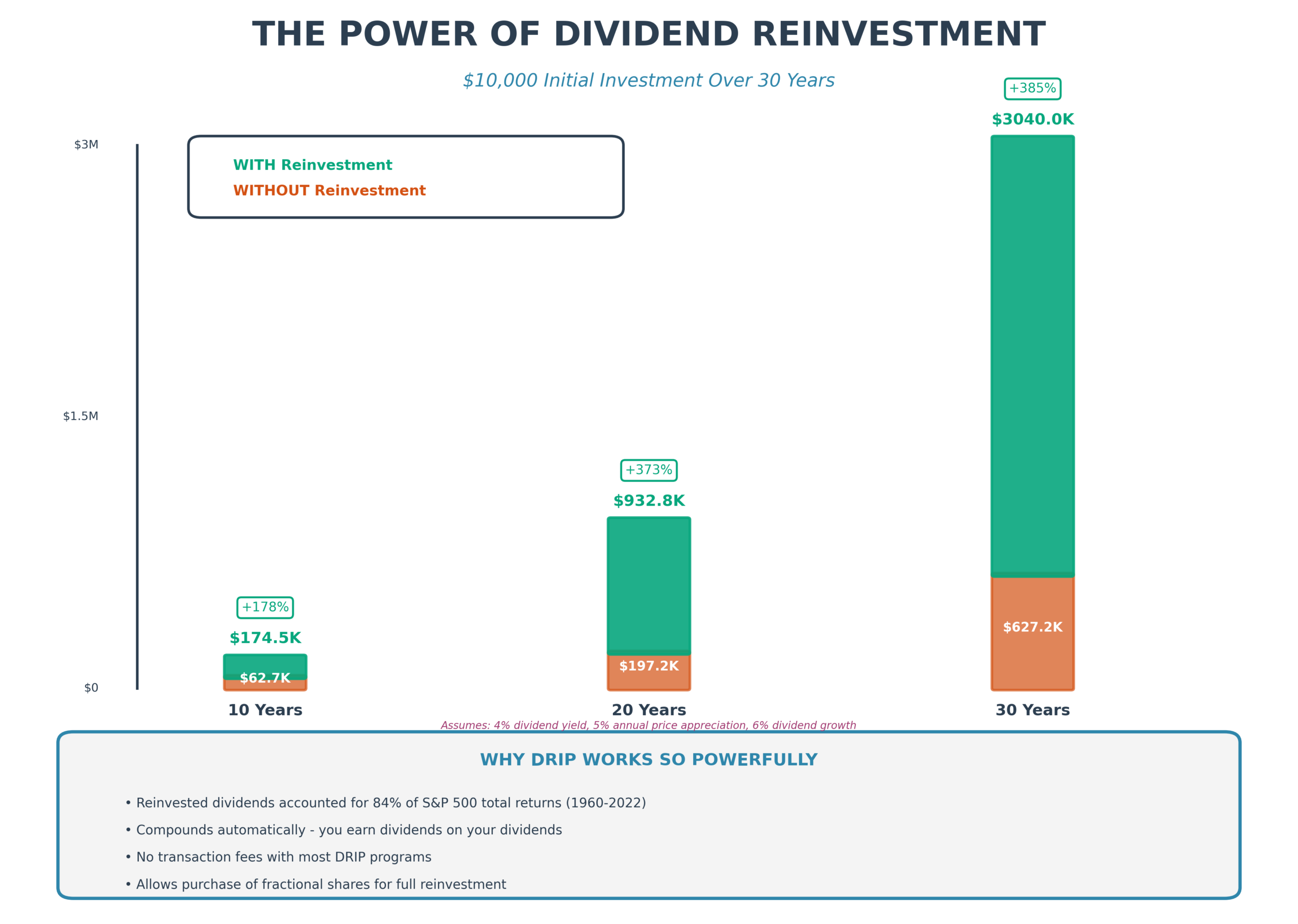

Dividend Reinvestment Plans (DRIPs) enable shareholders to automatically purchase additional shares using dividend payments, harnessing the power of compound growth. Research by Hartford Funds reveals that reinvested dividends accounted for 84% of S&P 500 total returns from 1960-2022, transforming a hypothetical $10,000 investment into $3.04 million versus just $627,161 without reinvestment.

The mathematics of compounding proves compelling over extended periods. A stock yielding 3.0% with 6% annual dividend growth and share price appreciation of 5% generates total returns exceeding 14% annually when dividends are reinvested, dramatically outpacing the same stock without reinvestment.

Historical Outperformance

Long-term data support dividend investing strategies. According to Ned Davis Research, dividend-paying stocks in the S&P 500 generated average annual returns of 9.2% from 1972-2023 compared to 3.8% for non-payers. Dividend growers and initiators delivered even stronger performance at 10.2% annually, while dividend cutters and eliminators produced negative returns of -0.5%.

During bear markets, dividend stocks provide superior downside protection. In the 2000-2002 technology bubble collapse, dividend-payers declined 11% versus 31% for non-payers. Similar patterns emerged during the 2007-2009 financial crisis and the 2020 pandemic-induced selloff.

Risks and Challenges

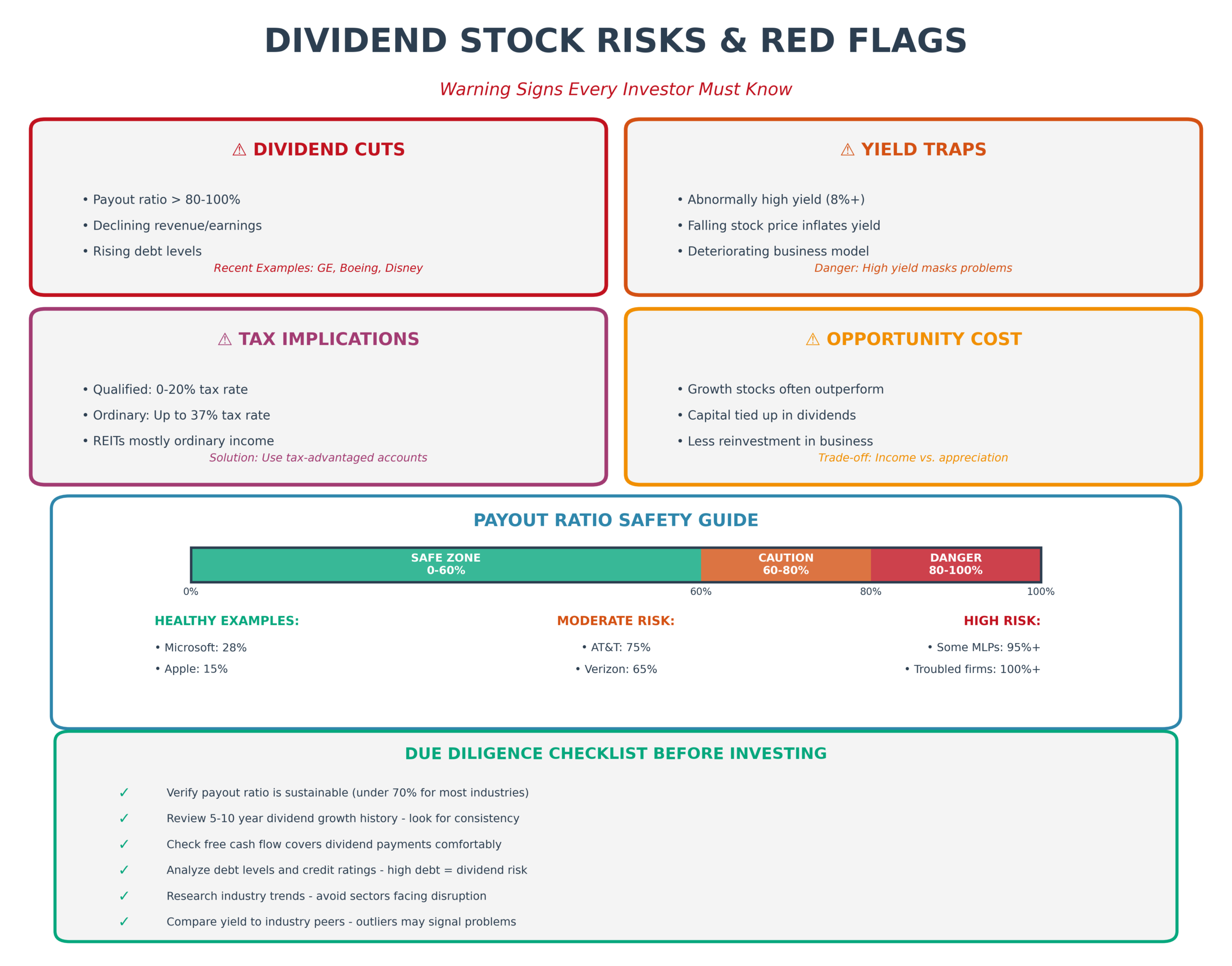

Dividend Cuts and Suspensions

Companies reduce or eliminate dividends when financial performance deteriorates, cash flows decline, or management prioritizes growth investments over shareholder distributions. Recent high-profile dividend cuts include:

- General Electric (2018): Reduced quarterly dividend from $0.12 to $0.01 per share, a 92% cut, as the industrial conglomerate restructured operations

- Boeing (2020): Suspended dividend entirely during the pandemic and 737 MAX crisis

- Disney (2020): Eliminated semi-annual dividend for the first time since 1956 due to theme park closures

- Energy sector companies (2020): Over 40 oil and gas firms cut dividends as crude prices collapsed

Dividend cuts typically trigger severe stock price declines, often 15-30% or more, as income-focused investors exit positions. Monitoring payout ratios, free cash flow trends, and debt levels helps identify at-risk dividends before cuts occur.

Lower Growth Potential

Dividend-paying stocks generally sacrifice growth potential compared to companies that reinvest all profits into expansion. Technology giants like Amazon and Alphabet operated for decades without paying dividends, enabling aggressive investment in innovation, acquisitions, and market expansion that fueled exceptional share price appreciation.

The opportunity cost becomes evident when comparing total returns. From 2010-2020, the S&P 500 Growth Index returned 17.2% annually versus 13.2% for the S&P 500 Value Index, which contains higher concentrations of dividend payers. Younger investors with extended time horizons may benefit more from growth-focused strategies, transitioning to dividend stocks as retirement approaches.

Tax Implications

Dividend taxation varies significantly based on holding period and investor tax status. Qualified dividends receive preferential long-term capital gains tax rates of 0%, 15%, or 20%, depending on taxable income. To qualify, investors must hold shares for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date.

Ordinary dividends face taxation at regular income rates up to 37%, substantially reducing after-tax returns. REITs predominantly distribute ordinary dividends due to their pass-through structure, making them more suitable for tax-advantaged accounts like IRAs or 401(k)s rather than taxable brokerage accounts.

High-income investors may also face the 3.8% Net Investment Income Tax on dividend income, effectively raising maximum qualified dividend rates to 23.8%. Tax-loss harvesting, strategic account placement, and timing of dividend receipts can optimize tax efficiency.

Yield Traps

Yield traps occur when abnormally high dividend yields result from collapsing stock prices rather than generous distributions, signaling underlying business problems. A stock yielding 10-12% may appear attractive, but often indicates market skepticism about dividend sustainability.

Warning signs of potential yield traps include:

- Payout ratios exceeding 100% (paying more than earnings)

- Declining revenues or negative earnings growth

- Rising debt levels and deteriorating credit ratings

- Industry disruption or competitive pressures

- Management turnover or strategic uncertainty

AT&T exemplified a yield trap during 2021-2022, yielding over 7% as investors anticipated the dividend cut that eventually occurred when the company spun off WarnerMedia, reducing the dividend by approximately 47%.

How to Invest in Dividend Stocks

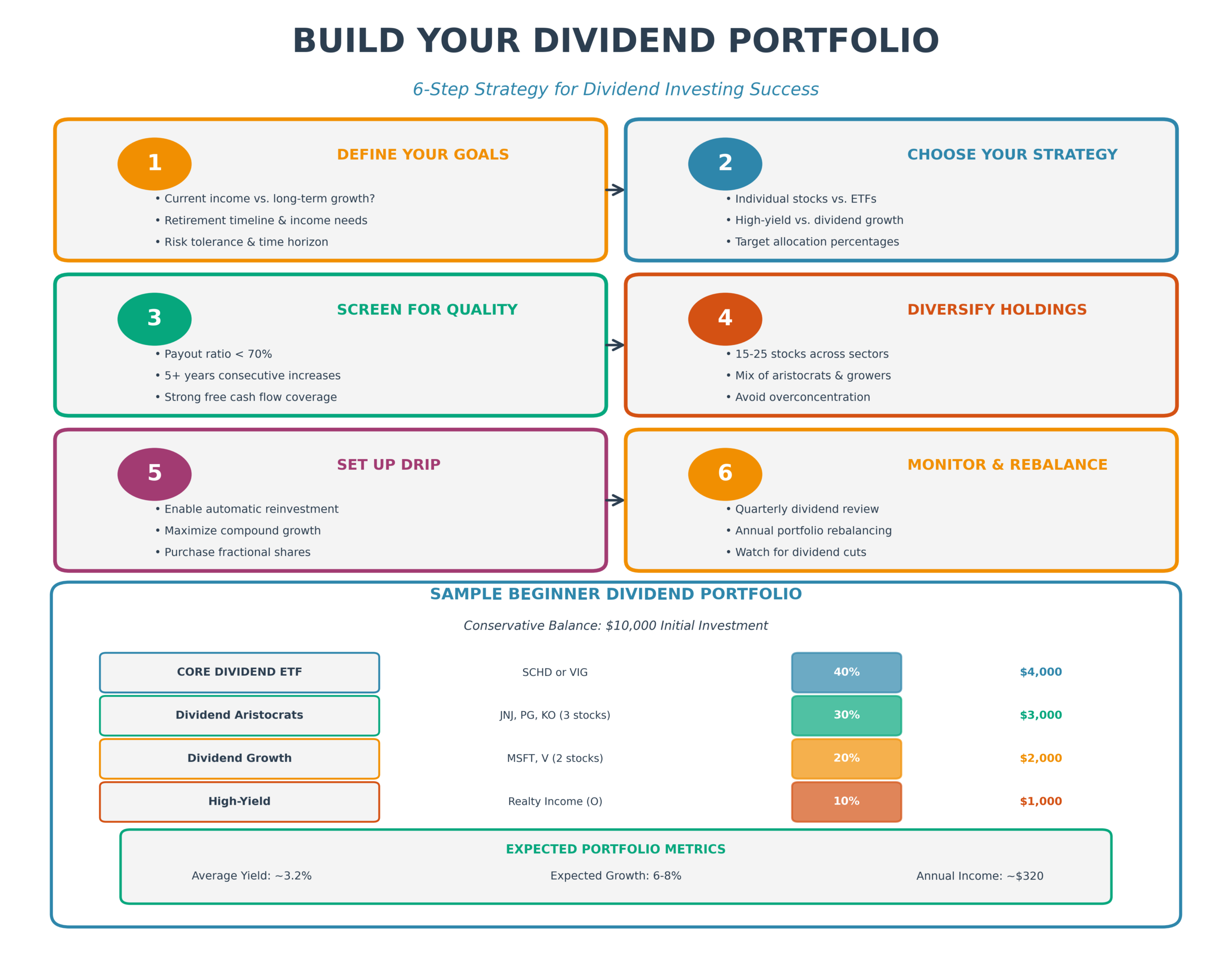

Individual Stocks vs. Dividend ETFs

Investors face a fundamental choice between selecting individual dividend stocks or purchasing diversified dividend ETFs. Individual stock selection provides maximum control, enabling investors to emphasize specific sectors, yield levels, or growth characteristics. This approach suits investors with time, expertise, and conviction to research companies, monitor financial performance, and maintain disciplined portfolio management.

Dividend ETFs offer instant diversification, professional management, and simplified administration. A single ETF purchase provides exposure to 30-100+ dividend stocks, eliminating concentration risk and reducing research requirements. Management fees typically range from 0.04-0.40% annually, representing minimal cost for automatic rebalancing and dividend collection.

Hybrid approaches combining 60-70% dividend ETF exposure with 30-40% individual stock positions balance diversification with selective opportunities. This structure provides core dividend exposure through ETFs while allowing investors to emphasize high-conviction individual positions.

Dividend Reinvestment Plans (DRIPs)

DRIPs enable automatic reinvestment of dividend payments into additional shares, including fractional shares, without transaction fees. Most brokerages offer DRIP services for stocks and ETFs held in customer accounts, requiring simple enrollment through account settings.

Direct stock purchase plans (DSPPs) allow investors to buy shares directly from companies, bypassing brokers entirely. Companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble sponsor DSPPs with minimal fees and automatic reinvestment features.

DRIPs prove particularly effective for accumulation-phase investors who do not require current income, enabling tax-deferred compounding within retirement accounts. Investors should disable DRIPs when transitioning to distribution phases or when portfolio rebalancing requires redirecting cash flows.

Portfolio Allocation Recommendations

Optimal dividend stock allocation depends on investor age, risk tolerance, income needs, and overall financial goals. General guidelines include:

Conservative investors (age 60+): 40-60% dividend stocks, 30-40% bonds, 10-20% growth stocks Moderate investors (age 40-59): 30-40% dividend stocks, 20-30% bonds, 30-40% growth stocks Aggressive investors (age under 40): 15-25% dividend stocks, 5-15% bonds, 60-75% growth stocks

These allocations should be customized based on individual circumstances. Retirees requiring 4% portfolio withdrawals may emphasize high-yield dividend stocks and REITs, while younger accumulators may focus on dividend growth stocks with lower current yields but superior long-term appreciation potential.

Best Dividend Stocks for Beginners

Beginning dividend investors should prioritize established companies with strong competitive positions, manageable payout ratios, and consistent dividend growth histories. Recommended starter positions include:

Dividend Aristocrats: Johnson & Johnson, Procter & Gamble, Coca-Cola, PepsiCo, McDonald’s

Blue-chip financials: JPMorgan Chase, Bank of America, Visa, Mastercard

Technology leaders: Microsoft, Apple, Broadcom, Texas Instruments

Consumer staples: Costco, Target, Walmart, Colgate-Palmolive

Healthcare giants: UnitedHealth Group, AbbVie, Merck, Pfizer

Alternatively, broad dividend ETFs like SCHD or VIG provide instant diversification and eliminate single-stock risk, making them ideal first purchases for dividend portfolio construction.

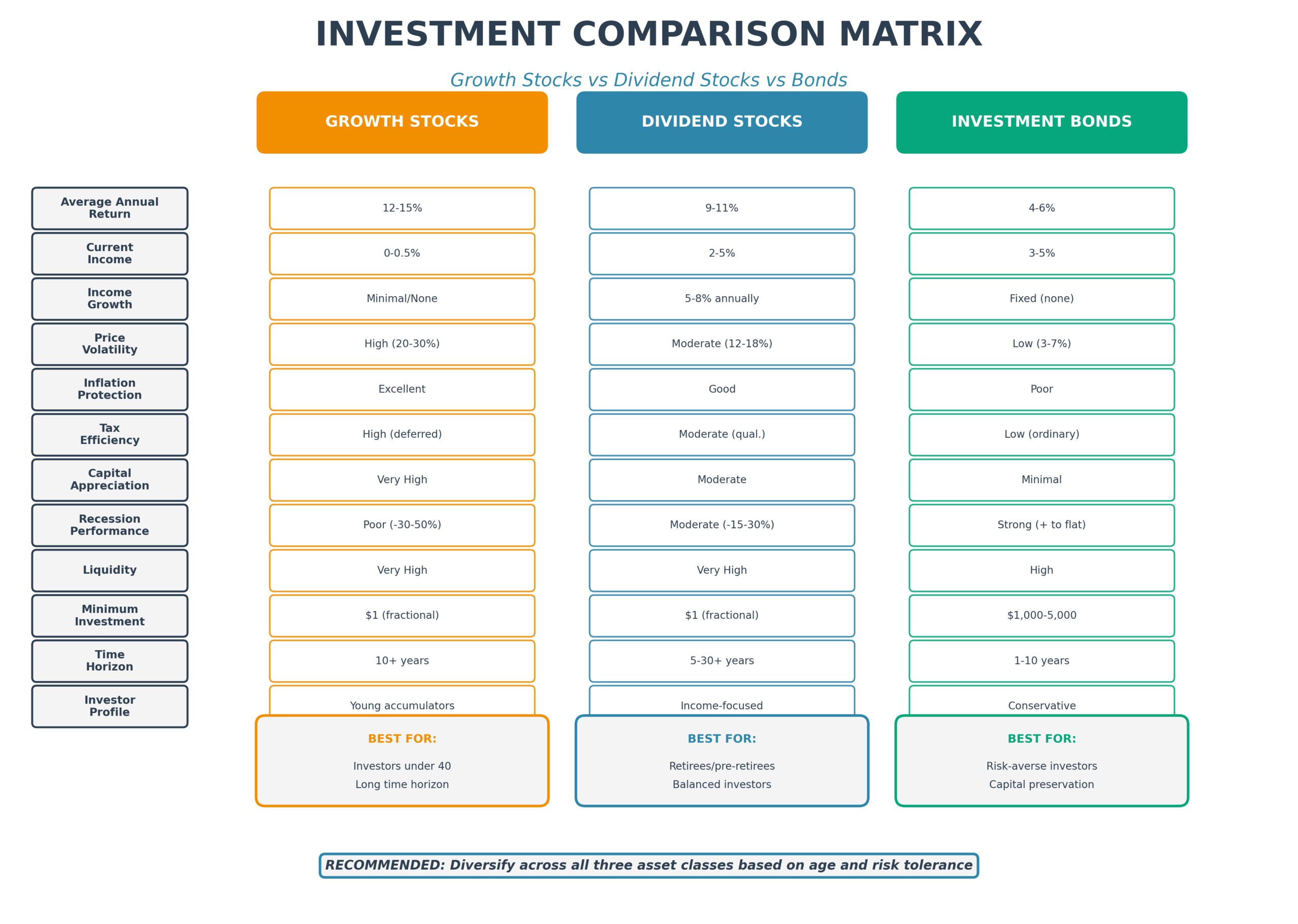

Comparison Table: Growth Stocks vs. Dividend Stocks vs. Bonds

| Characteristic | Growth Stocks | Dividend Stocks | Investment-Grade Bonds |

|---|---|---|---|

| Average Annual Return (Historical) | 12-15% | 9-11% | 4-6% |

| Current Income | 0-0.5% | 2-5% | 3-5% |

| Income Growth | Minimal/None | 5-8% annually | Fixed (no growth) |

| Price Volatility | High (20-30% annually) | Moderate (12-18% annually) | Low (3-7% annually) |

| Inflation Protection | Excellent | Good | Poor |

| Tax Efficiency | High (deferred gains) | Moderate (qualified dividends) | Low (ordinary income) |

| Capital Appreciation | Very High | Moderate | Minimal |

| Recession Performance | Poor (-30% to -50%) | Moderate (-15% to -30%) | Strong (positive to flat) |

| Liquidity | Very High | Very High | High |

| Minimum Investment | $1 (fractional shares) | $1 (fractional shares) | $1,000-$5,000 (individual bonds) |

| Suitable Investment Horizon | 10+ years | 5-30+ years | 1-10 years |

| Ideal Investor Profile | Young accumulators | Income-focused, moderate risk tolerance | Conservative, capital preservation |

Future Trends in Dividend Investing

Increasing Dividend Adoption Among Technology Companies

Historically, technology companies eschewed dividends in favor of reinvesting all profits into research, development, and expansion. This paradigm shifted dramatically during the past decade as mature technology giants initiated dividend programs. Apple began paying dividends in 2012, Microsoft significantly increased payouts starting in 2019, and Meta Platforms initiated dividends in 2024.

This trend continues accelerating as technology companies mature, generate substantial free cash flows, and face limited organic growth opportunities, justifying unlimited reinvestment. Analysts project that 15-20 additional technology companies will initiate dividend programs by 2027, including potential candidates like Alphabet, Netflix, and Salesforce, expanding the technology sector’s representation among dividend stocks from approximately 8% currently to 15-18% by 2030.

Environmental, Social, and Governance (ESG) Integration

Dividend investing increasingly incorporates ESG criteria as investors seek to align financial objectives with values and sustainability concerns. Dividend ETFs launched during the past five years include dedicated ESG screening, such as the Vanguard ESG U.S. Stock ETF (ESGV) and iShares MSCI USA ESG Select ETF (SUSA).

Research suggests a positive correlation between strong ESG practices and dividend sustainability. Companies with superior ESG ratings demonstrate 12-15% lower probability of dividend cuts during economic downturns compared to ESG laggards, according to MSCI data covering 2008-2022. This relationship stems from better risk management, stakeholder alignment, and long-term strategic planning inherent in ESG-focused organizations.

International Dividend Opportunities

While U.S. dividend stocks receive primary attention from American investors, international markets offer compelling opportunities with different characteristics. European dividend stocks typically provide higher yields (3-5%) with semi-annual or annual payment frequencies. Asian markets, particularly Australia and Singapore, feature strong dividend cultures with attractive yields and franking credit tax advantages.

Currency considerations, withholding taxes, and geopolitical risks complicate international dividend investing but potentially enhance diversification and yield. International dividend ETFs like Vanguard International High Dividend Yield ETF (VYMI) and iShares International Select Dividend ETF (IDV) provide simplified access to global dividend opportunities.

Rising Interest Rate Environment Impact

The Federal Reserve’s interest rate policies profoundly impact dividend stock valuations and relative attractiveness. During 2022-2024, aggressive rate increases to combat inflation reduced dividend stock appeal as risk-free Treasury yields approached or exceeded many dividend yields. Ten-year Treasury yields reaching 4.5-5.0% created formidable competition for dividend stocks yielding 2-4%.

However, dividend stocks offer crucial advantages over bonds: Inflation protection through dividend growth, capital appreciation potential, and tax efficiency (qualified dividends versus ordinary income taxation on bond interest). As interest rate normalization occurs during 2025-2027, dividend stocks should regain relative attractiveness, particularly dividend growth stocks with sustainable payout models and consistent increase histories.

Frequently Asked Questions

1. What dividend yield should investors target for an optimal balance of income and safety?

Most financial advisors recommend targeting dividend yields between 2.5% and 4.5% for an optimal balance. Yields below 2% may provide insufficient income, while yields exceeding 6% often signal elevated risk of dividend cuts. The sweet spot around 3-4% typically indicates established companies with sustainable dividends, reasonable growth prospects, and acceptable risk profiles. Investors should always evaluate yield in context with payout ratio, dividend growth history, and business fundamentals rather than focusing solely on yield percentage.

2. How much money does an investor need to generate meaningful dividend income?

Generating meaningful dividend income depends on individual income needs and portfolio yield. A portfolio yielding 4% requires $250,000 to produce $10,000 annually, $500,000 for $20,000 annually, or $1,000,000 for $40,000 annually. Beginning investors should focus on dividend reinvestment during accumulation phases rather than immediate income generation, recognizing that consistent contributions of $500-$1,000 monthly can build substantial dividend portfolios over 20-30 years through compounding growth.

3. Should dividend stocks be held in taxable accounts or retirement accounts?

The optimal account location for dividend stocks depends on dividend type and tax situation. Qualified dividends from U.S. corporations benefit from preferential tax rates (0-20%), making them relatively tax-efficient for taxable accounts. However, REITs, MLPs, and high-yield dividend stocks generating ordinary income should generally be held in tax-advantaged retirement accounts (IRAs, 401(k)s) to defer taxation. Dividend growth stocks with lower current yields work well in taxable accounts, while high-yield positions suit retirement accounts, maximizing overall tax efficiency.

4. How frequently should investors rebalance dividend portfolios?

Most dividend investors should rebalance portfolios annually or when allocations drift 5-10% from targets. Unlike growth portfolios requiring frequent adjustment, dividend portfolios benefit from long-term holding periods that minimize transaction costs and taxes while maximizing compounding. Quarterly dividend reviews, monitoring payout ratio changes, earnings trends, and dividend growth rates should supplement annual rebalancing. Investors using dividend reinvestment plans may rebalance less frequently, as automatic reinvestment naturally adjusts positions over time.

5. What payout ratio indicates dividend safety versus dividend risk?

Payout ratios between 30-60% generally indicate dividend safety, providing adequate reinvestment for business growth while maintaining comfortable dividend coverage. Ratios below 30% may signal opportunities for dividend increases, while ratios exceeding 80% raise sustainability concerns. However, appropriate payout ratios vary by industry: REITs typically maintain 75-90% ratios by regulatory requirement, utilities often sustain 60-75% ratios, while technology companies may target 20-40% ratios, retaining cash for acquisitions and innovation.

6. Do dividend stocks perform better during inflation or deflation?

Dividend stocks generally perform better during moderate inflation (2-4% annually) compared to deflation or high inflation. Moderate inflation enables companies to raise prices, supporting revenue and earnings growth that funds dividend increases, providing natural inflation protection. During deflation, revenue and earnings typically decline, pressuring dividend sustainability. High inflation (above 6-8%) often triggers aggressive Federal Reserve rate increases that reduce dividend stock valuations as bond yields rise. Dividend growth stocks with pricing power perform best across various inflation scenarios.

7. What happens to dividend stocks when interest rates rise sharply?

Rising interest rates typically pressure dividend stock valuations as bonds become more competitive income alternatives. When 10-year Treasury yields increase from 2% to 5%, dividend stocks yielding 3% lose relative attractiveness, often experiencing price declines of 10-20% or more. However, dividend growth stocks with strong business fundamentals recover relatively quickly as dividend increases offset higher discount rates. High-yield dividend stocks with limited growth potential face more persistent pressure during rising rate environments, while dividend aristocrats with consistent increase histories demonstrate superior resilience.

8. Can investors live entirely off dividend income in retirement?

Yes, investors can live entirely off dividend income in retirement with sufficient portfolio size and appropriate yield targets. Following the 4% withdrawal rule, a $1,000,000 portfolio generating 4% dividend yield provides $40,000 annually without touching principal. The dividend approach offers several advantages: no forced selling during market downturns, tax efficiency from qualified dividends, natural inflation protection from dividend growth, and psychological comfort from preserving capital. However, this strategy requires significantly larger portfolios than balanced withdrawal approaches that combine dividends, interest, and capital gains.

9. How do dividend stocks perform during recessions compared to growth stocks?

Dividend stocks substantially outperform growth stocks during recessions, declining less severely and recovering faster. During the 2008-2009 financial crisis, dividend-paying stocks fell approximately 35% versus 50% for non-payers. The 2020 pandemic selloff showed similar patterns, with dividend stocks declining 25% versus 35% for growth-focused positions. Regular dividend income provides psychological and financial cushion during downturns, while dividend-paying companies typically represent established businesses with predictable cash flows less vulnerable to economic volatility compared to speculative growth ventures dependent on future earnings potential.

10. Should investors focus on dividend yield or dividend growth rate?

The optimal focus depends on investment timeline and income needs. Near-retirees and retirees requiring immediate income should emphasize current yield (3-5%), accepting slower dividend growth rates of 2-4% annually. Younger investors with 20-30 year horizons should prioritize dividend growth (7-12% annually) over current yield (1-3%), recognizing that compound growth creates far larger future income streams. For example, a stock yielding 2% with 10% annual dividend growth produces higher income after 15 years than a stock yielding 5% with 3% growth. Balanced approaches combining both yield and growth suit investors in transitional life stages.

Conclusion

Dividend stocks offer a compelling investment strategy that combines regular income, capital appreciation potential, and lower volatility than growth-focused alternatives. The evidence supporting dividend investing is substantial: historical data show superior risk-adjusted returns, lower portfolio volatility, and meaningful inflation protection through dividend growth.

Companies maintaining consistent dividend payments and increases signal financial strength, disciplined capital allocation, and shareholder-friendly management teams committed to sharing profits rather than pursuing empire-building or wasteful expansion.

However, successful dividend investing requires discipline, research, and realistic expectations. Investors must avoid yield traps that offer unsustainably high payouts, monitor payout ratios and cash flow trends to identify potential dividend cuts before they occur, and construct diversified portfolios that balance yield with growth potential.

The optimal dividend strategy varies by individual circumstances: younger investors should emphasize dividend-growth stocks that build future income streams, while retirees may focus on higher-yielding aristocrats and blue-chip companies that provide immediate cash flow. Tax considerations, account location decisions, and reinvestment versus distribution choices significantly impact after-tax returns and wealth accumulation over decades.

Looking ahead, dividend investing continues to evolve as the technology sector matures, increasing dividend-paying opportunities; ESG integration aligns financial objectives with values and sustainability; and international markets offer diversification beyond U.S.-centric portfolios. Interest rate normalization following the 2022-2024 tightening cycle should enhance the attractiveness of dividend stocks relative to bonds in 2025-2027, particularly for dividend growth stocks that demonstrate pricing power and consistent dividend growth.

By understanding dividend mechanics, evaluating opportunities systematically, and maintaining a long-term perspective, investors can harness dividend stocks as foundational portfolio components, generating sustainable income and building generational wealth.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- ETF vs Mutual Fund: Best Comparison Guide for Investors

- What Is Diversification?

- How Compound Interest Works: The Complete Guide to Growing Your Wealth

- Investing 101: Everything You Need to Know to Start

- What Is an Index Fund? The Beginner’s Complete Guide

- Brokerage Account vs IRA vs 401k: Where to Invest First

- How the Stock Market Works: Simple Explanation

Get Your Free Dividend Aristocrats Screener

Download our comprehensive Excel spreadsheet featuring the Top 25 S&P 500 Dividend Aristocrats with current yields, payout ratios, dividend growth rates, and 10-year total return data.

🔒 No spam. Unsubscribe anytime. Just valuable dividend investing insights.

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance