In today’s volatile financial landscape, wealth preservation has become as crucial as wealth creation.

The ultra-wealthy employ sophisticated investment risk mitigation strategies that shield their assets from market downturns, economic instability, and unforeseen events – techniques that remain largely unknown to average investors but are increasingly accessible to those willing to learn.

Key Takeaways

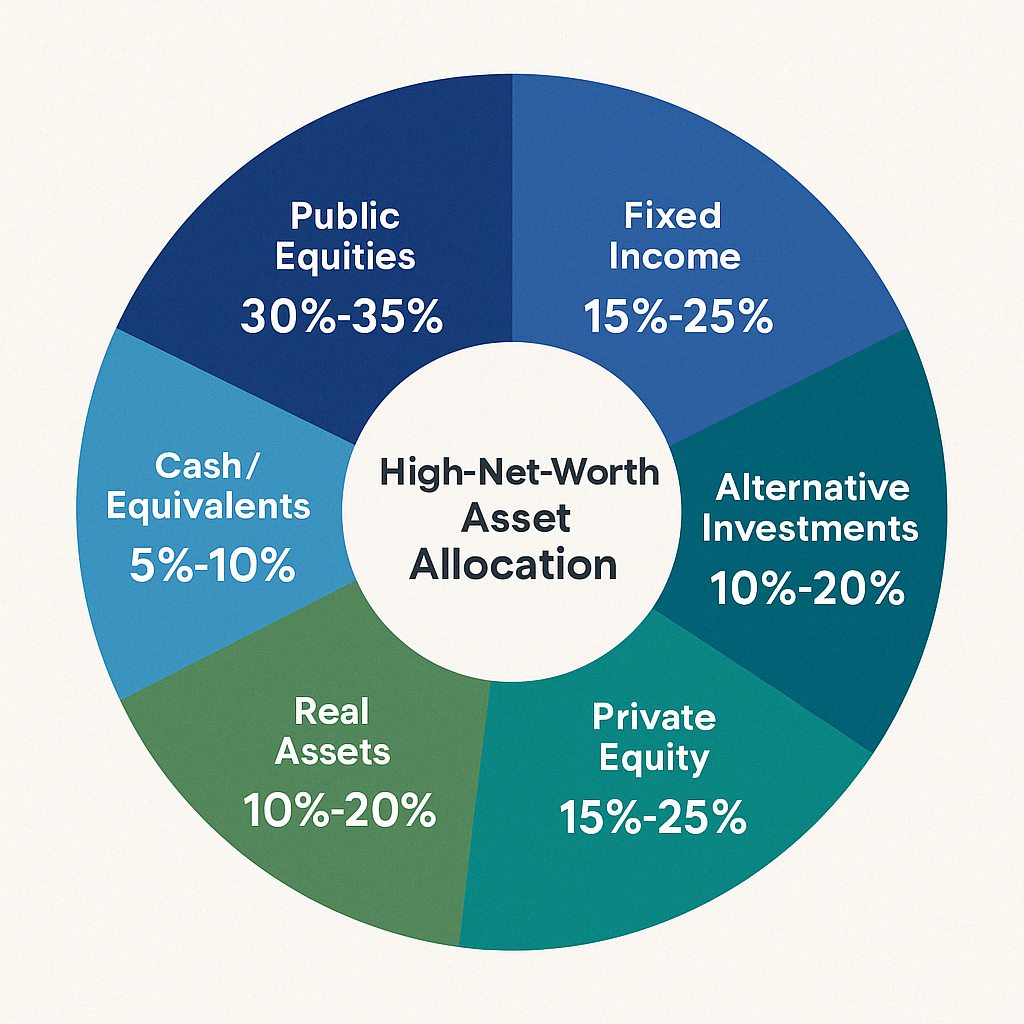

- Diversification beyond traditional asset classes is the cornerstone of wealth preservation, with high-net-worth individuals allocating 15-25% to alternative investments such as private equity, real assets, and market-neutral strategies to reduce portfolio correlation and volatility.

- Insurance-based wealth protection tools like private placement life insurance (PPLI) and captive insurance companies are increasingly utilized by wealthy families, with premium investments in these vehicles growing at 18% annually since 2020, offering both downside protection and tax advantages.

- Strategic use of legal entities and jurisdictions through family limited partnerships, trusts, and international diversification provides crucial asset protection against litigation, creditors, and geopolitical risks – 78% of individuals with over $10 million in investable assets employ at least two such structures.

Table of Contents

Understanding Investment Risk Mitigation

Investment risk mitigation encompasses the strategic practices employed to protect wealth from various threats while maintaining growth potential. Unlike simple risk avoidance, proper risk mitigation identifies, analyzes, and addresses potential hazards through carefully calibrated responses. The wealthy approach risk differently – not by eliminating it entirely, but by skillfully managing exposure while capitalizing on calculated opportunities.

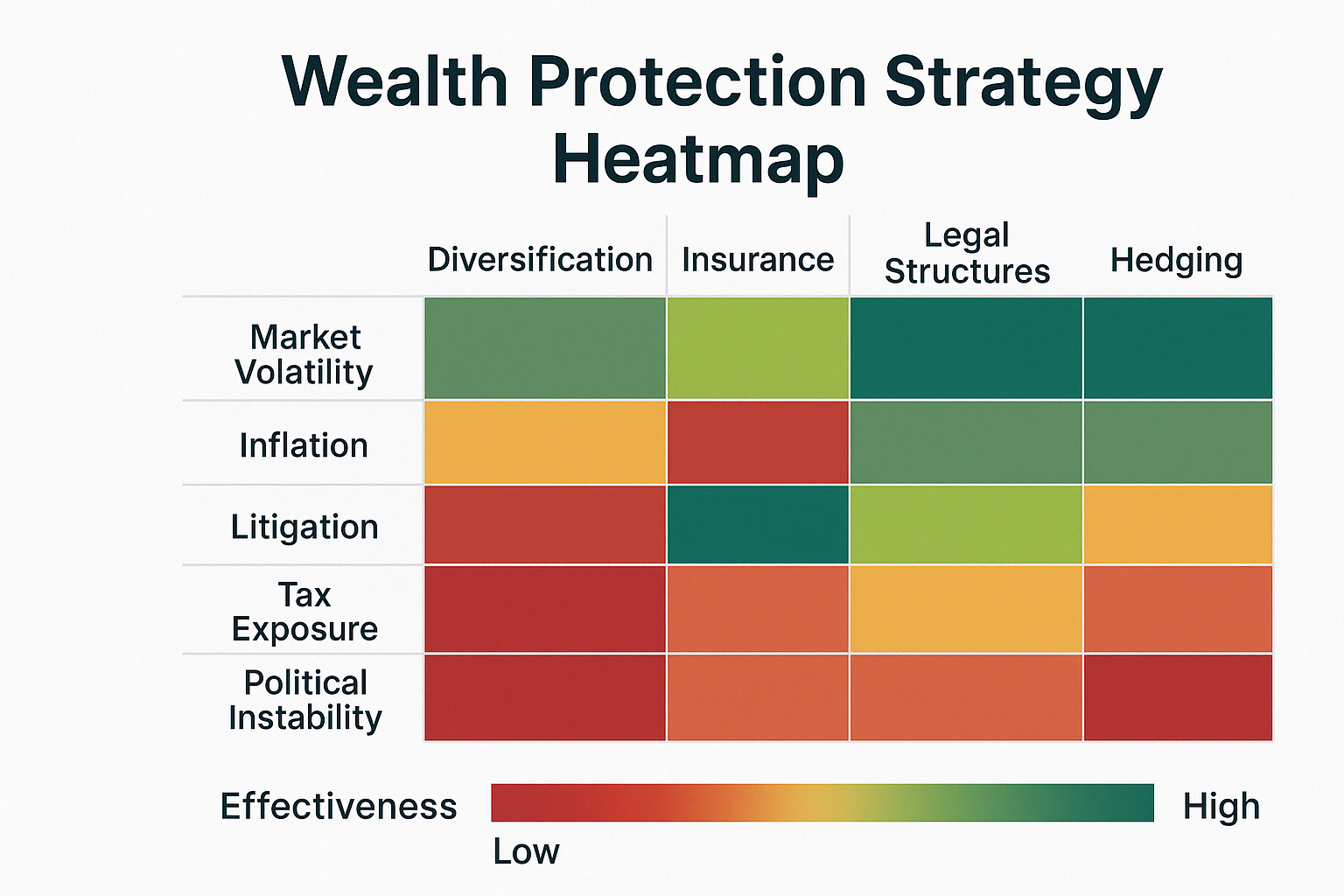

Risk mitigation begins with comprehensive identification of threats to wealth, including market volatility, inflation, taxation, geopolitical instability, litigation, and succession challenges. Each risk category requires distinct protection mechanisms, often working in concert to create multiple layers of defense.

The most sophisticated wealth protection frameworks operate on three levels: strategic asset allocation, tactical defensive positioning, and structural safeguards. This multi-layered approach allows for both offensive wealth growth during favorable conditions and defensive preservation during downturns.

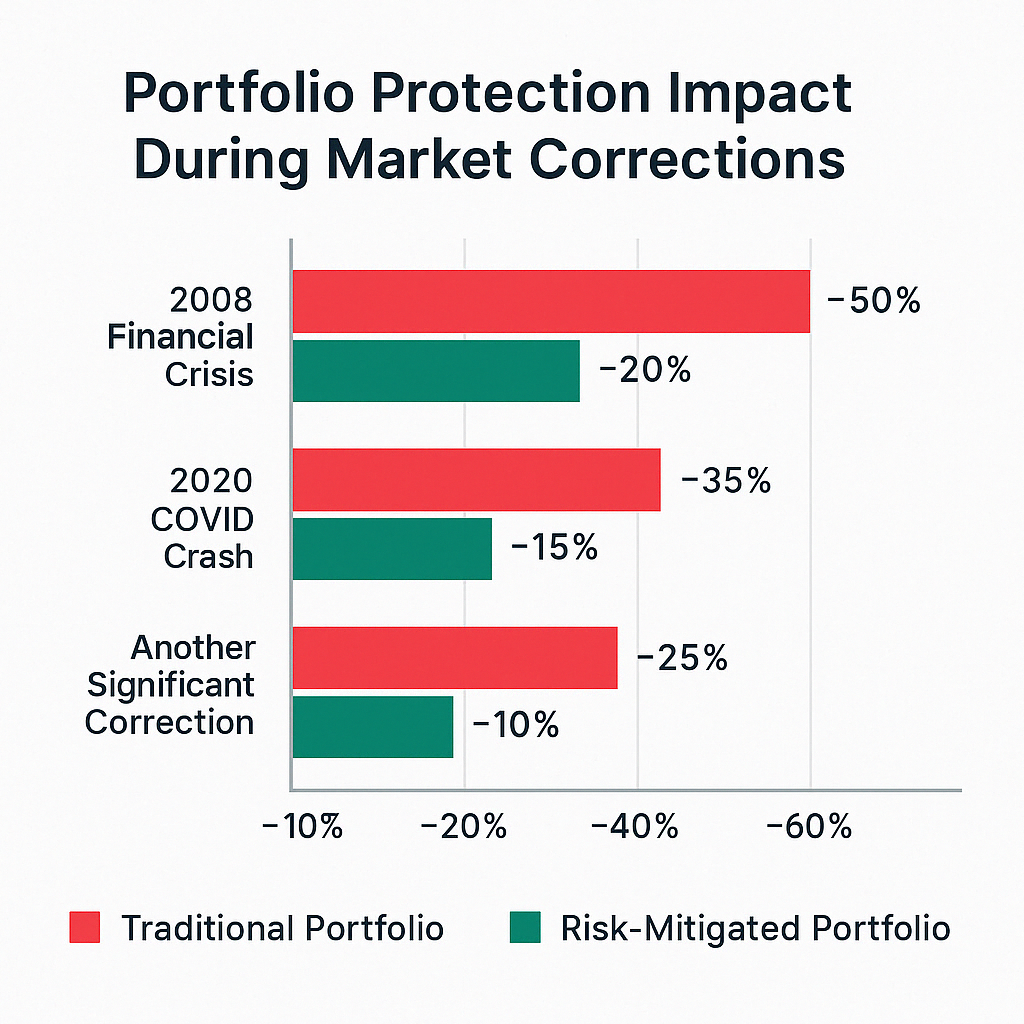

Studies show that properly implemented risk mitigation strategies can reduce portfolio drawdowns by 30-40% during major market corrections while capturing 70-80% of bull market returns. This asymmetric return profile – preserving more capital during downturns while participating in upside – creates substantial long-term wealth advantages through the mathematical power of avoiding deep losses.

For instance, a portfolio that loses 50% must subsequently gain 100% just to break even, while one that limits losses to 20% needs only a 25% gain to recover. This fundamental asymmetry explains why the wealthy focus so intently on downside protection as the foundation of their investment philosophy.

Types of Investment Risk Mitigation Strategies

Diversification Across Asset Classes

True diversification extends far beyond the traditional 60/40 stock-bond allocation. Wealthy investors employ sophisticated asset allocation frameworks that include:

| Asset Category | Typical Allocation Range | Risk Mitigation Benefits |

|---|---|---|

| Public Equities | 20-40% | Growth engine, but carefully sector/factor diversified |

| Fixed Income | 15-30% | Income generation, volatility dampening |

| Alternative Investments | 15-25% | Non-correlation, absolute return potential |

| Private Equity | 10-20% | Illiquidity premium, operational control |

| Real Assets | 10-20% | Inflation protection, cash flow generation |

| Cash/Equivalents | 5-15% | Optionality, opportunity funds |

This diversification extends to sub-asset classes as well. Within equities, for example, allocations are spread across value/growth factors, market capitalizations, geographic regions, and sectors to reduce concentration risk.

Hedging Techniques

Sophisticated investors employ various hedging mechanisms to protect against specific risks:

- Options strategies – Protective puts, covered calls, and collar strategies to limit downside while generating income

- Market-neutral positions – Long/short equity approaches that aim to generate returns regardless of market direction

- Tail risk hedging – Allocating 1-3% of portfolios to instruments that profit from extreme market dislocations

- Currency hedging – Protecting against adverse exchange rate movements, particularly important for international portfolios

Insurance-Based Protection

Beyond traditional diversification, insurance-based structures offer unique wealth protection benefits:

- Private Placement Life Insurance (PPLI) – Custom insurance wrappers allowing tax-advantaged investment in alternative assets

- Captive Insurance Companies – Self-owned insurance entities that combine risk management with tax planning

- Specialty Coverage – Policies addressing specific risks like key person protection, business interruption, or intellectual property

Legal Structures and Jurisdictional Diversification

The ultrawealth employ sophisticated legal frameworks, including:

- Family Limited Partnerships (FLPs) – Offering asset protection and transfer tax benefits

- Various Trust Structures – Including Domestic Asset Protection Trusts (DAPTs), Spousal Lifetime Access Trusts (SLATs), and Irrevocable Life Insurance Trusts (ILITs)

- International Asset Protection – Strategic use of offshore accounts, trusts, and business entities in favorable jurisdictions

Benefits of Investment Risk Mitigation

Wealth Preservation During Market Turbulence

Properly structured risk mitigation strategies have demonstrated remarkable resilience during major market corrections. During the 2008 financial crisis, well-diversified portfolios employing hedging techniques experienced drawdowns of 15-25%, compared to 50%+ for traditional equity-heavy allocations. Similarly, in the March 2020 COVID-induced market crash, portfolios with tactical risk overlays recovered to pre-crisis levels 6-8 months faster than unprotected investments.

Tax Efficiency

Strategic risk mitigation often delivers substantial tax benefits. For example:

- Properly structured insurance solutions can defer or eliminate capital gains taxes

- Asset location strategies across taxable, tax-deferred, and tax-exempt accounts can improve after-tax returns by 0.5-1.2% annually

- Tax-loss harvesting during market downturns can offset gains and provide up to $3,000 in ordinary income offsets annually

Legacy Planning and Intergenerational Wealth Transfer

Risk mitigation frameworks support efficient wealth transfer through:

- Reduced estate tax exposure via properly structured trusts and gifting strategies

- Protection from divorce, creditors, and litigation through appropriate asset titling

- Governance structures that preserve family values and prepare heirs for responsible stewardship

Peace of Mind and Improved Decision Making

Perhaps the most underrated benefit is psychological. Knowing that core wealth is protected allows for:

- Clearer decision-making during market extremes

- Ability to remain invested during volatility rather than panic-selling

- Capacity to deploy capital opportunistically during market dislocations

- Freedom to pursue passion investments or philanthropy with discretionary portions of wealth

Challenges and Risks in Implementation

Complexity and Oversight Requirements

Sophisticated risk mitigation strategies often involve multiple moving parts requiring consistent oversight. Managing complex structures across various advisors, custodians, and jurisdictions presents coordination challenges that must be addressed through integrated wealth management approaches.

Costs and Fee Considerations

Protection mechanisms come with costs including:

- Management fees for specialized alternative investments (typically 1-2% annually)

- Performance fees on certain strategies (often 15-20% of profits)

- Legal and accounting expenses for maintaining complex structures

- Insurance premiums and administration costs

These expenses must be carefully weighed against the protection value received. Studies suggest optimal spending on risk mitigation ranges from 0.75-1.25% of assets annually.

Regulatory and Compliance Risks

The regulatory landscape for sophisticated wealth structures continues to evolve, requiring:

- Regular compliance reviews and updates

- Transparent reporting across jurisdictions

- Adherence to substance requirements in international planning

- Careful navigation of anti-avoidance rules and reporting obligations

Implementation: Creating Your Risk Mitigation Framework

Assessment and Strategy Development

Effective risk mitigation begins with a comprehensive analysis of your current position:

- Risk profiling – Understanding your true risk tolerance, time horizon, and objectives

- Wealth mapping – Cataloging all assets, liabilities, entities, and ownership structures

- Vulnerability identification – Pinpointing specific threats to your wealth based on composition and circumstances

- Priority ranking – Addressing the highest-impact risks first through targeted interventions

Building Your Team

Successful implementation requires specialized expertise:

- Fiduciary financial advisor with expertise in advanced planning

- Estate planning attorney familiar with asset protection strategies

- Tax professional versed in complex structures and international considerations

- Insurance specialist with access to premium carriers and custom solutions

- Trust company or family office for cohesive implementation and administration

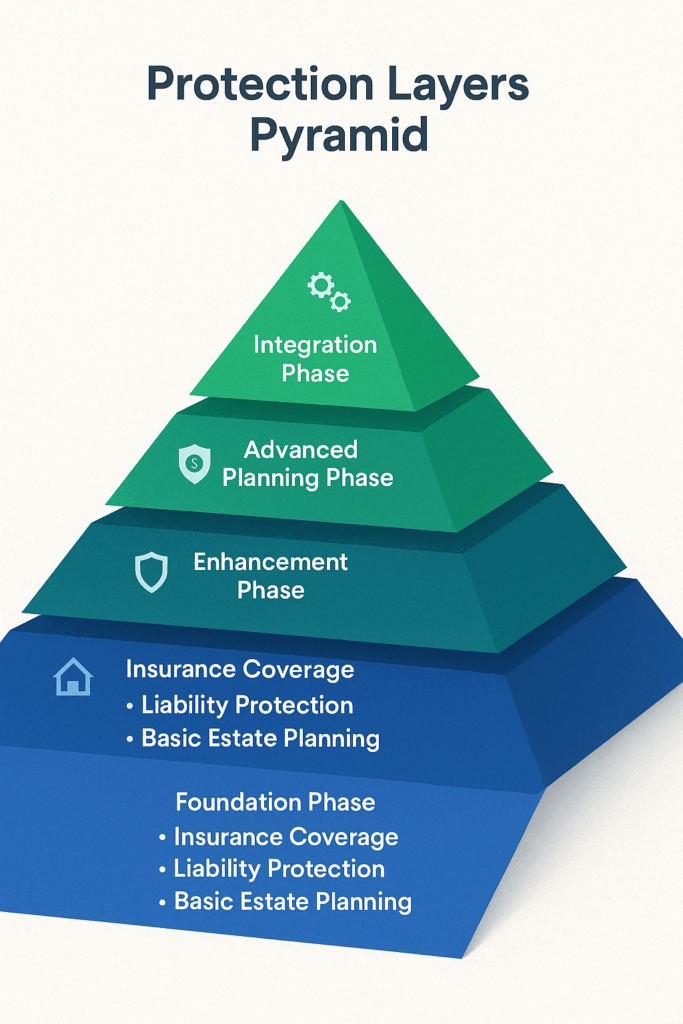

Phased Implementation

Rather than attempting a complete overhaul, a staged approach proves most effective:

- Foundation phase – Establishing core asset allocation and basic protective structures

- Enhancement phase – Adding specialized alternative investments and hedging overlays

- Advanced planning phase – Implementing sophisticated legal and jurisdictional strategies

- Integration phase – Ensuring all components work harmoniously with regular stress-testing

Ongoing Monitoring and Adaptation

Risk mitigation is never “set and forget,” but requires:

- Quarterly performance reviews against appropriate risk-adjusted benchmarks

- Annual stress-testing against various market and economic scenarios

- Biennial comprehensive strategy reviews with your full advisory team

- Continuous adaptation to changing tax laws, regulations, and family circumstances

Future Trends in Wealth Protection

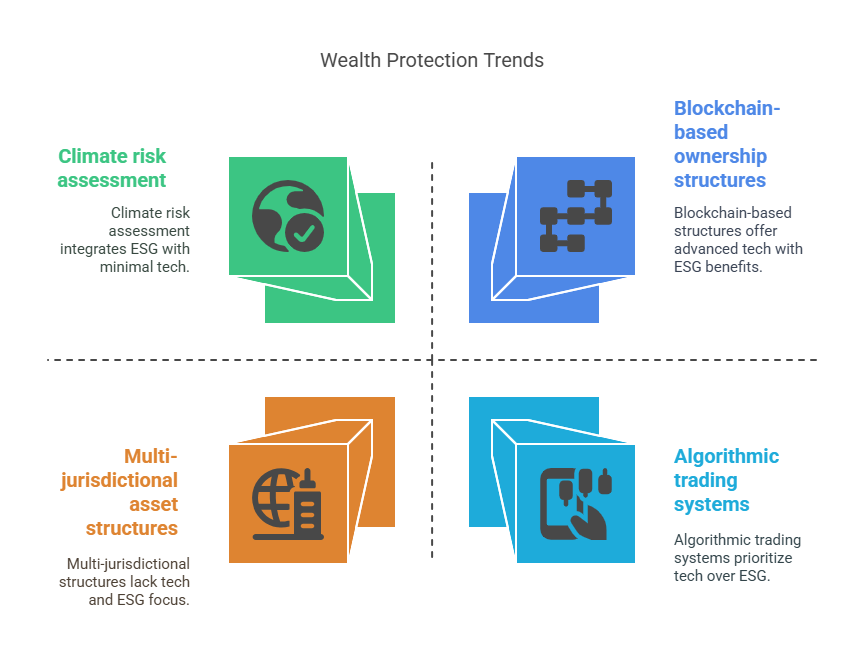

Technological Integration

Advanced analytics and artificial intelligence are transforming risk management through:

- Real-time portfolio stress-testing and simulation capabilities

- Natural language processing to monitor regulatory changes globally

- Algorithmic trading systems that execute hedging protocols automatically

- Blockchain-based ownership structures offering new forms of asset protection

Environmental, Social, and Governance (ESG) Risk Integration

Beyond traditional financial risks, the wealthy increasingly incorporate ESG factors:

- Climate risk assessment across investment portfolios and real assets

- Social impact considerations affecting brand equity and business valuation

- Governance evaluations to identify vulnerability to activist pressures

- Preemptive adaptation to emerging regulatory frameworks

Geopolitical Diversification

Rising global tensions are accelerating trends toward:

- Multi-jurisdictional asset and business structures

- Secondary residency and citizenship programs

- Digital asset allocation as a form of borderless wealth

- Crisis planning for political instability scenarios

FAQs – Investment Risk Mitigation

1. What percentage of their wealth do ultra-high-net-worth individuals typically allocate to investment risk mitigation strategies?

Most individuals with $30+ million in investable assets dedicate 20-35% of their portfolios specifically to protective strategies, including alternative investments with low correlation to traditional markets, hedging positions, and insurance structures. This allocation typically increases with age and total wealth level.

2. How do risk mitigation needs differ between first-generation wealth creators and inheritors?

First-generation wealth creators typically focus on business concentration risk and transition planning, often maintaining higher risk tolerances. Inheritors, by contrast, frequently emphasize preservation, governance structures, and sustainable withdrawal strategies. Studies show family wealth preservation success rates improve by 45% when second-generation members actively participate in risk management education.

3. Are offshore structures still viable for legitimate wealth protection?

Yes, when properly implemented with full tax compliance and reporting. The focus has shifted from secrecy to legitimate asset protection through jurisdictional diversification. Approximately 30% of private wealth exceeding $10 million includes some international component, though structures require substantial “substance” and legitimate business purpose to withstand increasing scrutiny.

4. How can investors with $1-5 million implement strategies similar to the ultra-wealthy?

Scaled versions of sophisticated strategies are increasingly accessible, including:

- Democratized alternative investments with lower minimums ($100,000-250,000)

- Simplified asset protection trusts in favorable domestic jurisdictions

- Multi-asset ETFs that replicate complex hedging strategies

- Pooled insurance structures that provide fractional access to premium coverage

5. What role should digital assets play in a risk mitigation framework?

Digital assets present both opportunities and risks. While crypto assets can offer non-correlation and potential inflation protection, they should typically constitute no more than 1-5% of a conservative risk mitigation framework due to regulatory uncertainty and volatility. More important is understanding blockchain technology’s implications for traditional asset classes and business models.

6. How frequently should risk mitigation strategies be reviewed and adjusted?

Core framework reviews should occur annually at minimum, with tactical adjustments quarterly. Major life events (business sale, inheritance, retirement, relocation) should trigger immediate comprehensive reviews. Market dislocations exceeding 15% should prompt reassessment of hedging positions and rebalancing opportunities.

7. What common mistakes do even sophisticated investors make with investment risk mitigation?

The most frequent errors include:

- Over-complexity leading to implementation gaps

- Strategy siloing rather than an integrated approach

- Performance chasing during bull markets, abandoning protection

- Neglecting tax implications of protection strategies

- Inadequate communication with heirs about the framework design and purpose

8. How do lending and leverage fit into an investment risk mitigation framework?

Strategic leverage can enhance risk-adjusted returns when properly structured. The wealthy typically maintain loan-to-value ratios below 25% on their overall portfolios, utilize fixed-rate structures for 60-80% of borrowing, and ensure liquidity reserves covering at least 12-24 months of debt service. Common implementations include securities-based lending, private banking facilities, and self-directed lending through family entities.

9. What insurance coverages are most overlooked in wealth protection planning?

Beyond standard property and casualty coverage, frequently neglected protections include:

- Director and Officer (D&O) liability for family business interests

- Representation and Warranty insurance for business transitions

- Intellectual property protection for family business assets

- Cyber liability coverage for high-profile families

- Excess liability coverage properly sized to net worth (typically 50-100% of liquid assets)

10. How can behavioral biases be addressed in risk mitigation planning?

Cognitive biases present significant risks to effective wealth protection. Successful strategies include:

- Documented investment policy statements with predefined action triggers

- Third-party decision coaches for major financial decisions

- Regular scenario planning to “pre-experience” market extremes

- Decision journals tracking both processes and outcomes

- Family governance structures requiring consensus for strategy shifts

Conclusion

Effective wealth protection is not about eliminating risk but managing it deliberately across multiple dimensions. By adopting the layered approach favored by the ultra-wealthy – combining strategic diversification, advanced structures, and ongoing vigilance – investors at various levels can meaningfully improve their wealth resilience. The most successful practitioners view risk mitigation not as a defensive afterthought but as the foundation of wealth strategy.

The integration of technology, evolving global tax regimes, and increasing economic uncertainty will continue to reshape the risk mitigation landscape. Those who adapt proactively, maintaining flexibility while adhering to core protection principles, will be best positioned to preserve and grow their wealth across generations and through market cycles.

The true “secret” of the wealthy isn’t any single strategy but rather their comprehensive approach to identifying, quantifying, and systematically addressing the full spectrum of threats to their financial legacy.

For your reference, recently published articles include:

- Trading Strategy Backtesting: The Ultimate Path To Profits

- Investment Decision Support: Best Secrets For Your Success

- Market Intelligence Platforms – All You Need To Know

- Never Lose Money Again: Investment Scenario Analysis Magic

- Unlock Wall Street’s Hidden Financial Modeling Tools Now

- Portfolio Optimization Software: All You Need To Know

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.