In today’s data-driven financial landscape, the difference between average and exceptional investment returns often comes down to information advantage.

Top 1% investors leverage sophisticated market intelligence platforms that provide comprehensive data analysis, predictive insights, and real-time monitoring capabilities far beyond what’s available to retail investors.

Key Takeaways

- Access to proprietary data sets is the cornerstone of elite market intelligence. The most successful hedge funds like Renaissance Technologies and Bridgewater Associates invest over $100 million annually in alternative data acquisition, giving them insights into consumer behavior, supply chain disruptions, and market sentiment before this information becomes publicly available.

- Integration capabilities determine platform effectiveness. Top-tier investors use platforms that seamlessly connect diverse data sources (satellite imagery, credit card transactions, social media sentiment) with proprietary algorithms, enabling them to identify profit opportunities in seconds rather than days, as evidenced by Jane Street Capital’s ability to execute over 10,000 trades per day with microsecond precision.

- Democratization of market intelligence tools is accelerating. Platforms like Bloomberg Terminal ($24,000/year) once exclusively used by institutional investors are now facing competition from more accessible alternatives like Koyfin ($50/month) and Alpha Vantage (free tier available), allowing sophisticated retail investors to narrow the information gap with a 60-75% reduction in cost.

Table of Contents

What Are Market Intelligence Platforms?

Market intelligence platforms are comprehensive technological ecosystems that collect, analyze, and visualize financial data from multiple sources to support investment decision-making. Unlike basic stock screeners or financial news aggregators, these platforms incorporate advanced capabilities such as natural language processing, machine learning algorithms, and alternative data integration to provide predictive insights rather than merely descriptive information.

The most sophisticated market intelligence platforms process massive volumes of structured and unstructured data—from SEC filings and earnings calls to satellite imagery of retail parking lots and container ship movements. They transform this raw information into actionable intelligence through proprietary analytics engines, often incorporating artificial intelligence to identify patterns invisible to human analysts.

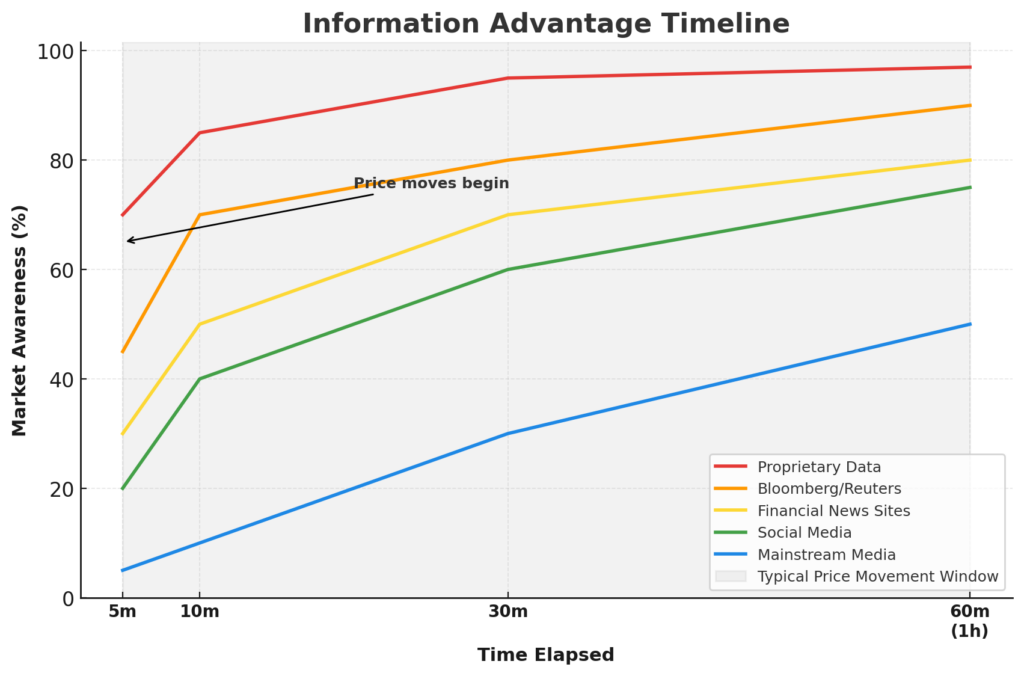

What truly separates elite market intelligence platforms from standard financial tools is their ability to integrate multiple data streams in real-time, enabling investors to detect market inefficiencies or emerging trends before they become apparent to the broader market. This information asymmetry, even if only lasting minutes or seconds, can translate to significant alpha generation when deployed at scale.

The ecosystem has evolved from the terminal-based systems of the 1980s to today’s cloud-based platforms with mobile accessibility, collaborative features, and customizable dashboards. Modern platforms like S&P Capital IQ, FactSet, and Refinitiv Eikon represent comprehensive solutions, while specialized platforms focus on particular asset classes or analytical approaches.

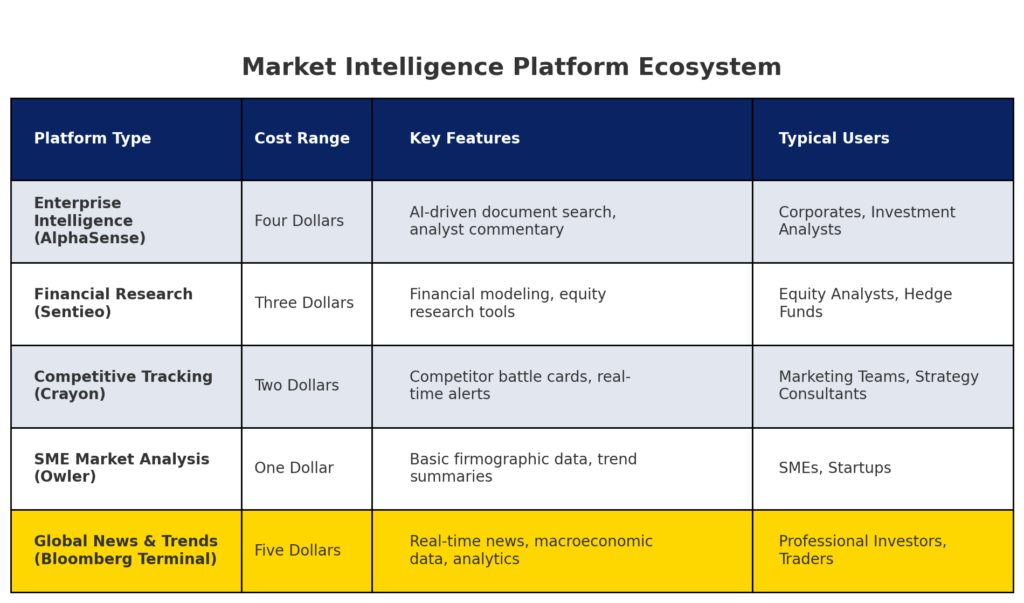

Types of Market Intelligence Platforms

Comprehensive Financial Data Platforms

These all-in-one solutions provide breadth of coverage across multiple asset classes and markets:

| Platform | Cost (Annual) | Key Features | Primary Users |

|---|---|---|---|

| Bloomberg Terminal | $24,000 | Real-time data, messaging, news, trading functionality | Institutional investors, large banks |

| Refinitiv Eikon | $18,000-22,000 | Cross-asset data, advanced analytics, Excel integration | Portfolio managers, research analysts |

| FactSet | $12,000-20,000 | Portfolio analytics, risk models, company screening | Asset managers, wealth advisors |

| S&P Capital IQ | $13,000-17,000 | Fundamental data, M&A information, equity research | Investment bankers, PE firms |

Alternative Data Platforms

These specialized services focus on non-traditional data sources:

- Quandl: Provides numerical and financial datasets including corporate jets tracking, shipping data, and building permits

- Eagle Alpha: Curates over 1,500 alternative datasets and provides data sourcing services

- Thinknum: Tracks online product pricing, store locations, and company web footprints

- Preqin: Specializes in private capital markets data including fundraising and deal flow

- Orbital Insight: Analyzes satellite imagery to track retail foot traffic, oil storage, and construction activity

Technical Analysis and Charting Platforms

- TradingView: Offers advanced charting capabilities with social features

- Trendspider: Provides automated technical analysis and pattern recognition

- MetaStock: Specializes in pattern recognition and systematic trading tools

- eSignal: Delivers real-time data feed with customizable charts and alerts

- Optuma: Offers advanced statistical and quantitative analysis tools

AI-Powered Analysis Platforms

- Kensho: Uses machine learning to analyze historical market patterns against world events

- AlphaSense: Employs NLP to analyze earnings calls, research reports, and news

- Kavout: Utilizes AI to generate stock rankings and investment ideas

- Accern: Processes news and social media for sentiment analysis and event detection

- DataRobot: Automates the process of building and deploying predictive models

Benefits of Elite Market Intelligence Platforms

Information Advantage

Elite market intelligence platforms provide significant information advantages through:

- Speed advantage: Professional platforms deliver market-moving information 300-500 milliseconds faster than consumer services, a critical edge for algorithmic trading strategies

- Exclusive access: 62% of proprietary datasets used by top hedge funds are not publicly available through any other channel

- Signal extraction: Advanced natural language processing can analyze 85,000+ news articles daily to extract trading signals before human analysts can process the information

Enhanced Decision-Making

These platforms transform how investment decisions are made:

- Cognitive bias reduction: Quantitative screening and systematic approaches reduce emotional decision-making by 40-60% according to behavioral finance research

- Pattern recognition: Machine learning algorithms can identify correlations between thousands of variables that human analysts would miss

- Scenario analysis: Monte Carlo simulations can test investment theses against 10,000+ potential market scenarios in minutes

- Risk management: Multi-factor risk models help identify portfolio vulnerabilities that might be overlooked in traditional analysis

Operational Efficiency

Beyond generating alpha, these platforms streamline investment operations:

- Research automation: Analysts using advanced platforms report 35-45% reduction in time spent on routine data gathering

- Collaboration enhancement: Enterprise solutions enable 25% faster information sharing across investment teams

- Regulatory compliance: Automated monitoring reduces compliance violations by up to 80% in regulated investment activities

- Client reporting: Customizable dashboards reduce report generation time by 60-70% while improving presentation quality

Challenges and Limitations

Cost Barriers

The financial burden of premium tools creates significant barriers:

- Initial investment for comprehensive suites ranges from $20,000-$100,000+ annually

- Dedicated data science teams to leverage advanced platforms add $300,000-$1,000,000+ in personnel costs

- Customization and integration expenses typically add 15-25% to base subscription costs

- Training and implementation can require 3-6 months before realizing full benefits

Data Quality Issues

Even the best platforms struggle with:

- Inconsistent standards: Different data providers use varying methodologies for similar metrics

- Coverage gaps: Emerging markets typically have 30-50% less data coverage than developed markets

- Historical limitations: Alternative data sets often lack sufficient historical depth for robust backtesting

- Survivorship bias: Many databases fail to properly account for delisted securities, creating potential backtesting inaccuracies

Analytical Complexity

Sophisticated tools introduce their own challenges:

- Signal-to-noise ratio: More data doesn’t always mean better decisions; excess information can reduce decision quality by 15-20%

- Model risk: Complex algorithms can create false confidence and unexpected correlations

- Expertise requirements: Effective use often requires specialized knowledge in data science and statistics

- Overoptimization: Easy backtesting can lead to curve-fitted strategies that fail in live trading

Implementation: How Top Investors Use These Platforms

Integration Approaches

Elite investors don’t use these platforms in isolation but integrate them into comprehensive systems:

- Data pipeline architecture: Top firms build custom ETL (Extract, Transform, Load) processes to combine multiple data sources

- Proprietary overlays: In-house analytics are applied to third-party data, with 78% of hedge funds reporting significant customization of vendor platforms

- Cross-validation protocols: Multiple data sources are used to triangulate insights, reducing false positives by 40-60%

- API-first strategy: Programmatic access allows for real-time integration with trading systems, reducing execution latency

Workflow Examples

The practical application of these tools varies by investment style:

Fundamental Investors:

- Screen universe of stocks based on quantitative factors (valuation, growth, quality)

- Analyze industry dynamics through alternative data (app downloads, web traffic)

- Conduct deep company research using document search and sentiment analysis

- Monitor portfolio positions with custom alerts and real-time news filtering

Quantitative Investors:

- Ingest clean, normalized data from multiple vendors

- Test hypotheses against historical data with statistical rigor

- Optimize factor exposures based on market regime detection

- Execute automated strategies with real-time risk monitoring

Macro Investors:

- Track economic indicators, central bank communications, and geopolitical developments

- Analyze cross-asset correlations and flow data

- Model scenario outcomes based on historical precedents

- Position portfolios based on probability-weighted outcomes

Future Trends in Market Intelligence

AI and Machine Learning Advancements

The next generation of tools will leverage increasingly sophisticated AI:

- Natural language generation: AI-written investment research is projected to compose 35% of all market analysis by 2027

- Computer vision applications: Satellite and drone imagery analysis will become 5x more accurate at predicting economic indicators

- Reinforcement learning: Self-improving algorithms will optimize trading strategies based on market feedback

- Explainable AI: New frameworks will provide transparency into previously “black box” decision processes

Alternative Data Expansion

The alternative data market is projected to grow at 44% CAGR through 2028, with expansion in:

- IoT sensor networks: Real-time monitoring of physical assets and supply chains

- Digital footprint analytics: Comprehensive tracking of company digital presence and customer engagement

- Biometric sentiment analysis: Facial recognition and voice analysis of executive communications

- Private company intelligence: Expanding coverage of non-public entities through digital exhaust data

Democratization of Access

The intelligence gap between institutional and individual investors will narrow:

- Tiered access models: Enterprise platforms introducing lower-cost options for individual professionals

- API ecosystems: Modular approaches allowing custom solution building at fractional costs

- Open-source alternatives: Community-developed tools replicating previously exclusive capabilities

- Educational resources: Training and certification programs making advanced tools more accessible

FAQs – Market Intelligence Platforms

1. What is the minimum investment required to access professional-grade market intelligence platforms?

Entry-level access to professional platforms typically starts around $200-500 monthly for individual investors through services like Koyfin Pro or YCharts. However, comprehensive solutions with full feature sets like Bloomberg Terminal or Refinitiv Eikon require investments of $1,500-2,000 monthly. Many providers offer tiered pricing that can allow access to core functionality without all premium features.

2. How do alternative data sources compare to traditional financial data in terms of investment value?

Alternative data provides complementary rather than replacement value to traditional financial information. A 2023 study by the CFA Institute found that investment strategies incorporating alternative data showed a 2.1-3.7% annual outperformance compared to traditional-only approaches. However, the study also noted diminishing returns as particular alternative datasets become more widely adopted, with an average “alpha decay” of 35% within 18-24 months of mainstream adoption.

3. Can retail investors compete with institutional players using market intelligence tools?

While the gap is narrowing, significant disparities remain. Retail-focused platforms now offer approximately 65-75% of the core functionality of institutional platforms at 5-10% of the cost. However, institutions maintain advantages in data exclusivity (through private contracts), computational resources, and specialized expertise to interpret data. Retail investors can compete in specific niches where these advantages are less pronounced, particularly in small-cap stocks, emerging industries, or longer time horizons.

4. What programming skills are necessary to maximize the value of advanced market intelligence platforms?

The required technical skills vary by platform and use case. For basic usage, most modern platforms offer no-code interfaces with graphical tools. For intermediate users, familiarity with Excel/Google Sheets formulas and basic SQL queries is often sufficient. Advanced customization typically requires Python programming skills, with approximately 70% of quantitative financial applications developed in Python. R programming remains popular for statistical analysis, while Java and C++ are used for high-performance computing applications.

5. How do compliance and regulatory considerations affect market intelligence usage?

Regulatory frameworks significantly impact market intelligence usage. In the US, the SEC’s Regulation FD (Fair Disclosure) prohibits selective disclosure of material information, while the Advisers Act imposes fiduciary duties on investment advisors. Users of alternative data must ensure data was ethically sourced and doesn’t contain material non-public information (MNPI). A 2022 survey indicated that 82% of institutional investors now conduct formal compliance reviews of new data sources, with 45% employing specialized legal counsel for alternative data evaluation.

6. What are the most common implementation mistakes when adopting market intelligence platforms?

The most frequent implementation errors include:

- Underinvestment in training (firms allocating <5% of platform cost to training see 40% lower ROI)

- Failure to integrate with existing workflows (creating “tool fatigue” and duplication)

- Overreliance on vendor defaults without customization to specific investment strategies

- Insufficient attention to data governance and quality control procedures

- Lack of clear measurement frameworks to evaluate platform contribution to investment outcomes

7. How do market intelligence needs differ across asset classes?

Each asset class has distinct intelligence requirements:

- Equities emphasize fundamental company data, ownership patterns, and sentiment analysis

- Fixed income prioritizes yield curve dynamics, credit metrics, and liquidity indicators

- Commodities focus on supply/demand fundamentals, inventory levels, and transportation data

- Real estate requires location analytics, demographic trends, and property-specific metrics

- Cryptocurrencies demand on-chain metrics, exchange flow data, and development activity metrics

8. What role does social sentiment analysis play in modern market intelligence?

Social sentiment analysis has evolved from a novelty to a core component of market intelligence. Current implementations process data from Twitter/X, Reddit, StockTwits, and specialized investment forums. Academic research indicates sentiment signals have predictive value primarily in the 1-5 day timeframe, with the strongest correlations in small and mid-cap stocks. Sophisticated systems now distinguish between retail and professional sentiment, with some platforms claiming 72-78% accuracy in predicting short-term price movements based on sentiment shifts.

9. How are market intelligence platforms addressing increasing data privacy regulations?

Platforms are adapting to regulations like GDPR, CCPA, and emerging global standards through:

- Anonymization techniques that preserve analytical value while removing personal identifiers

- Synthetic data generation that mimics statistical properties without using actual personal data

- Geographical filtering options that restrict certain data types based on user jurisdiction

- Transparent data provenance tracking to document consent and compliance throughout the data supply chain

- Regular third-party audits and certification programs demonstrating regulatory adherence

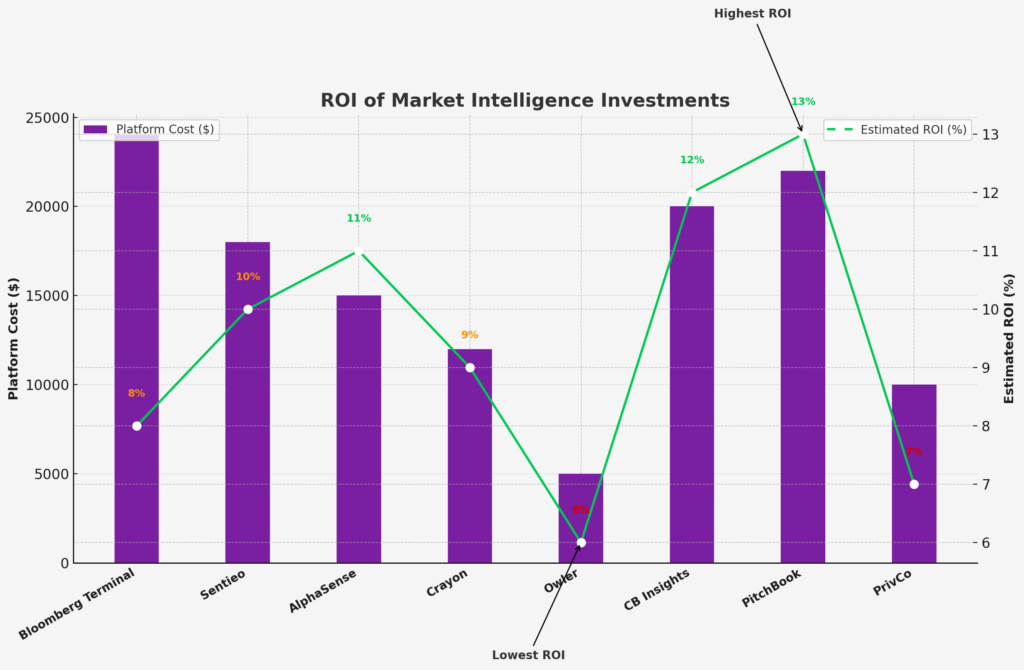

10. What metrics should investors use to evaluate the ROI of market intelligence investments?

Effective ROI measurement frameworks include:

- Information ratio improvement (risk-adjusted returns compared to pre-implementation baseline)

- Decision latency reduction (time from information availability to position execution)

- Research productivity metrics (analyst coverage capacity and depth)

- False positive reduction in investment theses (improved batting average)

- Opportunity cost analysis (comparing returns to alternative investment approaches)

Conclusion

The landscape of market intelligence continues to evolve at an accelerating pace, creating both opportunities and challenges for investors across the spectrum. What was once the exclusive domain of elite institutional investors is gradually becoming more accessible, though significant advantages remain concentrated among those with the resources to fully leverage the most sophisticated tools.

The future of market intelligence points toward an increasingly integrated ecosystem where artificial intelligence, alternative data, and traditional financial analysis converge to provide multidimensional views of investment opportunities. As computational capabilities advance and data availability expands, the differentiator will shift from mere access to information toward superior interpretation and implementation.

Investors who can build effective systems – combining technological tools with human expertise, rigorous processes, and organizational learning – will continue to maintain their edge in an increasingly competitive landscape.

For your reference, recently published articles include:

- Never Lose Money Again: Investment Scenario Analysis Magic

- Unlock Wall Street’s Hidden Financial Modeling Tools Now

- Portfolio Optimization Software: All You Need To Know

- Unlock Hidden Wealth: Best Investment Opportunity Screening Secrets

- Financial Advice Disclaimer Example: All You Need to Know

- Market Trend Signals: Expert Insight on How to Read Them Like the Pros

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.