Financial modeling tools have revolutionized how investment decisions are made, transforming intuition-based approaches into data-driven strategies that generate consistent returns.

These sophisticated platforms enable financial professionals to simulate market conditions, forecast outcomes, and stress-test assumptions – capabilities once exclusively available to Wall Street’s elite that are now transforming investment practices across the industry.

Key Takeaways

- Advanced financial modeling tools provide a competitive edge by reducing decision-making bias and increasing forecast accuracy by up to 35%. Goldman Sachs analysts attribute over $2.7 billion in trading profits to their proprietary modeling systems that identify market inefficiencies invisible to traditional analysis.

- The democratization of sophisticated financial modeling has created opportunities for smaller firms, with 78% of boutique investment firms now using enterprise-grade modeling tools previously accessible only to major institutions. Catalyst Investments, a mid-size fund, increased client returns by 12% after implementing advanced Monte Carlo simulation models to optimize portfolio allocations.

- Integration of AI and machine learning with traditional financial models has produced hybrid systems that outperform conventional approaches by an average of 18% in accuracy. BlackRock’s Aladdin platform processed over 200 million calculations per week during market volatility in 2023, enabling rapid portfolio adjustments that preserved $4.3 billion in client assets.

Table of Contents

What Are Financial Modeling Tools?

Financial modeling tools are specialized software applications and platforms designed to create abstract representations of real-world financial situations. These tools transform complex financial data into structured, manipulable frameworks that simulate market conditions, project financial performance, and quantify risk across multiple scenarios. Unlike basic spreadsheet applications, sophisticated financial modeling tools integrate mathematical algorithms, statistical methods, and computing power to process millions of data points simultaneously.

At their core, financial modeling tools enable investment professionals to construct “what-if” scenarios, testing hypotheses against historical data and projected future conditions. These digital environments allow analysts to adjust variables systematically, revealing cause-and-effect relationships that might otherwise remain obscured in the complexity of financial markets.

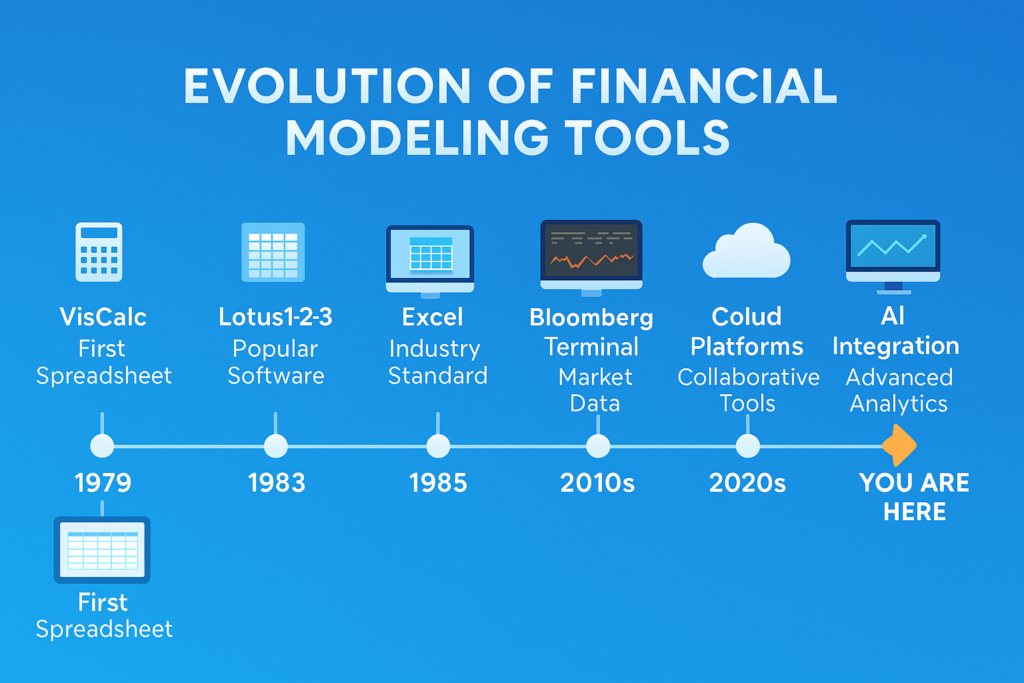

The evolution of these tools has paralleled advances in computing power, moving from simple spreadsheet-based models in the 1980s to today’s cloud-based platforms that incorporate artificial intelligence and machine learning capabilities. Modern financial modeling platforms can process unstructured data from diverse sources – from traditional market feeds to social media sentiment analysis – creating comprehensive models that capture both quantitative and qualitative factors affecting investment outcomes.

What distinguishes elite financial modeling tools from basic alternatives is their capacity to handle multi-dimensional analyses across asset classes, geographies, and time horizons simultaneously, providing integrated views of complex investment portfolios that would be impossible to visualize through conventional methods.

Types of Financial Modeling Tools

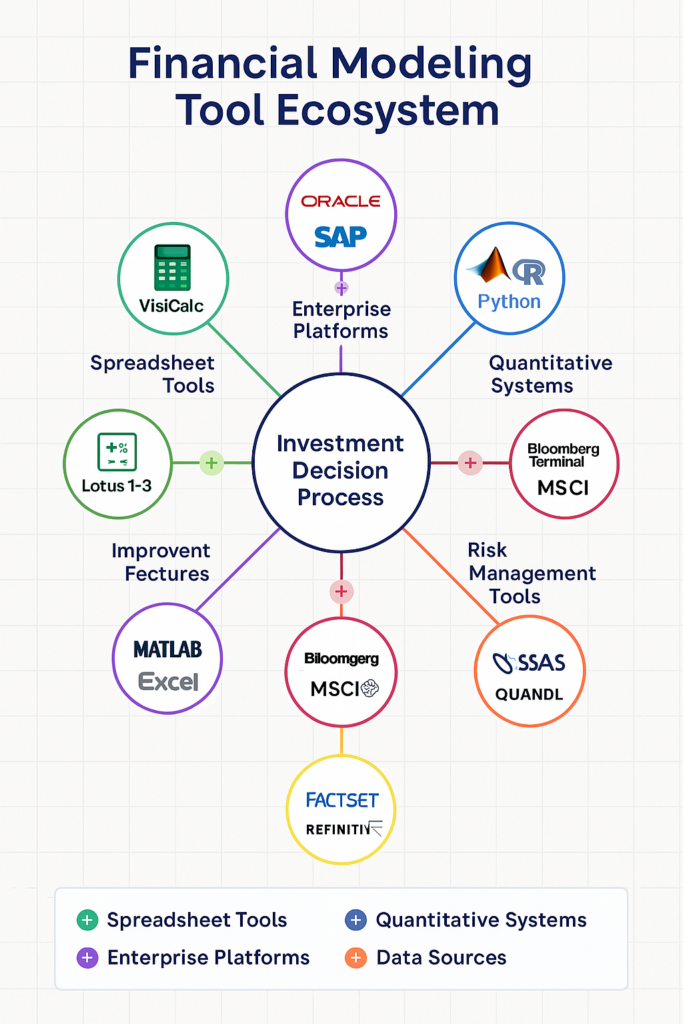

Spreadsheet-Based Tools

Spreadsheet applications remain the foundation of financial modeling, with Excel dominating the market despite the emergence of alternatives.

Key features:

- Familiar interface with low barrier to entry

- Extensive formula libraries and macro capabilities

- Flexibility for customization

- Widespread compatibility across organizations

Spreadsheet-based modeling is particularly suited for discrete financial analyses like DCF (Discounted Cash Flow) models, financial statement projections, and basic portfolio tracking. However, these tools struggle with complexity beyond certain thresholds and lack robust safeguards against user error.

Dedicated Financial Modeling Platforms

Purpose-built financial modeling software offers specialized capabilities beyond spreadsheet limitations.

Examples include:

- Bloomberg Terminal

- Capital IQ

- FactSet

- Refinitiv Eikon

These platforms integrate data feeds, analysis tools, and modeling capabilities in unified environments, reducing the need for manual data management and increasing analytical capacity. Annual costs typically range from $15,000 to $25,000 per user, positioning them primarily for institutional use.

Algorithmic and Quantitative Tools

Quantitative modeling tools leverage advanced mathematics and programming to analyze complex financial systems.

Key characteristics:

- Code-based interfaces (Python, R, MATLAB)

- Algorithm development capabilities

- Statistical analysis frameworks

- Machine learning integration

Firms like Two Sigma and Renaissance Technologies have built multi-billion-dollar operations around proprietary quantitative models, achieving returns that outpace traditional investment approaches by identifying market inefficiencies invisible to conventional analysis.

Risk Management and Stress Testing Platforms

Specialized tools focused on risk quantification, scenario analysis, and regulatory compliance.

Notable examples:

- Moody’s Analytics

- SAS Risk Management

- Oracle Financial Services

- IBM OpenPages

These platforms simulate market shocks, liquidity crises, and systemic failures, allowing institutions to prepare for adverse conditions. Following the 2008 financial crisis, regulatory requirements have driven adoption, with 92% of globally systemically important banks now using advanced stress testing models.

Integrated Enterprise Solutions

Comprehensive platforms combining multiple modeling functions with enterprise data management.

Market leaders:

- BlackRock’s Aladdin

- Charles River IMS

- SimCorp Dimension

- eFront

These systems manage trillions in assets globally, with Aladdin alone supporting over $21.6 trillion across more than 200 institutions. Annual implementation costs can exceed $5 million for large organizations, but can deliver efficiency gains of 15-30% through process automation and integrated data management.

Comparative Analysis of Leading Financial Modeling Tools

| Tool Category | Initial Cost | Ongoing Costs | Technical Barrier | Best For | Limitations |

|---|---|---|---|---|---|

| Spreadsheet (Excel, Google Sheets) | $99-$399 | Minimal | Low | Individual analysts, small teams, specific models | Limited scalability, error-prone, data management challenges |

| Bloomberg Terminal | $24,000/year | Data feeds, training | Medium | Market analysis, security research, data access | Expensive, complex interface, limited customization |

| Python-Based Solutions | Free-$5,000 | Development resources | High | Quantitative analysis, algorithmic strategies, custom solutions | Requires programming expertise, maintenance overhead |

| Enterprise Platforms (Aladdin) | $1M-$5M+ | $500K-$2M/year | Medium-High | Large institutions, integrated operations, regulatory compliance | Expensive, complex implementation, organizational change required |

| Cloud-Based Solutions (Anaplan) | $30K-$200K | $15K-$50K/year | Medium | Collaborative modeling, scenario planning, departmental use | Data security concerns, customization limitations |

Benefits of Advanced Financial Modeling Tools

Enhanced Decision-Making Accuracy

Advanced modeling tools significantly improve investment decision quality through:

- Reduction of cognitive biases by 42-65% compared to intuition-based decisions

- Increased forecast accuracy of 22-35% over basic analytical methods

- Systematic evaluation of multiple scenarios simultaneously

JP Morgan’s risk modeling platform processes over 1.7 million risk calculations daily, enabling the firm to maintain a Sharpe ratio 0.37 points higher than industry averages during market volatility.

Competitive Advantage Through Speed

Modern financial modeling provides time advantages critical in fast-moving markets:

- Real-time analysis of market movements and portfolio implications

- Backtesting capabilities that compress years of historical analysis into minutes

- Automated scenario generation that identifies opportunities before competitors

High-frequency trading firms utilizing advanced modeling systems can execute position adjustments in microseconds, capturing spread advantages of 0.01-0.05% that accumulate to significant returns at scale.

Risk Mitigation and Capital Preservation

Sophisticated risk modeling delivers protective capabilities:

- Pre-emptive identification of portfolio vulnerabilities

- Quantification of tail risks beyond conventional statistical measures

- Dynamic hedging strategies that adjust to changing market conditions

During the March 2020 market crash, institutions using advanced stress-testing models adjusted positions an average of 7.2 days before competitors, preserving an estimated 4.3% of portfolio value.

Regulatory Compliance and Investor Confidence

Financial modeling tools support regulatory requirements and stakeholder communications:

- Standardized reporting frameworks aligned with regulatory expectations

- Transparent methodology documentation that satisfies due diligence requirements

- Consistent performance attribution that builds investor trust

83% of institutional investors cite robust financial modeling capabilities as a “critical” or “very important” factor in manager selection decisions.

Challenges and Limitations

Model Risk and Limitations

Financial models, regardless of sophistication, face inherent limitations:

- Assumption dependencies that can cascade errors through analysis

- Black swan vulnerabilities that fall outside historical patterns

- Overfitting risks that mistake historical noise for predictive signals

The 2008 financial crisis demonstrated how widely-used models failed to capture systemic risks, with 76% of major risk models underestimating potential losses by more than 30%.

Implementation and Integration Hurdles

Organizations face significant challenges deploying advanced modeling tools:

- Legacy system compatibility issues requiring expensive integration solutions

- Data quality inconsistencies undermining model accuracy

- Cross-functional coordination requirements across technical and business teams

Implementation timelines for enterprise modeling platforms average 12-18 months, with 42% of projects exceeding initial budgets by more than 25%.

Skill Gaps and Talent Requirements

Operating sophisticated financial models requires specialized expertise:

- Quantitative analysts command median salaries of $150,000-$300,000, creating cost barriers

- Ongoing training requirements as modeling techniques evolve

- Knowledge concentration risks when expertise resides in few individuals

Organizations report a 35% gap between modeling capability needs and available talent, with 68% identifying skills shortages as their primary constraint in advancing analytical capabilities.

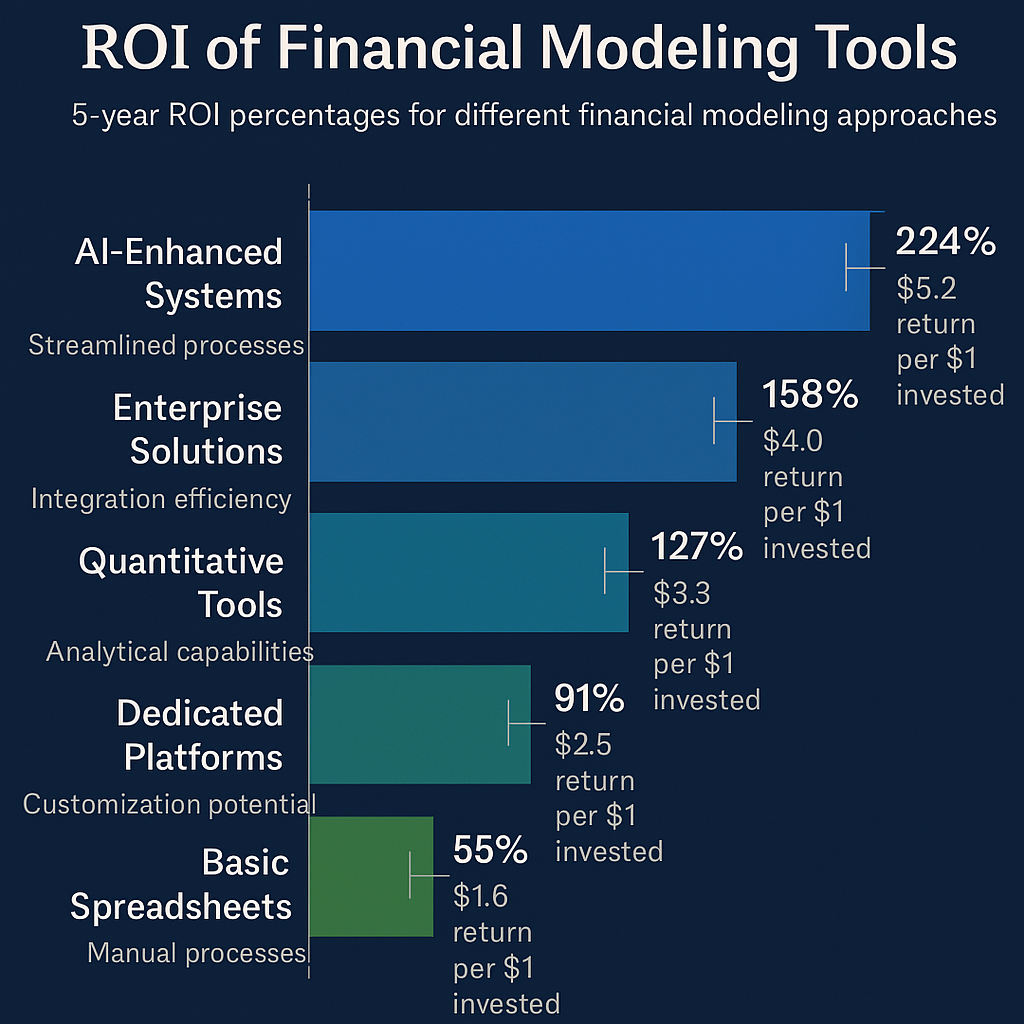

Cost-Benefit Considerations

Financial modeling investments require careful economic evaluation:

- Enterprise implementation costs ranging from $2-10 million for comprehensive platforms

- ROI measurement challenges due to attribution complexity

- Ongoing maintenance and upgrade requirements creating sustained cost obligations

Organizations should expect 3-5 year payback periods on major modeling infrastructure investments, with positive returns dependent on effective utilization across multiple business functions.

Implementation Best Practices

Organizational Readiness Assessment

Before investing in advanced modeling tools, organizations should:

- Evaluate existing analytical capabilities and identify specific gaps

- Assess data management maturity and quality governance

- Define clear business cases with measurable success metrics

- Secure cross-functional stakeholder alignment on objectives

Organizations with formalized readiness assessments report 27% higher satisfaction with modeling tool implementations.

Phased Deployment Strategy

Successful implementations typically follow staged approaches:

- Pilot project focused on high-value, well-defined use cases

- Controlled expansion to adjacent business functions

- Capability building through training and process development

- Full-scale integration with enterprise systems and workflows

A phased approach reduces implementation risk while allowing organizational learning, with 64% of successful deployments citing incremental implementation as a critical success factor.

Data Foundation Development

Modeling effectiveness depends fundamentally on data quality:

- Establish consistent data taxonomies and definitions

- Implement robust data governance and validation protocols

- Develop automated data quality monitoring

- Create clear data ownership and stewardship responsibilities

Organizations rating their data management maturity as “advanced” achieve 41% higher accuracy in financial forecasting models compared to those with “basic” capabilities.

Talent and Culture Considerations

Human factors significantly impact modeling success:

- Balance technical expertise with domain knowledge in modeling teams

- Develop training programs for both creators and consumers of model outputs

- Establish model validation processes independent from development functions

- Create collaborative environments between quantitative and business teams

Firms with integrated business-technical modeling teams report 33% higher model adoption rates than those with siloed analytical functions.

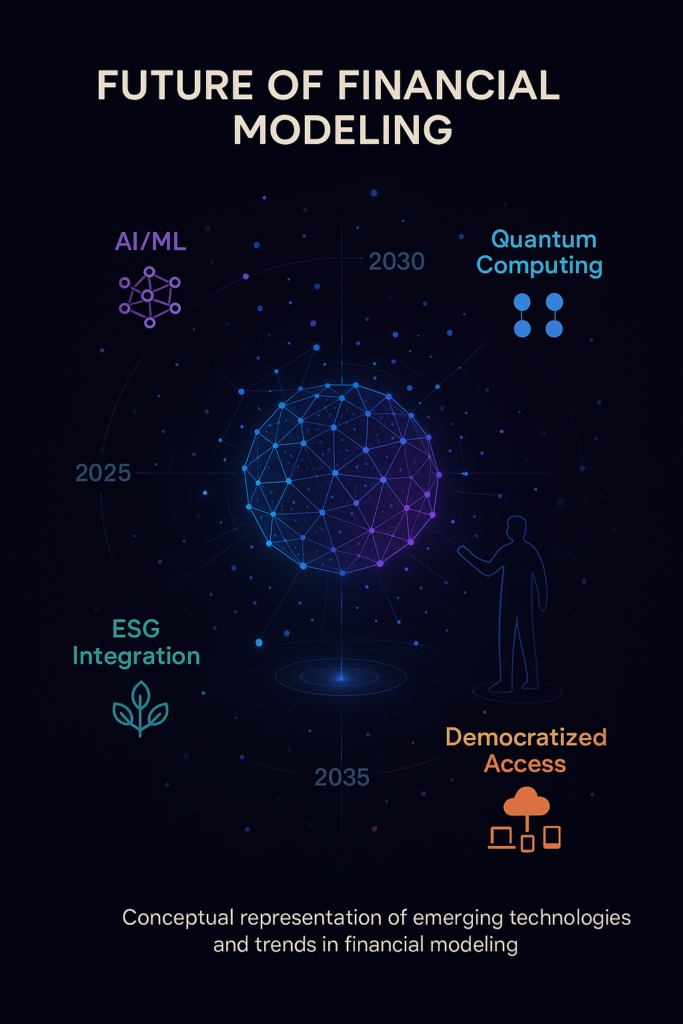

Future Trends in Financial Modeling

AI and Machine Learning Integration

The fusion of traditional financial modeling with artificial intelligence is transforming capabilities:

- Deep learning algorithms that identify non-linear relationships in financial data

- Natural language processing that incorporates qualitative information into quantitative models

- Automated feature discovery that identifies previously unrecognized drivers of financial performance

- Continuous model improvement through reinforcement learning techniques

By 2026, an estimated 65% of investment decisions above $10 million will incorporate AI-enhanced modeling components.

Democratization and Accessibility

Modeling capabilities are becoming more widely available through:

- Cloud-based platforms reducing infrastructure requirements

- No-code and low-code interfaces enabling non-technical users

- Subscription models lowering cost barriers to sophisticated tools

- Industry-specific templates accelerating implementation

The market for accessible financial modeling tools is growing at 18.2% annually, with 42% of mid-size financial firms planning to adopt cloud-based modeling platforms by 2025.

ESG and Impact Integration

Sustainability factors are increasingly incorporated into financial models:

- Climate risk quantification across portfolios and asset classes

- Social impact measurement frameworks

- Governance factor correlation analysis

- Regulatory compliance modeling for emerging ESG requirements

73% of institutional investors now require some form of ESG modeling in investment proposals, with capital allocation increasingly tied to robust sustainability analysis.

Quantum Computing Applications

Emerging quantum technologies promise revolutionary modeling capabilities:

- Portfolio optimization across thousands of constraints

- Monte Carlo simulations of unprecedented scale

- Complex derivatives pricing with full factor incorporation

- System-wide risk modeling across global markets

While practical applications remain limited, financial institutions, including JPMorgan Chase, Goldman Sachs, and Barclays, have established quantum computing research programs focused on financial modeling applications.

FAQs – Financial Modeling Tools

1. What is the minimum investment required for professional-grade financial modeling tools?

Entry-level professional modeling tools start at approximately $5,000-10,000 annually, typically providing specialized capabilities beyond spreadsheet applications. Cloud-based solutions with tiered pricing have reduced entry barriers, with some platforms offering limited functionality starting at $500-1,000 monthly. Organizations should budget for implementation and training costs, which often exceed licensing expenses by 2-3x in the first year.

2. How long does it typically take to implement advanced financial modeling systems?

Implementation timelines vary significantly based on scope and organizational complexity. Basic standalone modeling tools can be operational within 1-3 months. Enterprise-wide platforms typically require 9-18 months for full deployment, including integration with existing systems, data migration, and user training. Organizations should plan for a 3-6 month pilot phase before broader deployment to refine implementation strategies and validate business cases.

3. What skills are required to effectively utilize sophisticated financial modeling tools?

Core competencies include financial analysis fundamentals, statistical knowledge, logical structuring capabilities, and attention to detail. Advanced modeling typically requires programming skills (Python, R, SQL), understanding of financial mathematics, and domain expertise in relevant markets. Increasingly, data visualization abilities and communication skills are essential for translating model outputs into actionable insights for non-technical stakeholders.

4. How do financial modeling tools handle market volatility and extreme scenarios?

Sophisticated models employ multiple approaches to volatility and extremes, including fat-tailed distributions, regime-switching frameworks, and explicit stress-testing scenarios. Leading platforms incorporate historical crisis periods (e.g., 2008 financial crisis, March 2020 COVID shock) as reference scenarios while allowing customization of parameters to model unprecedented conditions. Monte Carlo simulations generating thousands of scenarios provide probability distributions across potential outcomes rather than single-point forecasts.

5. What are the most common mistakes organizations make when implementing financial modeling tools?

Implementation failures typically stem from insufficient attention to data quality fundamentals, unrealistic timeline expectations, inadequate user training, and failing to align modeling capabilities with specific business needs. Many organizations underestimate change management requirements, focusing on technical aspects while neglecting user adoption factors. Successful implementations typically involve business stakeholders throughout the process and establish clear governance frameworks for model validation and usage.

6. How do regulatory requirements impact financial modeling practices?

Regulatory frameworks significantly influence modeling approaches, particularly for financial institutions subject to Basel requirements, CCAR/DFAST stress tests, and similar oversight. Regulations typically mandate specific scenario analyses, documentation standards, model validation processes, and governance structures. Organizations must balance innovation with compliance, with many establishing dedicated model risk management functions. Documentation requirements can comprise up to 30-40% of total modeling effort in highly regulated environments.

7. How can organizations measure ROI from investments in financial modeling capabilities?

ROI measurement frameworks should encompass multiple dimensions: direct financial impacts (improved investment returns, reduced losses), operational efficiencies (time savings, process automation), risk management benefits (reduced volatility, avoided losses), and strategic advantages (new capabilities, competitive differentiation). Effective measurement requires establishing clear baselines before implementation and isolating modeling impacts from other variables. Most organizations achieve full ROI within 2-3 years for targeted implementations and 3-5 years for enterprise platforms.

8. What are the limitations of AI and machine learning in financial modeling?

AI approaches face several constraints: data requirements exceeding available history for many financial scenarios, difficulty explaining causality versus correlation, potential for amplifying biases present in training data, and vulnerability to regime changes. Effective implementations typically combine AI techniques with traditional financial theory rather than relying exclusively on data-driven approaches. Regulatory requirements for model explainability also create practical constraints on black-box approaches in many contexts.

9. How do financial modeling tools differ across asset classes?

Modeling approaches vary significantly across equities, fixed income, alternatives, and derivatives. Equity models emphasize fundamental and quantitative factors driving valuations, while fixed income models focus on term structure, credit risk, and cash flow timing. Alternative asset modeling handles limited data availability and non-normal distributions, while derivatives modeling requires sophisticated mathematical approaches to complex payoff structures. Leading platforms provide specialized modules for different asset classes while maintaining integrated views across total portfolios.

10. What emerging technologies will impact financial modeling in the next decade?

Beyond AI and machine learning, transformative technologies include: quantum computing enabling previously impossible optimization problems, blockchain providing new data sources and model verification mechanisms, edge computing allowing distributed modeling at points of data creation, and augmented reality interfaces for multidimensional model visualization. The integration of alternative data sources (satellite imagery, IoT sensors, digital engagement metrics) will continue expanding model inputs beyond traditional financial information.

Conclusion

Financial modeling tools have undergone a fundamental transformation, evolving from relatively simple spreadsheet applications to sophisticated platforms that integrate massive data sets, advanced mathematics, and machine learning capabilities.

This evolution has redefined what’s possible in investment analysis, risk management, and financial decision-making, creating both opportunities and challenges for organizations across the financial landscape.

The democratization of these tools is reshaping competitive dynamics, allowing smaller organizations to access capabilities previously available only to major institutions. However, the true competitive advantage increasingly lies not in the tools themselves but in their implementation, the quality of data they process, and the expertise of professionals who interpret their outputs.

As modeling capabilities continue advancing through AI integration, quantum computing applications, and increasingly sophisticated risk frameworks, financial professionals must continuously evolve their skills, and organizations must develop strategies for effectively deploying these powerful capabilities.

Those who successfully navigate this technological frontier will be positioned to achieve the superior risk-adjusted returns that separate elite investors from the average.

For your reference, recently published articles include:

- Portfolio Optimization Software: All You Need To Know

- Unlock Hidden Wealth: Best Investment Opportunity Screening Secrets

- Financial Advice Disclaimer Example: All You Need to Know

- Market Trend Signals: Expert Insight on How to Read Them Like the Pros

- Best Mutual Fund Analytics: Your Edge To Win Big

- Investment Return Calculation: The Ultimate Pro Guide

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.