Mutual fund analytics represents the sophisticated quantitative and qualitative assessment methodologies used to evaluate fund performance, risk characteristics, and management quality. In today’s increasingly complex financial landscape, mastering these analytical techniques has become essential for investors seeking to identify the minority of funds that consistently outperform their benchmarks and peers.

Key Takeaways

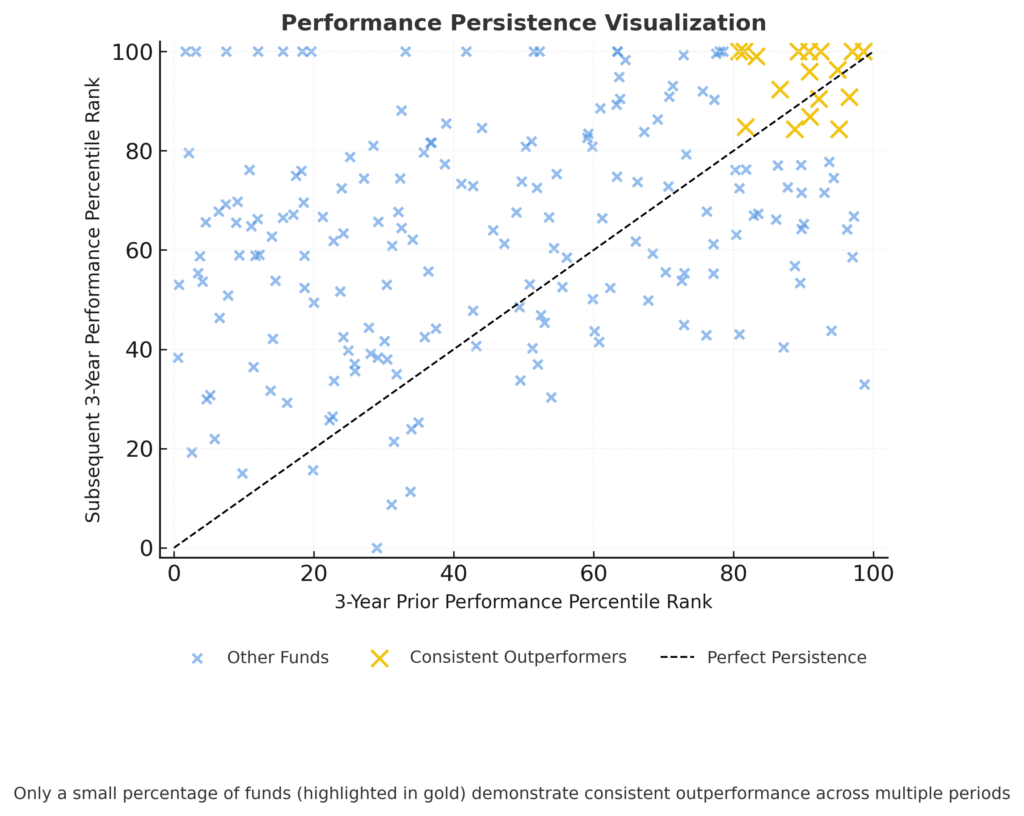

- Only 5-10% of actively managed mutual funds consistently outperform their benchmarks over 10+ year periods, with data from S&P Dow Jones Indices showing that 95.73% of large-cap funds underperformed the S&P 500 over a 20-year timeframe, making advanced analytics critical for identifying true outperformers.

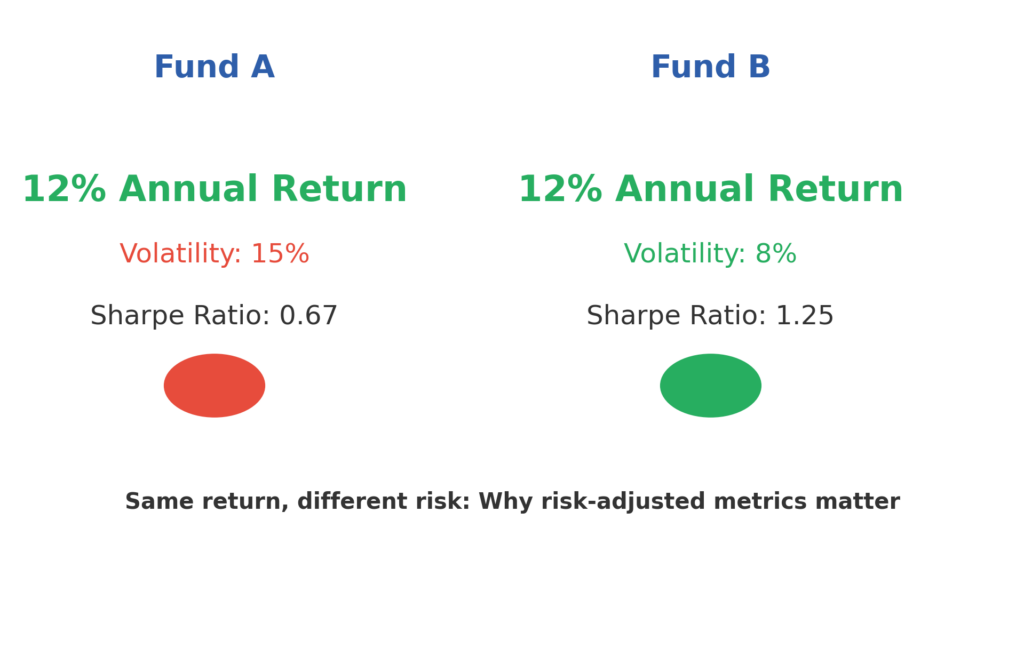

- Risk-adjusted performance metrics like Sharpe ratio, information ratio, and Sortino ratio provide deeper insights than absolute returns alone, as demonstrated when two funds with identical 12% annual returns can have dramatically different risk profiles—Fund A with 15% volatility (Sharpe ratio: 0.67) versus Fund B with 8% volatility (Sharpe ratio: 1.25).

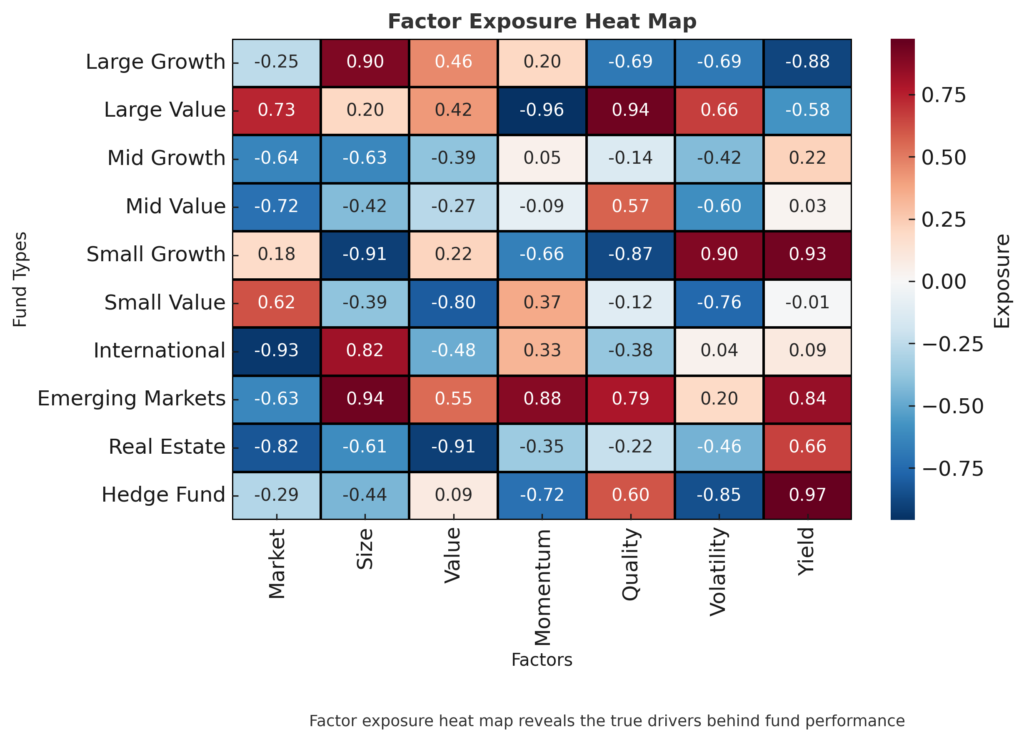

- Factor analysis and attribution models can reveal whether a fund’s outperformance stems from genuine skill or merely exposure to specific market factors, as seen when a $10 million portfolio gaining 15% appears impressive until analytics reveals that given its risk exposure, it should have returned 18%, indicating underperformance on a risk-adjusted basis.

Table of Contents

Understanding Mutual Fund Analytics

Mutual fund analytics encompasses a comprehensive set of quantitative and qualitative methodologies designed to evaluate investment vehicles across multiple dimensions. These analytical frameworks go far beyond simplistic performance metrics to assess risk-adjusted returns, manager skill, investment process consistency, and alignment with stated objectives. Professional analytics integrates statistical techniques, financial theory, and behavioral analysis to create a multi-faceted evaluation system.

The foundation of mutual fund analytics rests on the empirical observation that the vast majority of actively managed funds fail to beat their benchmarks consistently over extended time horizons. This reality creates a compelling imperative for investors to develop or leverage sophisticated analytical tools that can identify the small subset of funds with genuine alpha-generating capabilities.

Modern mutual fund analytics has evolved from simple historical return comparisons to encompass advanced risk decomposition, style analysis, and performance attribution models. These tools enable investors to look beyond absolute returns and understand precisely how and why a fund performs as it does. By decomposing returns into their constituent components—market exposure, sector bets, security selection, and factor tilts—analytics provides transparency into the actual sources of performance.

At its core, professional mutual fund analytics serves as a mechanism for distinguishing between random outcomes and genuine investment skill. The inherent randomness in financial markets means that even mediocre strategies can occasionally produce impressive short-term results. Advanced analytics helps separate statistical noise from sustainable skill, enabling investors to make more informed allocation decisions.

Historical Context and Evolution

Mutual fund analytics has undergone a remarkable evolution over the past several decades. In the 1950s and 1960s, fund evaluation primarily focused on absolute returns with minimal consideration of risk. The emergence of Modern Portfolio Theory in the 1950s, particularly through Harry Markowitz’s work on mean-variance optimization, laid the theoretical groundwork for risk-adjusted performance measurement.

The 1960s and 1970s introduced critical innovations with Jack Treynor, William Sharpe, and Michael Jensen developing groundbreaking risk-adjusted performance metrics—collectively known as the “Nobel measures.” These frameworks represented the first systematic attempt to quantify risk and evaluate funds on a level playing field.

By the 1990s, the emergence of factor models, particularly the Fama-French three-factor model, revolutionized performance evaluation by accounting for size and value effects. Later expansions incorporated momentum, quality, and other risk premia, creating increasingly sophisticated benchmarks against which to evaluate active management.

The 21st century has witnessed the integration of behavioral finance insights into quantitative models, acknowledging that markets are not perfectly efficient and that behavioral biases affect both fund managers and investors. Modern analytics now encompasses both quantitative metrics and qualitative assessments of investment processes, team dynamics, and organizational incentives.

Types of Mutual Fund Analytics

Performance Metrics

Performance analytics form the foundation of fund evaluation, though sophisticated approaches go far beyond simple return comparisons. These metrics assess a fund’s ability to generate returns relative to various benchmarks and peers, typically with adjustments for risk.

| Metric | Description | Interpretation | Limitation |

|---|---|---|---|

| Absolute Return | Raw percentage gain or loss over a specific period | Direct measure of wealth creation | Ignores risk taken to achieve returns |

| Relative Return (Alpha) | Performance versus a benchmark or category average | Measures value added by active management | Benchmark selection can skew results |

| Sharpe Ratio | Excess return per unit of total risk (volatility) | Higher values indicate better risk-adjusted returns | Penalizes upside volatility equally to downside |

| Information Ratio | Excess return per unit of tracking risk | Measures consistency of outperformance | Sensitive to benchmark selection |

| Sortino Ratio | Excess return per unit of downside deviation | Focuses on harmful volatility | Requires minimum acceptable return definition |

| Treynor Ratio | Excess return per unit of systematic risk (beta) | Useful for evaluating portfolios within asset allocation | Assumes beta fully captures relevant risk |

| Jensen’s Alpha | Risk-adjusted excess return based on CAPM | Measures risk-adjusted outperformance | Relies on CAPM assumptions |

| Calmar Ratio | Return relative to maximum drawdown | Useful for evaluating downside protection | Based on a single worst-case event |

Risk Analytics

Risk analytics dissects the various dimensions of investment risk, providing insights into volatility patterns, drawdown characteristics, and tail risk exposures. These metrics help investors understand the potential downsides and risk/reward tradeoffs.

- Standard Deviation: Measures total volatility of returns

- Downside Deviation: Focuses only on negative deviations from a target return

- Maximum Drawdown: Largest peak-to-trough decline over a specified period

- Value at Risk (VaR): Estimates potential loss at a given confidence level

- Conditional VaR (CVaR): Average loss beyond the VaR threshold

- Beta: Sensitivity to market movements

- Tracking Error: Deviation of returns from the benchmark

- R-squared: Percentage of returns explained by benchmark movements

- Kurtosis: Measures “fat tails” or extreme event frequency

- Skewness: Measures asymmetry in the return distribution

Style Analysis

Style analytics identifies a fund’s actual investment approach by examining holdings and return patterns. This helps verify consistency with the stated investment philosophy and identify style drift.

Returns-based style analysis (RBSA) uses regression techniques to determine a fund’s effective exposures to various market segments without requiring holdings data. For example, a fund claiming to be large-cap growth might show significant exposures to small-cap and value factors, revealing potential style drift.

Holdings-based analysis examines actual securities in the portfolio to determine characteristics like weighted average market capitalization, price-to-earnings ratios, and sector allocations. This approach provides a direct look at the fund’s positioning but may be limited by reporting delays and frequency.

Style box analysis, popularized by Morningstar, provides a visual representation of a fund’s positioning across size (large, mid, small) and style (value, blend, growth) dimensions. Tracking a fund’s movement within this framework over time can reveal intentional or unintentional style shifts.

Factor Analysis

Factor analytics decomposes performance into exposures to systematic risk factors versus idiosyncratic returns. This distinguishes between returns from known factor tilts and genuine alpha from security selection.

The traditional Capital Asset Pricing Model (CAPM) represented the earliest factor model, accounting only for market beta. Modern approaches have expanded to include multiple factors:

| Factor | Description | Typical Measurement |

|---|---|---|

| Market | Sensitivity to overall market movements | Beta to broad market index |

| Size | Exposure to small vs. large companies | Weighted average market capitalization |

| Value | Exposure to undervalued vs. growth stocks | Price-to-book ratio, P/E ratio |

| Momentum | Exposure to recent outperformers | Historical return trends |

| Quality | Exposure to financially strong companies | Profitability, earnings stability |

| Volatility | Exposure to low volatility stocks | Historical volatility measures |

| Yield | Exposure to dividend-paying securities | Dividend yield |

Modern factor-based analytics provides insight into whether a fund is truly generating alpha or simply harvesting well-known risk premia. For instance, a fund may outperform due to a persistent small-cap tilt rather than superior security selection.

Attribution Analysis

Attribution analytics breaks down performance into specific decision components to identify precisely where value is being added or subtracted. This helps pinpoint the sources of outperformance or underperformance.

Allocation Effect: Measures the impact of sector/asset class weightings relative to the benchmark. For example, an overweight position in technology during a tech rally would show positive allocation effect.

Selection Effect: Measures the impact of security choices within each sector/asset class. This reflects the manager’s skill in picking outperforming stocks within each segment.

Interaction Effect: Accounts for the combined impact of allocation and selection decisions that cannot be separated.

Currency Effect: For international funds, measures the impact of currency movements on performance.

Trading Effect: Assesses the impact of trading activity, including timing and execution quality.

By decomposing returns into these granular components, attribution analysis provides a detailed understanding of exactly how a portfolio manager is generating results.

Benefits of Professional Mutual Fund Analytics

Superior Fund Selection

Professional analytics enables investors to identify funds with sustainable competitive advantages rather than those experiencing temporary luck. This distinction is crucial given that approximately 95% of actively managed funds fail to outperform their benchmarks over extended periods.

By applying rigorous quantitative screening criteria—such as consistent rolling-period alpha, downside protection metrics, and risk-adjusted performance measures—investors can narrow the universe to a smaller subset of potentially skilled managers. Further qualitative analysis of these candidates can reveal the organizational, philosophical, and process-driven attributes that contribute to sustainable outperformance.

Analytics helps investors avoid common selection pitfalls like performance chasing, which research has consistently shown leads to suboptimal outcomes. Studies indicate that investors who select funds based primarily on recent outperformance typically experience subsequent underperformance as mean reversion occurs.

Risk Management

Sophisticated analytics provides a multidimensional view of risk beyond simple volatility measures. This comprehensive risk assessment helps investors build portfolios aligned with their specific risk tolerance and investment objectives.

Professional analytics can identify hidden risks not apparent through casual observation, such as:

- Factor concentration risks: Excessive exposure to particular style factors

- Liquidity risks: Potential challenges in stressed market environments

- Tail risks: Vulnerability to extreme market events

- Correlation shifts: Changing relationships between assets during crises

- Style drift: Unintentional changes in investment approach

By understanding these risk dimensions, investors can construct more resilient portfolios designed to weather various market environments. Analytics enables precise risk budgeting, allowing investors to allocate risk across managers and strategies intentionally rather than haphazardly.

Performance Monitoring

Ongoing monitoring using professional analytics helps investors distinguish between normal volatility and genuine deterioration in a fund’s process or skill. This distinction prevents both premature abandonment of sound strategies experiencing temporary underperformance and excessive patience with fundamentally impaired approaches.

Analytics provides objective frameworks for systematic review processes, establishing clear thresholds for manager evaluation and potential replacement. This reduces emotional decision-making and enhances long-term outcomes.

Sophisticated monitoring systems can detect subtle changes in a manager’s approach or risk profile, potentially providing early warning of style drift or organizational challenges before they significantly impact performance.

Fee Justification

Professional analytics provides a framework for evaluating whether a fund’s fee structure is justified by its value proposition. By precisely measuring risk-adjusted alpha and attributing performance to skill versus factor exposures, investors can determine whether active management fees represent fair compensation.

This analysis often reveals that many actively managed funds charging premium fees deliver what are effectively index exposures with modest active bets – sometimes called “closet indexers.” Identifying such funds can lead to significant fee savings without meaningful performance sacrifice.

Conversely, analytics can identify truly skilled managers who consistently deliver value beyond their fee level, justifying higher costs through superior risk-adjusted returns or other unique benefits like downside protection or tax efficiency.

Challenges and Risks in Mutual Fund Analytics

Data Quality Issues

Mutual fund analytics is fundamentally dependent on the quality, completeness, and timeliness of underlying data. Unfortunately, several common data issues can compromise analytical integrity:

- Survivorship bias: Excluding defunct funds from historical databases, artificially inflating average category performance

- Backfill bias: Adding successful funds with existing track records to databases retroactively

- Reporting delays: Stale holdings information that doesn’t reflect current positioning

- Self-reporting: Potential for strategic disclosure of holdings or characteristics

- Classification inconsistencies: Varying methodologies for categorizing funds

Professional analytics practitioners must implement rigorous data cleaning procedures and maintain awareness of these potential biases. Using survivorship-bias-free databases and applying appropriate statistical adjustments can mitigate some of these concerns.

Statistical Limitations

Even with perfect data, mutual fund analytics faces inherent statistical challenges. The most significant is distinguishing between skill and luck in an environment dominated by random noise.

The low signal-to-noise ratio in financial markets means that establishing statistical significance typically requires very long time periods – often longer than most funds’ existence. For example, a manager with a true alpha of 2% per year might need 16+ years of data to establish statistical significance at a 95% confidence level.

Mean reversion remains a powerful force in fund performance, with many studies showing that recent outperformers are more likely to underperform going forward. This pattern creates challenges for selection models based heavily on historical performance.

Overreliance on Quantitative Metrics

Excessive focus on quantitative measures without qualitative context can lead to misleading conclusions. Numbers alone cannot capture the complete picture of a fund’s investment process, organizational stability, or future prospects.

The most robust analytical approaches combine quantitative screening with in-depth qualitative assessment of:

- Investment philosophy and process consistency

- Team stability and experience

- Organizational incentives and culture

- Capacity management discipline

- Risk management infrastructure

Many critical aspects of fund evaluation – such as succession planning, team dynamics, and process discipline – cannot be fully captured through quantitative metrics alone.

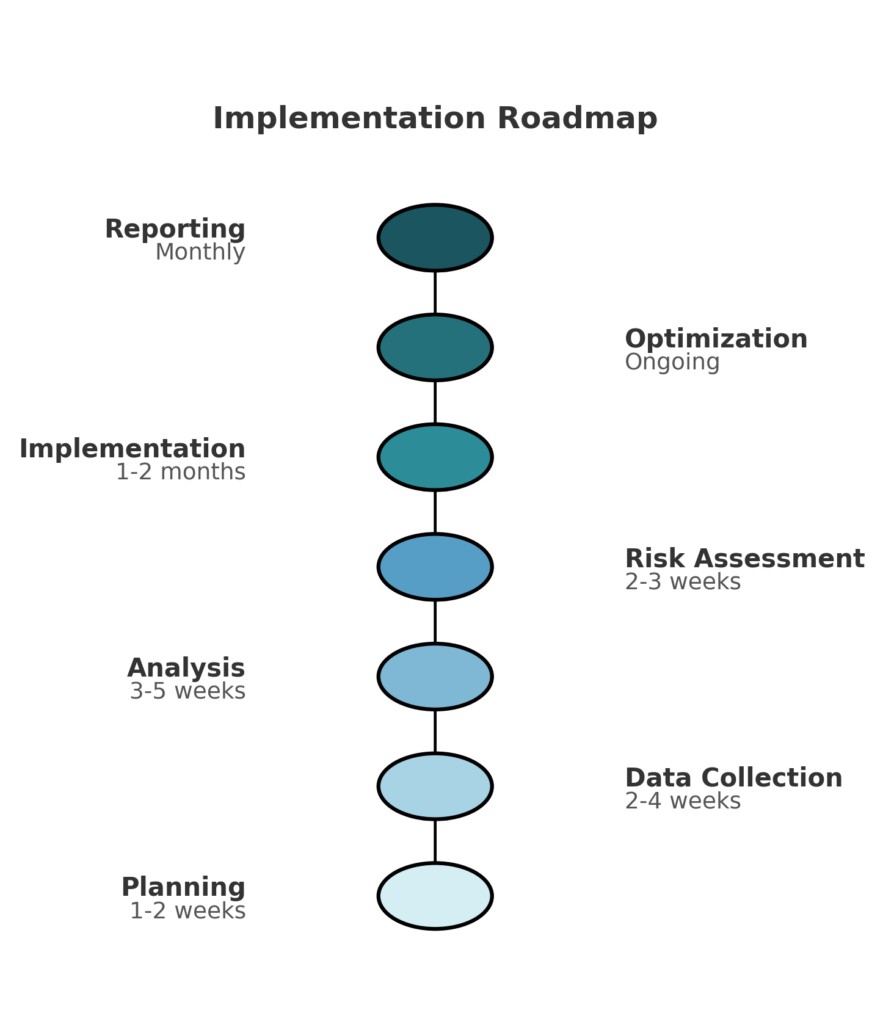

Implementation Complexity

Building and maintaining sophisticated analytical infrastructure requires significant resources, expertise, and ongoing commitment. Organizations implementing professional analytics face several challenges:

- Technical expertise requirements: Advanced statistical knowledge and programming skills

- Data management complexity: Integrating multiple data sources and maintaining data quality

- Model maintenance: Continuously updating and validating analytical models

- Interpretation expertise: Translating analytical outputs into actionable insights

- Integration with decision processes: Embedding analytics within existing workflows

These implementation hurdles often lead organizations to consider third-party analytics providers or consultants who specialize in fund evaluation. However, outsourcing creates its own challenges regarding customization, control, and knowledge transfer.

How to Implement Professional Mutual Fund Analytics

Building an Analytical Framework

Creating an effective mutual fund analytics system begins with establishing a clear, well-structured framework aligned with investment objectives. This requires defining:

- Investment beliefs and philosophy: Fundamental assumptions about markets that will guide analytical emphasis

- Clear evaluation criteria: Specific metrics and thresholds for fund assessment

- Time horizons: Appropriate measurement periods for different metrics

- Benchmark selection methodology: Process for identifying relevant comparison standards

- Rating or scoring system: Method for synthesizing multiple metrics into actionable assessments

The framework should balance quantitative rigor with qualitative insights, recognizing that numbers alone rarely tell the complete story. Different investor types may emphasize different aspects—institutional investors might focus heavily on risk management and downside protection, while wealth management platforms might prioritize style consistency and tax efficiency.

Essential Tools and Technologies

Implementing professional analytics requires appropriate technological infrastructure:

Data sources:

- Fund holdings and returns databases (e.g., Morningstar, Lipper)

- Benchmark and market factor data (e.g., Bloomberg, MSCI)

- Economic indicators and market data

- Qualitative research reports and manager interviews

Software and analytical platforms:

- Statistical analysis packages (R, Python with financial libraries)

- Specialized investment analytics platforms (Morningstar Direct, eVestment, Style Analytics)

- Performance attribution systems (FactSet, Wilshire Atlas)

- Risk analytics tools (Barra, Axioma)

- Visualization and reporting solutions (Tableau, Power BI)

The specific technology stack should align with organizational needs, in-house expertise, and budget constraints. Smaller organizations may rely more heavily on third-party platforms, while larger institutions often develop proprietary systems and integrate multiple data sources.

Step-by-Step Implementation Process

- Define objectives and requirements

- Identify key use cases and stakeholders

- Establish required metrics and outputs

- Determine resource constraints and timeline

- Design analytical architecture

- Select appropriate data sources

- Choose technology platforms

- Establish data governance procedures

- Design reporting formats and visualization approaches

- Develop screening and selection criteria

- Create initial quantitative screens

- Establish thresholds for further analysis

- Design scoring or ranking methodologies

- Develop due diligence questionnaires and qualitative assessment frameworks

- Build monitoring and review processes

- Establish regular review cadence

- Define performance and risk thresholds that trigger alerts

- Create standardized review formats

- Implement exception reporting

- Test and validate

- Backtest selection methodology

- Conduct sensitivity analysis on key parameters

- Perform peer review of analytical approaches

- Compare outputs with expert judgment

- Deploy and integrate

- Train users and stakeholders

- Integrate with existing workflows and decision processes

- Establish feedback mechanisms for continuous improvement

- Maintain and evolve

- Regular methodology reviews

- Ongoing data quality validation

- Periodic reassessment of metrics and thresholds

- Research integration of new analytical techniques

Real-World Application Example

A comprehensive implementation of professional mutual fund analytics typically follows a multi-stage process. Consider this example from a large wealth management organization:

Initial Quantitative Screening:

- Minimum 5-year track record

- Top quartile risk-adjusted returns (Sharpe ratio) over 3- and 5-year periods

- Positive alpha versus appropriate benchmark over 3- and 5-year periods

- Below-average expense ratio within category

- Minimum $500 million in assets

- Maximum 80% correlation with existing lineup options

This initial screen might narrow a universe of 8,000 funds to approximately 200-300 candidates for deeper analysis.

Detailed Quantitative Assessment:

- Rolling period performance analysis (36-month rolling windows)

- Performance attribution to identify sources of returns

- Factor exposure analysis

- Style consistency evaluation

- Downside protection metrics

- Stress testing across various market environments

Qualitative Due Diligence:

- Investment philosophy and process review

- Organization stability and resources

- Portfolio manager tenure and team structure

- Risk management practices

- Capacity management approach

- Fee structure analysis

Final Selection and Ongoing Monitoring:

- Consolidated scoring across quantitative and qualitative dimensions

- Committee review and approval

- Quarterly performance monitoring

- Annual comprehensive review

- Event-driven reviews (e.g., manager changes, significant underperformance)

This structured approach combines analytical rigor with judgment to identify funds with sustainable competitive advantages.

Future Trends in Mutual Fund Analytics

AI and Machine Learning Applications

Artificial intelligence and machine learning are revolutionizing mutual fund analytics by uncovering complex patterns and relationships traditional statistical methods might miss. These technologies are being applied across multiple dimensions:

Performance prediction models use machine learning to identify subtle patterns in historical data that may predict future outperformance. Unlike traditional regression models, these approaches can capture non-linear relationships and complex interactions between variables.

Natural language processing (NLP) algorithms analyze fund commentary, manager interviews, and regulatory filings to extract insights about investment approaches, potential style drift, or organizational changes. These techniques can quantify previously qualitative information.

Alternative data integration combines traditional financial metrics with unconventional data sources—such as satellite imagery, social media sentiment, or supply chain information—to generate unique insights into fund holdings and potential performance drivers.

The challenge with these approaches lies in balancing their power with the risk of overfitting or identifying spurious patterns. The most effective implementations combine machine learning insights with traditional financial theory and human judgment.

ESG Integration

Environmental, Social, and Governance (ESG) factors have become increasingly important in fund evaluation, creating new analytical challenges and opportunities. Modern analytics is evolving to incorporate these dimensions:

ESG scoring methodologies attempt to quantify previously subjective aspects of corporate behavior. Analytics platforms now integrate these scores into fund evaluation, assessing portfolio-level ESG characteristics.

Impact measurement frameworks go beyond risk and return to evaluate funds’ contributions to specific environmental or social outcomes. These approaches require new metrics and data sources beyond traditional financial information.

Greenwashing detection analytics uses natural language processing and holdings analysis to identify discrepancies between stated ESG commitments and actual portfolio construction. This helps investors distinguish between genuine ESG integration and marketing-driven approaches.

The integration of ESG considerations represents a fundamental expansion of the traditional risk-return framework, requiring analytical approaches that can handle both financial and non-financial dimensions of performance.

Customization and Personalization

Analytics is increasingly moving beyond standardized frameworks toward customized approaches tailored to specific investor preferences and constraints. This trend manifests in several ways:

Goals-based analytics evaluates funds not against universal benchmarks but based on their contribution to specific investor objectives like retirement income, education funding, or wealth preservation. This approach requires different evaluation metrics aligned with particular goals.

Values-based screening incorporates individual investor preferences regarding specific industries, practices, or values into the analytical process. This moves beyond standard ESG frameworks to accommodate highly personalized ethical or religious considerations.

Tax-aware analytics evaluates after-tax outcomes based on specific investor tax situations rather than focusing solely on pre-tax returns. This approach recognizes that tax efficiency varies dramatically across different investor circumstances.

These customization trends require more flexible analytical infrastructures capable of adapting standard methodologies to individual circumstances and preferences.

Democratization of Analytics

Sophisticated analytical capabilities once available only to institutional investors are increasingly accessible to individual investors and smaller organizations. This democratization is occurring through several channels:

Consumer-facing analytics platforms provide individual investors with institutional-quality metrics and visualization tools through user-friendly interfaces. These platforms translate complex analytical concepts into accessible insights.

Model portfolios and fund-of-funds solutions embed professional analytics within packaged investment solutions, allowing investors to benefit from sophisticated selection and monitoring without conducting the analysis themselves.

Advisor-focused technology equips financial advisors with powerful analytical tools they can use with clients, enhancing advice quality while maintaining the advisor-client relationship.

This democratization trend has significant implications for the active management industry, as it raises the bar for performance transparency and potentially accelerates the shift from underperforming active strategies to passive or systematic approaches.

FAQ – Mutual Fund Analytics

1. What is mutual fund analytics, and how does it differ from basic performance measurement?

Mutual fund analytics encompasses comprehensive quantitative and qualitative assessment methods that evaluate funds across multiple dimensions—including risk-adjusted performance, style consistency, factor exposures, and manager skill. While basic performance measurement might simply compare returns against a benchmark, professional analytics provides deeper insights into how returns are generated, what risks are taken, and whether performance is likely to persist.

2. Why do most actively managed funds underperform their benchmarks?

Multiple factors contribute to widespread underperformance: (1) Market efficiency makes consistent outperformance challenging, (2) Management fees and transaction costs create a performance drag that must be overcome before delivering excess returns, (3) Asset growth often dilutes previously successful strategies, (4) Style drift can occur as funds grow larger, and (5) Behavioral biases affect manager decision-making. Professional analytics helps identify the minority of funds that manage to overcome these challenges.

3. What are the most important metrics for evaluating mutual fund performance?

No single metric provides a complete picture. A comprehensive evaluation typically includes: (1) Risk-adjusted return measures like Sharpe ratio and information ratio, (2) Consistency metrics such as batting average and win/loss ratios, (3) Downside protection measures like maximum drawdown and downside capture ratio, (4) Factor-adjusted alpha to isolate genuine skill, and (5) Performance attribution to understand sources of returns. The specific emphasis should align with investor priorities and market conditions.

4. How long a track record is needed to evaluate a fund properly?

Statistical significance typically requires long time periods due to the high noise-to-signal ratio in investment returns. Most professional analytics frameworks suggest a minimum of 3-5 years, with 7-10 years providing greater confidence. However, even decade-long records may not guarantee future performance. The most robust approaches combine quantitative track record analysis with qualitative assessment of the investment process and team stability.

5. How can investors distinguish between luck and skill in fund performance?

Several analytical approaches help separate luck from skill: (1) Persistence analysis examines whether outperformance is consistent across different time periods, (2) Factor analysis determines whether excess returns derive from systematic factor exposures or genuine security selection skill, (3) Attribution analysis identifies exactly where value is being added, (4) Holdings-based analysis evaluates whether the stated investment process is consistently implemented, and (5) Qualitative assessment of the investment team and process provides context for quantitative findings.

6. What role does risk management play in mutual fund analytics?

Risk management is central to comprehensive fund evaluation, as returns must always be considered in the context of risks taken. Professional analytics assesses multiple risk dimensions: (1) Total volatility (standard deviation), (2) Relative risk (tracking error), (3) Downside risk (downside deviation, maximum drawdown), (4) Factor exposures and biases, (5) Liquidity risk, and (6) Potential tail risk exposures. These measures help investors select funds aligned with their risk tolerance and construct portfolios with intentional risk characteristics.

7. How does factor analysis improve mutual fund evaluation?

Factor analysis decomposes performance into exposures to known risk premia versus true alpha from security selection. This approach: (1) Identifies whether outperformance comes from skill or simply harvesting established risk factors, (2) Creates more appropriate benchmarks that account for a fund’s specific factor tilts, (3) Reveals potential factor concentration risks in portfolios, (4) Provides insight into a manager’s actual strategy versus stated approach, and (5) Helps investors avoid paying active management fees for what are effectively factor exposures available through lower-cost systematic strategies.

8. What are the limitations of quantitative mutual fund analytics?

Quantitative analytics faces several important limitations: (1) Past performance, even risk-adjusted, provides limited predictive power for future results, (2) Data quality issues like survivorship bias can distort findings, (3) Models and metrics inevitably simplify complex realities, (4) Qualitative aspects like team dynamics and decision processes are difficult to quantify, (5) Regime changes or market shifts can invalidate historical patterns, and (6) Unique fund characteristics may not be captured by standardized metrics. The most effective approaches acknowledge these limitations and complement quantitative analysis with qualitative assessment.

9. How should investors balance quantitative and qualitative factors in fund selection?

Best practices suggest a structured approach that: (1) Uses quantitative screening to efficiently narrow the investment universe, (2) Applies more detailed quantitative analysis to identify potential concerns or advantages, (3) Conducts thorough qualitative due diligence on the investment philosophy, process, and team, (4) Evaluates organizational factors like ownership structure and incentives, and (5) Synthesizes these inputs into a holistic assessment. The specific weighting between quantitative and qualitative factors should reflect investor preferences, with institutional investors often placing greater emphasis on quantitative rigor.

10. What technological tools are essential for conducting professional mutual fund analytics?

A comprehensive analytics infrastructure typically includes:

- Robust databases with survivorship-bias-free historical returns and holdings information

- Statistical analysis software for performance and risk calculations

- Factor models for performance attribution and style analysis

- Visualization tools to identify patterns and communicate findings

- Screening platforms to efficiently filter investment universes

- Reporting systems to document analysis and monitor ongoing performance

Organizations must balance building proprietary systems versus leveraging third-party solutions based on their specific needs and resources.

Conclusion

Professional mutual fund analytics represents a critical capability for investors seeking to navigate an investment landscape where most active managers fail to deliver consistent value. By applying rigorous quantitative methodologies complemented by thoughtful qualitative assessment, investors can significantly improve their odds of identifying truly skilled managers among the overwhelming noise of random outcomes.

The evolution of analytical techniques – from simple return comparisons to sophisticated factor models and machine learning approaches -has dramatically expanded our ability to understand the true drivers of fund performance. These advancements enable a more precise evaluation of whether outperformance stems from genuine skill, factor exposures, or simply good fortune.

As analytics continues democratizing through technology, the bar for active managers will likely rise further, potentially accelerating the bifurcation between truly skilled managers who can justify their fees and those who cannot.

Looking forward, integrating artificial intelligence, alternative data sources, and customized evaluation frameworks promises to further enhance our ability to identify investment skills. However, even as analytical techniques grow increasingly sophisticated, successful fund selection will likely remain a blend of science and art – combining the power of quantitative tools with the judgment and context that human expertise provides.

For investors willing to embrace this balanced approach, professional analytics offers a pathway to potentially joining the minority who successfully identify funds capable of delivering genuine long-term value.

For your reference, recently published articles include:

- Investment Return Calculation: The Ultimate Pro Guide

- Never Lose Money Again: The Ultimate Portfolio Diversification Tools

- Risk-Proof Your Wealth: Professional Investment Risk Scoring Methods Revealed

- Market Trend Analysis: Technical Analysis Secrets Exposed

- Digital Age Success Story: With AI To Private Wealth

- Investment Portfolio Tracking: Best Billionaire Hacks For You

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.