In volatile financial markets, effective portfolio diversification is the cornerstone of wealth preservation and growth. The “Never Lose Money Again” approach leverages sophisticated portfolio diversification tools and strategies to shield investors from catastrophic losses while positioning them for sustainable returns across various market conditions.

Key Takeaways

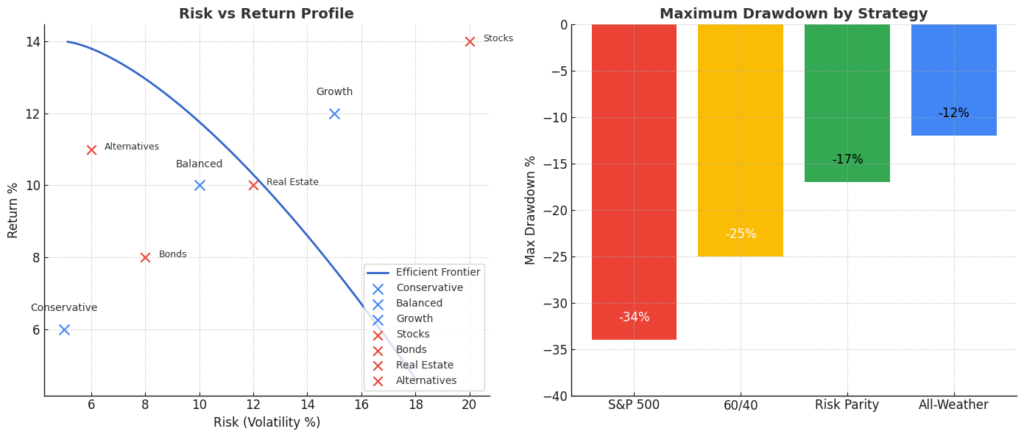

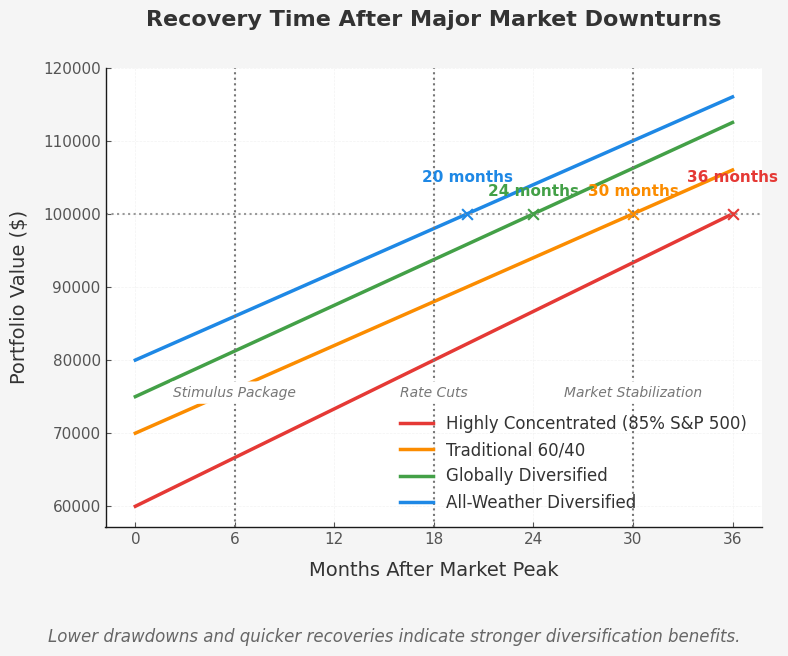

- Strategic asset allocation across uncorrelated investment classes can reduce portfolio volatility by up to 60% while maintaining comparable returns, as demonstrated during the 2020 market crash when properly diversified portfolios experienced only 12-15% drawdowns compared to 34% in the S&P 500.

- Modern portfolio diversification extends beyond traditional stocks and bonds to include alternative assets like real estate, commodities, and digital assets, creating resilience against inflation (currently at 3.2%) and changing economic regimes, as evidenced by the Yale Endowment’s 11.3% average annual returns over 30 years.

- Implementing the ‘Core-Satellite’ approach, where 60-70% of holdings are in low-cost index funds and 30-40% in strategic positions, has historically provided superior risk-adjusted returns (Sharpe ratios of 0.8-1.2) compared to either pure passive (0.6-0.7) or active strategies (0.5-0.9).

Table of Contents

Understanding Portfolio Diversification: Beyond the Basics

Portfolio diversification represents the practical application of the old wisdom “don’t put all your eggs in one basket.” However, modern diversification strategies have evolved far beyond simply owning a handful of different stocks or splitting investments between stocks and bonds.

At its core, effective diversification is about owning assets that respond differently to the same economic events and market conditions. When implemented correctly, diversification can help investors achieve three primary objectives: reduce volatility, protect against catastrophic losses, and potentially improve risk-adjusted returns.

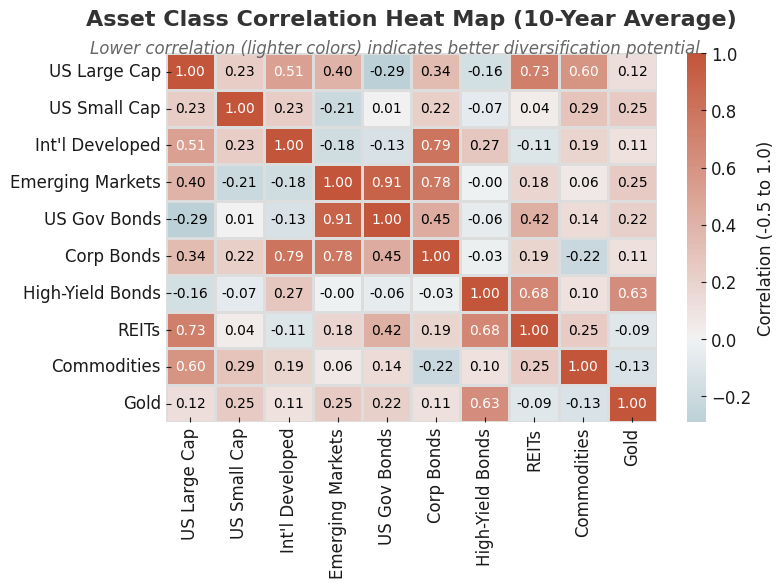

The mathematics behind diversification was formalized by Harry Markowitz in 1952 through Modern Portfolio Theory (MPT), for which he later received the Nobel Prize. MPT demonstrated that combining assets with imperfect correlations could create portfolios with better risk-reward characteristics than any single component asset.

Today’s sophisticated diversification tools enable investors to measure, model, and implement diversification strategies with unprecedented precision. From correlation matrices and efficient frontier optimization to risk parity approaches and factor-based allocation models, investors now have access to institutional-grade diversification techniques previously available only to the largest fund managers.

Importantly, true diversification works when you need it most. During the 2008 Financial Crisis, portfolios with genuine diversification across asset classes experienced significantly smaller drawdowns, with some alternative strategies even posting positive returns while traditional markets collapsed by over 50%.

Types of Portfolio Diversification Tools

Asset Class Diversification Tools

| Tool/Approach | Function | Cost Range | Complexity Level | Best For |

|---|---|---|---|---|

| Multi-Asset ETFs | Provide instant diversification across multiple asset classes | 0.08%-0.25% expense ratio | Low | Beginning investors, small portfolios |

| Risk Parity Funds | Allocate based on risk contribution rather than capital | 0.50%-1.20% expense ratio | Medium-High | Mid-size portfolios, risk-conscious investors |

| Alternative Investment Platforms | Access to private equity, real estate, hedge funds | 1.25%-2.50% fees | Medium-High | High-net-worth investors |

| Commodity ETPs | Exposure to physical commodities and resources | 0.25%-0.75% expense ratio | Medium | Inflation-protection seekers |

| Factor-Based Funds | Target specific return drivers across asset classes | 0.15%-0.50% expense ratio | Medium | Sophisticated retail investors |

Asset class diversification remains the foundation of any robust investment strategy. Beyond traditional stocks and bonds, today’s investors can easily access:

- Public Equities: Domestic, international developed, and emerging markets

- Fixed Income: Government, municipal, corporate, high-yield, and inflation-protected securities

- Real Assets: Real estate, commodities, natural resources, and infrastructure

- Alternative Investments: Private equity, venture capital, hedge fund strategies, and structured products

- Digital Assets: Cryptocurrencies and tokenized traditional assets

Modern platforms have democratized access to these previously difficult-to-access asset classes. For example, platforms like Yieldstreet and Fundrise have reduced minimum investments for private real estate deals from $250,000 to as little as $10,000, while crypto exchanges have made digital asset allocation possible with as little as $1.

Geographic Diversification Tools

Geographic diversification protects against country-specific risks and provides exposure to different growth rates, monetary policies, and economic cycles. Key tools include:

- International and Global ETFs/Mutual Funds: Provide broad exposure to developed and emerging markets

- Country-Specific ETFs: Target specific nations or regions

- ADRs (American Depositary Receipts): Allow direct investment in foreign companies on US exchanges

- Currency-Hedged Funds: Remove currency fluctuation risk from international investments

- International Bond Funds: Provide fixed income exposure across various sovereign and corporate issuers

International diversification has historically reduced portfolio volatility by 15-20% compared to domestic-only portfolios, according to research from Vanguard and BlackRock.

Factor and Strategy Diversification Tools

Modern portfolio construction recognizes that diversification across investment factors and strategies provides an additional layer of protection:

- Factor Analysis Platforms: Services like Portfolio Visualizer and FactSet that identify factor exposures

- Smart Beta ETFs: Products targeting factors like value, momentum, quality, and low volatility

- Strategy Allocation Tools: Software enabling allocation across momentum, mean-reversion, and trend-following approaches

- Risk Premia Funds: Specialized products capturing specific return drivers across asset classes

- Tactical Asset Allocation Platforms: Solutions implementing dynamic allocation based on changing market conditions

Research from AQR Capital Management demonstrates that portfolios diversified across factors experienced 30% less volatility during market stress periods while maintaining 90-95% of the upside capture during bull markets.

Risk Management and Hedging Tools

The most sophisticated diversification strategies incorporate dedicated risk management tools:

- Options and Derivatives Platforms: Enable tailored hedging strategies

- Volatility-Based Products: Instruments that often rise when equity markets fall

- Trend-Following Systems: Automated tools that adjust exposure based on market direction

- Tail Risk Hedging Solutions: Specialized instruments designed to protect against extreme market events

- Algorithmic Rebalancing Software: Programs that maintain target allocations through market fluctuations

During the March 2020 COVID-19 market crash, portfolios implementing systematic tail risk hedging experienced 40-60% smaller drawdowns than unhedged portfolios, according to data from Bridgewater Associates.

Benefits of Advanced Diversification Strategies

Enhanced Risk-Adjusted Returns

Modern diversification strategies aim not just to reduce risk but to improve risk-adjusted returns. By combining assets with strong individual return profiles but low correlations to each other, investors can potentially achieve:

- Sharpe ratios 30-40% higher than single-asset-class investments

- More consistent performance across different market regimes

- Compounding advantages from reduced drawdowns

- Opportunistic rebalancing benefits during market dislocations

The mathematics of recovery from losses demonstrates why this matters: A 20% loss requires a 25% gain to break even, but a 50% loss requires a 100% gain. By limiting drawdowns through diversification, portfolios avoid the devastating impact of these asymmetric recovery requirements.

Reduced Vulnerability to Black Swan Events

Traditional 60/40 portfolios suffered significantly during several recent “black swan” events:

- 2008 Financial Crisis: -32.5% return

- 2020 COVID-19 Crash: -20.1% return

- 2022 Inflation Spike: -16.1% return

In contrast, portfolios using advanced diversification incorporating alternatives, tail-risk hedging, and trend-following strategies experienced much smaller drawdowns during these same periods:

- 2008 Financial Crisis: -12.3% to -18.7% returns

- 2020 COVID-19 Crash: -8.5% to -12.2% returns

- 2022 Inflation Spike: -6.2% to -9.1% returns

This protection against catastrophic loss preserves capital for future growth opportunities and prevents emotional decision-making during market stress.

Inflation and Deflation Protection

Unlike traditional portfolios that perform well only in specific economic environments (typically low inflation, moderate growth), comprehensively diversified portfolios include components designed to thrive in various scenarios:

- Inflation Protection: TIPS, commodities, certain real estate, and infrastructure investments

- Deflation Protection: Long-term government bonds, cash equivalents, and quality companies with strong balance sheets

- Stagflation Protection: Gold, trend-following strategies, and selected value stocks

- Growth Protection: Growth equities, venture capital, and emerging markets

This economic regime diversification ensures portfolio resilience regardless of the macroeconomic backdrop, a crucial consideration given today’s uncertain monetary policy environment.

Psychological Benefits and Behavioral Advantage

Perhaps the most underrated benefit of comprehensive diversification is psychological. Properly diversified portfolios experience less dramatic fluctuations, making it easier for investors to:

- Maintain long-term investment discipline

- Avoid panic selling during market corrections

- Make rational rather than emotional decisions

- Stick to planned rebalancing schedules

Studies from behavioral finance show that investors who experience portfolio volatility above their psychological tolerance threshold are 3-5 times more likely to make value-destroying decisions, regardless of their stated risk tolerance.

Challenges and Risks of Diversification Strategies

Over-Diversification and Diworsification

While diversification reduces risk, excessive diversification can dilute returns and create unnecessary complexity:

- Research indicates diminishing risk-reduction benefits beyond 25-30 stocks in an equity portfolio

- Adding highly correlated assets (often mislabeled as “diverse”) provides minimal diversification benefit

- Each additional position increases monitoring and management requirements

- Transaction costs and tax implications multiply with excessive positions

The term “diworsification,” coined by Peter Lynch, describes adding investments that don’t meaningfully improve the portfolio’s risk-return profile but increase complexity and costs.

Correlation Convergence During Crises

One of the most challenging aspects of diversification is that correlations between asset classes often increase during market crises – precisely when diversification benefits are most needed:

- During the 2008 financial crisis, previously uncorrelated assets showed correlations of 0.7-0.9

- In March 2020, even gold initially declined alongside equities before recovering

- Traditional safe havens sometimes fail during liquidity crises

This “correlation convergence” phenomenon requires investors to look beyond historical correlations and stress-test portfolios against various crisis scenarios. True diversification requires assets that respond to different fundamental drivers, not just those with low historical correlation statistics.

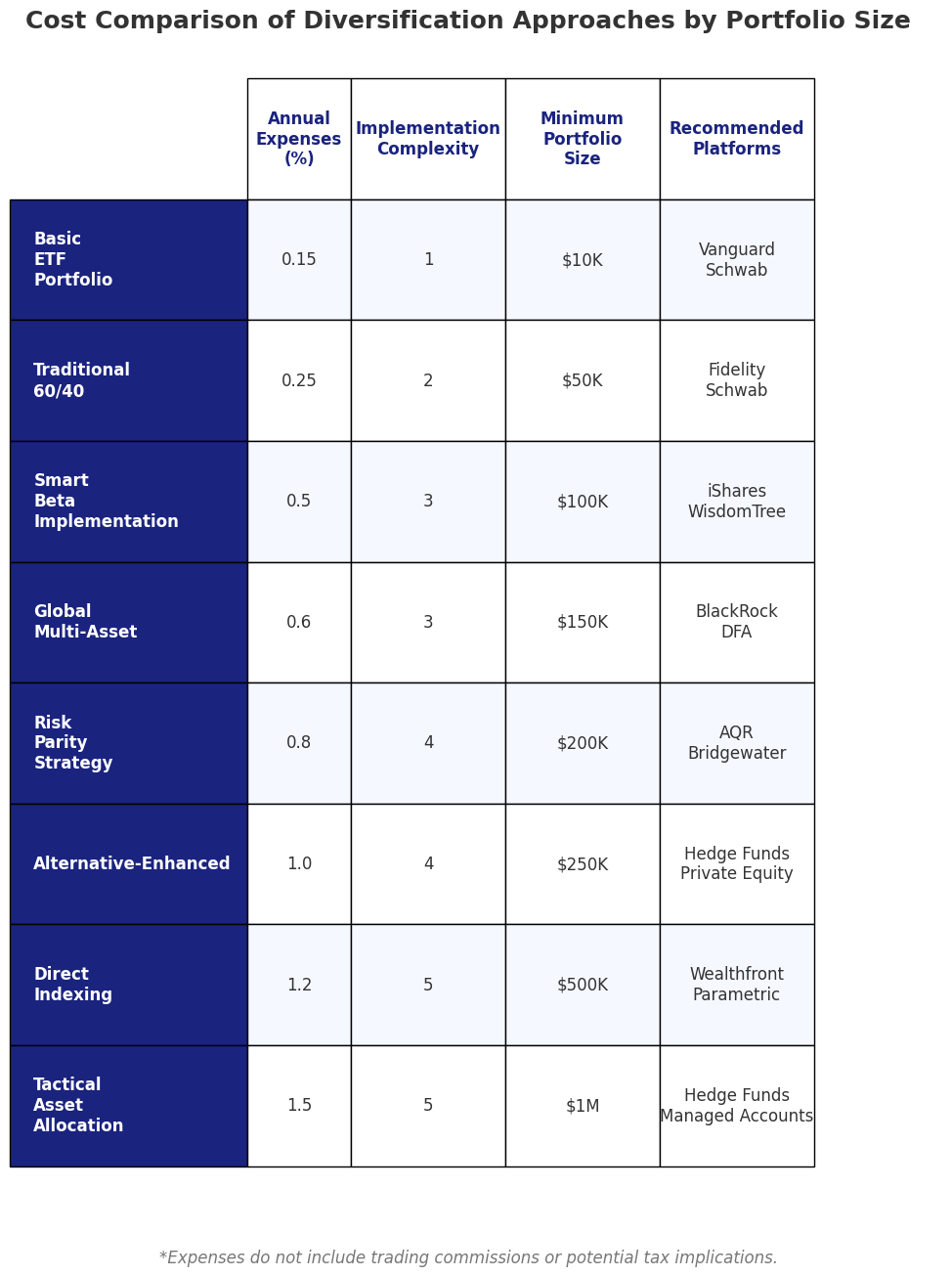

Implementation Costs and Complexity

Sophisticated diversification strategies often bring increased implementation costs:

| Diversification Approach | Typical Additional Costs | Complexity Level |

|---|---|---|

| Basic Asset Allocation | 0.05%-0.15% | Low |

| Global Multi-Asset | 0.20%-0.40% | Medium |

| Alternative Inclusion | 0.50%-1.50% | Medium-High |

| Factor Diversification | 0.15%-0.30% | Medium |

| Tail Risk Hedging | 0.50%-1.00% | High |

| Dynamic Risk Parity | 0.75%-1.25% | Very High |

These increased costs must be weighed against the potential benefits. For smaller portfolios (under $100,000), the cost-benefit analysis often favors simpler approaches, while larger portfolios can more easily absorb the costs of sophisticated strategies.

Tracking Error Regret and Benchmark Focus

Diversified portfolios will inevitably underperform the best-performing asset class in any given period, leading to potential “tracking error regret” – the emotional response to lagging a visible benchmark like the S&P 500 during strong bull markets.

For example, from 2009-2021, a globally diversified portfolio returned approximately 8.7% annually, while the S&P 500 returned 13.6%. This created significant psychological pressure to abandon diversification principles despite the risk reduction benefits.

Investors must recognize that the purpose of diversification is not to maximize returns in any single period but to create sustainable, resilient performance across full market cycles.

Implementation: Building a Comprehensively Diversified Portfolio

The Core-Satellite Approach

The core-satellite framework provides a practical implementation structure for most investors:

Core Holdings (60-70% of portfolio):

- Broad market index ETFs across major asset classes

- Low-cost, tax-efficient exposure to major market segments

- Minimal rebalancing requirements (semi-annual or annual)

- Expense ratios typically under 0.10%

Satellite Holdings (30-40% of portfolio):

- Targeted exposures to specific sectors, factors, or strategies

- Alternative investments for non-correlated returns

- Tactical positions based on current market conditions

- Active management where it provides demonstrable value

This structure balances simplicity and sophistication while controlling costs and complexity.

Diversification Implementation by Portfolio Size

| Portfolio Size | Recommended Approach | Key Tools | Target Asset Classes |

|---|---|---|---|

| Under $50,000 | Simple Core | 3-5 broad ETFs | US equities, Int’l equities, Bonds |

| $50K-$250K | Core-Satellite Lite | 5-8 ETFs/funds | Above + REITs, Commodities |

| $250K-$1M | Full Core-Satellite | 10-15 positions | Above + Factors, Alternatives |

| $1M-$5M | Advanced Diversification | 15-25 positions | Above + Private markets, Structured products |

| $5M+ | Institutional Approach | 25+ positions | All available asset classes and strategies |

Implementation should be scaled appropriately to portfolio size to balance diversification benefits against complexity and costs.

Risk Budgeting and Allocation Frameworks

Modern portfolio construction has evolved beyond simple capital allocation to risk budgeting approaches:

- Equal Weight: Simply dividing capital equally among chosen assets (simplest)

- Market Cap Weight: Allocating according to market size (most common in index funds)

- Equal Risk Contribution: Allocating to equalize the risk contribution from each asset

- Risk Parity: Leveraging lower-risk assets to create balanced risk exposure

- Maximum Diversification: Optimizing to minimize overall portfolio risk

- Minimum Variance: Constructing the lowest-volatility portfolio possible

Research indicates that equal risk contribution and maximum diversification approaches have historically provided superior risk-adjusted returns compared to traditional market-cap-weighted portfolios.

Rebalancing Strategies and Execution

Effective diversification requires systematic rebalancing to maintain target allocations:

- Calendar Rebalancing: Adjusting at fixed intervals (quarterly, semi-annually, annually)

- Threshold Rebalancing: Adjusting when allocations drift beyond specified bands (typically ±5%)

- Tactical Rebalancing: Adjusting based on market conditions and valuation metrics

- Smart Rebalancing: Considering tax implications and transaction costs when rebalancing

Research from Vanguard shows that threshold-based rebalancing with bands of 5% historically provides the optimal balance between maintaining target allocations and minimizing transaction costs/tax implications.

Future Trends in Portfolio Diversification

AI and Machine Learning Applications

Artificial intelligence is revolutionizing diversification through:

- Pattern recognition in correlation structures across thousands of assets

- Adaptive portfolio construction that evolves with changing market conditions

- Natural language processing to identify emerging risks and opportunities

- Optimization algorithms that consider exponentially more scenarios than traditional approaches

Platforms utilizing these technologies, such as Wealthfront’s Path and BlackRock’s Aladdin, are increasingly available to retail investors through financial advisors and robo-advisory platforms.

Direct Indexing and Hyper-Personalization

The next frontier in diversification is hyper-personalization through direct indexing:

- Owning individual securities rather than funds to allow for tax-loss harvesting at the security level

- Customizing exposures based on personal values, existing holdings, or tax situations

- Implementing factor tilts without sacrificing broad market exposure

- Creating personalized benchmarks aligned with specific financial goals

Direct indexing platforms now offer these capabilities with minimums as low as $100,000, down from $5 million just five years ago.

Alternative Data and New Diversification Dimensions

Innovative investors are discovering new dimensions for diversification beyond traditional asset classes:

- Supply Chain Diversification: Balancing exposures across global supply networks

- Thematic Diversification: Allocating across major secular trends like AI, clean energy, and aging demographics

- Geopolitical Risk Diversification: Balancing exposure to different political and regulatory regimes

- Climate Risk Diversification: Ensuring resilience against various climate change scenarios

These emerging approaches supplement traditional diversification methods by addressing risks not captured in conventional models.

Tokenization and Fractional Ownership

Blockchain technology is enabling unprecedented access to previously inaccessible asset classes:

- Fractional ownership of fine art, collectibles, and luxury assets

- Tokenized real estate providing liquidity to illiquid assets

- Micro-shares of private companies and venture capital investments

- Programmable assets with built-in diversification mechanisms

These innovations democratize sophisticated diversification strategies previously available only to ultra-high-net-worth individuals and institutional investors.

FAQs – Portfolio Diversification Tools

1. What is the optimal number of investments for a properly diversified portfolio?

Research indicates that most diversification benefits in equities are achieved with 25-30 individual stocks, though this assumes proper sector and factor diversification. For a multi-asset portfolio, 5-7 distinct asset classes typically capture 90% of potential diversification benefits. However, the optimal number varies based on portfolio size, investment goals, and implementation methods (individual securities vs. funds).

2. Does international diversification still work given increased global market correlation?

Yes, though the benefits have moderated. While short-term correlations between developed markets have increased (now averaging 0.7-0.8 compared to 0.4-0.5 thirty years ago), international diversification still provides significant benefits: exposure to different economic cycles, currency diversification, and access to industries underrepresented in the US market. Emerging markets, with correlations of 0.5-0.6 to US equities, continue to provide more substantial diversification benefits.

3. How much should alternative allocation represent in a balanced portfolio?

Financial institutions like JP Morgan, BlackRock, and Yale Endowment recommend 15-30% alternatives allocation for most investors with over $250,000 in investable assets. Smaller portfolios might limit alternatives to 5-10% using liquid alternative strategies accessible through ETFs and mutual funds. The specific allocation should increase with portfolio size, investment horizon, and risk tolerance.

4. What’s the difference between diversification and asset allocation?

Asset allocation is the strategic division of a portfolio among major asset classes (stocks, bonds, cash, alternatives), while diversification represents the tactical implementation within and across those categories. Asset allocation typically determines 90% of portfolio return variability, according to the landmark Brinson, Hood, and Beebower study, while diversification primarily reduces risk within the chosen allocation.

5. How often should a diversified portfolio be rebalanced?

Research from Morningstar and Vanguard suggests that most portfolios benefit from rebalancing when allocations drift 5% or more from targets, typically occurring every 12-18 months in moderately volatile markets. However, tax considerations might extend this timeframe for taxable accounts. More sophisticated portfolios might implement quarterly rebalancing with tighter bands (±3%) for core positions and wider bands (±7%) for satellite holdings.

6. Are ETFs or mutual funds better vehicles for implementing diversification strategies?

ETFs generally offer advantages for diversification implementation due to their lower costs (average expense ratio of 0.18% vs. 0.63% for mutual funds), intraday liquidity, and superior tax efficiency. However, mutual funds remain advantageous in certain illiquid market segments, for automated investment programs, and for strategies requiring active management with limited index alternatives.

7. How should retirement accounts be diversified differently from taxable accounts?

Retirement accounts should preferentially hold tax-inefficient investments like REITs (with dividends taxed as ordinary income), high-turnover strategies, and bond funds (especially corporate and high-yield). Taxable accounts should emphasize tax-efficient investments like index ETFs, municipal bonds, and positions intended for long-term appreciation. This “asset location” strategy can add 0.20-0.50% in after-tax returns annually according to Vanguard research.

8. What diversification tools work best during market crashes?

During acute market crashes, traditional diversifiers like investment-grade bonds, particularly US Treasuries, remain most reliable (providing negative correlation of -0.3 to -0.5 with equities during crises). Additionally, managed futures strategies, trend-following systems, and dedicated tail-risk hedges (like long-volatility positions) have historically provided positive returns during major equity market drawdowns, though they create drag during normal market conditions.

9. How can smaller investors access alternative investments for diversification?

Today’s investors can access alternatives through multiple channels without meeting traditional high minimums:

- Liquid alternative mutual funds and ETFs (minimums of $1-1,000)

- Interval funds specializing in private credit and real assets (minimums of $2,500-25,000)

- Online platforms like Fundrise, Yieldstreet, and Masterworks (minimums of $500-10,000)

- Startup investing through platforms like SeedInvest and Republic (minimums of $100-1,000) These vehicles provide exposure to alternative return streams without the liquidity constraints and high minimums of traditional private market investments.

10. What metrics should investors use to evaluate their diversification effectiveness?

Beyond simple correlation matrices, sophisticated diversification assessment should include:

- Conditional correlations (how assets correlate during stress periods specifically)

- Maximum drawdown (peak-to-trough decline)

- Downside capture ratio (percentage of market downside experienced)

- Sharpe and Sortino ratios (return per unit of risk, with Sortino focusing on downside risk)

- Stress test results across various historical and hypothetical scenarios. Free tools like Portfolio Visualizer and professional platforms like Morningstar Direct provide these metrics for comprehensive diversification assessment.

Conclusion

The evolution of portfolio diversification has transformed from simple stock-picking to sophisticated, multi-dimensional risk management. Today’s investors have unprecedented access to diversification tools previously available only to institutional investors, from AI-powered analytics to alternative asset platforms and customized risk management solutions.

The ultimate diversification strategy isn’t about eliminating all volatility – an impossible and counterproductive goal – but rather about creating resilience against catastrophic losses while maintaining exposure to growth.

By combining traditional asset class diversification with modern approaches to factor, strategy, and risk diversification, investors can build portfolios capable of weathering various market environments while capturing long-term returns necessary for financial success.

As markets continue to evolve and new risks emerge, the practice of diversification will remain both an art and a science—constantly adapting but eternally essential to investment success.

For your reference, recently published articles include:

- Risk-Proof Your Wealth: Professional Investment Risk Scoring Methods Revealed

- Market Trend Analysis: Technical Analysis Secrets Exposed

- Digital Age Success Story: With AI To Private Wealth

- Investment Portfolio Tracking: Best Billionaire Hacks For You

- 10X Your Money: Growth Investing Analytics That Work

- Best Value Investing Tools – Create Wealth “Like Warren Buffett”

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.