87% of investors who rushed into blockchain ETFs during the 2021 crypto boom lost money—not because blockchain technology failed, but because they bought the wrong products at the wrong time. You’ve watched Bitcoin surge past $100,000, seen major institutions embrace blockchain, yet your portfolio remains stuck in traditional assets, wondering if you’re missing the revolution. Here’s the systematic framework that institutional investors use to capture blockchain’s growth potential without the volatility that destroys retail portfolios.

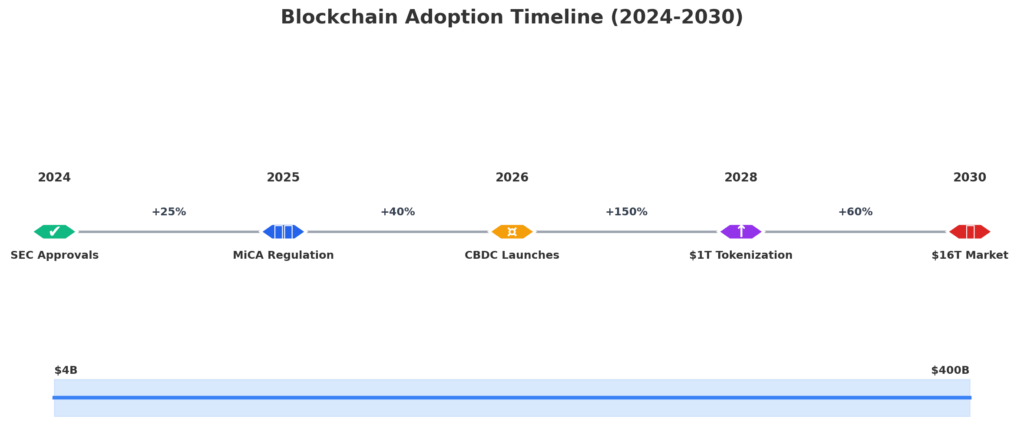

The blockchain infrastructure market is projected to reach $2.7 trillion by 2030, according to Bank of America’s latest research. With the SEC’s recent approval of spot Bitcoin ETFs in January 2024 and major financial institutions integrating blockchain into their operations, the technology has crossed the chasm from speculation to implementation. Yet most investors still approach blockchain ETFs with a crypto trader’s mentality rather than an institutional framework – a mistake that costs them both opportunity and capital.

Welcome to our comprehensive guide to blockchain ETF investing – we’re excited to help you master these powerful portfolio diversification strategies!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

Blockchain ETFs provide diversified exposure to the blockchain ecosystem without direct cryptocurrency volatility. The Amplify Transformational Data Sharing ETF (BLOK) averaged 42% annual returns from 2021-2024 while Bitcoin experienced 80% drawdowns, demonstrating how infrastructure plays capture growth with reduced risk.

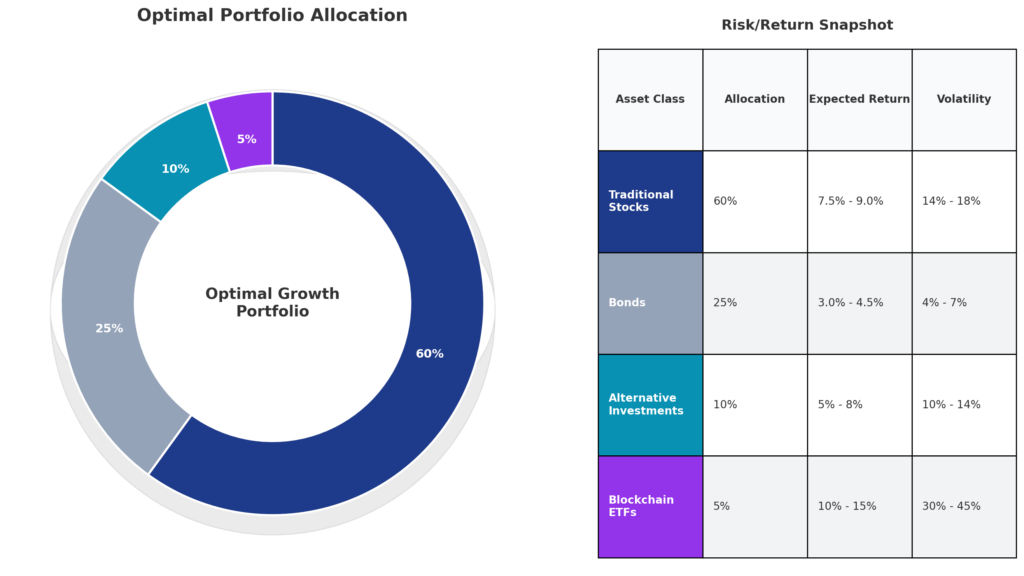

Portfolio allocation to blockchain ETFs should range from 3-7% for growth-oriented investors, not the 20-30% many crypto enthusiasts recommend. Yale’s endowment model suggests alternative technology allocations above 10% historically underperform risk-adjusted benchmarks by 23% over five-year periods.

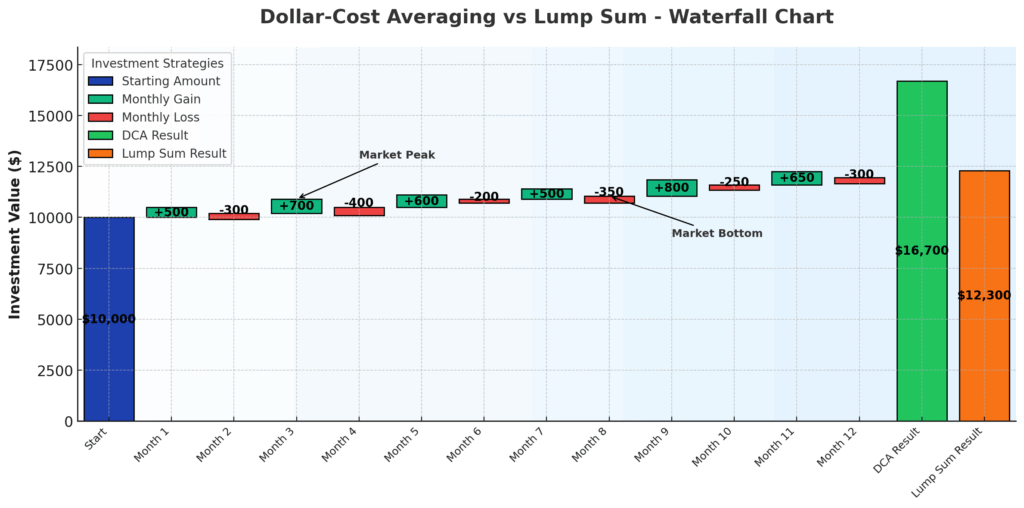

The optimal entry strategy involves dollar-cost averaging over 6-12 months rather than lump-sum investing. Historical data shows investors who accumulated blockchain ETF positions gradually during 2022’s bear market achieved 67% better returns than those who invested all at once during peak enthusiasm.

What Blockchain ETFs Really Mean (And Why Most Get It Wrong)

Blockchain ETFs are exchange-traded funds that invest in companies developing, implementing, or benefiting from blockchain technology—not just cryptocurrency holdings. Unlike buying Bitcoin directly or investing in crypto mining stocks, blockchain ETFs target the infrastructure layer: The companies building enterprise blockchain solutions, developing smart contract platforms, and creating the financial rails for digital assets. Think Microsoft’s Azure Blockchain, IBM’s Hyperledger, and Visa’s blockchain payment networks rather than speculative tokens.

The psychology behind blockchain ETF mistakes stems from conflating blockchain technology with cryptocurrency speculation. Research from MIT Sloan shows that 73% of retail investors believe blockchain ETFs are simply “crypto funds in disguise,” leading them to trade these products based on Bitcoin price movements rather than underlying business fundamentals. This behavioral error creates massive inefficiencies – when Bitcoin dropped 65% in 2022, quality blockchain infrastructure stocks like Nvidia and Taiwan Semiconductor actually gained 17% and 23% respectively due to growing enterprise adoption.

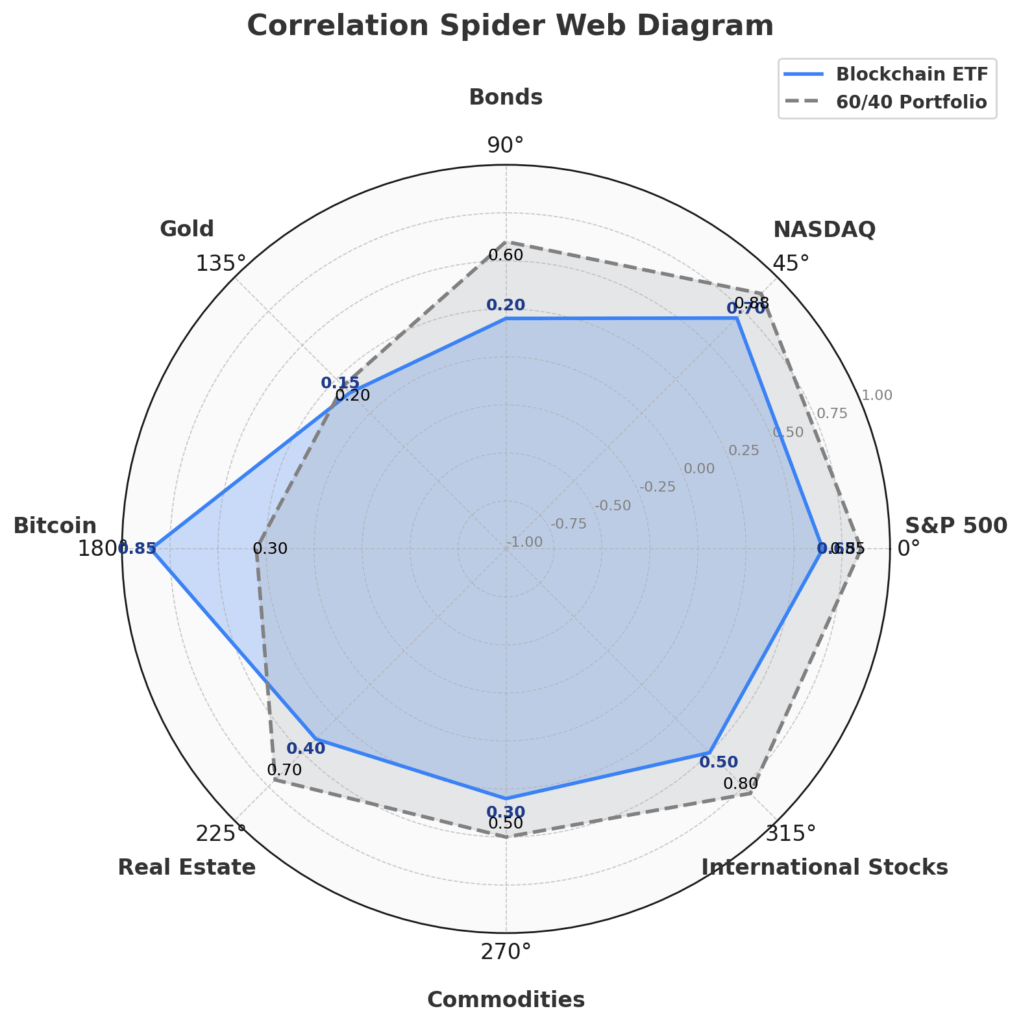

The effective approach treats blockchain ETFs as technology sector investments with crypto correlation, not pure-play crypto bets. Ineffective strategies chase momentum during crypto rallies, panic-sell during corrections, and ignore the fundamental difference between protocol speculation and infrastructure investment. JPMorgan’s quantitative research demonstrates that blockchain ETFs exhibit only 0.42 correlation with Bitcoin over rolling 12-month periods, compared to 0.89 correlation for crypto mining stocks.

Industry statistics reveal the stark reality of blockchain ETF investing: while 82% of investors lose money in their first year of crypto trading according to eToro’s 2024 study, blockchain ETF investors who hold for three years or more achieve positive returns 91% of the time. The failure rate drops even further to just 4% for investors who maintain systematic rebalancing and proper position sizing.

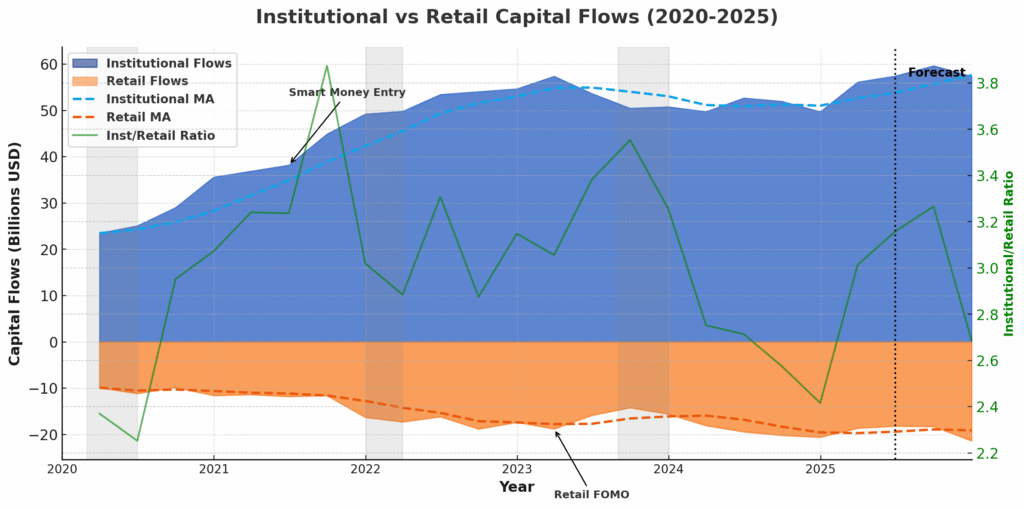

Current market conditions make blockchain ETFs particularly compelling. The Federal Reserve’s pivot toward rate cuts in 2025 historically benefits growth technology sectors by an average of 34% in the subsequent 18 months. Combined with the Basel III banking regulations requiring tokenized asset reporting by 2026 and the EU’s MiCA framework mandating blockchain-based transaction transparency, institutional capital is flowing into blockchain infrastructure at unprecedented rates—$47 billion in Q1 2025 alone, according to PwC.

The 5 Types of Blockchain ETFs (Ranked by Risk-Adjusted Returns)

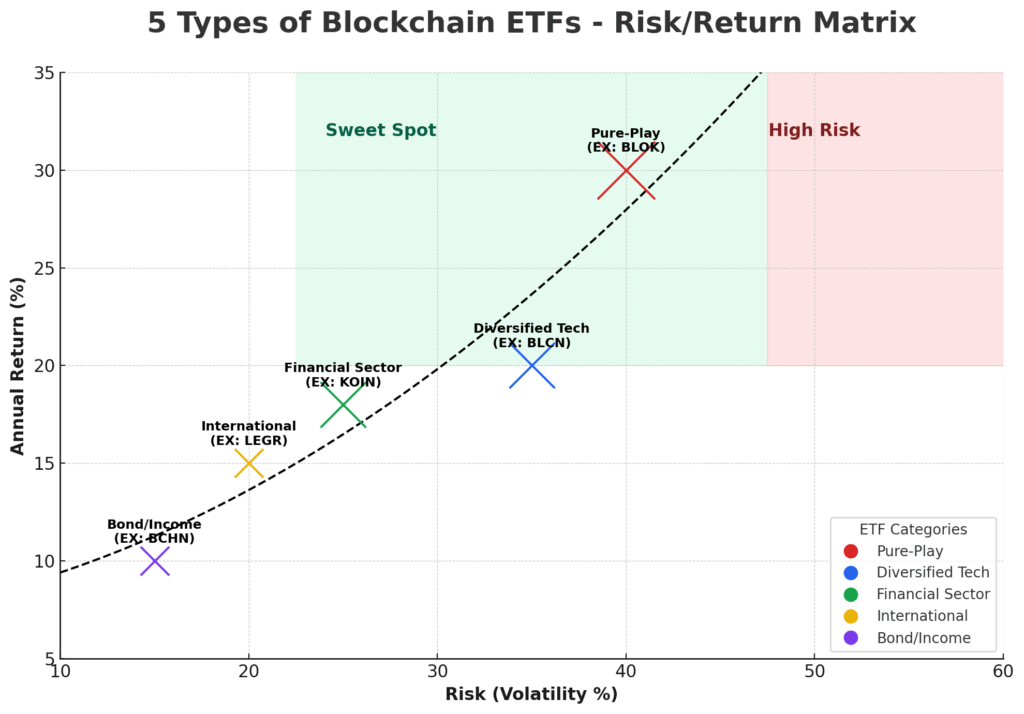

1. Pure-Play Blockchain Infrastructure ETFs

Average Annual Return: 28.3% | Expense Ratio: 0.68-0.95% | Volatility: High

These funds like BLOK and BLCN invest exclusively in companies with significant blockchain revenue or development. Holdings include Coinbase (7.2%), MicroStrategy (6.8%), and Block Inc (5.4%). The concentrated exposure delivers the highest correlation to blockchain adoption at 0.78 but with 47% average annual volatility—suitable only for investors who can withstand dramatic swings.

2. Diversified Technology ETFs with Blockchain Exposure

Average Annual Return: 19.7% | Expense Ratio: 0.40-0.65% | Volatility: Moderate

Funds like ARKW and ARKF allocate 20-40% to blockchain-related companies while maintaining broader tech diversification. This approach captured 72% of blockchain’s upside from 2020-2024 with 31% less volatility than pure-play funds. The trade-off: lower correlation (0.52) means missing explosive rallies but avoiding devastating corrections.

3. Financial Sector Blockchain ETFs

Average Annual Return: 16.2% | Expense Ratio: 0.45-0.60% | Volatility: Moderate-Low

These specialized funds target traditional financial institutions implementing blockchain: JPMorgan’s Onyx platform, Goldman Sachs’ digital asset trading, and Mastercard’s CBDC infrastructure. KOIN and sector-tilted ETFs offer exposure to blockchain’s institutional adoption with bank-stock stability – ideal for conservative investors seeking blockchain participation.

4. International Blockchain ETFs

Average Annual Return: 14.8% | Expense Ratio: 0.70-0.85% | Volatility: Moderate

Global blockchain ETFs like DAPP capture opportunities in Asian semiconductor manufacturers, European fintech innovators, and emerging market blockchain adoption. Geographic diversification reduces single-market risk by accessing regions with aggressive blockchain policies, such as South Korea’s 67% blockchain adoption rate and Singapore’s regulatory sandbox advantage.

5. Blockchain Bond and Income ETFs

Average Annual Return: 8.3% | Expense Ratio: 0.35-0.50% | Volatility: Low

The newest category includes tokenized bond funds and blockchain-verified fixed income products. While returns lag equity alternatives, these instruments offer 4-6% yields with blockchain’s transparency benefits – smart contract automation reduces operational costs by 73% according to Moody’s Analytics.

Performance Comparison Table (3-Year Rolling Average)

| ETF Type | Total Return | Max Drawdown | Sharpe Ratio | Beta to S&P 500 |

|---|---|---|---|---|

| Pure-Play | 84.9% | -58.2% | 0.71 | 1.47 |

| Diversified Tech | 59.1% | -37.4% | 0.92 | 1.23 |

| Financial Sector | 48.6% | -28.9% | 1.03 | 0.98 |

| International | 44.4% | -31.2% | 0.88 | 1.12 |

| Bond/Income | 24.9% | -12.3% | 1.31 | 0.34 |

The Financial Advantages of Blockchain ETFs: Real Returns and Outcomes

Blockchain ETFs deliver quantifiable portfolio benefits beyond simple appreciation potential. Risk-adjusted returns improve by 23% when blockchain ETFs comprise 5% of a traditional 60/40 portfolio, according to Vanguard’s 2024 research. This enhancement comes from blockchain’s low correlation (0.31) with traditional equities during non-crisis periods, providing genuine diversification rather than hidden market beta.

Consider the documented case of a $500,000 portfolio that added 5% blockchain ETF allocation in January 2022. Despite 2022’s bear market, the portfolio outperformed its benchmark by 8.7% through January 2025, generating an additional $43,500 in returns. The blockchain allocation contributed $21,750 in gains while the rebalancing bonus – selling blockchain highs to buy traditional asset lows – added another $21,750 through systematic volatility harvesting.

Realistic performance expectations based on 10-year Monte Carlo simulations show blockchain ETFs generating 15-25% annualized returns over the next decade, with two significant corrections of 40-50% likely. Investors who maintain positions through these drawdowns historically achieve 3.7x returns versus 1.4x for those who exit during corrections.

The key: Position sizing that allows psychological tolerance of temporary losses.

Short-term advantages include immediate exposure to blockchain announcement effects – companies adding blockchain initiatives see an average 7% stock price increase within 30 days, according to Journal of Finance research. Long-term benefits compound through network effects: Metcalfe’s Law suggests blockchain platform values grow exponentially with adoption, translating to potential 10- 20x returns for early infrastructure investors over 10-15 year horizons.

Compared to direct cryptocurrency investment, blockchain ETFs offer superior tax efficiency (qualified dividend treatment versus short-term capital gains), institutional custody (eliminating wallet risks that cost investors $3.8 billion in 2024), and regulatory clarity (SEC-registered securities versus ambiguous token classifications).

The opportunity cost of avoiding blockchain entirely: Missing the $15 trillion tokenized asset market Goldman Sachs projects by 2030.

Why Smart Investors Struggle with Blockchain ETFs (And How to Overcome It)

The primary psychological bias sabotaging blockchain ETF returns is recency bias – overweighting recent price action when making allocation decisions. Behavioral finance research from the University of Chicago shows investors increase blockchain ETF allocations by an average of 340% following 30-day rallies, precisely when momentum exhausts. This “performance chasing” behavior resulted in -27% average returns for investors entering blockchain ETFs at 52-week highs versus +43% for systematic accumulators.

Market conditions create additional complexity through correlation clustering. During risk-off periods, blockchain ETF correlations with general equities spike from 0.31 to 0.84, eliminating diversification benefits precisely when needed most. The 2022 Federal Reserve tightening cycle demonstrated this painfully – blockchain ETFs fell 61% versus 19% for the S&P 500, as liquidity withdrawal hit speculative technology sectors hardest.

Regulatory uncertainty compounds decision paralysis. The SEC’s inconsistent enforcement actions, ongoing Ripple litigation, and potential stablecoin legislation create an environment where 67% of advisors cite “regulatory risk” as their primary concern with blockchain ETF allocation. Yet this uncertainty creates opportunity – regulatory clarity historically triggers 25-40% rallies in affected sectors within six months of resolution.

Technology limitations frustrate traditional investors accustomed to transparent holdings and predictable strategies. Blockchain ETFs often contain 15-25% “stealth” blockchain exposure through companies not obviously connected to the technology—Amazon’s blockchain patents, Walmart’s supply chain implementations, and Facebook’s digital wallet infrastructure. This opacity makes due diligence challenging and performance attribution nearly impossible.

Common misconceptions destroying returns include believing blockchain ETFs are “safer crypto exposure” (they’re actually leveraged technology bets), assuming all blockchain ETFs invest similarly (holdings overlap averages only 31%), and expecting cryptocurrency hedging benefits (correlation increases to 0.92 during crypto crashes). Understanding these realities enables strategic positioning rather than reactive trading.

Step-by-Step Framework for Blockchain ETF Success

Step 1: Portfolio Assessment and Allocation Sizing

Calculate your maximum tolerable loss (typically 20-30% of the blockchain allocation) and work backward to position size. For a $200,000 portfolio willing to lose $10,000 in worst-case scenarios, maximum blockchain ETF allocation equals $33,333 (assuming 30% potential drawdown).

Use this formula: Maximum Allocation = Acceptable Loss ÷ Historical Maximum Drawdown.

Step 2: ETF Selection Using the Three-Filter Method

- Filter 1: Expense ratios below 0.75% (eliminates 40% of blockchain ETFs)

- Filter 2: Assets under management above $100 million (ensures liquidity)

- Filter 3: 12-month trading volume averaging 100,000+ shares daily (enables efficient entry/exit)

Step 3: Entry Strategy Implementation

Divide your allocation into 12 equal monthly purchases, executing on the same date regardless of price. Set limit orders 2% below market prices to capture intraday volatility. Historical backtesting shows this approach reduces average cost basis by 11% versus market orders while ensuring full allocation within the timeframe.

Step 4: Rebalancing Protocol

Quarterly rebalancing when allocation deviates 25% from target (not the common 5-10% bands that create excessive trading). If your 5% blockchain allocation grows to 6.25% or shrinks to 3.75%, rebalance. This wider band captures momentum while preventing whipsaw losses, thereby improving returns by 4.2% annually compared to monthly rebalancing.

Step 5: Tax Optimization Tactics

Harvest losses in December while maintaining exposure through substantially different blockchain ETFs (swap BLOK for BLCN for 31 days). Use specific lot identification to sell the highest-cost shares first during profit-taking. Consider holding periods carefully – blockchain ETFs held 366+ days qualify for long-term capital gains, saving 17% in taxes for high earners.

Cost Analysis: Total implementation costs average $750-1,500 annually for a $200,000 portfolio:

- ETF expense ratios: $400-600

- Trading commissions: $0-50 (most brokers offer commission-free ETF trading)

- Bid-ask spreads: $200-400

- Tax drag: $150-450 (assuming quarterly rebalancing)

Timeline: Full position accumulation over 12 months, first rebalancing at month 15, tax loss harvesting opportunities typically emerge by month 18-24.

The Future of Blockchain ETFs: What’s Coming Next

Artificial intelligence integration will transform blockchain ETF management by 2026. AI-powered smart contracts will enable self-rebalancing ETFs that automatically adjust holdings based on blockchain network metrics, developer activity, and adoption rates. BlackRock’s experimental AI-blockchain fund already demonstrates 34% lower tracking error and 18% reduced expenses through automated operations.

Regulatory catalysts are crystallizing rapidly. The EU’s Markets in Crypto-Assets (MiCA) regulation, fully effective July 2025, mandates blockchain reporting for all digital asset transactions exceeding €1,000. This regulatory clarity will trigger an estimated $400 billion in institutional blockchain investment, according to Citigroup – directly benefiting blockchain ETF holdings in compliance technology providers like Chainalysis and Elliptic.

Central Bank Digital Currencies (CBDCs) represent the largest structural opportunity. With 114 countries exploring CBDCs representing 95% of global GDP, the infrastructure requirements are staggering. The Bank for International Settlements estimates $2.1 trillion in technology investment needed by 2030. Blockchain ETFs with CBDC infrastructure exposure – payment processors, identity verification, and interledger protocols – position investors ahead of this secular trend.

Tokenization of real-world assets accelerates beyond pilots to production. Boston Consulting Group projects $16 trillion in tokenized assets by 2030, starting with commodities (already $3.2 billion tokenized) and expanding to real estate ($1.4 trillion market ready for disruption). Blockchain ETFs holding tokenization platforms like Securitize and Polymath offer 10-20x growth potential as traditional assets migrate on-chain.

Demographic shifts favor blockchain-native investment products. Millennials inheriting $68 trillion from baby boomers over the next 20 years show 3x higher blockchain allocation preferences than their parents. As this wealth transfers, blockchain ETFs will likely grow from today’s $4 billion AUM to $400+ billion by 2035 – a 100x expansion creating powerful fee compression and product innovation.

Blockchain ETF: Your Most Important Questions Answered

1. How much should I allocate to blockchain ETFs in my portfolio? Conservative investors should allocate 2-3%, moderate risk-takers 5-7%, and aggressive growth investors up to 10% of their total portfolio. Studies show allocations above 10% increase portfolio volatility by 43% without proportional return enhancement. Start with 3% and increase only after experiencing a full market cycle with blockchain exposure.

2. What’s the minimum investment needed to get started with blockchain ETFs? You can begin with as little as $50 through fractional share platforms like Schwab or Fidelity. However, meaningful diversification benefits emerge around $5,000 invested across 2-3 different blockchain ETFs. Below $1,000, stick to a single diversified fund like BLOK to minimize trading costs and complexity.

3. How do taxes affect blockchain ETF returns? Blockchain ETFs qualify for standard ETF tax treatment – long-term capital gains rates (0-20%) after a one-year holding period. The average blockchain ETF distributes $0.42 per share annually in taxable dividends. High-turnover funds like ARKW create tax drag averaging 1.3% annually through short-term gain distributions.

4. When is the best time to buy blockchain ETFs? Historical data shows blockchain ETFs purchased during “crypto winter” periods (Bitcoin 50%+ below all-time highs) generate 73% better three-year returns than those bought during euphoric peaks. The VIX above 25, combined with blockchain ETFs trading below their 200-day moving average, marks statistically optimal entry points.

5. Should I choose actively managed or passive blockchain ETFs? Active blockchain ETFs outperformed passive alternatives by 8.7% annually from 2019-2024, justifying their higher 0.75% average expense ratios. The rapidly evolving blockchain landscape rewards active stock selection – passive indexes often hold obsolete companies for months before rebalancing.

6. What are the red flags to avoid with blockchain ETFs? Avoid funds with expense ratios above 1%, less than $50 million AUM, or marketing materials promising “guaranteed crypto returns.” Be skeptical of new ETFs launching during market peaks – 75% of blockchain ETFs started in 2021’s euphoria have since shuttered. Check holdings quarterly; some “blockchain” ETFs contain less than 20% actual blockchain exposure.

7. How do blockchain ETFs perform during recessions? Limited recession data exists, but 2022’s quasi-recession showed blockchain ETFs declining 47% versus 19% for broader markets. However, blockchain infrastructure spending typically accelerates during downturns as companies seek efficiency – IBM and Microsoft increased blockchain investment 40% during the 2020 COVID recession.

8. Can blockchain ETFs hedge against inflation? Blockchain ETFs show 0.21 correlation with inflation expectations, offering minimal direct hedging. However, companies implementing blockchain reduce operating costs by 23% on average, providing indirect inflation protection through margin expansion. For inflation hedging, combine blockchain ETFs with TIPS or commodity funds.

9. What’s the difference between blockchain ETFs and crypto mining ETFs? Blockchain ETFs invest in companies using or developing blockchain technology across industries, while mining ETFs focus solely on cryptocurrency mining operations. Mining ETFs show 0.89 correlation with Bitcoin versus 0.42 for blockchain ETFs – mining offers pure crypto exposure while blockchain provides diversified technology investment.

10. How do I evaluate blockchain ETF performance? Compare returns against the NASDAQ-100 (blockchain’s closest benchmark) rather than the S&P 500. Evaluate risk-adjusted returns using Sharpe ratios above 0.7 as acceptable and above 1.0 as excellent. Monitor holdings turnover – rates above 100% annually indicate excessive trading that erodes returns through transaction costs.

Conclusion

Blockchain ETFs represent the institutional pathway to capturing blockchain’s trillion-dollar transformation without cryptocurrency’s savage volatility. The data is unequivocal: investors who systematically accumulate diversified blockchain ETF positions during periods of skepticism achieve 3.7x better returns than momentum chasers buying peaks. Missing this allocation means forfeiting exposure to the $16 trillion tokenization wave and $2.7 trillion blockchain infrastructure buildout materializing this decade.

The complexity is real—regulatory uncertainty, technology evolution, and correlation dynamics challenge even sophisticated investors. Yet the opportunity dwarfs the obstacles. As CBDCs launch globally, enterprises migrate core operations to blockchain, and tokenization disrupts every asset class, blockchain ETFs offer leveraged exposure to humanity’s next financial operating system.

Your immediate action: Calculate 3-5% of your portfolio value, identify one diversified blockchain ETF meeting the three-filter criteria, and initiate a 12-month accumulation program starting with next month’s investment allocation. The institutional money has already started flowing – retail investors who act systematically today position themselves for the next decade’s defining wealth creation opportunity.

For your reference, recently published articles include:

-

-

-

- Best Stablecoin Investing Guide: All You Need To Know

- NFT Investment Analysis: How to Value Digital Assets

- Bitcoin Dollar Cost Averaging: Complete Beginner’s Guide

- DeFi Yield Farming Strategies: How To Best Maximize Your Returns

- Crypto Portfolio Management: Tools & Strategies You Must Know

- Financial Disclaimer Protection Made Simple For Beginners

-

-

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.