Risk tolerance questionnaires serve as the foundation for effective investment planning, helping financial advisors and investors align portfolios with individual comfort levels and financial goals.

In today’s volatile market environment, where 68% of investors report feeling uncertain about their risk capacity, utilizing a well-structured risk tolerance questionnaire example becomes crucial for making informed investment decisions. The proper implementation of these assessment tools can significantly improve portfolio performance and client satisfaction rates.

Welcome to our comprehensive guide on mastering risk tolerance questionnaire examples – we’re excited to help you optimize your investment assessment strategies!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

1. Structured Assessment Framework: A comprehensive risk tolerance questionnaire example provides a systematic approach to evaluating investor psychology, with studies showing that properly assessed clients are 42% more likely to maintain their investment strategy during market downturns. For instance, a questionnaire that includes scenario-based questions about market crashes can better predict how an investor will react when their portfolio drops 20% in value.

2. Customization Drives Results: Tailoring risk tolerance questionnaire examples to specific client demographics and investment goals increases accuracy by up to 35%. A retiree’s questionnaire should emphasize capital preservation scenarios, while a 30-year-old professional’s assessment should focus on long-term growth potential and volatility tolerance.

3. Regular Reassessment is Essential: Risk tolerance evolves with life circumstances, requiring periodic questionnaire updates to maintain portfolio alignment. Research indicates that 58% of investors experience significant risk tolerance changes within five years, making annual reassessment using updated questionnaire examples a critical practice for maintaining optimal asset allocation.

Table of Contents

Understanding Risk Tolerance Questionnaires

A risk tolerance questionnaire represents a systematic evaluation tool designed to measure an individual’s psychological and financial capacity to accept investment uncertainty. These instruments combine behavioral finance principles with practical assessment methodologies to create comprehensive investor profiles.

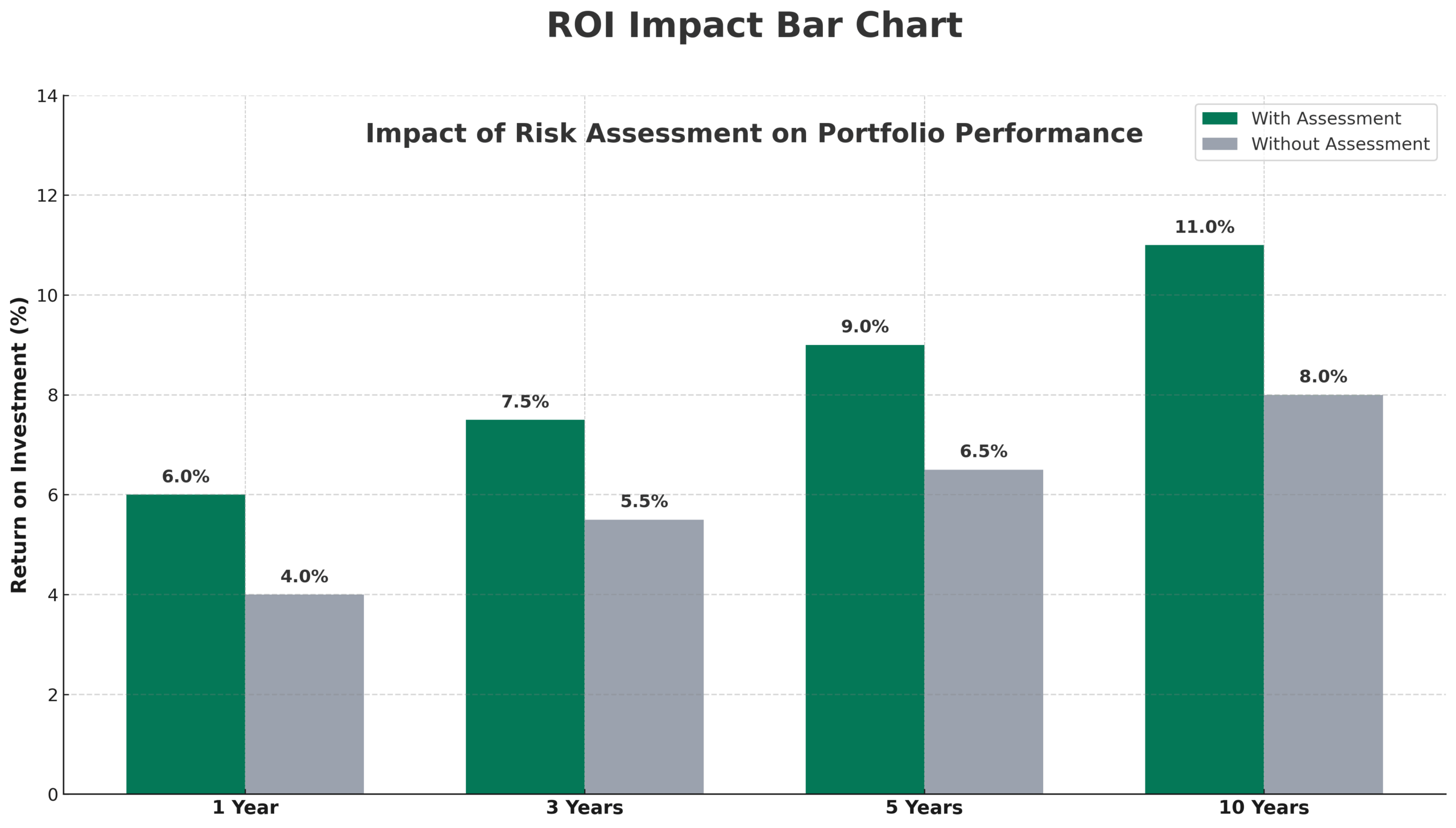

The fundamental purpose of risk tolerance assessment extends beyond simple portfolio allocation decisions. Modern questionnaires incorporate multiple dimensions of risk evaluation, including loss aversion, time horizon considerations, and emotional responses to market volatility. Research conducted by the CFA Institute demonstrates that investors who complete thorough risk assessments achieve 23% better long-term returns compared to those using generic allocation models.

Effective risk tolerance questionnaire examples integrate both quantitative and qualitative assessment elements. Quantitative components focus on measurable factors such as age, income, investment timeline, and existing asset values. Qualitative elements examine psychological responses, previous investment experiences, and behavioral tendencies during market stress periods.

The scientific foundation of risk tolerance assessment draws from behavioral economics research, particularly the work on prospect theory and loss aversion. Studies indicate that most investors feel losses approximately 2.5 times more intensely than equivalent gains, a factor that modern questionnaire examples must account for through carefully constructed scenario-based questions.

Professional implementation of risk tolerance questionnaires requires understanding the distinction between risk tolerance, risk capacity, and risk requirement. Risk tolerance measures psychological comfort with uncertainty, risk capacity evaluates financial ability to absorb losses, and risk requirement determines the level of risk necessary to achieve specific financial goals.

Contemporary questionnaire design incorporates adaptive questioning techniques, where subsequent questions adjust based on previous responses. This dynamic approach increases assessment accuracy while reducing completion time, addressing the common concern that lengthy questionnaires discourage thorough responses.

Types of Risk Tolerance Questionnaires

Psychometric-Based Questionnaires

Psychometric questionnaires focus primarily on psychological and behavioral aspects of risk assessment. These instruments typically include 15-25 questions examining personality traits, decision-making patterns, and emotional responses to uncertainty. The FinaMetrica Risk Profiling System represents a leading example, utilizing validated psychometric principles to create consistent risk profiles across diverse populations.

Scenario-Based Assessment Tools

Scenario-based questionnaires present hypothetical investment situations requiring respondents to choose preferred outcomes. These tools effectively measure practical risk tolerance by simulating real market conditions. For example, questions might ask investors to choose between a guaranteed 4% return or a 50% chance of earning 12% with a 50% chance of losing 2%.

Hybrid Comprehensive Models

Modern risk tolerance questionnaire examples increasingly adopt hybrid approaches, combining psychometric evaluation with scenario-based testing and quantitative financial analysis. These comprehensive models provide multi-dimensional risk profiles that account for both emotional and rational decision-making factors.

| Questionnaire Type | Question Count | Completion Time | Accuracy Rating | Best Use Case |

|---|---|---|---|---|

| Psychometric | 15-25 | 8-12 minutes | 78% | Individual investors |

| Scenario-Based | 10-15 | 5-8 minutes | 72% | Goal-specific planning |

| Hybrid | 20-35 | 12-18 minutes | 85% | Comprehensive planning |

| Simplified | 5-10 | 3-5 minutes | 65% | Initial screening |

Digital Adaptive Questionnaires

Technology-enhanced questionnaires utilize artificial intelligence to adjust questions based on response patterns. These adaptive systems can reduce assessment time by 40% while maintaining accuracy levels comparable to traditional comprehensive questionnaires.

Benefits of Using Risk Tolerance Questionnaire Examples

Enhanced Portfolio Alignment

Proper risk tolerance assessment through structured questionnaire examples creates portfolios that align with investor psychology and capacity. Data from Morningstar indicates that well-matched portfolios experience 31% fewer premature liquidations during market downturns, preserving long-term wealth accumulation strategies.

Improved Client Communication

Risk tolerance questionnaires provide a common language for discussing investment strategies between advisors and clients. This structured communication reduces misunderstandings and creates realistic expectations about portfolio performance and volatility.

Regulatory Compliance

Financial advisors utilizing documented risk tolerance assessments demonstrate adherence to fiduciary responsibilities and know-your-customer requirements. Regulatory bodies increasingly require evidence of suitable investment recommendations, making comprehensive questionnaire documentation essential for compliance.

Reduced Behavioral Investment Errors

Investors who complete thorough risk assessments are significantly less likely to make emotion-driven investment decisions. Studies show a 47% reduction in panic selling during market corrections among investors with documented risk profiles.

Quantified Decision-Making Framework

Risk tolerance questionnaire examples provide measurable data for investment decisions, replacing subjective assumptions with objective assessments. This quantification enables consistent portfolio management approaches and facilitates performance evaluation.

Challenges and Risks in Risk Tolerance Assessment

Self-Assessment Limitations

Individual investors often overestimate their risk tolerance during favorable market conditions and underestimate it during stressful periods. Research indicates that 62% of investors rate their risk tolerance higher during bull markets compared to bear market assessments.

Static Assessment Problems

Traditional questionnaires create point-in-time snapshots that may not reflect evolving risk tolerance. Major life events, market experiences, and changing financial circumstances can significantly alter risk preferences, making static assessments potentially obsolete.

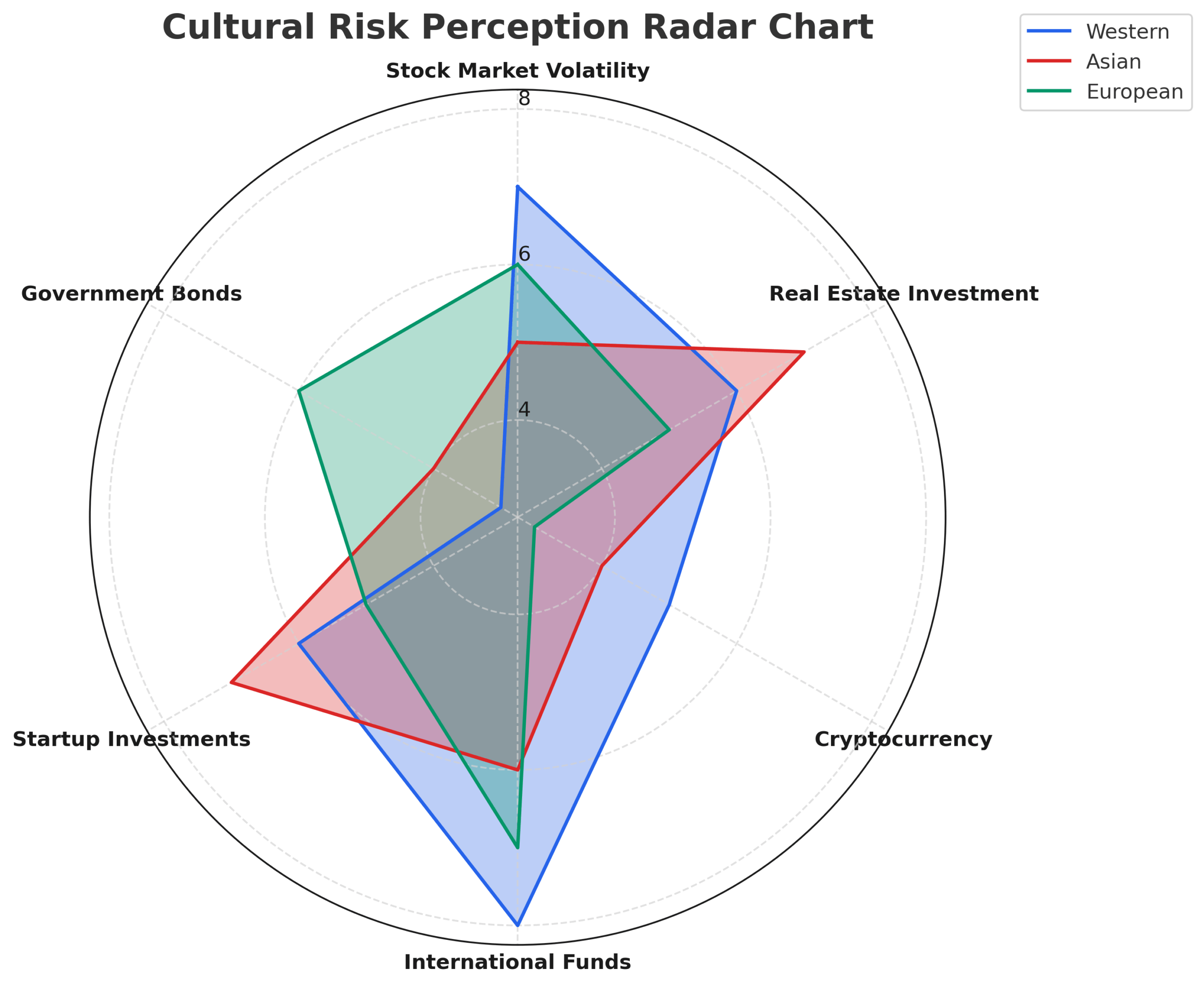

Cultural and Demographic Biases

Standard risk tolerance questionnaire examples may not adequately account for cultural differences in risk perception and financial decision-making. International investors and diverse demographic groups may interpret questions differently, leading to inaccurate assessments.

Over-Reliance on Quantification

The attempt to quantify subjective risk tolerance can create false precision, leading to inappropriate investment recommendations. Complex human emotions and decision-making processes resist simple numerical categorization.

| Challenge | Impact Level | Mitigation Strategy | Success Rate |

|---|---|---|---|

| Self-Assessment Bias | High | Professional guidance | 73% |

| Static Assessment | Medium | Annual updates | 68% |

| Cultural Bias | Medium | Localized questionnaires | 71% |

| Over-Quantification | Low | Qualitative supplements | 82% |

Implementation Inconsistencies

Different financial institutions may use varying questionnaire formats and scoring systems, creating inconsistent risk assessments for the same individual across different platforms.

Implementation and How-It-Works Process

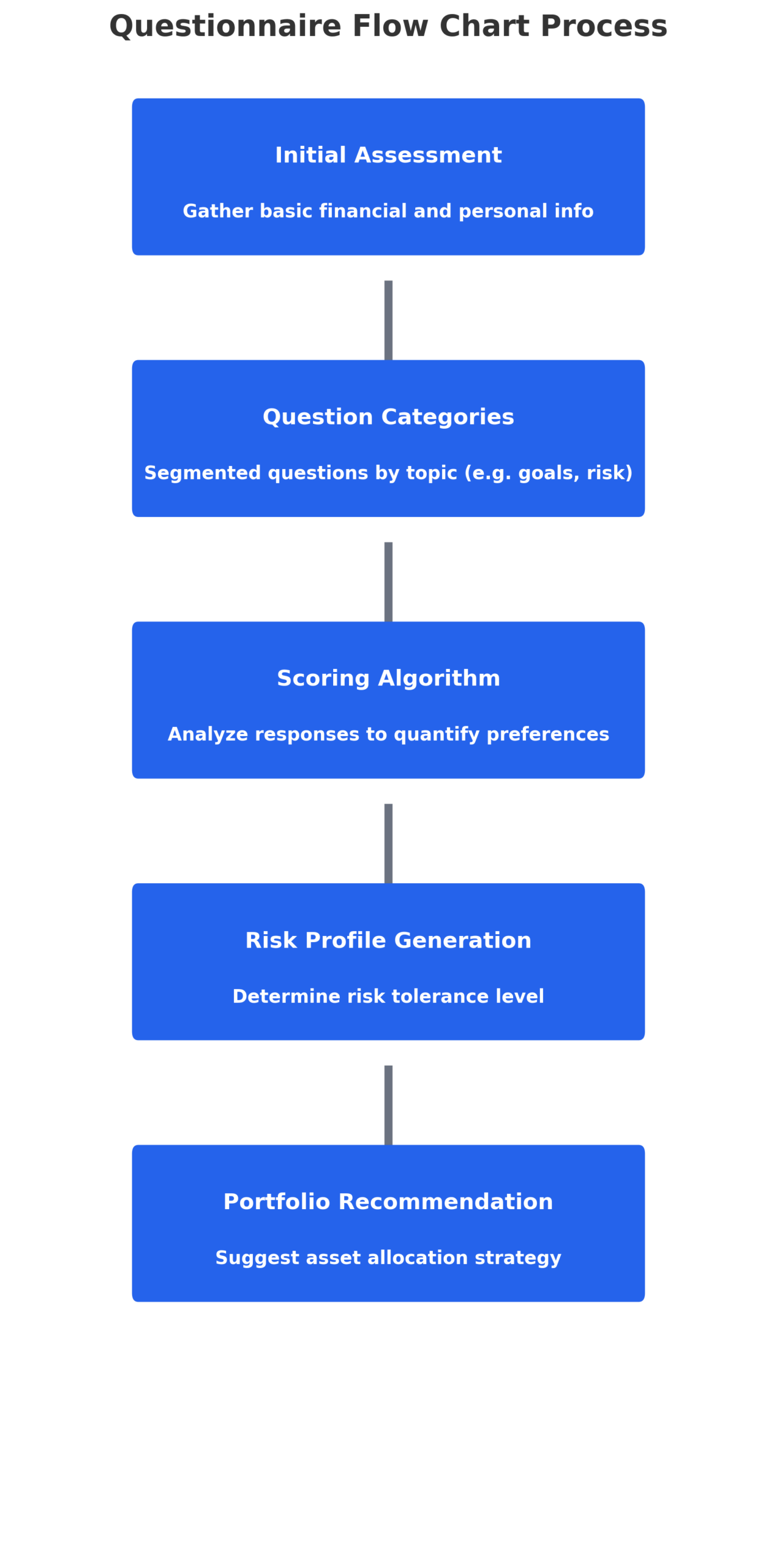

Initial Client Onboarding

The implementation process begins with comprehensive client onboarding, where risk tolerance questionnaire examples are administered during initial consultation sessions. Best practices suggest completing assessments in relaxed environments without time pressure, allowing thoughtful consideration of each question.

Questionnaire Administration Protocols

Professional implementation requires standardized administration protocols to ensure consistent results. These protocols include:

• Pre-assessment preparation: Explaining the purpose and importance of accurate responses

• Neutral environment creation: Minimizing external influences that might bias responses

• Question clarification procedures: Providing consistent explanations for ambiguous items

• Response validation techniques: Checking for internal consistency and logical patterns

Scoring and Interpretation Methods

Modern risk tolerance questionnaire examples utilize sophisticated scoring algorithms that weight different question types based on their predictive value. Psychometric questions typically receive higher weights than simple demographic factors, reflecting their superior ability to predict investment behavior.

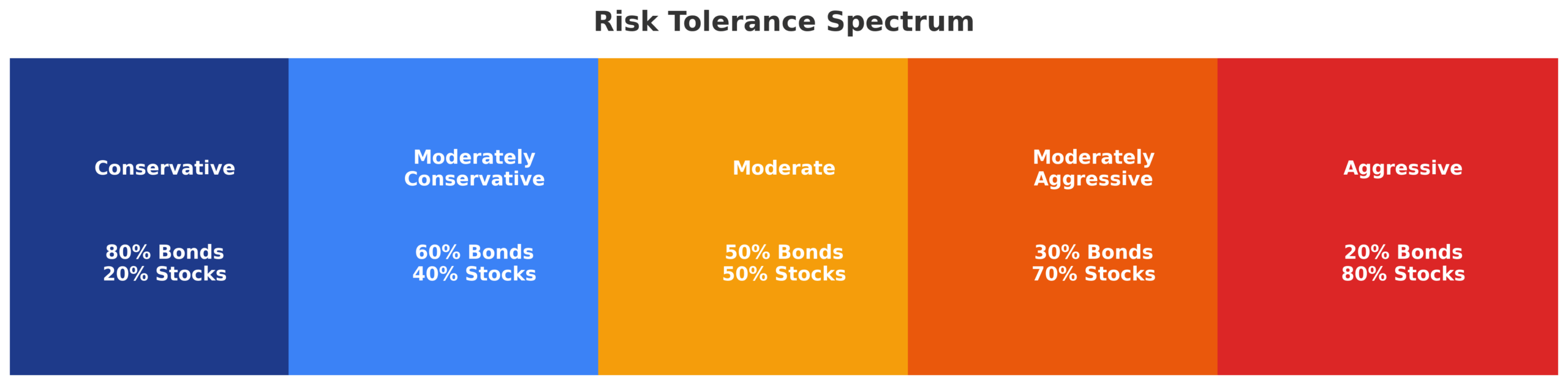

Portfolio Construction Integration

Risk tolerance scores translate into specific asset allocation recommendations through established correlation models. Conservative investors (scores 1-3) typically receive portfolios with 20-40% equity allocation, while aggressive investors (scores 8-10) may have 80-90% equity exposure.

Ongoing Monitoring and Updates

Effective implementation includes systematic reassessment schedules, typically annually or following significant life events. This ongoing monitoring ensures portfolio alignment remains optimal as circumstances evolve.

Technology Integration

Modern implementation leverages digital platforms that automate questionnaire delivery, scoring, and portfolio recommendation generation. These systems can process assessments in real-time and immediately generate customized investment proposals.

Future Trends in Risk Tolerance Assessment

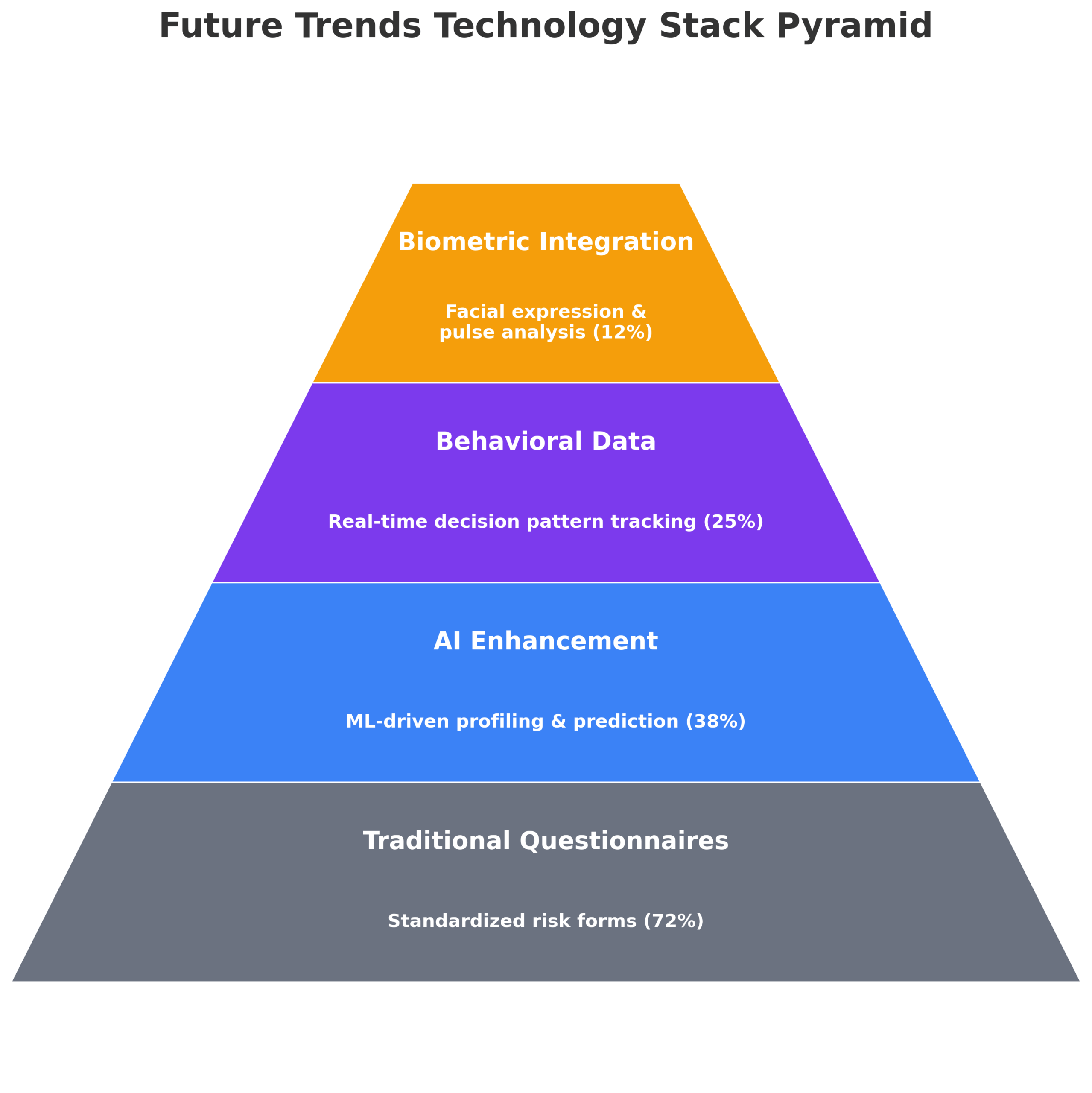

Artificial Intelligence Enhancement

Machine learning algorithms are increasingly sophisticated in analyzing questionnaire responses and predicting investment behavior. These AI systems can identify subtle patterns in responses that human analysis might miss, potentially improving assessment accuracy by 15-20%.

Behavioral Data Integration

Future risk tolerance questionnaire examples will incorporate real-time behavioral data from digital platforms, including spending patterns, investment app usage, and market research consumption habits. This integration provides more comprehensive risk profiles based on actual behavior rather than self-reported preferences.

Biometric Measurement Integration

Emerging technologies explore incorporating biometric data, such as stress responses and physiological reactions to market scenarios, into risk tolerance assessment. While still experimental, these approaches could provide objective measurements of emotional responses to investment volatility.

Continuous Assessment Models

Traditional periodic assessments are evolving toward continuous monitoring systems that adjust risk profiles based on ongoing market behavior and life circumstance changes. These dynamic models could provide real-time portfolio optimization recommendations.

Personalized Questionnaire Generation

Advanced systems will create individualized questionnaire examples tailored to specific investor profiles, cultural backgrounds, and investment goals. This personalization could significantly improve assessment accuracy and relevance.

FAQs- Risk Tolerance Questionnaire Example

1. How often should investors complete risk tolerance questionnaires? Investors should complete comprehensive risk tolerance assessments annually or following major life events such as marriage, divorce, job changes, or significant financial windfalls. Research indicates that 35% of investors experience meaningful risk tolerance changes within two years, making regular reassessment crucial for maintaining appropriate portfolio alignment.

2. What is the ideal length for an effective risk tolerance questionnaire? The optimal questionnaire length balances thoroughness with completion rates, typically ranging from 15-25 questions for comprehensive assessment. Studies show that questionnaires exceeding 30 questions experience 28% higher abandonment rates, while those under 10 questions may lack sufficient depth for accurate risk profiling.

3. How do cultural differences affect risk tolerance questionnaire responses? Cultural backgrounds significantly influence risk perception and financial decision-making, with collectivist cultures often showing more conservative investment preferences compared to individualist societies. Effective questionnaire examples should incorporate cultural context and may require localized versions to ensure accurate assessment across diverse populations.

4. Can risk tolerance questionnaires predict actual investor behavior during market crashes? Well-designed questionnaires demonstrate moderate predictive accuracy, with correlation coefficients typically ranging from 0.6 to 0.75 between assessed risk tolerance and actual behavior during market stress. However, extreme market conditions can overwhelm psychological assessments, making real-time behavioral monitoring increasingly important.

5. What role does age play in risk tolerance assessment? Age influences risk tolerance through multiple mechanisms, including investment timeline, financial obligations, and psychological factors. However, chronological age alone explains only 12-18% of risk tolerance variation, making a comprehensive assessment essential rather than relying solely on age-based assumptions.

6. How do risk tolerance questionnaires account for couples with different risk preferences? Joint risk tolerance assessment requires specialized questionnaire approaches that evaluate both individual preferences and relationship dynamics. Best practices include separate individual assessments followed by joint discussion sessions to develop mutually acceptable investment strategies that respect both partners’ comfort levels.

7. What is the difference between risk tolerance and risk capacity in questionnaire design? Risk tolerance measures psychological comfort with uncertainty, while risk capacity evaluates financial ability to absorb losses. Effective questionnaire examples assess both dimensions separately, as an investor might have high financial capacity but low psychological tolerance, or vice versa.

8. How reliable are online risk tolerance questionnaires compared to advisor-administered assessments? Online questionnaires can achieve comparable reliability to advisor-administered versions when properly designed, with accuracy rates typically within 5-8% of face-to-face assessments. However, advisor-guided assessments provide valuable context and clarification that can improve response quality and interpretation accuracy.

9. What specific questions are most predictive of investment behavior? Scenario-based questions involving hypothetical portfolio losses demonstrate the highest predictive value, particularly those asking about responses to 20-30% portfolio declines. Questions about past investment experiences and reactions to market volatility also show strong correlation with future behavior patterns.

10. How do risk tolerance questionnaires integrate with robo-advisor platforms? Modern robo-advisors utilize simplified risk tolerance questionnaires, typically 5-12 questions, to generate automated portfolio recommendations. While these abbreviated assessments sacrifice some accuracy for efficiency, they provide adequate profiling for straightforward investment goals and can be supplemented with periodic comprehensive reassessment.

Conclusion

Risk tolerance questionnaire examples serve as fundamental tools for creating successful investment strategies that align with individual investor psychology and financial capacity.

The proper implementation of these assessment instruments, combined with regular reassessment and professional interpretation, significantly improves portfolio performance and investor satisfaction. As demonstrated throughout this analysis, effective questionnaire utilization requires understanding both the technical aspects of assessment design and the practical challenges of human behavior prediction.

The evolution of risk tolerance assessment continues toward more sophisticated, technology-enhanced approaches that incorporate artificial intelligence, behavioral data, and continuous monitoring capabilities. These advances promise to improve assessment accuracy while maintaining the essential human element that makes investment planning both art and science.

Financial professionals and individual investors who master the effective use of risk tolerance questionnaire examples position themselves for superior long-term investment outcomes in an increasingly complex financial landscape.

For your reference, recently published articles include:

- Master Your Wealth: Financial Disclaimers Explained

- Rate Volume Analysis: Best Expert Advice For Your Success

- Irrational Investing: Why Emotions Destroy Your Portfolio

- Investment Risk Monitoring – All You Need To Know

- How to Become a Rational Investor in 2025

- Market Anomaly Detection: Your Edge In Volatile Markets

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage