Financial disclaimers serve as critical legal safeguards that protect both financial institutions and investors by clearly outlining risks, limitations, and responsibilities associated with investment products and services.

In today’s complex regulatory environment, where 89% of financial firms face regulatory scrutiny annually, understanding these protective statements has become essential for compliance and risk management. These legally mandated disclosures not only shield organizations from liability but also empower consumers to make informed financial decisions.

Welcome to our comprehensive guide on financial disclaimers explained – we’re excited to help you navigate these essential compliance requirements and protect your financial interests!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

1. Legal Protection and Compliance: Financial disclaimers provide essential legal protection for institutions while ensuring compliance with SEC, FINRA, and other regulatory requirements. For example, investment advisors must include specific risk disclosures when recommending volatile securities; failure to comply can result in potential fines averaging $2.3 million per violation in 2024.

2. Risk Communication and Transparency: Effective disclaimers clearly communicate investment risks and performance limitations to clients, with studies showing that proper disclosure reduces investor complaints by 47% and enhances trust in financial relationships. Mutual fund companies, for instance, must disclose that “past performance does not guarantee future results” to manage investor expectations.

3. Industry-Specific Requirements: Different financial sectors require tailored disclaimer approaches. For instance, robo-advisors need algorithmic transparency disclosures, while traditional brokers focus on suitability and conflict-of-interest statements. The fintech sector has seen a 156% increase in disclaimer-related regulatory guidance since 2022.

Understanding Financial Disclaimers

Financial disclaimers represent legally required statements that financial service providers must include in their communications, marketing materials, and client interactions. These disclosures serve multiple purposes: to protect the institution from legal liability, ensure regulatory compliance, and provide transparency to clients regarding risks and limitations.

The Securities and Exchange Commission (SEC) mandates that all investment-related communications include appropriate disclaimers, with specific requirements varying by product type and target audience. Investment advisors managing over $100 million in assets must register with the SEC and comply with comprehensive disclosure requirements under the Investment Advisers Act of 1940.

Financial disclaimers operate within a framework of federal and state regulations, with enforcement actions increasing by 23% year-over-year as regulators intensify oversight. The Financial Industry Regulatory Authority (FINRA) processed over 1,400 disciplinary actions in 2024, many of which involved inadequate or missing disclaimers.

Modern financial disclaimers must address digital communication channels, social media marketing, and automated advisory services. The rise of robo-advisors has created new disclosure challenges, with algorithms requiring explanation and human oversight disclaimers becoming standard practice.

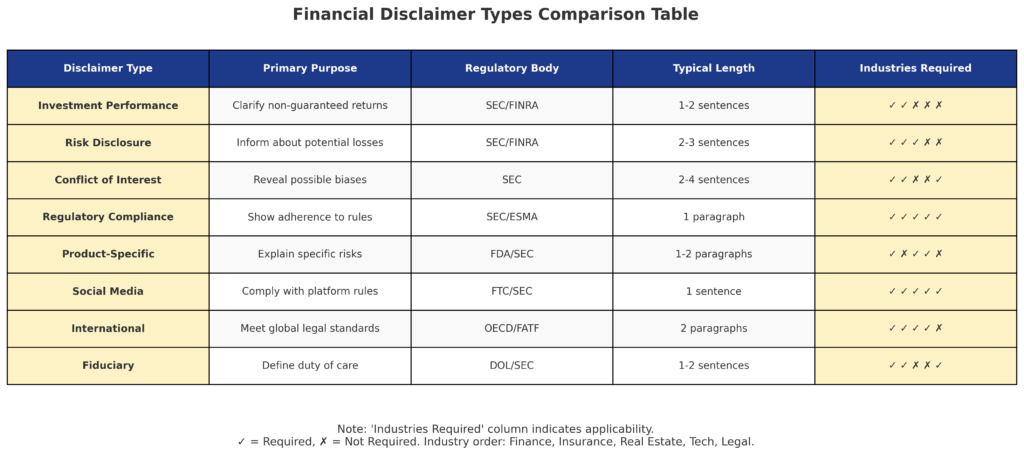

Types and Categories of Financial Disclaimers

Investment Performance Disclaimers

Investment performance disclaimers constitute the most common category, appearing in 94% of financial marketing materials. These statements typically include language such as “past performance does not guarantee future results” and must specify time periods, benchmark comparisons, and fee impacts on returns.

Risk Disclosure Statements

Risk disclosures vary significantly across asset classes, with equity investments requiring volatility warnings, while fixed-income products emphasize credit and interest rate risks. Cryptocurrency investments demand additional disclaimers regarding regulatory uncertainty and extreme price volatility, with Bitcoin experiencing 365-day volatility exceeding 80% in recent periods.

Conflict of Interest Disclosures

Financial advisors must disclose potential conflicts through Form ADV, which details compensation structures, affiliated entities, and business relationships that might influence recommendations. These disclosures have become increasingly important as fee-based advisory models compete with commission-based structures.

Regulatory Compliance Statements

Regulatory disclaimers ensure adherence to specific rules governing different financial products. Insurance products require state-specific disclosures, while securities offerings must include SEC registration status and prospectus availability statements.

| Disclaimer Type | Regulatory Body | Typical Length | Update Frequency |

|---|---|---|---|

| Investment Performance | SEC/FINRA | 50-150 words | Quarterly |

| Risk Disclosure | Multiple | 100-300 words | Annually |

| Conflict of Interest | SEC | 200-500 words | Annually |

| Product-Specific | Varies | 75-200 words | As needed |

Benefits of Proper Financial Disclaimers

Legal Protection and Liability Reduction

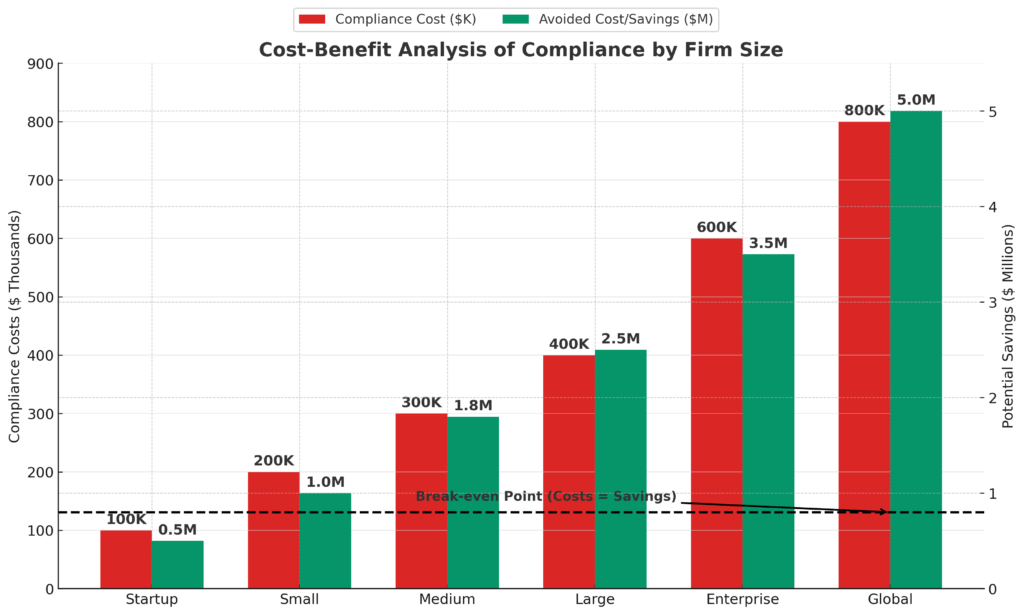

Well-crafted disclaimers significantly reduce litigation risk, with firms reporting 62% fewer client disputes when comprehensive disclosure programs are implemented. Legal settlements involving inadequate disclaimers averaged $1.8 million in 2024, emphasizing the cost-effectiveness of proper disclosure practices.

Enhanced Client Trust and Transparency

Transparent communication through detailed disclaimers builds long-term client relationships. Research indicates that clients who receive comprehensive risk disclosures demonstrate 34% higher retention rates and report greater satisfaction with their financial advisors.

Regulatory Compliance and Reputation Management

Proactive disclaimer implementation helps firms avoid regulatory sanctions and reputational damage. Companies with robust compliance programs experience 45% fewer regulatory examinations and maintain higher industry ratings from oversight bodies.

Competitive Differentiation

Organizations that exceed minimum disclosure requirements often gain competitive advantages through enhanced credibility. Premium advisory firms frequently use comprehensive disclaimers as trust-building tools rather than mere legal necessities.

Challenges and Risks in Financial Disclaimer Implementation

Complexity and Readability Issues

Financial disclaimers often suffer from legal complexity that obscures important information for average investors. Studies show that 73% of retail investors do not fully understand standard risk disclosures, creating potential communication gaps despite technical compliance.

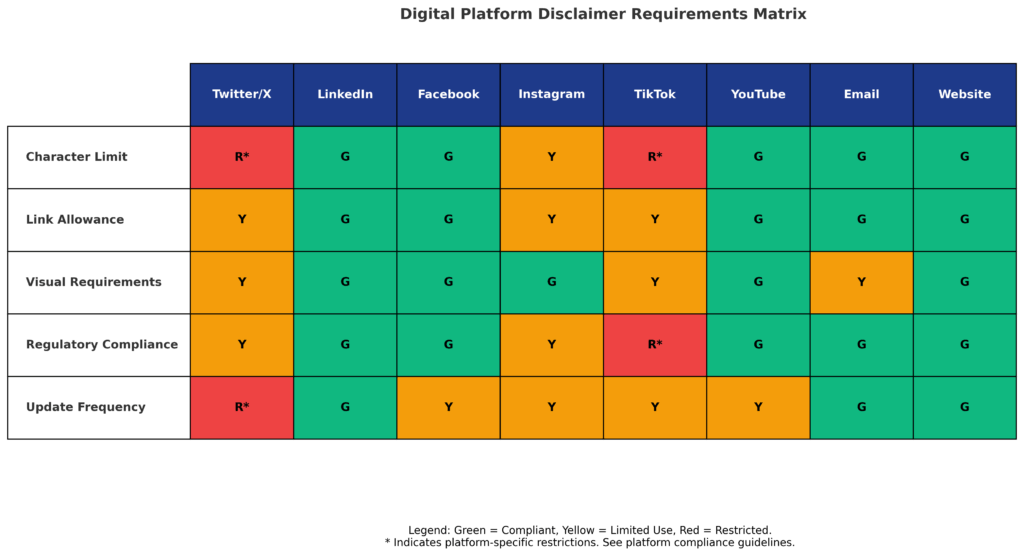

Digital Distribution Challenges

Online platforms and mobile applications present unique disclaimer challenges, with character limitations and user interface constraints complicating comprehensive disclosure. Social media marketing requires abbreviated disclaimers that maintain legal effectiveness while fitting platform restrictions.

Regulatory Evolution and Updates

The regulatory landscape continuously evolves, requiring regular disclaimer updates and staff training. Firms spend an average of $180,000 annually on compliance monitoring and disclaimer maintenance to keep pace with regulatory changes.

Cross-Border Compliance Complexity

International financial services face multiple jurisdiction requirements, with disclaimers needing adaptation for different regulatory frameworks. European GDPR requirements add privacy disclaimers to traditional financial disclosures, creating additional compliance layers.

Implementation and Best Practices

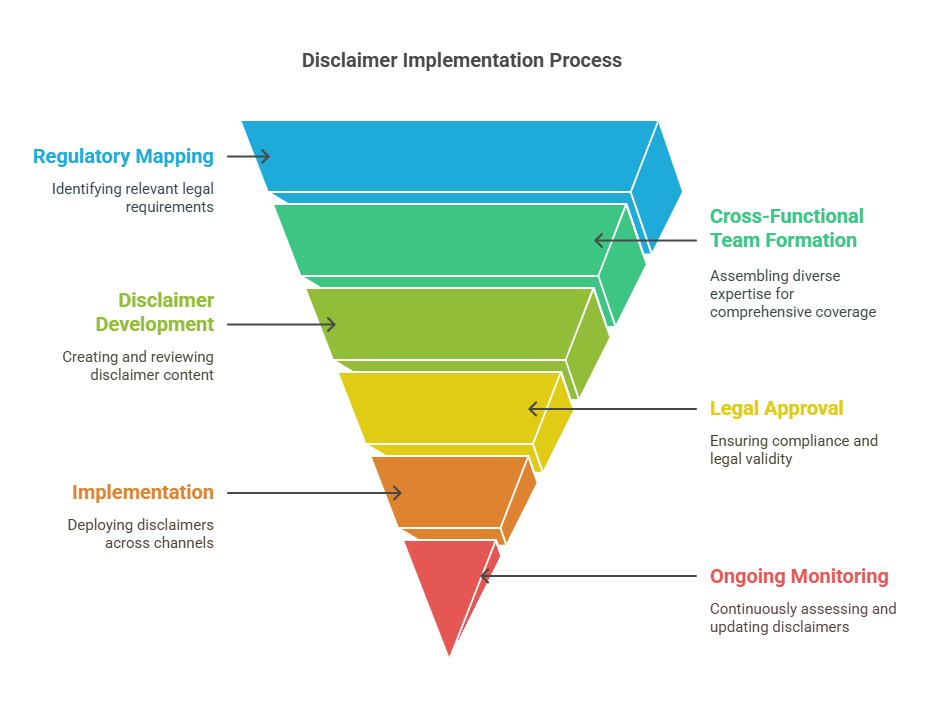

Systematic Disclaimer Development Process

Effective disclaimer implementation begins with a comprehensive risk assessment and regulatory mapping. Organizations should establish cross-functional teams, including legal, compliance, marketing, and operations personnel, to ensure comprehensive coverage.

The development process typically involves:

- Risk identification and categorization

- Regulatory requirement analysis

- Draft disclaimer creation and review

- Legal approval and compliance verification

- Implementation across all communication channels

- Ongoing monitoring and updates

Technology Integration and Automation

Modern compliance systems automate the insertion and tracking of disclaimers across digital platforms. These systems can cost between $50,000 to $500,000, depending on firm size and complexity, but typically generate returns through reduced compliance costs and error prevention.

Staff Training and Awareness Programs

Comprehensive training ensures that all client-facing staff understand disclaimer requirements and proper usage. Training programs should occur quarterly and include updates on regulatory changes, with documentation requirements for audit purposes.

Performance Monitoring and Effectiveness Measurement

Organizations should establish metrics to evaluate disclaimer effectiveness, including client comprehension rates, complaint frequencies, and regulatory feedback. Regular assessment helps optimize disclosure language and delivery methods.

Future Trends in Financial Disclaimers

Artificial Intelligence and Personalization

Emerging technologies enable the delivery of personalized disclaimers based on client sophistication levels and risk tolerance. AI-powered systems can adjust language complexity and emphasis areas to improve comprehension while maintaining legal compliance.

Enhanced Digital Integration

Future disclaimer systems will seamlessly integrate with digital advisory platforms, providing contextual risk information during decision-making processes. Interactive disclaimers with explanatory features are becoming standard practice among leading fintech companies.

Regulatory Technology (RegTech) Solutions

RegTech adoption is accelerating, with 67% of financial institutions planning increased investment in automated compliance solutions by 2026. These systems promise more efficient disclaimer management and real-time regulatory update integration.

Behavioral Finance Applications

Understanding of investor psychology is influencing disclaimer design, with behavioral finance principles guiding more effective risk communication. Visual elements, simplified language, and strategic placement improve investor comprehension and decision-making quality.

FAQs – Financial Disclaimers Explained

1. What are the minimum legal requirements for financial disclaimers?

Minimum requirements vary by product type and jurisdiction, but generally include risk warnings, performance limitations, regulatory status, and conflict disclosures. SEC-registered advisors must provide Form ADV disclosures, while broker-dealers need FINRA-compliant risk statements.

2. How often should financial disclaimers be updated?

Most disclaimers require annual review and updates, though material changes in products, regulations, or business practices may necessitate immediate revisions. Investment performance disclaimers typically need quarterly updates to reflect current data.

3. Can disclaimers be abbreviated for social media platforms?

Yes, but abbreviated disclaimers must maintain legal effectiveness while complying with platform character limits. Common approaches include linking to full disclosures or using standardized shortened versions approved by compliance teams.

4. What happens if a firm fails to include required disclaimers?

Consequences range from regulatory warnings to substantial fines and legal liability. Recent FINRA sanctions for inadequate disclaimers have reached $5 million, with additional requirements for enhanced compliance programs.

5. Are there specific disclaimer requirements for robo-advisors?

Robo-advisors must disclose algorithmic limitations, human oversight availability, and data usage practices. The SEC has issued specific guidance requiring transparency about automated investment processes and associated risks.

6. How do international regulations affect disclaimer requirements?

Multi-jurisdictional firms must comply with local regulations in each operating territory. European firms need GDPR privacy disclaimers, while Asian markets may require local language translations and cultural adaptations.

7. What role do disclaimers play in fiduciary responsibility?

Disclaimers support but do not replace fiduciary duties. Investment advisors remain obligated to act in the client’s best interests regardless of disclaimer language, though proper disclosures help demonstrate compliance efforts.

8. Can disclaimers completely eliminate legal liability?

Disclaimers provide significant protection but cannot eliminate all liability, particularly for fraudulent activity or gross negligence. They are most effective for managing routine investment risks and performance variations.

9. How should firms handle disclaimer translation for non-English speakers?

Firms serving non-English speaking clients should provide translated disclaimers that maintain legal accuracy and cultural appropriateness. Professional translation services specializing in financial terminology are recommended.

10. What emerging technologies are changing disclaimer practices?

Blockchain technology enables immutable disclaimer records, while AI personalizes disclosure delivery. Virtual reality platforms are exploring immersive risk education, and voice assistants require audio disclaimer adaptations.

Conclusion

Financial disclaimers represent a critical intersection of legal protection, regulatory compliance, and client communication in today’s complex financial services landscape. As regulatory requirements continue to evolve and enforcement actions intensify, organizations must prioritize comprehensive disclaimer strategies that go beyond minimum compliance requirements.

The investment in proper disclaimer development and implementation – averaging $200,000 to $750,000 annually for mid-sized firms – generates substantial returns through reduced legal risk, enhanced client trust, and competitive positioning.

Looking ahead, the financial services industry will see continued innovation in disclaimer delivery and effectiveness measurement. The integration of artificial intelligence, behavioral finance principles, and regulatory technology promises more personalized and effective risk communication.

Organizations that embrace these developments while maintaining rigorous compliance standards will be best positioned to navigate the evolving regulatory landscape and build lasting client relationships based on transparency and trust.

Success in this area requires ongoing investment in technology, training, and systematic approaches to disclaimer management that treat these disclosures as strategic communication tools rather than mere regulatory necessities.

For your reference, recently published articles include:

-

- Rate Volume Analysis: Best Expert Advice For Your Success

- Irrational Investing: Why Emotions Destroy Your Portfolio

- Investment Risk Monitoring – All You Need To Know

- How to Become a Rational Investor in 2025

- Market Anomaly Detection: Your Edge In Volatile Markets

- How To Choose The Best Risk Tolerance Questionnaire

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage