Investment strategy evaluation represents the systematic process of analyzing, measuring, and optimizing portfolio performance to ensure alignment with financial objectives and risk tolerance.

In today’s volatile market environment, where global economic uncertainty and technological disruption reshape investment landscapes daily, the ability to evaluate investment strategies professionally has become essential for both institutional and individual investors.

This comprehensive analysis framework enables investors to make data-driven decisions, minimize risks, and maximize returns through structured assessment methodologies.

Welcome to our comprehensive exploration of investment strategy evaluation techniques. We’re excited to help you master these essential analytical skills that distinguish professional investors from amateurs.

Be sure to sign up on the home page for our free Newsletter and other related information that will take your investment skills to the next level.

Key Takeaways

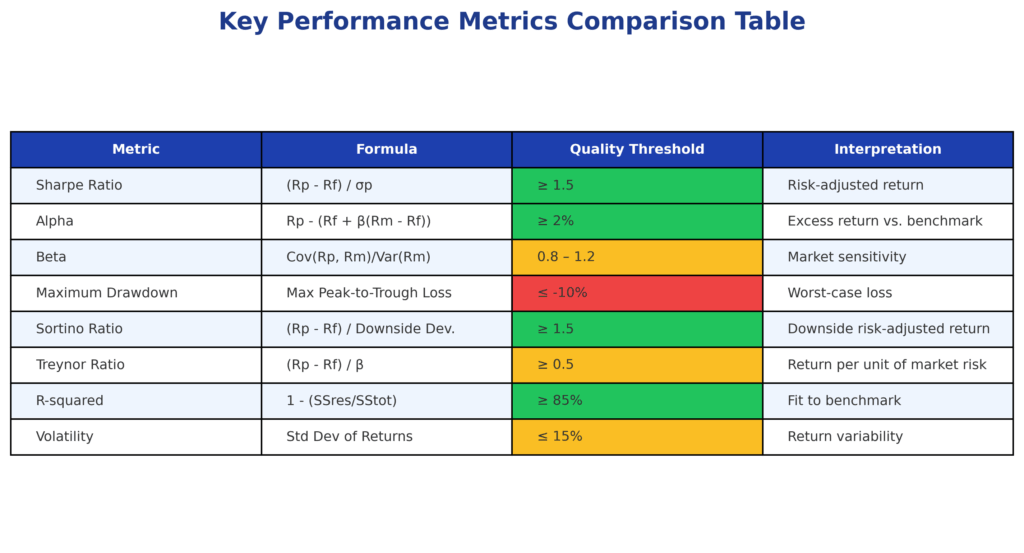

1. Quantitative Metrics Drive Professional Evaluation. Professional investment strategy evaluation relies heavily on quantitative metrics such as the Sharpe ratio (typically ranging from 0.5 to 2.0 for quality strategies), alpha generation (excess returns above benchmark), and maximum drawdown analysis. For example, a hedge fund achieving a Sharpe ratio of 1.8 with maximum drawdown of 8% demonstrates superior risk-adjusted performance compared to strategies with ratios below 1.0 and drawdowns exceeding 15%.

2. Multi-Timeframe Analysis Reveals Strategy Durability. Effective strategy evaluation examines performance across multiple time horizons, typically analyzing 1-year, 3-year, 5-year, and 10-year periods to identify consistency patterns. A growth strategy showing 12% annual returns over one year but only 4% over five years indicates potential unsustainability, while consistent 8-10% returns across all timeframes suggest robust strategy fundamentals.

3. Risk-Adjusted Returns Trump Absolute Performance. Professional evaluation prioritizes risk-adjusted returns over absolute gains, recognizing that a strategy generating 15% returns with 25% volatility may be inferior to one producing 12% returns with 10% volatility. This principle explains why institutional investors often prefer strategies with Sharpe ratios above 1.5, even when absolute returns appear modest.

Table of Contents

Understanding Investment Strategy Evaluation

Investment strategy evaluation involves a comprehensive assessment of portfolio management approaches, investment methodologies, and performance outcomes to determine their effectiveness and sustainability. This systematic process involves analyzing both quantitative metrics and qualitative factors that influence long-term investment success.

The evaluation framework begins with performance measurement, which examines absolute returns, relative performance against benchmarks, and risk-adjusted metrics. Professional evaluators utilize standardized calculations such as the Sharpe ratio (excess return divided by standard deviation), Treynor ratio (excess return divided by beta), and Jensen’s alpha (excess return above expected return based on CAPM) to ensure objective assessment.

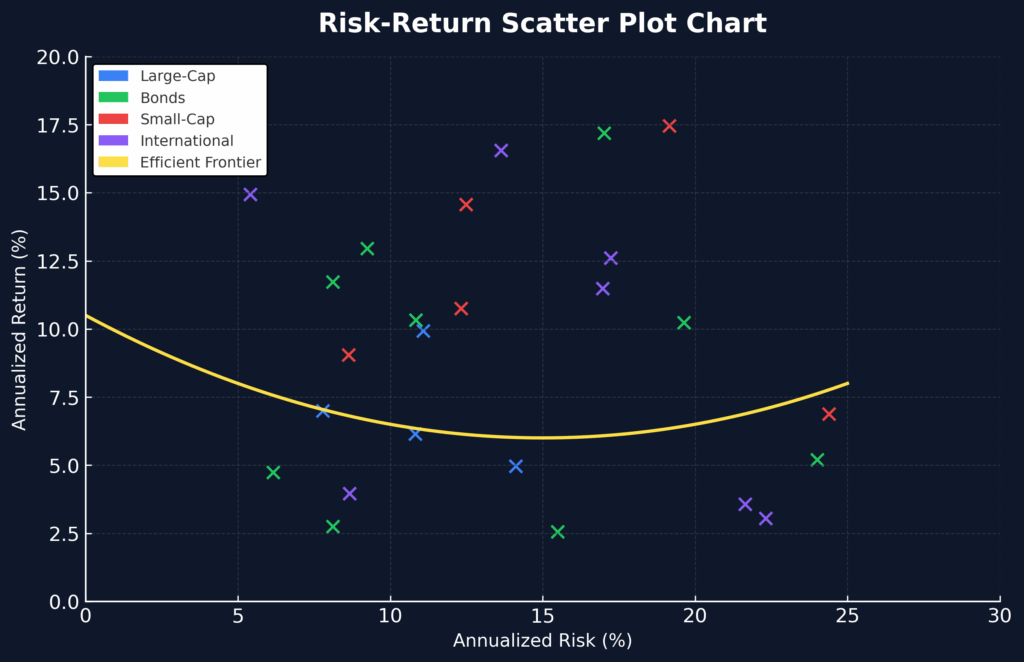

Risk assessment forms the second pillar of professional evaluation, examining volatility patterns, correlation coefficients, and downside protection mechanisms. Modern portfolio theory emphasizes that investors should be compensated for systematic risk through higher expected returns, making risk analysis crucial for strategy validation.

The third component involves consistency analysis, which evaluates strategy performance across various market conditions, economic cycles, and time periods. Professional evaluators examine rolling returns, tracking error, and information ratios to identify strategies that maintain effectiveness regardless of market environments.

Benchmark comparison provides context for strategy performance by comparing results against relevant market indices, peer groups, and risk-free rates. This analysis helps determine whether strategy outcomes result from skill (alpha generation) or market exposure (beta capture).

Finally, attribution analysis identifies specific factors contributing to strategy performance, including sector allocation, security selection, and timing decisions. This granular examination enables investors to understand strategy mechanics and assess reproducibility of results.

Types and Categories of Investment Strategy Evaluation

Quantitative Evaluation Methods

Statistical Performance Analysis employs mathematical models to assess strategy effectiveness through metrics such as standard deviation (typically 10-20% for balanced strategies), beta coefficients (measuring market sensitivity), and correlation analysis. This approach provides objective measurement tools for comparing strategies across different asset classes and time periods.

Risk-Adjusted Performance Metrics focus on returns relative to risk undertaken, utilizing calculations such as the Calmar ratio (annual return divided by maximum drawdown) and Sortino ratio (excess return divided by downside deviation). Professional evaluators typically seek Calmar ratios above 0.5 and Sortino ratios exceeding 1.0 for quality strategies.

Factor-Based Analysis examines strategy exposure to systematic risk factors including market risk, size premium, value premium, and momentum effects. This methodology, popularized by the Fama-French model, helps identify whether strategy returns stem from factor exposure or genuine alpha generation.

Qualitative Evaluation Approaches

Process Assessment evaluates the systematic approach underlying investment decisions, examining research methodologies, decision-making frameworks, and implementation procedures. This analysis considers factors such as team experience, investment philosophy consistency, and operational infrastructure quality.

Scenario Analysis tests strategy resilience under various market conditions, including bear markets, high inflation periods, and economic recessions. Professional evaluators typically examine strategy performance during the 2008 financial crisis, COVID-19 pandemic, and other significant market disruptions.

Due Diligence Reviews involve comprehensive examination of strategy documentation, historical performance records, and operational procedures. This process includes verification of performance claims, assessment of risk management systems, and evaluation of compliance frameworks.

Benefits of Professional Investment Strategy Evaluation

Enhanced Decision-Making Capabilities

Professional evaluation methodologies provide investors with objective decision-making frameworks that eliminate emotional biases and subjective judgments. Research indicates that systematic evaluation processes can improve investment outcomes by 2-4% annually through better strategy selection and timing decisions.

Data-driven insights enable investors to identify strategies with sustainable competitive advantages, typically characterized by consistent alpha generation above 200-300 basis points annually. This analytical approach helps distinguish between skill-based performance and market timing luck.

Risk Management Optimization

Comprehensive evaluation identifies hidden risks within investment strategies, including concentration risk, liquidity constraints, and correlation breakdowns during market stress. Professional analysis typically reveals that strategies with apparent diversification may exhibit correlation coefficients above 0.8 during crisis periods.

Downside protection assessment quantifies strategy behavior during adverse market conditions, helping investors understand potential losses and recovery timeframes. Quality strategies typically limit maximum drawdowns to 10-15% while maintaining recovery periods under 12-18 months.

Performance Attribution and Improvement

Detailed evaluation provides granular performance attribution, identifying specific sources of returns and risks within investment strategies. This analysis enables strategy refinement and optimization, potentially improving risk-adjusted returns by 1-3% annually.

Benchmark-relative analysis helps investors understand whether strategy performance results from market exposure or active management skills, with professional-grade strategies typically generating information ratios above 0.5-0.7.

Challenges and Risks in Strategy Evaluation

Data Quality and Availability Issues

Historical data limitations present significant challenges for strategy evaluation, particularly for newer investment approaches or alternative assets. Many strategies lack sufficient performance history (minimum 3-5 years recommended) for statistical significance, creating evaluation uncertainty.

Survivorship bias affects evaluation accuracy when databases exclude failed strategies, potentially overstating average performance by 2-4% annually. Professional evaluators must account for this bias by examining complete strategy universes rather than surviving strategies only.

Market Environment Dependencies

Regime changes in market conditions can render historical evaluation results less relevant for future performance prediction. Strategies optimized for low-interest-rate environments may underperform when rates rise, highlighting the challenge of extrapolating past performance.

Economic cycle sensitivity affects strategy evaluation accuracy, as performance during specific market phases may not represent long-term capabilities. Professional evaluators typically require performance data spanning multiple economic cycles for comprehensive assessment.

Complexity and Resource Requirements

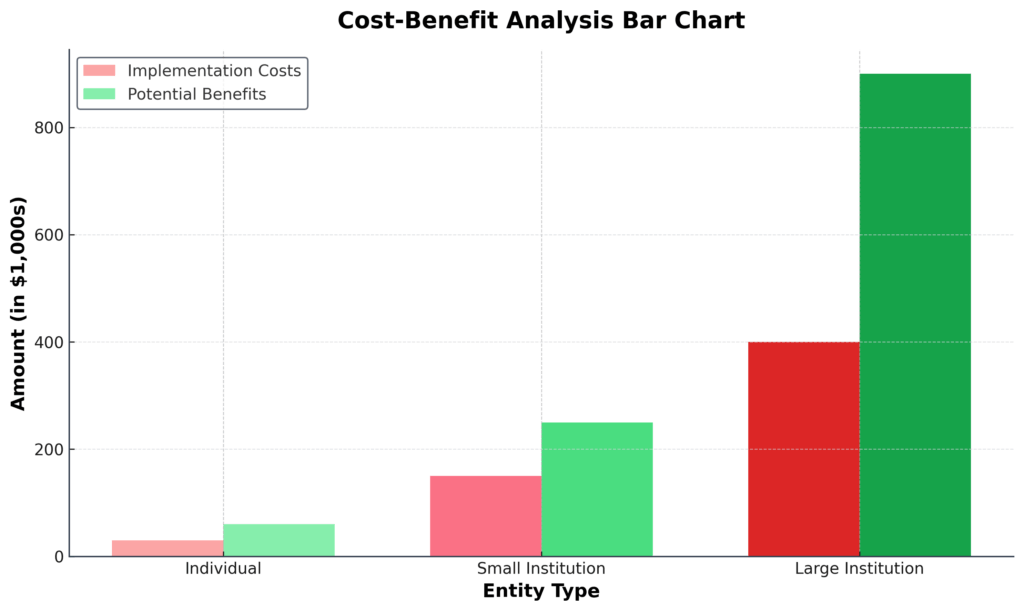

Technical expertise requirements limit accessibility of professional evaluation methodologies, with comprehensive analysis requiring knowledge of advanced statistical techniques and financial modeling. This complexity often necessitates specialized personnel or external consultants.

Cost considerations for thorough strategy evaluation can range from $50,000 to $500,000 annually for institutional investors, depending on the scope and sophistication level. These expenses must be weighed against potential performance improvements and risk reduction benefits.

Implementation Framework for Strategy Evaluation

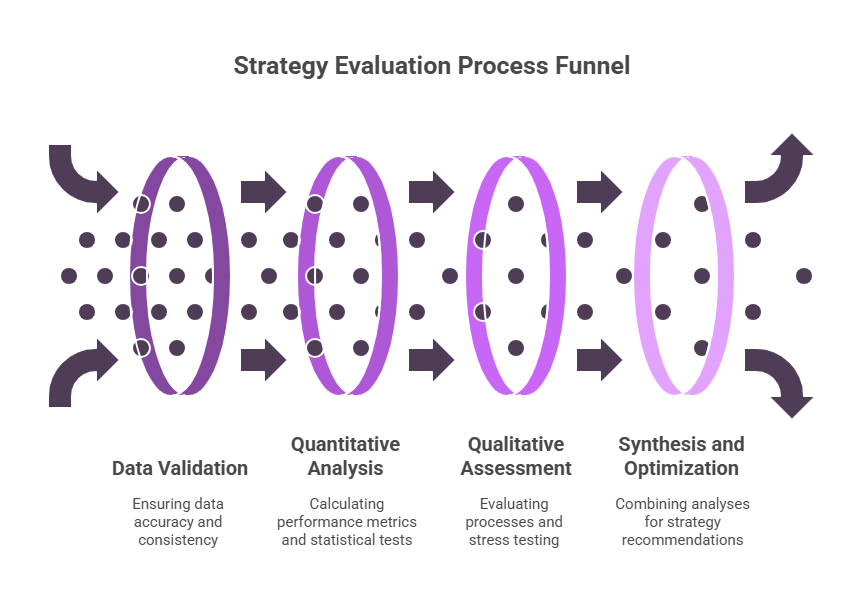

Phase 1: Data Collection and Preparation

The implementation process begins with comprehensive data gathering, including monthly returns, benchmark data, and risk-free rates spanning minimum 36-month periods. Professional evaluators typically require daily return data for volatility analysis and monthly data for performance attribution.

Data validation procedures ensure accuracy and consistency of performance information, including verification of calculation methodologies and adjustment for corporate actions. This process typically identifies 5-10% data inconsistencies requiring correction.

Phase 2: Quantitative Analysis Execution

Performance metric calculation involves computing standardized measures including Sharpe ratios, maximum drawdown, and tracking error using consistent methodologies. Professional analysis typically examines 15-20 key metrics across multiple time periods.

Statistical significance testing determines whether performance differences represent genuine skill or random variation. Professional evaluators typically require t-statistics above 2.0 for 95% confidence in performance superiority.

Phase 3: Qualitative Assessment Integration

Process evaluation examines investment decision-making procedures, risk management systems, and operational infrastructure quality. This assessment typically involves on-site visits, personnel interviews, and documentation review.

Scenario stress testing evaluates strategy resilience under adverse conditions, including market crashes, liquidity crises, and correlation breakdowns. Professional testing typically examines 10-15 historical stress scenarios.

Phase 4: Synthesis and Recommendation Development

Integrated analysis combines quantitative metrics with qualitative assessments to develop comprehensive strategy recommendations. This synthesis typically weights quantitative factors at 60-70% and qualitative factors at 30-40%.

Risk-return optimization ensures recommended strategies align with investor objectives and constraints, typically targeting Sharpe ratios above 1.0 with maximum drawdowns below 15%.

Future Trends in Investment Strategy Evaluation

Technology Integration and Automation

Artificial intelligence and machine learning applications are revolutionizing strategy evaluation through automated pattern recognition and predictive modeling. Advanced algorithms can process vast datasets to identify subtle performance patterns invisible to traditional analysis, potentially improving evaluation accuracy by 20-30%.

Real-time monitoring systems enable continuous strategy assessment rather than periodic reviews, allowing for more responsive portfolio management. These systems typically update performance metrics daily and trigger alerts when strategies deviate from expected parameters.

Alternative Data Sources

Alternative data integration expands evaluation capabilities beyond traditional financial metrics to include satellite imagery, social media sentiment, and economic indicators. This approach provides earlier signals of strategy effectiveness changes, potentially improving prediction accuracy by 15-25%.

ESG factor incorporation reflects growing investor demand for sustainable investment strategies, requiring evaluation frameworks to assess environmental, social, and governance impacts alongside financial performance. Professional evaluation increasingly weighs ESG scores at 10-20% of overall strategy assessment.

Regulatory Evolution

Enhanced transparency requirements are expanding mandatory performance reporting and standardizing calculation methodologies across investment management industry. These regulations aim to improve investor protection and enable more accurate strategy comparisons.

Risk management standards are becoming more stringent, requiring comprehensive stress testing and scenario analysis as part of strategy evaluation processes. Professional evaluators must adapt to evolving regulatory requirements while maintaining evaluation effectiveness.

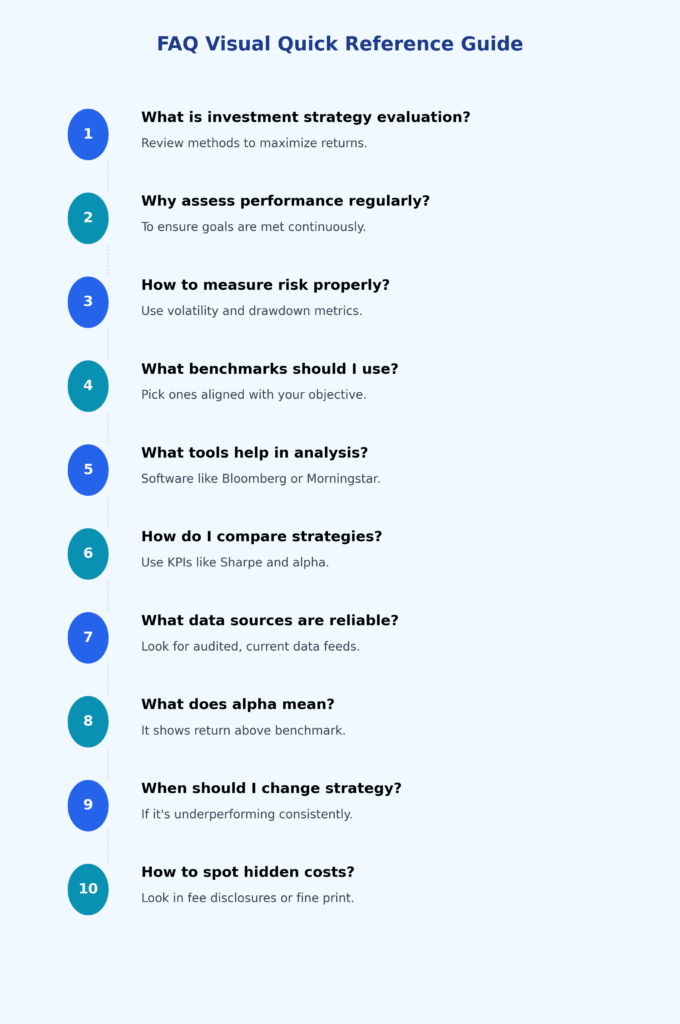

FAQs – Investment Strategy Evaluation

1. What is the minimum time period required for a reliable investment strategy evaluation?

Professional investment strategy evaluation requires a minimum of 36 months of performance data for statistical significance, though 60 months (5 years) is preferred for comprehensive analysis. Shorter time periods may not capture full market cycles or provide sufficient data points for reliable statistical inference, particularly when calculating risk-adjusted metrics like Sharpe ratios or maximum drawdown analysis.

2. How do professional evaluators account for market timing and luck versus genuine skill?

Professional evaluators distinguish between skill and luck through statistical significance testing, typically requiring t-statistics above 2.0 for 95% confidence levels. They also examine the consistency of performance across different market conditions, analyze rolling returns, and compare results to random performance simulations. Genuine skill typically manifests as consistent alpha generation across multiple time periods and market environments.

3. What are the most important quantitative metrics for investment strategy evaluation?

The most critical quantitative metrics include the Sharpe ratio (measuring risk-adjusted returns), maximum drawdown (assessing downside risk), alpha (excess returns above benchmark), and information ratio (measuring active management effectiveness). Professional evaluators typically examine 15-20 metrics simultaneously, with Sharpe ratios above 1.0 and information ratios above 0.5 indicating quality strategies.

4. How does benchmark selection impact investment strategy evaluation accuracy?

Benchmark selection significantly affects evaluation accuracy, as inappropriate benchmarks can misrepresent strategy performance by 2-5% annually. Professional evaluators select benchmarks that match strategy characteristics, including asset class exposure, geographic focus, and investment style. They often use multiple benchmarks and custom composite indices to ensure accurate performance attribution.

5. What role does correlation analysis play in professional strategy evaluation?

Correlation analysis identifies diversification benefits and concentration risks within investment strategies, examining relationships between strategy returns and various market factors. Professional evaluators typically examine correlation coefficients across different time periods and market conditions, as correlations can increase dramatically during crisis periods, potentially reaching 0.8-0.9 even among seemingly diversified strategies.

6. How do evaluators assess investment strategy performance during market downturns?

Professional evaluators examine downside capture ratios, maximum drawdown periods, and recovery timeframes during historical market stress events. They typically analyze strategy behavior during major market corrections, including 2008 financial crisis, dot-com crash, and COVID-19 pandemic. Quality strategies typically exhibit downside capture ratios below 80% and recovery periods under 18 months.

7. What is the typical cost range for professional investment strategy evaluation services?

Professional investment strategy evaluation costs range from $25,000 to $500,000 annually, depending on scope, complexity, and institutional requirements. Basic evaluation services for individual strategies typically cost $25,000-$75,000, while comprehensive institutional evaluations, including multiple strategies, ongoing monitoring, and custom reporting, can exceed $200,000-$500,000 annually.

8. How frequently should investment strategies undergo professional evaluation?

Professional investment strategies should undergo comprehensive evaluation annually, with quarterly performance monitoring and semi-annual risk assessment updates. However, strategies experiencing significant performance deviation (typically 3-5% tracking error) or major personnel changes require immediate re-evaluation. Market regime changes or major economic events may also trigger unscheduled evaluation cycles.

9. What are the key differences between institutional and retail investment strategy evaluation?

Institutional evaluation typically employs more sophisticated metrics, longer time horizons, and comprehensive due diligence processes, including on-site visits and operational assessments. Retail evaluation often focuses on simplified metrics like total return and expense ratios. Institutional evaluation also considers factors like capacity constraints, operational risk, and regulatory compliance that may be less relevant for individual investors.

10. How do evaluators handle alternative investment strategies with limited performance history?

For alternative strategies with limited history, professional evaluators employ proxy analysis using similar strategies or asset classes, stress testing using historical scenarios, and enhanced due diligence focusing on process evaluation and team experience. They typically require higher risk premiums (additional 200-400 basis points) to compensate for uncertainty and may recommend smaller initial allocations pending additional performance history.

Conclusion

Professional investment strategy evaluation represents a critical competency for successful portfolio management in today’s complex financial markets. The systematic application of quantitative metrics, qualitative assessments, and comprehensive risk analysis enables investors to make informed decisions based on objective evidence rather than speculation or marketing materials.

As demonstrated throughout this analysis, effective evaluation requires sophisticated methodologies that examine multiple dimensions of strategy performance, from risk-adjusted returns to operational infrastructure quality.

The future of investment strategy evaluation continues to evolve through technological advancement, regulatory development, and expanding data availability. Professional investors who master these evaluation techniques and adapt to emerging trends will be better positioned to identify superior strategies, manage risks effectively, and achieve long-term financial objectives.

The investment of time and resources in developing professional evaluation capabilities typically generates substantial returns through improved strategy selection, enhanced risk management, and more informed portfolio construction decisions.

As markets become increasingly complex and competitive, the ability to evaluate investment strategies with professional rigor will remain a crucial skill for achieving investment success.

For your reference, recently published articles include:

- Investment Risk Management Tools – All You Need To Know

- Investment Strategies Validation Made Simple

- Investment Risk Management Software – Best Expert Guide

- Market Sentiment Indicators: Your Edge In Volatile Markets

- Hot Investing Trends For Next Decade To Watch Now

- Trading Strategies Backtesting – All You Need To Know

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.