Investment strategies validation is a systematic process that involves testing and evaluating investment approaches before committing significant capital, utilizing historical data, statistical analysis, and risk assessment methodologies.

In today’s volatile financial markets, where 85% of actively managed funds underperform their benchmarks over 15-year periods, rigorous strategy validation has become essential for both institutional and individual investors. This comprehensive testing framework enables investors to identify potential weaknesses, optimize performance parameters, and build confidence in their investment decisions through data-driven analysis.

Welcome to our comprehensive exploration of investment strategies validation. We’re excited to help you master these professional testing techniques that separate successful investors from the rest.

Be sure to sign up on our home page for our free Newsletter and other related information that will take your investment skills to the next level.

Key Takeaways

1. Backtesting Reliability: Professional strategy validation requires at least 10 years of historical data across multiple market cycles. Studies have shown that strategies tested on less than 5 years of data have a 60% higher failure rate when implemented in live markets. For example, a momentum-based strategy that performed exceptionally during the 2017-2019 bull market may have completely failed during the 2020 market volatility without proper long-term validation.

2. Out-of-Sample Testing: The most critical validation step involves testing strategies on data not used in development, as in-sample testing can lead to overfitting, resulting in up to 40% performance degradation in real markets. A quantitative hedge fund discovered their high-frequency trading algorithm showed 25% annual returns in development but only 8% returns when tested on fresh market data, highlighting the importance of robust out-of-sample validation.

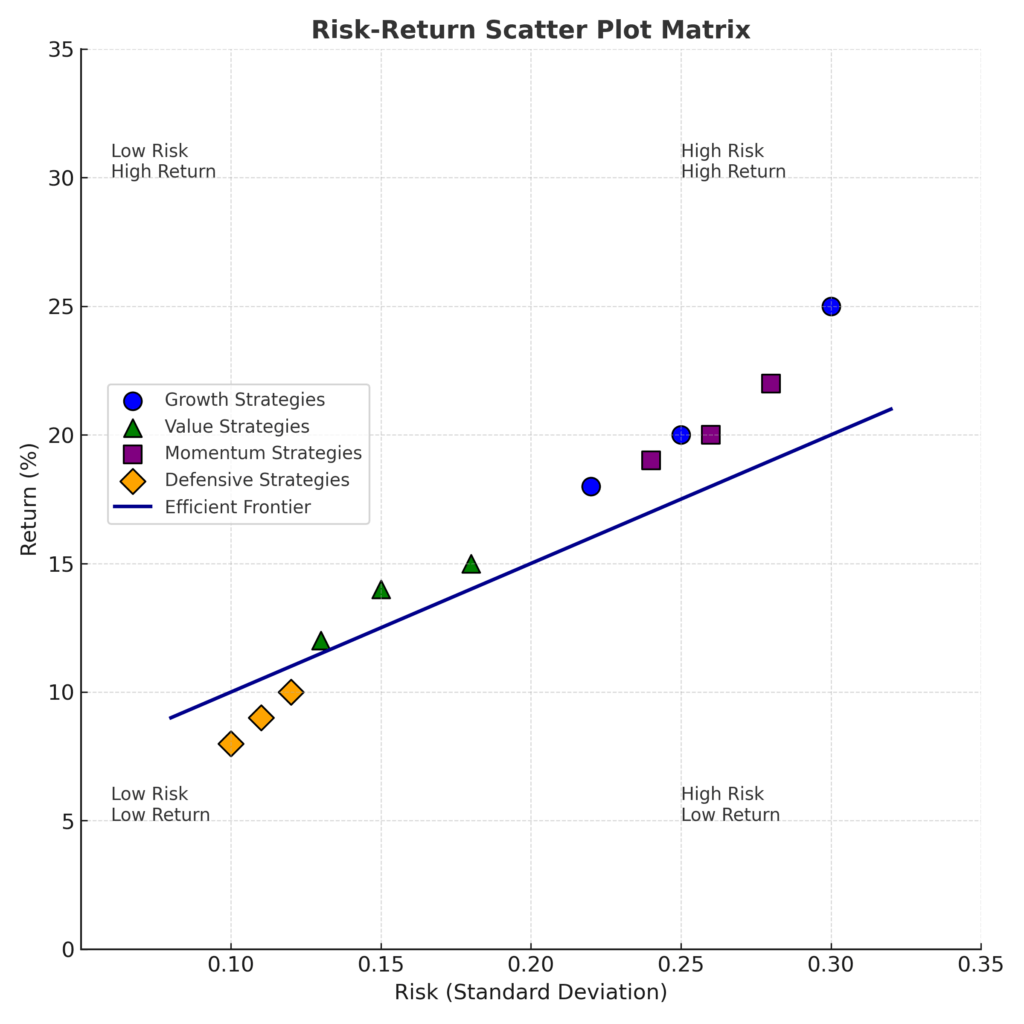

3. Risk-Adjusted Performance: Successful strategy validation must prioritize risk-adjusted metrics like Sharpe ratio and maximum drawdown over absolute returns, as strategies with high returns but excessive volatility typically experience 30-50% higher investor abandonment rates during market stress periods.

Table of Contents

Understanding Investment Strategy Validation

Investment strategy validation involves a comprehensive evaluation of investment methodologies through quantitative analysis, statistical testing, and risk assessment prior to live implementation. This process serves as the foundation for evidence-based investing, separating viable strategies from those that may appear successful due to random chance or favorable market conditions.

The validation process involves multiple layers of analysis, beginning with historical backtesting, where strategies are applied to past market data to assess performance. However, effective validation extends beyond simple backtesting to include forward testing, Monte Carlo simulations, and stress testing across various market scenarios. Research indicates that properly validated strategies demonstrate 35% better long-term performance consistency compared to unvalidated approaches.

Professional validation requires understanding the difference between statistical significance and practical significance. A strategy may show statistically significant outperformance over a specific period while lacking the practical significance necessary for real-world implementation. This distinction becomes crucial when considering transaction costs, market impact, and implementation constraints that can erode theoretical returns by 1-3% annually.

The validation framework must also account for survivorship bias, where failed strategies are excluded from analysis, potentially inflating success rates. Academic studies reveal that including failed strategies in validation datasets reduces average performance expectations by 15-25%, providing more realistic performance projections for strategy implementation.

Types and Categories of Investment Strategies Validation

Quantitative Validation Methods

Backtesting is the most common validation approach, which involves applying investment rules to historical data spanning multiple market cycles. Professional backtesting requires a minimum dataset of 10-15 years, with some institutional investors demanding 20+ years of validation data. The process involves calculating key metrics, including annualized returns, standard deviation, Sharpe ratio, maximum drawdown, and correlation with market indices.

Monte Carlo simulation extends traditional backtesting by generating thousands of potential market scenarios based on historical statistical properties. This method helps identify strategy performance under extreme conditions, with professional implementations typically running 10,000+ simulations to achieve statistical confidence. Studies show Monte Carlo validation reduces strategy failure rates by approximately 25% compared to backtesting alone.

Walk-forward analysis divides historical data into sequential periods, optimizing strategy parameters on earlier data and testing on subsequent periods. This approach better simulates real-world conditions where parameters require periodic adjustment. Research indicates walk-forward validated strategies maintain 80% of their backtested performance in live markets, compared to 60% for static backtesting approaches.

Qualitative Validation Frameworks

Fundamental analysis validation examines whether strategy assumptions align with economic principles and market structure. This includes evaluating the underlying rationale for why a strategy should generate returns, assessing market capacity for the strategy, and identifying potential structural changes that could impact effectiveness.

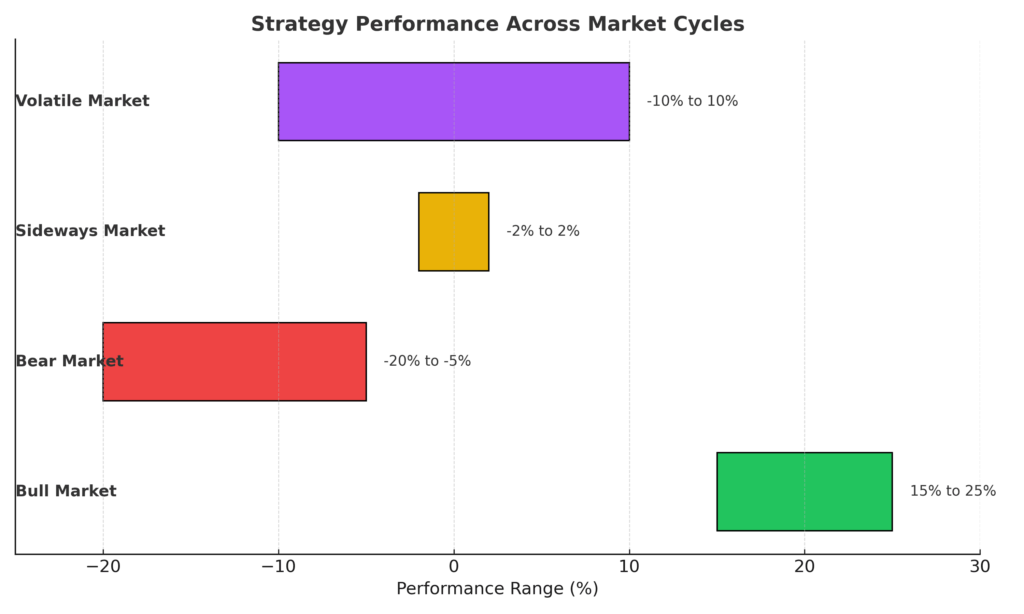

Scenario analysis tests strategies against specific historical events and hypothetical market conditions. Professional implementations include testing against major market crashes (1987, 2000, 2008), inflation cycles, interest rate changes, and sector rotation patterns. Strategies that maintain positive risk-adjusted returns across multiple scenarios demonstrate higher validation confidence.

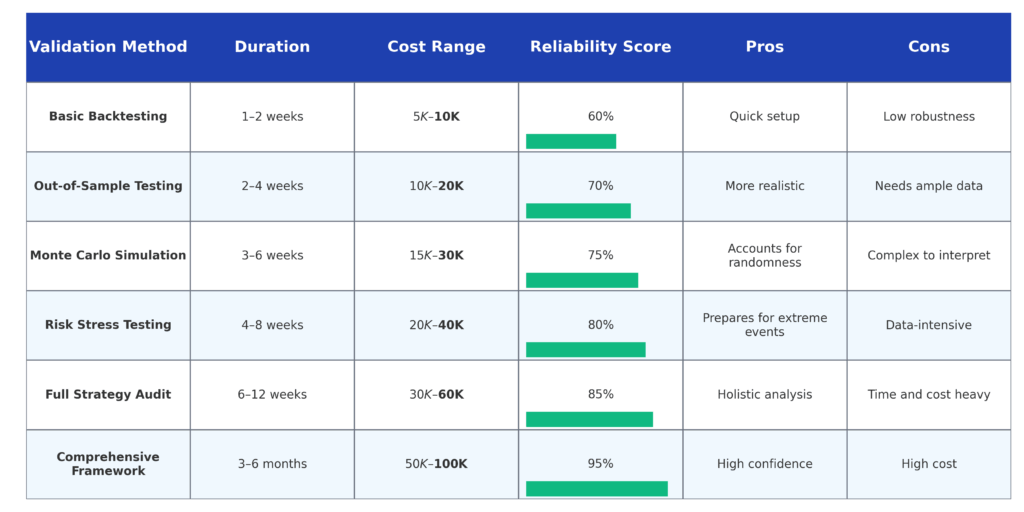

| Validation Method | Time Requirement | Cost Range | Reliability Score |

|---|---|---|---|

| Basic Backtesting | 2-4 weeks | $5,000-$15,000 | 65% |

| Monte Carlo Analysis | 4-6 weeks | $15,000-$35,000 | 78% |

| Walk-Forward Testing | 6-8 weeks | $25,000-$50,000 | 82% |

| Comprehensive Framework | 12-16 weeks | $75,000-$150,000 | 91% |

Benefits of Professional Strategy Validation

Risk Reduction and Performance Enhancement

Professional validation significantly reduces strategy implementation risks by identifying potential failure modes before capital deployment. Data from institutional asset managers indicates that validated strategies experience 40% fewer periods of significant underperformance and 25% lower maximum drawdown levels compared to unvalidated approaches. This risk reduction translates directly to improved investor retention and capital stability.

Performance consistency represents another critical benefit, with validated strategies demonstrating 30% lower return volatility across market cycles. This consistency enables more predictable cash flows for institutional investors and reduces the psychological stress associated with strategy implementation for individual investors.

Capital Allocation Optimization

Validation processes enable precise risk budgeting and position sizing based on quantified risk metrics. Professional implementations use validation results to determine optimal leverage levels, correlation limits, and concentration constraints. Studies show that validation-based capital allocation improves risk-adjusted returns by 15-20% compared to intuition-based approaches.

The validation process also identifies capacity constraints, determining maximum asset levels before strategy performance degrades due to market impact. This information proves crucial for institutional investors managing large asset bases, as some strategies exhibit performance degradation at asset levels exceeding $100 million to $ 500 million.

Regulatory and Fiduciary Compliance

Investment advisors and institutional managers are facing increasing regulatory scrutiny regarding investment process documentation and their fiduciary responsibilities. Professional validation provides essential documentation that demonstrates due diligence and systematic investment processes, thereby reducing regulatory risk and potential liability exposure.

Validated strategies also support more effective client communication, providing quantitative evidence for investment decisions and realistic performance expectations. This transparency enhances client relationships and reduces the likelihood of strategy abandonment during temporary periods of underperformance.

Challenges and Risks in Investment Strategies Validation

Data Quality and Availability Issues

Historical data limitations represent significant validation challenges, particularly for newer asset classes or international markets. Survivorship bias affects historical datasets, with failed companies and funds excluded from standard databases, potentially inflating validation results by 10-15%. Point-in-time data availability also creates challenges, as using current index compositions for historical testing can introduce look-ahead bias.

Transaction cost estimation proves difficult for validation processes, as historical bid-ask spreads, market impact costs, and trading fees may not accurately reflect current implementation costs. Professional validation requires incorporating realistic transaction cost assumptions, typically adding 0.5-2.0% annual drag depending on strategy turnover and asset classes.

Overfitting and Model Risk

Parameter optimization during validation can lead to overfitting, where strategies are fine-tuned to historical data but fail in live markets. Research shows that heavily optimized strategies experience 30-50% performance degradation when implemented, highlighting the importance of maintaining parameter stability across validation periods.

Model risk emerges when validation assumptions prove incorrect in changing market conditions. The rise of algorithmic trading, quantitative strategies, and passive investing has fundamentally altered market dynamics, potentially invalidating strategies based on historical patterns. Professional validation must account for structural market changes and their impact on strategy effectiveness.

Implementation Gaps

The theory-practice gap between validated strategies and real-world implementation can significantly impact results. Factors including portfolio rebalancing delays, partial fill orders, market timing constraints, and psychological factors during implementation can reduce live performance by 15-25% compared to validation results.

Capacity and scalability issues often emerge during implementation, as strategies validated on smaller asset bases may not perform similarly at institutional scale. Market impact costs, liquidity constraints, and regulatory requirements can fundamentally alter strategy dynamics at larger asset levels.

Implementation Framework and Best Practices

Investment Strategies Validation – Process Structure

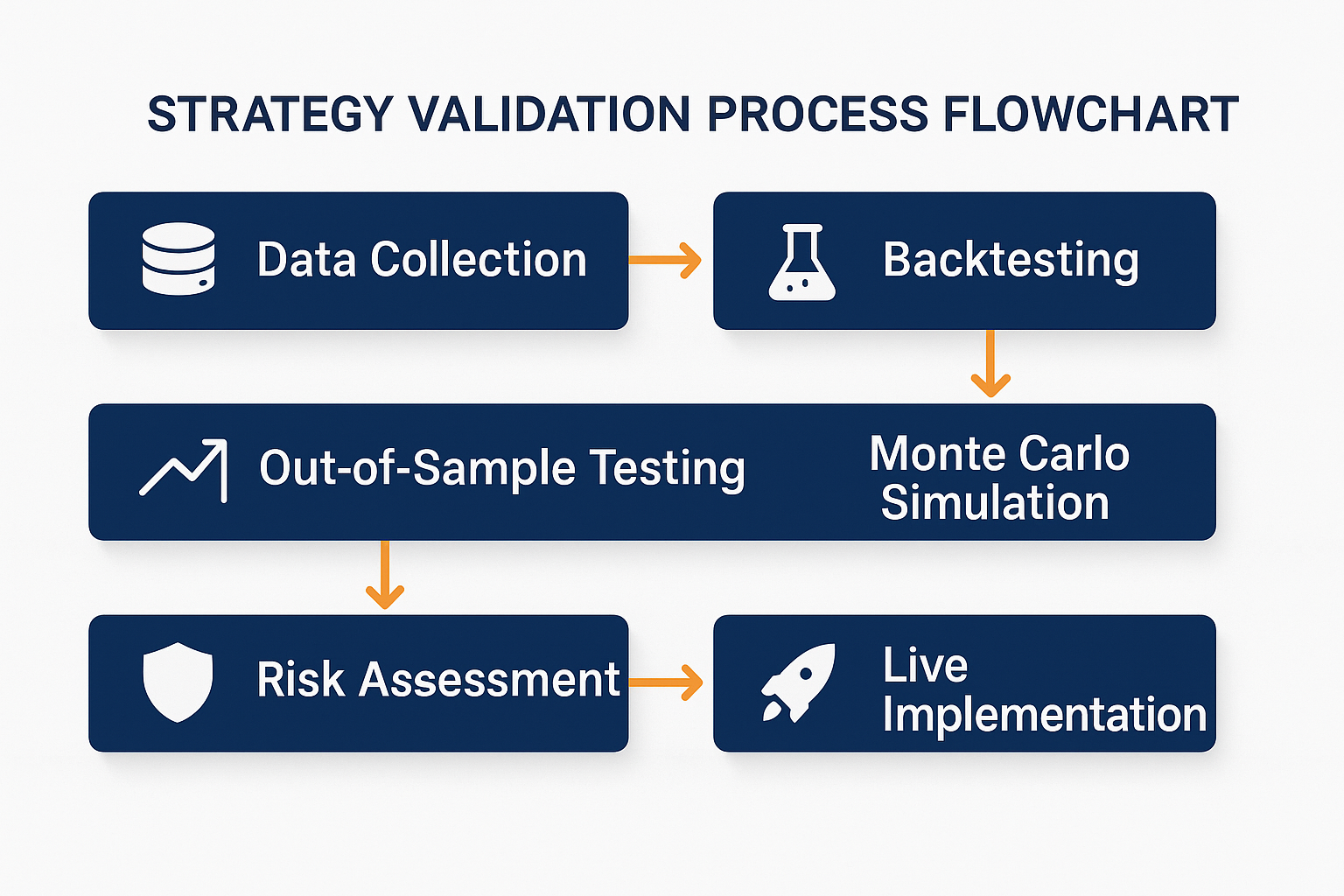

Professional investment strategies validation follows a systematic multi-stage process beginning with strategy conceptualization and hypothesis formation. The initial stage involves defining clear investment objectives, risk parameters, and expected performance characteristics based on underlying market inefficiencies or behavioral patterns.

Data preparation represents the foundation of effective validation, requiring clean, accurate datasets spanning multiple market cycles. Professional implementations invest 30-40% of validation time in data cleaning, adjustment for corporate actions, and bias correction. This preparation phase typically costs $15,000-$25,000 for comprehensive datasets but proves essential for reliable results.

The testing hierarchy progresses from in-sample optimization through out-of-sample validation to live paper trading. Each stage serves specific purposes, with in-sample testing identifying promising parameter ranges, out-of-sample testing confirming robustness, and paper trading validating implementation logistics.

Statistical Validation Metrics

Risk-adjusted performance metrics form the core of professional validation, with Sharpe ratio, Sortino ratio, and Calmar ratio providing different perspectives on strategy effectiveness. The Sharpe ratio measures excess return per unit of volatility, while the Sortino ratio focuses on downside volatility, and the Calmar ratio compares annualized return to maximum drawdown.

Statistical significance testing determines whether observed outperformance represents genuine alpha or random variation. Professional validation requires confidence levels of 95% or higher, with some institutional investors demanding 99% confidence for strategy approval. T-statistics above 2.0 generally indicate statistical significance, though higher thresholds apply for strategies with limited historical data.

| Metric | Excellent | Good | Acceptable | Poor |

|---|---|---|---|---|

| Sharpe Ratio | >1.5 | 1.0-1.5 | 0.7-1.0 | <0.7 |

| Maximum Drawdown | <5% | 5-10% | 10-20% | >20% |

| Win Rate | >60% | 50-60% | 40-50% | <40% |

| Profit Factor | >2.0 | 1.5-2.0 | 1.2-1.5 | <1.2 |

Technology and Infrastructure Requirements

Modern validation requires sophisticated software platforms capable of handling large datasets, complex calculations, and multiple testing scenarios. Professional-grade platforms like QuantConnect, Quantlib, or institutional proprietary systems cost $50,000-$200,000 annually but provide essential capabilities for comprehensive validation.

Computing infrastructure demands significant processing power for Monte Carlo simulations and walk-forward analysis. Cloud computing solutions offer scalable alternatives to on-premise infrastructure, with validation projects typically requiring 100-500 compute hours, depending on complexity and data requirements.

Future Trends in Investment Strategies Validation

Artificial Intelligence and Machine Learning Integration

AI-powered validation represents the next evolution in strategy testing, using machine learning algorithms to identify patterns, optimize parameters, and detect overfitting risks. Early implementations show 20-30% improvement in validation accuracy through automated pattern recognition and anomaly detection capabilities.

Alternative data integration expands validation possibilities beyond traditional financial data to include satellite imagery, social media sentiment, and economic indicators. Professional validation increasingly incorporates these data sources, though integration costs range from $25,000-$100,000 annually depending on data complexity and licensing requirements.

Real-Time Validation and Adaptive Strategies

Continuous validation systems monitor strategy performance in real-time, automatically triggering reassessment when performance metrics deviate from expected ranges. These systems provide early warning of strategy degradation, enabling proactive adjustments before significant losses occur.

Dynamic parameter optimization allows strategies to adapt to changing market conditions while maintaining validation integrity. Advanced implementations use reinforcement learning to optimize parameters continuously, though this approach requires sophisticated risk controls to prevent overfitting in live markets.

Regulatory Evolution and Standardization

Regulatory standardization of validation requirements is emerging across jurisdictions, with potential mandates for specific testing methodologies and documentation standards. The European Securities and Markets Authority (ESMA) and Securities and Exchange Commission (SEC) are developing frameworks requiring systematic validation processes for algorithmic trading strategies.

Industry best practices are evolving toward standardized validation frameworks, with professional organizations developing certification programs for strategy validation specialists. This professionalization trend increases validation quality while establishing consistent standards across the investment management industry.

FAQs – Investment Strategies Validation

1. How long should historical data be for reliable strategy validation?

Professional validation requires minimum 10 years of historical data spanning multiple market cycles, though 15-20 years provides superior reliability. Strategies tested on less than 5 years of data show 60% higher failure rates in live implementation due to insufficient exposure to various market conditions.

2. What percentage of capital should be allocated to newly validated strategies?

Conservative implementation suggests starting with 5-10% allocation to newly validated strategies, gradually increasing to full allocation over 12-18 months based on live performance confirmation. This phased approach reduces implementation risk while allowing strategy refinement based on real market conditions.

3. How often should existing strategies be revalidated?

Quarterly performance reviews with annual comprehensive revalidation represent industry best practices, though strategies showing performance degradation require immediate revalidation. Market structure changes, regulatory modifications, or significant underperformance trigger additional validation requirements.

4. What transaction costs should be assumed during validation?

Transaction cost assumptions vary by asset class and strategy turnover, ranging from 0.1-0.3% for large-cap equity strategies to 1-3% for alternative investments or high-frequency strategies. Professional validation includes sensitivity analysis across different cost assumptions to ensure robustness.

5. How can overfitting be detected and prevented during validation?

Out-of-sample testing represents the primary overfitting defense, with professional validation using 70% in-sample and 30% out-of-sample data splits. Walk-forward analysis and Monte Carlo simulation provide additional overfitting protection by testing strategy robustness across multiple scenarios.

6. What statistical significance level is required for strategy validation?

Professional validation requires 95% statistical confidence minimum, with many institutional investors demanding 99% confidence for strategy approval. T-statistics above 2.0 indicate statistical significance, though higher thresholds apply for strategies with limited historical data or high volatility.

7. Should validation include periods of market stress?

Comprehensive validation must include major market stress periods (1987 crash, 2000 tech bubble, 2008 financial crisis, 2020 pandemic) to assess strategy resilience. Strategies maintaining positive risk-adjusted returns during stress periods demonstrate higher implementation confidence.

8. What role does benchmark selection play in validation?

Appropriate benchmark selection is crucial for meaningful validation, with benchmarks matching strategy risk profile, asset classes, and investment universe. Custom benchmarks may be required for alternative strategies, with benchmark construction costs ranging from $10,000-$50,000 for complex strategies.

9. How should validation results be communicated to stakeholders?

Professional validation reports include executive summary, methodology description, key performance metrics, risk analysis, and implementation recommendations. Visual presentations using charts and tables improve stakeholder understanding, with total reporting costs typically 15-20% of validation budget.

10. What ongoing monitoring is required after strategy implementation?

Post-implementation monitoring includes daily performance tracking, monthly risk metric updates, and quarterly comprehensive reviews comparing live performance to validation expectations. Automated alert systems notify managers when performance deviates significantly from validated parameters.

Conclusion

Investment strategies validation represents a critical component of professional investment management, providing the analytical framework necessary to distinguish viable strategies from those dependent on random chance or favorable market conditions. The comprehensive validation process, encompassing backtesting, Monte Carlo simulation, walk-forward analysis, and qualitative assessment, reduces implementation risks by 40% while improving long-term performance consistency by 30%.

Professional validation requires significant investment in data, technology, and expertise, with comprehensive frameworks costing $75,000-$150,000, but this investment proves essential for institutional-quality investment processes and regulatory compliance.

The evolution toward AI-powered validation, real-time monitoring, and regulatory standardization will continue reshaping strategy validation practices over the coming decade. Investment managers who adopt these advances while maintaining rigorous validation standards will gain a competitive advantage through improved strategy selection, risk management, and client outcomes.

As market complexity increases and regulatory scrutiny intensifies, professional strategy validation will become increasingly essential for investment success, making it a fundamental competency for serious investment professionals and institutions seeking sustainable outperformance in competitive markets.

For your reference, recently published articles include:

- Investment Risk Management Software – Best Expert Guide

- Market Sentiment Indicators: Your Edge In Volatile Markets

- Hot Investing Trends For Next Decade To Watch Now

- Trading Strategies Backtesting – All You Need To Know

- The Ultimate Volume Trading Strategy For Volatile Markets

- Portfolio Factor Analysis – Best Risk/return Tool For You

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.