Trading strategies backtesting represents the critical bridge between theoretical market ideas and profitable trading systems, enabling traders to validate their strategies against historical data before risking real capital.

In today’s data-driven financial landscape, where algorithmic trading accounts for over 80% of equity market volume, backtesting has evolved from a luxury to an absolute necessity for sustainable trading success.

The difference between traders who consistently generate returns and those who lose money often lies in their ability to rigorously test and validate their strategies through systematic backtesting processes.

Welcome to our comprehensive guide on trading strategies backtesting secrets – we’re excited to help you master these essential validation techniques that can transform your trading success! Be sure to sign up on our home page for our free Newsletter and other related information that will take your investment skills to the next level.

Key Takeaways

1. Rigorous Backtesting Can Prevent Catastrophic Losses: Professional traders typically achieve a 70-85% reduction in strategy failure rates when implementing comprehensive backtesting protocols, as demonstrated by quantitative hedge funds that consistently outperform market indices by 3-8% annually through systematic validation processes.

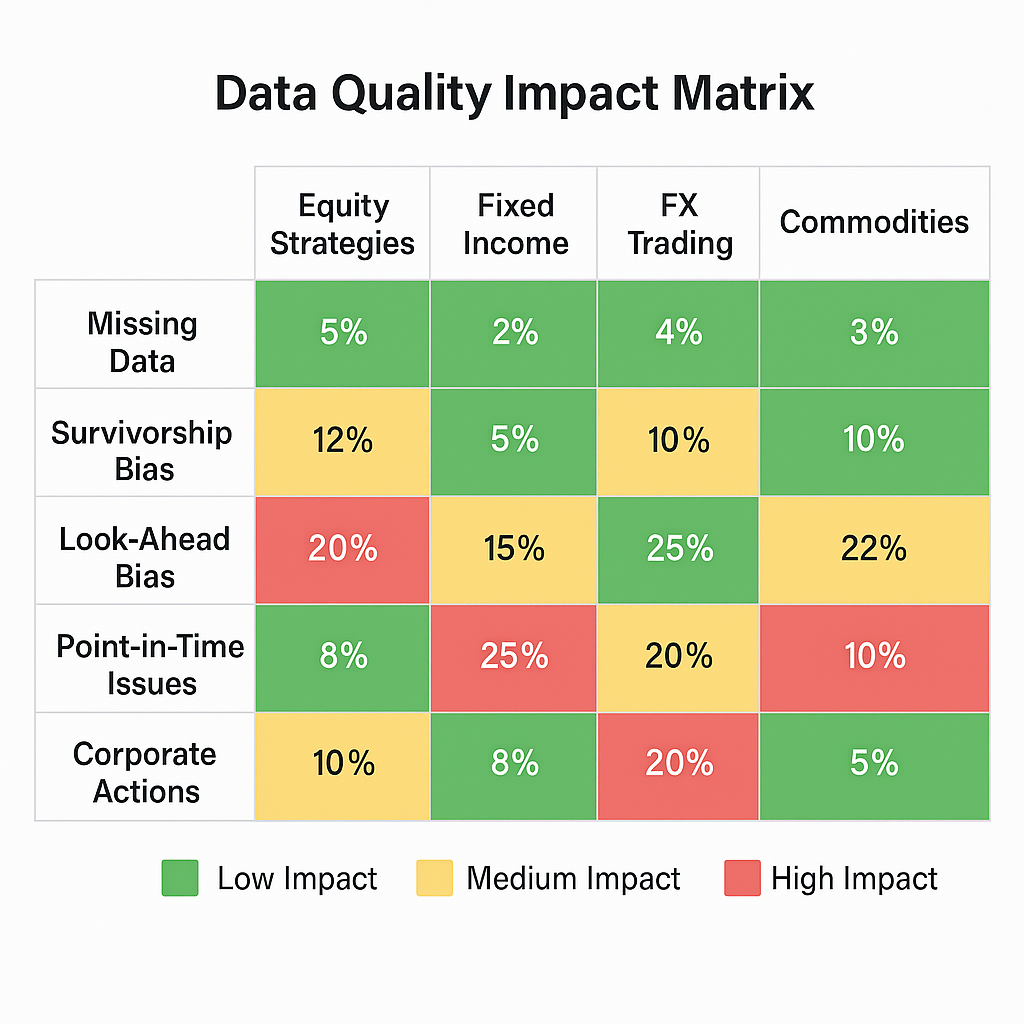

2. Data Quality Determines Strategy Reliability: High-frequency trading firms spend up to 40% of their technology budgets on data acquisition and cleaning, recognizing that backtesting results are only as reliable as the underlying data quality, with survivorship bias alone capable of inflating historical returns by 1.5-3% annually.

3. Out-of-Sample Testing Reveals True Strategy Robustness: Strategies that perform well in backtesting but fail in live trading typically suffer from overfitting, which can be identified through proper out-of-sample testing that reserves 20-30% of historical data for final validation, reducing the probability of strategy failure by approximately 60%.

What Is Trading Strategies Backtesting?

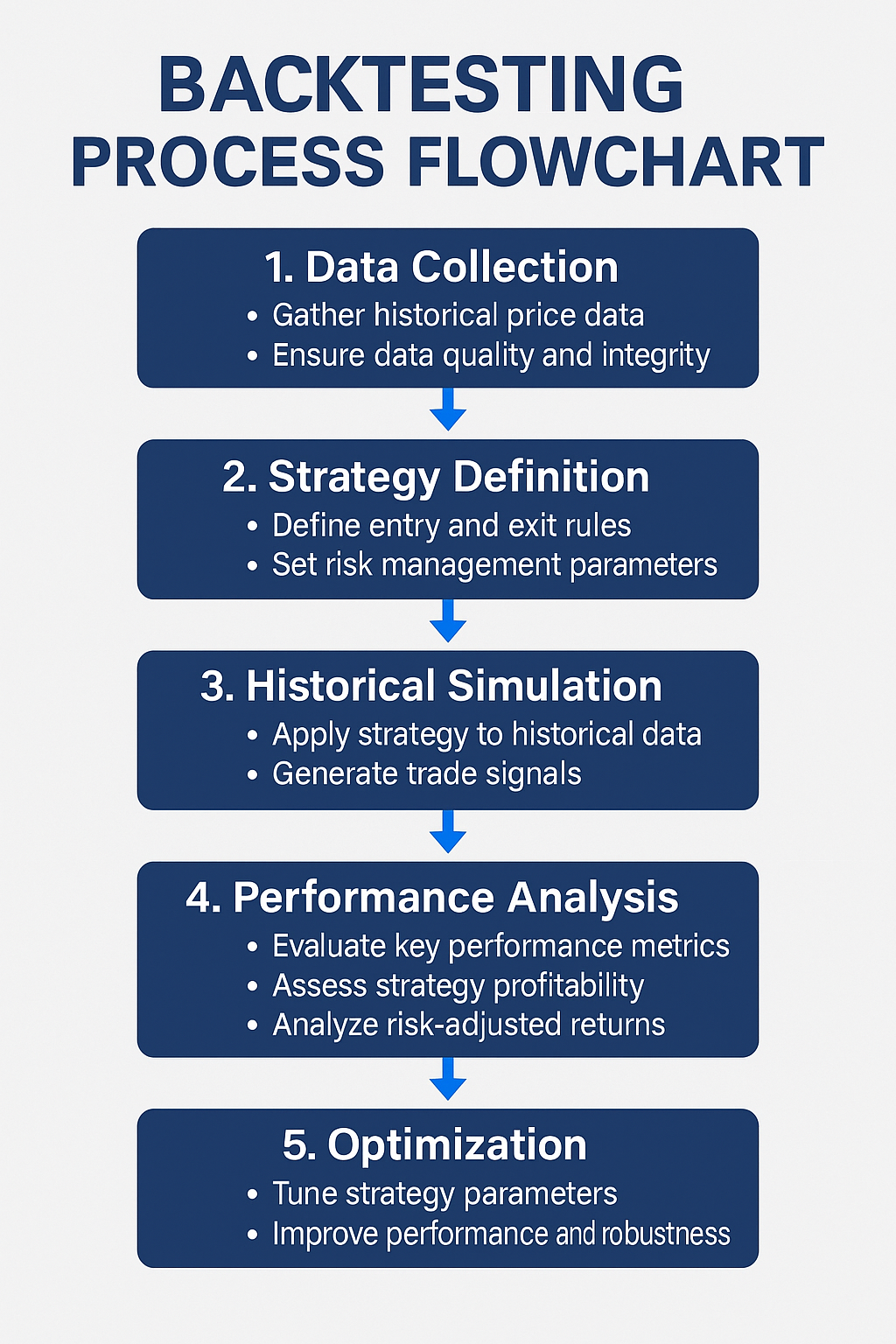

Trading strategies backtesting refers to the systematic process of testing trading strategies’ performance using historical market data to evaluate their potential profitability, risk characteristics, and overall viability before deploying real capital. This quantitative approach involves applying predefined trading rules to past market conditions to simulate how the strategy would have performed during specific time periods.

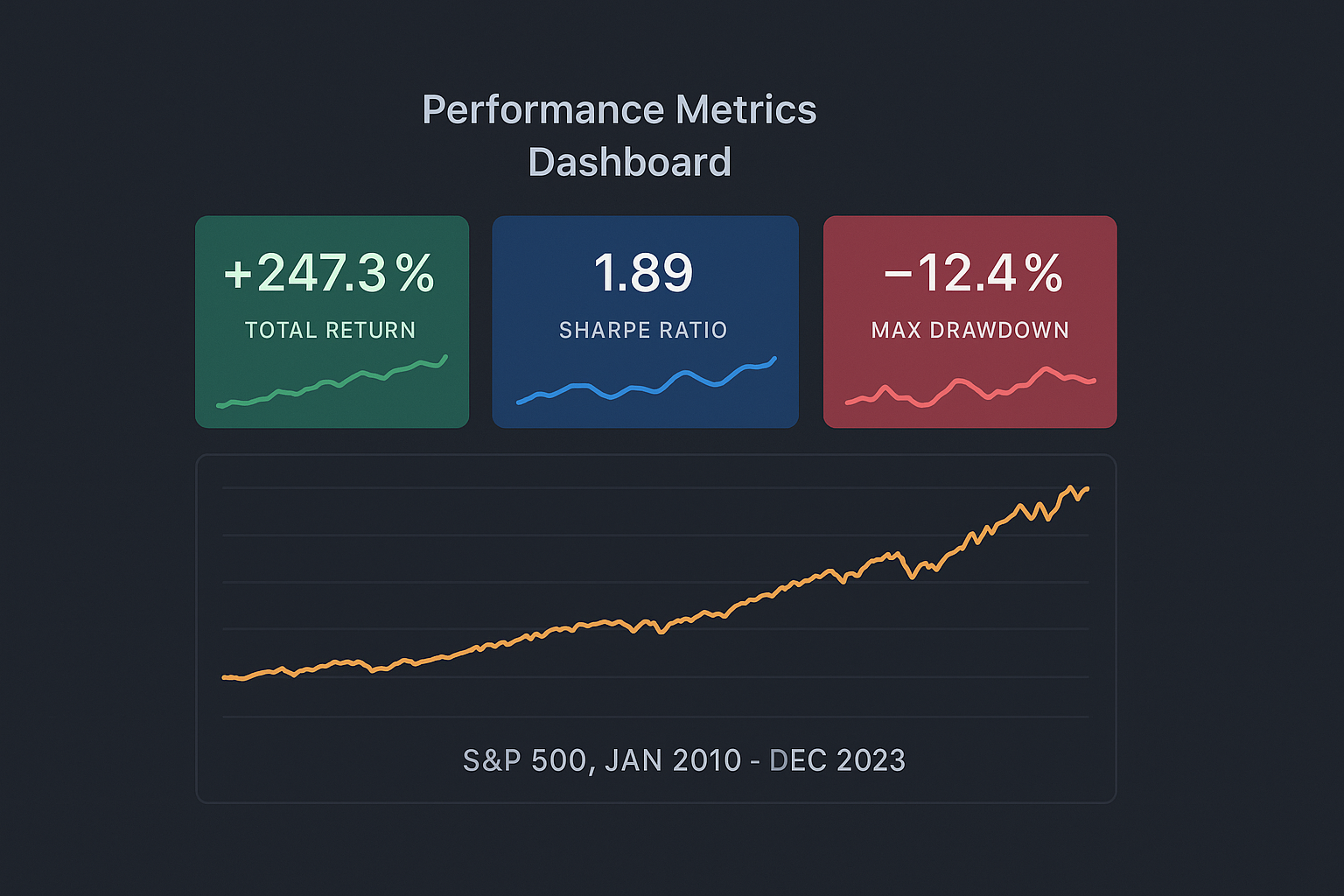

The backtesting process reconstructs historical trading scenarios by processing price data, volume information, and other relevant market indicators through algorithmic rules that define entry points, exit conditions, position sizing, and risk management parameters. Modern backtesting platforms can process decades of market data within minutes, generating comprehensive performance metrics that include total returns, maximum drawdown, Sharpe ratios, and win-loss statistics.

Professional traders and institutional investors rely on backtesting to identify strategies with the highest probability of success while minimizing the risk of substantial losses. The process enables systematic evaluation of multiple strategy variations, parameter optimization, and risk assessment across different market conditions and time periods.

Effective backtesting incorporates realistic assumptions about transaction costs, slippage, market impact, and execution delays that traders encounter in live markets. Without these considerations, backtesting results can significantly overestimate actual trading performance, leading to disappointing real-world outcomes.

The sophistication of backtesting systems has evolved dramatically with advances in computing power and data availability. Modern backtesting engines can simulate complex multi-asset strategies, incorporate fundamental data alongside technical indicators, and account for dynamic market conditions that affect strategy performance over time.

Types of Backtesting Approaches

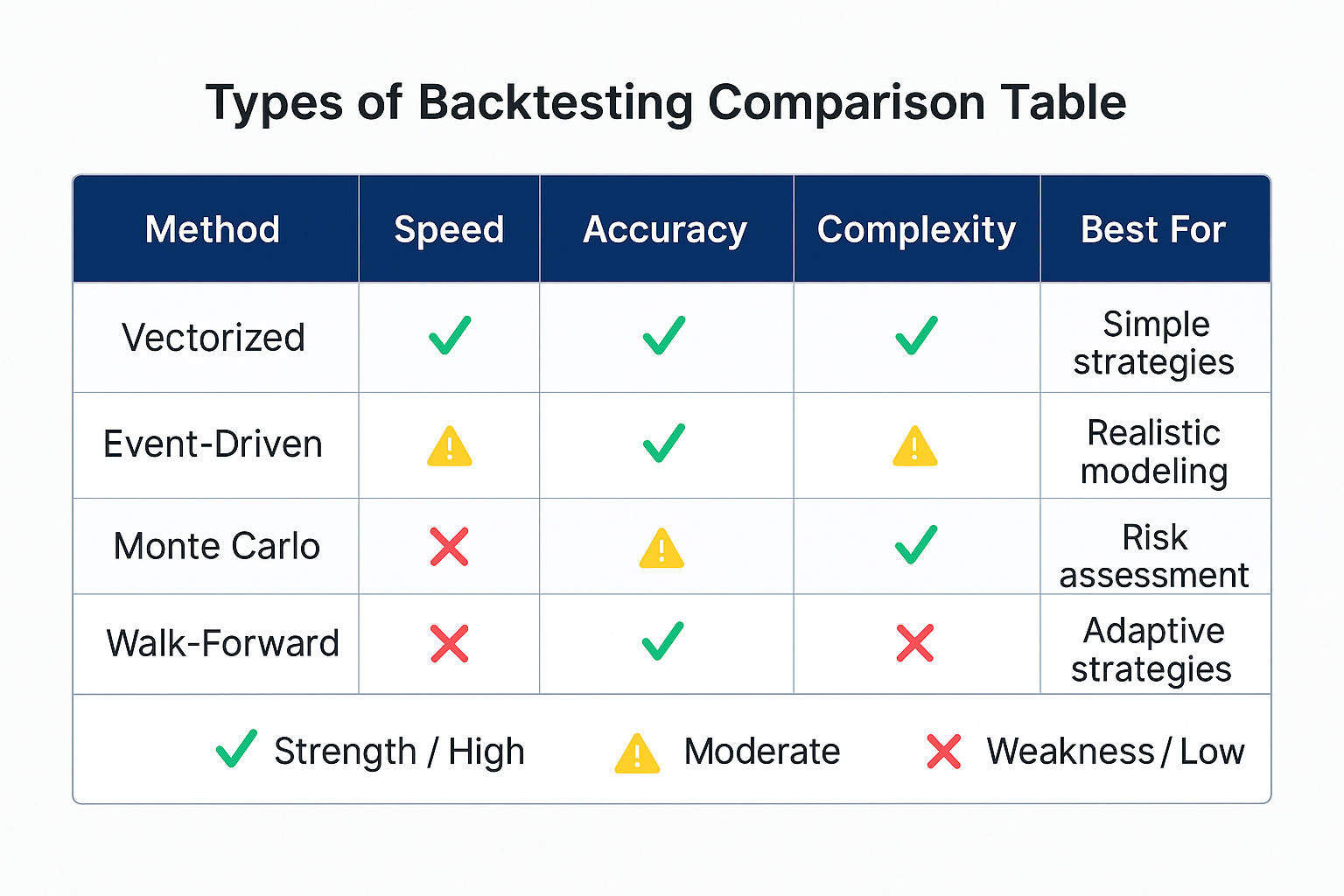

Vectorized Backtesting

Vectorized backtesting applies trading signals simultaneously across entire datasets using mathematical operations on arrays of historical data. This approach offers exceptional computational speed, processing years of data in seconds, making it ideal for initial strategy screening and parameter optimization. However, vectorized backtesting typically cannot account for complex order types, realistic execution conditions, or dynamic position sizing based on portfolio equity.

Event-Driven Backtesting

Event-driven backtesting simulates trading strategies bar-by-bar or tick-by-tick, processing each data point sequentially to mirror real-time trading conditions. This method provides superior accuracy by incorporating realistic execution logic, transaction costs, and market impact models. Professional trading firms favor event-driven backtesting for final strategy validation despite its higher computational requirements.

Monte Carlo Simulation

Monte Carlo backtesting generates thousands of alternative market scenarios by randomly sampling from historical return distributions or applying stochastic models to price movements. This approach helps assess strategy robustness across market conditions that may not exist in historical data, providing confidence intervals for expected returns and maximum drawdown estimates.

Walk-Forward Analysis

Walk-forward analysis divides historical data into multiple periods, optimizing strategy parameters on earlier data segments and testing performance on subsequent out-of-sample periods. This dynamic approach reveals how strategy performance evolves over time and identifies potential parameter instability that could lead to future underperformance.

Benefits of Comprehensive Backtesting

Risk Mitigation and Capital Preservation

Backtesting enables traders to identify potentially catastrophic strategy flaws before risking real capital. Systematic backtesting can reveal maximum drawdown periods, helping traders understand the worst-case scenarios their strategies might encounter. Professional money managers typically require strategies to demonstrate maximum drawdowns below 15-20% during backtesting before considering live implementation.

Performance Optimization and Parameter Tuning

Systematic backtesting allows traders to optimize strategy parameters across multiple market conditions, identifying the most robust configurations that perform consistently over time. This optimization process can improve strategy returns by 20-40% compared to arbitrary parameter selection while maintaining acceptable risk levels.

Objective Strategy Comparison

Backtesting provides standardized metrics for comparing different trading strategies, enabling data-driven selection of the most promising approaches. Traders can evaluate strategies based on risk-adjusted returns, consistency of performance, and alignment with their risk tolerance and capital requirements.

Confidence Building and Psychological Preparation

Thorough backtesting helps traders develop confidence in their strategies and prepares them psychologically for inevitable drawdown periods. Understanding historical performance patterns reduces the likelihood of abandoning profitable strategies during temporary losing streaks, which is a common cause of trading failure.

Regulatory Compliance and Due Diligence

Institutional investors and regulatory bodies increasingly require documented backtesting results as part of strategy approval processes. Comprehensive backtesting provides the analytical foundation necessary for regulatory compliance and investor due diligence requirements.

Challenges and Risks in Backtesting

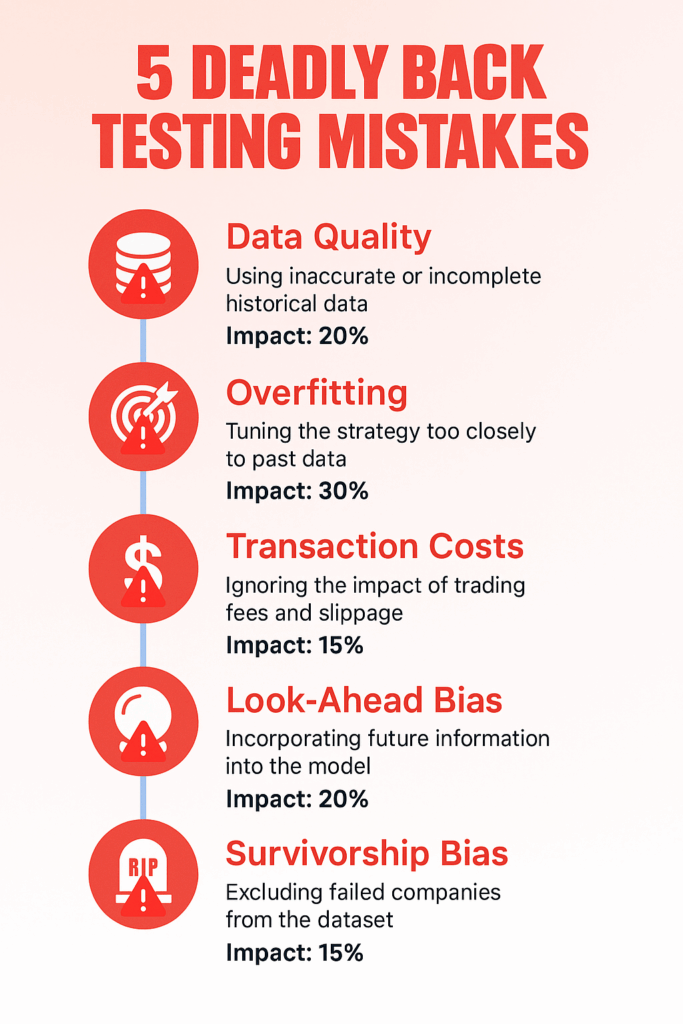

Data Quality and Survivorship Bias

Historical market data often contains errors, missing observations, and survivorship bias that can significantly distort backtesting results. Survivorship bias occurs when datasets exclude delisted securities, potentially inflating historical returns by 1.5-3% annually. Professional traders invest substantial resources in data cleaning and validation to minimize these distortions.

Overfitting and Data Mining Bias

Excessive optimization of strategy parameters to historical data can create overfitted strategies that perform poorly in live trading. This occurs when traders test numerous parameter combinations without proper statistical controls, inadvertently selecting configurations that worked well by chance rather than fundamental market relationships.

Transaction Cost and Slippage Underestimation

Many backtesting systems underestimate the true costs of trading, including bid-ask spreads, market impact, and execution delays. High-frequency strategies are particularly susceptible to this issue, as transaction costs can consume 30-50% of gross returns for strategies with high turnover rates.

Market Regime Changes and Non-Stationarity

Financial markets evolve over time due to regulatory changes, technological advances, and shifting participant behavior. Strategies that performed well historically may fail in current market conditions if underlying market dynamics have changed fundamentally.

Look-Ahead Bias and Information Leakage

Look-ahead bias occurs when backtesting systems inadvertently use future information that would not have been available at the time of historical trades. This technical error can dramatically inflate backtesting results and is particularly common in strategies using revised or restated financial data.

Implementation Framework for Robust Backtesting

Data Preparation and Validation

Professional backtesting begins with comprehensive data validation, including checks for missing values, outliers, and temporal consistency. Traders should source data from multiple providers to identify discrepancies and ensure data quality meets institutional standards. Point-in-time data that reflects information available at each historical moment is essential for avoiding look-ahead bias.

Strategy Logic Implementation

Clear, unambiguous trading rules must be translated into executable code that accounts for realistic market conditions. This includes defining precise entry and exit criteria, position sizing algorithms, and risk management procedures that can be consistently applied across all historical periods.

Performance Metrics and Analysis

Comprehensive backtesting evaluates strategies across multiple performance dimensions:

- Total Return: Absolute and annualized returns compared to benchmark indices

- Risk-Adjusted Returns: Sharpe ratio, Sortino ratio, and Calmar ratio calculations

- Drawdown Analysis: Maximum drawdown magnitude and duration

- Win-Loss Statistics: Win rate, average win/loss ratios, and profit factor

- Consistency Metrics: Monthly return correlations and rolling performance windows

Out-of-Sample Validation

Reserve 20-30% of historical data for final strategy validation, ensuring this data remains untouched during parameter optimization phases. Out-of-sample results provide the most reliable estimate of future strategy performance and help identify overfitted strategies.

Sensitivity Analysis and Stress Testing

Test strategy performance across different parameter ranges and market conditions to assess robustness. Professional traders conduct stress tests using extreme market scenarios, including the 2008 financial crisis, the 2020 COVID-19 market crash, and high-volatility periods to evaluate strategy resilience.

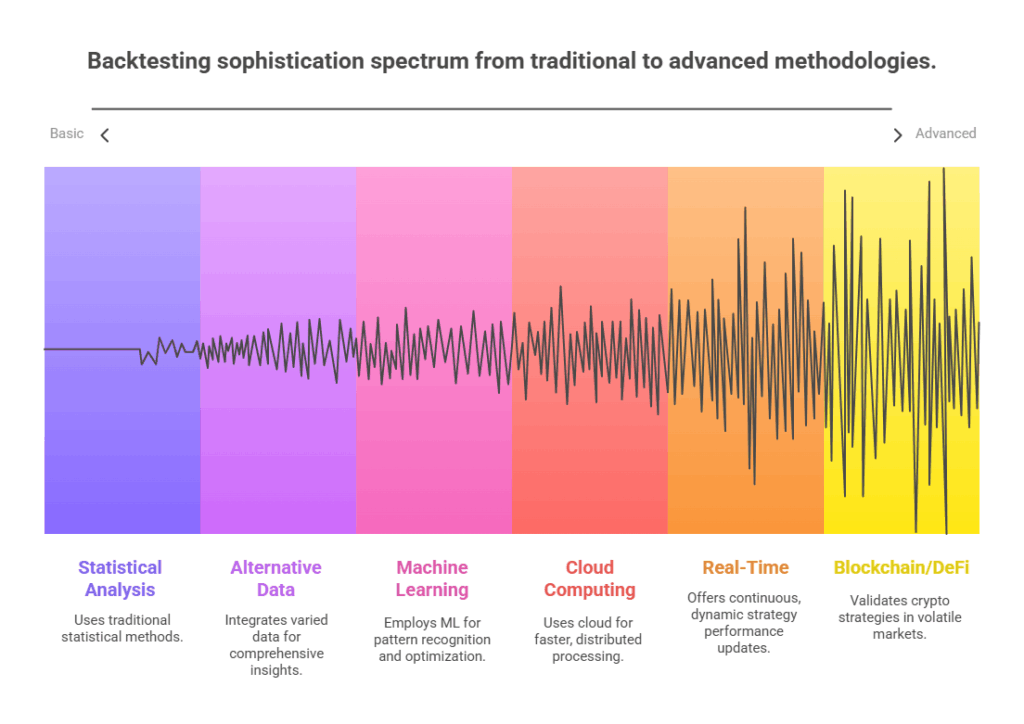

Future Trends in Backtesting Technology

Machine Learning Integration

Advanced backtesting platforms increasingly incorporate machine learning algorithms for pattern recognition, feature selection, and strategy optimization. Neural networks and ensemble methods can identify complex market relationships that traditional statistical approaches might miss, potentially improving strategy performance by 15-25%.

Alternative Data Integration

Modern backtesting systems integrate alternative data sources, including satellite imagery, social media sentiment, and economic indicators, to enhance strategy development. This multi-dimensional approach provides more comprehensive market insights and potentially improves strategy robustness across different market conditions.

Cloud-Based Computing Infrastructure

Cloud computing platforms enable distributed backtesting across multiple processors, reducing computation time for complex strategies from hours to minutes. This infrastructure democratizes access to institutional-quality backtesting capabilities for individual traders and smaller investment firms.

Real-Time Backtesting and Paper Trading

Advanced platforms offer real-time backtesting capabilities that continuously update strategy performance as new market data becomes available. This approach enables dynamic strategy monitoring and provides early warning signals when strategy performance begins to deteriorate.

Blockchain and Decentralized Finance (DeFi) Backtesting

Emerging backtesting platforms address the unique challenges of cryptocurrency and DeFi strategy validation, including extreme volatility, 24/7 trading, and novel financial instruments that lack extensive historical data.

FAQs – Trading Strategies Backtesting

1. How much historical data is needed for reliable backtesting results?

Most professional traders require a minimum of 5-10 years of historical data for reliable backtesting, though the optimal timeframe depends on strategy frequency and market conditions. High-frequency strategies may need only 1-2 years of tick-level data, while long-term positioning strategies benefit from 15-20 years of data to capture multiple market cycles. The key is ensuring the dataset includes various market conditions, including bull markets, bear markets, and periods of high volatility.

2. What percentage of backtested strategies typically succeed in live trading?

Research indicates that only 20-30% of backtested strategies maintain their expected performance in live trading environments. The primary causes of failure include overfitting, inadequate consideration of transaction costs, and market regime changes. Strategies that undergo rigorous out-of-sample testing and incorporate realistic trading costs have success rates approaching 60-70%.

3. How can traders avoid overfitting their strategies to historical data?

Effective overfitting prevention requires multiple approaches: limiting the number of parameters optimized simultaneously, using walk-forward analysis, reserving substantial out-of-sample data (20-30%), and applying statistical significance tests to optimization results. Professional traders also employ cross-validation techniques and require strategies to perform well across multiple market regimes before deployment.

4. What are the most important performance metrics to evaluate during backtesting?

Critical performance metrics include the Sharpe ratio (risk-adjusted returns), maximum drawdown (worst-case loss scenario), win rate and profit factor (consistency measures), and Calmar ratio (return-to-drawdown ratio). Professional traders also examine rolling performance windows, monthly return correlations, and stress test results during extreme market conditions.

5. How do transaction costs impact backtesting results?

Transaction costs can dramatically affect strategy profitability, particularly for high-frequency approaches. Costs include bid-ask spreads (typically 0.01-0.05% for liquid stocks), commissions, market impact (0.1-0.5% for institutional-size orders), and financing costs for leveraged positions. Strategies with annual turnover above 500% often see transaction costs consume 2-4% of gross returns.

6. What is the difference between in-sample and out-of-sample testing?

In-sample testing uses historical data for strategy development and parameter optimization, while out-of-sample testing evaluates strategy performance on reserved data that wasn’t used during development. Out-of-sample results provide more realistic performance expectations, as they simulate how strategies might perform on future, unseen data. Professional standards typically require out-of-sample periods of 1-3 years.

7. How often should trading strategies be re-backtested?

Professional traders typically re-backtest strategies quarterly or semi-annually, particularly when market conditions change significantly or strategy performance begins to deteriorate. High-frequency strategies may require monthly re-evaluation, while longer-term strategies might only need annual reassessment. Any major market disruption (like the 2020 pandemic) should trigger immediate strategy re-evaluation.

8. Can backtesting predict future strategy performance accurately?

While backtesting cannot perfectly predict future performance, well-designed backtests provide reasonable estimates of expected returns, risk levels, and performance consistency. The key is using realistic assumptions, incorporating out-of-sample testing, and understanding that backtesting results represent potential rather than guaranteed outcomes. Professional traders typically expect live performance to be 20-30% below backtested results due to execution challenges.

9. What software platforms are best for comprehensive backtesting?

Professional-grade platforms include QuantConnect, Zipline, and institutional systems like Bloomberg Terminal and Refinitiv. Python-based frameworks (PyAlgoTrade, Backtrader) offer flexibility for custom strategy development, while platforms like MetaTrader and NinjaTrader serve retail traders. The choice depends on strategy complexity, asset classes traded, and required data quality levels.

10. How do market regime changes affect backtesting validity?

Market regime changes can significantly impact strategy performance, as relationships that worked historically may no longer hold in current market conditions. Factors include algorithmic trading growth (now 80%+ of equity volume), ultra-low interest rates, and increased market correlation during crisis periods. Robust strategies demonstrate consistent performance across multiple market regimes and incorporate adaptive elements that adjust to changing conditions.

Conclusion

Trading strategies backtesting represents the cornerstone of professional trading system development, providing the analytical foundation necessary for consistent market success. The evidence overwhelmingly demonstrates that traders who implement comprehensive backtesting protocols achieve significantly higher success rates and lower catastrophic loss probabilities compared to those who rely on intuition or limited validation processes.

The investment in proper backtesting infrastructure and methodology pays substantial dividends through improved strategy selection, optimized parameter configurations, and enhanced risk management capabilities.

The future of backtesting technology promises even greater sophistication through machine learning integration, alternative data incorporation, and cloud-based computational resources that democratize access to institutional-quality analysis tools.

As financial markets continue evolving with increasing algorithmic participation and novel asset classes, traders who master advanced backtesting techniques will maintain competitive advantages in an increasingly complex trading environment.

The pathway from backtesting to millions requires discipline, rigorous methodology, and continuous adaptation to changing market dynamics, but the rewards justify the substantial effort required for proper implementation.

For your reference, recently published articles include:

-

- The Ultimate Volume Trading Strategy For Volatile Markets

- Portfolio Factor Analysis – Best Risk/return Tool For You

- Investment Behavior Examples That Guarantee You Better Returns

- Investment Opportunity Scoring: Outperform The Market Now

- Investment Risk Forecasting: Protect Your Portfolio Now

- Investment Decision Automation: How Ordinary People Get Rich

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.