Introduction to “Value vs Growth” Investing

The debate between value vs growth investing represents one of the most fundamental strategic decisions investors face when building their portfolios. Value investing focuses on purchasing undervalued companies trading below their intrinsic worth, while growth investing targets companies expected to expand earnings at above-average rates regardless of current valuation.

Understanding the distinction between these two philosophies – and how they perform across different market cycles – is essential for constructing a portfolio aligned with one’s financial goals and risk tolerance.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways – Value vs Growth

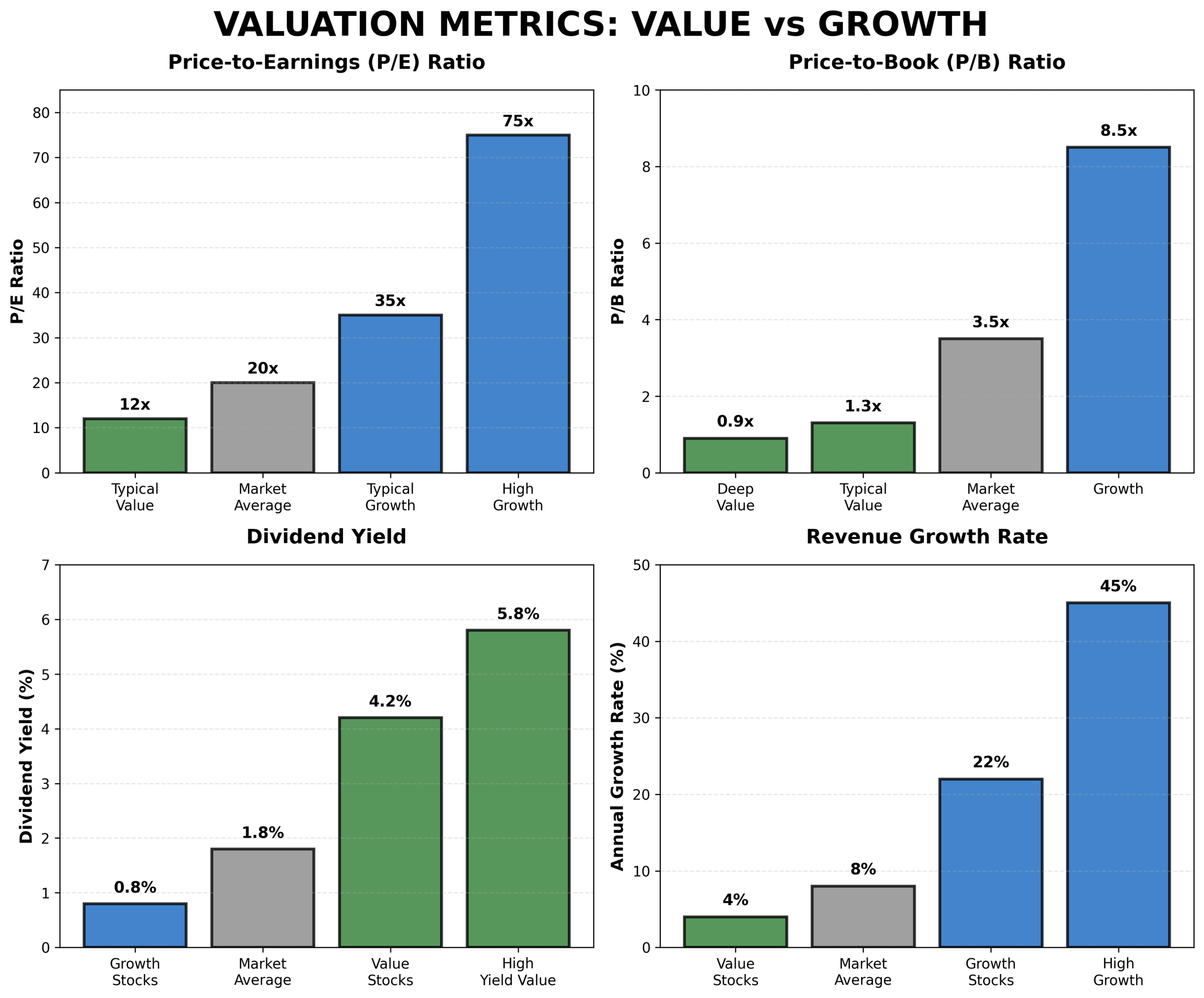

Value investing prioritizes purchasing established companies trading at discounts to their intrinsic value, typically identified by metrics such as price-to-earnings (P/E) ratios below 15 or price-to-book (P/B) ratios under 1.5. For example, during the 2008 financial crisis, investors who purchased blue-chip banks like JPMorgan Chase at severely depressed valuations saw substantial returns as these companies recovered to fair value over the subsequent decade.

Growth investing targets companies that demonstrate exceptional potential for revenue and earnings growth, even when current valuations appear expensive by traditional metrics. Amazon’s stock traded at P/E ratios exceeding 100 during the 2010s, yet investors who recognized its market disruption potential and held through periods of high valuation realized extraordinary gains as the company’s earnings eventually justified and surpassed those multiples.

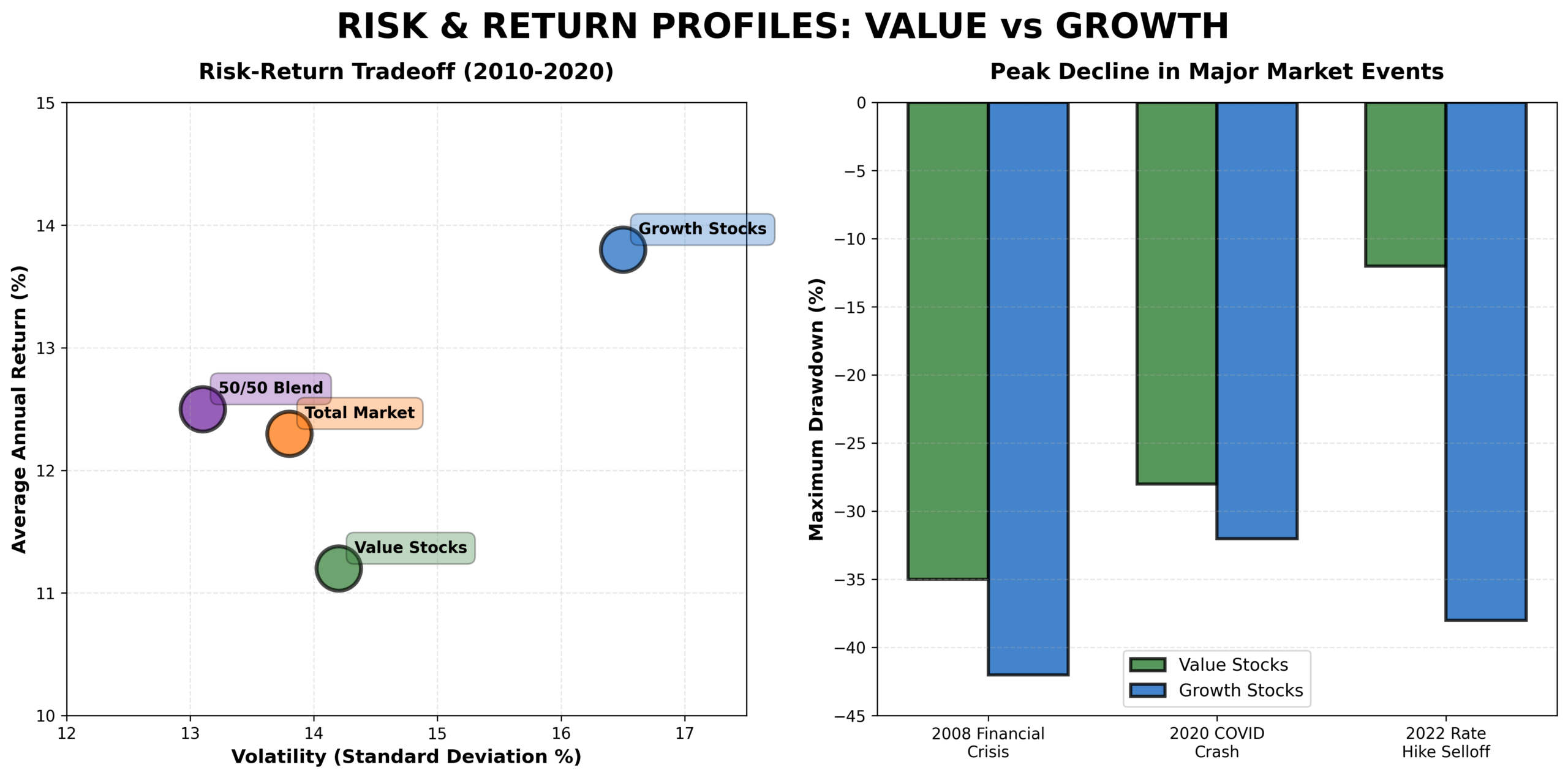

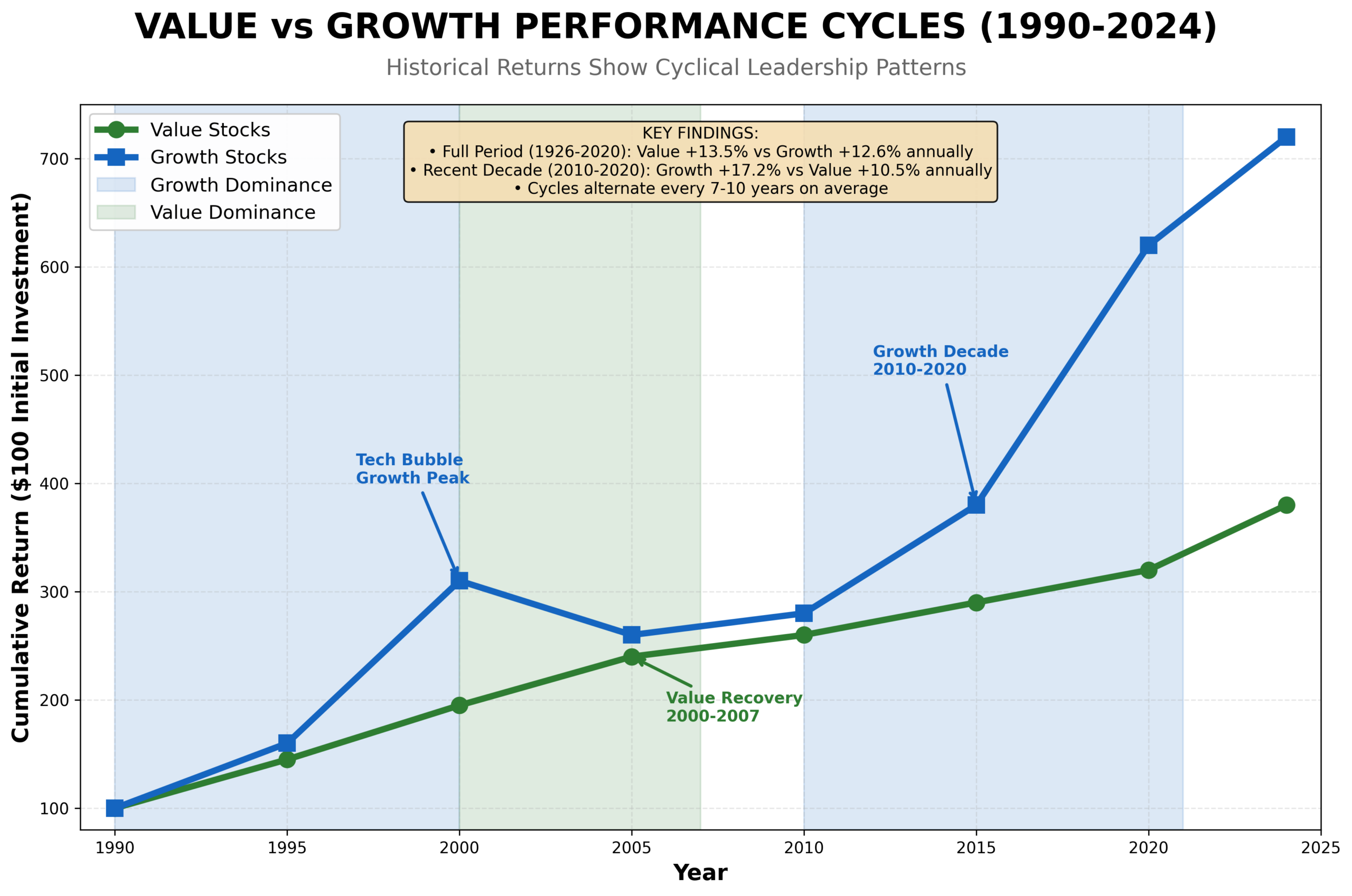

Historical data demonstrates that value and growth strategies alternate periods of outperformance, with value stocks delivering superior returns over the full 1926-2020 period (average annual return of 13.5% versus 12.6% for growth), yet growth stocks dominate the 2010-2020 decade with returns exceeding 17% annually compared to value’s 10%. This cyclical pattern suggests that maintaining exposure to both styles through diversified index funds provides the most reliable path to long-term wealth accumulation.

Table of Contents

What Value Investing Is

Value investing is based on the fundamental principle that markets occasionally misprice securities, creating opportunities to buy quality companies at discounts to their intrinsic value. The strategy involves identifying these undervalued stocks through rigorous financial analysis and holding them until the market recognizes their true value.

Definition and Core Principles

Value investing centers on purchasing stocks trading below their calculated intrinsic value, as determined through fundamental analysis of financial statements, assets, earnings power, and competitive position. Investors employing this strategy typically seek companies with low P/E ratios (below the market average of approximately 15-20), low P/B ratios (ideally below 1.5), and dividend yields exceeding market averages (currently above 2.5% for the S&P 500).

The strategy’s intellectual foundation traces to Benjamin Graham and David Dodd’s seminal 1934 work “Security Analysis,” which established the framework for identifying stocks trading below their liquidation value or replacement cost. Warren Buffett, Graham’s most famous student, refined this approach by emphasizing “quality at a fair price” rather than merely “cheap stocks,” seeking companies with durable competitive advantages (economic moats), strong management teams, and predictable cash flows trading at temporary discounts.

Characteristics of Value Stocks

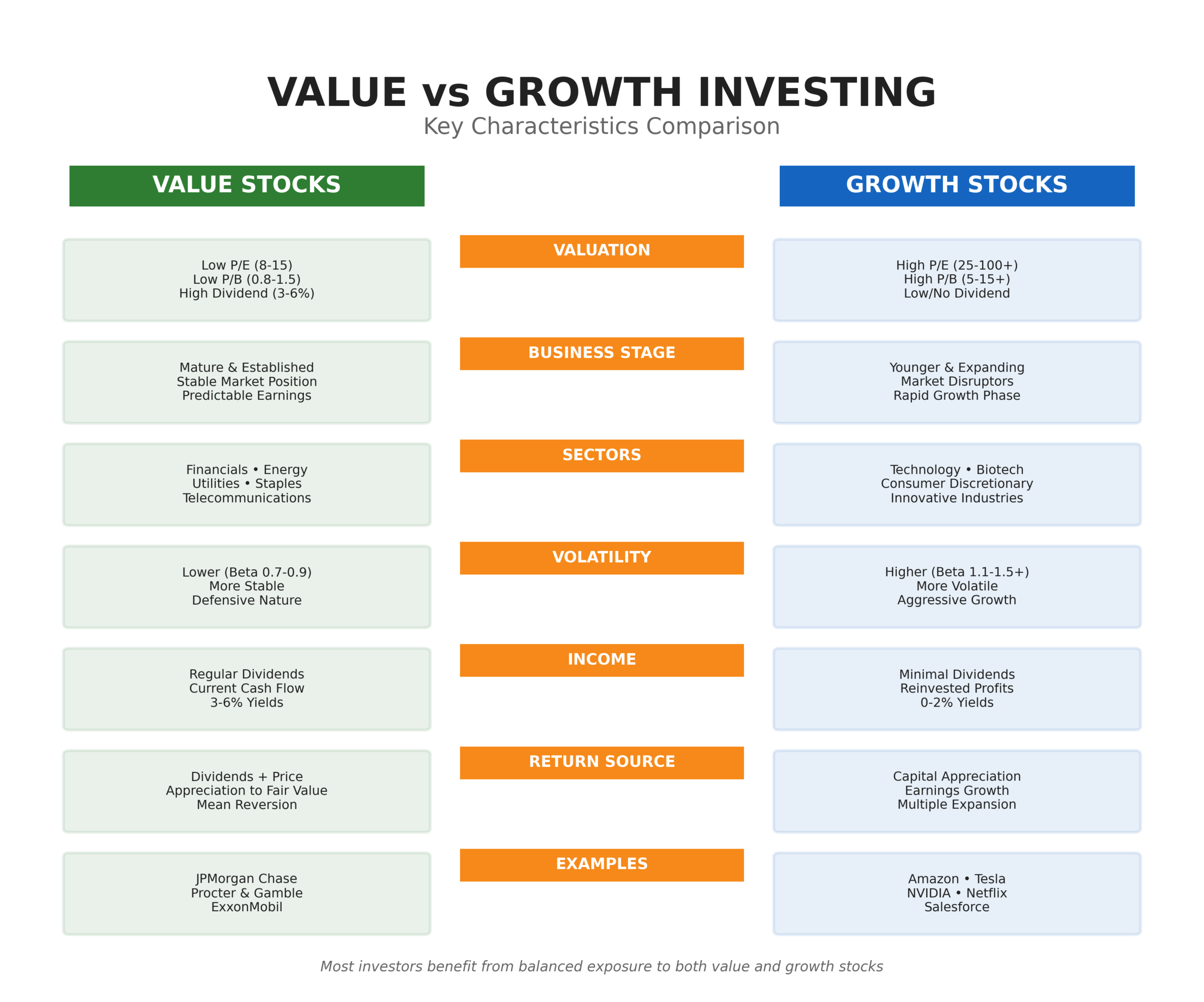

Value stocks typically exhibit several identifiable characteristics that distinguish them from growth-oriented investments. These companies generally operate in mature, stable industries with established business models and predictable revenue streams. Their earnings tend to be consistent rather than rapidly expanding, and they often return cash to shareholders through regular dividend payments rather than reinvesting all profits into expansion.

Common sectors housing value stocks include financials (regional banks, insurance companies), utilities (electric and gas providers), energy (integrated oil companies), consumer staples (food producers, household products), and telecommunications (established carriers). Companies like AT&T, Procter & Gamble, ExxonMobil, and JPMorgan Chase frequently appear in value portfolios due to their stable earnings, substantial assets, and shareholder-friendly policies.

Value Investing Metrics

Value investors employ specific financial metrics to identify potentially undervalued securities. The P/E ratio compares a company’s stock price to its earnings per share, with value stocks typically displaying ratios below the market average. The P/B ratio divides market capitalization by book value (assets minus liabilities), helping identify companies trading below their net asset value. Dividend yield, calculated as annual dividends divided by the stock price, provides insight into the stock’s immediate income-generating potential.

Additional metrics include price-to-sales (P/S) ratio, enterprise value-to-EBITDA (EV/EBITDA), free cash flow yield, and return on equity (ROE). Value investors seek combinations of low valuation multiples paired with strong fundamental business metrics, avoiding “value traps”—stocks that appear cheap but face genuine business deterioration rather than temporary market mispricing.

What Growth Investing Is

Growth investing focuses on capital appreciation rather than current income, targeting companies demonstrating above-average expansion in revenues, earnings, or market share. These investors willingly pay premium valuations for businesses expected to deliver exceptional long-term earnings growth.

Definition and Core Principles

Growth investing involves purchasing stocks of companies expected to increase earnings at rates significantly exceeding market averages (typically 15% or higher annually), even when current valuations appear elevated by traditional metrics. This strategy prioritizes future earnings potential over present-day cheapness, accepting higher P/E ratios (often exceeding 25-30 or even reaching triple digits) based on projections of substantial future value creation.

Peter Lynch, legendary manager of Fidelity’s Magellan Fund from 1977-1990, popularized growth investing through his concept of “growth at a reasonable price” (GARP), seeking companies with earnings growth rates matching or exceeding their P/E ratios. Philip Fisher, another growth investing pioneer, emphasized qualitative factors like management quality, competitive position, and innovation capacity over purely quantitative valuation metrics.

Characteristics of Growth Stocks

Growth companies typically operate in dynamic, expanding industries with significant runway for market penetration or disruption. These businesses reinvest most or all profits into research and development, market expansion, acquisitions, or infrastructure rather than paying dividends. Their revenue and earnings growth rates substantially exceed GDP growth and market averages.

Technology represents the quintessential growth sector, encompassing software (Microsoft, Salesforce), semiconductors (NVIDIA, AMD), e-commerce (Amazon, Shopify), and digital platforms (Alphabet, Meta). Biotechnology and pharmaceutical companies developing breakthrough treatments, renewable energy firms addressing climate transition, and emerging market consumer companies capturing rising middle-class spending also frequently qualify as growth investments.

Growth Investing Metrics

Growth investors prioritize metrics measuring business expansion and future potential rather than current valuation cheapness. Revenue growth rate – particularly when accelerating quarter-over-quarter or year-over-year – signals increasing market acceptance and competitive positioning. Earnings growth rate, both historical and projected, indicates management’s ability to convert sales into profits.

Additional important metrics include total addressable market (TAM) size, market share trends, customer acquisition costs versus lifetime value, gross margin expansion, operating leverage, and innovation pipeline strength. Growth investors accept high P/E ratios when accompanied by strong revenue growth, improving unit economics, network effects, or winner-take-most competitive dynamics.

Key Differences Explained – Value vs Growth

Understanding the fundamental distinctions between value and growth investing enables investors to make informed allocation decisions aligned with their financial objectives and market outlook.

Valuation Approach

Value investing emphasizes purchasing securities at discounts to their calculated intrinsic value, requiring prices significantly below fair value estimates to provide a “margin of safety” that protects against analysis errors or adverse developments. Value investors typically demand 30-50% discounts to their intrinsic value calculations before purchasing.

Growth investing accepts – even embraces – premium valuations when justified by exceptional future earnings potential. Growth investors pay what appears expensive by current metrics, betting that rapid earnings expansion will make today’s prices appear reasonable or cheap in retrospect. A stock trading at 40 times current earnings may seem expensive, but if earnings quintuple over five years, the forward P/E based on future earnings becomes just 8 times.

Risk Profile and Volatility

Value stocks generally exhibit lower price volatility than growth stocks due to their established business models, stable earnings, and often substantial dividend yields that provide downside support. During market downturns, value stocks typically decline less than growth stocks, though they may also participate less fully in bull market advances.

Growth stocks exhibit higher volatility due to uncertainty about future growth projections and their sensitivity to changing market conditions or competitive threats. A quarterly earnings miss or reduced growth guidance can trigger sharp price declines, as elevated valuations leave little room for disappointment. The 2022 technology selloff illustrated this dynamic, with many high-growth stocks declining 50-80% as rising interest rates made future earnings less valuable in present-value terms.

Income Generation

Value stocks frequently pay substantial dividends, providing current income alongside potential capital appreciation. Dividend yields for value stocks typically range from 3-6%, meaningfully exceeding the S&P 500 average of approximately 1.5-2.0%. These payments provide cash flow during periods when stock prices stagnate and compound returns when reinvested.

Growth stocks rarely pay dividends, instead reinvesting all available capital into business expansion. This approach maximizes long-term compound growth potential but provides no income cushion during market downturns. Investors seeking current income generally find growth stocks unsuitable, while those prioritizing maximum wealth accumulation often prefer avoiding the tax drag of dividend payments.

Time Horizon and Patience Requirements

Value investing requires patience as markets may take years to recognize and correct mispricing. The “value realization period” – time required for stocks to reach fair value – can extend 3-7 years or longer. Value investors must endure periods when their holdings underperform while waiting for catalysts like improved earnings, management changes, or sector rotation to unlock value.

Growth investing demands conviction in long-term secular trends while withstanding substantial short-term volatility. Growth investors must maintain positions through temporary setbacks, competitive challenges, or market rotation away from growth stocks, trusting that superior business fundamentals will eventually drive stock price appreciation despite interim volatility.

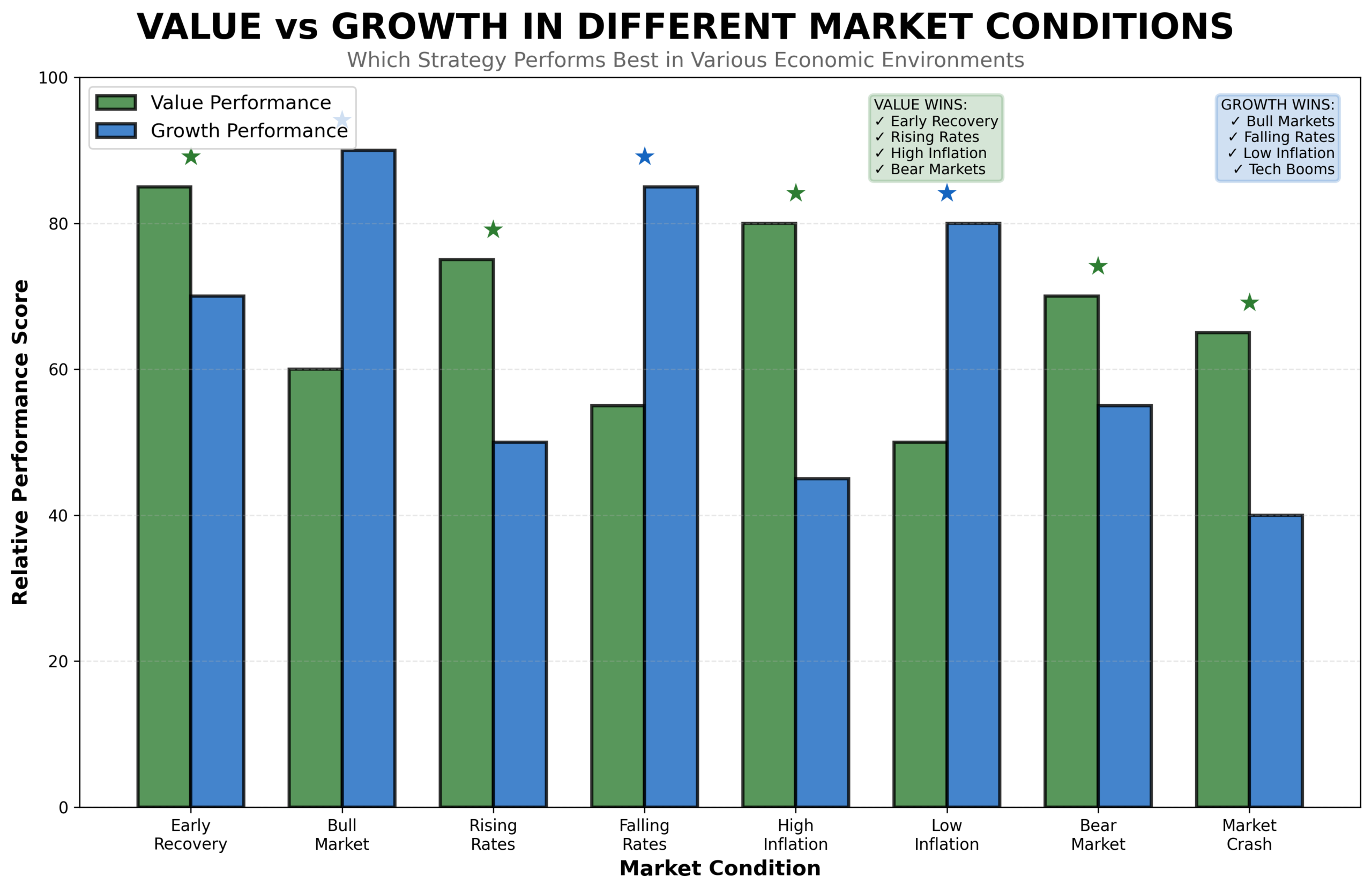

Performance Across Market Cycles

Value stocks tend to outperform during market recoveries following recessions, when investors recognize that cyclical companies trading at depressed valuations will benefit from economic expansion. Value also performs well during periods of rising interest rates and inflation, as its current earnings and dividends become more valuable relative to distant future cash flows.

Growth stocks excel during bull markets characterized by economic expansion, low interest rates, and investor optimism about future prospects. The low-rate environment of 2010-2021 particularly favored growth stocks, as near-zero discount rates made distant future earnings extremely valuable in present-value terms, justifying premium valuations.

Historical Performance Comparison – Value vs Growth

Examining long-term performance data reveals that value and growth strategies each have periods of dominance, with overall returns dependent on the specific timeframe analyzed.

Long-Term Historical Returns (1926-2020)

Research by Fama and French examining U.S. stock returns from 1926-2020 demonstrates that value stocks outperformed growth stocks over the full period. Small-cap value stocks delivered average annual returns of 13.5%, while small-cap growth stocks returned 11.2%. Large-cap value stocks achieved 11.6% returns compared to large-cap growth at 10.0%.

This value premium – the tendency for value stocks to outperform growth stocks over long periods – averaged approximately 2-4 percentage points annually across different market capitalizations.

Over decades, this seemingly modest advantage produces substantial wealth differences: $10,000 invested in small-cap value stocks in 1926 would have grown to approximately $336 million by 2020, compared with $53 million for small-cap growth stocks.

Recent Decade Performance (2010-2020)

The 2010-2020 period marked an unprecedented reversal, with growth stocks dramatically outperforming value stocks. The Russell 1000 Growth Index returned 17.2% annually during this decade, compared to 10.5% for the Russell 1000 Value Index—a performance gap exceeding 6 percentage points annually.

Multiple factors contributed to growth’s dominance: historically low interest rates (making distant future earnings more valuable), technology platform companies achieving winner-take-most market positions, globalization enabling unprecedented scaling, and quantitative easing programs inflating asset valuations. The “FAANG” stocks (Facebook, Apple, Amazon, Netflix, Google) alone accounted for substantial portions of total market returns during this period.

Cyclical Rotation Patterns

Historical analysis reveals that value and growth stocks alternate leadership roughly every 7-10 years, though cycles vary considerably in duration and magnitude. Value outperformed substantially during the late 1990s technology bubble burst (2000-2007), while growth dominated the 1990s bull market and the 2010-2020 period.

The 2022-2023 period demonstrated renewed strength in value stocks as rising interest rates reduced the present value of distant future earnings, benefiting value stocks with current earnings and dividends. Energy stocks – quintessential value investments – led market performance in 2022 with returns exceeding 60%, while technology growth stocks declined 20-30%.

Why Both Deserve Portfolio Space

The cyclical nature of value and growth performance, combined with low or negative correlation between the two styles during certain periods, creates a compelling diversification rationale for maintaining exposure to both approaches. Portfolios combining value and growth stocks have historically exhibited lower volatility than pure value or pure growth portfolios, while capturing returns from whichever style is currently in favor.

Academic research suggests that the optimal portfolio includes both value and growth stocks in roughly equal weights, or alternatively, holds total market index funds automatically capturing both styles. This approach eliminates the need to predict which style will outperform during the coming years – a task that has proven extraordinarily difficult even for professional investors.

Types of Value and Growth Investing Strategies

Investors can implement value and growth philosophies through various specific approaches, each with distinct characteristics and risk-return profiles.

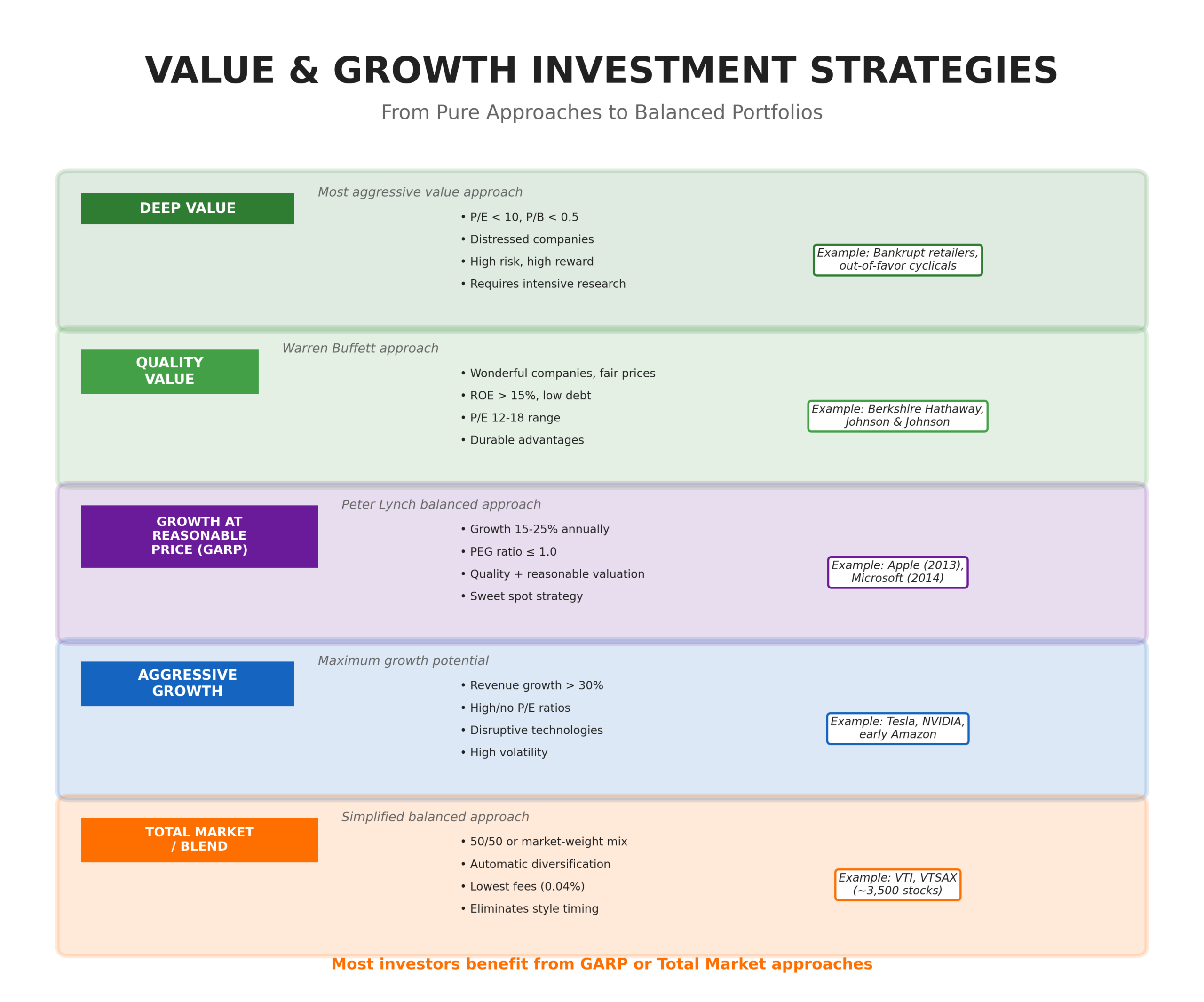

Deep Value Investing

Deep value investing, the most aggressive value strategy, targets severely distressed companies trading at substantial discounts to liquidation value, book value, or replacement cost. These investors seek stocks trading at P/B ratios below 0.5 or P/E ratios in single digits, often in out-of-favor sectors or companies facing temporary challenges.

This approach carries elevated risks, as many deeply discounted stocks face genuine business deterioration rather than mere temporary mispricing. However, successful deep value investors who accurately identify misunderstood or temporarily challenged companies can generate exceptional returns. The strategy requires intensive research, a strong stomach for volatility, and a willingness to be contrarian.

Quality Value Investing

Quality value investing, popularized by Warren Buffett, seeks “wonderful companies at fair prices” rather than “fair companies at wonderful prices.” This approach prioritizes businesses with durable competitive advantages, strong management, consistent profitability, and clean balance sheets trading at reasonable (though not necessarily bargain) valuations.

Quality value investors typically seek companies with ROE exceeding 15%, low debt levels, consistent earnings growth, and strong free cash flow generation, trading at P/E ratios of 12-18. This strategy balances value principles with quality considerations, producing lower volatility and fewer permanent capital losses than deep value approaches while potentially sacrificing some upside when truly distressed situations recover.

Aggressive Growth Investing

Aggressive growth investing targets the highest-growth companies regardless of current valuation, prioritizing revenue growth rates exceeding 30-40% annually. These investors focus on disruptive technologies, emerging industries, or companies with the potential to dominate large addressable markets.

This strategy accepts extreme valuations – P/E ratios of 50-100 or even unprofitable companies trading at high price-to-sales multiples – betting that exceptional growth will ultimately justify current prices. The approach generates highly volatile returns, with potential for multibagger gains alongside substantial losses when growth disappoints or valuations compress.

Growth at a Reasonable Price (GARP)

GARP investing bridges growth and value philosophies, seeking companies demonstrating strong growth trading at reasonable valuations. GARP investors typically target companies with earnings growth rates of 15-25% trading at P/E ratios approximating or below their growth rates (PEG ratios at or below 1.0).

This balanced approach, exemplified by Peter Lynch’s Magellan Fund, combines growth’s upside potential with value’s margin of safety. GARP investors find opportunities in temporarily out-of-favor growth stocks, turnaround situations, or undiscovered companies before mainstream recognition drives valuations higher.

Blended Approach

Blended portfolios intentionally combine value and growth stocks in balanced proportions, either by tracking the entire market with index funds or by allocating to both styles. This approach eliminates style timing risk while ensuring participation in whichever investment philosophy currently leads market performance.

Blended strategies typically allocate 40-60% to each style, adjusting based on relative valuations, market cycle position, or investor preferences. The approach provides diversification benefits and historically competitive returns with moderate volatility.

Benefits of Value and Growth Investing

Both investment philosophies offer distinct advantages depending on investor objectives, risk tolerance, and market conditions.

Value Investing Benefits

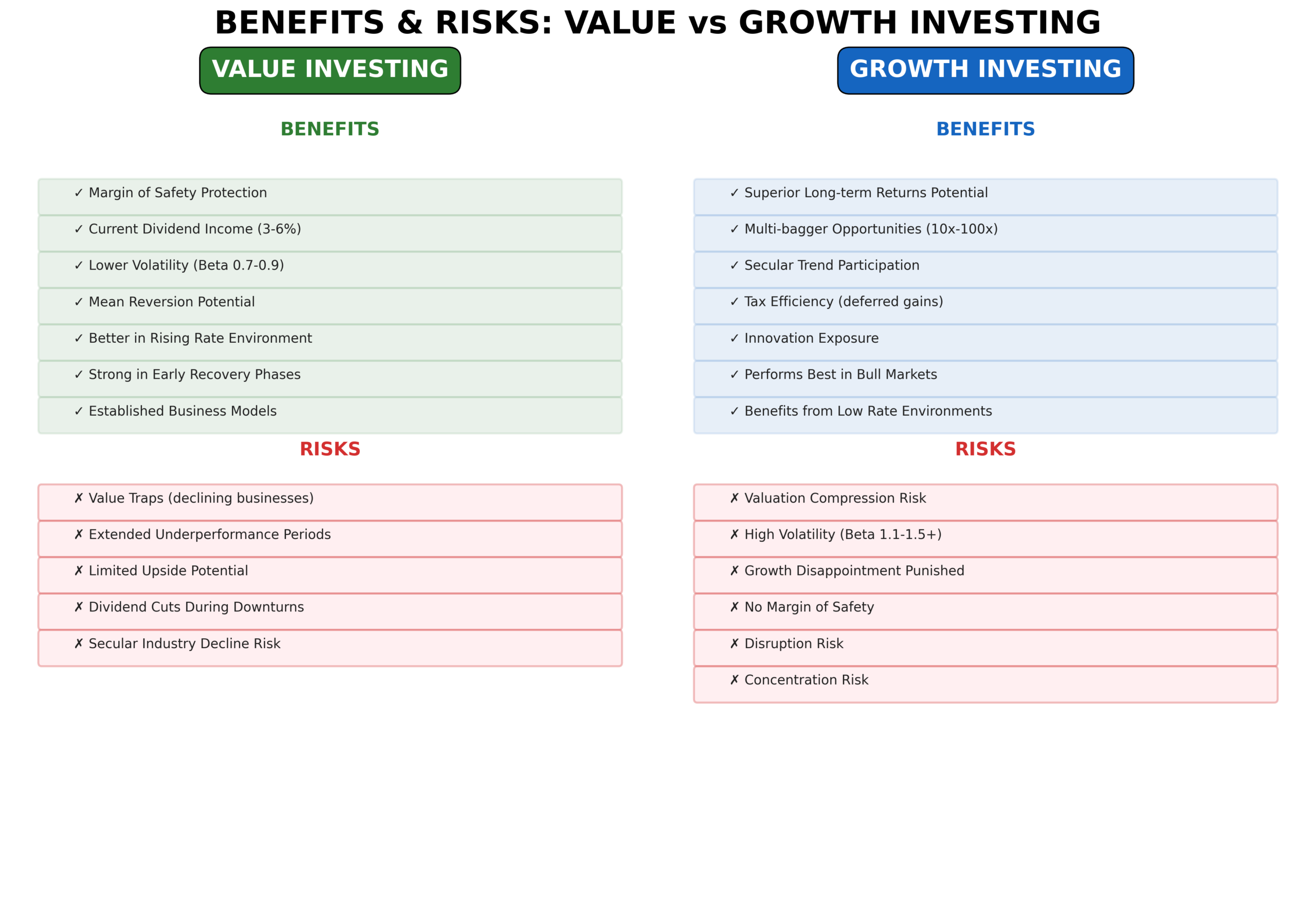

Value investing provides downside protection through margin of safety principles, requiring significant discounts to intrinsic value before purchase. This conservative approach reduces the risk of permanent capital loss, as companies trading substantially below fair value have limited downside if business fundamentals remain intact.

Dividend income from value stocks provides current cash flow, reduces portfolio volatility, and enables compounding through reinvestment. Historical data show dividend-paying stocks outperform non-dividend-payers over long periods, particularly when dividends are reinvested.

Value stocks typically exhibit lower correlation with economic cycles than growth stocks, performing relatively well during inflationary periods or rising interest rate environments. Their current earnings and dividends maintain value even as the present value of distant future cash flows declines.

Mean reversion tendencies benefit value investors, as deeply discounted stocks tend to recover toward fair value over time. Market inefficiencies and behavioral biases (loss aversion, recency bias, herding) create the mispricing opportunities that value investors exploit.

Growth Investing Benefits

Growth investing offers superior long-term compound returns when successfully identifying companies that deliver sustained exceptional growth. Technology platforms achieving network effects and winner-take-most economics have generated life-changing returns for early investors – Amazon returning 190,000% from its 1997 IPO through 2021, Apple returning 55,000% from its 2003 lows through 2021.

Growth stocks benefit from secular trends like technological advancement, globalization, and demographic shifts, capturing multi-decade tailwinds independent of economic cycles. Companies riding these trends can deliver consistent growth even during recessions or challenging environments.

Tax efficiency advantages accrue to growth investors, as unrealized capital gains avoid taxation until sale, while dividends face immediate taxation. This tax deferral accelerates wealth compounding, particularly for investors in high tax brackets.

Growth investing aligns with innovation and progress, enabling investors to participate in companies advancing human welfare through medical breakthroughs, clean energy, communication technologies, or other transformative developments.

Challenges and Risks

Both value and growth investing face specific challenges and risks that investors must understand and manage.

Value Investing Risks

Value traps represent the primary risk facing value investors – situations where apparently cheap stocks are appropriately priced due to deteriorating business fundamentals, secular industry decline, or permanent competitive disadvantage. Newspaper publishers, traditional retailers, and legacy energy companies have trapped value investors in declining businesses despite initially attractive valuations.

Extended underperformance periods test value investors’ patience and conviction. The 2010-2020 period witnessed unprecedented value stock underperformance, causing many investors to abandon value strategies near the bottom before the 2022 reversal. Maintaining discipline during such periods requires strong psychological fortitude.

Limited upside potential constrains value investing returns compared to growth investing home runs. While value stocks may double or triple when reaching fair value, they rarely deliver the 10x or 100x returns occasionally achieved by successful growth investments.

Dividend cuts during economic downturns eliminate expected income and often trigger sharp price declines. The 2020 pandemic saw major companies like Boeing, Disney, and numerous banks suspend dividends, devastating value-oriented income investors.

Growth Investing Risks

Valuation compression risk threatens growth investors when elevated multiples contract even as earnings grow, producing negative or modest returns despite business success. Many 2020-2021 vintage growth stocks experienced 50-80% declines during 2022-2023 despite continuing revenue growth, as valuations normalized from extreme levels.

Growth disappointment severely punishes growth stocks when companies miss growth expectations or guidance. A single quarter of decelerating growth can trigger 20-40% single-day declines in highly valued growth stocks, as investors reassess long-term assumptions.

Disruption risk continually threatens growth companies, as today’s disruptor becomes tomorrow’s disrupted. Yahoo, BlackBerry, Nokia, and MySpace all appeared unstoppable before superior competitors emerged. Technology sectors exhibit particularly high disruption risk.

No margin of safety leaves growth investors vulnerable to multiple compressions, competitive threats, or execution missteps. Paying 50-100 times earnings provides no cushion if growth disappoints or market sentiment shifts.

Concentration risk affects growth portfolios, as successful growth investing often requires concentrated positions in highest-conviction ideas. This concentration amplifies both gains and losses, potentially producing severe volatility.

Implementation Strategies – Value vs Growth

Investors can implement value and growth strategies through various vehicles and approaches, each with distinct characteristics.

Individual Stock Selection

Direct stock selection provides maximum control and potential for outperformance but requires substantial research, expertise, and time commitment. Investors must analyze financial statements, assess competitive positions, evaluate management quality, and monitor portfolio holdings continuously.

This approach suits sophisticated investors with analytical skills, research resources, and sufficient capital to build diversified portfolios (typically 20-30 positions minimum). Transaction costs, tax implications, and behavioral biases must be carefully managed.

Actively Managed Funds

Actively managed value and growth funds employ professional managers conducting research and stock selection. These funds provide instant diversification, professional management, and economies of scale in research and trading.

However, active funds charge higher fees (typically 0.50-1.00% annually), and most underperform their benchmark indexes over long periods after fees. Manager selection becomes critical, requiring evaluation of the investment process, performance history, fee structure, and organizational stability.

Index Funds and ETFs

Passively managed index funds and exchange-traded funds (ETFs) offer low-cost, tax-efficient exposure to value and growth stocks. Vanguard Value ETF (VTV) tracks the CRSP US Large Cap Value Index with a 0.04% expense ratio, while Vanguard Growth ETF (VUG) tracks the CRSP US Large Cap Growth Index at the same cost.

This approach provides broad diversification, minimal fees, and eliminates manager selection risk. However, index funds cannot outperform their benchmarks and may include overvalued stocks (in growth indexes) or value traps (in value indexes) due to mechanical selection rules.

Total Market Approach

Total market index funds capturing the entire market automatically include both value and growth stocks in market-weight proportions. The Vanguard Total Stock Market Index Fund (VTSAX) and corresponding ETF (VTI) provide exposure to approximately 3,500 U.S. stocks with a 0.04% expense ratio.

This approach maximizes diversification, minimizes costs, and eliminates style timing risk. Research demonstrates that total market indexes outperform most actively managed funds over long periods while requiring minimal investor effort or expertise.

Asset Allocation Approach

Investors can deliberately allocate portfolio percentages to value and growth strategies based on personal preferences, market conditions, or valuation metrics. A balanced 50/50 split provides equal exposure, while tactical adjustments might overweight currently undervalued styles.

This approach requires periodic rebalancing to maintain target allocations, creating a disciplined sell-high, buy-low mechanism. However, successful tactical allocation requires accurate market timing – a skill few investors consistently demonstrate.

“Value vs Growth” – Which Strategy Is Right for You?

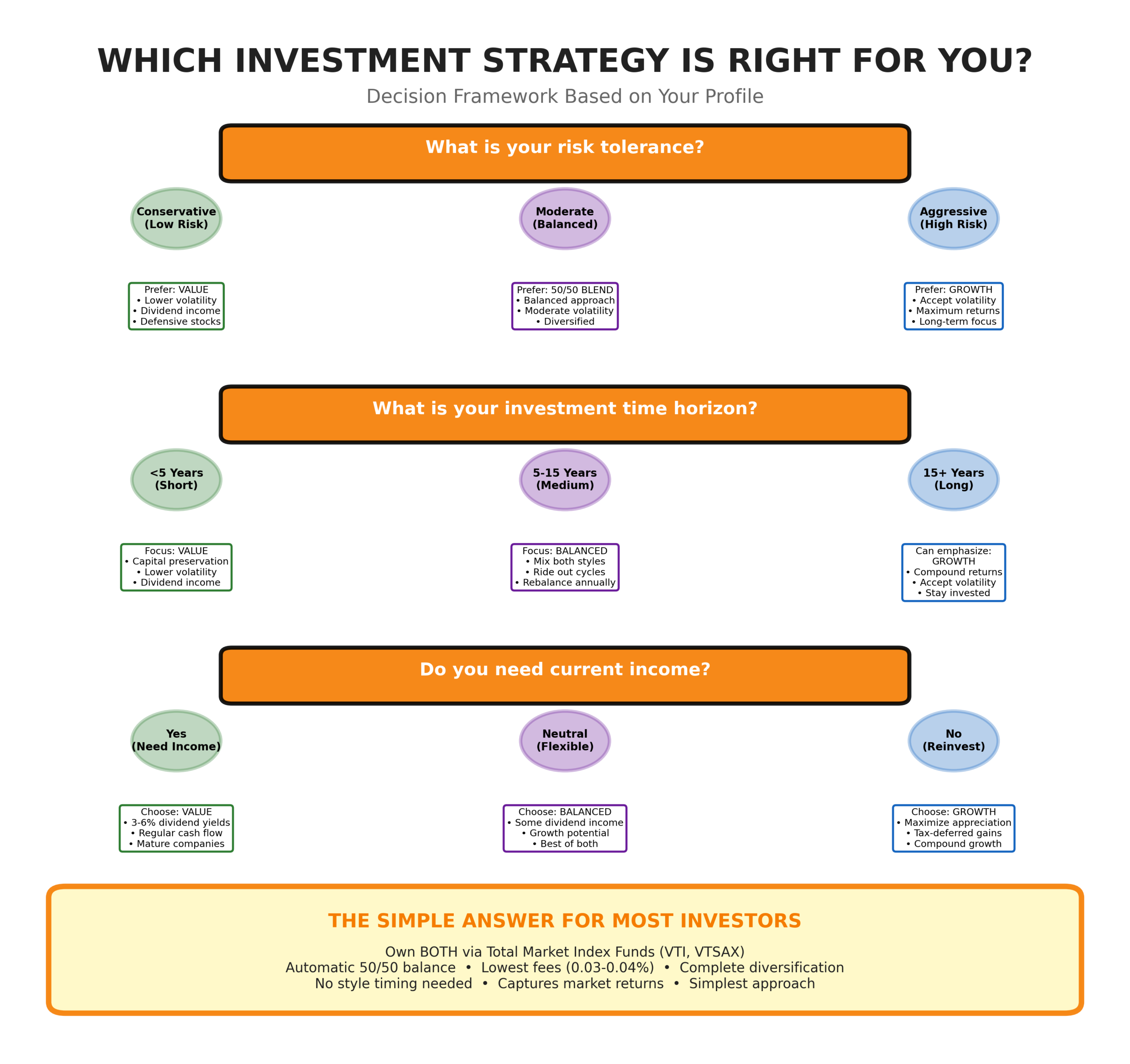

Selecting between value and growth investing depends on multiple personal and market factors requiring careful consideration.

Age and Time Horizon Considerations

Conventional wisdom suggests younger investors with 30-40 year time horizons should emphasize growth stocks, accepting higher volatility in exchange for superior long-term compound returns. The ability to ride out market crashes and benefit from extended growth curves theoretically favors aggressive growth strategies during wealth accumulation phases.

Older investors approaching or in retirement traditionally favor value stocks providing current dividend income and lower volatility. However, increasing longevity and extended retirement periods (potentially 30+ years) complicate this simple framework, as retirees may still require growth exposure to maintain purchasing power.

Modern research questions age-based style allocation, suggesting that total market exposure or balanced approaches serve most investors well regardless of age. Individual risk tolerance and spending needs matter more than age alone.

Risk Tolerance Assessment

Conservative investors prioritizing capital preservation and stable income naturally gravitate toward value stocks with dividend yields and lower volatility. These investors typically struggle psychologically with the 30-50% drawdowns common in growth-heavy portfolios.

Aggressive investors comfortable with substantial volatility and extended drawdown periods can pursue growth strategies offering higher return potential. These investors must honestly assess their ability to maintain positions during severe declines without panic selling.

Most investors fall between these extremes, suggesting balanced or total market approaches matching moderate risk tolerance. Behavioral considerations often outweigh theoretical optimization, as investors who panic sell during downturns realize inferior returns regardless of strategy.

Market Environment Considerations

Value stocks historically perform best during early economic recovery phases, rising interest rate environments, and inflationary periods. Current market conditions showing value stocks trading at historically wide discounts to growth stocks (P/E or P/B ratios) may signal attractive value entry points.

Growth stocks excel during low-rate environments, economic expansions, and deflationary periods. Technology-driven secular trends may favor growth stocks independent of economic cycles, particularly as artificial intelligence, renewable energy, and biotechnology transform industries.

However, timing style rotations has proven exceptionally difficult, with many professional investors failing to successfully navigate these shifts. This difficulty reinforces the case for maintaining balanced exposure rather than attempting tactical style timing.

The Simple Answer to “Value vs Growth”: Own Both

For most investors, the optimal solution involves owning both value and growth stocks through total market index funds or balanced allocations to style-specific funds. This approach provides several compelling advantages:

Diversification benefits reduce portfolio volatility by reducing the correlation between value and growth during certain periods. Balanced portfolios historically exhibited 10-20% lower volatility than pure value or pure growth portfolios.

Eliminates timing risk by ensuring participation in whichever style currently leads market performance. Investors avoid the painful experience of watching their chosen style underperform for extended periods while the alternative style surges.

Simplicity and low cost characterize total market approaches, with single-fund solutions like VTI or VTSAX providing complete exposure at 0.04% annual costs. This simplicity reduces decision fatigue and behavioral errors.

Historical performance shows that balanced or total market approaches deliver returns that approximate those of pure style portfolios while reducing volatility and psychological stress.

| Portfolio Approach | 10-Year Return (2010-2020) | Standard Deviation | Expense Ratio |

|---|---|---|---|

| Pure Value (VTV) | 10.5% | 14.2% | 0.04% |

| Pure Growth (VUG) | 17.2% | 15.8% | 0.04% |

| 50/50 Blend | 13.9% | 13.1% | 0.04% |

| Total Market (VTI) | 13.7% | 13.4% | 0.04% |

Comparison Table: Value vs Growth Stocks

| Bull markets, low rates, deflationary environments, and technology booms | Value Stocks | Growth Stocks |

|---|---|---|

| Valuation Metrics | Low P/E (8-15), Low P/B (0.8-1.5), High dividend yield (3-6%) | High P/E (25-100+), High P/B (5-15+), Low/no dividend yield (0-2%) |

| Representative Sectors | Financials, Energy, Utilities, Consumer Staples, Telecommunications | Technology, Healthcare/Biotech, Consumer Discretionary, Industrials |

| Business Stage | Mature, established companies with stable market positions | Younger, rapidly expanding companies or market disruptors |

| Revenue Growth | Low to moderate (2-7% annually) | High to exceptional (15-50%+ annually) |

| Dividend Policy | Regular, substantial dividends | Minimal or no dividends; profits reinvested |

| Volatility | Lower (beta 0.7-0.9) | Higher (beta 1.1-1.5+) |

| Primary Return Source | Dividends + Price appreciation to fair value | Capital appreciation through earnings growth |

| Example Companies | JPMorgan Chase, Procter & Gamble, ExxonMobil, AT&T, Berkshire Hathaway | Amazon, Tesla, NVIDIA, Salesforce, Netflix |

| Performance Drivers | Economic recovery, rising rates, mean reversion, dividend reinvestment | Innovation, market disruption, secular trends, multiple expansion |

| Best Market Environments | Early recovery, value bear markets, inflationary periods | Bull markets, low rates, deflationary environments, technology booms |

| Risk Profile | Lower volatility, value trap risk, limited upside | Higher volatility, valuation compression risk, unlimited upside potential |

| Investor Profile | Income-oriented, conservative, patient, contrarian | Capital appreciation-focused, aggressive, growth-oriented, trend-following |

| Tax Efficiency | Lower (current dividend taxation) | Higher (deferred capital gains taxation) |

| Research Focus | Financial statement analysis, asset valuation, margin of safety | Market opportunity, competitive position, innovation pipeline, TAM analysis |

Future Trends in Value and Growth Investing

Several emerging trends will likely reshape value and growth investing dynamics in the coming years.

Factor Investing Evolution

Quantitative factor investing strategies that combine value factors (low price multiples), quality factors (high profitability, low debt), and momentum factors (price trends) are gaining institutional and retail adoption. These multi-factor approaches seek to capture value and growth premiums while avoiding traditional value traps or overvalued growth stocks.

Smart beta ETFs implementing factor strategies have grown from negligible assets in 2010 to over $1.5 trillion by 2024, offering low-cost systematic exposure to research-backed factor premiums. This trend will likely accelerate as investors seek alternatives to pure market-cap-weighted indexing.

Technology Disruption Impact

Artificial intelligence, machine learning, and big data analytics are transforming both value and growth investing. Quantitative hedge funds and robo-advisors employ sophisticated algorithms identifying mispriced securities or high-growth opportunities faster and more accurately than traditional fundamental analysis.

This technological edge may compress value and growth premiums over time, as more efficient markets reduce mispricing opportunities. However, new complexities and behavioral biases continuously create fresh inefficiencies for skilled investors to exploit.

Climate Transition Effects

The global transition to renewable energy and sustainable business practices will create both value and growth opportunities. Traditional energy companies trading at depressed valuations may represent value plays if they successfully transition business models, while clean technology companies offer growth potential despite premium valuations.

ESG (Environmental, Social, Governance) investing considerations increasingly influence value and growth stock selection, with some investors excluding fossil fuel companies regardless of valuation or accepting premium prices for sustainable businesses.

Demographic and Geographic Shifts

Aging populations in developed markets support value stocks paying dividends for income, while younger, growing populations in emerging markets favor growth-oriented consumption and technology adoption. Geographic diversification across these demographic trends may require both value and growth exposure.

The rise of emerging market technology companies challenges the historical association of growth investing with developed market stocks. Companies like Alibaba, Tencent, and MercadoLibre demonstrate that high-growth opportunities exist globally.

Interest Rate Environment

The 2022-2024 transition from zero interest rates to normalized rates (4-5%) fundamentally altered value versus growth dynamics. If rates remain elevated relative to 2010-2021 levels, value stocks may enjoy extended favorable conditions as present value calculations favor current earnings over distant future cash flows.

Alternatively, potential return to lower rates amid economic weakness or deflation could reignite growth stock outperformance. This uncertainty reinforces the case for maintaining balanced exposure rather than making concentrated style bets.

FAQs – Value vs Growth

1. Is value investing better than growth investing?

Neither value nor growth investing is universally superior; each strategy experiences extended periods of outperformance followed by underperformance. Value stocks outperformed growth stocks over the full 1926-2020 period by approximately 2-3 percentage points annually, but growth stocks dominated the 2010-2020 decade by over 6 percentage points annually. The optimal approach for most investors involves maintaining exposure to both styles through diversified total market index funds, capturing returns from whichever style currently leads while avoiding the impossible task of predicting future style rotation.

2. What is the difference between value and growth stocks?

Value stocks trade at low prices relative to fundamentals like earnings, book value, or dividends (low P/E and P/B ratios, high dividend yields), representing established companies in mature industries. Growth stocks trade at premium valuations based on expectations of exceptional future earnings expansion (high P/E and P/B ratios, minimal dividends), typically younger companies in dynamic industries. Value stocks prioritize current cheapness and income generation, while growth stocks emphasize future potential and capital appreciation regardless of current valuation.

3. Can I invest in both value and growth stocks simultaneously?

Investing in both value and growth stocks simultaneously is not only possible but recommended for most investors. Balanced portfolios combining both styles provide diversification benefits, reduce volatility through low correlation periods, and eliminate style timing risk. Investors can implement this approach through total market index funds (automatically capturing both styles in market-weight proportions), dedicated allocations to value and growth index funds (such as 50% VTV and 50% VUG), or diversified individual stock portfolios spanning both categories.

4. How do I know if a stock is value or growth?

Stocks are classified as value or growth based on valuation metrics and business characteristics. Value stocks typically display P/E ratios below 15, P/B ratios below 1.5, dividend yields above 3%, mature business models, and stable earnings in established industries like financials, utilities, or consumer staples. Growth stocks show P/E ratios exceeding 25 (often 50-100+), high or no P/B ratios, minimal or zero dividends, rapidly expanding revenues (15%+ annually), and operate in dynamic sectors like technology or biotechnology. Index providers like Russell, MSCI, and CRSP use systematic criteria combining these factors to categorize stocks.

5. Should younger investors focus on growth stocks?

While conventional wisdom suggests younger investors should emphasize growth stocks due to longer time horizons and greater volatility tolerance, modern research questions this simplistic approach. Although younger investors can theoretically recover from growth stock crashes over 30-40 year periods, behavioral factors often lead to panic selling during severe downturns, negating theoretical advantages. Most younger investors benefit more from balanced total market exposure, providing growth participation without concentration risk, ensuring they maintain positions through inevitable market cycles rather than abandoning strategies during underperformance periods.

6. Do value stocks perform better in bear markets?

Value stocks generally decline less than growth stocks during bear markets due to lower valuations, dividend income providing downside support, and established business models with stable earnings. During the 2000-2002 technology crash, value stocks declined approximately 12% while growth stocks fell 48%. However, this pattern doesn’t hold universally – during the 2020 pandemic crash, growth stocks recovered faster than value stocks due to technology companies benefiting from digital acceleration trends. Overall, value stocks provide modest defensive characteristics but don’t guarantee protection during all market declines.

7. What are the best ETFs for value and growth investing?

The most popular and cost-effective value and growth ETFs include Vanguard Value ETF (VTV, 0.04% expense ratio, tracks CRSP US Large Cap Value Index), Vanguard Growth ETF (VUG, 0.04%, tracks CRSP US Large Cap Growth Index), iShares Russell 1000 Value ETF (IWD, 0.19%), iShares Russell 1000 Growth ETF (IWF, 0.19%), Schwab U.S. Large-Cap Value ETF (SCHV, 0.04%), and Schwab U.S. Large-Cap Growth ETF (SCHG, 0.04%). For diversified exposure, total market ETFs like Vanguard Total Stock Market ETF (VTI, 0.04%) automatically include both value and growth stocks in market-weight proportions.

8. How often should I rebalance between value and growth?

Most investors benefit from annual or semi-annual rebalancing between value and growth allocations to maintain target percentages and enforce disciplined selling of outperformers to purchase underperformers. More frequent rebalancing (quarterly or monthly) generates excessive transaction costs and potential tax consequences without meaningful benefits. However, if allocations drift significantly (more than 5-10 percentage points from targets) due to strong performance divergence, immediate rebalancing may be warranted. Investors using total market index funds avoid rebalancing complexity entirely, as these funds automatically adjust to market-weight style exposure.

9. Can value investing work in technology stocks?

Value investing can successfully identify opportunities in technology stocks during periods when quality companies trade at temporary discounts due to market overreaction, sector rotation, or company-specific challenges. Apple traded at single-digit P/E ratios during 2013 despite strong fundamentals, representing a value opportunity in technology. Microsoft similarly appeared undervalued during its 2013-2014 transition period. However, many technology companies legitimately warrant premium valuations due to network effects, winner-take-most economics, and exceptional growth, making traditional value metrics less applicable. Technology-focused value investors must adapt methodologies to account for intangible assets and platform economics.

10. What is the PEG ratio, and how does it relate to value vs growth?

The PEG (Price/Earnings-to-Growth) ratio divides a stock’s P/E ratio by its earnings growth rate, providing a growth-adjusted valuation metric bridging value and growth investing. A PEG ratio below 1.0 suggests a stock is undervalued relative to growth potential (attractive for growth investors), while ratios above 2.0 indicate expensive valuations even accounting for growth. Peter Lynch popularized PEG ratios through his “growth at a reasonable price” (GARP) strategy, seeking companies with PEG ratios near 1.0 – representing the sweet spot where growth stocks trade at reasonable valuations. However, PEG ratios rely on growth rate estimates that may prove inaccurate, limiting their reliability.

Conclusion – Value vs Growth

The value vs growth investing debate represents a false dichotomy for most investors, as both philosophies offer distinct advantages during different market environments and serve complementary roles within diversified portfolios. Value investing provides downside protection through margin of safety principles, current dividend income, and mean reversion tendencies, while growth investing offers superior long-term compound returns through participation in transformative companies and secular expansion trends.

Historical performance demonstrates that each strategy experiences extended periods of dominance – value stocks outperformed over the full 1926-2020 period, yet growth stocks delivered exceptional returns during the 2010-2020 decade – making style timing extraordinarily difficult even for professional investors.

The optimal solution for most investors involves maintaining balanced exposure to both value and growth stocks through low-cost total market index funds, eliminating style timing risk while capturing returns from whichever philosophy currently leads market performance. This approach provides diversification benefits, reduces volatility, minimizes costs, and aligns with research demonstrating that consistent, diversified indexing strategies outperform most active management attempts over long periods.

As markets evolve through technological disruption, demographic shifts, climate transition, and changing interest rate environments, both value and growth opportunities will continue emerging – reinforcing the wisdom of maintaining exposure to both investment styles rather than making concentrated strategic bets on either approach.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- Active vs Passive Investing – Your Best Guide

- Expense Ratios: Why Fees Matter

- Dollar-Cost Averaging Explained: The Simple Strategy That Removes Emotion from Investing

- What Are Dividend Stocks – The Ultimate Income Guide

- What Is Diversification?

- How Compound Interest Works: The Complete Guide to Growing Your Wealth

- Investing 101: Everything You Need to Know to Start