Education Hub | Investment Concepts – “active vs passive”

The debate between active vs passive investing represents one of the most consequential decisions an investor can make, with implications that compound over decades and potentially determine hundreds of thousands of dollars in retirement wealth.

Active investing attempts to outperform market benchmarks through stock selection, market timing, and tactical allocation, while passive investing seeks to match market returns through low-cost index funds and a buy-and-hold approach.

Understanding the evidence, costs, and trade-offs between these strategies empowers investors to make informed decisions aligned with their financial goals, time horizon, and temperament.

In conclusion, the debate of active vs passive investing will guide your decisions as you navigate the complex world of finance.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways

| 1. Evidence overwhelmingly favors passive investing: According to the SPIVA Scorecard, 92% of large-cap active fund managers fail to beat the S&P 500 over a 15-year period. After fees and taxes, the odds of selecting a winning active manager are approximately equivalent to random chance. 2. Cost differences compound dramatically: A $100,000 investment over 30 years with 7% annual returns costs approximately $8,000 in a passive fund charging 0.05%, versus $180,000 in an active fund charging 1.5%. This $172,000 difference represents wealth transferred from investor to fund manager. 3. Passive investing suits most investors: The combination of lower costs, superior tax efficiency, minimal time requirements, and better risk-adjusted returns makes passive investing appropriate for approximately 95% of individual investors, regardless of wealth level or investment sophistication. |

Table of Contents

To further understand the differences in active vs passive strategies, consider the following comparisons that highlight their unique characteristics.

What is Active Investing?

Active investing is an investment strategy that attempts to outperform market benchmarks through deliberate security selection, market timing, and tactical asset allocation. Active investors believe that markets are inefficient enough to exploit through superior research, analysis, and decision-making. This approach requires continuous monitoring of markets, economic conditions, and individual securities to identify opportunities the broader market has overlooked or mispriced.

The foundation of active investing rests on the premise that skilled managers can identify undervalued securities before the market recognizes their true worth, or can anticipate market movements and position portfolios accordingly. Professional active managers typically employ teams of analysts, utilize sophisticated quantitative models, and maintain extensive research capabilities to gain informational or analytical advantages over other market participants.

Core Characteristics of Active Investing

- Stock picking and security selection: Active managers analyze financial statements, competitive positioning, management quality, and growth prospects to identify securities they believe will outperform. This process involves fundamental analysis, technical analysis, or combinations of both approaches.

- Market timing: Active strategies attempt to adjust portfolio exposure based on anticipated market movements. This includes increasing cash positions before expected downturns and increasing equity exposure before anticipated rallies.

- Frequent trading: Active portfolios typically experience annual turnover rates of 50% to 100% or higher, compared to 3% to 5% for passive index funds. This trading generates transaction costs and tax consequences that reduce net returns.

- Research-intensive approach: Professional active management requires substantial investment in research, data, technology, and human capital. These costs are passed to investors through higher expense ratios.

- Examples of active investment vehicles: Hedge funds, actively managed mutual funds, separately managed accounts, and individual stock portfolios all represent forms of active investing.

What is Passive Investing?

Passive investing is an investment strategy that seeks to replicate market returns rather than exceed them. Passive investors accept the efficient market hypothesis, which posits that securities prices generally reflect all available information, making consistent outperformance through active management statistically improbable after accounting for costs. This approach emphasizes broad market exposure, minimal trading, and cost minimization.

The intellectual foundation of passive investing emerged from academic research by economists, including Eugene Fama, whose efficient market hypothesis suggested that information is rapidly incorporated into prices, and William Sharpe, whose arithmetic of active management demonstrated that active managers must collectively underperform passive managers by the amount of their costs. John Bogle founded Vanguard in 1975 and launched the first retail index fund, democratizing access to passive investing for individual investors.

Core Characteristics of Passive Investing

- Index fund strategy: Passive investing is implemented through index funds that hold all or a representative sample of securities in a benchmark index. The fund mechanically replicates the index composition rather than making subjective selection decisions.

- Buy and hold approach: Passive investors maintain consistent market exposure through market cycles, avoiding the temptation to time entries and exits. This discipline eliminates behavioral errors that typically reduce investor returns.

- Minimal trading and low costs: Passive funds trade only to rebalance or accommodate index changes, resulting in turnover rates of 3% to 5% annually. Combined with simplified operations, this enables expense ratios as low as 0.03%.

- Examples of passive investment vehicles: S&P 500 index funds, total stock market funds, total international funds, and target-date funds composed of index funds all represent passive investing approaches.

The Performance Data: Why Passive Usually Wins

The empirical evidence comparing active and passive investing consistently demonstrates that the majority of active managers fail to outperform their benchmark indices over meaningful time periods. This underperformance is not a reflection of manager incompetence but rather a mathematical reality driven by costs and the structure of markets.

SPIVA Scorecard: The Definitive Active vs Passive Research

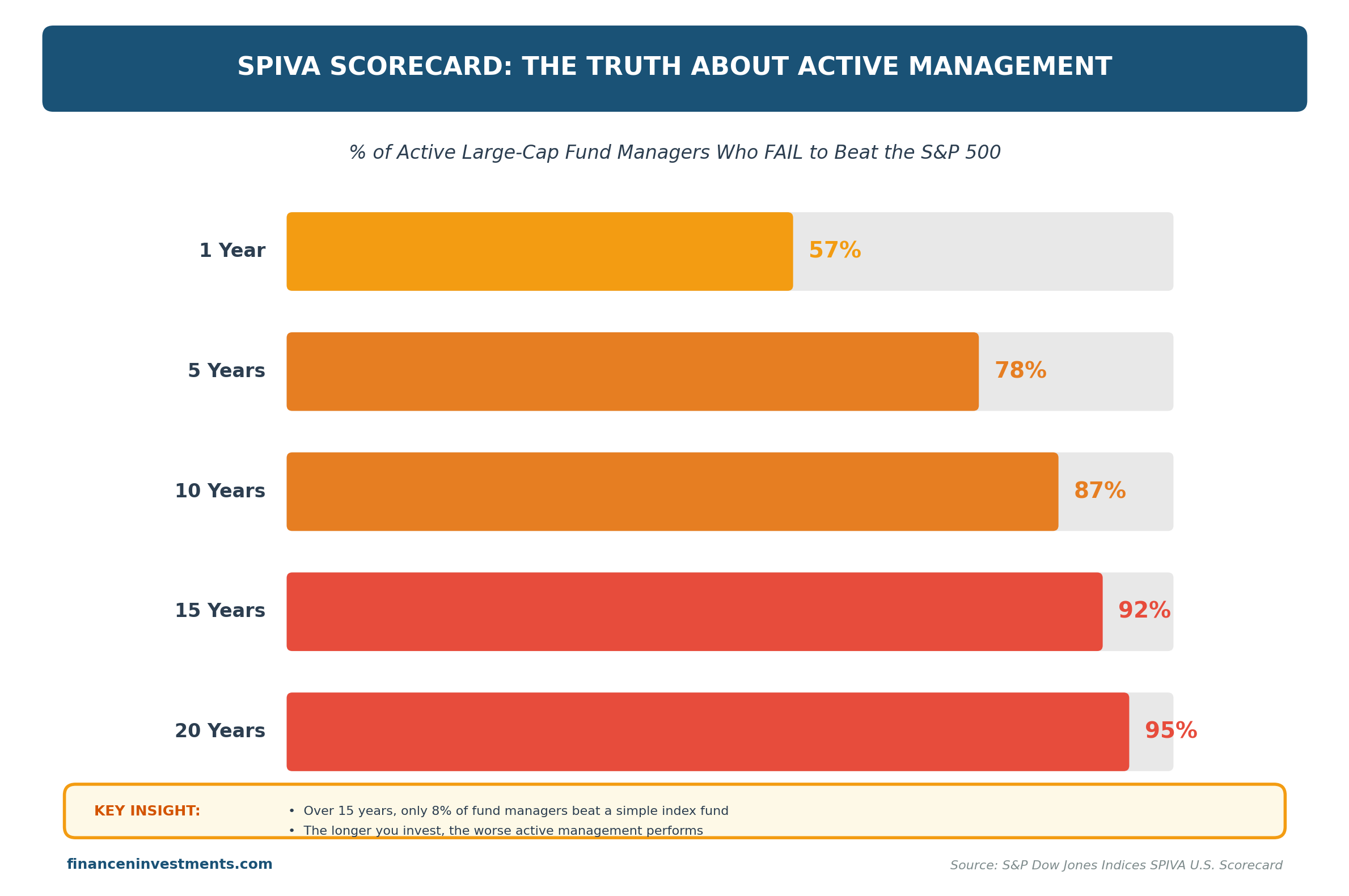

Standard & Poor’s maintains the SPIVA (S&P Indices Versus Active) Scorecard, which provides the most comprehensive and methodologically rigorous comparison of active fund performance against benchmarks. The data reveal a consistent pattern of active manager underperformance that intensifies over longer time horizons.

| Time Period | % of Large-Cap Active Funds Underperforming S&P 500 | % of All Active Funds Underperforming Benchmarks |

| 1 Year | 57% | 51% |

| 5 Years | 78% | 73% |

| 10 Years | 87% | 83% |

| 15 Years | 92% | 89% |

| 20 Years | 95% | 92% |

Source: S&P Dow Jones Indices SPIVA U.S. Scorecard

Deciding between active vs passive investing strategies significantly impacts your long-term financial success.

Why Beating the Market is So Difficult

Several structural factors explain why active managers struggle to outperform passively managed alternatives:

- Zero-sum mathematics: Before costs, every dollar of outperformance by one investor requires a dollar of underperformance by another. Active investors collectively must earn market returns minus their costs, making the average active manager a guaranteed underperformer relative to passive alternatives.

- Cost drag: Active funds must overcome expense ratios of 0.50% to 2.00% annually, compared to 0.03% to 0.20% for passive funds. Over 30 years, this 1% to 1.5% annual drag compounds to substantial wealth destruction.

- Competitive markets: Institutional investors now control approximately 80% of U.S. equity market trading. When professional managers compete against each other with similar tools and information, generating consistent alpha becomes exceedingly difficult.

- Winner’s curse: Past performance does not predict future results. Studies consistently show that top-performing active funds rarely repeat their success, while poor performers often improve through mean reversion.

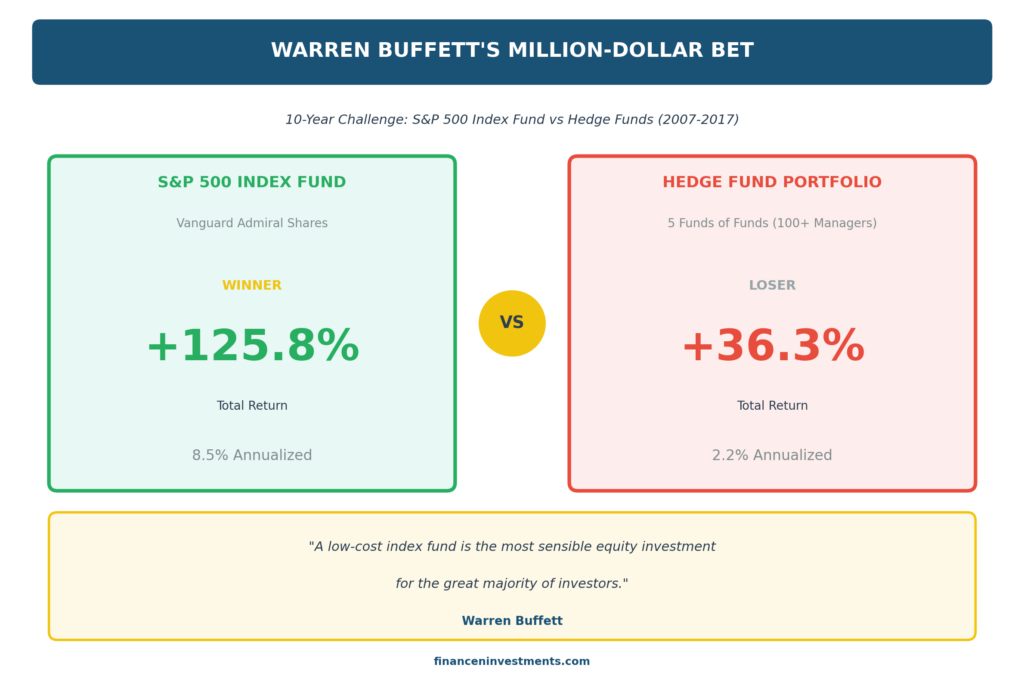

Warren Buffett’s “Million-Dollar Bet”

In 2007, Warren Buffett wagered $1 million that an S&P 500 index fund would outperform a selection of hedge funds over 10 years. Ted Seides of Protégé Partners accepted the bet, selecting five funds of hedge funds (portfolios that invest in multiple hedge funds, representing over 100 underlying managers).

By the end of 2017, the S&P 500 index fund had returned 125.8% cumulatively, while the hedge fund portfolio returned just 36.3%. The winning proceeds were donated to charity. Buffett’s point was not that hedge fund managers lack skill, but that fees consume too much of any alpha generated.

His recommendation for most investors: “A low-cost index fund is the most sensible equity investment for the great majority of investors.”

Active vs Passive: Comprehensive Comparison

The following table provides a detailed comparison across the most relevant dimensions for investors evaluating these approaches:

| High; holdings mirror the published index | Active Investing | Passive Investing |

| Expense Ratio | 0.50% – 2.00%+ annually | 0.03% – 0.20% annually |

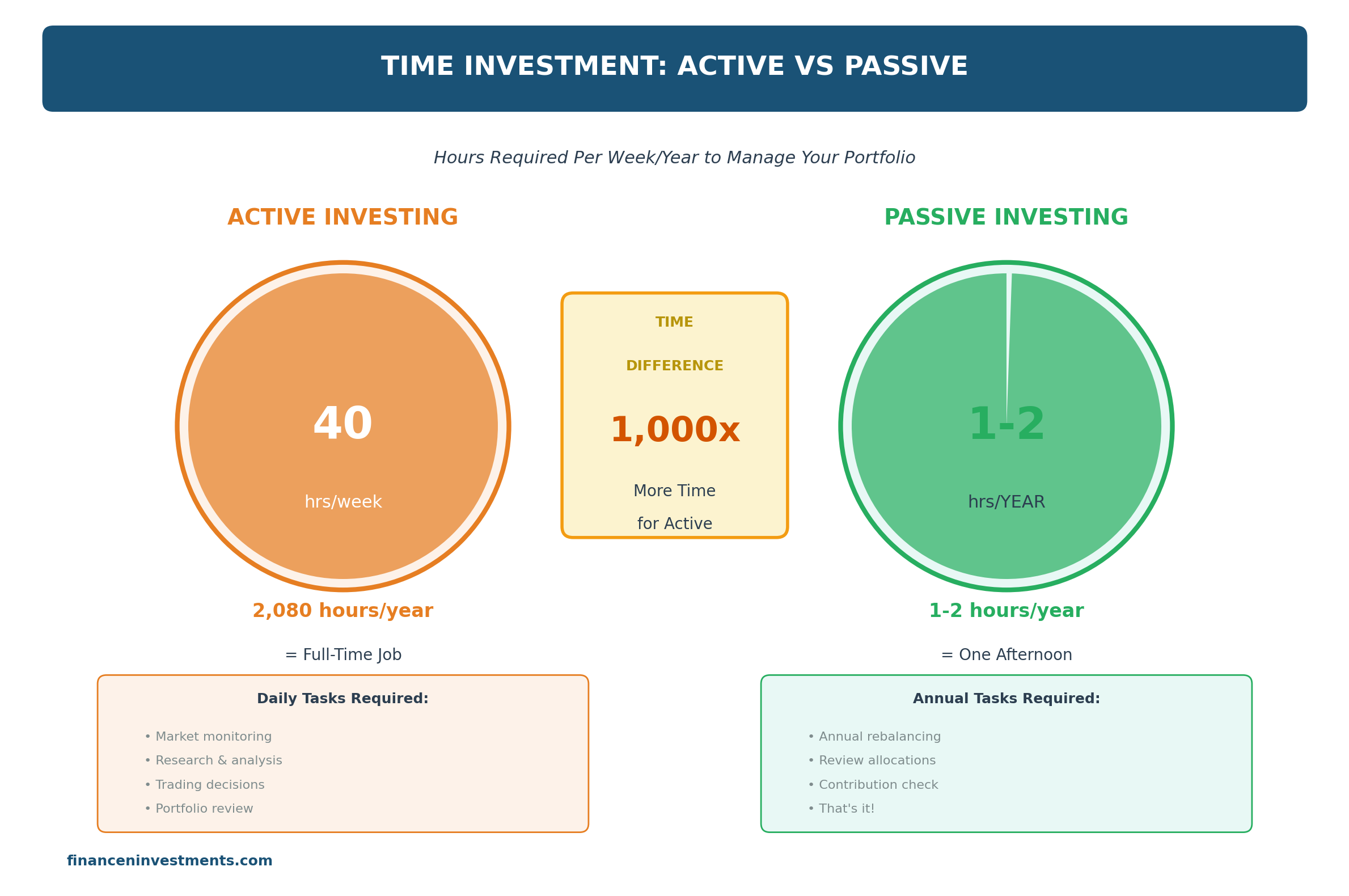

| Time Commitment | 10-40+ hours/week for individual investors; continuous monitoring | 1-2 hours/year for rebalancing and review |

| Tax Efficiency | Low; frequent trading triggers short-term capital gains | High; minimal trading reduces taxable events |

| Stress Level | High; constant decision-making and performance anxiety | Low; systematic approach reduces emotional burden |

| Suitable For | Professional managers, dedicated hobbyists with time/expertise | Most investors regardless of wealth or sophistication |

| Goal | Beat market benchmark (alpha generation) | Match market benchmark (beta capture) |

| Trading Frequency | High; 50-100%+ annual turnover | Very low; 3-5% annual turnover |

| Diversification | Variable; concentrated bets common | Broad; index funds hold hundreds/thousands of securities |

| 15-Year Success Rate | ~8% of managers outperform | 100% match index minus minimal costs |

| Minimum Investment | Often $100,000+ for quality managers; hedge funds $1M+ | Often $1 or $0 minimum for index funds |

| Transparency | Variable; many funds disclose holdings quarterly | Most investors, regardless of wealth or sophistication |

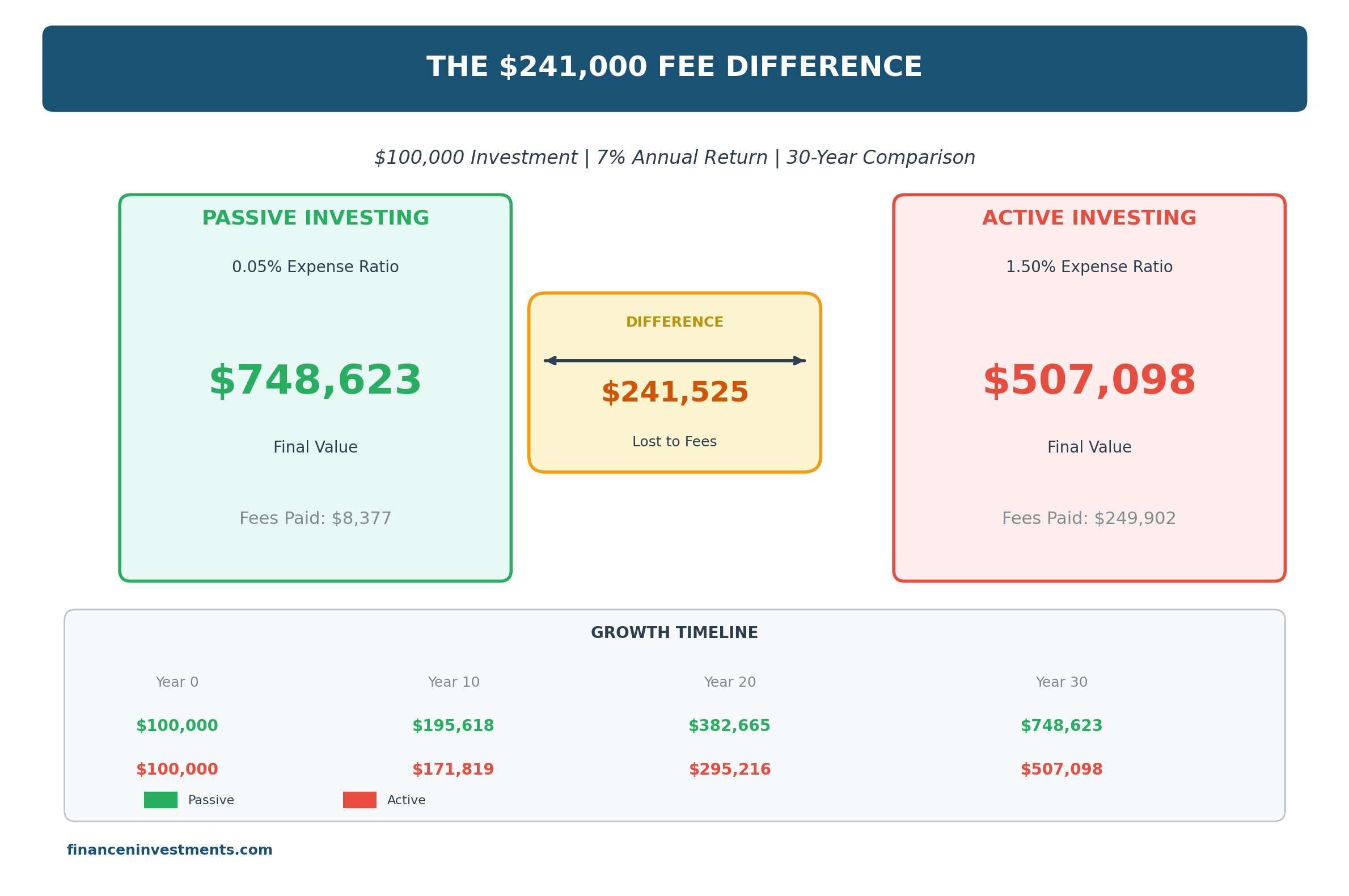

Fee Impact: The $172,000 Difference

Investment fees compound over time just as returns do, creating substantial wealth differences between high-cost and low-cost approaches. The following table illustrates the impact of expense ratios on a $100,000 investment earning 7% annually before fees:

| Time Period | Passive (0.05% fee) | Active (1.50% fee) | Cost of Active |

| 10 Years | $195,618 | $171,819 | $23,799 |

| 20 Years | $382,665 | $295,216 | $87,449 |

| 30 Years | $748,623 | $507,098 | $241,525 |

Based on a $100,000 initial investment with 7% pre-fee annual return

When Active Investing Might Make Sense

While passive investing is optimal for most investors in most circumstances, certain situations may warrant active approaches:

- Tax-loss harvesting in taxable accounts: Active management of individual securities allows investors to realize losses strategically to offset gains, potentially improving after-tax returns by 0.50% to 1.00% annually. However, automated tax-loss harvesting services now offer this benefit at a low cost.

- Niche and inefficient markets: Small-cap stocks, emerging markets, and specialized sectors may offer greater opportunities for skilled active managers because these markets have less analyst coverage and lower institutional participation. However, even in these areas, most active managers still underperform.

- Professional investors with a genuine edge: A small minority of investors possess legitimate informational, analytical, or structural advantages that enable consistent outperformance. These individuals typically have professional training, institutional resources, and full-time dedication to markets.

- Fun money allocation: Some investors derive satisfaction from active trading as a hobby. A small allocation (typically 5% to 10% of the portfolio) to individual stocks or speculative positions can satisfy this interest without jeopardizing long-term financial goals, provided the core portfolio remains passively invested.

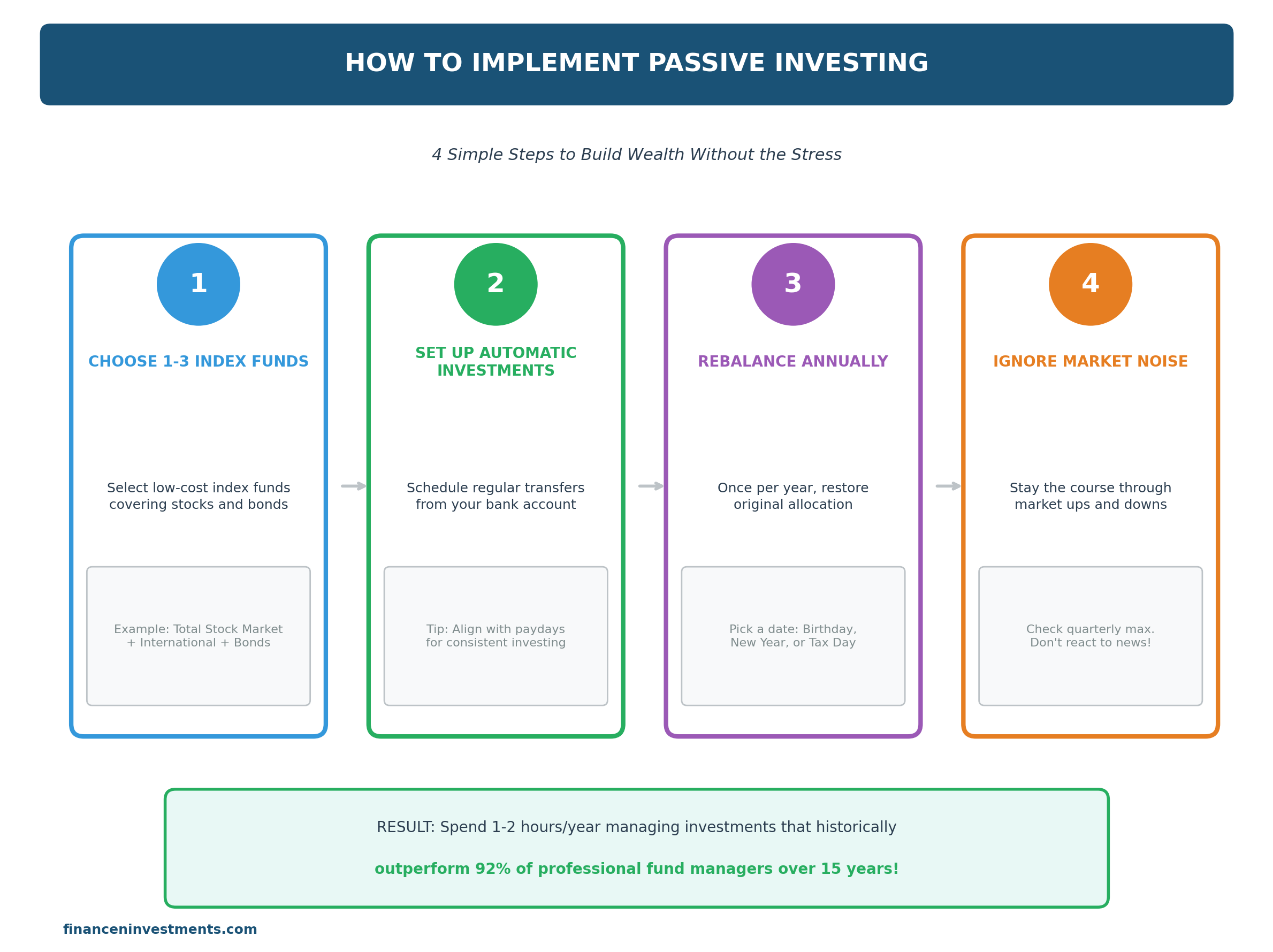

How to Implement Passive Investing

Ultimately, the choice of active vs passive investing strategies will define your approach to wealth accumulation.

Implementing a passive investment strategy requires minimal complexity and can be accomplished in four straightforward steps:

Step 1: Choose 1-3 Index Funds

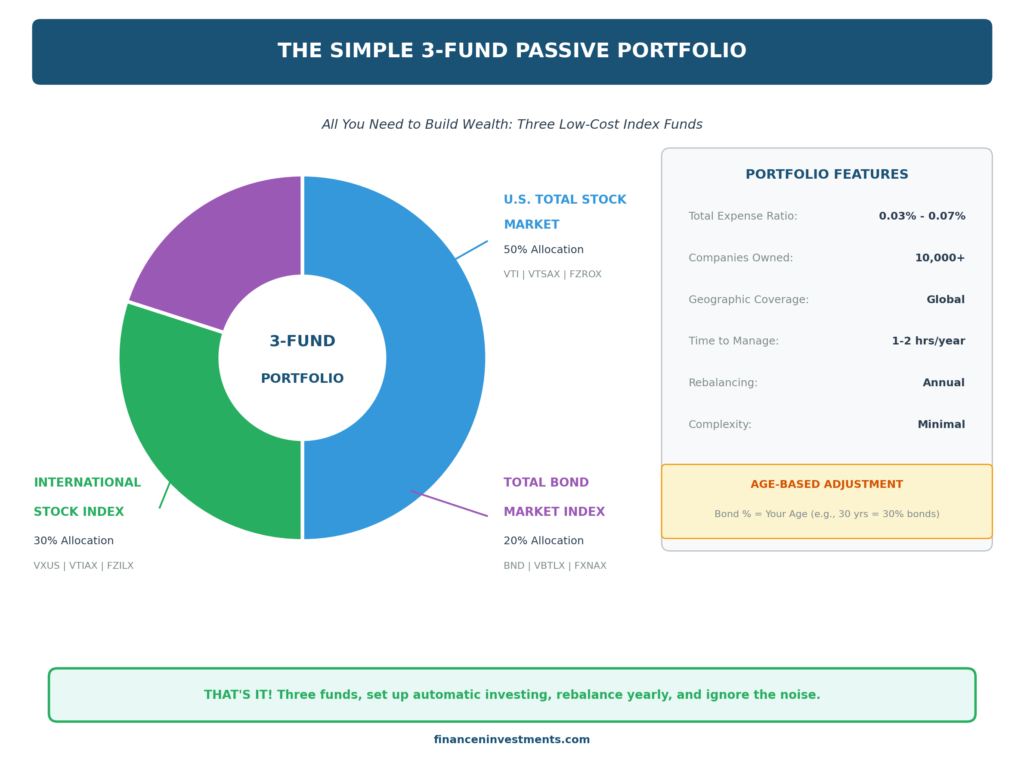

A simple yet highly effective passive portfolio can be constructed with as few as one to three index funds. The most common approach is the three-fund portfolio, consisting of a U.S. total stock market index fund, an international stock index fund, and a bond index fund. Alternatively, a single target-date fund provides instant diversification with automatic rebalancing. Leading providers include Vanguard, Fidelity, and Charles Schwab, all offering comparable products with expense ratios below 0.10%.

Step 2: Set Up Automatic Investments

Automation is crucial for successful passive investing. Configure automatic transfers from bank accounts to investment accounts on a regular schedule, typically aligned with pay dates. This systematic approach implements dollar-cost averaging, reduces the temptation to time the market, and ensures consistent wealth accumulation regardless of market conditions or investor emotion.

Step 3: Rebalance Annually

Over time, asset classes will grow at different rates, causing portfolio allocation to drift from target weights. Annual rebalancing restores the original allocation by selling appreciated assets and purchasing underperforming assets. This disciplined approach maintains appropriate risk levels and implements a systematic “buy low, sell high” mechanism. Many investors rebalance on a fixed date such as their birthday or January 1st.

Step 4: Ignore Market Noise

The greatest challenge to successful passive investing is behavioral: resisting the urge to react to market volatility, news events, or short-term performance. Research consistently demonstrates that frequent checking and trading reduce investor returns. A quarterly or semi-annual review is sufficient for most portfolios. The passive investor’s mantra is simple: stay the course.

Benefits of Passive Investing

This overview of active vs passive investing illustrates the critical factors every investor should consider.

- Superior long-term performance: With 92% of active managers failing to beat their benchmarks over 15 years, passive investing offers statistically superior expected returns for most investors.

- Dramatically lower costs: Expense ratios of 0.03% to 0.20% versus 0.50% to 2.00% for active funds translate to substantial wealth accumulation over time.

- Tax efficiency: Minimal trading reduces taxable capital gains distributions, allowing more wealth to compound tax-deferred.

- Simplicity and time savings: Passive portfolios require minimal maintenance, freeing time for career, family, and other pursuits.

- Reduced behavioral errors: A systematic, rules-based approach eliminates emotionally driven decisions that typically harm returns.

- Broad diversification: Index funds provide instant exposure to hundreds or thousands of securities, reducing company-specific risk.

Challenges and Risks of Each Approach

Active Investing Challenges

- High probability of underperformance: The vast majority of active investors, both professional and amateur, fail to beat passive alternatives after costs.

- Significant time requirements: Effective active investing requires substantial research, monitoring, and decision-making time.

- Higher costs erode returns: Management fees, trading costs, and taxes create substantial performance drag.

- Psychological stress: Active investors experience higher anxiety related to performance comparison and decision regret.

Passive Investing Challenges

- No possibility of outperformance: Passive investors, by definition, cannot beat the market; returns will match the index minus small costs.

- Full exposure to market downturns: Passive portfolios decline with the market during corrections and bear markets, with no defensive mechanisms in place.

- Behavioral discipline required: Staying invested during market volatility requires psychological fortitude that some investors lack.

- Potential market distortions: Some critics argue that widespread passive investing could reduce price discovery and market efficiency, though evidence for this remains limited.

Future Trends in Active vs Passive Investing

The investment landscape continues to evolve, with several trends likely to shape the active vs passive debate in the coming years:

- Continued passive fund growth: Passive funds now exceed $15 trillion in assets globally, and flows continue to favor index products. By some estimates, passive strategies may control over 50% of equity assets within the next decade.

- Fee compression in active management: Competition from passive alternatives is driving active fund fees lower, with some managers offering performance-based fees or reduced expense ratios.

- Direct indexing growth: Technology now enables investors to own individual stocks that replicate an index, providing passive-like returns with enhanced tax-loss harvesting capabilities.

- Factor-based and smart beta strategies: These approaches blend passive implementation with rules-based exposure to factors like value, momentum, or quality, offering a middle ground between pure passive and active.

- AI and quantitative approaches: Artificial intelligence and machine learning may eventually provide scalable active management with lower costs, though success remains unproven at scale.

FAQs – Active vs Passive Investing

1. What is the main difference between active and passive investing?

Active investing attempts to outperform market benchmarks through security selection and market timing, while passive investing seeks to match market returns by holding diversified index funds. Active strategies require higher costs and greater time commitment, while passive strategies emphasize low costs and minimal maintenance. The empirical evidence strongly favors passive approaches for most investors.

2. Why do most active managers fail to beat the market?

Active managers face a mathematical disadvantage: before costs, all investors collectively earn market returns. After accounting for expense ratios, trading costs, and taxes, the average active manager must underperform passive alternatives. Additionally, professional markets are highly competitive, making consistent outperformance extremely difficult. The SPIVA Scorecard shows that 92% of large-cap active managers underperform the S&P 500 over 15 years.

3. How much do active fund fees really cost over time?

A 1.5% annual fee versus a 0.05% fee on a $100,000 investment over 30 years costs approximately $241,000 in foregone wealth, assuming 7% annual returns before fees. This represents wealth transferred from the investor to the fund manager that could otherwise compound for the investor’s benefit. The longer the investment horizon, the greater the impact of fee differences.

4. Is passive investing suitable for all investors?

Passive investing is appropriate for approximately 95% of individual investors, regardless of wealth level or investment sophistication. The combination of lower costs, better tax efficiency, superior expected returns, and minimal time requirements makes passive strategies optimal for most people. Exceptions may include professional investors with demonstrable skill, those utilizing specific tax strategies, or investors allocating small amounts to active trading as a hobby.

5. Can I combine active and passive strategies?

Yes, many investors adopt a “core and satellite” approach, maintaining the majority of assets (80% to 90%) in passive index funds while allocating a smaller portion (10% to 20%) to active strategies or individual securities. This approach captures most passive investing benefits while allowing some active exposure for investors who find it engaging or believe they have identified skilled managers.

6. What was Warren Buffett’s bet about passive investing?

In 2007, Warren Buffett wagered $1 million that an S&P 500 index fund would outperform a portfolio of hedge funds over 10 years. By 2017, the index fund had returned 125.8% cumulatively, while the hedge fund portfolio returned only 36.3%. Buffett argued that hedge fund fees consume too much of any alpha generated, and he recommends low-cost index funds for most investors.

7. How often should passive investors check their portfolios?

Research suggests that frequent portfolio monitoring leads to worse investment decisions. Passive investors benefit from checking portfolios quarterly or semi-annually at most, with annual rebalancing. Excessive monitoring increases the likelihood of emotional reactions to short-term volatility that harm long-term returns. The most successful passive investors adopt a “set it and forget it” approach.

8. Are there any markets where active investing works better?

Active managers have slightly better odds in less efficient markets such as small-cap stocks, emerging markets, and certain specialized sectors. These markets have less analyst coverage and institutional participation, potentially creating more opportunities for skilled managers. However, even in these areas, the majority of active managers still underperform their benchmarks, and passive options remain compelling.

9. What is the simplest passive portfolio I can build?

The simplest passive portfolio is a single target-date fund that provides instant diversification across stocks and bonds with automatic rebalancing. For slightly more control, a two-fund portfolio of a total U.S. stock market index fund and a total bond market index fund offers comprehensive exposure. The classic three-fund portfolio adds international stock exposure. All options are available with expense ratios below 0.10%.

10. How do taxes differ between active and passive investing?

Passive investing is significantly more tax-efficient than active investing. Active strategies generate frequent taxable events through trading, often at short-term capital gains rates of up to 37%. Passive index funds rarely distribute capital gains and allow investors to defer taxes until shares are sold. This tax efficiency can add 0.50% to 1.00% annually to after-tax returns, further widening the advantage of passive strategies.

Recommended Passive Investing Platforms

- Vanguard: The pioneer of passive investing, offering some of the lowest expense ratios in the industry. Ideal for buy-and-hold investors.

- Fidelity: Offers zero-expense-ratio index funds (ZERO series) and excellent research tools. No minimums on most funds.

- Betterment: Automated passive investing with tax-loss harvesting, goal-based planning, and low advisory fees. Perfect for hands-off investors.

Conclusion – “Active vs Passive”

The debate about active vs passive investing has been definitively settled by decades of empirical evidence. While active investing offers the theoretical possibility of market-beating returns, the reality is that the vast majority of active managers, including highly compensated professionals with extensive resources, fail to outperform simple, low-cost index funds over meaningful time periods.

The combination of higher fees, increased trading costs, tax inefficiency, and behavioral challenges creates structural disadvantages that active strategies rarely overcome. For most investors, passive investing represents not merely a reasonable choice but the optimal strategy for building long-term wealth.

The path forward for most investors is clear: Select a diversified portfolio of low-cost index funds, automate contributions, rebalance annually, and ignore the noise of financial markets. This approach requires minimal time, generates superior expected returns, reduces stress, and allows investors to focus on what matters most in their lives.

Those who feel compelled toward active investing should limit such activities to a small “fun money” allocation while maintaining passive strategies for core retirement assets. The greatest investment edge available to individual investors is not stock-picking skill or market timing ability, but rather the discipline to minimize costs and maintain consistent exposure to market returns over decades of compounding.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- Expense Ratios: Why Fees Matter

- Dollar-Cost Averaging Explained: The Simple Strategy That Removes Emotion from Investing

- What Are Dividend Stocks – The Ultimate Income Guide

- What Is Diversification?

- How Compound Interest Works: The Complete Guide to Growing Your Wealth

- Investing 101: Everything You Need to Know to Start

- What Is an Index Fund? The Beginner’s Complete Guide

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Past performance does not guarantee future results. Consult a qualified financial advisor before making investment decisions. Affiliate links may be present; see our disclosure policy.