The 3-Fund Portfolio – Introduction

The 3-fund portfolio represents one of the most elegant solutions in personal finance: a complete, globally diversified investment strategy built with just three low-cost index funds. This approach, championed by Vanguard founder John Bogle and embraced by millions of investors worldwide, delivers institutional-quality diversification without complexity, high fees, or the need for constant management.

In an era of overwhelming investment choices – where thousands of mutual funds, ETFs, and alternative investments compete for attention – the 3-fund portfolio cuts through the noise with refreshing simplicity. The strategy rests on a foundational truth that decades of academic research and real-world performance have repeatedly confirmed: broad market exposure through low-cost index funds outperforms the vast majority of actively managed alternatives over meaningful time horizons.

What makes this approach particularly compelling in 2026 is its accessibility. Major brokerages now offer the component funds with expense ratios approaching zero, no minimum investment requirements, and commission-free trading. An investor with $100 or $10 million can implement the identical strategy, capturing returns from thousands of companies across developed and emerging markets while maintaining appropriate bond exposure for stability.

The 3-fund portfolio is not merely a beginner’s strategy to be abandoned as sophistication grows. Many of the most knowledgeable investors – including financial advisors, academics, and even fund managers themselves – use this approach for their personal portfolios. The strategy’s power lies not in complexity but in discipline: owning the entire market, keeping costs minimal, maintaining consistent allocations, and allowing compound growth to work unimpeded over decades.

This guide provides everything needed to understand, implement, and maintain a 3-fund portfolio, from selecting specific funds to determining appropriate allocations to establishing a sustainable rebalancing routine.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways

- The 3-fund portfolio captures global market returns with minimal cost and complexity. By combining a U.S. total stock market fund, an international stock fund, and a bond fund, investors gain exposure to over 10,000 securities worldwide while paying expense ratios as low as 0.03-0.05% – approximately $3-5 annually per $10,000 invested.

- Asset allocation, not fund selection, drives most portfolio outcomes. Research indicates that approximately 90% of portfolio return variability stems from allocation decisions between stocks and bonds rather than individual security selection, making the simple allocation choices within a 3-fund portfolio the primary determinant of long-term results.

- The strategy succeeds through discipline rather than optimization. Investors who maintain their chosen allocation through market cycles, rebalance periodically, and resist the temptation to chase performance or add complexity consistently outperform those pursuing more elaborate strategies – the 3-fund portfolio’s simplicity is a feature, not a limitation.

Table of Contents

What Is a 3-Fund Portfolio?

A 3-fund portfolio is an investment strategy that builds a complete, diversified portfolio using only three broad-market index funds: one covering U.S. stocks, one covering international stocks, and one covering bonds. This approach provides exposure to virtually every publicly traded company globally while maintaining a stabilizing fixed-income allocation, all within a structure simple enough to manage in minutes per year.

The concept emerged from the broader index investing philosophy pioneered by John Bogle, who founded Vanguard in 1975 and introduced the first index mutual fund available to individual investors. Bogle’s insight – that most investors would achieve better results owning the entire market at minimal cost rather than attempting to beat it through active management – revolutionized investing and laid the groundwork for the 3-fund approach.

The “Bogleheads,” a community of investors following Bogle’s principles, formalized and popularized the 3-fund portfolio as the practical implementation of index investing philosophy. The strategy gained widespread adoption through online forums, books, and word of mouth, as investors discovered that simplicity and low costs translated directly into superior long-term results.

What distinguishes the 3-fund portfolio from other diversified approaches is its deliberate minimalism. While target-date funds and robo-advisors offer similar diversification, they introduce additional complexity, slightly higher costs, or reduced investor control. The 3-fund portfolio strips away everything nonessential, leaving only the core building blocks necessary for comprehensive market exposure.

The strategy operates on several foundational principles that align with decades of financial research:

- Market efficiency: Stock prices generally reflect available information, making consistent outperformance through security selection extremely difficult

- Cost matters: Every dollar paid in fees reduces returns dollar-for-dollar, making low-cost index funds mathematically superior to higher-cost alternatives

- Diversification reduces risk: Owning thousands of securities eliminates company-specific risk while capturing overall market returns

- Simplicity enables discipline: Portfolios simple enough to understand and maintain encourage the consistent behavior that drives long-term success

The Three Funds Explained

Fund 1: U.S. Total Stock Market Index Fund

The U.S. stock component forms the portfolio’s growth engine, providing exposure to the world’s largest and most dynamic equity market. A total stock market index fund holds shares in virtually every publicly traded U.S. company, from the largest mega-caps like Apple and Microsoft to small regional businesses with market capitalizations under $500 million.

What it contains:

A typical U.S. total stock market fund holds approximately 3,500-4,000 stocks, weighted by market capitalization. This means larger companies account for a larger share of the portfolio, naturally tilting toward established, profitable enterprises while still including smaller, growth-oriented firms.

| Market Cap Segment | Approximate Portfolio Weight | Examples |

|---|---|---|

| Large-Cap (>$10B) | 70-75% | Apple, Microsoft, Amazon, Nvidia |

| Mid-Cap ($2B-$10B) | 15-20% | Regional banks, industrial companies |

| Small-Cap (<$2B) | 8-12% | Emerging growth companies |

Why it matters:

U.S. stocks have delivered approximately 10% average annual returns over the past century, though with significant year-to-year volatility. This component provides the growth potential necessary to build wealth over time and outpace inflation. The broad market approach ensures participation in whatever sectors or companies drive future returns – eliminating the need to predict which specific industries will thrive.

Recommended funds:

| Fund | Ticker | Expense Ratio | Minimum Investment |

|---|---|---|---|

| Vanguard Total Stock Market Index Fund | VTSAX/VTI | 0.03% | $3,000 (mutual fund) / $1 (ETF) |

| Fidelity Total Market Index Fund | FSKAX/FZROX | 0.015% / 0.00% | None |

| Schwab Total Stock Market Index Fund | SWTSX/SCHB | 0.03% | None |

Fund 2: International Stock Index Fund

The international component extends equity exposure beyond U.S. borders, capturing growth from developed markets (Europe, Japan, Australia) and emerging markets (China, India, Brazil). This diversification reduces reliance on any single country’s economic performance and provides access to companies serving the majority of global consumers.

What it contains:

A total international stock fund typically holds 7,000-8,000 securities across 40+ countries, excluding the United States. Holdings span developed market blue chips, emerging market growth companies, and everything in between.

| Region | Approximate Weight | Key Markets |

|---|---|---|

| Europe | 40-45% | UK, France, Germany, Switzerland |

| Pacific | 25-30% | Japan, Australia, Hong Kong |

| Emerging Markets | 25-30% | China, Taiwan, India, Brazil |

| Canada | 5-8% | Canada |

Why it matters:

International stocks provide crucial diversification benefits. U.S. and international markets frequently perform differently – when one lags, the other often leads. From 2000-2009, international stocks substantially outperformed U.S. stocks, while the reverse occurred from 2010-2024. Owning both ensures participation regardless of which region leads in any given period.

International exposure also provides access to economic growth in faster-developing regions. Emerging markets, despite higher volatility, offer exposure to populations and economies that are growing faster than those of mature developed nations.

Recommended funds:

| Fund | Ticker | Expense Ratio | Minimum Investment |

|---|---|---|---|

| Vanguard Total International Stock Index Fund | VTIAX/VXUS | 0.12% | $3,000 (mutual fund) / $1 (ETF) |

| Fidelity Total International Index Fund | FTIHX/FZILX | 0.06% / 0.00% | None |

| Schwab International Equity ETF | SCHF | 0.06% | None |

Fund 3: Bond Index Fund

The bond component provides stability, income, and reduced portfolio volatility. While stocks generate long-term growth, bonds cushion downturns and provide predictable returns during equity market stress. This stabilizing function allows investors to maintain their strategy through market cycles rather than panic-selling during corrections.

What it contains:

A total bond market fund holds thousands of investment-grade bonds, primarily U.S. government securities and high-quality corporate bonds. The diversification across issuers, maturities, and bond types creates a stable foundation that moves largely independently of stock market fluctuations.

| Bond Type | Approximate Weight | Characteristics |

|---|---|---|

| U.S. Treasury | 40-45% | Government-backed, highest safety |

| Mortgage-Backed Securities | 25-30% | Government-agency backed |

| Investment-Grade Corporate | 25-30% | Higher yield, moderate risk |

| Government Agency | 5-10% | Near-government safety |

Why it matters:

Bonds serve multiple portfolio functions. They generate income through interest payments, preserve capital during stock market downturns, and reduce overall portfolio volatility. During the 2008-2009 financial crisis, while stocks fell approximately 50%, investment-grade bonds gained value, dramatically cushioning portfolio losses for balanced investors.

The appropriate bond allocation depends heavily on individual circumstances, particularly time horizon and risk tolerance. Younger investors with decades until retirement might hold minimal bond allocations, while those approaching or in retirement typically increase their bond allocations substantially.

Recommended funds:

| Fund | Ticker | Expense Ratio | Minimum Investment |

|---|---|---|---|

| Vanguard Total Bond Market Index Fund | VBTLX/BND | 0.03% | $3,000 (mutual fund) / $1 (ETF) |

| Fidelity U.S. Bond Index Fund | FXNAX | 0.025% | None |

| Schwab U.S. Aggregate Bond Index Fund | SCHZ | 0.03% | None |

Asset Allocation: Determining Your Mix

Asset allocation – the division of investments among U.S. stocks, international stocks, and bonds – represents the most consequential decision in portfolio construction. Research consistently shows that allocation choices account for approximately 90% of portfolio return variability over time, dwarfing the impact of individual security selection or market timing.

Stock vs. Bond Allocation

The fundamental allocation decision involves determining the split between stocks (growth assets with higher volatility) and bonds (stability assets with lower returns). This decision depends primarily on two factors: time horizon and risk tolerance.

Time horizon considerations:

Longer investment horizons permit greater stock allocations because short-term volatility becomes irrelevant when measured against decades of compound growth. An investor with 30 years until retirement can weather multiple bear markets and benefit from subsequent recoveries, while someone retiring in five years cannot afford a 40% portfolio decline immediately before withdrawing funds.

Risk tolerance considerations:

Psychological capacity to endure portfolio declines varies significantly among individuals. Some investors remain composed during 30% drawdowns; others panic and sell. Honest self-assessment matters more than theoretical optimization: a theoretically optimal allocation that an investor abandons during a downturn yields worse results than a conservative allocation maintained consistently.

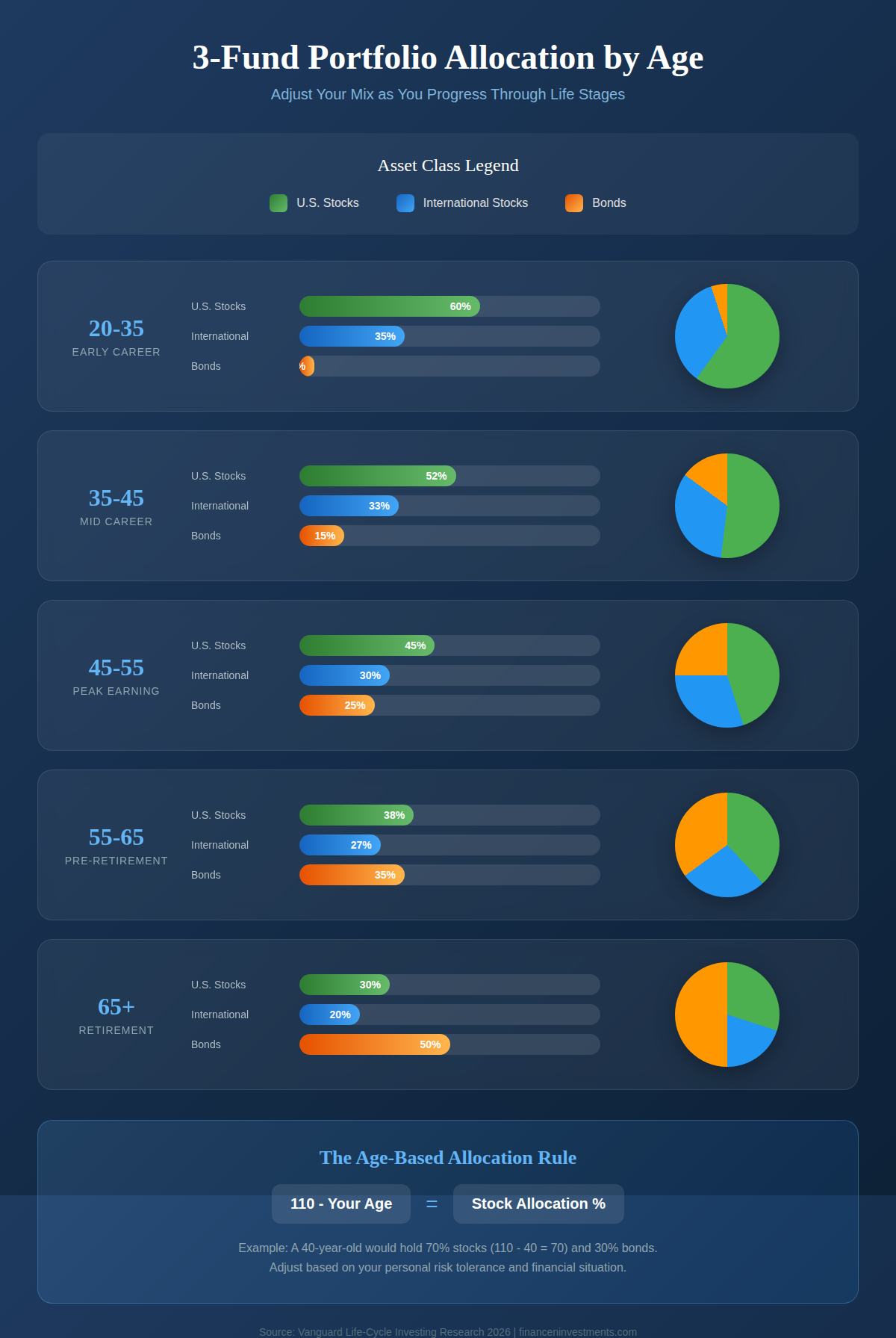

Age-Based Allocation Guidelines

While individual circumstances vary, general guidelines provide useful starting points for allocation decisions:

| Age Range | Stock Allocation | Bond Allocation | Rationale |

|---|---|---|---|

| 20-35 | 90-100% | 0-10% | Maximum growth horizon, decades to recover from downturns |

| 35-45 | 80-90% | 10-20% | Still long horizon, slight stability increase |

| 45-55 | 70-80% | 20-30% | Wealth preservation gains importance |

| 55-65 | 60-70% | 30-40% | Approaching retirement, increased stability |

| 65+ | 40-60% | 40-60% | Retirement income needs, capital preservation |

A traditional rule of thumb suggests holding a bond allocation equal to one’s age (a 30-year-old holds 30% in bonds), though many modern advisors consider this too conservative given longer life expectancy. An alternative approach subtracts age from 110 or 120 to determine stock allocation.

U.S. vs. International Stock Allocation

Within the stock portion, the split between domestic and international holdings continues to generate debate among investors. Reasonable approaches range from heavily U.S.-weighted to globally market-weighted:

| Approach | U.S. Stocks | International Stocks | Rationale |

|---|---|---|---|

| U.S.-Focused | 70-80% | 20-30% | Home country preference, dollar-based expenses |

| Balanced | 60% | 40% | Meaningful diversification, global exposure |

| Market-Weight | 55-60% | 40-45% | Reflects actual global market capitalization |

The global stock market comprises approximately 55-60% U.S. companies by market capitalization, with international stocks representing the remainder. Holding this market-weight allocation provides the purest form of diversification, though many U.S.-based investors reasonably tilt toward domestic holdings given dollar-denominated living expenses and reduced currency risk.

Sample Portfolios by Investor Profile

Aggressive Growth (Age 25, High Risk Tolerance):

- U.S. Total Stock Market: 60%

- International Stock: 35%

- Total Bond Market: 5%

Moderate Growth (Age 40, Moderate Risk Tolerance):

- U.S. Total Stock Market: 48%

- International Stock: 32%

- Total Bond Market: 20%

Balanced (Age 55, Moderate Risk Tolerance):

- U.S. Total Stock Market: 40%

- International Stock: 25%

- Total Bond Market: 35%

Conservative (Age 65, Lower Risk Tolerance):

- U.S. Total Stock Market: 30%

- International Stock: 20%

- Total Bond Market: 50%

Platform Implementation

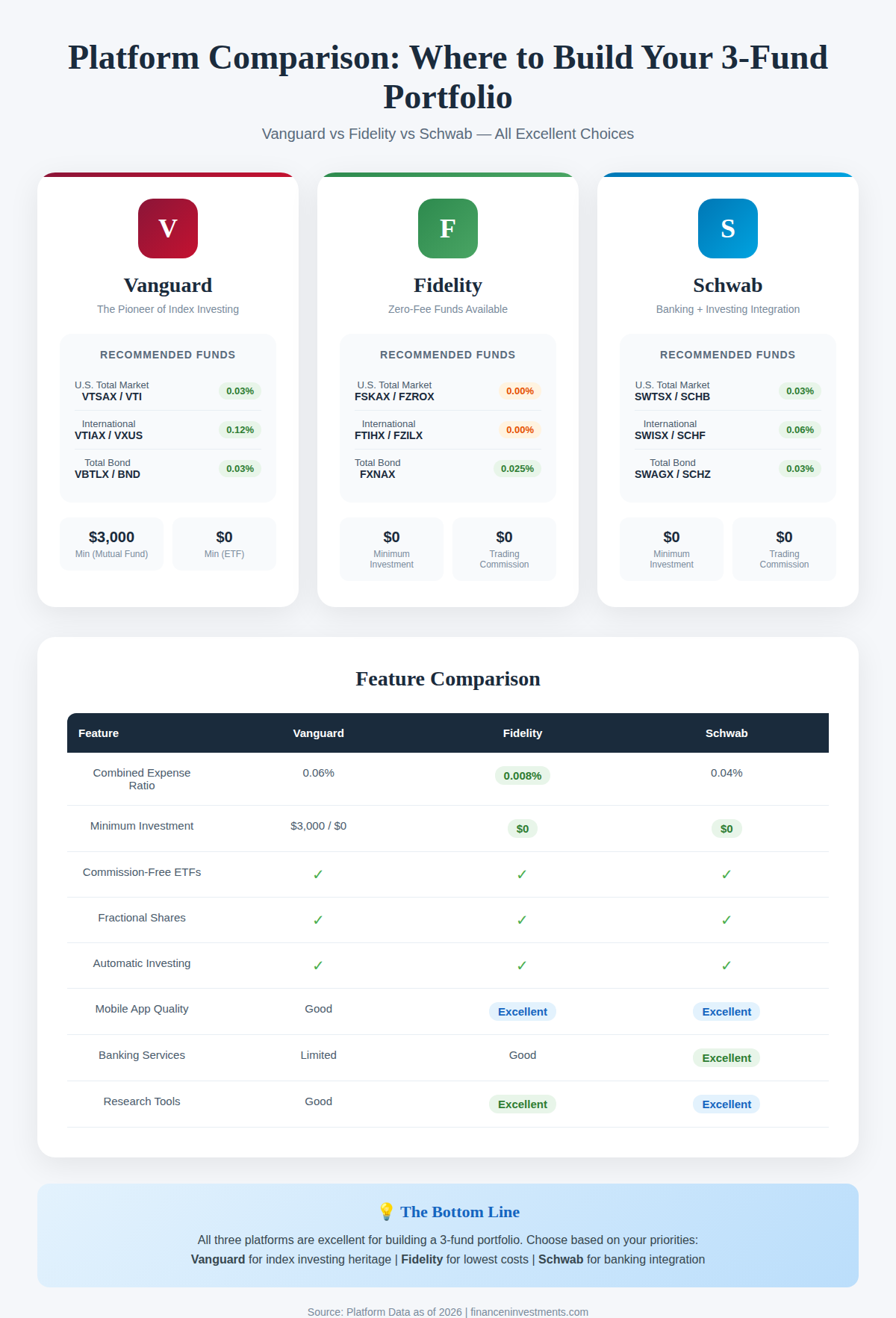

Implementing a 3-fund portfolio requires selecting a brokerage and choosing specific funds. The major low-cost providers – Vanguard, Fidelity, and Schwab – each offer excellent options with slightly different characteristics.

Vanguard Implementation

Vanguard, as the birthplace of index investing, remains the natural home for 3-fund portfolios. The company’s unique mutual ownership structure (fund shareholders own the company) aligns incentives directly with investors.

Recommended Vanguard 3-fund portfolio:

| Component | Mutual Fund | ETF | Expense Ratio |

|---|---|---|---|

| U.S. Stocks | VTSAX | VTI | 0.03% |

| International Stocks | VTIAX | VXUS | 0.12% |

| Bonds | VBTLX | BND | 0.03% |

Vanguard-specific considerations:

- Admiral Shares (lowest-cost mutual fund class) require $3,000 minimum per fund

- ETF versions have no minimum and identical expense ratios

- Automatic investment available for mutual funds but not ETFs

- Platform interface less polished than competitors but fully functional

Fidelity Implementation

Fidelity matches or beats Vanguard on costs while offering a more modern platform experience and no minimum investments. The Zero funds charge literally no expense ratio, though they are proprietary to Fidelity accounts.

Recommended Fidelity 3-fund portfolio:

| Component | Standard Fund | Zero Fund | Expense Ratio |

|---|---|---|---|

| U.S. Stocks | FSKAX | FZROX | 0.015% / 0.00% |

| International Stocks | FTIHX | FZILX | 0.06% / 0.00% |

| Bonds | FXNAX | — | 0.025% |

Fidelity-specific considerations:

- Zero funds not available if transferring to another brokerage (must sell and rebuy)

- Excellent mobile app and user interface

- Strong customer service reputation

- Fractional share purchasing available for all funds

Schwab Implementation

Charles Schwab offers competitive funds with no minimums and a comprehensive platform including banking integration. The 2024 TD Ameritrade integration brought additional research tools and trading capabilities.

Recommended Schwab 3-fund portfolio:

| Component | Mutual Fund | ETF | Expense Ratio |

|---|---|---|---|

| U.S. Stocks | SWTSX | SCHB | 0.03% |

| International Stocks | SWISX | SCHF | 0.06% |

| Bonds | SWAGX | SCHZ | 0.03% |

Schwab-specific considerations:

- Integrated banking and brokerage services

- Schwab Intelligent Portfolios (robo-advisor) is available as an alternative

- Strong branch network for in-person support

- Excellent research and educational resources

ETFs vs. Mutual Funds

Both exchange-traded funds (ETFs) and traditional mutual funds work effectively for 3-fund portfolios, with modest differences:

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading | Throughout market hours at market price | Once daily at NAV |

| Minimum Investment | None (or one share) | Often $1,000-$3,000 |

| Automatic Investing | Limited | Fully supported |

| Tax Efficiency | Slightly better | Slightly less efficient |

| Fractional Shares | Broker-dependent | Always available |

For investors making regular automatic contributions, mutual funds offer convenience advantages. For those making periodic lump-sum investments or prioritizing maximum tax efficiency, ETFs offer a slight edge. The differences are minor enough that either choice serves well.

The Rebalancing Approach

Rebalancing – periodically adjusting holdings back to target allocations – maintains intended risk levels and captures a disciplined “buy low, sell high” effect. As different assets perform differently, allocations drift from targets; rebalancing restores the original balance.

Why Rebalancing Matters

Consider a portfolio starting with 80% stocks and 20% bonds. After a strong stock market year, the allocation might drift to 88% stocks and 12% bonds. Without rebalancing, the portfolio has become more aggressive than intended, exposing the investor to greater downside risk than originally accepted.

Rebalancing also enforces disciplined investing behavior. Selling portions of recent winners and buying recent laggards may seem counterintuitive, but it consistently improves risk-adjusted returns over time.

Rebalancing Methods

Calendar-based rebalancing:

The simplest approach involves rebalancing at fixed intervals regardless of market conditions – annually, semi-annually, or quarterly. Annual rebalancing provides a reasonable balance between maintaining targets and minimizing trading activity.

Threshold-based rebalancing:

This approach triggers rebalancing only when allocations drift beyond predetermined thresholds, typically 5% absolute or 25% relative. If the target stock allocation is 80%, rebalancing occurs when the actual allocation exceeds 85% or falls below 75%.

Hybrid approach:

Many investors combine methods – checking allocations quarterly but only rebalancing if thresholds are breached. This prevents unnecessary trading during minor fluctuations while ensuring significant drifts are addressed.

Tax-Efficient Rebalancing

In taxable accounts, rebalancing through selling triggers capital gains taxes. Tax-efficient approaches minimize this impact:

- Direct new contributions: Add new money to underweight assets rather than selling overweight positions

- Dividend reinvestment: Direct dividends and distributions toward underweight funds

- Rebalance in tax-advantaged accounts: Perform most rebalancing within IRAs and 401(k)s, where no tax consequences apply

- Tax-loss harvesting: When selling in taxable accounts, prioritize positions with losses to offset gains elsewhere

Rebalancing Frequency Comparison

| Frequency | Advantages | Disadvantages |

|---|---|---|

| Annual | Simple, minimal effort, low trading costs | Allocations may drift significantly between reviews |

| Semi-Annual | Reasonable balance of effort and control | More attention required |

| Quarterly | Tighter allocation control | May trigger more taxable events |

| Threshold-Based | Rebalances only when necessary | Requires monitoring |

Research suggests that rebalancing frequency matters less than consistency. Annual rebalancing performs similarly to more frequent approaches while requiring minimal attention.

Benefits of the 3-Fund Portfolio

The 3-fund approach delivers advantages extending beyond simple diversification:

Comprehensive diversification: Three funds provide exposure to over 10,000 securities across virtually every public company worldwide and thousands of bonds, eliminating single-company and single-sector risk.

Minimal costs: Combined expense ratios below 0.10% annually mean nearly all investment returns flow to the investor rather than fund managers. Over a 30-year investment horizon, this cost advantage compounds to substantial wealth differences.

Simplicity enables consistency: A portfolio simple enough to explain in one sentence is simple enough to maintain through market cycles. Complexity creates opportunities for error; simplicity promotes discipline.

Tax efficiency: Index funds generate minimal taxable distributions compared to actively managed funds, and the limited trading involved in rebalancing minimizes tax drag in taxable accounts.

Time efficiency: After the initial setup, the 3-fund portfolio requires perhaps 30 minutes annually for review and rebalancing, freeing time to earn income, enjoy life, or both.

Transparency: Investors know exactly what they own and why. No mysterious strategies, complex derivatives, or manager decisions to evaluate.

Flexibility: The same three funds serve investors across age ranges, risk tolerances, and account types -only the allocation percentages change.

Challenges and Limitations

Acknowledging the approach’s limitations promotes realistic expectations:

Requires self-discipline: Without an advisor or automated service maintaining the strategy, investors must resist behavioral temptations – panic selling, performance chasing, or unnecessary tinkering.

No downside protection: The portfolio participates fully in market downturns. During severe bear markets, stock-heavy allocations may decline 40-50%, testing psychological resolve.

Currency risk in international holdings: International stock funds expose U.S. investors to foreign currency fluctuations, which can unpredictably amplify or dampen returns.

Tracking error acceptance: Index funds closely track their benchmarks but never perfectly match them. Minor tracking differences, though typically small, do occur.

Limited customization: Investors seeking specific factor tilts (value, small-cap), sector exclusions (fossil fuels, weapons), or alternative asset classes must modify or abandon the pure 3-fund approach.

Behavioral challenges: The simplicity that makes the portfolio powerful also makes it feel insufficiently sophisticated to some investors, tempting them toward unnecessary complexity.

Future Trends in Index Investing

Several developments will shape 3-fund portfolio implementation in the coming years:

Continued expense ratio compression: Competition among fund providers continues driving costs toward zero, benefiting all index investors.

Direct indexing accessibility: Technology that enables ownership of individual stocks rather than funds may eventually provide greater tax efficiency for smaller accounts.

ESG integration options: Environmental, social, and governance-screened index funds offer increasing options for values-aligned investing within a similar framework.

International market evolution: Emerging markets’ development and potential shifts in global market weights may alter optimal international allocations over time.

Tax-advantaged account expansion: Legislative changes expanding retirement account options could affect optimal portfolio placement decisions.

FAQs – “3-Fund Portfolio”

1. Why only three funds when more diversification seems better?

Three funds providing exposure to over 10,000 securities achieve comprehensive diversification. Adding more funds increases complexity without meaningfully improving diversification; each additional holding adds overlap with existing positions and increases the risk of allocation errors.

2. Should I include REITs, commodities, or other asset classes?

The 3-fund portfolio intentionally excludes alternative asset classes for simplicity. REITs are already included within total stock market funds. While additional asset classes may provide diversification benefits, they also add complexity and rebalancing requirements. Most investors achieve excellent outcomes with three funds alone.

3. Is the 3-fund portfolio appropriate for retirement accounts and taxable accounts?

Yes, the strategy works across all account types. For optimal tax efficiency, hold bond funds in tax-advantaged accounts (IRAs, 401(k)s) where their interest payments avoid current taxation, while holding stock index funds in taxable accounts where they benefit from favorable capital gains rates.

4. How does the 3-fund portfolio compare to target-date funds?

Target-date funds offer similar diversification with automatic rebalancing and age-appropriate allocation adjustment. The 3-fund approach provides lower costs (particularly for Fidelity Zero funds), greater control over allocation, and transparency regarding holdings. Target-date funds suit investors preferring complete automation.

5. What if my 401(k) doesn’t offer total market index funds?

Approximate the 3-fund portfolio using available options. An S&P 500 fund substitutes reasonably for the total stock market (it captures 80% of the U.S. market value). Combine available international and bond funds as closely as possible to target allocations. The specific funds matter less than maintaining low costs and broad diversification.

6. How do I handle the 3-fund portfolio during a market crash?

Maintain the strategy unchanged. Market crashes create opportunities to buy stocks at lower prices through regular contributions and rebalancing from bonds to stocks. Historically, investors who maintained discipline through downturns captured subsequent recoveries; those who sold locked in losses permanently.

7. At what portfolio size does the 3-fund portfolio become inappropriate?

The strategy scales effectively from hundreds to millions of dollars. Very large portfolios (typically exceeding $1 million in taxable accounts) might benefit from direct indexing for enhanced tax efficiency, but the 3-fund approach remains viable at any size.

8. Should I adjust my allocation based on market valuations?

Consistent allocation typically outperforms tactical adjustments. Market timing requires correctly predicting both when to exit and when to reenter – a feat few investors accomplish reliably. Maintaining target allocations through market cycles produces superior results for most investors.

9. How often should I check my 3-fund portfolio?

Quarterly or annual reviews suffice for most investors. More frequent monitoring encourages emotional reactions to normal volatility. Establish a rebalancing schedule and check only at those predetermined intervals.

10. Can I use the 3-fund portfolio with a financial advisor?

Yes, though the simplicity of the approach makes professional management unnecessary for most investors. Fee-only advisors charging flat fees or hourly rates can help establish appropriate allocations without ongoing portfolio management costs. Avoid advisors charging percentage-based fees for managing simple index fund portfolios.

Conclusion

The 3-fund portfolio embodies the principle that simplicity, consistently applied, outperforms complexity abandoned. Three low-cost index funds – covering U.S. stocks, international stocks, and bonds – provide everything necessary for building long-term wealth: Comprehensive diversification, minimal costs, and a structure simple enough to maintain through decades of market cycles.

The strategy’s power lies not in sophisticated optimization but in eliminating the obstacles that derail most investors: high fees that compound against returns, complexity that invites errors, and constant decision-making that enables emotional mistakes.

By reducing investing to its essential elements, the 3-fund portfolio allows investors to focus on the controllable factors that actually determine success: saving consistently, maintaining appropriate allocations, keeping costs minimal, and staying the course regardless of market conditions.

For investors beginning their wealth-building journey or those seeking to simplify existing portfolios, the 3-fund approach offers a proven path requiring neither exceptional knowledge nor extraordinary discipline – only the wisdom to recognize that elegant simplicity, steadfastly maintained, achieves what elaborate strategies rarely deliver.

Good luck with your future investments!

Didi Somm & Team

Recently published articles include:

- Value vs Growth Investing: Which Strategy Wins in 2026?

- Active vs Passive Investing – Your Best Guide

- Expense Ratios: Why Fees Matter

- Dollar-Cost Averaging Explained: The Simple Strategy That Removes Emotion from Investing

- What Are Dividend Stocks – The Ultimate Income Guide

- What Is Diversification?

- How Compound Interest Works: The Complete Guide to Growing Your Wealth

- Investing 101: Everything You Need to Know to Start

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance